Beruflich Dokumente

Kultur Dokumente

Oceanic Bank International PLC Audited Financial Statement For Period Ended December 31, 2009

Hochgeladen von

Oceanic Bank International PLCOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Oceanic Bank International PLC Audited Financial Statement For Period Ended December 31, 2009

Hochgeladen von

Oceanic Bank International PLCCopyright:

Verfügbare Formate

CONSOLIDATED BALANCE SHEET

Report on financial statements

AS AT 31 DECEMBER 2009

We have audited the accompanying consolidated financial statements of Oceanic Bank International Plc

Group Group Bank Bank (“the Bank”) and its subsidiaries (together, “the Group”) which comprise the consolidated balance sheets

2009 2008 2009 2008 as of 31 December 2009, consolidated profit and loss accounts and consolidated statements of cash flow

N'000 N'000 N'000 N'000 for the year then ended and a summary of significant accounting policies and other explanatory notes.

Assets

Cash and balances with central banks 54,707,470 219,603,069 32,512,146 209,928,721

Treasury bills 30,447,834 51,599,267 29,896,915 51,143,306 Directors’ responsibility for the financial statements

Due from other banks 39,182,601 188,624,756 35,298,039 186,354,159 The directors are responsible for the preparation and fair presentation of these consolidated financial

Loans and advances to customers 387,803,733 503,693,644 383,666,171 490,075,624 statements in accordance with Nigerian Statements of Accounting Standards and with the requirements

Advances under finance lease 3,209,040 4,833,839 3,197,888 4,832,376

Insurance receivables 340,860 223,437 - -

of the Companies and Allied Matters Act and the Banks and Other Financial Institutions Act. This responsi-

Investment securities 132,988,205 104,906,107 108,252,341 80,545,839 bility includes: designing, implementing and maintaining internal control relevant to the preparation and

Investment in subsidiaries - - 29,589,451 33,068,771 fair presentation of financial statements that are free from material misstatement, whether due to fraud or

Deferred tax asset 133,422,861 102,098,798 132,384,720 101,606,826 error; selecting and applying appropriate accounting policies; and making accounting estimates that are

Other assets 40,616,768 37,885,550 46,607,454 36,529,451

Investment property 12,156,324 11,865,798 4,367,745 4,300,000

reasonable in the circumstances.

Property and equipment 66,213,838 62,969,353 63,546,306 60,959,754

Total assets 901,089,534 1,288,303,618 869,319,176 1,259,344,827 Auditor’s responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our audit.

Liabilities

We conducted our audit in accordance with International Standards on Auditing. Those Standards require

Customer deposits 556,781,495 1,088,881,437 545,915,514 1,090,506,806

Due to other banks 278,330,695 81,133,911 277,144,003 79,144,343 that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance

Liability on investment contracts 640,630 463,664 - - whether the financial statements are free from material misstatement.

Liability on insurance contracts 1,208,092 1,033,847 - -

Borrowed funds 25,830,000 85,504,350 25,830,000 77,920,850

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in

Current income tax 2,797,328 2,461,024 847,820 886,969

Other liabilities 49,867,726 52,867,108 43,658,342 42,478,234 the financial statements. The procedures selected depend on the auditor’s judgment, including the assess-

Retirement benefit obligations 1,557,719 3,764,955 1,521,372 3,352,809 ment of the risks of material misstatement of the financial statements, whether due to fraud or error. In

CBN Convertible loan 100,000,000 - 100,000,000 - making those risk assessments, the auditor considers internal control relevant to the entity’s preparation

1,017,013,685 1,316,110,296 994,917,051 1,294,290,011

and fair presentation of the financial statements in order to design audit procedures that are appropriate

Equity in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s

Share capital 11,110,685 11,110,685 11,110,685 11,110,685 internal control. An audit also includes evaluating the appropriateness of accounting policies used and

Share premium 176,748,589 176,748,589 176,748,589 176,748,589 the reasonableness of accounting estimates made by management, as well as evaluating the overall

Retained earnings (319,074,081) (230,375,878) (327,837,959) (237,185,268)

presentation of the financial statements.

Other reserves 15,648,226 14,816,834 14,380,810 14,380,810

Equity holders of parent (115,566,581) (27,699,770) (125,597,875) (34,945,184)

Non-controlling interest (357,570) (106,908) - - We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for

Total equity (115,924,151) (27,806,678) (125,597,875) (34,945,184) our audit opinion.

Total equity and liabilities 901,089,534 1,288,303,618 869,319,176 1,259,344,827

Opinion

Acceptances and guarantees 107,715,379 171,929,386 102,241,028 170,812,831 In our opinion, the consolidated financial statements give a true and fair view of the state of financial

affairs of the Bank and Group as of 31 December 2009, and of their losses and cash flows for the period

CONSOLIDATED PROFIT & LOSS ACCOUNT then ended in accordance with Nigerian Statements of Accounting Standards, the Companies and Allied

FOR PERIOD ENDED 31 DECEMBER 2009 Matters Act and the Banks and Other Financial Institutions Act.

Group Group Bank Bank

12 months to 15 months to 12 months to 15 months to Emphasis of matter

December December December December Without qualifying our opinion, we draw attention to the following matters.

2009 2008 2009 2008

N'000 N'000 N'000 N'000

As described in note 43 in the financial statements the Bank and the Group incurred losses before tax

Gross earnings 196,407,964 118,298,500 190,838,871 106,038,572 amounting to N118 billion and N116 billion respectively for the year ended 31 December 2009 and had

negative shareholders funds of N126 billion and N116 billion respectively as of that date. These conditions,

Loss before taxation (116,147,211) (338,233,659) (117,865,654) (345,724,748) along with other matters as set forth in note 43 indicate the existence of a material uncertainty which may

Taxation 27,139,652 103,557,554 27,212,964 104,401,107

Loss after taxation (89,007,559) (234,676,105) (90,652,690) (241,323,641) cast significant doubt about the bank’s ability to continue as a going concern. However, as indicated in

Non-controlling interest 388,115 96,387 - - note 43 the bank has received financial support from the Central Bank of Nigeria and has also received a

Loss attributable to the group (88,619,444) (234,579,718) (90,652,690) 104,401,107 confirmation of continued financial support for a period of at least 12 months from the date of these finan-

cial statements.

Appropriated as follows:

Transfer to statutory reserve - 29,557 - -

Transfer to contingency reserve 102,430 176,733 - - Report on other legal and regulatory requirements

Transfer to retained earnings reserve (88,721,874) (234,786,008) (90,652,690) (241,323,641) The Companies and Allied Matters Act and the Banks and Other Financial Institutions Act require that in

(88,619,444) (234,579,718) (90,652,690) (241,323,641) carrying out our audit we consider and report to you on the following matters. We confirm that:

Earnings per share (basic) (N3.99) (N10.56) (N4.07) (N10.86) i. we obtained all the information and explanations which to the best of our knowledge and belief were

necessary for the purposes of our audit;

ii. in our opinion proper books of account were kept by the Bank;

iii. the Bank’s balance sheet and profit and loss account are in agreement with the books of account;

iv. our examination of loans and advances was carried out in accordance with the Prudential Guidelines for

licensed banks issued by the Central Bank of Nigeria;

Apostle Hayford I. Alile Mr John Aboh

Chairman Managing Director v. related party transactions and balances are disclosed in Note 36 to the consolidated financial

statements in accordance with the Central Bank of Nigeria Circular BSD/1/2004.

The balance sheets, profit and loss accounts, report of the independent auditor and specific disclosures are published

in compliance with the requirements of S.27 of the Banks and Other Financial Institutions Act.The information disclosed Contraventions

have been extracted from the full financial statements of the bank and the group and cannot be expected to provide as During the period, the bank contravened certain provisions of the Banks and Other Financial Institutions

full an understanding of the financial performance, financial position and financing and investing activities of the bank Act and the relevant circulars issued by the Central Bank of Nigeria. The details of these contraventions are

and the group as the full financial statements. Copies of the full financial statements can be obtained from the

Registrars of the Bank. disclosed in Note 42 to the consolidated financial statements.

Chartered Accountants 11 June 2010

Lagos

www.oceanicbank.com experience peace...

Das könnte Ihnen auch gefallen

- Oceanic Bank International PLC - Revised Financial Statement For The 15 Month Period Ended December 31, 2008Dokument1 SeiteOceanic Bank International PLC - Revised Financial Statement For The 15 Month Period Ended December 31, 2008Oceanic Bank International PLC50% (2)

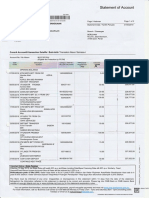

- Bank Consolidated StatementsDokument5 SeitenBank Consolidated StatementsEthan RoyNoch keine Bewertungen

- Jamie Leigh Case 2608 Haines City Crest, DR 33844Dokument1 SeiteJamie Leigh Case 2608 Haines City Crest, DR 33844SolomonNoch keine Bewertungen

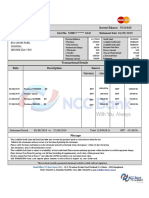

- Credit Card StatementDokument3 SeitenCredit Card StatementMUHAMMAD ASIM SHIRAZINoch keine Bewertungen

- Creditcard StatementDokument3 SeitenCreditcard Statementnaga100% (1)

- Minimum Payment Due: $25.00 New Balance: $412.44 Payment Due Date: 03/20/15Dokument4 SeitenMinimum Payment Due: $25.00 New Balance: $412.44 Payment Due Date: 03/20/15MaathiaasElopoldiel100% (1)

- Bickslow Bank Statement Template - TemplateLabDokument1 SeiteBickslow Bank Statement Template - TemplateLabbaga ibakNoch keine Bewertungen

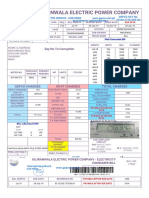

- UtilityBill 2Dokument1 SeiteUtilityBill 2ADMIN HRNoch keine Bewertungen

- Bank Statement Template 4 - TemplateLabDokument1 SeiteBank Statement Template 4 - TemplateLabAida Bracken100% (1)

- (PDF) Download Card Statement PDFDokument4 Seiten(PDF) Download Card Statement PDFSamNoch keine Bewertungen

- DocOrigin Utility Bill Tyler-TechnologiesDokument1 SeiteDocOrigin Utility Bill Tyler-TechnologiesazayNoch keine Bewertungen

- Carasa 0808Dokument17 SeitenCarasa 0808thefranknessNoch keine Bewertungen

- August 2020 E-StatementDokument2 SeitenAugust 2020 E-StatementMark WilliamsNoch keine Bewertungen

- Document PDFDokument3 SeitenDocument PDFMariennea SimataNoch keine Bewertungen

- Bank Statement Template 3Dokument1 SeiteBank Statement Template 3Frank GallagherNoch keine Bewertungen

- Account 505-275-7745 220: Billing Date Jul 22, 2023Dokument40 SeitenAccount 505-275-7745 220: Billing Date Jul 22, 2023kathyta03Noch keine Bewertungen

- Bank Statement Template 16 PDFDokument2 SeitenBank Statement Template 16 PDFBara CreativesNoch keine Bewertungen

- Bank Statement Template 3Dokument1 SeiteBank Statement Template 3Frank Gallagher100% (1)

- Ub Bill Print ProcessDokument1 SeiteUb Bill Print ProcessRuth BrandãoNoch keine Bewertungen

- NationwideDokument1 SeiteNationwideЮлия ПNoch keine Bewertungen

- Mobile Services: Your Account Summary This Month'S ChargesDokument3 SeitenMobile Services: Your Account Summary This Month'S Chargesprasadrahul12Noch keine Bewertungen

- Utility BillDokument1 SeiteUtility BillaliNoch keine Bewertungen

- Bank Reconciliation StatementDokument3 SeitenBank Reconciliation StatementZuŋɘʀa AɓɗuɭɭʌhNoch keine Bewertungen

- Postpay Bill: VAT Registration Number VAT: 0113241A PIN Number: P051129820X 1-229587980332Dokument3 SeitenPostpay Bill: VAT Registration Number VAT: 0113241A PIN Number: P051129820X 1-229587980332Chrispus MutabuuzaNoch keine Bewertungen

- Debit 2021 2 StatementDokument1 SeiteDebit 2021 2 StatementJames DunbarNoch keine Bewertungen

- Bank StatementDokument2 SeitenBank StatementFast ComputersNoch keine Bewertungen

- Your Account Summary: F-240 Telephone Number: MultipleDokument4 SeitenYour Account Summary: F-240 Telephone Number: MultipleAaron CruzNoch keine Bewertungen

- Maste CardDokument1 SeiteMaste CardMST HAZERA KHATUN100% (1)

- Gen. Juan Castaneda Senior High School: Statement of AccountDokument6 SeitenGen. Juan Castaneda Senior High School: Statement of AccountAida BellonNoch keine Bewertungen

- Bank StatementDokument1 SeiteBank StatementsachinrmishraNoch keine Bewertungen

- Uber Philippines Centre of Excellence LLC: PayslipDokument1 SeiteUber Philippines Centre of Excellence LLC: PayslipKatey Yumul - OdiamanNoch keine Bewertungen

- Water and Sewerage Department: 28,424 Gallons 0 GallonsDokument2 SeitenWater and Sewerage Department: 28,424 Gallons 0 GallonsAce MereriaNoch keine Bewertungen

- Cimbislamic: Statement of AccountDokument1 SeiteCimbislamic: Statement of AccountAuristene Dos Anjos CostaNoch keine Bewertungen

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDokument1 SeiteE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsStephen NjeruNoch keine Bewertungen

- Simply Jordan TD Bank Statement Andrew Oct 2021Dokument2 SeitenSimply Jordan TD Bank Statement Andrew Oct 2021MD MasumNoch keine Bewertungen

- Bill CE Bernard Jefferson 02-18-20 0224 CSDokument6 SeitenBill CE Bernard Jefferson 02-18-20 0224 CSMike MarchukNoch keine Bewertungen

- Example of Bank Reconciliation StatementDokument1 SeiteExample of Bank Reconciliation StatementElla Mae TimbangNoch keine Bewertungen

- HUDSON VALLEY Satement USADokument5 SeitenHUDSON VALLEY Satement USAЮлия ПNoch keine Bewertungen

- Promise Timeyin CFSB Bank StatementDokument1 SeitePromise Timeyin CFSB Bank StatementSolomonNoch keine Bewertungen

- Statement - 2Dokument4 SeitenStatement - 2Gavin GoodNoch keine Bewertungen

- NEDA-Acct#653716583-SOA July2020Dokument6 SeitenNEDA-Acct#653716583-SOA July2020Pe Anthony NoricoNoch keine Bewertungen

- Account Statement: Account No. Account TypeDokument6 SeitenAccount Statement: Account No. Account TypeRS. RafflesiaNoch keine Bewertungen

- BillDokument4 SeitenBilldeepakbshettyNoch keine Bewertungen

- Summary For Customer Account Number (CAN) 1723833781Dokument2 SeitenSummary For Customer Account Number (CAN) 1723833781Mobile TesterNoch keine Bewertungen

- Duplicate Utility BillsDokument1 SeiteDuplicate Utility BillsMohammad Riaz RRNoch keine Bewertungen

- Statement of AccountDokument3 SeitenStatement of AccountrenitnglNoch keine Bewertungen

- PDF PDFDokument1 SeitePDF PDFSTEVEN DOCUMENTSNoch keine Bewertungen

- 6 MonthDokument2 Seiten6 Monthharan5533Noch keine Bewertungen

- Lenox Supplies Accounts Statement Jan 2016 To August 2016Dokument7 SeitenLenox Supplies Accounts Statement Jan 2016 To August 2016nobleconsultantsNoch keine Bewertungen

- Final Bill Summary PDFDokument4 SeitenFinal Bill Summary PDFramana nrtNoch keine Bewertungen

- Brac Bank StatementDokument1 SeiteBrac Bank Statementshahid2opu100% (2)

- Your Basic Banking Plan Account Summary: Here's What Happened in Your Account This Statement PeriodDokument5 SeitenYour Basic Banking Plan Account Summary: Here's What Happened in Your Account This Statement PeriodsarahNoch keine Bewertungen

- StatementDokument4 SeitenStatementjoan manuel100% (1)

- Simply Jordan TD Bank Statement Andrew Mar 2021Dokument2 SeitenSimply Jordan TD Bank Statement Andrew Mar 2021MD MasumNoch keine Bewertungen

- eStatement2772LK - 2011 03 10Dokument2 SeiteneStatement2772LK - 2011 03 10wwibuddhikaNoch keine Bewertungen

- Audited Consolidated Financial Statements For The Year Ended 31 October 2009Dokument32 SeitenAudited Consolidated Financial Statements For The Year Ended 31 October 2009amitkanhere4397Noch keine Bewertungen

- Nestle Financial StatementDokument48 SeitenNestle Financial Statementjhenkq100% (2)

- 2017 Year End FinancialsDokument37 Seiten2017 Year End FinancialsFryan GreenhousegasNoch keine Bewertungen

- Financials VTL - Merged - RemovedDokument15 SeitenFinancials VTL - Merged - Removedmuhammadasif961Noch keine Bewertungen

- Independent Auditor'S Report: The Board of Directors Philippine Deposit Insurance Corporation Makati CityDokument17 SeitenIndependent Auditor'S Report: The Board of Directors Philippine Deposit Insurance Corporation Makati CityRapha JohnNoch keine Bewertungen

- © 1999. Omega Research, Inc. Miami, FloridaDokument160 Seiten© 1999. Omega Research, Inc. Miami, Floridajamesfin68100% (1)

- 018.ASX IAW Feb 1 2008 Appendix 4C QuarterlyDokument10 Seiten018.ASX IAW Feb 1 2008 Appendix 4C QuarterlyASX:ILH (ILH Group)Noch keine Bewertungen

- Adaptive Markets - Andrew LoDokument22 SeitenAdaptive Markets - Andrew LoQuickie Sanders100% (4)

- Database of Stock BrokersDokument11 SeitenDatabase of Stock BrokersDoctor planet global instituteNoch keine Bewertungen

- CIBIL - Know Your Cibil Score - Get Your Cibil Score Deal4loansDokument2 SeitenCIBIL - Know Your Cibil Score - Get Your Cibil Score Deal4loansVenkatrao GarigipatiNoch keine Bewertungen

- Fong v. DueñasDokument3 SeitenFong v. DueñasGia DimayugaNoch keine Bewertungen

- Presentation On Corporate GovernanceDokument29 SeitenPresentation On Corporate Governancesuren471988Noch keine Bewertungen

- BSA2BQuiz 3Dokument19 SeitenBSA2BQuiz 3Monica Enrico0% (1)

- International Financial Management PgapteDokument25 SeitenInternational Financial Management PgapterameshmbaNoch keine Bewertungen

- Religious Freedom Non Impairment of ContractsDokument4 SeitenReligious Freedom Non Impairment of ContractsJean Jamailah Tomugdan100% (1)

- Tobin, J. (1987) Financial IntermediariesDokument14 SeitenTobin, J. (1987) Financial IntermediariesClaudia PalaciosNoch keine Bewertungen

- Proposed Products For Dudu SACCODokument7 SeitenProposed Products For Dudu SACCOmbesyaNoch keine Bewertungen

- Linde India Limited - Delisting Letter of Offer - 140120191028Dokument48 SeitenLinde India Limited - Delisting Letter of Offer - 140120191028Arushi ChaudharyNoch keine Bewertungen

- Activity: Ansano Rey M. Bs Entrepreneurship 3-BDokument13 SeitenActivity: Ansano Rey M. Bs Entrepreneurship 3-BErick MequisoNoch keine Bewertungen

- HSBC AlgosDokument1 SeiteHSBC Algosdoc_oz3298Noch keine Bewertungen

- Technical Analysis of Indian Stock MarketDokument62 SeitenTechnical Analysis of Indian Stock MarketPritesh PuntambekarNoch keine Bewertungen

- ADR and GDRDokument3 SeitenADR and GDRJonney MarkNoch keine Bewertungen

- Chapter 4Dokument56 SeitenChapter 4Crystal Brown100% (1)

- MILAOR+ +Province+of+Tarlac+vs.+AlcantaraDokument3 SeitenMILAOR+ +Province+of+Tarlac+vs.+AlcantaraAndrea MilaorNoch keine Bewertungen

- Mating Industrial and Commercial Corporation vs. CorosDokument10 SeitenMating Industrial and Commercial Corporation vs. CorosLiz LorenzoNoch keine Bewertungen

- Entrepreneur : Group or Individual Creativity Technique Alex Faickney OsbornDokument3 SeitenEntrepreneur : Group or Individual Creativity Technique Alex Faickney OsbornAkshay KamathNoch keine Bewertungen

- The Accompanying Notes Are An Integral Part of The Financial StatementsDokument7 SeitenThe Accompanying Notes Are An Integral Part of The Financial Statementsravibhartia1978Noch keine Bewertungen

- Course Collections by Coursera - MiniMBADokument8 SeitenCourse Collections by Coursera - MiniMBAshmtuhinNoch keine Bewertungen

- KBA - Accounting and BookkeepingDokument8 SeitenKBA - Accounting and BookkeepingKBA Accounting & Bookkeeping Services LLCNoch keine Bewertungen

- RSM FinalDokument29 SeitenRSM FinalNihal LamgeNoch keine Bewertungen

- Kinds of Companies Under Companies ActDokument3 SeitenKinds of Companies Under Companies ActSoumo DasNoch keine Bewertungen

- Bharti Airtel Offer LetterDokument365 SeitenBharti Airtel Offer LetterPranav BhatNoch keine Bewertungen

- Collateral Assignment FormDokument2 SeitenCollateral Assignment FormChris Anthony AncajasNoch keine Bewertungen

- 9 14 2015 Canaccord UADokument6 Seiten9 14 2015 Canaccord UAWilliam HarrisNoch keine Bewertungen

- Investment Securities Classification On Balance SheetDokument2 SeitenInvestment Securities Classification On Balance Sheetfawad101Noch keine Bewertungen