Beruflich Dokumente

Kultur Dokumente

Chapter 7 (Case) : Joan Holtz

Hochgeladen von

jenice joyOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chapter 7 (Case) : Joan Holtz

Hochgeladen von

jenice joyCopyright:

Verfügbare Formate

JENICE JOY S.

SUMAWAY

BM 220 - PROF. TRINIDAD

Chapter 7: Long-Lived Nonmonetary Assets and Their Ammortization

Case: Joan Holtz

Reference: Accounting Text and Cases (9th Ed)

Joan Holtz said to the accounting instructor. "The general principle for arriving at the amount

of a fixed asset that is to be capitalized is reasonably clear, but there certainly are a great many

problems in applying this principle to specific situations."

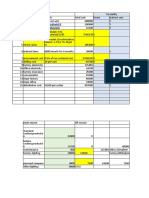

1. Suppose that the Bruce Manufacturing Company used its own maintenance crew to build an additional

additional wing on its existing factory building. What would be the proper accounting treatment of the following

items (items a-i)?

Solution: Note --- amount shown is not given in the question

Building

Architects' fee $ 1,200

Snow removal cost $ 1,300

Removal of old building $ 20,000

Interest payable on construction $ 2,500

Local real estate taxes $ 2,000

Cost of mistakes during construction $ 3,000

Accumulated overhead cost $ 25,000

Insurance on building construction $ 6,500

Other cost of damages or loses during construction $ 3,500 $ 65,000

Less: Cash discounts $ 2,000

$ 63,000

Cash $ 63,000.00

2) Assume that the Archer Company bought a large piece of land, including the buildings thereon,

with the intent of razing the buildings and constructing a combined hotel and office building in their

place. The existing buildings consisted of a theater and several stores and small apartment buildings,

all in active use at the time of the purchase.

a) What accounting treatment should be accorded that portionof the purchase price considered to be amount

paid for the buildings that are subsequently razed?

Land and Building

Cash paid for land and building $ 3,000,000

Cash $ 3,000,000

b) How should the costs of demolishing the old buildings be treated?

Building

Removal of old building $ 250,000

Cash $ 250,000

LONG-LIVED NONMONETARY ASSET AND THEIR AMMORTIZATION

JENICE JOY S. SUMAWAY

BM 220 - PROF. TRINIDAD

c) In what respect, if any, should the accounting treatment of the old buildings and the cost of demolishing them differ from your

recommendations with respect to (a) and (b) above? Why?

Building

Cash paid for land and building $ 3,000,000

Removal of old building $ 250,000

New building constructed $ 1,500,000 $ 4,750,000

Cash $ 4,750,000

3) Midland Manufacturing company purchased a new machine. It is clear that the invoice price of the new machine should be capitalized,

and it also seems reasonable to capitalize the transportation cost to bring the machine to the Mindland plant.

a) Should this cost be charged to the building, added to the cost of the machine or be expensed? Why?

Installation of additional steal beams cost should be charged to the cost of the machine --- "Cost of Installation", because the

equipment as mentioned above should be capitalized. The cost incurred to install the new machine, therefore it is a cost

requirement for machine to get ready for operation.

b) Before the new machine was working properly, a large amount of material had been spoiled during trial runs. How should all of these

costs be treated? Why?

Regular installation maintenance crew, engineer, plant superintendednt labor cost and other labor costs incurred

and materials spoiled during the trial runs, all these cost should be charged to the cost of the machine, because all these costs

incurred to get the new machine ready for operation.

c) Is state sales tax on purchasing the machine part of the machine's cost? Why?

Yes, state sales tax and other taxes that may incur to purchase the machine would be part of the machine costs.

d) Should trade-in gain be treated as a reduction in the cost of the new machine or a gain disposal of the old one? Why?

The difference between the trade-in value and the depreciated value of the old machine should be treated as deduction to the

cost of the new machine because accepting Midland Company's old machine as partial payment is trading old asset to

a similar new asset. And the value of the old asset is used in calculating the acquisition cost of the new asset.

LONG-LIVED NONMONETARY ASSET AND THEIR AMMORTIZATION

Das könnte Ihnen auch gefallen

- Chapter 5 ProblemsDokument7 SeitenChapter 5 Problemsanu balakrishnanNoch keine Bewertungen

- Chap 018Dokument25 SeitenChap 018Neetu RajaramanNoch keine Bewertungen

- Revenue and Monetary Assets: Changes From Eleventh EditionDokument21 SeitenRevenue and Monetary Assets: Changes From Eleventh EditionMenahil KNoch keine Bewertungen

- Stern Corporation (B)Dokument3 SeitenStern Corporation (B)Rahul SinghNoch keine Bewertungen

- California CreameryDokument2 SeitenCalifornia CreameryHeena GuptaNoch keine Bewertungen

- Debt sources and accounting in Norman Corporation caseDokument19 SeitenDebt sources and accounting in Norman Corporation caseDhiwakar Sb100% (1)

- Save Mart and Copies Express CaseDokument7 SeitenSave Mart and Copies Express CaseanushaNoch keine Bewertungen

- Chap 021Dokument19 SeitenChap 021Neetu Rajaraman100% (1)

- Dispensers of California, IncDokument9 SeitenDispensers of California, IncHimanshu PatelNoch keine Bewertungen

- Bonus ch15 PDFDokument45 SeitenBonus ch15 PDFFlorence Louise DollenoNoch keine Bewertungen

- AHM Chapter 3 Exercises CKvxWXG1tmDokument2 SeitenAHM Chapter 3 Exercises CKvxWXG1tmASHUTOSH BISWALNoch keine Bewertungen

- Chap 006Dokument15 SeitenChap 006Neetu RajaramanNoch keine Bewertungen

- Final Exam Paper (C) 2020.11 OpenDokument3 SeitenFinal Exam Paper (C) 2020.11 OpenKshitiz NeupaneNoch keine Bewertungen

- ARS Waltham Case TransactionsDokument2 SeitenARS Waltham Case TransactionsRajnikaanth SteamNoch keine Bewertungen

- CASE 8 - Norman Corporation (A) (Final)Dokument3 SeitenCASE 8 - Norman Corporation (A) (Final)Katrizia FauniNoch keine Bewertungen

- Case1 1,1 2,2 1,2 2,2 3,3 1,3 2,4 1,4 2,5 1 pb2 6,3 9Dokument20 SeitenCase1 1,1 2,2 1,2 2,2 3,3 1,3 2,4 1,4 2,5 1 pb2 6,3 9amyth_dude_9090100% (2)

- Maynard Company Balance Sheet AnalysisDokument2 SeitenMaynard Company Balance Sheet AnalysisArchin Padia100% (1)

- Financial Reporting and Analysis: Assignment - 1Dokument8 SeitenFinancial Reporting and Analysis: Assignment - 1Sai Chandan Duggirala100% (1)

- Soal AkmDokument5 SeitenSoal AkmCarvin HarisNoch keine Bewertungen

- Lawsuit and bond discount accounting questionsDokument2 SeitenLawsuit and bond discount accounting questionsPatrick HariramaniNoch keine Bewertungen

- AkuntansiDokument3 SeitenAkuntansier4sallNoch keine Bewertungen

- Case 3 - 1: Maynard Company (B) : DR Ashish Varma / IMTDokument4 SeitenCase 3 - 1: Maynard Company (B) : DR Ashish Varma / IMTkunalNoch keine Bewertungen

- Accounting Case Study: PC DepotDokument7 SeitenAccounting Case Study: PC DepotPutri Saffira YusufNoch keine Bewertungen

- Case Study On Giberson Glass StudioDokument16 SeitenCase Study On Giberson Glass StudioChandan Pahelwani0% (2)

- Control: The Management Control Environment: Changes From The Eleventh EditionDokument22 SeitenControl: The Management Control Environment: Changes From The Eleventh EditionRobin Shephard Hogue100% (1)

- Chemalite Group - Cash Flow Statement - PBTDokument8 SeitenChemalite Group - Cash Flow Statement - PBTAmit Shukla100% (1)

- CH 21Dokument7 SeitenCH 21Rand Al-akamNoch keine Bewertungen

- Stone Industries: Accounting Case StudyDokument7 SeitenStone Industries: Accounting Case StudyAshok Sharma100% (1)

- Chap 003Dokument19 SeitenChap 003jujuNoch keine Bewertungen

- Case Study - Lone Pine Cafe (A)Dokument6 SeitenCase Study - Lone Pine Cafe (A)rdx216Noch keine Bewertungen

- Stern Corporation Balance Sheet AdjustmentsDokument4 SeitenStern Corporation Balance Sheet AdjustmentsYessy KawiNoch keine Bewertungen

- Financial StatementDokument46 SeitenFinancial StatementViNoch keine Bewertungen

- (Case 6-7) 5-1 Stern CorporationDokument1 Seite(Case 6-7) 5-1 Stern CorporationJuanda0% (1)

- Case ChemaliteDokument1 SeiteCase ChemaliteRosario PhillipsNoch keine Bewertungen

- Case 5-3Dokument2 SeitenCase 5-3ragil1988Noch keine Bewertungen

- Harsh ElectricalsDokument7 SeitenHarsh ElectricalsR GNoch keine Bewertungen

- Chemalite Inc - Assignment - AccountingDokument2 SeitenChemalite Inc - Assignment - Accountingthi_aar100% (1)

- Balance Sheet BasicsDokument20 SeitenBalance Sheet BasicsSarbani Mishra0% (1)

- SMA Notes (Imp. Problems)Dokument26 SeitenSMA Notes (Imp. Problems)Naresh GuduruNoch keine Bewertungen

- Revenue and Monetary Assets: Changes From Eleventh EditionDokument22 SeitenRevenue and Monetary Assets: Changes From Eleventh EditionDhiwakar SbNoch keine Bewertungen

- anthonyIM 06Dokument18 SeitenanthonyIM 06Jigar ShahNoch keine Bewertungen

- Small business cash flow analysisDokument2 SeitenSmall business cash flow analysisAgANoch keine Bewertungen

- CVPDokument3 SeitenCVPRajShekarReddyNoch keine Bewertungen

- AHM13e Chapter - 03 - Solution To Problems and Key To CasesDokument24 SeitenAHM13e Chapter - 03 - Solution To Problems and Key To CasesGaurav ManiyarNoch keine Bewertungen

- Basic Accounting Concepts: The Income Statement: Changes From Eleventh EditionDokument19 SeitenBasic Accounting Concepts: The Income Statement: Changes From Eleventh EditionDhiwakar SbNoch keine Bewertungen

- Balakrishnan MGRL Solutions Ch14Dokument36 SeitenBalakrishnan MGRL Solutions Ch14Aditya Krishna100% (1)

- Ahmad FA - Chapter4Dokument1 SeiteAhmad FA - Chapter4ahmadfaNoch keine Bewertungen

- ConAgra Processes Beef Cattle ProductsDokument13 SeitenConAgra Processes Beef Cattle ProductsMawaz Khan MirzaNoch keine Bewertungen

- Format For Preparing Cash Flow Statement - Start With PBT: (4) Reclassify Interest Paid Under Financing Activities +Dokument2 SeitenFormat For Preparing Cash Flow Statement - Start With PBT: (4) Reclassify Interest Paid Under Financing Activities +shidupk5 pkNoch keine Bewertungen

- Sinclair Company Group Case StudyDokument20 SeitenSinclair Company Group Case StudyNida AmriNoch keine Bewertungen

- Ross Appendix19ADokument7 SeitenRoss Appendix19ARichard RobinsonNoch keine Bewertungen

- PC DepotDokument2 SeitenPC DepotJohn Carlos WeeNoch keine Bewertungen

- SEATWORK-LBM 1st2324 STUDENTSDokument3 SeitenSEATWORK-LBM 1st2324 STUDENTSpadayonmhieNoch keine Bewertungen

- Intermediate Accounting 11Th Edition Nikolai Test Bank Full Chapter PDFDokument67 SeitenIntermediate Accounting 11Th Edition Nikolai Test Bank Full Chapter PDFprise.attone.itur100% (3)

- Intermediate Accounting 11th Edition Nikolai Test BankDokument61 SeitenIntermediate Accounting 11th Edition Nikolai Test Bankesperanzatrinhybziv100% (26)

- Answer KeysDokument35 SeitenAnswer Keyspayos manuelNoch keine Bewertungen

- Notes Capital Revenue AnsDokument3 SeitenNotes Capital Revenue AnsMuhammad JavedNoch keine Bewertungen

- Aud Application 2 - Handout 2 Borrowing Cost (UST)Dokument2 SeitenAud Application 2 - Handout 2 Borrowing Cost (UST)RNoch keine Bewertungen

- Ppe - ModuleDokument7 SeitenPpe - ModuleYejin ChoiNoch keine Bewertungen

- Assessment No. 3-Midterm - Exam SheetDokument7 SeitenAssessment No. 3-Midterm - Exam Sheetarnel buanNoch keine Bewertungen

- Value Chain Management-Group 1Dokument64 SeitenValue Chain Management-Group 1jenice joyNoch keine Bewertungen

- Value Chain Management-Group 1Dokument64 SeitenValue Chain Management-Group 1jenice joyNoch keine Bewertungen

- 6 - Browning MFTG Company Case SolutionDokument12 Seiten6 - Browning MFTG Company Case Solutionjenice joy100% (2)

- 6 - Cost of Sales and InventoriesDokument39 Seiten6 - Cost of Sales and Inventoriesjenice joyNoch keine Bewertungen

- Get Solved NMIMS 1st Year Assignment Solution Call 9025810064Dokument22 SeitenGet Solved NMIMS 1st Year Assignment Solution Call 9025810064Palaniappan NNoch keine Bewertungen

- Budget Template WFF ProposalsDokument6 SeitenBudget Template WFF ProposalsLailan Syahri RamadhanNoch keine Bewertungen

- Financial Derivatives Question and SolutionDokument2 SeitenFinancial Derivatives Question and SolutionNithya NairNoch keine Bewertungen

- A Tobin's Q Model of House PricesDokument28 SeitenA Tobin's Q Model of House PriceskobiwNoch keine Bewertungen

- Coffee Bar Marketing PlanDokument13 SeitenCoffee Bar Marketing PlanMay Oo LayNoch keine Bewertungen

- Macro Unit 2 MC QuestionsDokument3 SeitenMacro Unit 2 MC QuestionsHimanshu Kumar100% (1)

- Retail Management Word Search PuzzleDokument1 SeiteRetail Management Word Search PuzzleSitiSuharijanSaidNoch keine Bewertungen

- Six bullish and bearish candlestick patternsDokument47 SeitenSix bullish and bearish candlestick patternsAtanu Pandit100% (1)

- AF208 Assignment V2Dokument5 SeitenAF208 Assignment V2Aryan KalyanNoch keine Bewertungen

- Cat t7 Variance Q PJ KLDokument11 SeitenCat t7 Variance Q PJ KLati19Noch keine Bewertungen

- Microeconomics Macroeconomics PDFDokument17 SeitenMicroeconomics Macroeconomics PDFtarakesh17Noch keine Bewertungen

- Afs Copa & PCDokument6 SeitenAfs Copa & PCMadiha Maan100% (1)

- Handout in Financial Assets 2Dokument2 SeitenHandout in Financial Assets 2Micaella GrandeNoch keine Bewertungen

- Ekam ApplicationDokument17 SeitenEkam ApplicationSehgal EstatesNoch keine Bewertungen

- Introduction To The OVIDokument13 SeitenIntroduction To The OVIwinstoncomNoch keine Bewertungen

- Macro Qch1Dokument13 SeitenMacro Qch1Kiều AnhNoch keine Bewertungen

- AssigmentDokument8 SeitenAssigmentMuhammad Rafique0% (1)

- Cost 1st Summative AssessmentDokument13 SeitenCost 1st Summative AssessmentApas Pel Joshua M.Noch keine Bewertungen

- Cost Volume Profit AnalysisDokument18 SeitenCost Volume Profit AnalysisLea GaacNoch keine Bewertungen

- FIN 213 Review Questions: Question OneDokument16 SeitenFIN 213 Review Questions: Question OneJustus MusilaNoch keine Bewertungen

- Accounting Report (Maan) 3Dokument14 SeitenAccounting Report (Maan) 3Hamid SohailNoch keine Bewertungen

- S&P VIX Futures Indices: MethodologyDokument38 SeitenS&P VIX Futures Indices: MethodologyLock SNoch keine Bewertungen

- Analyzing Meridicom's Response to Free Broadband ChallengeDokument10 SeitenAnalyzing Meridicom's Response to Free Broadband Challengevaibhavraj7Noch keine Bewertungen

- Modi, A Mistake by A. GopannaDokument45 SeitenModi, A Mistake by A. GopannaDesiya MurasuNoch keine Bewertungen

- EXAM 2 Concept MasterDokument20 SeitenEXAM 2 Concept MasterShane TorrieNoch keine Bewertungen

- Progress Test 2A ReviewDokument4 SeitenProgress Test 2A ReviewBrigita ButkutėNoch keine Bewertungen

- Axe Competitive Advantage Plan Part 1Dokument24 SeitenAxe Competitive Advantage Plan Part 1Hayat Omer Malik100% (1)

- Phoenix Lamps 231007Dokument18 SeitenPhoenix Lamps 231007rahul.pms100% (1)

- Day Trader Business: Trader Entities With Steve Ribble (ShrinkMyTaxes - Com) Presentation SlidesDokument54 SeitenDay Trader Business: Trader Entities With Steve Ribble (ShrinkMyTaxes - Com) Presentation SlidesMarketHEIST.comNoch keine Bewertungen

- Consumer Price Index NumberDokument6 SeitenConsumer Price Index NumberNirmalNoch keine Bewertungen