Beruflich Dokumente

Kultur Dokumente

Capital Alert - 7/3/2008

Hochgeladen von

Russell KlusasOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Capital Alert - 7/3/2008

Hochgeladen von

Russell KlusasCopyright:

Verfügbare Formate

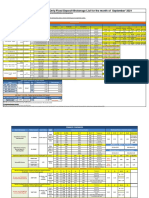

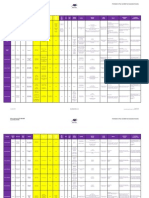

July 3, 2008

Multi-Family Loan Programs > $3 Million

Agency Lenders Portfolio Lenders*

Term Leverage Max. Interest Rates Leverage Max. Interest Rates

5 Yr. 80% 6.01% to 6.16% 75% 6.05% to 6.25%

7 Yr. 80% 6.08% to 6.17% 75% 6.40% to 6.65%

10 Yr. 80% 6.15% to 6.36% 75% 6.55% to 6.85%

15 Yr. 80% 6.57% to 7.17% 75% 6.85% to 7.35%

*Rates based on Act/360

Multi-Family Loan Programs < $3 Million

Fixed Rate Agency Lenders Portfolio Lenders*

Term Leverage Max. Interest Rates Leverage Max. Interest Rates

3 Yr. 80% 5.95% to 6.39% 75% 5.90% to 6.25%

5 Yr. 80% 5.93% to 6.31% 75% 6.05% to 6.35%

7 Yr. 80% 5.95% to 6.25% 75% 6.40% to 6.65%

10 Yr. 80% 6.09% to 6.39% 75% 6.55% to 6.85%

15 Yr. 80% 6.65% to 7.56% 75% 6.85% to 7.35%

*Rates based on Act/360

Commercial Loan Programs

Fixed Rate Portfolio Lenders* Index Rate as of 7/3/2008

Term Leverage Max. Interest Rates

5-Year Treasury: 3.28% 10-Year Treasury: 3.97%

5 Yr. 75% 6.25% to 6.55%

5-Year Swap: 4.28% 10-Year Swap: 4.74%

7 Yr. 75% 6.45% to 6.65%

Prime: 5.00% LIBOR: 3.12%

10 Yr. 75% 6.65% to 6.90%

15 Yr. 75% 6.95% to 7.45%

Bridge Floating Leverage Max. Spread Over Libor

Stabilized 75% 225 to 300

Re-Position 80% 275 to 350

(*Portfolio Lenders include Banks, Life Insurance Companies and Credit Unions)

Economic Commentary

7-3-08 While mortgage rates remained somewhat unchanged, concerns

about inflation increased this week. Oil prices hit yet another record high at

$145 per barrel and U.S. employment dropped for the sixth month in a row,

indicating that the economic slowdown is continuing. CMBS lenders are still

in the market at 300 plus basis point spreads that put them in the low-7

percent rates, which are getting closer to being competitive as 10-year

portfolio rates move into the high-6 percent area.

Recent Transactions

2001 W. Mission 150 Acalanes Drive 6131 West Thomas Rd. University Square

Office - Class B Multi-Family Mid Rise Multi-Family Garden Apt. Retail - Regional Mall

Pomona, CA Sunnyvale, CA Phoenix, AZ San Diego, CA

$8,000,000 $9,200,000 $7,309,000 $6,000,000

Refinance Refinance / Permanent Purchase / Permanent Fee Only

Interim/Bridge Financing 5.56% Interest rate 5.95% Interest rate Preferred Equity

For more information, contact:

William Hughes

Senior Vice President / Managing Director

Newport Beach, CA

Office: (949) 851-3030

Das könnte Ihnen auch gefallen

- CapAlertPDF 072508Dokument1 SeiteCapAlertPDF 072508Russell KlusasNoch keine Bewertungen

- Capital Alert - 7/12/2008Dokument1 SeiteCapital Alert - 7/12/2008Russell KlusasNoch keine Bewertungen

- Capital Markets - 6/30/2008Dokument1 SeiteCapital Markets - 6/30/2008Russell KlusasNoch keine Bewertungen

- Capital Markets - 4/25/2008Dokument1 SeiteCapital Markets - 4/25/2008Russell KlusasNoch keine Bewertungen

- Capital Alert 6/13/2008Dokument1 SeiteCapital Alert 6/13/2008Russell KlusasNoch keine Bewertungen

- Capital Alert - 8/29/2008Dokument1 SeiteCapital Alert - 8/29/2008Russell KlusasNoch keine Bewertungen

- Capital Alert - 6/20/2008Dokument1 SeiteCapital Alert - 6/20/2008Russell KlusasNoch keine Bewertungen

- Capital Markets - 4/18/2008Dokument1 SeiteCapital Markets - 4/18/2008Russell KlusasNoch keine Bewertungen

- Capital Markets - 8/15/2008Dokument2 SeitenCapital Markets - 8/15/2008Russell KlusasNoch keine Bewertungen

- Multi-Family Loan Programs $3 MillionDokument1 SeiteMulti-Family Loan Programs $3 MillionRussell KlusasNoch keine Bewertungen

- Capital Alert - 5/30/2008Dokument1 SeiteCapital Alert - 5/30/2008Russell KlusasNoch keine Bewertungen

- Capital Markets - 5/16/2008Dokument1 SeiteCapital Markets - 5/16/2008Russell KlusasNoch keine Bewertungen

- Capital Alert - 8/22/2008Dokument1 SeiteCapital Alert - 8/22/2008Russell KlusasNoch keine Bewertungen

- Capital Alert - 2/1/2008Dokument1 SeiteCapital Alert - 2/1/2008Russell KlusasNoch keine Bewertungen

- Capital Markets - 3/14/2008Dokument2 SeitenCapital Markets - 3/14/2008Russell KlusasNoch keine Bewertungen

- Capital Markets - 3/07/2008Dokument1 SeiteCapital Markets - 3/07/2008Russell KlusasNoch keine Bewertungen

- Capital Markets - 2/29/2008Dokument1 SeiteCapital Markets - 2/29/2008Russell KlusasNoch keine Bewertungen

- Bank A: Housing Loan Property Equity LoanDokument6 SeitenBank A: Housing Loan Property Equity LoanRaesa BadelNoch keine Bewertungen

- Website Disclosure Effective 05 Apr 2024Dokument4 SeitenWebsite Disclosure Effective 05 Apr 2024Ab CdNoch keine Bewertungen

- Capital Markets - 4/11/2008Dokument1 SeiteCapital Markets - 4/11/2008Russell KlusasNoch keine Bewertungen

- Project FşnanceDokument2 SeitenProject FşnanceAhmet ErNoch keine Bewertungen

- Term Deposit Rate Sheet: ShajarDokument1 SeiteTerm Deposit Rate Sheet: ShajarchqaiserNoch keine Bewertungen

- 08 - Term Structure of Interest Rate and Yield Curve - AnnotatedDokument6 Seiten08 - Term Structure of Interest Rate and Yield Curve - AnnotatedFindri Palias BokyNoch keine Bewertungen

- Rates of Return On PLSDeposits OtherDepositsDokument2 SeitenRates of Return On PLSDeposits OtherDepositsranamkhan553Noch keine Bewertungen

- Bank A: Housing Loan Property Equity LoanDokument5 SeitenBank A: Housing Loan Property Equity LoanRaesa BadelNoch keine Bewertungen

- Website Disclosure Effective 02nd May 2023Dokument3 SeitenWebsite Disclosure Effective 02nd May 2023Prathamesh PatikNoch keine Bewertungen

- HDFC RatesDokument4 SeitenHDFC RatesdesikanttNoch keine Bewertungen

- Tel No: 022-4215 9068Dokument3 SeitenTel No: 022-4215 9068mamatha niranjanNoch keine Bewertungen

- Loan RatesDokument1 SeiteLoan RatesAndrew ChambersNoch keine Bewertungen

- Website Disclosure Effective 03 Feb 2024Dokument3 SeitenWebsite Disclosure Effective 03 Feb 2024abhishek sharmaNoch keine Bewertungen

- Cho RM 73 2020-21Dokument1 SeiteCho RM 73 2020-21Steve WozniakNoch keine Bewertungen

- IIFL Associate FD List September'2021Dokument4 SeitenIIFL Associate FD List September'2021BHARAT SNoch keine Bewertungen

- Effective Annualized Rate of Return - Resident-NRO TD 1-09-2023Dokument1 SeiteEffective Annualized Rate of Return - Resident-NRO TD 1-09-2023Arun sharmaNoch keine Bewertungen

- Interest Rates On FDR: Monthly Benefit PlanDokument2 SeitenInterest Rates On FDR: Monthly Benefit Planmushfik arafatNoch keine Bewertungen

- Interest Rates On Domestic Recurring Deposit: WWW - Utkarsh.bankDokument1 SeiteInterest Rates On Domestic Recurring Deposit: WWW - Utkarsh.bankSusovan DasNoch keine Bewertungen

- Administrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008Dokument3 SeitenAdministrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008gmatweakNoch keine Bewertungen

- Yield CurveDokument3 SeitenYield CurveRochelle Anne OpinaldoNoch keine Bewertungen

- Group Members:: Comparison Between Bank AL Habib & Habib Metro BankDokument13 SeitenGroup Members:: Comparison Between Bank AL Habib & Habib Metro BankAbbas AliNoch keine Bewertungen

- HDFC Deposit FormDokument4 SeitenHDFC Deposit FormnaguficoNoch keine Bewertungen

- Website Disclosure Effective 30 Nov 2023Dokument3 SeitenWebsite Disclosure Effective 30 Nov 2023bggbggNoch keine Bewertungen

- BankingDokument4 SeitenBankingBhavin GhoniyaNoch keine Bewertungen

- HBL Asset Management FM LTD - PPTX UpdatedDokument16 SeitenHBL Asset Management FM LTD - PPTX UpdatedMisbah Khan100% (1)

- Atlas Investment CaseDokument3 SeitenAtlas Investment CaseCalypso StarsNoch keine Bewertungen

- Interest Rates For Fixed DepositsDokument2 SeitenInterest Rates For Fixed Depositssaurav katarukaNoch keine Bewertungen

- Yes Bank FD Rates - 5.6.21Dokument1 SeiteYes Bank FD Rates - 5.6.21Chandan SahaNoch keine Bewertungen

- Interest Rates For Fixed DepositsDokument2 SeitenInterest Rates For Fixed Depositssasi 'sNoch keine Bewertungen

- Excel FormatDokument38 SeitenExcel FormatSaad QureshiNoch keine Bewertungen

- Website Disclosure EffectiveDokument3 SeitenWebsite Disclosure EffectiveHimanshu MilanNoch keine Bewertungen

- FD Customer Leaflet-A4 - WEBDokument1 SeiteFD Customer Leaflet-A4 - WEBmyloan partnerNoch keine Bewertungen

- Week 2 Practice Questions SolutionDokument8 SeitenWeek 2 Practice Questions SolutionCaroline FrisciliaNoch keine Bewertungen

- Rates Declaration LCY FCY From Jul Dec16 6Dokument1 SeiteRates Declaration LCY FCY From Jul Dec16 6M Abbas JadoonNoch keine Bewertungen

- Slabs Profit Rate: Deposit and Prematurity RatesDokument1 SeiteSlabs Profit Rate: Deposit and Prematurity RatesJay KhanNoch keine Bewertungen

- Interest Rates For Fixed DepositsDokument2 SeitenInterest Rates For Fixed DepositsY_AZNoch keine Bewertungen

- FD Brochure Whatsapp Dec'2021Dokument1 SeiteFD Brochure Whatsapp Dec'2021dharam singhNoch keine Bewertungen

- UntitledDokument5 SeitenUntitledPhương Hiền NguyễnNoch keine Bewertungen

- PRUretirement GrowthDokument32 SeitenPRUretirement GrowthlongcyNoch keine Bewertungen

- FD Leaflet - A5 - 13 Dec 23Dokument2 SeitenFD Leaflet - A5 - 13 Dec 23Shaily SinhaNoch keine Bewertungen

- Interest Rates For Fixed DepositsDokument2 SeitenInterest Rates For Fixed DepositsV NaveenNoch keine Bewertungen

- Deposite Products 2015: Saving Product Interest Type Payable Frequency Saving Bank AccountDokument3 SeitenDeposite Products 2015: Saving Product Interest Type Payable Frequency Saving Bank AccountAbhishek ChoudharyNoch keine Bewertungen

- The Mathematics of Financial Models: Solving Real-World Problems with Quantitative MethodsVon EverandThe Mathematics of Financial Models: Solving Real-World Problems with Quantitative MethodsNoch keine Bewertungen

- Capital Markets - 8/15/2008Dokument2 SeitenCapital Markets - 8/15/2008Russell KlusasNoch keine Bewertungen

- Milwaukee - Office - 8/7/08Dokument4 SeitenMilwaukee - Office - 8/7/08Russell KlusasNoch keine Bewertungen

- Capital Alert - 8/29/2008Dokument1 SeiteCapital Alert - 8/29/2008Russell KlusasNoch keine Bewertungen

- Capital Alert - 8/22/2008Dokument1 SeiteCapital Alert - 8/22/2008Russell KlusasNoch keine Bewertungen

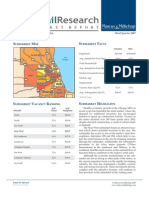

- Chicago - Industrial - 1/1/2008Dokument1 SeiteChicago - Industrial - 1/1/2008Russell KlusasNoch keine Bewertungen

- Milwaukee - South Milwaukee County Submarket - Retail - 10/1/2007Dokument2 SeitenMilwaukee - South Milwaukee County Submarket - Retail - 10/1/2007Russell KlusasNoch keine Bewertungen

- Chicago - Southwest Submarket - Retail - 1/1/2008Dokument2 SeitenChicago - Southwest Submarket - Retail - 1/1/2008Russell KlusasNoch keine Bewertungen

- DesMoines Submarket - Retail - 10/1/2007Dokument2 SeitenDesMoines Submarket - Retail - 10/1/2007Russell KlusasNoch keine Bewertungen

- Milwaukee - Retail Construction - 4/1/2008Dokument3 SeitenMilwaukee - Retail Construction - 4/1/2008Russell Klusas100% (1)

- Milwaukee - Retail - 4/1/2008Dokument4 SeitenMilwaukee - Retail - 4/1/2008Russell KlusasNoch keine Bewertungen

- Chicago - South Submarket - Retail - 7/1/2007Dokument2 SeitenChicago - South Submarket - Retail - 7/1/2007Russell KlusasNoch keine Bewertungen

- Indianapolis - Retail - 4/1/2008Dokument4 SeitenIndianapolis - Retail - 4/1/2008Russell Klusas100% (1)

- Chicago - Retail - 4/1/2008Dokument4 SeitenChicago - Retail - 4/1/2008Russell KlusasNoch keine Bewertungen

- Chicago - Near West Submarket - Retail - 7/1/2007Dokument2 SeitenChicago - Near West Submarket - Retail - 7/1/2007Russell KlusasNoch keine Bewertungen

- Indianapolis - Apartment - Construction - 4/1/2008Dokument3 SeitenIndianapolis - Apartment - Construction - 4/1/2008Russell Klusas100% (1)

- Evansville - Apartment - 1/1/2008Dokument2 SeitenEvansville - Apartment - 1/1/2008Russell KlusasNoch keine Bewertungen

- Analytical Chem Lab #3Dokument4 SeitenAnalytical Chem Lab #3kent galangNoch keine Bewertungen

- Introduction To BiogasDokument5 SeitenIntroduction To BiogasLouis EldertardNoch keine Bewertungen

- A Review of Service Quality ModelsDokument8 SeitenA Review of Service Quality ModelsJimmiJini100% (1)

- Case Study Single Sign On Solution Implementation Software Luxoft For Ping IdentityDokument5 SeitenCase Study Single Sign On Solution Implementation Software Luxoft For Ping IdentityluxoftNoch keine Bewertungen

- Alternative Network Letter Vol 7 No.1-Apr 1991-EQUATIONSDokument16 SeitenAlternative Network Letter Vol 7 No.1-Apr 1991-EQUATIONSEquitable Tourism Options (EQUATIONS)Noch keine Bewertungen

- Manual E07ei1Dokument57 SeitenManual E07ei1EiriHouseNoch keine Bewertungen

- Introduction To Retail LoansDokument2 SeitenIntroduction To Retail LoansSameer ShahNoch keine Bewertungen

- Student Management SystemDokument232 SeitenStudent Management Systemslu_mangal73% (37)

- Cyclic MeditationDokument8 SeitenCyclic MeditationSatadal GuptaNoch keine Bewertungen

- Specifications (018-001) : WarningDokument6 SeitenSpecifications (018-001) : WarningRómulo Simón Lizarraga LeónNoch keine Bewertungen

- JFC 180BBDokument2 SeitenJFC 180BBnazmulNoch keine Bewertungen

- Formula:: High Low Method (High - Low) Break-Even PointDokument24 SeitenFormula:: High Low Method (High - Low) Break-Even PointRedgie Mark UrsalNoch keine Bewertungen

- FE CH 5 AnswerDokument12 SeitenFE CH 5 AnswerAntony ChanNoch keine Bewertungen

- DION IMPACT 9102 SeriesDokument5 SeitenDION IMPACT 9102 SeriesLENEEVERSONNoch keine Bewertungen

- Building and Structural Construction N6 T1 2024 T2Dokument9 SeitenBuilding and Structural Construction N6 T1 2024 T2FranceNoch keine Bewertungen

- Ilocos Norte Youth Development Office Accomplishment Report 2Dokument17 SeitenIlocos Norte Youth Development Office Accomplishment Report 2Solsona Natl HS MaanantengNoch keine Bewertungen

- 24 DPC-422 Maintenance ManualDokument26 Seiten24 DPC-422 Maintenance ManualalternativblueNoch keine Bewertungen

- Angle Grinder Gws 7 100 06013880f0Dokument128 SeitenAngle Grinder Gws 7 100 06013880f0Kartik ParmeshwaranNoch keine Bewertungen

- EdisDokument227 SeitenEdisThong Chan100% (1)

- ResumeDokument3 SeitenResumeapi-280300136Noch keine Bewertungen

- Grid Pattern PortraitDokument8 SeitenGrid Pattern PortraitEmma FravigarNoch keine Bewertungen

- Matka Queen Jaya BhagatDokument1 SeiteMatka Queen Jaya BhagatA.K.A. Haji100% (4)

- Roxas City For Revision Research 7 Q1 MELC 23 Week2Dokument10 SeitenRoxas City For Revision Research 7 Q1 MELC 23 Week2Rachele DolleteNoch keine Bewertungen

- Instructions For Preparing Manuscript For Ulunnuha (2019 Template Version) Title (English and Arabic Version)Dokument4 SeitenInstructions For Preparing Manuscript For Ulunnuha (2019 Template Version) Title (English and Arabic Version)Lailatur RahmiNoch keine Bewertungen

- Smart Gas Leakage Detection With Monitoring and Automatic Safety SystemDokument4 SeitenSmart Gas Leakage Detection With Monitoring and Automatic Safety SystemYeasin Arafat FahadNoch keine Bewertungen

- Grade 9 Science Biology 1 DLPDokument13 SeitenGrade 9 Science Biology 1 DLPManongdo AllanNoch keine Bewertungen

- EVOM ManualDokument2 SeitenEVOM ManualHouston WhiteNoch keine Bewertungen

- 10 Killer Tips For Transcribing Jazz Solos - Jazz AdviceDokument21 Seiten10 Killer Tips For Transcribing Jazz Solos - Jazz Advicecdmb100% (2)

- Final WMS2023 HairdressingDokument15 SeitenFinal WMS2023 HairdressingMIRAWATI SAHIBNoch keine Bewertungen

- Semi Detailed Lesson PlanDokument2 SeitenSemi Detailed Lesson PlanJean-jean Dela Cruz CamatNoch keine Bewertungen