Beruflich Dokumente

Kultur Dokumente

Cash Flow Analysis: (Wavell Corporation) Year 1 2 3 4

Hochgeladen von

venkatmatsOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Cash Flow Analysis: (Wavell Corporation) Year 1 2 3 4

Hochgeladen von

venkatmatsCopyright:

Verfügbare Formate

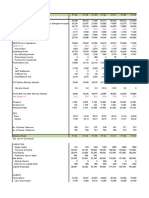

CASH FLOW ANALYSIS: (Wavell Corporation)

YEAR 1 2 3 4

EBIT 650,000 650,000 650,000 650,000

LESS: INTEREST 252,000 213,968 170,572 121,051

EBT 398,000 436,032 479,428 528,949

LESS:TAX@40% 159,200 174,413 191,771 211,580

NET INCOME 238,800 261,619 287,657 317,369

DEPRECIATION 119,976 119,976 119,976 119,976

CASH FLOW 358,776 381,595 407,632 437,345

PRINCIPAL REPAID 272,422 310,454 353,850 403,371

CASH FLOW CUSHION 86,354 71,141 53,782 33,974

EQUITY 200,000 438,800 700,419 988,076 1,305,445

DEBT 1,800,000 1,527,578 1,217,124 863,274 459,903

TOTAL ASSETS 2,000,000 1,966,378 1,917,543 1,851,350 1,765,348

% OF DEBT

TOTAL % OF RETURN 8.28367

1.526316

0.526316

payment to ins 537824

total equity 1656734

Firm/ Mnagement 1118910

NOTE

Mgmt

bv 100000

ev 1118910

% Return for the management 11.1891

1.62091048319002

0.620910483190018

5

650,000

64,519

585,481

234,192

351,289

119,976

471,264

459,903

11,361

1,656,734

0

1656734

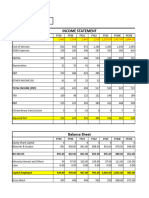

Estimated Equity Returns from Acquisition of PGM

LBO Method ( Levered)

Panel a:

Projected Net Income and Equity Free Cash Flow

Year 0 1 2 3 4 5

EBITDA 100 110 121 133.1 146.41 161.05

less: Depricaiation 40 45 50 55 60 65

EBIT 65 71 78.1 86.41 96.05

Interest 52.05 52.06 50.34 47.11 42.14

EBT 12.95 18.94 27.76 39.3 53.91

taxes @ 35% 4.5325 6.629 9.716 13.755 18.8685

Net Income 8.4175 12.311 18.044 25.545 35.0415

Calculation of EFCF

Das könnte Ihnen auch gefallen

- ATC Valuation - Solution Along With All The ExhibitsDokument20 SeitenATC Valuation - Solution Along With All The ExhibitsAbiNoch keine Bewertungen

- Investment (Valuation of Stock)Dokument9 SeitenInvestment (Valuation of Stock)Lim JaehwanNoch keine Bewertungen

- Ronak L & Yash FADokument9 SeitenRonak L & Yash FAronakNoch keine Bewertungen

- Particulars Mar 2019 Mar 2018 Mar 2017 Mar 2016 Mar 2015 .CR .CR .CR .CR .CRDokument12 SeitenParticulars Mar 2019 Mar 2018 Mar 2017 Mar 2016 Mar 2015 .CR .CR .CR .CR .CRChandan KumarNoch keine Bewertungen

- Data of BhartiDokument2 SeitenData of BhartiAnkur MehtaNoch keine Bewertungen

- Caso John Wilson Ramirez.Dokument5 SeitenCaso John Wilson Ramirez.Jose Alfredo BarriosNoch keine Bewertungen

- Alk SidoDokument2 SeitenAlk SidoRebertha HerwinNoch keine Bewertungen

- IFS - Simple Three Statement ModelDokument1 SeiteIFS - Simple Three Statement ModelThanh NguyenNoch keine Bewertungen

- FSA AssignmentDokument4 SeitenFSA AssignmentDharmil OzaNoch keine Bewertungen

- IFS Dividends IntroductionDokument2 SeitenIFS Dividends IntroductionMohamedNoch keine Bewertungen

- CV Assignment - Agneesh DuttaDokument14 SeitenCV Assignment - Agneesh DuttaAgneesh DuttaNoch keine Bewertungen

- BritanniaDokument4 SeitenBritanniaHiral JoshiNoch keine Bewertungen

- Term Paper Sandeep Anurag GautamDokument13 SeitenTerm Paper Sandeep Anurag GautamRohit JainNoch keine Bewertungen

- Financial InfoDokument4 SeitenFinancial InfoPawan SinghNoch keine Bewertungen

- Add Dep Less Tax OCF Change in Capex Change in NWC FCFDokument5 SeitenAdd Dep Less Tax OCF Change in Capex Change in NWC FCFGullible KhanNoch keine Bewertungen

- Financial Management II ProjectDokument11 SeitenFinancial Management II ProjectsimlimisraNoch keine Bewertungen

- TCS RATIO Calulations-1Dokument4 SeitenTCS RATIO Calulations-1reddynagendrapalle123Noch keine Bewertungen

- Atlas Honda Motor Company LimitedDokument10 SeitenAtlas Honda Motor Company LimitedAyesha RazzaqNoch keine Bewertungen

- Accounts (TCS Project) by Group 2Dokument8 SeitenAccounts (TCS Project) by Group 253Gunjan DubeyNoch keine Bewertungen

- 17 - Manoj Batra - Hero Honda MotorsDokument13 Seiten17 - Manoj Batra - Hero Honda Motorsrajat_singlaNoch keine Bewertungen

- Asian P & L CapitaTemplate1Dokument1 SeiteAsian P & L CapitaTemplate1vinoth_kannan149058Noch keine Bewertungen

- Company Finance Profit & Loss (Rs in CRS.) : Company: ACC LTD Industry: Cement - Major - North IndiaDokument26 SeitenCompany Finance Profit & Loss (Rs in CRS.) : Company: ACC LTD Industry: Cement - Major - North IndiaAbhinavSagarNoch keine Bewertungen

- Ratio Analysis TemplateDokument20 SeitenRatio Analysis TemplatenishantNoch keine Bewertungen

- Recap: Profitability:ROE - Dupont Solvency Capital Employed DER Debt/TA Interest Coverage RatioDokument7 SeitenRecap: Profitability:ROE - Dupont Solvency Capital Employed DER Debt/TA Interest Coverage RatioSiddharth PujariNoch keine Bewertungen

- Accounts Case Study On Ratio AnalysisDokument6 SeitenAccounts Case Study On Ratio AnalysisRADHIKA.J 19MCO033Noch keine Bewertungen

- Apollo Hospitals Enterprise LimitedDokument4 SeitenApollo Hospitals Enterprise Limitedpaigesh1Noch keine Bewertungen

- Contoh Simple FCFFDokument5 SeitenContoh Simple FCFFFANNY KRISTIANTINoch keine Bewertungen

- IFS - Simple Three Statement ModelDokument1 SeiteIFS - Simple Three Statement ModelMohamedNoch keine Bewertungen

- Data3 0Dokument18 SeitenData3 0huhu xadNoch keine Bewertungen

- Financial Statement AnalysisDokument25 SeitenFinancial Statement AnalysisAldrin CustodioNoch keine Bewertungen

- This Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksDokument32 SeitenThis Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksSukanya Shridhar 1 9 9 0 3 5Noch keine Bewertungen

- Balance Sheet (2009-2003) of TCS (US Format)Dokument15 SeitenBalance Sheet (2009-2003) of TCS (US Format)Girish RamachandraNoch keine Bewertungen

- Business - Valuation - Modeling - Assessment FileDokument6 SeitenBusiness - Valuation - Modeling - Assessment FileGowtham VananNoch keine Bewertungen

- Revenue 3. Net Revenue 5. Gross ProfitDokument3 SeitenRevenue 3. Net Revenue 5. Gross ProfitPhuong Anh NguyenNoch keine Bewertungen

- FMUE Group Assignment - Group 4 - Section B2CDDokument42 SeitenFMUE Group Assignment - Group 4 - Section B2CDyash jhunjhunuwalaNoch keine Bewertungen

- Ratio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDDokument9 SeitenRatio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDparika khannaNoch keine Bewertungen

- 29 - Tej Inder - Bharti AirtelDokument14 Seiten29 - Tej Inder - Bharti Airtelrajat_singlaNoch keine Bewertungen

- Financial Table Analysis of ZaraDokument9 SeitenFinancial Table Analysis of ZaraCeren75% (4)

- Bajaj Auto Financial StatementsDokument19 SeitenBajaj Auto Financial StatementsSandeep Shirasangi 986Noch keine Bewertungen

- Ultratech Cement LTD.: Total IncomeDokument36 SeitenUltratech Cement LTD.: Total IncomeRezwan KhanNoch keine Bewertungen

- CV Assignment - Agneesh DuttaDokument9 SeitenCV Assignment - Agneesh DuttaAgneesh DuttaNoch keine Bewertungen

- State Bank of India: Balance SheetDokument9 SeitenState Bank of India: Balance SheetKatta AshishNoch keine Bewertungen

- Valuation AssignmentDokument20 SeitenValuation AssignmentHw SolutionNoch keine Bewertungen

- Agneesh Dutta (PGFB2106) - Investment ManagementDokument71 SeitenAgneesh Dutta (PGFB2106) - Investment ManagementAgneesh DuttaNoch keine Bewertungen

- Apollo Hospitals Enterprise LimitedDokument10 SeitenApollo Hospitals Enterprise LimitedHemendra GuptaNoch keine Bewertungen

- Ratio Analysis: Balance Sheet of HPCLDokument8 SeitenRatio Analysis: Balance Sheet of HPCLrajat_singlaNoch keine Bewertungen

- 39828211-ValuationDokument13 Seiten39828211-ValuationDian AgustianNoch keine Bewertungen

- Financial Statements - TATA - MotorsDokument6 SeitenFinancial Statements - TATA - MotorsSANDHALI JOSHI PGP 2021-23 BatchNoch keine Bewertungen

- FS TRIALDokument7 SeitenFS TRIALJosephine ButalNoch keine Bewertungen

- 58 Annual Report 2009-2010 Performance Profile: Assets & Provision For Diminution in InvestmentDokument4 Seiten58 Annual Report 2009-2010 Performance Profile: Assets & Provision For Diminution in InvestmentKartheek DevathiNoch keine Bewertungen

- Income Statement of Mercantile Bank Limited and NRB Commercial BankDokument4 SeitenIncome Statement of Mercantile Bank Limited and NRB Commercial BankmahadiparvezNoch keine Bewertungen

- Financial Modelling CIA 2Dokument45 SeitenFinancial Modelling CIA 2Saloni Jain 1820343Noch keine Bewertungen

- For The Year Ended Year 1 Year 2 Year 3 Year 4: Income Statement ParticularsDokument5 SeitenFor The Year Ended Year 1 Year 2 Year 3 Year 4: Income Statement ParticularsTanya SinghNoch keine Bewertungen

- Balance Sheet - Subros: Optimistic Senario Normal ScenarioDokument9 SeitenBalance Sheet - Subros: Optimistic Senario Normal ScenarioAnonymous tgYyno0w6Noch keine Bewertungen

- V MartDokument44 SeitenV MartPankaj SankholiaNoch keine Bewertungen

- Profit and Loss AccountDokument4 SeitenProfit and Loss AccountprajapatisunilNoch keine Bewertungen

- DCF 3 CompletedDokument3 SeitenDCF 3 CompletedPragathi T NNoch keine Bewertungen

- Operating Lease Converter: InputsDokument44 SeitenOperating Lease Converter: InputsJosé Manuel EstebanNoch keine Bewertungen

- MIRTADokument18 SeitenMIRTAleylaNoch keine Bewertungen

- RitwickGoswami (4,6)Dokument3 SeitenRitwickGoswami (4,6)venkatmatsNoch keine Bewertungen

- Term4 GSTDokument30 SeitenTerm4 GSTvenkatmatsNoch keine Bewertungen

- Siddu 1Dokument3 SeitenSiddu 1venkatmatsNoch keine Bewertungen

- Depriciation Calculation Particulars Year 1 Year 2Dokument7 SeitenDepriciation Calculation Particulars Year 1 Year 2venkatmatsNoch keine Bewertungen

- ManasGoswami (4,3)Dokument3 SeitenManasGoswami (4,3)venkatmatsNoch keine Bewertungen

- Riddhi Dutta: Senior Opportunity Business AnalystDokument4 SeitenRiddhi Dutta: Senior Opportunity Business AnalystvenkatmatsNoch keine Bewertungen

- IndranilChatterjee (4,0)Dokument3 SeitenIndranilChatterjee (4,0)venkatmatsNoch keine Bewertungen

- KunalNagpal (4,0)Dokument3 SeitenKunalNagpal (4,0)venkatmatsNoch keine Bewertungen

- PremGautham (4,0)Dokument2 SeitenPremGautham (4,0)venkatmatsNoch keine Bewertungen

- Karthikarjun (0,3)Dokument2 SeitenKarthikarjun (0,3)venkatmatsNoch keine Bewertungen

- Krishnan SirDokument4 SeitenKrishnan SirvenkatmatsNoch keine Bewertungen

- Ashok LeylandDokument12 SeitenAshok LeylandvenkatmatsNoch keine Bewertungen

- DeepikaMendiratta (0,6)Dokument2 SeitenDeepikaMendiratta (0,6)venkatmatsNoch keine Bewertungen

- Income Tax PPT 120114083854 Phpapp01Dokument155 SeitenIncome Tax PPT 120114083854 Phpapp01Prâtèék ShâhNoch keine Bewertungen

- Inventory ManagementDokument3 SeitenInventory ManagementvenkatmatsNoch keine Bewertungen

- Particulars Oty Rate AmountDokument6 SeitenParticulars Oty Rate AmountvenkatmatsNoch keine Bewertungen

- B.tax+Case StudiesDokument19 SeitenB.tax+Case StudiesvenkatmatsNoch keine Bewertungen

- Mats Institute of Management & Entreprenuership (Mime) : A Study On "Legendary Investors"Dokument22 SeitenMats Institute of Management & Entreprenuership (Mime) : A Study On "Legendary Investors"venkatmatsNoch keine Bewertungen

- Inventory Management in Power IndustryDokument70 SeitenInventory Management in Power Industryvenkatmats100% (12)

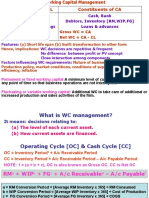

- Working Capital ManagementDokument10 SeitenWorking Capital ManagementvenkatmatsNoch keine Bewertungen

- Capital BudgetingDokument7 SeitenCapital BudgetingvenkatmatsNoch keine Bewertungen

- Information Sheet No. 1.3 1Dokument7 SeitenInformation Sheet No. 1.3 1Lav Casal CorpuzNoch keine Bewertungen

- Arev 420 Preliminary ExaminationDokument6 SeitenArev 420 Preliminary ExaminationLiza Magat MatadlingNoch keine Bewertungen

- Sales Less: Operating Expenses Opg Variable Expenses Opg Fixed Expenses Pbit Interest Fin Fixed Exp PBT TAX PAT EPSDokument102 SeitenSales Less: Operating Expenses Opg Variable Expenses Opg Fixed Expenses Pbit Interest Fin Fixed Exp PBT TAX PAT EPSAksh KhandelwalNoch keine Bewertungen

- Mock Test 1Dokument20 SeitenMock Test 1Quỳnh'ss Đắc'ssNoch keine Bewertungen

- Business Mathematics Worksheet Week 4Dokument6 SeitenBusiness Mathematics Worksheet Week 4300980 Pitombayog NHSNoch keine Bewertungen

- Preparation of Tax ReturnsDokument6 SeitenPreparation of Tax ReturnsChel GualbertoNoch keine Bewertungen

- IBF Short Notes Chapter 3Dokument4 SeitenIBF Short Notes Chapter 3Minhaj TariqNoch keine Bewertungen

- PGBPDokument6 SeitenPGBPamansachdeva994Noch keine Bewertungen

- ABM TextDokument6 SeitenABM TextPauline TayabanNoch keine Bewertungen

- AFAR QuestionnaireDokument7 SeitenAFAR QuestionnaireShenna Mae LibradaNoch keine Bewertungen

- Chapter 3. Finance Department 3.1 Essar Steel LTD.: 3.1.1 P&L AccountDokument8 SeitenChapter 3. Finance Department 3.1 Essar Steel LTD.: 3.1.1 P&L AccountT.Y.B68PATEL DHRUVNoch keine Bewertungen

- First Income Tax Quiz LetranDokument15 SeitenFirst Income Tax Quiz LetranAnselmo Rodiel IVNoch keine Bewertungen

- Adobe Scan Jan 26, 2023Dokument25 SeitenAdobe Scan Jan 26, 2023Rafael AbedesNoch keine Bewertungen

- The Reforms To Enhance Tax Culture in PakistanDokument2 SeitenThe Reforms To Enhance Tax Culture in PakistanAamir AliNoch keine Bewertungen

- Speech Debate 2 Negative Side - ECON103K - BDokument5 SeitenSpeech Debate 2 Negative Side - ECON103K - BUnited PaguntalansNoch keine Bewertungen

- (No Key) FINAL EXAMINATION IN ENTREPRENEURIAL MANAGEMENTDokument6 Seiten(No Key) FINAL EXAMINATION IN ENTREPRENEURIAL MANAGEMENTAngelie AnilloNoch keine Bewertungen

- Module-2 Session-1-National Income - Concepts and MeasurementsDokument28 SeitenModule-2 Session-1-National Income - Concepts and MeasurementsROY PAULNoch keine Bewertungen

- Instructions: Cpa Review School of The PhilippinesDokument17 SeitenInstructions: Cpa Review School of The PhilippinesCyn ThiaNoch keine Bewertungen

- FIMA 30013 FS Analysis Premium Notes P1Dokument5 SeitenFIMA 30013 FS Analysis Premium Notes P1dcdeguzman.pup.pulilanNoch keine Bewertungen

- Solution Aassignments CH 9Dokument10 SeitenSolution Aassignments CH 9RuturajPatilNoch keine Bewertungen

- Practice HW CH 2 FA21 (25 Ed)Dokument4 SeitenPractice HW CH 2 FA21 (25 Ed)Thomas TermoteNoch keine Bewertungen

- Payslip - 1Dokument1 SeitePayslip - 1bktsuna0201Noch keine Bewertungen

- Accenture - 1 B Com ProfileDokument7 SeitenAccenture - 1 B Com ProfileTHIMMAIAH B CNoch keine Bewertungen

- Rules (Amendment) On The Income Tax Act of The Kingdom of Bhutan 2001 - Fifth EditionDokument198 SeitenRules (Amendment) On The Income Tax Act of The Kingdom of Bhutan 2001 - Fifth EditionKuenga GeltshenNoch keine Bewertungen

- TH HĐNSV Buổi 5Dokument2 SeitenTH HĐNSV Buổi 5Dỹ KhangNoch keine Bewertungen

- Income Tax Question BankDokument8 SeitenIncome Tax Question Banksurya.notes19Noch keine Bewertungen

- Chap 2 Financial AnalysisDokument43 SeitenChap 2 Financial AnalysisGizachew AlazarNoch keine Bewertungen

- Taxation Chapter 5 - 8Dokument117 SeitenTaxation Chapter 5 - 8Hồng Hạnh NguyễnNoch keine Bewertungen

- Sol-Lecture Ques - MOODLEDokument15 SeitenSol-Lecture Ques - MOODLERami RRKNoch keine Bewertungen

- Accounting 199-Accounting For Problem Solving Assignment #2 Professor Peter DemerjianDokument5 SeitenAccounting 199-Accounting For Problem Solving Assignment #2 Professor Peter DemerjianEvelyn B. YareNoch keine Bewertungen