Beruflich Dokumente

Kultur Dokumente

Income Statement (Updated)

Hochgeladen von

Val John L. BaacOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Income Statement (Updated)

Hochgeladen von

Val John L. BaacCopyright:

Verfügbare Formate

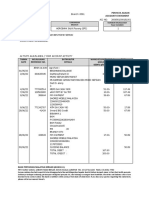

Sumango™

Projected Income Statement

November 1, 2010 –January 31,2010

Income

Gross Sales Php 144,000

Cost of Goods Sold (Php 72,000 )

Gross Profit Php 72,000

(Expenses)

Rent expense Php 33,000

Overhead costs and allowances Php 6,000

Advertising Php 304

Total Expenses (Php 39, 304)

Net Income Php 32,696

Explanations and computations

Composition of Gross Sales "300 pcs. Of Sumango , sold at 2 for Php 40 for 24 selling days for/in 3 months

then 24 selling days = ( 12 selling days outside of school + 12 selling days in school)

300 is Halved = as the real number of units "sold"

300 pcs. Of Sumango ,sold at "package/bulk deal" of ; 2 Sumangoes for a total of only Php 40

300pcs. Of Sumangoes / 2 = 150 pcs of Sumangoes actually "sold" @ Php 40

thus: Gross sales = 150 pcs. Of Sumangoes @ Php 40 =Php 6000

Php 6,000 x 24 selling days = Php 144,000

Cost of Goods Sold 300 pcs @ Php 10 per piece for four weekend days

thus 300 x 10 = Php 3000

then 24 selling days = ( 12 selling days outside of school + 12 selling days in school)

thus 3000 x 24 = Php 72,000

Rent expense Rent expense

Emporia Bazaar

Rate: Php 5,500 for 4 days; Php 1,375/day

Selling days total 24 days

Rate of Php 1,375 x 24 selling days = P33,000

Overhead costs and allowances Includes Gas and transportation expenses for pick-up and delivery of order to selling location)

Advertising Advertising expense does not accrue or generate every month

since we will only be expending for Printing and Photocopying of Fliers

Printing of Php 4 (one copy only) and Photo Copying Php 1 multiplied to 300 copies

Thus: Php 4 + ( Php 1 x 300 copies of Fliers ) = Php 304

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Procedure For Identification of Aspect Impact & HIRADokument1 SeiteProcedure For Identification of Aspect Impact & HIRAArjun Rathore100% (2)

- Acca F5Dokument133 SeitenAcca F5Andin Lee67% (3)

- GroupeAriel S.ADokument3 SeitenGroupeAriel S.AEina GuptaNoch keine Bewertungen

- BMA4106 Investment and Asset Management Lecture 2Dokument21 SeitenBMA4106 Investment and Asset Management Lecture 2Dickson OgendiNoch keine Bewertungen

- C4 - OverheadDokument23 SeitenC4 - OverheadSITI NUR LYANA YAHYANoch keine Bewertungen

- Jun 2022Dokument1 SeiteJun 2022aiman marwanNoch keine Bewertungen

- C1H021021 - Almas Delian - Resume MIS Bab 1Dokument2 SeitenC1H021021 - Almas Delian - Resume MIS Bab 1Almas DelianNoch keine Bewertungen

- Non Citizen Property Restriction ActDokument3 SeitenNon Citizen Property Restriction ActVishwajeet UjhoodhaNoch keine Bewertungen

- C V Umair ShahidDokument5 SeitenC V Umair ShahidHaris HafeezNoch keine Bewertungen

- Compiled By: Tanveer M Malik (17122) Atif Abbas Faizan Puri - 13368 MaheshDokument38 SeitenCompiled By: Tanveer M Malik (17122) Atif Abbas Faizan Puri - 13368 MaheshM.TalhaNoch keine Bewertungen

- SWDokument1 SeiteSWAnne BustilloNoch keine Bewertungen

- Subhasis CV FP&ADokument3 SeitenSubhasis CV FP&Asubhasis7689Noch keine Bewertungen

- Balance Sheet For Mahindra & Mahindra Pvt. LTD.: Assets Amount (In Crores) Non-Current AssetsDokument32 SeitenBalance Sheet For Mahindra & Mahindra Pvt. LTD.: Assets Amount (In Crores) Non-Current AssetsAniketNoch keine Bewertungen

- Accreditation Is Not:: Benefits of Accreditation To The Accredited Conformity Assessment BodyDokument5 SeitenAccreditation Is Not:: Benefits of Accreditation To The Accredited Conformity Assessment BodyFanilo RazafindralamboNoch keine Bewertungen

- How To Succeed at Retail - Winning Case Studies and Strategies For Retailers and Brands PDFDokument224 SeitenHow To Succeed at Retail - Winning Case Studies and Strategies For Retailers and Brands PDFPrashant SinghNoch keine Bewertungen

- Class Presentation CS502226 ClassPresentation CS502226 RoigEscolano AU2022Dokument42 SeitenClass Presentation CS502226 ClassPresentation CS502226 RoigEscolano AU2022mohamed nouhNoch keine Bewertungen

- Product Management Maturity Model: Tools LeadershipDokument1 SeiteProduct Management Maturity Model: Tools LeadershipAlexandre NascimentoNoch keine Bewertungen

- Chapter 6 ReceivablesDokument8 SeitenChapter 6 ReceivablesHaileluel WondimnehNoch keine Bewertungen

- Economic Environment of Business Mini ProjectDokument19 SeitenEconomic Environment of Business Mini Projectpankajkapse67% (3)

- B2C Cross-Border E-Commerce Export Logistics ModeDokument7 SeitenB2C Cross-Border E-Commerce Export Logistics ModeVoiceover SpotNoch keine Bewertungen

- Budget Circular No 2018 4 PDFDokument245 SeitenBudget Circular No 2018 4 PDFJoey Villas MaputiNoch keine Bewertungen

- Global Location Strategy For Automotive SuppliersDokument24 SeitenGlobal Location Strategy For Automotive SuppliersJia XieNoch keine Bewertungen

- Libro Azul de ApproDokument46 SeitenLibro Azul de ApproEduard MartiNoch keine Bewertungen

- The Guide - LCMDokument25 SeitenThe Guide - LCMMansi NaikNoch keine Bewertungen

- BridgestoneDokument1 SeiteBridgestoneRam JainNoch keine Bewertungen

- External Factor EvaluationDokument8 SeitenExternal Factor EvaluationRobert ApolinarNoch keine Bewertungen

- Effect of Merger and Acqusition On The Financial Performance of Deposit Money Banks in Nigeria (A Study of Access Bank PLC)Dokument50 SeitenEffect of Merger and Acqusition On The Financial Performance of Deposit Money Banks in Nigeria (A Study of Access Bank PLC)Feddy Micheal FeddyNoch keine Bewertungen

- Residual Income and Business Unit Profitability AnalysisDokument7 SeitenResidual Income and Business Unit Profitability AnalysisLealyn CuestaNoch keine Bewertungen

- June 2015 QP - Paper 1 Edexcel Economics IGCSEDokument24 SeitenJune 2015 QP - Paper 1 Edexcel Economics IGCSEShibraj DebNoch keine Bewertungen

- Case Study Analysis Graphic OrganizerDokument3 SeitenCase Study Analysis Graphic OrganizerAshwinKumarNoch keine Bewertungen