Beruflich Dokumente

Kultur Dokumente

Tax Calculator 2010 11

Hochgeladen von

Sanjay DasCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Tax Calculator 2010 11

Hochgeladen von

Sanjay DasCopyright:

Verfügbare Formate

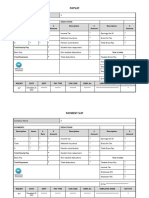

Fill the Details in WHITE COLORED CELLS only

COMPUTATION OF TOTAL TAXABLE INCOME FOR THE PERIOD 01.04.2010 TO 31.03.2011

Yearly Figure Yearly

(i.e. Figure

SALARY DETAILS =Monthly INVESTMENTS DETAILS ( Same as in

Amount * No. Declaration

of Months) Form)

BASIC SALARY *LIC Premium Paid

HRA * Mutual Fund (ELSS)

SPECIAL ALLOWANCE *NSC -

HOME TRAVEL ALLOWANCE *Interest on NSC -

TOTAL - *Housing Loan Repayment -

P.F *Provident Fund -

P.TAX *Pension Fund (80CCC) -

T. D. S *Public Provident Fund -

NET SALARY - *Infrastructure Bond -

Personal Details *Unit Linked Insurance Plan -

Name *Tution Fees for children -

PAN *Fixed Deposits With Bank -

Date of joining *Stamp Duty/Registration

fees paid for the House

*5 Year Time Deposit Under

Male(M)/ Female(F) (fill the cell) property during the year

Postoffice Time Deposit Rule

1984 -

* House Rent : (Rent p.m * No. of Months) Total -

*Long Term Infrastructure Bond

*Medical Ins(Mediclaim)

YOUR TOTAL TAX LIABILITY - *Interest on Education loan

TAX ALREADY DEDUCTED - *Interest on House Loan

FURTHER TAX TO BE DEDUCTED - *Maintenance of physically

REFUND OF TAX - challenged dependent

Income Tax Computation Sheet

(Informations will come Automatically . Donot Fill here)

ASSESSMENT YEAR 2010-2011

COMPUTATION OF INCOME

INCOME FROM SALARY:-

Basic Salary -

Special Allowance -

House Rent Allowance

Less: Exemption (least of the following) -

Actual amount received -

50% of Basic Salary -

Rent paid in excess of 10% of salary -

- -

Conveyance Allowance -

Less: Exempt - -

Gross Salary -

Less: Professional Tax u/s 16(iii) - -

Gross income -

Less: Deduction u/s 24 ( House Loan Interest) - -

Gross total income -

Less: Deduction u/s 80D -

Deduction u/s 80DD -

Deduction u/s 80E -

Deduction u/s 80CCF -

Deduction u/s 80C & 80CCC

LIC Premium -

NSC -

Interest on NSC -

Housing Loan Repayment -

Provident Fund -

Mutual Fund -

Public Provident Fund -

Infrastructure Bond -

Unit Linked Insurance Plan -

Tution Fees for children -

Fixed Deposits With Bank -

Stamp Duty/Registration fees paid for the

House property during the year -

Pension Fund (80CCC) -

5 Year Time Deposit Under Postoffice Time Deposit Rule -

- - -

Total income -

Rounded Off -

COMPUTATION OF TAX:-

Income Tax -

Total Tax -

Add : Surcharge

Add : Education Cess @3% -

-

Prepaid Taxes Paid by way of TDS -

Total Tax Liability -

Balance payable/(refundable) -

Das könnte Ihnen auch gefallen

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsVon Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsNoch keine Bewertungen

- Chapter 4 Income TaxDokument1 SeiteChapter 4 Income TaxLhorene Hope DueñasNoch keine Bewertungen

- New Income Tax Calculator for Old & New Tax Regime for Salaried EmployeeDokument4 SeitenNew Income Tax Calculator for Old & New Tax Regime for Salaried EmployeeKiran KumarNoch keine Bewertungen

- It 23-24Dokument5 SeitenIt 23-24Alok G ShindeNoch keine Bewertungen

- PFMDokument42 SeitenPFMRavi PandeyNoch keine Bewertungen

- PayslipDokument4 SeitenPayslipmrfayaNoch keine Bewertungen

- RENT, DIVIDEND, AND OTHER INCOME DETAILSDokument1 SeiteRENT, DIVIDEND, AND OTHER INCOME DETAILSLhorene Hope DueñasNoch keine Bewertungen

- Before Going To The Next (T C) Sheet, First Read The Following InstructionsDokument16 SeitenBefore Going To The Next (T C) Sheet, First Read The Following InstructionsGopal KasatNoch keine Bewertungen

- Form 16Dokument4 SeitenForm 16Rakesh KumarNoch keine Bewertungen

- Visit To File Your Income Tax Return: S.NO. Particulars Amount (In RS.)Dokument4 SeitenVisit To File Your Income Tax Return: S.NO. Particulars Amount (In RS.)Sandeep SinghNoch keine Bewertungen

- 2021 GeneralDokument8 Seiten2021 GeneralWajiha HaroonNoch keine Bewertungen

- ITR 1 Excel Sheet To Download OnlyDokument6 SeitenITR 1 Excel Sheet To Download OnlyRahul Kumar100% (1)

- Income Tax Calculator FY 2023 24Dokument1 SeiteIncome Tax Calculator FY 2023 24Balamurali KirankumarNoch keine Bewertungen

- Income Tax Calculator For FY 2022-23 & 2023-24 AY 2023-24 & 2024-25Dokument134 SeitenIncome Tax Calculator For FY 2022-23 & 2023-24 AY 2023-24 & 2024-25Vipul SharmaNoch keine Bewertungen

- Mat CalculaterDokument1 SeiteMat CalculatershriniskNoch keine Bewertungen

- Enter Income Details in This Sheet To Know Your Tax Liability in The Next SheetDokument3 SeitenEnter Income Details in This Sheet To Know Your Tax Liability in The Next SheetSuryaprakashNoch keine Bewertungen

- Notes - Income From SalaryDokument13 SeitenNotes - Income From SalarySajan N ThomasNoch keine Bewertungen

- Budget 12thDokument1 SeiteBudget 12thAbhi MohitNoch keine Bewertungen

- Chart Showing Computation of 'Salary' IncomeDokument3 SeitenChart Showing Computation of 'Salary' IncomeRocky RkNoch keine Bewertungen

- Lecture 4to9 - SalaryDokument15 SeitenLecture 4to9 - SalaryVandana VaidyaNoch keine Bewertungen

- Worksheet: Getting StartedDokument4 SeitenWorksheet: Getting StartedAndrewNoch keine Bewertungen

- Declaration Form (23-24) - NMPLDokument1 SeiteDeclaration Form (23-24) - NMPLRamamoorthy RamuNoch keine Bewertungen

- Income Tax Calculator For F.YDokument8 SeitenIncome Tax Calculator For F.YRavindra BagateNoch keine Bewertungen

- Personal Financial StatementDokument2 SeitenPersonal Financial StatementDiane PilonNoch keine Bewertungen

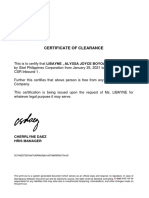

- Certificate of Clearance: Cherrlyne Daez Hris ManagerDokument2 SeitenCertificate of Clearance: Cherrlyne Daez Hris ManagerFernan MacusiNoch keine Bewertungen

- ACTAX-3153-N002-Intro To Income Taxation PDFDokument5 SeitenACTAX-3153-N002-Intro To Income Taxation PDFJwyneth Royce DenolanNoch keine Bewertungen

- Income Tax Form Guide for 2006-07Dokument9 SeitenIncome Tax Form Guide for 2006-07Chalan B SNoch keine Bewertungen

- Income Tax Calculator For F.Y 2021 22 A.Y 2022 23 ArthikDishaDokument8 SeitenIncome Tax Calculator For F.Y 2021 22 A.Y 2022 23 ArthikDishaKunal KhandualNoch keine Bewertungen

- Residency StatusDokument13 SeitenResidency StatusPhương NguyễnNoch keine Bewertungen

- Report Writing-03Dokument1 SeiteReport Writing-03Abdullah Al-naser EmonNoch keine Bewertungen

- Rudraksh Sharma Emp Code I1015 Pay Slip For Novmber 2022Dokument1 SeiteRudraksh Sharma Emp Code I1015 Pay Slip For Novmber 2022Vipul TyagiNoch keine Bewertungen

- Rudraksh Sharma Emp Code I1015 Pay Slip For Decl 2022Dokument1 SeiteRudraksh Sharma Emp Code I1015 Pay Slip For Decl 2022Vipul TyagiNoch keine Bewertungen

- TAX 1 - Gross ProfitDokument3 SeitenTAX 1 - Gross ProfitPacaña, Vincent Michael M.Noch keine Bewertungen

- Lumbera NotesDokument41 SeitenLumbera Notesthinkbeforeyoutalk67% (3)

- Inancial Lanning Orksheet: Statement of Net WorthDokument9 SeitenInancial Lanning Orksheet: Statement of Net WorthKevin Baladad100% (1)

- Irect Axes Ypes: Mrunal's Economy Pillar#2A: Budget Revenue Part Tax-Receipts Page 116Dokument3 SeitenIrect Axes Ypes: Mrunal's Economy Pillar#2A: Budget Revenue Part Tax-Receipts Page 116Washim Alam50CNoch keine Bewertungen

- Tax Calculator 7.1 (T) 2012 13Dokument17 SeitenTax Calculator 7.1 (T) 2012 13karthickNoch keine Bewertungen

- Itr 2 in Excel Format With Formula For A.Y. 2010 11Dokument12 SeitenItr 2 in Excel Format With Formula For A.Y. 2010 11Shakeel sheoranNoch keine Bewertungen

- TDSDokument3 SeitenTDSpeteno5623Noch keine Bewertungen

- Score Financial Spreadsheet TemplateDokument29 SeitenScore Financial Spreadsheet TemplateMohamed Shaffaf Ali RasheedNoch keine Bewertungen

- CASHFLOW The Board Game Personal Financial StatementDokument1 SeiteCASHFLOW The Board Game Personal Financial StatementGejehNoch keine Bewertungen

- CASHFLOW The Board Game Personal Financial Statement PDFDokument1 SeiteCASHFLOW The Board Game Personal Financial Statement PDFfpenalozal100% (1)

- CASHFLOW The Board Game Personal Financial StatementDokument1 SeiteCASHFLOW The Board Game Personal Financial StatementCarl SoriaNoch keine Bewertungen

- CASHFLOW The Board Game Personal Financial StatementDokument1 SeiteCASHFLOW The Board Game Personal Financial StatementKNNoch keine Bewertungen

- CASHFLOW The Board Game Personal Financial StatementDokument1 SeiteCASHFLOW The Board Game Personal Financial StatementUtiyyalaNoch keine Bewertungen

- CASHFLOW The Board Game Personal Financial Statement PDFDokument1 SeiteCASHFLOW The Board Game Personal Financial Statement PDFfpenalozalNoch keine Bewertungen

- CASHFLOW The Board Game Personal Financial Statement PDFDokument1 SeiteCASHFLOW The Board Game Personal Financial Statement PDFCarl SoriaNoch keine Bewertungen

- CASHFLOW JuegoDokument1 SeiteCASHFLOW JuegoRebeca Valverde DelgadoNoch keine Bewertungen

- CASHFLOW The Board Game Personal Financial Statement PDFDokument1 SeiteCASHFLOW The Board Game Personal Financial Statement PDFArifNoch keine Bewertungen

- CASHFLOW The Board Game Personal Financial StatementDokument1 SeiteCASHFLOW The Board Game Personal Financial StatementKakz KarthikNoch keine Bewertungen

- Employees Proof Submission Form (EPSF) - 2010-11Dokument1 SeiteEmployees Proof Submission Form (EPSF) - 2010-11amararenaNoch keine Bewertungen

- Income TaxDokument79 SeitenIncome TaxRaj HanumanteNoch keine Bewertungen

- Financial Act 2Dokument1 SeiteFinancial Act 2Kashif AliNoch keine Bewertungen

- DownloadDokument6 SeitenDownloadpankhewalegNoch keine Bewertungen

- 2018 07 26 08 12 24 532 - 1926212275 - PDFDokument6 Seiten2018 07 26 08 12 24 532 - 1926212275 - PDFRAKESHNoch keine Bewertungen

- Tax & TDS Calculation From Salary Income (20-21 Assess Year) - ShortDokument17 SeitenTax & TDS Calculation From Salary Income (20-21 Assess Year) - ShortMohammad Shah Alam ChowdhuryNoch keine Bewertungen

- Employee Provident FundDokument4 SeitenEmployee Provident Fundhr.prefortuneNoch keine Bewertungen

- Risk Rating Model - BlankDokument23 SeitenRisk Rating Model - BlankpaozinNoch keine Bewertungen

- Salary Slip Format 6 1Dokument1 SeiteSalary Slip Format 6 1siva reddyNoch keine Bewertungen

- Income Tax Option Cum Declaration Form (2022 2023)Dokument4 SeitenIncome Tax Option Cum Declaration Form (2022 2023)kkkNoch keine Bewertungen

- Electronica Finance Limited: Designing The Future of Micro, Small, and Medium EnterprisesDokument11 SeitenElectronica Finance Limited: Designing The Future of Micro, Small, and Medium EnterprisesSamadarshi SiddharthaNoch keine Bewertungen

- 1.cash Flow Material - T S Grewal 01.12.2018Dokument78 Seiten1.cash Flow Material - T S Grewal 01.12.2018Upendra bhati100% (1)

- Res Judicata Bars Second Suit Over Same Land SaleDokument2 SeitenRes Judicata Bars Second Suit Over Same Land SaleCari Mangalindan MacaalayNoch keine Bewertungen

- The Asian Currency Crisis: A Case StudyDokument7 SeitenThe Asian Currency Crisis: A Case StudyTantanLeNoch keine Bewertungen

- Schedule C Income and DeductionsDokument29 SeitenSchedule C Income and DeductionsReese Parker20% (5)

- Bar Questions in Credit TransactionsDokument3 SeitenBar Questions in Credit TransactionsMay Chan100% (1)

- Grove Isle Savings & Loan Is Paying 6% Interest Compounded Monthly. How Much Will $100 Deposited at The End of Each Month Be Worth After 2 Years?Dokument8 SeitenGrove Isle Savings & Loan Is Paying 6% Interest Compounded Monthly. How Much Will $100 Deposited at The End of Each Month Be Worth After 2 Years?Gabby NattyNoch keine Bewertungen

- Sales Law Case Review NotesDokument8 SeitenSales Law Case Review NotesMIKE OGADNoch keine Bewertungen

- AssignmentDokument5 SeitenAssignmentPrashanthRameshNoch keine Bewertungen

- Eblr Switch Over FormatDokument2 SeitenEblr Switch Over FormatMontu Bhai59% (17)

- Sujitha Resume Underwriter ExperienceDokument3 SeitenSujitha Resume Underwriter ExperienceAnil Kumar SadanaNoch keine Bewertungen

- Management Management ManagementDokument113 SeitenManagement Management Managementalizah khadarooNoch keine Bewertungen

- Suzanne Mellen, HVS: Hotel Values and Cap RatesDokument29 SeitenSuzanne Mellen, HVS: Hotel Values and Cap RatesJefferMangelsNoch keine Bewertungen

- Tax File Number Declaration Form PDFDokument1 SeiteTax File Number Declaration Form PDFAzamNoch keine Bewertungen

- SteinhoffDokument18 SeitenSteinhoffBusinessTechNoch keine Bewertungen

- Tampakan Copper and Gold Mine Project PDFDokument6 SeitenTampakan Copper and Gold Mine Project PDFRene Raymond NotoApeco RanesesNoch keine Bewertungen

- Basic Concepts of Trade FinanceDokument18 SeitenBasic Concepts of Trade Financecityboy77Noch keine Bewertungen

- Mortel vs. BrundigeDokument12 SeitenMortel vs. BrundigeElvin BauiNoch keine Bewertungen

- Sarah ReviewerDokument20 SeitenSarah ReviewerdoraemoanNoch keine Bewertungen

- Tuason v. MachucaDokument2 SeitenTuason v. MachucaAdi CruzNoch keine Bewertungen

- Altus Group 19 Canadian Cost Guide Final 2Dokument22 SeitenAltus Group 19 Canadian Cost Guide Final 2k100% (1)

- Special ContractsDokument4 SeitenSpecial ContractsATBNoch keine Bewertungen

- Response To SGX Queries and Letter To The Editor of Business TimesDokument5 SeitenResponse To SGX Queries and Letter To The Editor of Business TimesWeR1 Consultants Pte LtdNoch keine Bewertungen

- Chapter 7 Advacc 1 DayagDokument31 SeitenChapter 7 Advacc 1 Dayagchangevela83% (6)

- BF Assign1Dokument3 SeitenBF Assign1Mian Shawal67% (3)

- US - Bank - Amended - 110328 WDokument24 SeitenUS - Bank - Amended - 110328 WDinSFLANoch keine Bewertungen

- Beating The Bear - Lessons From The 1929 Crash Applied To Today's WorldDokument224 SeitenBeating The Bear - Lessons From The 1929 Crash Applied To Today's Worldkjkl3469Noch keine Bewertungen

- How To Open PPF AccountDokument6 SeitenHow To Open PPF Accountnitinsharma1984Noch keine Bewertungen

- Funds Flow StatementDokument4 SeitenFunds Flow Statementsoumya_2688Noch keine Bewertungen

- Purchasing Debt June 2018Dokument2 SeitenPurchasing Debt June 2018dcd528Noch keine Bewertungen