Beruflich Dokumente

Kultur Dokumente

Hire purchase and installment sale transactions explained

Hochgeladen von

Shwetta GogawaleOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Hire purchase and installment sale transactions explained

Hochgeladen von

Shwetta GogawaleCopyright:

Verfügbare Formate

Log on to: http://azzeeweb.co.

cc 1

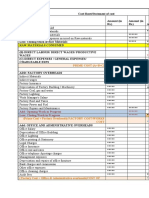

HIRE PURCHASE AND INSTALLMENT SALE TRANSACTIONS

TYPES OF PRICES

Cost Price Cash Price Hire Purchase Price

HIRE PURCHASE BUSINESS/TRANSACTIONS

1. SUBSTANTIAL VALUE GOODS/SALES 2. SMALL VALUE GOODS/SALES

I. Cash Price Method I. Debtors Method

II. Interest Suspense Method II. Stock and Debtors Method

IN THE BOOKS OF HIRE PURCHASER (Substantial Value Goods/Sales)

1. SUBSTANTIAL VAULE GOODS/SALES Note: Substantial Value Goods is referred for expensive Goods

I. CASH PRICE METHOD:-

JOURNAL ENTRIES

In the Books of HIRE PURCHASER

S.NO. PARTICULARS DR. CR.

1. (When Assets are purchased on Hire Purchase System)

Assets A/c

***

To Hire Vendor’s A/c

***

2. (When Down Payment is made)

Hire Vendor’s A/c

***

To Bank A/c

***

3. (When Interest on Hire Purchase installment becomes Due)

Interest on Hire Purchase A/c

***

To Hire Vendor’s A/c

***

4. (When Installment on Hire Purchase is paid)

Hire Vendor A/c

***

To Bank A/c

***

5. (When Depreciation is charged on Assets)

Depreciation A/c

***

To Assets A/c

***

6. (When Interest on Hire Purchase and Depreciation are transferred to Profit

and Loss Account)

Profit and Loss A/c ***

To Interest on Hire Purchase A/c ***

To Depreciation A/c ***

Created by Azharuddin Khan under Guidance of Mr. Intakhab Ahmad (BVA)

Log on to: http://azzeeweb.co.cc 2

1. SUBSTANTIAL VALUE GOODS/SALES---------------CASH PRICE METHOD

LEDGERS

In the Books of Hire Purchaser

HIRE VENDOR’S ACCOUNT

Date Particulars Amt. Date Particulars Amt.

1st Yrs To Bank A/c (Down Payment) *** 1st Yrs By Assets ***

““ To Bank A/c (1st Installment) *** ““ By Interest on Hire Purchase A/c ***

[(Assets-Down Payment)*R%]

““ To Balance c/d ***

### ###

2nd Yrs nd

To Bank A/c (2 Installment) *** 2nd Yrs By Balance b/d ***

““ To Balance c/d *** ““ By Interest on Hire Purchase A/c ***

### ###

rd rd

3 Yrs To Bank A/c (Final Installment) *** 3 Yrs By Balance b/d ***

By Interest on Hire Purchase A/c ***

### ###

Note:

Interest is always calculated on Balance Amount if there is down payment than the interest is calculated

for first Installment after deduction of Down Payment.

Interest can never become a part of Assets that’s why assets are shown on Cash Price.

Liability Decreases shown in Debit side of Hire Vendor’s A/c and

Liability Increases shown in Credit side of Hire Vendor’s A/c

ASSETS ACCOUNT

Date Particulars Amt. Date Particulars Amt.

1st Yrs To Hire Vendor’s A/c *** 1st Yrs By Depreciation A/c ***

*** ““ By Balance c/d ***

### ###

2nd Yrs To Balance b/d *** 2nd Yrs By Depreciation A/c ***

*** ““ By Balance c/d ***

### ###

rd rd

3 Yrs To Balance b/d *** 3 Yrs By Depreciation A/c ***

““ By Balance c/d ***

### ###

4th Yrs To Balance b/d ***

INTEREST ON HIRE PURCHASE ACCOUNT

Date Particulars Amt. Date Particulars Amt.

1st Yrs To Hire Vendor’s A/c *** 1st Yrs By Profit and Loss A/c ***

nd nd

2 Yrs To Hire Vendor’s A/c *** 2 Yrs By Profit and Loss A/c ***

rd rd

3 Yrs To Hire Vendor’s A/c *** 3 Yrs By Profit and Loss A/c ***

Created by Azharuddin Khan under Guidance of Mr. Intakhab Ahmad (BVA)

Log on to: http://azzeeweb.co.cc 3

DEPRECIATION ACCOUNT

Date Particulars Amt. Date Particulars Amt.

1st Yrs To Assets A/c *** 1st Yrs By Profit and Loss A/c ***

2nd Yrs To Assets A/c *** 2nd Yrs By Profit and Loss A/c ***

rd rd

3 Yrs To Assets A/c *** 3 Yrs By Profit and Loss A/c ***

Note: When amount are same of both sides just draw double line and close the year.

1. SUBSTANTIAL VAULE GOODS/SALES

II. INTEREST SUSPENSE METHOD:-

JOURNAL ENTRIES

In the Books of HIRE PURCHASER

S.NO. PARTICULARS DR. CR.

1. (When Assets are purchased on Hire Purchase System)

Assets A/c

***

To Hire Vendor’s A/c

***

2. (When Down Payment is made)

Hire Vendor’s A/c

***

To Bank A/c

***

3. (When Total Interest becomes Due)

Interest Suspense A/c

To Hire Vendor’s A/c

4. (When Interest on Hire Purchase installment is charged)

Interest on Hire Purchase A/c

***

To Interest Suspense A/c

***

5. (When Installment on Hire Purchase is paid)

Hire Vendor A/c

***

To Bank A/c

***

6. (When Depreciation is charged on Assets)

Depreciation A/c

***

To Assets A/c

***

7. (When Interest on Hire Purchase and Depreciation are transferred to Profit

and Loss Account)

Profit and Loss A/c ***

To Interest on Hire Purchase A/c ***

To Depreciation A/c ***

Created by Azharuddin Khan under Guidance of Mr. Intakhab Ahmad (BVA)

Log on to: http://azzeeweb.co.cc 4

1. SUBSTANTIAL VALUE GOODS/SALES---------------INTEREST SUSPENSE METHOD

LEDGERS

In the Books of Hire Purchaser

HIRE VENDOR’S ACCOUNT

Date Particulars Amt. Date Particulars Amt.

1st Yrs To Bank A/c (Down Payment) *** 1st Yrs By Assets ***

““ To Bank A/c (1st Installment) *** ““ By Interest Suspense A/c ***

[Total Interest which becomes due]

““ To Balance c/d ***

### ###

2nd Yrs nd

To Bank A/c (2 Installment) *** 2nd Yrs By Balance b/d ***

““ To Balance c/d ***

### ###

rd rd

3 Yrs To Bank A/c (Final Installment) *** 3 Yrs By Balance b/d ***

### ###

INTEREST SUSPENSE ACCOUNT

Date Particulars Amt. Date Particulars Amt.

1st Yrs To Hire Vendor’s A/c (Total Interest) *** 1st Yrs By Interest on Hire Purchase ***

““ By Balance c/d ***

### ###

nd nd

2 Yrs To Balance b/d *** 2 Yrs By Interest on Hire Purchase ***

““ By Balance c/d ***

### ###

3rd Yrs To Balance b/d *** 3rd Yrs By Interest on Hire Purchase ***

### ###

INTEREST ON HIRE PURCHASE ACCOUNT

Date Particulars Amt. Date Particulars Amt.

1st Yrs To Interest Suspense A/c *** 1st Yrs By Profit and Loss A/c ***

nd nd

2 Yrs To Interest Suspense A/c *** 2 Yrs By Profit and Loss A/c ***

3rd Yrs To Interest Suspense A/c *** 3rd Yrs By Profit and Loss A/c ***

DEPRECIATION ACCOUNT

Date Particulars Amt. Date Particulars Amt.

1st Yrs To Assets A/c *** 1st Yrs By Profit and Loss A/c ***

2nd Yrs To Assets A/c *** 2nd Yrs By Profit and Loss A/c ***

rd rd

3 Yrs To Assets A/c *** 3 Yrs By Profit and Loss A/c ***

Created by Azharuddin Khan under Guidance of Mr. Intakhab Ahmad (BVA)

Log on to: http://azzeeweb.co.cc 5

IN THE BOOKS OF HIRE VENDOR (Substantial Value Goods/Sales)

1. SUBSTANTIAL VAULE GOODS/SALES

I. SALES METHOD (HERE CALLED SALES METHOD INSTEAD OF “CASH PRICE METHOD”):-

JOURNAL ENTRIES

In the Books of Hire Vendor

S.NO. PARTICULARS DR. CR.

1. (When Assets/Goods are sold on Hire Purchase System)

Hire Purchaser’s A/c

***

To Hire Purchase Sales A/c

***

2. (When Down Payment is received)

Bank A/c

***

To Hire Purchaser’s A/c

***

3. (When Interest on Hire Purchase installment is charged)

Hire Purchaser’s A/c

***

To Interest on Hire Purchase A/c

***

4. (When Installment on Hire Purchase is received)

Bank A/c

***

To Hire Purchaser’s A/c

***

5. (When Interest on Hire Purchase is transferred to Profit and Loss Account)

Interest on Hire Purchase A/c ***

To Profit and Loss A/c ***

1. SUBSTANTIAL VALUE GOODS/SALES---------------SALES METHOD

LEDGERS

In the Books of Hire Vendor

HIRE PURCHASER’S ACCOUNT

Date Particulars Amt. Date Particulars Amt.

1st Yrs To Hire Purchase Sales A/c *** 1st Yrs By Bank A/c (Down Payment) ***

““ To Interest on Hire Purchase A/c *** ““ By Bank A/c (1st Installment) ***

[(Assets-Down Payment)*R%]

““ By Balance c/d ***

### ###

nd nd

2 Yrs To Balance b/d *** 2 Yrs By Bank A/c (2nd Installment) ***

““ To Interest on Hire Purchase A/c *** ““ By Balance c/d ***

### ###

rd rd

3 Yrs To Balance b/d *** 3 Yrs By Bank A/c (Final Installment) ***

To Interest on Hire Purchase A/c ***

### ###

Note: 1. Increasing in Debtors shown in Debit Side. 2. After Last Installment both sides are equal.

Created by Azharuddin Khan under Guidance of Mr. Intakhab Ahmad (BVA)

Log on to: http://azzeeweb.co.cc 6

INTEREST ON HIRE PURCHASE ACCOUNT

Date Particulars Amt. Date Particulars Amt.

1st Yrs To Profit and Loss A/c *** 1st Yrs By Hire Purchaser’s A/c ***

2nd Yrs To Profit and Loss A/c *** 2nd Yrs By Hire Purchaser’s A/c ***

rd rd

3 Yrs To Profit and Loss A/c *** 3 Yrs By Hire Purchaser’s A/c ***

1. SUBSTANTIAL VAULE GOODS/SALES

II. INTEREST SUSPENSE METHOD:-

JOURNAL ENTRIES

In the Books of HIRE VENDOR

S.NO. PARTICULARS DR. CR.

1. (When Assets/Goods are sold on Hire Purchase System)

Hire Purchaser’s A/c

***

To Hire Purchase Sales A/c

***

2. (When Down Payment is received)

Bank A/c

***

To Hire Purchaser’s A/c

***

3. (When Total Interest on Hire Purchase is charged)

Hire Purchaser’s A/c

***

To Interest Suspense A/c

***

4. (When Interest is Charged on Interest Suspense A/c)

Interest Suspense A/c

***

To Interest on Hire Purchase A/c

***

5. (When Interest on Hire Purchase is transferred to Profit and Loss Account)

Interest on Hire Purchase A/c ***

To Profit and Loss A/c ***

6. (When Installment is Received)

Bank A/c ***

To Hire Purchaser’s A/c ***

1. SUBSTANTIAL VALUE GOODS/SALES---------------INTEREST SUSPENSE METHOD

LEDGERS

In the Books of Hire Vendor

(To be Continue on Next Page……….)

Created by Azharuddin Khan under Guidance of Mr. Intakhab Ahmad (BVA)

Log on to: http://azzeeweb.co.cc 7

HIRE PURCHASER’S ACCOUNT

Date Particulars Amt. Date Particulars Amt.

1st Yrs To Hire Purchase Sales A/c *** 1st Yrs By Bank A/c (Down Payment) ***

““ To Interest Suspense A/c *** ““ By Bank A/c (1st Installment) ***

[Full Interest Charged on H.P]

By Balance c/d ***

### ###

2nd Yrs To Balance b/d *** 2nd Yrs nd

By Bank A/c (2 Installment) ***

““ By Balance c/d ***

### ###

rd rd

3 Yrs To Balance b/d *** 3 Yrs By Bank A/c (Final Installment) ***

### ###

INTEREST SUSPENSE ACCOUNT

Date Particulars Amt. Date Particulars Amt.

1st Yrs To Interest on Hire Purchase A/c *** 1st Yrs By Hire Purchaser’s A/c ***

To Balance c/d *** ***

### ###

nd nd

2 Yrs To Interest on Hire Purchase A/c *** 2 Yrs By Balance b/d ***

To Balance c/d

### ###

3rd Yrs To Interest on Hire Purchase A/c *** 3rd Yrs By Balance b/d ***

### ###

INTEREST ON HIRE PURCHASE ACCOUNT

Date Particulars Amt. Date Particulars Amt.

1st Yrs To Profit and Loss A/c *** 1st Yrs By Interest Suspense A/c ***

nd nd

2 Yrs To Profit and Loss A/c *** 2 Yrs By Interest Suspense A/c ***

3rd Yrs To Profit and Loss A/c *** 3rd Yrs By Interest Suspense A/c ***

2. SMALL VALUE GOODS/SALES METHOD

I. Debtors Method/System (In the Books of Hire Vendor) LEDGERS

HIRE PURCHASE TRADING A/C (AT COST)

Date Particulars Amt. Date Particulars Amt.

To Shop Stock A/c *** By Cash A/c ***

To Installment Not Due *** By Goods Repossessed (Market Value) ***

To Installment Due *** By Shop Stock A/c ***

Purchase A/c *** By Installment Not Due ***

To Hire Expenses *** By Installment Due ***

To Profit ***

### ###

Created by Azharuddin Khan under Guidance of Mr. Intakhab Ahmad (BVA)

Log on to: http://azzeeweb.co.cc 8

HIRE PURCHASE TRADING A/C (AT HIRE PURCHASE PRICE)

Date Particulars Amt. Date Particulars Amt.

To Installment Not Due (HPP) *** By Cash A/c ***

To Installment Due *** By Stock Reserve (Loading) ***

To Goods Sold on Hire Purchase *** By Goods Sold on Hire Purchase ***

(HPP) (Loading)

To Stock Reserve (Loading) *** By Goods Repossessed ***

(Market Value)

To Hire Expenses *** By Installment Not Due (HPP) ***

To Profit *** By Installment Due

By Profit on Sale of Goods ***

Repossessed

### ###

WORKING:

1. CALCULATION OF GOODS SOLD ON HIRE PURCHASE

Opening Stock at Shop ***

Add: Purchases ***

Stock Available ###

Less: Closing Stock at Shop ***

Cost of Goods Sold on Hire Purchase ###

Add: Loading ***

Goods Sold on Hire Purchase ###

(To Find Out Any Missing Figure We Have To Make the Following Accounts)

2. INSTALLMENTS NOT DUE A/C

INSTALLMENT NOT DUE A/C

Date Particulars Amt. Date Particulars Amt.

To Balance b/d *** By Installment Due A/c ***

To Goods Sold on Hire Purchase *** By Goods Repossessed A/c ***

(Original Value)

Note: (Normally not comes in this

account but in few cases)

### ###

3. INSTALLMENTS DUE A/C

INSTALLMENT NOT DUE A/C

Date Particulars Amt. Date Particulars Amt.

To Balance b/d *** By Cash A/c ***

To Installment Not Due A/c *** By Goods Repossessed A/c ***

(Original Value)

By Balance c/d ***

### ###

Created by Azharuddin Khan under Guidance of Mr. Intakhab Ahmad (BVA)

Log on to: http://azzeeweb.co.cc 9

2. SMALL VALUE GOODS/SALES METHOD

II. Stock and Debtors System (In the Books of Hire Vendor)

Basic Structure

PURCHAS

E

SHOP

CUSTOMERS

DEBTORS

CASH GOODS REPOSSESSED

NOTE: Here “Installment Not Due A/c” is called “Hire Purchase Stock A/c” and “Installment Due A/c” is called

“Hire Purchase Debtors A/c”

JOURNAL ENTRIES

S.NO. PARTICULARS DR. CR.

1. (When Goods are Purchased)

Purchases A/c

***

To Creditors A/c/Suppliers A/c/Bank A/c

***

2. (When Goods are kept in Shop)

Shop Stock A/c

***

To Purchases A/c

***

3. (When Goods are sold on Hire Purchase)

Hire Purchase Stock A/c

***

To Shop Stock A/c

***

To Hire Purchase Adjustment A/c

4. (When Installment becomes due)

Hire Purchase Debtors A/c

***

To Hire Purchases Stock A/c

***

Created by Azharuddin Khan under Guidance of Mr. Intakhab Ahmad (BVA)

Log on to: http://azzeeweb.co.cc 10

5. (When Cash received from Hire Purchase Debtors)

Cash A/c ***

To Hire Purchases Debtors A/c ***

6. (When Goods are repossessed on Account of Non-Payment of Installment)

Goods Repossessed A/c ***

Hire Purchase Adjustment A/c ***

To Hire Purchase Debtors A/c ***

7. (When Goods Repossessed are repaired)

Goods Repossessed A/c ***

To Bank A/c ***

8. (When Goods Repossessed are re-sold)

Bank A/c ***

To Goods Repossessed A/c ***

9. (For recording of Profit/Loss on Sale of Goods repossessed)

(a) In Case of Profit:-

Goods Repossessed A/c ***

To Hire Purchase Adjustment A/c ***

(b) In Case of Loss:-

Hire Purchase Adjustment A/c ***

To Goods Repossessed A/c ***

10. (For Recording of Loading on Opening Stock of Hire Purchase A/c)

Stock Reserve A/c ***

To Hire Purchase Adjustment A/c ***

11. (For Recording of Loading on Closing Stock of Hire Purchase A/c)

Hire Purchase Adjustment A/c ***

To Stock Reserve A/c ***

LEDGERS

SHOP STOCK A/C

Date Particulars Amt. Date Particulars Amt.

To Balance b/d *** By Hire Purchase Stock A/c (At Cost) ***

To Purchases A/c *** By Balance c/d ***

### ###

HIRE PURCHASE STOCK A/C

Date Particulars Amt. Date Particulars Amt.

To Balance b/d *** By Hire Purchase Debtors A/c ***

To Shop Stock A/c *** By Goods Repossessed A/c ***

(Some time here Goods can be

HPP

repossessed but normally in H.P

Debtors A/c)

To Hire Purchases Adj. A/c *** By Balance c/d ***

### ###

Hire Purchases Adj. A/c is the Loading of the H.P Stock A/c

Created by Azharuddin Khan under Guidance of Mr. Intakhab Ahmad (BVA)

Log on to: http://azzeeweb.co.cc 11

HIRE PURCHASE DEBTORS A/C

Date Particulars Amt. Date Particulars Amt.

To Balance b/d *** By Cash A/c ***

To Hire Purchase Stock A/c *** By Goods Repossessed A/c (M.V) ***

By Hire Purchase Adj. A/c ***

By Balance c/d ***

### ###

HIRE PURCHASE ADJUSTMENT A/C

Date Particulars Amt. Date Particulars Amt.

To Stock Reserve A/c *** By Stock Reserve A/c ***

To Hire Purchase Debtors A/c *** By Hire Purchase Stock A/c ***

To Profit *** By Goods Repossessed A/c ***

(Profit on Sale)

### ###

GOODS REPOSSESSED A/C

Date Particulars Amt. Date Particulars Amt.

To Hire Purchase Debtors A/c *** By Bank (Sale) ***

To Bank A/c ***

To Hire Purchase Adjustment A/c ***

(Profit on Sale of Repossessed Goods)

### ###

PROBLEMS IN HIRE PURCHASE (SOME IMPORTANT POINTS)

1. When Rate of Interest is not given. (Calculation of Amount of Interest)

Problem: Cash Price of the Assets is Rs. 56,000, Hire Purchase price of the Assets is Rs. 60,000

payable in Rs. 15,000 Down and 3 Equal Installment of Rs. 15,000.

Calculate the Amount of Interest of each Installment.

Sol.: Calculation of Amount of Interest for each installment

Installment Amount Due Ratio Amount of Interest

I 45000 3 4000*3/6=2000

II 30000 2 4000*2/6=1333

III 15000 1 4000*1/6=667

2. When Cash Price is not given. (Calculation of Cash Price)

Problem: Hire Purchase price of the Assets is Rs. 5000 payable as Rs. 800 down and 3 Equal

Annual Installment of Rs. 1200, 2200 and Rs. 800 respectively, rate of interest is 10% pa.

Created by Azharuddin Khan under Guidance of Mr. Intakhab Ahmad (BVA)

Log on to: http://azzeeweb.co.cc 12

Sol.: Calculation of Cash Price.

Rate of Interest

Interest paid= Amt. Due+Installment Amt.

100+Rate of Interest

10

800 73

3. 110

CP=800-73=727

10

2200 727 2927 266

2. 110

CP=2200-266=1934

10

1200 1934 727 3861 351

1. 110

CP=1200-351=849

Total Cash Price=800+849+1934+727=Rs. 4310

Created by Azharuddin Khan under Guidance of Mr. Intakhab Ahmad (BVA)

Das könnte Ihnen auch gefallen

- Tally Assignment AfrozDokument17 SeitenTally Assignment AfrozAfrozNoch keine Bewertungen

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703Von EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703Noch keine Bewertungen

- Chapter # 2 Financial AnalysisDokument94 SeitenChapter # 2 Financial Analysiswondosen birhanuNoch keine Bewertungen

- 3 MDokument12 Seiten3 MRicha KothariNoch keine Bewertungen

- IDBI Bank Statement TitleDokument4 SeitenIDBI Bank Statement TitleRaghu Veer100% (1)

- Costing FormulaDokument76 SeitenCosting FormulaRamyapapu100% (5)

- Lease - Lessee's Perspective: Lecture NotesDokument9 SeitenLease - Lessee's Perspective: Lecture NotesDonise Ronadel SantosNoch keine Bewertungen

- April Charney Emergency Motion To Stop Foreclosure Sale 1Dokument10 SeitenApril Charney Emergency Motion To Stop Foreclosure Sale 1winstons2311100% (2)

- Deloitte Approach On IRRBBDokument4 SeitenDeloitte Approach On IRRBBraiden9413Noch keine Bewertungen

- Dividend Adjustment and Managerial Remuneration RulesDokument3 SeitenDividend Adjustment and Managerial Remuneration RulesShwetta GogawaleNoch keine Bewertungen

- Sales TrainingDokument19 SeitenSales TrainingAashish PardeshiNoch keine Bewertungen

- Passive Infrastructure Sharing in TelecommunicationsDokument16 SeitenPassive Infrastructure Sharing in Telecommunicationsmib_santosh67% (3)

- IFRS 9 Financial InstrumentsDokument38 SeitenIFRS 9 Financial Instrumentssaoodali1988Noch keine Bewertungen

- APF 55 Oct15 SinglesDokument100 SeitenAPF 55 Oct15 SinglesAmir ZarehNoch keine Bewertungen

- Hire Purchase and Installment Sale TransactionsDokument12 SeitenHire Purchase and Installment Sale TransactionsAshish SisodiaNoch keine Bewertungen

- Amalgamation Summary NotesDokument10 SeitenAmalgamation Summary NotesAvinash RoyNoch keine Bewertungen

- Financial Statements (With Adjustment)Dokument18 SeitenFinancial Statements (With Adjustment)1515inchNoch keine Bewertungen

- Final Accounts of Sole ProprietorDokument33 SeitenFinal Accounts of Sole Proprietorrasmi78009Noch keine Bewertungen

- Balance Sheet FormatDokument4 SeitenBalance Sheet FormatDebalina MahataNoch keine Bewertungen

- Cash Flow Statement Format Direct MethodDokument4 SeitenCash Flow Statement Format Direct MethodvishalkulthiaNoch keine Bewertungen

- Fund Flow Statement ExplainedDokument4 SeitenFund Flow Statement ExplainedPlaban Mukherjee100% (1)

- Address Line 1 Address Line 2: Abc Co-Operative Society LTDDokument10 SeitenAddress Line 1 Address Line 2: Abc Co-Operative Society LTDMamta ShelarNoch keine Bewertungen

- PARTNERSHIPDokument72 SeitenPARTNERSHIPDivya RaniNoch keine Bewertungen

- Chapter 1: Cost Sheet: Rohit AgarwalDokument4 SeitenChapter 1: Cost Sheet: Rohit Agarwalbcom100% (1)

- Insolvency Account 222Dokument22 SeitenInsolvency Account 222Sajjadur RahmanNoch keine Bewertungen

- Prime Cost (A+B+C) : Add: Opening Work in Progress Less: Closing Work in ProgressDokument6 SeitenPrime Cost (A+B+C) : Add: Opening Work in Progress Less: Closing Work in ProgressHarish PahadiyaNoch keine Bewertungen

- Business Entity Building LandDokument6 SeitenBusiness Entity Building LandPrakash PalanisamyNoch keine Bewertungen

- Dissolution Notes FullDokument4 SeitenDissolution Notes FullVansh BarsaiyanNoch keine Bewertungen

- Underwriting of Shares and DebenturesDokument5 SeitenUnderwriting of Shares and Debenturesharsh singhNoch keine Bewertungen

- Royalty Accounting SolutionsDokument5 SeitenRoyalty Accounting SolutionsRehan RaufNoch keine Bewertungen

- TDS Tax Challan Filing GuideDokument3 SeitenTDS Tax Challan Filing GuideSURABHI PATRANoch keine Bewertungen

- NPO & Parnership For Students - 240229 - 151237Dokument202 SeitenNPO & Parnership For Students - 240229 - 151237Sandeep KumarNoch keine Bewertungen

- Auditing Problems IAS 17: LEASES (0ld Standard) Dr. Glen de Leon, CPADokument29 SeitenAuditing Problems IAS 17: LEASES (0ld Standard) Dr. Glen de Leon, CPAArcelli Dela CruzNoch keine Bewertungen

- Accounting 002Dokument20 SeitenAccounting 002Win Lwin OoNoch keine Bewertungen

- Discussion Problems: FAR.2831-Leases MAY 2020Dokument13 SeitenDiscussion Problems: FAR.2831-Leases MAY 2020Eira ShaneNoch keine Bewertungen

- Accounting for Revenue Recognition Over Time and at a Single PointDokument9 SeitenAccounting for Revenue Recognition Over Time and at a Single PointLorie Roncal JimenezNoch keine Bewertungen

- ACCOUNTING CYCLE STEP 1 TO 4 With IllustrationsDokument6 SeitenACCOUNTING CYCLE STEP 1 TO 4 With IllustrationsmallarilecarNoch keine Bewertungen

- SIDBI MSME Application FormDokument4 SeitenSIDBI MSME Application FormPalaniswamy K100% (1)

- Account AnjuDokument29 SeitenAccount Anjupreet kaurNoch keine Bewertungen

- Balance Sheet Vs Fund Flow StatementDokument19 SeitenBalance Sheet Vs Fund Flow StatementsuasiveNoch keine Bewertungen

- 1) Debit The Receiver & Credit The Giver 2) Debit What Comes in & Credit What Goes Out 3) Debit All Expenses/losses & Credit All Profits/gainsDokument4 Seiten1) Debit The Receiver & Credit The Giver 2) Debit What Comes in & Credit What Goes Out 3) Debit All Expenses/losses & Credit All Profits/gainsDharmrajNoch keine Bewertungen

- Income From HP - March, 2023Dokument5 SeitenIncome From HP - March, 2023Ayush BholeNoch keine Bewertungen

- Hire Purchase System AccountingDokument10 SeitenHire Purchase System AccountingAamna ShabbirNoch keine Bewertungen

- IT Proof Submission Guidelines FY 22-23Dokument48 SeitenIT Proof Submission Guidelines FY 22-23Chandan SinghNoch keine Bewertungen

- 3.3.12 STPI Process Flow ChartDokument5 Seiten3.3.12 STPI Process Flow Chartsabya007asnNoch keine Bewertungen

- Consignment Accounts Proforma EntriesDokument4 SeitenConsignment Accounts Proforma EntriesM SHILPANoch keine Bewertungen

- Royalty AccountsDokument19 SeitenRoyalty Accountsjashveer rekhi100% (2)

- 10.cashflows AAFR NotesDokument10 Seiten10.cashflows AAFR Notesmehdi.jjh313Noch keine Bewertungen

- Hire PurchaseDokument6 SeitenHire PurchaseHarsha ThawaniNoch keine Bewertungen

- Reserve Bank of India: Trade Receivable E-Discounting System (Treds)Dokument18 SeitenReserve Bank of India: Trade Receivable E-Discounting System (Treds)omprakash padhi100% (1)

- Tax Deducted at SourceDokument3 SeitenTax Deducted at SourceShivam SharmaNoch keine Bewertungen

- T.D.S./Tcs Tax ChallanDokument3 SeitenT.D.S./Tcs Tax ChallanRukmani GuptaNoch keine Bewertungen

- Review 105 - Day 20 TOADokument6 SeitenReview 105 - Day 20 TOAChronos ChronosNoch keine Bewertungen

- Contract For The Supply of RBD Palm OleinDokument10 SeitenContract For The Supply of RBD Palm OleinbillNoch keine Bewertungen

- Costing Formulae Topic WiseDokument81 SeitenCosting Formulae Topic Wiseamit kathaitNoch keine Bewertungen

- Check List For Loan Process-1Dokument8 SeitenCheck List For Loan Process-1kiran.3ddesignerNoch keine Bewertungen

- Cost sheet format breakdownDokument2 SeitenCost sheet format breakdownabhijeetNoch keine Bewertungen

- Tax Deposit-Challan 281-Excel FormatDokument5 SeitenTax Deposit-Challan 281-Excel FormatpreetNoch keine Bewertungen

- Incoterms 2010 Reference Chart: Cost Sharing Between Seller and BuyerDokument1 SeiteIncoterms 2010 Reference Chart: Cost Sharing Between Seller and BuyerMohammed IkramaliNoch keine Bewertungen

- Handout 1 - Cost & Management Accounting - Feb 17, 2019 - 3pm To 6pmDokument3 SeitenHandout 1 - Cost & Management Accounting - Feb 17, 2019 - 3pm To 6pmBhunesh KumarNoch keine Bewertungen

- FAR 3 Lease AccountingDokument10 SeitenFAR 3 Lease AccountingMhyke Vincent Panis100% (1)

- Lesson 2 LeaseDokument26 SeitenLesson 2 Leaselil telNoch keine Bewertungen

- LeasesDokument30 SeitenLeasesREIGN EBONY ANNE AGUSTINNoch keine Bewertungen

- Financial Transactions Recordings ExplainedDokument8 SeitenFinancial Transactions Recordings Explainedamir100% (3)

- Manufacturing Cost ClassificationDokument61 SeitenManufacturing Cost Classificationdamayogesh4Noch keine Bewertungen

- Domestic Credit Related Service Charges: Head Office, BangaloreDokument27 SeitenDomestic Credit Related Service Charges: Head Office, BangaloreAnwesha SinghNoch keine Bewertungen

- CCL - Basic Engineering Service R1Dokument1 SeiteCCL - Basic Engineering Service R1Ranu Januar100% (1)

- Record Financial TransactionsDokument25 SeitenRecord Financial TransactionsMirza NoumanNoch keine Bewertungen

- Accounting-Bonus Issue and Right-Issue-1653399018535704Dokument9 SeitenAccounting-Bonus Issue and Right-Issue-1653399018535704Badhrinath ShanmugamNoch keine Bewertungen

- TDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11Dokument1 SeiteTDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11Shwetta GogawaleNoch keine Bewertungen

- 3 Partnership AccountsDokument93 Seiten3 Partnership AccountsCA K D Purkayastha100% (1)

- Hire purchase and installment sale transactions explainedDokument12 SeitenHire purchase and installment sale transactions explainedShwetta GogawaleNoch keine Bewertungen

- RM PPT SwapDokument10 SeitenRM PPT SwappankajkubadiyaNoch keine Bewertungen

- Relative Strength Index: HistoryDokument4 SeitenRelative Strength Index: HistoryAnonymous sDnT9yuNoch keine Bewertungen

- CH 23Dokument16 SeitenCH 23Madiyar Mambetov100% (1)

- TNT PreMarketCapsule 22august22Dokument13 SeitenTNT PreMarketCapsule 22august22IMaths PowaiNoch keine Bewertungen

- D.A. Davidson ConsumerDokument44 SeitenD.A. Davidson ConsumerRay CarpenterNoch keine Bewertungen

- Cash ManagementDokument13 SeitenCash ManagementMeah Claire AgpuldoNoch keine Bewertungen

- Project 1 - FCF Intel Example - DirectionsDokument27 SeitenProject 1 - FCF Intel Example - Directionsअनुशा प्रसादम्Noch keine Bewertungen

- Delta Spinners 2008Dokument38 SeitenDelta Spinners 2008bari.sarkarNoch keine Bewertungen

- Generic Engineering PreesentationDokument50 SeitenGeneric Engineering Preesentationshailesh1978kNoch keine Bewertungen

- Chapter 6 Are Financial Markets EfficientDokument12 SeitenChapter 6 Are Financial Markets EfficientJay Ann DomeNoch keine Bewertungen

- Luckscout Ultimate Wealth System: The Ultimate Guide Toward Wealth and Financial FreedomDokument36 SeitenLuckscout Ultimate Wealth System: The Ultimate Guide Toward Wealth and Financial FreedomSamuel AnemeNoch keine Bewertungen

- Verbal Section Reading CompDokument35 SeitenVerbal Section Reading CompBasharat AliNoch keine Bewertungen

- Financial System OverviewDokument34 SeitenFinancial System OverviewravikumarreddytNoch keine Bewertungen

- AD1 Global Buys Marriott Myrtle Beach HotelDokument3 SeitenAD1 Global Buys Marriott Myrtle Beach HotelPR.comNoch keine Bewertungen

- Summary Ins EconomicsDokument24 SeitenSummary Ins EconomicsJensNoch keine Bewertungen

- Charles P. Jones, Investments: Principles and Concepts, 11 Edition, John Wiley & SonsDokument40 SeitenCharles P. Jones, Investments: Principles and Concepts, 11 Edition, John Wiley & SonsmuazNoch keine Bewertungen

- Project Report On Comparison of Mutual Funds With Other Investment OptionsDokument57 SeitenProject Report On Comparison of Mutual Funds With Other Investment Optionsdharmendra dadhichNoch keine Bewertungen

- 9.403 Chapter 4: Efficient Securities MarketsDokument10 Seiten9.403 Chapter 4: Efficient Securities MarketsYanee ReeNoch keine Bewertungen

- Presentation: BancassuranceDokument14 SeitenPresentation: BancassurancemenonpratishNoch keine Bewertungen

- CH 02Dokument56 SeitenCH 02AL SeneedaNoch keine Bewertungen