Beruflich Dokumente

Kultur Dokumente

Retirement Calculator

Hochgeladen von

gunawanharijadiCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Retirement Calculator

Hochgeladen von

gunawanharijadiCopyright:

Verfügbare Formate

recalc1

Retire Early Home Page

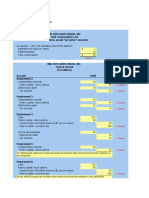

Generation-X Retirement Calculator -- Version 2.02

Release Date: October 15, 2006 Retirement Assets

You can retire when the red and black lines cross on the chart at right. $2,000,000

$1,800,000

Annual Spending Model 2 1=Spending increases with salary

2=Spending increases limited to inflation $1,600,000

If "2" selected, increase Annual Spending 0.0% more than inflation

$1,400,000

Annual Income and Savings

Gross Annual Income $40,000 $1,200,000

Portfolio Value

Percent of Gross Saved 50.0% of Initial Salary

Present Age 25 Years Old $1,000,000

Age at Death 95 Years Old

Max Annual IRA Contrib. $4,000 $800,000

Max 401k Contrib. (%) 10.0%

IRS 401k Limit $15,000 $600,000

Max Company 401k Contrib. 3.0%

$400,000

Starting Account Balances

401k & IRA accounts $0 $200,000

Taxable accounts $0

Income Tax Assumptions $-

Itemized Deductions 0.0% as a percent of Gross Income 2 4 6 8 10 12 14 16 18 20 22 24

No. of Exemptions 1 Federal Tax Return 1 3 5 7 9 11 13 15 17 19 21 23 25

Filing Status 1 1=Single, 2=Married

Years to Retirement

FICA Wages 1 1=Single or Married w/1 income,

2=Married both working Current Retirement

State Income Tax 0.0% as a percent of Federal Income Tax Portfolio Assets

Adjust Retirement Taxes for Cap Gains 1.00 1.00 = all ordinary income Balance Required

Living Expenses in Retirement

Ratio to Current Living Expenses 1.00

Safe Withdrawal Risk 1 1 = 100% Safe, 2=98%, 3=95%, 4=90%

Assumptions You can retire in 15 years

(Assumes no Social Security or pension benefits.) when you are 40 years old,

Annual Inflation Rate (Exp.) 4.0% with Retirement Assets of $735,780 and an

Annual Salary Increase 5.0% annual pre-tax withdrawal of $26,129 with

Annual Investment Return 5.0% after-tax living expenses of $25,386 per year.

Investment Expenses (% of assets) 0.20%

Page 1

Das könnte Ihnen auch gefallen

- Terminate W-4 Voluntary Withholding AgreementDokument1 SeiteTerminate W-4 Voluntary Withholding AgreementFreeman Lawyer100% (1)

- Notice of Assessment 2021 04 30 07 31 55 748105Dokument4 SeitenNotice of Assessment 2021 04 30 07 31 55 748105jack robinsonNoch keine Bewertungen

- Test Bank For Public Policy Politics Analysis and Alternatives 7th Edition Michael e Kraft Scott R FurlongDokument18 SeitenTest Bank For Public Policy Politics Analysis and Alternatives 7th Edition Michael e Kraft Scott R Furlongchristinecruzfbszmkipyd100% (18)

- Chapter 05 SolutionsDokument7 SeitenChapter 05 SolutionsShahnawaz KhanNoch keine Bewertungen

- Pay StubsDokument2 SeitenPay StubsmatthewmerricksNoch keine Bewertungen

- SCH 19Dokument10 SeitenSCH 19Vishal P RaoNoch keine Bewertungen

- Practice Problems Chapter 12 Corporate Cash Flow and Project AnalysisDokument57 SeitenPractice Problems Chapter 12 Corporate Cash Flow and Project AnalysiszoeyNoch keine Bewertungen

- Financial Management Accounting Case StudyDokument24 SeitenFinancial Management Accounting Case StudyHannahPojaFeria0% (1)

- Useful Invoice ProjectDokument1 SeiteUseful Invoice ProjectAruna100% (1)

- Tax ReviewerDokument10 SeitenTax ReviewerZtrick 1234100% (2)

- FIN 500 Extra Problems Fall 20-21Dokument4 SeitenFIN 500 Extra Problems Fall 20-21saraNoch keine Bewertungen

- 07 Retirement-CalculatorDokument5 Seiten07 Retirement-CalculatorrealtorsinfaridabadNoch keine Bewertungen

- US Master Tax Guide (PDFDrive)Dokument1.258 SeitenUS Master Tax Guide (PDFDrive)sutan mNoch keine Bewertungen

- (SINGLE TEMPLATE) Federal Tax Analysis - Last Name, First Name (2021)Dokument6 Seiten(SINGLE TEMPLATE) Federal Tax Analysis - Last Name, First Name (2021)MD RAKIBNoch keine Bewertungen

- Managed Funds CalculatorDokument19 SeitenManaged Funds CalculatorJulio Cesar ChavezNoch keine Bewertungen

- Chapter 08 Test BankDokument158 SeitenChapter 08 Test BankBrandon LeeNoch keine Bewertungen

- Chapter 4 - TaxesDokument28 SeitenChapter 4 - TaxesabandcNoch keine Bewertungen

- Illustrating Effects of Financial LeverageDokument4 SeitenIllustrating Effects of Financial LeverageWawex DavisNoch keine Bewertungen

- Chapter 17Dokument7 SeitenChapter 17Khalil AbdoNoch keine Bewertungen

- Capital Structure - Basic ConceptsDokument10 SeitenCapital Structure - Basic ConceptsDUY LE NHAT TRUONGNoch keine Bewertungen

- Tax Foundation FF6241Dokument5 SeitenTax Foundation FF6241muhammad mudassarNoch keine Bewertungen

- Credit Analysis Worksheet FAC COMPLETEDokument4 SeitenCredit Analysis Worksheet FAC COMPLETEpaozinNoch keine Bewertungen

- Taxes by The NumbersDokument2 SeitenTaxes by The NumbersBrad StevensNoch keine Bewertungen

- Rosas Palas Franchise Assumptions For WHDokument2 SeitenRosas Palas Franchise Assumptions For WHMB ManyauNoch keine Bewertungen

- Rattner Robotics Chapter Two ProblemsDokument46 SeitenRattner Robotics Chapter Two ProblemsBabatunde Victor AjalaNoch keine Bewertungen

- SALOMON-CASE_STUDY (Repaired)Dokument8 SeitenSALOMON-CASE_STUDY (Repaired)kylaasio8Noch keine Bewertungen

- Good InformationDokument3 SeitenGood InformationHoshen MollaNoch keine Bewertungen

- Maddelein - Performance ReportDokument1 SeiteMaddelein - Performance ReportBay Area Equity Group, LLCNoch keine Bewertungen

- M3. CAPEX Appraisal Answer 8.4.19Dokument24 SeitenM3. CAPEX Appraisal Answer 8.4.19hanis nabilaNoch keine Bewertungen

- Introduction To Debt PolicyDokument8 SeitenIntroduction To Debt PolicyRatnesh DubeyNoch keine Bewertungen

- 6.01 Develop An Income StatementDokument2 Seiten6.01 Develop An Income StatementAditya NigamNoch keine Bewertungen

- Financial Worksheet Master File 3Dokument13 SeitenFinancial Worksheet Master File 3Alex Rafael Lleva AngelNoch keine Bewertungen

- Investment Valuation Model TemplateDokument37 SeitenInvestment Valuation Model TemplateousmaneNoch keine Bewertungen

- REVENUE (Average) : 100.00% Gross Sales 1201000 1,201,000 Less: 0 Net Revenue 116,000Dokument2 SeitenREVENUE (Average) : 100.00% Gross Sales 1201000 1,201,000 Less: 0 Net Revenue 116,000Saiyid Ali Haider RazaNoch keine Bewertungen

- 7803 Stahelin - Performance ReportDokument1 Seite7803 Stahelin - Performance ReportBay Area Equity Group, LLCNoch keine Bewertungen

- ExtraTaxProblem-TY2020 Student - SUSANDokument6 SeitenExtraTaxProblem-TY2020 Student - SUSANhhunter530Noch keine Bewertungen

- 401k CalculatorDokument6 Seiten401k Calculatortrungtinh1506Noch keine Bewertungen

- 3-Statement Model PracticeDokument6 Seiten3-Statement Model PracticeWill SkaloskyNoch keine Bewertungen

- Module 7 QuizDokument6 SeitenModule 7 QuizArif RahmanNoch keine Bewertungen

- Tax Rates Ontario 2019Dokument2 SeitenTax Rates Ontario 2019Pratik BajajNoch keine Bewertungen

- 17vs18taxbracket FinalDokument2 Seiten17vs18taxbracket Finalapi-426611448Noch keine Bewertungen

- Fin2001 Pset3Dokument8 SeitenFin2001 Pset3Valeria MartinezNoch keine Bewertungen

- Financial Planing & ForecastingDokument31 SeitenFinancial Planing & ForecastingRetno Yuniarsih Marekhan IINoch keine Bewertungen

- Ey Tax Rates Alberta 2023 01 15 v1Dokument2 SeitenEy Tax Rates Alberta 2023 01 15 v1AltafNoch keine Bewertungen

- Head Description: Income Tax Ratio Gross Income/Tax LiabilityDokument4 SeitenHead Description: Income Tax Ratio Gross Income/Tax LiabilityGhodawatNoch keine Bewertungen

- Taxation Exam Part IIDokument14 SeitenTaxation Exam Part IIGabriel Christopher MembrilloNoch keine Bewertungen

- FIRE EstimatorDokument10 SeitenFIRE EstimatorJared PerezNoch keine Bewertungen

- Tax Cuts and Jobs Act of 2017: Reduced Individual Tax RatesDokument3 SeitenTax Cuts and Jobs Act of 2017: Reduced Individual Tax RatesAlex SimonettiNoch keine Bewertungen

- TSI_interest_ratesDokument2 SeitenTSI_interest_ratesOshan IndrajithNoch keine Bewertungen

- As 22.deffered - TaxDokument7 SeitenAs 22.deffered - TaxabrastogiNoch keine Bewertungen

- LU5 Homework AnswersDokument15 SeitenLU5 Homework Answersh9rkbdhx57Noch keine Bewertungen

- Fire Your Over-Priced Financial Advisor and Retire SoonerVon EverandFire Your Over-Priced Financial Advisor and Retire SoonerBewertung: 5 von 5 Sternen5/5 (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnVon EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNoch keine Bewertungen

- Surviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesVon EverandSurviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesNoch keine Bewertungen

- The Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesVon EverandThe Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesNoch keine Bewertungen

- Build Tax-Free Wealth: How to Permanently Lower Your Taxes and Build More WealthVon EverandBuild Tax-Free Wealth: How to Permanently Lower Your Taxes and Build More WealthNoch keine Bewertungen

- Small Business Taxes: Putting More Money Back in Your PocketVon EverandSmall Business Taxes: Putting More Money Back in Your PocketNoch keine Bewertungen

- Device InvoiceDokument5 SeitenDevice InvoiceMohamed ZakiNoch keine Bewertungen

- Susanne BoddieDokument2 SeitenSusanne Boddiescrose1Noch keine Bewertungen

- CIR vs. Negros Consolidated Framers MPC VAT ExemptionDokument3 SeitenCIR vs. Negros Consolidated Framers MPC VAT ExemptionVINCENTREY BERNARDONoch keine Bewertungen

- Tax LawDokument32 SeitenTax Lawgilbert213Noch keine Bewertungen

- BIR Ruling Involving CGTDokument3 SeitenBIR Ruling Involving CGTGEiA Dr.Noch keine Bewertungen

- The Negative Impact of GST On Indian EconomyDokument3 SeitenThe Negative Impact of GST On Indian EconomyMOHIT MUKULNoch keine Bewertungen

- Facebook Financial Analysis Shows Revenue and Cost Growth Despite ScandalsDokument4 SeitenFacebook Financial Analysis Shows Revenue and Cost Growth Despite ScandalsNabhanNoch keine Bewertungen

- Hotel Booking DemoDokument1 SeiteHotel Booking Demositghana01Noch keine Bewertungen

- Gray Company S Financial Statements Showed Income Before Income Taxes ofDokument1 SeiteGray Company S Financial Statements Showed Income Before Income Taxes ofFreelance WorkerNoch keine Bewertungen

- Financial Statements, Cash Flow, and TaxesDokument44 SeitenFinancial Statements, Cash Flow, and TaxesreNoch keine Bewertungen

- Taxation I Midterm ReviewerDokument16 SeitenTaxation I Midterm ReviewerKaren CueNoch keine Bewertungen

- 2018 07 14 18 04 09 892 - 1041233281Dokument6 Seiten2018 07 14 18 04 09 892 - 1041233281nibeditapompy7314Noch keine Bewertungen

- Employee Referral Program Slick SheetDokument1 SeiteEmployee Referral Program Slick SheetRajaNoch keine Bewertungen

- SF-64-96 R1 - Amendment To Consultant AgreementDokument4 SeitenSF-64-96 R1 - Amendment To Consultant Agreementsandee1983Noch keine Bewertungen

- 07092021205546Dokument6 Seiten07092021205546Jay XNoch keine Bewertungen

- QGov Your Payslip ExplainedDokument2 SeitenQGov Your Payslip ExplainedbradrimmNoch keine Bewertungen

- Computation of Total Income (As Per Normal Provisions) Income From Salary (Chapter IV A) 4746736Dokument10 SeitenComputation of Total Income (As Per Normal Provisions) Income From Salary (Chapter IV A) 4746736nABSAMNNoch keine Bewertungen

- Report Mr. Tharun 936 25 16 Age 18 SA 500000Dokument5 SeitenReport Mr. Tharun 936 25 16 Age 18 SA 500000tharunshanmugam25Noch keine Bewertungen

- Release, Waiver and Quitclaim: Know All Men by These PresentsDokument1 SeiteRelease, Waiver and Quitclaim: Know All Men by These PresentsPj CuarterosNoch keine Bewertungen

- A Use The Run The Numbers Worksheet On Page 338Dokument1 SeiteA Use The Run The Numbers Worksheet On Page 338Amit PandeyNoch keine Bewertungen

- MOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat May 2022 UnlockedDokument1 SeiteMOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat May 2022 UnlockedArul Mhmmd10Noch keine Bewertungen

- Test Soal AdjustingDokument2 SeitenTest Soal AdjustingNicolas ErnestoNoch keine Bewertungen

- Invoice TemplateDokument4 SeitenInvoice TemplateObulesu NanganuruNoch keine Bewertungen

- Tax NotesDokument6 SeitenTax NotesblingblingmstrgNoch keine Bewertungen

- ParCor Chapter 3 - Hernandez - BSA 1-1 PDFDokument11 SeitenParCor Chapter 3 - Hernandez - BSA 1-1 PDFBSA 1-1Noch keine Bewertungen

- Week 1Dokument14 SeitenWeek 1kohalehNoch keine Bewertungen