Beruflich Dokumente

Kultur Dokumente

Horizontal or Trend Analysis

Hochgeladen von

Raja Sheraz Kayani0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

50 Ansichten2 SeitenBalance Sheet: Comparative Balance Sheet December 31, 2010, 2009 and 2008 (Rupees in '000') Assets Increase (Decrease) 2010 and 2009 Amount Percent Increase(Decrease) 2009 and 2008 Amount Percent Non Current Assets Property, Plant & equipment Intangible Assets Long term Advance Long term deposits Stores and Spares Stock in trade trade Debts Loans and advance Short term prepayments Other Receivables Tax refund due from the Govt. Taxation - Net Sales tax

Originalbeschreibung:

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenBalance Sheet: Comparative Balance Sheet December 31, 2010, 2009 and 2008 (Rupees in '000') Assets Increase (Decrease) 2010 and 2009 Amount Percent Increase(Decrease) 2009 and 2008 Amount Percent Non Current Assets Property, Plant & equipment Intangible Assets Long term Advance Long term deposits Stores and Spares Stock in trade trade Debts Loans and advance Short term prepayments Other Receivables Tax refund due from the Govt. Taxation - Net Sales tax

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

50 Ansichten2 SeitenHorizontal or Trend Analysis

Hochgeladen von

Raja Sheraz KayaniBalance Sheet: Comparative Balance Sheet December 31, 2010, 2009 and 2008 (Rupees in '000') Assets Increase (Decrease) 2010 and 2009 Amount Percent Increase(Decrease) 2009 and 2008 Amount Percent Non Current Assets Property, Plant & equipment Intangible Assets Long term Advance Long term deposits Stores and Spares Stock in trade trade Debts Loans and advance Short term prepayments Other Receivables Tax refund due from the Govt. Taxation - Net Sales tax

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

Horizontal or Trend Analysis

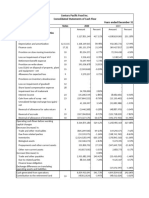

Balance Sheet:

Comparative Balance Sheet

December 31, 2010, 2009 and 2008

(Rupees in ‘000’ )

Assets Increase(Decrease) Increase(Decrease)

2010 and 2009 2009 and 2008

Amount Percent Amount Percent

Non Current Assets

Property, Plant & 901,383 2.95% 4,595,497 17.75%

equipment

Intangible Assets 2,977 - -

Long term Advance 0 55,373 -

Long term Deposits 0 0 0%

904,360 2.96 % 4,650,870 17.97 %

Current Assets

Stores & Spares 596,739 17.49% (748,597) (17.99%)

Stock in trade (587,795) (49.12%) 487,236 68.68%

Trade Debts (487943) (38.50%) 546,934 75.92%

Loans and advance (2961) (2.71%) (3113) (2.77%)

Short term (179,880) (94.85%)

prepayments 39046 400.02%

Other Receivables 125,554 211.90% (830,953) (93.34%)

Tax refund due from 0

the Govt. 0

Taxation – Net (31,433) (17.80%) 45685 34.90%

Sales tax refundable 77,777 193.65% (593,974) (93.66%)

Cash and Bank (715,462) (68.19%) 779,080 288.53%

balances

(986,478) (12.55%) (497,582) (5.96 %)

Total Assets (82,118) (0.21%) 4,153,288 12.13 %

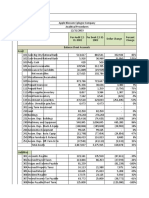

Equity & Increase (Decrease) Increase (Decrease)

Liabilities 2010 and 2009 2009 and 2008

Amount Percent Amount Percent

Share Capital &

Reserves

Share Capital 0 0

Reserves 1,843,957 9.21% 4,596,549 29.80%

1,840,957 7.91% 4,596,549 24.64%

Non Current

Liabilities

Long term Finance (2,641,400) (61.42%) (2,333,333) (35.17 %)

Long term deposits 3368 11.78% (1,663) (5.49 %)

Deferred Liabilities 84,584 36.04% 60,462 34.71 %

Deferred taxation 84,360 5.70% 419,492 39.61 %

(2,469,088) (40.86%) (1,855,042) (23.49 %)

Current Liabilities

Trade and other 365,964 13.66% (872,187) (24.57 %)

payables

Accrued Mark up (77,881) 33.375 (55,596) (19.23 %)

Short term 79,171 1.27% 2,581,231 71.56 %

borrowings

Current portion of 175,759 (241,667)

long term finance

543,031 5.96% 1,411,781 18.37 %

Total Equity & (82,118) (0.21%) 4,153,288 12.13 %

Liabilities

Das könnte Ihnen auch gefallen

- Ratio Analysis of Engro Vs NestleDokument24 SeitenRatio Analysis of Engro Vs NestleMuhammad SalmanNoch keine Bewertungen

- Final Task in Fundamentals of Accountancy, Business, and Management 2Dokument11 SeitenFinal Task in Fundamentals of Accountancy, Business, and Management 2Apply Ako Work EhNoch keine Bewertungen

- HYUNDAI Motors Balance SheetDokument4 SeitenHYUNDAI Motors Balance Sheetsarmistha guduliNoch keine Bewertungen

- AssetsDokument5 SeitenAssetseverythingbuthate588Noch keine Bewertungen

- Comparative Analysis of Financial Statement of Two CompaniesDokument24 SeitenComparative Analysis of Financial Statement of Two Companiesrexieace75% (4)

- FM121 - Ba2f - Financial AnalysisDokument12 SeitenFM121 - Ba2f - Financial AnalysisStephene MaynopasNoch keine Bewertungen

- Exhibit 1: Income Statement & Balance Sheet ActualsDokument3 SeitenExhibit 1: Income Statement & Balance Sheet ActualsGNoch keine Bewertungen

- Interim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesDokument2 SeitenInterim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesMike TruongNoch keine Bewertungen

- UltraTech Financial Statement - Ratio AnalysisDokument11 SeitenUltraTech Financial Statement - Ratio AnalysisYen HoangNoch keine Bewertungen

- Income Statement: USD Millions FY2024 FY2023 FY2022 FY2021Dokument7 SeitenIncome Statement: USD Millions FY2024 FY2023 FY2022 FY2021Vile KushNoch keine Bewertungen

- Pilipinas Shell Petroleum CorporationDokument4 SeitenPilipinas Shell Petroleum Corporation레미렘100% (1)

- Dandot Mar 09Dokument6 SeitenDandot Mar 09studioad324Noch keine Bewertungen

- Goodyear Indonesia TBK.: Balance SheetDokument20 SeitenGoodyear Indonesia TBK.: Balance SheetsariNoch keine Bewertungen

- Financial - Analysis (SCI and SFP)Dokument4 SeitenFinancial - Analysis (SCI and SFP)Joshua BristolNoch keine Bewertungen

- Tesla Company AnalysisDokument83 SeitenTesla Company AnalysisStevenTsaiNoch keine Bewertungen

- ROMarsDokument11 SeitenROMarsApply Ako Work EhNoch keine Bewertungen

- Notes 2020 Cash Flows From Operating ActivitiesDokument5 SeitenNotes 2020 Cash Flows From Operating ActivitiesKei SenpaiNoch keine Bewertungen

- Packages Financial AnalysisDokument24 SeitenPackages Financial AnalysisImran AbbasNoch keine Bewertungen

- Earnings Quality Score % 84 72: PT Kalbe Farma TBKDokument5 SeitenEarnings Quality Score % 84 72: PT Kalbe Farma TBKHari HikmawanNoch keine Bewertungen

- Project Company Subject Group Group Members: GC University FaisalabadDokument23 SeitenProject Company Subject Group Group Members: GC University FaisalabadMuhammad Tayyab RazaNoch keine Bewertungen

- Particulars Absolute Amounts 2018-19 2019-20 2018-19 2019-20 Rs. (In Lakhs) Rs. (In Lakhs) (%) (%) Percentage of Net SalesDokument6 SeitenParticulars Absolute Amounts 2018-19 2019-20 2018-19 2019-20 Rs. (In Lakhs) Rs. (In Lakhs) (%) (%) Percentage of Net SalesPrafful VyasNoch keine Bewertungen

- Yates Case Study - LT 11Dokument23 SeitenYates Case Study - LT 11JerryJoshuaDiazNoch keine Bewertungen

- CBRE 2008 - RatiosDokument2 SeitenCBRE 2008 - RatiosMatthew TinkelmanNoch keine Bewertungen

- 5a Comparative AnalyisDokument3 Seiten5a Comparative AnalyisramaNoch keine Bewertungen

- Financial Statement Analysis UnsolvedDokument3 SeitenFinancial Statement Analysis Unsolvedavani singhNoch keine Bewertungen

- Horizontal and VerticalDokument16 SeitenHorizontal and VerticalFadzir AmirNoch keine Bewertungen

- MiniScribe Corporation - FSDokument5 SeitenMiniScribe Corporation - FSNinaMartirezNoch keine Bewertungen

- United Tractors TBK.: Balance Sheet Dec-06 DEC 2007 DEC 2008Dokument26 SeitenUnited Tractors TBK.: Balance Sheet Dec-06 DEC 2007 DEC 2008sariNoch keine Bewertungen

- BF1 Package Ratios ForecastingDokument16 SeitenBF1 Package Ratios ForecastingBilal Javed JafraniNoch keine Bewertungen

- Tablas Financieras 1Q13Dokument76 SeitenTablas Financieras 1Q13Chavez AznaranNoch keine Bewertungen

- Horizontal SFPDokument17 SeitenHorizontal SFPJanefren Pada EdilloNoch keine Bewertungen

- Balance SheetDokument6 SeitenBalance SheetayeshnaveedNoch keine Bewertungen

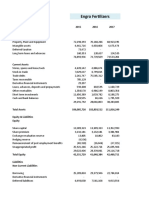

- Engro FertilizerDokument9 SeitenEngro FertilizerAbdullah Sohail100% (1)

- Nestle and Alcon - The Value of ADokument33 SeitenNestle and Alcon - The Value of Akjpcs120% (1)

- VERTICAL ANALYSIS OF INCOME STATEMENT of Toyota 2022-2021Dokument8 SeitenVERTICAL ANALYSIS OF INCOME STATEMENT of Toyota 2022-2021Touqeer HussainNoch keine Bewertungen

- Kansai Nerolac QuestionDokument6 SeitenKansai Nerolac Questionricha krishnaNoch keine Bewertungen

- Emu LinesDokument22 SeitenEmu LinesRahul MehraNoch keine Bewertungen

- Copy of (SW.BAND) Урок 6. Lenta - DCF - SolutionDokument143 SeitenCopy of (SW.BAND) Урок 6. Lenta - DCF - SolutionLee SinNoch keine Bewertungen

- Horizontal AnalysisDokument6 SeitenHorizontal AnalysisjohhanaNoch keine Bewertungen

- TeslaDokument5 SeitenTeslaRajib ChatterjeeNoch keine Bewertungen

- Nestle Group FS AnalisysDokument7 SeitenNestle Group FS Analisysablay logene50% (2)

- Horizontal and Vertical Analysis of ProfitDokument3 SeitenHorizontal and Vertical Analysis of ProfitIfzal AhmadNoch keine Bewertungen

- Non Current Liabilities: Rupees in ThousandsDokument28 SeitenNon Current Liabilities: Rupees in ThousandstanzeilNoch keine Bewertungen

- Focus of The Final PaperDokument8 SeitenFocus of The Final PaperDenis MuneneNoch keine Bewertungen

- Horizontal and Vertical AnalysisDokument3 SeitenHorizontal and Vertical AnalysisJane Ericka Joy MayoNoch keine Bewertungen

- Financial+Statement+Analysis SolvedDokument5 SeitenFinancial+Statement+Analysis SolvedMary JoyNoch keine Bewertungen

- 5a Comparative AnalyisDokument2 Seiten5a Comparative AnalyisramaNoch keine Bewertungen

- Adidas Group Consolidated Balance Sheet (IFRS) : in Millions Dec. 31 Dec. 31 Change 2009 2008Dokument3 SeitenAdidas Group Consolidated Balance Sheet (IFRS) : in Millions Dec. 31 Dec. 31 Change 2009 2008Pranit ShahNoch keine Bewertungen

- Ho Chi Minh Securities Corporation: Financial AnalysisDokument26 SeitenHo Chi Minh Securities Corporation: Financial AnalysisNgọc Dương Thị BảoNoch keine Bewertungen

- Complete Financial Model & Valuation of ARCCDokument46 SeitenComplete Financial Model & Valuation of ARCCgr5yjjbmjsNoch keine Bewertungen

- Interim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesDokument2 SeitenInterim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesDaniyal NawazNoch keine Bewertungen

- Horizontal Analysis FinalDokument9 SeitenHorizontal Analysis FinalJerry ManatadNoch keine Bewertungen

- It Dic 13 Eng - NDokument11 SeitenIt Dic 13 Eng - NcoccobillerNoch keine Bewertungen

- Tire City ClassDokument2 SeitenTire City ClasshamedkharrazNoch keine Bewertungen

- Tesla FinModelDokument58 SeitenTesla FinModelPrabhdeep DadyalNoch keine Bewertungen

- Ha GSMDokument1 SeiteHa GSMVenus PalmencoNoch keine Bewertungen

- Infosys Technologies LTD RatioDokument4 SeitenInfosys Technologies LTD Ratioron1436Noch keine Bewertungen

- 18 Horizontal & Vertical AnalysisDokument2 Seiten18 Horizontal & Vertical AnalysisChaudhry EzHarNoch keine Bewertungen

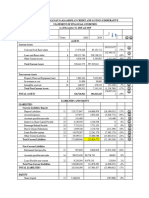

- Kabuhayan Sa Ganap Na Kasarinlan Credit and Savings CooperativeDokument4 SeitenKabuhayan Sa Ganap Na Kasarinlan Credit and Savings CooperativeAngelica MijaresNoch keine Bewertungen

- Equity Valuation: Models from Leading Investment BanksVon EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNoch keine Bewertungen

- MSME Pulse Jun 19 - With Statewise RankingDokument23 SeitenMSME Pulse Jun 19 - With Statewise RankingmeenaldutiaNoch keine Bewertungen

- 11 G.R. No. 123567Dokument2 Seiten11 G.R. No. 123567MARY CHRISTINE JOY E. BAQUIRINGNoch keine Bewertungen

- Solved According To A 2010 Study Conducted by The Toronto Based Social PDFDokument1 SeiteSolved According To A 2010 Study Conducted by The Toronto Based Social PDFAnbu jaromiaNoch keine Bewertungen

- Cash Receipts Journal PDFDokument1 SeiteCash Receipts Journal PDFMilena AckovicNoch keine Bewertungen

- Previous Year PaperDokument19 SeitenPrevious Year PaperVikiNoch keine Bewertungen

- Project Report: M/S Kamla Hari Group of Institute SocietyDokument42 SeitenProject Report: M/S Kamla Hari Group of Institute SocietyPraveen Singh0% (1)

- POs Pre Joining Study Material PDFDokument152 SeitenPOs Pre Joining Study Material PDFKushagra Pratap SinghNoch keine Bewertungen

- AC MBA FEP Dec 2013 PDFDokument38 SeitenAC MBA FEP Dec 2013 PDFfaazalwahabNoch keine Bewertungen

- Agency Trust and PartnershipDokument3 SeitenAgency Trust and PartnershipJhoel VillafuerteNoch keine Bewertungen

- Sample MOADokument8 SeitenSample MOAStewart Paul TorreNoch keine Bewertungen

- Financial Risk Management: Executive SummaryDokument7 SeitenFinancial Risk Management: Executive Summarymishal chNoch keine Bewertungen

- Budgeting ProblemDokument7 SeitenBudgeting ProblemBest Girl RobinNoch keine Bewertungen

- FOIA For Public RecordsDokument8 SeitenFOIA For Public Recordsfisherre2000100% (2)

- RA 11057 or The Personal Property Security ActDokument14 SeitenRA 11057 or The Personal Property Security ActLaughLy ReuyanNoch keine Bewertungen

- 1 - Cash and Cash EquivalentsDokument6 Seiten1 - Cash and Cash EquivalentsPrincess Raniah AcmadNoch keine Bewertungen

- Lesson Number: Dates Subject Management 1 Activity Title Learning Targets Reference (S) Source (S) AuthorsDokument11 SeitenLesson Number: Dates Subject Management 1 Activity Title Learning Targets Reference (S) Source (S) AuthorsZybel RosalesNoch keine Bewertungen

- ACC 108 Drill 1 2s2223Dokument6 SeitenACC 108 Drill 1 2s2223Ghie RodriguezNoch keine Bewertungen

- Performance Standard: The Learners Are Able To Define Finance, Describe Who Are Responsible ForDokument37 SeitenPerformance Standard: The Learners Are Able To Define Finance, Describe Who Are Responsible ForArjae DantesNoch keine Bewertungen

- Section 3: Obligations of The Partners With Regard To Third PersonsDokument20 SeitenSection 3: Obligations of The Partners With Regard To Third PersonsRafael AdanNoch keine Bewertungen

- Cashflow Projection TemplateDokument1 SeiteCashflow Projection TemplatePAMAJANoch keine Bewertungen

- 5 Meeting Partnership LiquidationDokument5 Seiten5 Meeting Partnership LiquidationaudreyNoch keine Bewertungen

- To Accrue Advertising Expense: I PXRXTDokument6 SeitenTo Accrue Advertising Expense: I PXRXTShane Nayah78% (9)

- Jenny Merchandising Common-Size Analysis'Dokument2 SeitenJenny Merchandising Common-Size Analysis'Theang ʚĩɞNoch keine Bewertungen

- Bank Reconciliation StatementDokument32 SeitenBank Reconciliation StatementMuhammad Arslan100% (2)

- As A Recent Graduate You Have Been Hired by CanadianDokument2 SeitenAs A Recent Graduate You Have Been Hired by CanadianAmit PandeyNoch keine Bewertungen

- Activity 3.4 Financial AssumptionsDokument9 SeitenActivity 3.4 Financial AssumptionsRojin TingabngabNoch keine Bewertungen

- Tutorial 5 QsDokument7 SeitenTutorial 5 QsDarren Khew0% (1)

- Mcom 1 Sem Advanced Financial N Cost Accounting New S 2019Dokument7 SeitenMcom 1 Sem Advanced Financial N Cost Accounting New S 2019Krishna TiwariNoch keine Bewertungen

- Lesson 3 Financing PDFDokument20 SeitenLesson 3 Financing PDFAngelita Dela cruzNoch keine Bewertungen

- Fundamentals of Accounting - Session 1Dokument42 SeitenFundamentals of Accounting - Session 1Joseph Labrado VillartaNoch keine Bewertungen