Beruflich Dokumente

Kultur Dokumente

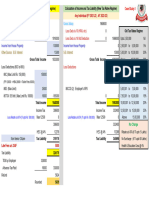

Calculation For Exemption of House Rent Allowances From Income Tax

Hochgeladen von

Pranab Banerjee0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

82 Ansichten4 SeitenCalculation for Exemption of H.R.A Allowances from income tax

Originaltitel

Exemption of HRA FROM IT

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

XLS, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCalculation for Exemption of H.R.A Allowances from income tax

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als XLS, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

82 Ansichten4 SeitenCalculation For Exemption of House Rent Allowances From Income Tax

Hochgeladen von

Pranab BanerjeeCalculation for Exemption of H.R.A Allowances from income tax

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als XLS, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

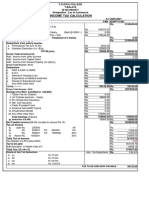

Calculation for Exemption of House Rent Allowances from Income Tax

Prepared by Pranab Banerjee,Kalisthanpara, Jiaganj,Murshidabad,West Bengal, Mail:-

pranab.banerjee83@gmail.com,9474316768,8906279547, For More Calculation Please Visit:-

www.pranab.jiaganj.com

Total Basic Salary + Grade Pay (PerYear)

300000 Total=B.Pay +G.Pay + D.A.

{ Apr to Mar}

Total of B.Pay +

Total D.A.(Per Year){Apr to Mar} 60000 360000

Grade Pay+ D.A.

Total H.R.A. Received(Per Year){Apr to Mar} 240000 Edit only Yellow Cell

House Rent Paid (Per Year) {Apr to Mar} 120000 84000 50%

10% or 40% + D.A.

of B.Pay

If you Live in Metro city Put Yes or No

Yes 180000

( Others City

40%,Metro City 50%)

ALLOWAED H.R.A. EXEMPTION FROM INCOME TAX 84000 on B.pay + D.A.

CHARGABLE AMOUNT OF EXCESS HRA Will be Paid Rs. 156000

www.pranab.jiaganj.com

Das könnte Ihnen auch gefallen

- Tax statement for Mrs. Elizabeth FarajiDokument29 SeitenTax statement for Mrs. Elizabeth FarajiDead Beat's RandomNoch keine Bewertungen

- ACFrOgCPKi70npV5R8ZO4Qe-CnF8yvJMWMlGx2SIx6bqMAfZA-YZJASbPgbSy7zbg0 cxrqcx5 sDGlx7VQi8IwTtYXto39d9pXkFK7wWNgU2QXrc U6WVrwDtAG6rQO7MrVVMWrGFcak-ZPM95DDokument10 SeitenACFrOgCPKi70npV5R8ZO4Qe-CnF8yvJMWMlGx2SIx6bqMAfZA-YZJASbPgbSy7zbg0 cxrqcx5 sDGlx7VQi8IwTtYXto39d9pXkFK7wWNgU2QXrc U6WVrwDtAG6rQO7MrVVMWrGFcak-ZPM95DManleen KaurNoch keine Bewertungen

- Income Tax PDFDokument23 SeitenIncome Tax PDFSHASHWAT MISHRANoch keine Bewertungen

- Income Tax Calculation Lec in CommerceDokument2 SeitenIncome Tax Calculation Lec in CommerceMadhan Kumar BobbalaNoch keine Bewertungen

- Motilal Excel PlanDokument8 SeitenMotilal Excel Plansourajit kunduNoch keine Bewertungen

- Financial Year 2020-21 Annual Income Tax Declaration ComparisonDokument4 SeitenFinancial Year 2020-21 Annual Income Tax Declaration ComparisonHaresh RajputNoch keine Bewertungen

- HRA and SalaruDokument1 SeiteHRA and SalaruAnushree DeyNoch keine Bewertungen

- Income From SalaryDokument5 SeitenIncome From Salarydbgdemo6Noch keine Bewertungen

- From The Following Particulars Compute Gross Annual Value MRV: 18000 FRV: 21000 ARV:36000 SRV: 24000 Urr (In MonthsDokument5 SeitenFrom The Following Particulars Compute Gross Annual Value MRV: 18000 FRV: 21000 ARV:36000 SRV: 24000 Urr (In Monthsrathison neonNoch keine Bewertungen

- Previous Year April To June July To March 2016-17 Nil 15000 2017-18 15000 16500 2018-19 16500 18000 2019-20 18000 19500Dokument4 SeitenPrevious Year April To June July To March 2016-17 Nil 15000 2017-18 15000 16500 2018-19 16500 18000 2019-20 18000 19500Sumit PattanaikNoch keine Bewertungen

- Total 90100 Salary Bill: December To May: Amit Expenses Since DecemberDokument2 SeitenTotal 90100 Salary Bill: December To May: Amit Expenses Since DecemberamitsundarNoch keine Bewertungen

- Hari Chand - October 2019 PDFDokument1 SeiteHari Chand - October 2019 PDFVasu GuptaNoch keine Bewertungen

- Income From Salary Solution ZDokument3 SeitenIncome From Salary Solution ZMuhammad FaisalNoch keine Bewertungen

- Taxable - Income - Formula - Excel - TemplateDokument8 SeitenTaxable - Income - Formula - Excel - TemplateFaizan AhmadNoch keine Bewertungen

- Monthly salary breakup with components like basic, HRA, allowances, reimbursements, annual bonusDokument1 SeiteMonthly salary breakup with components like basic, HRA, allowances, reimbursements, annual bonusVankishKhoslaNoch keine Bewertungen

- XYZ Company flexible budget and variance analysisDokument15 SeitenXYZ Company flexible budget and variance analysisTanvir OnifNoch keine Bewertungen

- Income TAX: Particular Case 1 Case 2Dokument15 SeitenIncome TAX: Particular Case 1 Case 2Shekh SalmanNoch keine Bewertungen

- Questions & Answers - Salary IncomeDokument14 SeitenQuestions & Answers - Salary IncomeKiran BendeNoch keine Bewertungen

- Assignment TAX (21 AIS 039)Dokument18 SeitenAssignment TAX (21 AIS 039)Amran OviNoch keine Bewertungen

- B1 Renand Dsouza TYBFMDokument8 SeitenB1 Renand Dsouza TYBFMRenandNoch keine Bewertungen

- Divine Company Began OperationsDokument1 SeiteDivine Company Began OperationsQueen ValleNoch keine Bewertungen

- Ty Baf TaxationDokument4 SeitenTy Baf TaxationAkki GalaNoch keine Bewertungen

- Salary Slip (Indra)Dokument3 SeitenSalary Slip (Indra)Ali MuzaffarNoch keine Bewertungen

- PI Industries April 2020 Pay SlipDokument1 SeitePI Industries April 2020 Pay SlipRahul mishraNoch keine Bewertungen

- Blank Income Tax FormDokument3 SeitenBlank Income Tax FormmmmukhtarNoch keine Bewertungen

- ch14 ExercisesDokument10 Seitench14 ExercisesAriin TambunanNoch keine Bewertungen

- Income Tax Calculation SheetDokument8 SeitenIncome Tax Calculation SheetArajrubanNoch keine Bewertungen

- Activity 1 Partnership Formation and OperationDokument3 SeitenActivity 1 Partnership Formation and OperationDianna Rose VicoNoch keine Bewertungen

- Clubbing of Income ProvisionsDokument6 SeitenClubbing of Income Provisionssnowbell 95Noch keine Bewertungen

- Techniques of Capital Budgeting SumsDokument15 SeitenTechniques of Capital Budgeting Sumshardika jadavNoch keine Bewertungen

- Problems On Income From Salaries: Tax SupplementDokument20 SeitenProblems On Income From Salaries: Tax SupplementJkNoch keine Bewertungen

- Basic Concepts PDFDokument14 SeitenBasic Concepts PDFsumitNoch keine Bewertungen

- 9.1 INCOME FROM PROPERTY Notes Questions With SolutionsDokument5 Seiten9.1 INCOME FROM PROPERTY Notes Questions With SolutionsHASNAT SABIRNoch keine Bewertungen

- Assignment AccountingDokument6 SeitenAssignment AccountingColine DueñasNoch keine Bewertungen

- CALCULATING FIRM INCOMEDokument12 SeitenCALCULATING FIRM INCOMEKabita BhowmickNoch keine Bewertungen

- Taxable Salary Problem With Solution Part 1Dokument2 SeitenTaxable Salary Problem With Solution Part 1NagadeepaNoch keine Bewertungen

- How To Calculate Total IncomeDokument16 SeitenHow To Calculate Total IncomeAshish ChatrathNoch keine Bewertungen

- Numerical Problems On Salary 1Dokument5 SeitenNumerical Problems On Salary 1Shubham K RNoch keine Bewertungen

- HRA Sums.Dokument4 SeitenHRA Sums.Saranya kandhasamyNoch keine Bewertungen

- 3.tax Free PDFDokument3 Seiten3.tax Free PDFArun ShettarNoch keine Bewertungen

- Problems On Taxable Salary Income Additional PDFDokument24 SeitenProblems On Taxable Salary Income Additional PDFNALIN MEHTA 1713068Noch keine Bewertungen

- Income Tax Calculator 2018-19Dokument15 SeitenIncome Tax Calculator 2018-19Raju Ranjan SinghNoch keine Bewertungen

- Compound Interest Quiz Solved with Detailed ExplanationsDokument11 SeitenCompound Interest Quiz Solved with Detailed ExplanationsSurayyaNoch keine Bewertungen

- Learn More Salaries - August 2020Dokument5 SeitenLearn More Salaries - August 2020Adarsh PandeyNoch keine Bewertungen

- House Property - IllustrationDokument10 SeitenHouse Property - IllustrationAnirban ThakurNoch keine Bewertungen

- Calculation of Cost To CompanyDokument1 SeiteCalculation of Cost To CompanySoumyaranjan BeheraNoch keine Bewertungen

- G. S. T Goods and Service Tax: Alcoholic Drinks ElectricityDokument6 SeitenG. S. T Goods and Service Tax: Alcoholic Drinks ElectricityRabindra DashNoch keine Bewertungen

- Problems On Business/Profession Income: SEM It AssignmentDokument9 SeitenProblems On Business/Profession Income: SEM It AssignmentNikhilNoch keine Bewertungen

- Sol 1Dokument1 SeiteSol 1alex breymannNoch keine Bewertungen

- Income Tax Calculator for Govt EmployeesDokument11 SeitenIncome Tax Calculator for Govt Employeeschandu3060Noch keine Bewertungen

- Assignment No 02 Business Law and Taxation: Tauraira Arshad 16320 SolutionDokument2 SeitenAssignment No 02 Business Law and Taxation: Tauraira Arshad 16320 SolutionSYEDA -Noch keine Bewertungen

- Assets Liabilties + Paid in Capital + (BEG Retained Earnings + Net Income - Dividends End Retained Earnings) Firm ADokument2 SeitenAssets Liabilties + Paid in Capital + (BEG Retained Earnings + Net Income - Dividends End Retained Earnings) Firm ACNoch keine Bewertungen

- Understanding financial statement relationships and the accounting equationDokument2 SeitenUnderstanding financial statement relationships and the accounting equationCNoch keine Bewertungen

- Assets Liabilties + Paid in Capital + (BEG Retained Earnings + Net Income - Dividends End Retained Earnings) Firm ADokument2 SeitenAssets Liabilties + Paid in Capital + (BEG Retained Earnings + Net Income - Dividends End Retained Earnings) Firm ACNoch keine Bewertungen

- Computation of Total Income of DR Gurumoorthy For The A.Y 2016-2017Dokument2 SeitenComputation of Total Income of DR Gurumoorthy For The A.Y 2016-2017sumitNoch keine Bewertungen

- Computation of Toatal IncomeDokument4 SeitenComputation of Toatal IncomePRITAM PATRANoch keine Bewertungen

- Business Promoter: Work From HomeDokument2 SeitenBusiness Promoter: Work From HomeEkhizz VicenteNoch keine Bewertungen

- Shree Chanakya Education Society's Indira Institute of Management, Pune Master of Business Administration Semester - IIDokument5 SeitenShree Chanakya Education Society's Indira Institute of Management, Pune Master of Business Administration Semester - IIBanti guptaNoch keine Bewertungen

- Earnings Deductions: Eicher Motors LimitedDokument1 SeiteEarnings Deductions: Eicher Motors LimitedR SEETHARAMANNoch keine Bewertungen

- 5.5 Income Tax Return Calculator For Non-Govt Employees Fy 2010-2011Dokument19 Seiten5.5 Income Tax Return Calculator For Non-Govt Employees Fy 2010-2011Pranab BanerjeeNoch keine Bewertungen

- Maharastra Govt Employees All in One Income Tax Return Preparation Fy 10-11Dokument26 SeitenMaharastra Govt Employees All in One Income Tax Return Preparation Fy 10-11Pranab BanerjeeNoch keine Bewertungen

- Compact Income Tax For Non-Govt Employees For FY 2010-2011Dokument24 SeitenCompact Income Tax For Non-Govt Employees For FY 2010-2011Pranab BanerjeeNoch keine Bewertungen

- Form No. 24 in Excel Format of Income Tax Annual Statement - XLDokument25 SeitenForm No. 24 in Excel Format of Income Tax Annual Statement - XLPranab BanerjeeNoch keine Bewertungen

- Prymary Teacher's GPF Account Slip For W.BDokument4 SeitenPrymary Teacher's GPF Account Slip For W.BPranab Banerjee86% (7)

- Automated Form 16 FY 10-11Dokument8 SeitenAutomated Form 16 FY 10-11Pranab BanerjeeNoch keine Bewertungen

- All in One Income Tax Return Preparation of All Govt & Private Employees For FY 2010-2011Dokument25 SeitenAll in One Income Tax Return Preparation of All Govt & Private Employees For FY 2010-2011Pranab BanerjeeNoch keine Bewertungen

- Family Pension For W.b.govt Employees (Death Case)Dokument2 SeitenFamily Pension For W.b.govt Employees (Death Case)Pranab Banerjee100% (1)

- All in One Income Tax Return Preparation For W.B. Govt - Employees Fy 10-11Dokument24 SeitenAll in One Income Tax Return Preparation For W.B. Govt - Employees Fy 10-11Pranab BanerjeeNoch keine Bewertungen

- GRATUITY Calculator For Central Govt & Private Concern EmployeesDokument2 SeitenGRATUITY Calculator For Central Govt & Private Concern EmployeesPranab Banerjee100% (1)

- New Fixation of Promotional Benefit Calculation For West Bengal Govt Employees.Dokument4 SeitenNew Fixation of Promotional Benefit Calculation For West Bengal Govt Employees.Pranab Banerjee100% (1)

- Pension Calculation For W.B.Govot Employees OnlyDokument1 SeitePension Calculation For W.B.Govot Employees OnlyPranab BanerjeeNoch keine Bewertungen

- Death Gratuity Calculation For West Bengal Govt EmployeesDokument2 SeitenDeath Gratuity Calculation For West Bengal Govt EmployeesPranab Banerjee100% (4)

- Leave Salary Calculation For Central Govt EmployeesDokument1 SeiteLeave Salary Calculation For Central Govt EmployeesPranab Banerjee100% (1)

- Leave Salary Calculation Govt EmployeeDokument1 SeiteLeave Salary Calculation Govt EmployeePranab BanerjeeNoch keine Bewertungen

- Gratuity Calculation For Municipality) EmployeesDokument4 SeitenGratuity Calculation For Municipality) EmployeesPranab BanerjeeNoch keine Bewertungen

- Retirement Gratuity Calculation For West Bengal Govt EmployeeDokument4 SeitenRetirement Gratuity Calculation For West Bengal Govt EmployeePranab Banerjee100% (1)

- G.P.F. Calculation For West Bengal Govt EmployeesDokument3 SeitenG.P.F. Calculation For West Bengal Govt EmployeesPranab Banerjee100% (6)

- Leave Salary Calculation For MunicipalityDokument1 SeiteLeave Salary Calculation For MunicipalityPranab BanerjeeNoch keine Bewertungen

- Calculation For Commuted Pension of W.B.Govt EmployeesDokument2 SeitenCalculation For Commuted Pension of W.B.Govt EmployeesPranab Banerjee100% (1)

- C A S (8 - 16 - 25)Dokument2 SeitenC A S (8 - 16 - 25)Pranab Banerjee100% (1)