Beruflich Dokumente

Kultur Dokumente

Balance Sheet Problem

Hochgeladen von

trupti_naik08725Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Balance Sheet Problem

Hochgeladen von

trupti_naik08725Copyright:

Verfügbare Formate

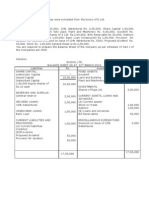

The following ledger balances were extracted from the books of R Ltd.

On 31st March, 2010.

Land and Building Rs. 2,00,000; 12% debentures Rs. 2,00,000; Share Capital 1,00,000

equity shares Rs. 10 each fully paid; Plant and Machinery Rs. 8,00,000; Goodwill Rs.

2,00,000;Investments in shares of S Ltd. Rs.2,00,000; Bills Receivable Rs 50,000; Debtors

Rs. 1,50,000; Creditors Rs 1,00,000; Bank Loan (Unsecured) Rs 1,00,000; Provision for

taxation Rs. 50,000; Discount on issue of 12% debentures Rs. 5000; Proposed dividend Rs.

55,000. Stock Rs. 1,00,000 General Reserve Rs 2,00,000.

You are required to prepare the Balance Sheet of the company as per schedule VI Part I of

the Companies act 1956.

Solution:

RUSHIL LTD.

BALANCE SHEET AS AT 31ST MARCH,2010.

Liabilities Rs. Assets Rs.

SAHRE CAPITAL: FIXED ASSETS:

Authorized Capital ______?___ Goodwill 2,00,000

Issued Capital 10,00,000 Land and Building 2,00,000

Subscribed Capital Plant and Machinery 8,00,000

1,00,000 Equity shares of 10,00,000

Rs.10 each INVESTMENTS:

Shares of Raja Ltd. 2,00,000

RESERVES AND SURPLUS:

General reserve 2,00,000 CURRENT ASSETS, LOANS AND

ADVANCES:

SECURED LOANS: 2,00,000 (A) Current assets:

12% Debentures Stock-in-Trade 1,00,000

Debtors 1,50,000

UNSECURED LOANS: 1,00,000 (B) Loans and Advances

Bank Loan Bill Receivables 50,000

CURRENT LIABILITIES AND MISCELLANEOUS EXPENDITURE:

PROVISIONS: 1,00,000 Discount on issue of 12% 5,000

(A) Current liabilities Debentures

Creditors

(B)Provisions

Proposed dividend 55,000

Provision for taxation

50,000

17,05,000

17,05,000

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Cline Plus - Brochure-A PDFDokument2 SeitenCline Plus - Brochure-A PDFtrupti_naik08725Noch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Minimum Wages ActDokument11 SeitenMinimum Wages Acttrupti_naik08725Noch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Esic Claim Sickness Form9Dokument1 SeiteEsic Claim Sickness Form9trupti_naik08725Noch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Balance Sheet ProblemDokument1 SeiteBalance Sheet Problemtrupti_naik08725Noch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Management AccountingDokument3 SeitenManagement Accountingtrupti_naik08725Noch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- HP Compaq Presario c700 - Compal La-4031 Jbl81 - Rev 1.0 - ZouaveDokument42 SeitenHP Compaq Presario c700 - Compal La-4031 Jbl81 - Rev 1.0 - ZouaveYonny MunozNoch keine Bewertungen

- Introduction The Myth of SomaliaDokument14 SeitenIntroduction The Myth of SomaliaKhader AliNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Superstitions, Rituals and Postmodernism: A Discourse in Indian Context.Dokument7 SeitenSuperstitions, Rituals and Postmodernism: A Discourse in Indian Context.Dr.Indranil Sarkar M.A D.Litt.(Hon.)Noch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Project On Hospitality Industry: Customer Relationship ManagementDokument36 SeitenProject On Hospitality Industry: Customer Relationship ManagementShraddha TiwariNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Ethiopia Pulp & Paper SC: Notice NoticeDokument1 SeiteEthiopia Pulp & Paper SC: Notice NoticeWedi FitwiNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Message of Malachi 4Dokument7 SeitenThe Message of Malachi 4Ayeah GodloveNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Acknowledgment, Dedication, Curriculum Vitae - Lanie B. BatoyDokument3 SeitenAcknowledgment, Dedication, Curriculum Vitae - Lanie B. BatoyLanie BatoyNoch keine Bewertungen

- African American LiteratureDokument9 SeitenAfrican American LiteratureStephen Ali BarkahNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Detailed Lesson PlanDokument6 SeitenDetailed Lesson PlanMa. ChrizelNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Listo Si Kap!Dokument32 SeitenListo Si Kap!Bluboy100% (3)

- Appleby, Telling The Truth About History, Introduction and Chapter 4Dokument24 SeitenAppleby, Telling The Truth About History, Introduction and Chapter 4Steven LubarNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- People vs. Tampus DigestDokument2 SeitenPeople vs. Tampus Digestcmv mendozaNoch keine Bewertungen

- Ais CH5Dokument30 SeitenAis CH5MosabAbuKhater100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Philippine Phoenix Surety vs. WoodworksDokument1 SeitePhilippine Phoenix Surety vs. WoodworksSimon James SemillaNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Online Advertising BLUE BOOK: The Guide To Ad Networks & ExchangesDokument28 SeitenOnline Advertising BLUE BOOK: The Guide To Ad Networks & ExchangesmThink100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Decline of Mughals - Marathas and Other StatesDokument73 SeitenDecline of Mughals - Marathas and Other Statesankesh UPSCNoch keine Bewertungen

- Profile Story On Survivor Contestant Trish DunnDokument6 SeitenProfile Story On Survivor Contestant Trish DunnMeganGraceLandauNoch keine Bewertungen

- Mock Act 1 - Student - 2023Dokument8 SeitenMock Act 1 - Student - 2023Big bundahNoch keine Bewertungen

- Data Warga RT 02 PDFDokument255 SeitenData Warga RT 02 PDFeddy suhaediNoch keine Bewertungen

- Carl Rogers Written ReportsDokument3 SeitenCarl Rogers Written Reportskyla elpedangNoch keine Bewertungen

- BloggingDokument8 SeitenBloggingbethNoch keine Bewertungen

- Concept Note TemplateDokument2 SeitenConcept Note TemplateDHYANA_1376% (17)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Accounting For Revenue and Other ReceiptsDokument4 SeitenAccounting For Revenue and Other ReceiptsNelin BarandinoNoch keine Bewertungen

- BorgWarner v. Pierburg Et. Al.Dokument9 SeitenBorgWarner v. Pierburg Et. Al.PriorSmartNoch keine Bewertungen

- In Christ: Romans 6:4Dokument6 SeitenIn Christ: Romans 6:4Bruce LyonNoch keine Bewertungen

- Bos 2478Dokument15 SeitenBos 2478klllllllaNoch keine Bewertungen

- SIP Annex 5 - Planning WorksheetDokument2 SeitenSIP Annex 5 - Planning WorksheetGem Lam SenNoch keine Bewertungen

- Ronaldo FilmDokument2 SeitenRonaldo Filmapi-317647938Noch keine Bewertungen

- ACCT1501 MC Bank QuestionsDokument33 SeitenACCT1501 MC Bank QuestionsHad0% (2)

- The Aesthetic Revolution and Its Outcomes, Jacques RanciereDokument19 SeitenThe Aesthetic Revolution and Its Outcomes, Jacques RanciereTheoria100% (1)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)