Beruflich Dokumente

Kultur Dokumente

Case Study: Security Analysis Abc Bank LTD

Hochgeladen von

Siddharajsinh GohilOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Case Study: Security Analysis Abc Bank LTD

Hochgeladen von

Siddharajsinh GohilCopyright:

Verfügbare Formate

CASE STUDY

SECURITY ANALYSIS

ABC BANK LTD

ABC Ltd. is a Banking Company constituted under the Indian Company’s Act 1956

established in 1996. It is a closely held Company having six branches including one at

Surat and another at Mumbai. The Bank has break even right from first year of its

operations and is commending a good reputation also in the market. The Bank is

managed by full time banking professionals besides a board constituting reputed

personalities from mercantile and social sphere.

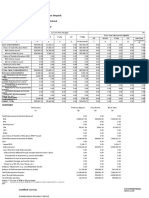

Balance Sheet

Liabilities (Rs.. In lacs)

As On 31.03.2008 31.03.2009

31.08.2009

(Audited) (Provisional)

Issued & Paid Up Capital 20,00 30,00

30,00

Reserves & Surpluses 25,00

39,00 39,00

------------ -----------

-----------

45,00 69,00

69,00

Savings Bank 76,00 88,00

84,00

Current Deposits 32,00 44,00 43,00

Term Deposits 58,50 64,00

78,00

16,650 19,600

205,00

Other Current Liabilities 11,00 12,50

14,25

P & L A/C 9,00 14,50

17,50

----------------------------------------------------------------------

----------

Total Liabilities 23,150 29,200

30,575

Assets

As On 31.03.2008 31.03.2009

31.08.2009

Fixed Assets 36,00 34,50

34,50

Cash Balances 7,10 12.10

9,10

Balances with Banks 11,30 18,20 21,70

Loans & Advances 132,25 157,92

166,00

Investments

Mutual Funds 2,00 270 370

Treasury Bills 31,50 37,50

35,80

Government Of India

Commercial Paper 13,25 11,63 9,35

IDBI Bonds 10,00 10,00 10,00

Investment in

Subsidiary Co. 750 625 450

42,25 68,08 63,35

Misc. Current Assets 260 120 11,10

-------- ---------

---------

23,150 29,200

30,575

--------- ---------

---------

Additional Information

Contingent Liabilities 700 1100 1300

Overdue Term Deposits 2% 5% 8%

Dividend from subsidiary Co 90 49 Not Declared

Net Profit 720 960 300 (Prov)

You are required to

1. Comment on solvency of ABC Bank Ltd 2.Make Security Analysis

2. Calculate Share intrinsic value

3. Would you suggest the Bank to go in capital market? Quantify. Also suggest

which out of the following securities could be worth while the present

capital market scenario

ONGC SBI Power Grid ICICI BANK

Infosis Adani Power Tata Power Binani Cement

DLF Gail India Reliance Capital

4. Calculate CRR & SLR

5. Examine possibility of IPO. If at all worthwhile, also suggest price band

6. Comment on profitability/productivity performance & suggest for its

improvement

7. Comment on Low Cost Deposits 8. Calculate Capital Adequacy Ratio .

Das könnte Ihnen auch gefallen

- Death Claim ManualDokument66 SeitenDeath Claim ManualPuneet RanaNoch keine Bewertungen

- Business Advantage Statement: Welcome To Your Anz Account at A GlanceDokument12 SeitenBusiness Advantage Statement: Welcome To Your Anz Account at A GlanceAlexander BondNoch keine Bewertungen

- Banker S Right of Set Off - Explained - BankExamsTodayDokument4 SeitenBanker S Right of Set Off - Explained - BankExamsTodayHimanshu Panchpal100% (3)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- CC Loan ProjectDokument11 SeitenCC Loan ProjectAjay ThakurNoch keine Bewertungen

- Ratio Analysis WorksheetDokument5 SeitenRatio Analysis WorksheetAnish AroraNoch keine Bewertungen

- Quizzer Cash - Solution Printed KoDokument119 SeitenQuizzer Cash - Solution Printed Kogoerginamarquez80% (10)

- What Is The Difference Between Commercial Banking and Merchant BankingDokument8 SeitenWhat Is The Difference Between Commercial Banking and Merchant BankingScarlett Lewis100% (2)

- Equitable PCI Bank V Tan - Santos - 8Dokument2 SeitenEquitable PCI Bank V Tan - Santos - 8Jasmine Rose Maquiling100% (2)

- Gempesaw vs. Court of Appeals, 218 SCRA 682, February 09, 1993Dokument14 SeitenGempesaw vs. Court of Appeals, 218 SCRA 682, February 09, 1993RenNoch keine Bewertungen

- Company Info - Print Financials PDFDokument2 SeitenCompany Info - Print Financials PDFutkarsh varshneyNoch keine Bewertungen

- City Bank StatementDokument1 SeiteCity Bank StatementMuhammed Abul Kalam Acma63% (8)

- 20 Axis Bank ProjectDokument53 Seiten20 Axis Bank ProjectNaveen Hegde100% (1)

- Week 9 NegoDokument18 SeitenWeek 9 NegoyassercarlomanNoch keine Bewertungen

- JayathDokument5 SeitenJayathJayaprakash JayathNoch keine Bewertungen

- Infosys: Balance SheetDokument6 SeitenInfosys: Balance SheetchiragNoch keine Bewertungen

- Balance Sheet of Hindustan UnileverDokument7 SeitenBalance Sheet of Hindustan UnileverPranjal JoshiNoch keine Bewertungen

- Financial Goal PlanningDokument10 SeitenFinancial Goal Planningsharvari kadamNoch keine Bewertungen

- Fund Flow Statement WorksheetDokument3 SeitenFund Flow Statement WorksheetAnish AroraNoch keine Bewertungen

- Business Accounting and Analysis (Semester I) q1xAKCGPn2Dokument3 SeitenBusiness Accounting and Analysis (Semester I) q1xAKCGPn2PriyankaNoch keine Bewertungen

- Management Accounting Problem Unit 2Dokument7 SeitenManagement Accounting Problem Unit 2princeNoch keine Bewertungen

- Eicher Motors: PrintDokument3 SeitenEicher Motors: PrintAryan BagdekarNoch keine Bewertungen

- CS Ratio Analysis - March 2020Dokument2 SeitenCS Ratio Analysis - March 2020Onaderu Oluwagbenga EnochNoch keine Bewertungen

- DR Group - 2019-2020Dokument43 SeitenDR Group - 2019-2020Mohammad Rejwan UllahNoch keine Bewertungen

- Analysis of Financial StatementsDokument6 SeitenAnalysis of Financial StatementsRakshithaNoch keine Bewertungen

- Revision QN On Ratio AnalysisDokument3 SeitenRevision QN On Ratio Analysisamosoundo59Noch keine Bewertungen

- Balance Sheet SampleDokument1 SeiteBalance Sheet Samplewaqas akramNoch keine Bewertungen

- Balance Sheet Format For ItrDokument3 SeitenBalance Sheet Format For ItrCommerce Adda ConsultancyNoch keine Bewertungen

- p7sgp 2011 Dec QDokument10 Seitenp7sgp 2011 Dec QamNoch keine Bewertungen

- Question ADV GMDokument6 SeitenQuestion ADV GMsherlockNoch keine Bewertungen

- SBR Consolidation Mock QueDokument7 SeitenSBR Consolidation Mock QuePratham BarotNoch keine Bewertungen

- Banking QaDokument10 SeitenBanking QaBijay AgrawalNoch keine Bewertungen

- Hindustan Unilever: PrintDokument2 SeitenHindustan Unilever: PrintSamil MusthafaNoch keine Bewertungen

- Shail End RaDokument24 SeitenShail End Rabharat khandelwalNoch keine Bewertungen

- Financial Reporting: September/December 2017 - Sample QuestionsDokument4 SeitenFinancial Reporting: September/December 2017 - Sample QuestionsNurul Nabilah SuhamiNoch keine Bewertungen

- Unit 1 - QuestionsDokument4 SeitenUnit 1 - QuestionsMohanNoch keine Bewertungen

- Practice QNSDokument2 SeitenPractice QNSIan chisemaNoch keine Bewertungen

- MTP Nov 16 Grp-2 (Series - I)Dokument58 SeitenMTP Nov 16 Grp-2 (Series - I)keshav rakhejaNoch keine Bewertungen

- Maruti Suzuki India LTD.: Balance Sheet (Standalone)Dokument5 SeitenMaruti Suzuki India LTD.: Balance Sheet (Standalone)Denish VekariyaNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Harkesh Kumar Singh Payslip For: SEP 2010: HDFC Bank LimitedDokument4 SeitenHarkesh Kumar Singh Payslip For: SEP 2010: HDFC Bank LimitedPawan Kumar SinghNoch keine Bewertungen

- Dokumen Standar Proyeksi Arus KasDokument5 SeitenDokumen Standar Proyeksi Arus KasrizkiNoch keine Bewertungen

- CFS Test - 1 Set-A 13-2-2022Dokument2 SeitenCFS Test - 1 Set-A 13-2-2022Hitesh SemwalNoch keine Bewertungen

- Sample Company Project AssumptionsDokument4 SeitenSample Company Project AssumptionsRasserNoch keine Bewertungen

- Test Series: March, 2021 Mock Test Paper - 1 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDokument7 SeitenTest Series: March, 2021 Mock Test Paper - 1 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNoch keine Bewertungen

- Financial Accounting Company: Tata Consultancy Services LTDDokument13 SeitenFinancial Accounting Company: Tata Consultancy Services LTDSanJana NahataNoch keine Bewertungen

- 12 Acs (S) - Set A 19.7.2021Dokument3 Seiten12 Acs (S) - Set A 19.7.2021Sakshi NagotkarNoch keine Bewertungen

- 6.0 Financial PlanDokument2 Seiten6.0 Financial PlanraihanNoch keine Bewertungen

- CA23 Financial Reporting and AnalysisDokument6 SeitenCA23 Financial Reporting and AnalysisBENSON NGARINoch keine Bewertungen

- Company Info - Print Financials 1Dokument2 SeitenCompany Info - Print Financials 1rjaman9981Noch keine Bewertungen

- Dynamic Mattress Company - Financial PlanningDokument11 SeitenDynamic Mattress Company - Financial Planningishita ghutakeNoch keine Bewertungen

- Irma4 104904Dokument2 SeitenIrma4 104904Al QadriNoch keine Bewertungen

- Test - Section B - Corporate AccountingDokument3 SeitenTest - Section B - Corporate AccountingNathoNoch keine Bewertungen

- 71844bos Interp5qDokument7 Seiten71844bos Interp5qMayank RajputNoch keine Bewertungen

- Taxation of CompaniesDokument10 SeitenTaxation of CompaniesnikhilramaneNoch keine Bewertungen

- Mid Term FIN 514Dokument4 SeitenMid Term FIN 514Showkatul IslamNoch keine Bewertungen

- Department: Department of Education (Deped) Agency: Office of The Secretary Operating Unit: Hingyon National High School Organization Code 07 001 0914136 Fund Cluster: 01 Regular Agency FundDokument6 SeitenDepartment: Department of Education (Deped) Agency: Office of The Secretary Operating Unit: Hingyon National High School Organization Code 07 001 0914136 Fund Cluster: 01 Regular Agency FundErleen T GuimbunganNoch keine Bewertungen

- Company Info - Print FinancialsDokument2 SeitenCompany Info - Print FinancialsSpuran RamtejaNoch keine Bewertungen

- Test Series: October, 2019 Mock Test Paper Final (Old) Course: Group - I Paper - 1: Financial ReportingDokument8 SeitenTest Series: October, 2019 Mock Test Paper Final (Old) Course: Group - I Paper - 1: Financial ReportingDev ReddyNoch keine Bewertungen

- 05 DEC QuestionDokument10 Seiten05 DEC Questionkhengmai100% (1)

- Ratio Analysis Numericals Including Reverse RatiosDokument6 SeitenRatio Analysis Numericals Including Reverse RatiosFunny ManNoch keine Bewertungen

- Hindustan Unilever: PrintDokument2 SeitenHindustan Unilever: PrintAbhay Kumar SinghNoch keine Bewertungen

- Financial Statement AnalysisDokument14 SeitenFinancial Statement AnalysisManoj ManchandaNoch keine Bewertungen

- Cash Flow Projections WORDDokument2 SeitenCash Flow Projections WORDElliot BalesamangNoch keine Bewertungen

- Tech Mahindra Financial Statement: Balance SheetDokument45 SeitenTech Mahindra Financial Statement: Balance SheetHRIDESH DWIVEDINoch keine Bewertungen

- Tech Mahindra Financial Statement: Balance SheetDokument15 SeitenTech Mahindra Financial Statement: Balance SheetHRIDESH DWIVEDINoch keine Bewertungen

- Accounting 22 - Final Exam - 2023Dokument9 SeitenAccounting 22 - Final Exam - 2023LaurenNoch keine Bewertungen

- IAS 28 AssociatesDokument7 SeitenIAS 28 AssociatesRumbidzai Mapanzure100% (1)

- Financial Statements (Hridesh Dwivedi)Dokument62 SeitenFinancial Statements (Hridesh Dwivedi)HRIDESH DWIVEDINoch keine Bewertungen

- Cash BudgetDokument10 SeitenCash BudgetShrinivasan IyengarNoch keine Bewertungen

- CH 2Dokument2 SeitenCH 2Aryan RawatNoch keine Bewertungen

- Roadmap To A Deposit-Taking Franchise Through Acquisition of 39.76% Stake in OakNorth Bank, A Licensed UK Bank (Company Update)Dokument26 SeitenRoadmap To A Deposit-Taking Franchise Through Acquisition of 39.76% Stake in OakNorth Bank, A Licensed UK Bank (Company Update)Shyam SunderNoch keine Bewertungen

- Dos Lifestyledebit 07122018 PDFDokument38 SeitenDos Lifestyledebit 07122018 PDFSarra AmyleaNoch keine Bewertungen

- RFP RTGSDokument14 SeitenRFP RTGSShakil Chowdhury0% (1)

- The Royal Monetary Authority of Bhutan Act 1982Dokument26 SeitenThe Royal Monetary Authority of Bhutan Act 1982Sonam PhuntshoNoch keine Bewertungen

- Banking - MODULE 1 Question and Answers Dr. SoumyaDokument13 SeitenBanking - MODULE 1 Question and Answers Dr. SoumyaAkshay KsNoch keine Bewertungen

- Case StudiesDokument3 SeitenCase StudiesjmfaleelNoch keine Bewertungen

- Educator Guide For: Created by Daria PlumbDokument24 SeitenEducator Guide For: Created by Daria Plumbno-replyNoch keine Bewertungen

- Bank Reconciliation (IA)Dokument7 SeitenBank Reconciliation (IA)rufamaegarcia07Noch keine Bewertungen

- What Is This Depository Institution's Total Liquidity Requirement?Dokument2 SeitenWhat Is This Depository Institution's Total Liquidity Requirement?Hanh Hong LENoch keine Bewertungen

- SR No. PG No.: 1 2 Executive Summary 3 History 4 Objective 5 Product 6 Bank in India 7 StrengthDokument16 SeitenSR No. PG No.: 1 2 Executive Summary 3 History 4 Objective 5 Product 6 Bank in India 7 Strengthpriyadsouza196Noch keine Bewertungen

- Introduction To Accounting An Integrated Approach 6th Edition Ainsworth Solutions ManualDokument25 SeitenIntroduction To Accounting An Integrated Approach 6th Edition Ainsworth Solutions ManualMichaelHughesafdmb100% (63)

- Annual Report 69-70 - 20140305122025 PDFDokument210 SeitenAnnual Report 69-70 - 20140305122025 PDFanupa bhattaraiNoch keine Bewertungen

- Cesar Areza and Lolita Areza V Express Savings Bank, Inc. and Michael PotencianoDokument9 SeitenCesar Areza and Lolita Areza V Express Savings Bank, Inc. and Michael PotencianoMarchini Sandro Cañizares KongNoch keine Bewertungen

- Guide For Credinet WebDokument58 SeitenGuide For Credinet WebVladimir Ramos MachacaNoch keine Bewertungen

- Saving AccountDokument30 SeitenSaving AccountKunal PuriNoch keine Bewertungen

- Pidm Insured DepositsDokument2 SeitenPidm Insured Depositstest1212Noch keine Bewertungen

- Shreejan CUSTOMER - SERVICES - DEPARTMENT - AND - MARKETING - ATDokument14 SeitenShreejan CUSTOMER - SERVICES - DEPARTMENT - AND - MARKETING - ATtli.sanilshahNoch keine Bewertungen

- Name Jawad AliDokument17 SeitenName Jawad AliWaqas AhmedNoch keine Bewertungen

- G.R. No. 217411 - PHILIPPINE BANK OF COMMUNICATIONS, PETITIONER, VS. RIA DE GUZMAN RIVERA, RESPONDENT.D E C I S I O N - Supreme Court E-LibraryDokument10 SeitenG.R. No. 217411 - PHILIPPINE BANK OF COMMUNICATIONS, PETITIONER, VS. RIA DE GUZMAN RIVERA, RESPONDENT.D E C I S I O N - Supreme Court E-Librarymarvinnino888Noch keine Bewertungen