Beruflich Dokumente

Kultur Dokumente

Loehmann's Petition For Chapter 11

Hochgeladen von

DealBook0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

2K Ansichten20 SeitenLoehmann's filing for Chapter 11 bankruptcy reorganization.

Originaltitel

Loehmann's Petition for Chapter 11

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenLoehmann's filing for Chapter 11 bankruptcy reorganization.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

2K Ansichten20 SeitenLoehmann's Petition For Chapter 11

Hochgeladen von

DealBookLoehmann's filing for Chapter 11 bankruptcy reorganization.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 20

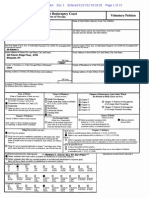

B 1 (Official Form 1)( 1/08)

Estimated Number of Creditors (Consolidated with affiliated Debtors)

1-49 50-99 100-199 200-999 1,000-5,000 5,00 I-I 0,000 te.eor- 25,001- 50,001- Over 100,000

25,000 50,000 100,000

0 0 0 0 [ZJ 0 0 0 0 0

Estimated Assets (Consolidated with affiliated Debtors)

SO to $50,001 to SIOO,OOI to $500,00) to $1,000,001 to $10,000,00 I $50,000,00 I st 00,000,00 I $500,000,00) More than S)

50,000 SIOO,OOO $500,000 $1 million $)0 million to $50 to S)OO to $500 to $) billion billion

million million million

0 0 0 0 0 0 0 [ZJ 0 0

Estimated Liabilities (Consolidated with affiliated Debtors)

$0 to $50,001 to $)00,00) to 5500,001 to $1,000,00) to $10,000,00 I $50,000,00 I $ I 00,000,001 $500,000,00 ) More than $1

50.000 $)00,000 $500,000 SI million S)O million to S50 to $100 to $500 to $) billion billion

million million million

0 D 0 0 0 0 0 [ZJ 0 0 THIS SPACE

IS FOR COURT USE ONLY

United States Bankruptcy Court Southern District of New York

Voluntary P~tition

ZIP CODE: 10461

All Other Names used by the Joint Debtor in the last 6 years (include married, maiden, and trade names):

Name of Debtor (if individual, enter Last, First, Middle):

Loehmann's Holdings, Inc,

Name of Joint Debtor (Spouse) (Last, First, Middle):

All Other Names used by the Debtor in the last 6 years (include married, maiden, and trade names):

Last four digits of Soc, Sec/Complete EIN or other Tax J.D, No. (if more than one, state all); 13-4129380

Last four digits of Soc. Sec/Complete EIN or other Tax J.D, No. (if more than one, state all);

Street Address of Debtor (No and Street, City, and State): 2500 Halsey Street

Bronx, New York

Street Address of Joint Debtor (No and Street, City, and State):

I ZIP CODE:

County of Residence or the Principal Place of Business: Bronx County

County of Residence or the Principal Place of Business:

Mailing Address of Joint Debtor (if different from street address):

Mailing Address of Debtor (if different from street address):

I ZIP CODE:

I ZIP CODE:

Location of Principal Assets of Business Debtor (if different from street address above);

Filing Fee (Check one box)

I ZIP CODE:

Type of Debtor (Form of Organization) (Check one box)

Nature of Business

Chapter of Bankruptcy Code Under Which

the Petition is Filed (Check one box.)

o Chapter 7 0 Chapter 15 Petition for

o Chapter 9 Recognition of'a Foreign

[ZJ Chapter 11 Main Proceeding

o Chapter 12 0 Chapter 15 Petition for

o Chapter 13 Recognition ofa Foreign Nonmain Proceeding

o Individual (Includes Joint Debtors)

See Exhibit D. on page Z of this form. [8J Corporation (includes LLC and LLP)

o Partnersh ip

o Other (1 r debtor is not one of the above entities, check this box and state type of'enuty below.)

(Check one box.)

o Health Care Business,

o Single Asset Real Estate as defined in

II U.S,c. § 101(51 B)

o Railroad

o Stockbroker

o Commodity Broker

o Clearing Bank [ZJ Other

Tax-Exempt Entity (Check box, if applicable.)

o Debtor is a tax-exempt organization under Title 26 of the United States Code (the Internal Revenue Code).

Nature of Debts (Check one box.)

D Debts nrc primarily consumer primarily debts, .,

defined in II U.S.C. § 10 I (1I) as "incurred by an individual primarily for a personal, family or house-hold purpose."

[ZJ Debts arc primarily business debts.

Chapter 11 Debtors

[8J Full Filing Fee attached.

o Filing Fee to be paid in installments (Applicable to individuals only)

Must attach signed application for the court's consideration certifying thai the debtor is unable to pay fee except in installments. Rule lO06(b). See Official Form 3A.

o Filing Fee waiver requested (applicable to chapter 7 individuals only). Must attach signed application for the court's consideration. See Official Form 3B,

Check one box:

o Debtor is a small business debtor as defined in II U,S,c. § 101 (51 D).

[g] Debtor is a not small business debtor as defined in 11 U.S,C. § 101(51 D), Check if:

o Debtor's aggregate noncontingent liquidated debts (excluding debts owed to insiders or affiliates) are less than $2,190,000.

Check all applicable boxes:

o A plan is being filed with this petition.

o Acceptances of the plan were solicited prepetition from one or more classes of creditors, in accordance with 11 U.S.C. § I 126(b).

Statlstlcal/Adm inlstratlve Information

[g] Debtor estimates that funds will be available for distribution to unsecured creditors.

o Debtor estimates that, after any exempt property is excluded and administrative expenses paid, there will be no funds available for distribution to unsecured creditors.

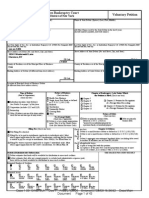

B 1 (Official Form 1) (]lOll) FORM BI,Page2

Voluntary Petition Name of Debtor(s):

(This page must be completed and filed in every case) Loehmann's Holdings, Inc.

All Prior Bankruptcy Case Filed Within Last 8 Years (1fmore than two, attach additional sheet)

Location Case Number: Date Filed:

Where Filed:

Location Case Number: Date Filed:

Where Filed:

Pending Bankruptcy Case Filed by any Spouse, Partner or Affiliate of this Debtor (If more than one, attach additional sheet)

Name of Debtor: Case Number: Date Filed:

See attached Schedule 1

District: Relationship: Judge:

Southern District of New York

Exhibit A Exhibit B

(To be completed if debtor is an individual

(To be completed if debtor is required to file periodic reports (e.g., forms 10K and whose debts are primarily consumer debts.)

10Q with the Securities and Exchange Commission pursuant to Section 13 or IS(d)

of the Securities Exchange Act of 1934 and is requesting relief under chapter 11.) 1, the attorney for the petitioner named in the foregoing petition, declare that 1

'. have informed the petitioner that [he or she) may proceed under chapter 7, II,

D Exhibit A is attached and made a part of this petition. 12, or 13 of title II, United States Code, and have explained the relief available

under each such chapter. I further certify that I have delivered to the debtor the

notice required by J I U.S.C. § 342(b).

X

Signature of Attorney for Debtor(s) (Date)

:

Exhibit C

Does the d~btor own or have possession of any property that poses or is alleged to pose a threat of imminent and identifiable harm to public health or safety?

D Yes. and Exhibit C is anached and made a part of this petition.

rg] No.

ExhibitD

(To be completed by every individual debtor. If a joint petition is filed, each spouse must complete and attach a separate Exhibit D.)

D Exhibit D completed and signed by the debtor is attached and made a part of this petition.

If this is a joint petition:

D Exhibit D also completed and signed by the joint debtor is attached and made a part of this petition.

Information Regarding tbe Debtor - Venue

(Check any applicable box.)

l'2J Debtor has been domiciled or has had a residence, principal place of business, or principal assets in this District for J 80 days immediately

preceding the date of this petition or for a longer part of such 180 days than in any other District.

l2J There is a bankruptcy case concerning debtor's affiliate, general partner, or partnership pending in this District.

D Debtor is a debtor in a foreign proceeding and has its principal place of business or principal assets in the United States in this District, or

has no principal place of business or assets in the United States but is a defendant in an action or proceeding [in a federal or stale court] in

this District, or the interests of the parties wi11 be served in regard to the relief sought in this District.

Certification by a Debtor Who Resides .. a Tenant of Residential Property

(Check all applicable boxes.)

D Landlord has a judgment against the debtor for possession of debtor's residence. (If box checked, complete the following.)

(Name of landlord that obtained judgment)

(Address of landlord)

D Debtor claims that under applicable nonbankruptcy law, there are circumstances under which the debtor would be permitted to cure the entire monetary default

that gave rise to the judgment for possession, after the judgment for possession was entered, and

D Debtor has included with this petition the deposit with the court of any rent that would become due during the 30-day period after the filing ofthe petition.

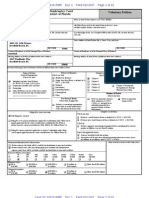

D Debtor certifies that he/she has served the Landlord with this certification (I J U.S.C. § 362(1 ). B 1 Official Form I (I/OS} Form B1, Page 3

Voluntary Petition Name of Debtor(s):

(This page must be completed and filed in every case) Loehmann's Holdings, Inc.

Signatures

Signature(s) of Debtors(s) (Individual/Joint) Signature of a Foreign Representative

I declare under penalty of perjury that the information provided in this petition is [ declare under penalty of perjury that the information provided in this petition is

true and correct. true and correct, that I am the foreign representative of a debtor in a foreign

[If petitioner is an individual whose debts are primarily consumer debts and has proceeding, and that I am authorized to file this petition.

chosen to file under chapter 7]1 am ware that I may proceed under chapter 7, II,

[2 or 13 of title II, United States Code, understand the relief available under each (Check only one box.)

such chapter, and choose to proceed under chapter 7. D I request relief in accordance with chapter 15 of lit Ie II. United States Code.

[If no attorney represents me and no bankruptcy petition preparer signs the

petition] I have obtained and read the notice required by II U.S.c. § 342(b}. Certified copies of the documents required by II U.S.C. § 1515 are attached.

I request rei ief in accordance with the chapter of title II. United States Code, D Pursuant to II U.S.C. § 1515. I request relief in accordance with the chapter

specified in this petition. of title II specified in this petition. A certified copy of'the order granting

recognition of the foreign main proceeding is attached.

X

Signature of Debtor X

X (S ignature 0 f Foreign Representative)

Signature of Joint Debtor

(Printed Name of Foreign Representative)

Telephone Number (if not represented by attorney)

Date

Date

Signature of Attorney Signature of Non~Attorney Petition Pr eparer ~ .

X lsI Frank A. Oswald I declare under penalty of perjury that: (1) r am a bankruptcy petition prepared as

Signature of Attorney for Debtor(s) defined in II U.S.C. § 110; (2) I prepared this document for compensation and

Albert T0l:ut and Frank A. Oswald have provided the debtor with a copy of this document and the notices and

Printed Name of Attorney for Debtor(s) information required under II U.S.c. §§ 110(b), IIO(h), and 342(b); and (3) if

Togut Sel1;aI & Sella I LLP rules or guidelines have been promulgated pursuant to II U.S.C. § 110(h) setting a

Firm Name maximum fee for services chargeable by bankruptcy petition preparers. I have

One Penn Plaza given the debtor notice of the maximum amount before preparing any document

Address for filing for a debtor or accepting any fee from the debtor, as required in that

New York NY 10119 section. Official Form 19 is attached.

Printed Name and title, if any, of Bankruptcy Petition Preparer

(2121 594-5000

Telephone Number Social Security number (If the bankruptcy petition preparer is not an

November 14 2010 individual, state the Social Security number of the officer, principal,

Date responsible person OT partner of the bankruptcy petition preparer.)

(Required by II U.S.C. § 110.)

Address Signature of Debtor (Corporation/Partnership)

I declare under penalty of perjury that the information provided in this petition is true and correct, and that I have been authorized to file this petition on behalf of the debtor.

The debtor requests relief in accordance with the chapter of title I I, United States Code, specified in this petition.

X 1st Joseph Melvin

Signature of Authorized Individual

Joseph Melvin

Printed Name of Authorized Individual

Chief Financial Officer/ChiefOperating Officer

Title of Authorized Individual November 14 2010

Date

Dale

Signature of bankruptcy petition preparer or officer, principal, responsible person, or partner whose Social Security number is provided above.

Names and Social Security numbers of all other individuals who prepared or assisted in preparing this document unless the bankruptcy petition preparer is not an individual.

If more than one person prepared this document, attach additional sheets conforming to the appropriate official form for each person.

A bankruptcy petition preparer 's failure 10 compfy with the provisions oj title J J and the Federal Rules oj Bankruptcy Procedure may result in fines or imprisonment or both. 11 U.s.C. § 1/0; /8 U.S.C. § 156.

3

Schedule 1

Pending Bankruptcy Cases Filed by the Debtor and Affiliates of the Debtor

On November 14, 2010 each of the entities listed below filed a petition in this Court for relief under chapter 11 of title 11 of the United States Code. The Debtors have moved for joint administration of these cases under the number assigned to the chapter 11 case of LOEH1-fANN'S HOLDINGS, INC.

1 Loehrnann's Holdings Inc.

2 Loehmann's Inc.

3 Loehrnann's Operating Co.

4 Loehmann's Real Estate Holdings, Inc.

5 Loehmann's Capital Corp. CERTIFICATE OF RESOLUTIONS OF LOEHMANN'S HOLDINGS, INC.

November 14, 2010

The undersigned, being Vice President and General Counsel of Loehmann's Holdings, Inc., a Delaware Corporation (the "Company"), DOES HEREBY CERTIFY that the resolutions set forth on Exhibit "AJI attached hereto is a true copy of the resolutions adopted by the Board of Directors of the Company (the "Board") at the Board meeting of the Company held on November 14,2010 and that such resolutions have not been altered, amended or rescinded and are still in full force and effect as of the date hereof.

IN WITNESS WHEREOF, the undersigned has hereto subscribed her name as of the date first written above

lsi Karen Lapidus

By: Karen Lapidus

Title: Vice President and General Counsel Loehmann's Holdings, Inc.

RESOLUTIONS OF THE BOARD OF DIRECTORS OF LOEHMANN'S HOLDINGS INC.

WHEREAS! the Board of Directors has reviewed the materials presented by the management and the legal and financial advisors of the Company regarding the liabilities and liquidity situation of the Company! and the impact of the foregoing on the Company! s businesses, and the strategic alternatives available to the Company; and

WHEREAS, the Board of Directors has had the opportunity to consult with the management and the legal and financial advisors of the Company and fully consider each of the strategic alternatives available to the Company;

1. Voluntary Petition Under the Provisions of Chapter 11 of the United States Bankruptcy Code

NOW, THEREFORE, BE IT RESOLVED, that in the judgment of the Board of Directors of the Company, it is desirable and in the best interests of the Company, its creditors and other parties in interest, that the Company file or cause to be filed a voluntary petition for relief (the "Chapter 11 Casell) under the provisions of chapter 11 of title 11 of the United States Code (the IIBankruptcy Code"); and be it

FURTHER RESOLVED, that the officers of the Company (collectively, the 1/ Authorized Officersll), acting alone or with one or more other Authorized Officers be, and they hereby are, authorized, empowered, and directed to execute and file on behalf of the Company all petitions, schedules, lists and other motions, papers or documents, and to take any and all action that they deem necessary or proper to obtain such relief, including, without limitation, any action necessary to maintain the ordinary course operation of the Company's business; and be it

FURTHER RESOLVED, that the Authorized Officers be, and they hereby are! authorized and directed to employ the law firm of Togut Segal & Segal, LLP as general bankruptcy counsel to represent and assist the Company in carrying out its duties under the Bankruptcy Code, and to take any and all actions to advance the Company! s rights and obligations, including filing any pleadings; and in connection therewith, the Authorized Officers are hereby authorized and directed to execute appropriate retention agreements, pay

appropriate retainers prior to and immediately upon filing of the Chapter 11 Case and cause to be filed an appropriate application for authority to retain the services of Togut, Segal & Segal LLP; and be it

FURTHER RESOLVED, that the Authorized Officers be, and they hereby are, authorized and directed to employ the firm of Perella Weinberg Partners LP, as investment banker and financial advisor, to represent and assist the Company in carrying out its duties under the Bankruptcy Code, and to take any and all actions to advance the Company's rights and obligations; and in connection therewith, the Authorized Officers, wi th power of delegation, are hereby authorized and directed to execute appropriate retention agreements, pay appropriate retainers, and to cause to be filed appropriate applications for authority to retain the services of Perella Weinberg Partners LP; and be it

FURTHER RESOLVED, that the Authorized Officers be, and they hereby are, authorized and directed to employ the firm of Clear Thinking Group LLC, as restructuring advisor, to represent and assist the Company in carrying out its duties under the Bankruptcy Code, and to take any and all actions to advance the Company's rights and obligations; and in connection therewith, the Authorized Officers are hereby authorized and directed to execute appropriate retention agreements, pay appropriate retainers, and to cause to be filed an appropriate application for authority to retain the services of Clear Thinking Group LLC; and be it

FURTHER RESOLVED, that the Authorized Officers be, and they hereby are, authorized and directed to employ the law firm of Troutman Sanders LLP as special corporate counsel to represent and assist the Company in carrying out its duties under the Bankruptcy Code, and to take any and all actions to advance the Company's rights and obligations, including filing any pleadings; and in connection therewith, the Authorized Officers are hereby authorized and directed to execute appropriate retention agreements, pay appropriate retainers prior to and immediately upon filing of the Chapter 11 Case and cause to be filed an appropriate application for authority to retain the services of Troutman Sanders LLP; and be it

FURTHER RESOLVED, that the Authorized Officers be, and they hereby are, authorized and directed to employ any other professionals to assist the Company in carrying out its duties under the Bankruptcy Code; and in connection therewith, the Authorized Officers are hereby authorized

2

and directed to execute appropriate retention agreements, pay appropriate retainers prior to or immediately upon the filing of the Chapter 11 Case and cause to be filed an appropriate application for authority to retain the services of any other professionals as necessary.

II. Debtor in Possession Financing

FURTHER RESOLVED, that the Company, as debtor and debtor in possession under the Chapter 11 case shall be, and hereby is, authorized to: (a) enter into a new debtor in possession financing facility and/ or any comparable financing arrangement (including, but not limited to, a "use of cash collateral" facility) and any associated documents and to consummate the transactions contemplated therein with such lenders (the "DIP Lenders") and upon such terms and conditions as one or more of the Authorized Officers may approve, (b) provide guaranties to and undertake any and all related transactions contemplated thereby ((a) and (b), collectively, the "Financing Transactions" and each such transaction a "Financing Transaction") with such lenders and on such terms as may be approved by anyone or more of the Authorized Officers, as reasonably necessary for the continuing conduct of the affairs of the Company; and (c) pay related fees and grant security interests in and liens upon some, all or substantially all of the Company's assets, as may be deemed necessary by anyone or more of the Authorized Officers in connection with Financing Transactions and the transactions contemplated thereby; and be it

FURTHER RESOLVED, that each of the Authorized Officers, be, and each of them hereby is, authorized, directed and empowered in the name at and on behalf at the Company, as debtor and debtor in possession, to take such actions and negotiate or cause to be prepared and negotiated and to execute and file, or cause to be executed and filed, all such instruments, documents, and other agreements, certificates, contracts, notes, bonds, documents, disclosure documents, instruments, receipts, petitions, motions or other papers, (collectively, the "DIP Loan Documents"), incur and payor cause to be paid all fees and expenses and engage such persons, in each case, as such Authorized Officer or Authorized Officers shall in his, her or their respective judgment determine to be necessary or appropriate to consummate the Financing Transactions, which determination and the approval thereof by the Board of Directors, shall be conclusively evidenced by his or their execution or delivery thereof; and be it

3

FURTHER RESOLVED, that the Authorized Officers be, and each of them hereby is, authorized and empowered, in the name of, and on behalf of the Company, as debtor and debtor in possession, to file any Uniform Commercial Code (the "UCC") financing statements and any necessary assignments for security or other security documents in the name of the Company that any agent for the DIP Lenders (the If Agent") . or the DIP Lenders deem necessary or convenient to perfect any lien or security interest granted under the DIP Loan Documents, including any such UCC financing statement containing a super-generic description of collateral, such as /I all assets," II all property now or hereafter acquired" and other similar descriptions of like import and to execute and deliver, and to record or authorize the recording of, such mortgages and deeds of trust in respect of real property of the Company and such other filings in respect of intellectual and other property of the Company, in each case as the Agent or the DIP Lenders, as applicable, may reasonably request to perfect the security interests of the Agent on behalf of itself, the DIP Lenders and the other secured parties under the DIP Loan Documents, or the DIP Lenders; and be it

FURTHER RESOLVED, that each of the Authorized Officers be, and hereby is, authorized, directed and empowered in the name of, and on behalf of the Company to execute and deliver any amendments, restatements, supplements, modifications, renewals, replacements, consolidations, substitutions and extensions of the DIP Loan Documents, and to execute and file on behalf of the Company all petitions, schedules, lists and other motions, papers or documents, which shall in their sole judgment be necessary, proper or advisable, which determination, and the approval thereof by the Board of Directors, shall be conclusively evidenced by his or their execution thereof; and be it

FURTHER RESOLVED, that each of Authorized Officers be, and hereby is, authorized, directed and empowered in the name of, and on behalf of, the Company, to take all such other and further action, and to execute, deliver and perform all such other and further documents, instruments, and agreements, as the Authorized Officer or Authorized Officers so acting may deem necessary or appropriate, the taking of such action, and/ or the execution, delivery and/ or performance of such documents, instruments, and agreements, to be conclusive evidence of their approval; and be it

4

FURTHER RESOLVED, that the Company will obtain benefits from the incurrence of the loans under the DIP Loan Documents and the consummation of the Financing Transactions which are necessary and convenient to the conduct, promotion and attainment of the business of the Company.

III. Restructuring Support Agreement and Investment Commitment Letter

FURTHER RESOLVED, that the Company, as debtor and debtor in possession under the Chapter 11 case shall be, and hereby is, authorized to enter into (x) that certain Restructuring Support Agreement, dated November 14,2010 (the "Restructuring Support Agreement"), by and among (i) Loehmann's Holdings Inc., (ii) Loehmann's, Inc., (iii) Loehmann's Real Estate Holdings, Inc., (iv) Loehmann's Operating Co., (v) Loehmann's Capital Corp., (vi) Istithmar Retail Investments, (vii) Whippoorwill Associates, Inc, as agent for its discretionary accounts that are legal and/ or beneficial owners of certain of the Senior Secured Notes (as defined in the Restructuring Support Agreement), and (viii) any other holders of the Senior Secured Notes (as defined in the Restructuring Support Agreement) identified on the signature pages to the Restructuring Support Agreement and (y) that certain Investment Commitment Letter, dated November 14, 2010, by and among (i) Loehmann's Holdings Inc., (ii) Loehmann's, Inc., (iii) Loehmann's Real Estate Holdings, Inc., (iv) Loehmann's Operating Co., (v) Loehmann's Capital Corp., (vi) Istithrnar Retail Investments and (vii) Whippoorwill Associates, Inc., as agent for its discretionary accounts that are legal and/ or beneficial owners of certain of the Senior Secured Notes (as defined in the Restructuring Support Agreement), upon such terms and conditions as one or more of the Authorized Officers may approve; and be it

FURTHER RESOLVED, that each of the Authorized Officers, be, and each of them hereby is, authorized, directed and empowered in the name of, and on behalf of, the Company, as debtor and debtor in possession, to take such actions and negotiate or cause to be prepared and negotiated and to execute and file, or cause to be executed and filed, all such instruments, documents, and other agreements, certificates, contracts, notes, bonds, documents, disclosure documents, instruments, receipts, petitions, motions or other papers, (collectively, the "Documents"), incur and payor cause to be paid all fees and expenses and engage such persons, in each case, as such Authorized Officer or Authorized Officers shall

5

in his, her or their respective judgment determine to be necessary or appropriate to consummate the transactions described or contemplated in the aforesaid Documents and resolutions (the "Transactions"), which determination and the approval thereof by the Board of Directors, shall be conclusively evidenced by his or their execution or delivery thereof; and be it

FURTHER RESOLVED, that each of the Authorized Officers be, and hereby is, authorized, directed and empowered in the name of, and on behalf of, the Company to execute and deliver any amendments, restatements, supplements, modifications, renewals, replacements, consolidations, substitutions and extensions of the aforesaid Documents relating to the Transactions, and to execute and file on behalf of the Company all petitions, motions, papers or documents, which shal1 in their sole judgment be necessary, proper or advisable, which determination, and the approval thereof by the Board of Directors, shall be conclusively evidenced by his or their execution thereof; and be it

FURTHER RESOL VED, that the Company will obtain benefits from the equity infusion contemplated by the Documents and the consummation of the Transactions which are necessary and convenient to the conduct, promotion and attainment of the business of the Company.

IV. Further Actions and Prior Actions

FURTHER RESOLVED, that in addition to the specific authorizations heretofore conferred upon the Authorized Officers, each of the Authorized Officers or their designees shall be, and each of them, acting alone, hereby is, authorized, empowered, and directed, in the name of, and on behalf of, the Company, to take or cause to be taken any and all such further actions, to execute and deliver any and all such agreements, certificates, instruments and other documents and to pay all expenses, including filing fees, in each case as in such officer or officers' judgment shall be necessary or desirable to fully carry out the intent and accomplish the purposes of the resolutions adopted herein; and be it

FURTHER RESOLVED, that all acts, actions and transactions relating to the matters contemplated by the foregoing resolutions done in the name of and on behalf of the Company, which acts would have been approved by the foregoing resolutions except that such acts were taken before the adoption of these resolutions, are hereby in all respects

6

approved and ratified as the true acts and deeds of the Company with the same force and effect as if each such act, transaction, agreement or certificate had been specifically authorized in advance by resolution of the Board of Directors of the Company and that the Authorized Officer did execute the same.

7

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK

--------------------------------------------------------------)(

Inre:

Chapter 11

Case No. _

LOEHMANN'S HOLDINGS, INC., et al.,

(Jointly Administered)

Debtors.

--------------------------------------------------------------)(

CONSOLIDATED LIST OF 30 LARGEST UNSECURED CLAIMS

The attached Exhibit A is a list of creditors holding the thirty (30) largest unsecured claims against the above-captioned debtor and its debtor affiliates (collectively, the "Debtors")/ all of which simultaneously have commenced chapter 11 cases in this Court. The list has been prepared on a consolidated basis from the unaudited books and records of the Debtors. The list has been prepared in accordance with Fed. R. Bankr. P. 10079d) for filing in the Debtors' chapter 11 cases. The list does not include (i) persons who fall within the definition of "insider" set forth in

11 U.S.c. § 101(31) or (ii) secured creditors unless the value of the collateral is such that the unsecured deficiency places the creditor among the holders of the 50 largest unsecured claims. The information contained herein shall not constitute an admission of liability by, nor is it binding on, the Debtors. Moreover, nothing herein shall affect any Debtor's right to challenge the amount or characterization of any claim at a later date.

1 The Debtors, together with the last four digits of each Debtor's federal tax identification number, are: (i) Loehmann's Holdings, Inc. (9380); (ii) Loehmann's, Inc. (1356); (iii) Loehmann's Real Estate Holdings, Inc. (6682); (iv) Loehmann's Operating Co. (6681); and (v) Loehmann's Capital Corp. (2694).

EXHIBIT A

30 Largest Unsecured Claims (Excluding Insiders)!

As required and in addition to what is required under Local Rule l007-2(a)(4), the following is a schedule of the Debtors' 30 largest unsecured claims.'

Creditor Contact Mailing Address and Amount of Contingent,

Telephone Number Claim Unliquidated,

Disputed or

Partially

Secured

PO BOX 24292, NEW YORK, NY

l. G III LADIES 10087

DMSION FAX 212-403-0551 201-866-4900 $ 774,798

PO BOX 200799,PITTSBURGH

PA,90057

2. TAHARILTD FAX 212-768-2049 212-763-2000 $ 580,939

209 WEST 38TH STREET, NEW

YORK NY, 10018

3. URBAN OUTFITTERS FAX 215-454-4994 212-454-4773 $ 569,438

C/O LIZ CLAmORNE, PO BOX

13866, NEWARK, NJ 07188-0866

4. JUICY COUTURE FAX 201-295-7159 888-908-1160 $ 519,131

225 WEST 39TH STREET, NEW

5. REPUBLIC CLOTHING YORK, NY 10018

CORP FAX 212-302-4376 212-719-3000 $ 509,240

1717 SOUTH FIGUEROA

STREET, LOS ANGELES CA,

90015

6. U.S. OUTLET INC FAX 213-745-7487 213-745-5574 $ 452,082

BUILDING' A', 3400

MCINTOSH ROAD, PORT

7. STEVE EVERGLADES, FL 33316

MADDEN /STEVEN FAX 718-446-5747 954-468-0060 $ 422,036

35 SAWGRASS DR, STE #2

BELLPORT, NY 11713

8. SCENT OF WORTH FAX 631-254-9340 866-444-3225 $ 383,569

140 DOCKS CORNER RD,

9. CALVIN KLEIN DAYTON, NJ 08810

OUTERWEAR FAX 212-403-0551 212-403-0500 $ 374,001

PO BOX 845362, BOSTON, MA,

02284-5362

10. VICTORINOX FAX 203-225-2727 800-442-2706 $ 317,037

629 EAST 30th STREET, LOS

ANGELES, CA 90011

11. LUCCA FAX 212-747-7737 213-748-9898 $ 310,837

1650 INDIAN BROOK WAY,

NORCROSS GA, 30093

12. ALTERNATIVE FAX 678-380-1894 678-380-1890 $ 307,560

CYNTHIA STEFFE

550 SEVENTH AVE, NEW

YORK, NY 10018

13. JUST CYNTHIA FAX 212-302-1254 212-403-6200 $ 304,428 The information herein shall not constitute an admission of liability by, nor is it binding on, the Debtors. All claims are subject to customary offsets, rebates, discounts, reconciliations, credits and adjustments, which are not reflected on this schedule.

The amounts set forth on this Exhibit represent estimated amounts as of the Petition Date.

2

Creditor Contact Mailing Address and Amount of Contingent,

Telephone Number Claim Unliquidated,

Disputed or

Partially

Secured

PO BOX 849166, BOSTON, MA,

14. MODERN SHOE 02284-9166

COMPANY FAX 617-333-7483 617-333-7476 $ 300,210

40 W. 57th ST, 23RD FL

NEW YORK NY 10019

15. FEDERAL REALTY LP FAX 212-708-6531 212-708-6549 $ 291,474

512 SEVENTH A VENUE NEW

YORK, NY, 10018

16. LEVY GROUP FAX 212-398-0707 212-398-0707 $ 266,776

C/O MADISON

ADMINISTRATIVE SERVICES,

INC.

232 MADISON AVE, STE 1307

17. POUR LA VICTOIRE- NEW YORK NY 10016

PLVSTU FAX 212-696-5318 212-696-4393 $ 264,884

1410 BROADWAY NEW YORK,

NY, 10018

18. PLANET GOLD FAX 212-221-7256 212-239-4657 $ 254,772

11 W.42NDST

NEW YORK NY 10036

19. MICHAEL KORS LLC FAX 646-354-4931 212-201-8100 $ 235,752

8680 CAMBIE ST

VANCOUVER, BC CANADA

20. KERSH/IFL INC. FAX 604-688-3657 V6P6M9 $ 233,554

C/O CARUSO AFFILIATED

101 THE GROVE DR

LOS ANGELES, CA 90036

21. CRM PROPERTIES FAX 323-900-8101 323-900-8100 $ 212,313

22. LISTEFF FASHIONS PO BOX 29242, NEW YORK, NY

INC FAX 212-403-0551 10087-9242 $ 211,332

2820 16TH ST

23. NATIONAL RETAIL NORTH BERGEN, NJ 07047

CONSOLIDATORS FAX 201-866-3137 201-330-1900 $ 205,562

350 FIFTH A \IE

24. ACCESSORY NEW YORK, NY 10118

NETWORK GROUP FAX 212-842-3232 212-842-3088 $ 199,586

3151 EAST WASHINGTON

BL YD., LOS ANGELES, CA,

25. SEVEN LICENSING 90023

COMPANY FAX 323-881-0369 323-265-8000 $ 197,807

512 SEVENTH AVE, NEW

YORK, NY 10018

26. ADRIANNA PAPELL FAX 212-714-1871 212-695-5244 $ 196,413

530 SEVENTH AVE

21ST FLOOR NEW YORK, NY,

10018

27. MAX MARA FAX 212-302-1134 212-302-1221 $ 196,229

611 USHWY46

W. HASBROUCK HEIGHTS, NJ

28. KEYSTONE FREIGHT 07064

CORP FAX 201-288-1195 201-330-1900 $ 194,261

29. CALVIN KLEIN PO BOX 9, MAULDIN, SC 29662

UNDERWEAR FAX 203-301-7976 203-301-7263 $ 191,577

PO BOX 30508, LOS ANGELES,

30. INTERNATIONAL CA 90030

ACCESSORIES FAX 818-780-2676 818-780-7800 $ 188,788 2

DECLARATION CONCERNING CONSOLIDATED LIST OF CREDITORS HOLDING 30 LARGEST UNSECURED CLAIMS

I, the undersigned authorized officer of the debtor in this case, declare under penalty of perjury that I have reviewed the foregoing Consolidated List of Creditors Holding 30 Largest Unsecured Claims and that the list is true and correct to the best of my information and belief.

Dated: November 14, 2010

lsI Joseph Melvin

By: Joseph Melvin

Title: Chief Operating Officer

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK

------------------------------------------------------x

LOEHMANN'S HOLDINGS, INC.,

Chapter 11

Case No. 10- __ (_)

In re

Debtor.

------------------------------------------------------x

(Joint Administration Requested)

LIST OF CREDITORSl

Contemporaneously herewith, the above-captioned debtor and its affiliated debtors and debtors in possession (collectively, the "Debtors") have filed a motion requesting a waiver of the requirement for filing a list of creditors pursuant to sections 105(a), 342(a), and 521(a)(I) of title II of the United States Code, Rules 1007(a)(I) and 2002(a), (f), and (1) of the Federal Rules of Bankruptcy Procedure, Rule 1007-1 of the Local Bankruptcy Rules for the Southern District of New York, and General Orders 1-133, M-137, M-138t and M-192 of the United States Bankruptcy Court for the Southern District of New York. The Debtors propose to furnish their lists of creditors to the proposed noticing and claims agent. The Debtors have consulted with and received the approval of the Clerk of this Court to implement the foregoing procedures. The list of creditors will contain only those creditors whose names and addresses were maintained in the Debtors' consolidated database or were otherwise ascertainable by the Debtors prior to the commencement of these cases. The schedules of liabilities to be filed subsequently should be consulted for a list of the Debtors' creditors that is comprehensive and current as of the date of the commencement of these cases.

The information contained herein shall not constitute an admission of liability by, nor is it binding on, the Debtors.

LIST OF EQUITY SECURITY HOLDERS PURSUANT

TO RULE lO07(a)(3) OF THE FEDERAL RULES OF BANKRUPTCY PROCEDURE

Name and Last Known Address Kind of Interest Number of Interests Held

of Equity Interest Holder

Designer Apparel Holding Membership Interest 100%

Company

2500 Halsey Street

Bronx, New York 10461 DECLARATION UNDER PENALTY OF PERJURY

I, the undersigned officer of Loehmann's Holdings, Inc., named as the debtor in this case, declare under penalty of perjury that I have reviewed the "List of Equity Security Holders Pursuant to Rule 1007(a)(3) of the Federal Rules of Bankruptcy Procedure" and that it is true and correct to the best of my knowledge, information, and belief, with reliance on appropriate corporate officers.

Dated: November 14, 2010

lsi Joseph Melvin

By: Joseph Melvin

Ti tle: Chief Financial Officer / Chief Operating Officer

CORPORATE OWNERSHIP STATEMENT

Pursuant to Rules 1007(a) and 7007.1 of the Federal Rules of Bankruptcy Procedure and Rule 1007-3 of the Local Bankruptcy Rules for the Southern District of New York and to enable the Judges to evaluate possible disqualifications or recusals, on behalf of Loehmann's Holdings, Inc., its parent Designer Apparel Holding Company and their debtor affiliates, as debtors and debtors in possession (collectively, the "Debtors"), the undersigned authorized officer certifies the following:

A. Ownership of the Debtors' Equity Interests

1. Designer Apparel Holding Company owns 100% of the equity interests in the Debtor

B. The Debtors' Ownership of Equity Securities, Partnership Interests, and Joint Venture Interest.

1. No Debtor directly or indirectly owns 10% or more of any class of equity interests in any corporation whose securities are publicly traded.

DECLARATION UNDER PENALTY OF PERJURY

I, the undersigned officer of Loehmann's Holdings, Inc., named as the debtor in this case, declare under penalty of perjury that I have reviewed the "Corporate Ownership Statement" and that it is true and correct to the best of my knowledge, information, and belief, with reliance on appropriate corporate officers.

Dated: November 14, 2010

lsI Joseph Melvin

By: Joseph Melvin

Title: Chief Financial Officer / Chief Operating Officer

Das könnte Ihnen auch gefallen

- A Guide to District Court Civil Forms in the State of HawaiiVon EverandA Guide to District Court Civil Forms in the State of HawaiiNoch keine Bewertungen

- Citadel Broadcasting's Bankruptcy PetitionDokument23 SeitenCitadel Broadcasting's Bankruptcy PetitionDealBook100% (1)

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsVon EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsBewertung: 5 von 5 Sternen5/5 (1)

- CIT Bankruptcy PetitionDokument30 SeitenCIT Bankruptcy PetitionDealBook100% (1)

- United States Bankruptcy Court Southern District of New York Voluntary PetitionDokument18 SeitenUnited States Bankruptcy Court Southern District of New York Voluntary PetitionChapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court Voluntary Petition: District of DelawareDokument16 SeitenUnited States Bankruptcy Court Voluntary Petition: District of DelawareChapter 11 DocketsNoch keine Bewertungen

- 10000000597Dokument5.120 Seiten10000000597Chapter 11 Dockets0% (1)

- 10000001843Dokument110 Seiten10000001843Chapter 11 DocketsNoch keine Bewertungen

- Inge Alia Bongo (Aka Lynn Collins Bongo) Bankruptcy CaseDokument144 SeitenInge Alia Bongo (Aka Lynn Collins Bongo) Bankruptcy CaseaengwNoch keine Bewertungen

- Borders' Bankruptcy PetitionDokument21 SeitenBorders' Bankruptcy PetitionDealBook100% (1)

- Fisker Automotive Holdings IncDokument4 SeitenFisker Automotive Holdings IncChapter 11 DocketsNoch keine Bewertungen

- Blockbuster Chapter 11 PetitionDokument25 SeitenBlockbuster Chapter 11 PetitionDealBook100% (1)

- District of Delaware: 20-2349869 1600 Manor Drive, Suite 110 Chalfont, PADokument12 SeitenDistrict of Delaware: 20-2349869 1600 Manor Drive, Suite 110 Chalfont, PAChapter 11 DocketsNoch keine Bewertungen

- Senator Sean Nienow Minnesota Bankruptcy FilingsDokument58 SeitenSenator Sean Nienow Minnesota Bankruptcy FilingsghostgripNoch keine Bewertungen

- U S B C Southern District of New York Voluntary Petition: Nited Tates Ankruptcy OurtDokument19 SeitenU S B C Southern District of New York Voluntary Petition: Nited Tates Ankruptcy OurtMelanie CohenNoch keine Bewertungen

- Solavei Bankruptcy14 14505 TWD 1Dokument249 SeitenSolavei Bankruptcy14 14505 TWD 1John CookNoch keine Bewertungen

- CaesarsDokument31 SeitenCaesarsZerohedgeNoch keine Bewertungen

- James R. Rosendall Jr.'s Bankruptcy Filing.Dokument50 SeitenJames R. Rosendall Jr.'s Bankruptcy Filing.rob_snell_1Noch keine Bewertungen

- Atari Interactive's Bankruptcy FilingDokument12 SeitenAtari Interactive's Bankruptcy FilingDealBookNoch keine Bewertungen

- Daffys 1Dokument18 SeitenDaffys 1Chapter 11 DocketsNoch keine Bewertungen

- Michigan Brewing Company Bankruptcy FilingDokument171 SeitenMichigan Brewing Company Bankruptcy FilingLansingStateJournalNoch keine Bewertungen

- 001 NYC Opera PetitionDokument10 Seiten001 NYC Opera Petitionahawkins8223Noch keine Bewertungen

- Bart Coffee KiosksDokument28 SeitenBart Coffee KioskskatherinestechNoch keine Bewertungen

- United States Bankruptcy Court Voluntary Petition: Southern District of New York AmendedDokument4 SeitenUnited States Bankruptcy Court Voluntary Petition: Southern District of New York AmendedChapter 11 DocketsNoch keine Bewertungen

- Riiitzaiit6F5T-L I: R1 Official Form 1) (12/11Dokument41 SeitenRiiitzaiit6F5T-L I: R1 Official Form 1) (12/11Chapter 11 DocketsNoch keine Bewertungen

- Braswell BankruptcyDokument58 SeitenBraswell BankruptcyMatt DixonNoch keine Bewertungen

- Bankruptcy Filing of "Sister Wife" Christine Allred Brown 3/2010Dokument5 SeitenBankruptcy Filing of "Sister Wife" Christine Allred Brown 3/2010borninbrooklynNoch keine Bewertungen

- Legacy Construction (Hardy) BankruptcyDokument13 SeitenLegacy Construction (Hardy) BankruptcyLas Vegas Review-JournalNoch keine Bewertungen

- Conway BankruptcyDokument43 SeitenConway Bankruptcyhurricanesmith2Noch keine Bewertungen

- Sinbad's BankruptcyDokument3 SeitenSinbad's BankruptcyGeri KoeppelNoch keine Bewertungen

- MOONGABSOOBKFORMDokument3 SeitenMOONGABSOOBKFORMJames KimNoch keine Bewertungen

- 10000019287Dokument165 Seiten10000019287Chapter 11 DocketsNoch keine Bewertungen

- Marlene Davis Bankruptcy FilingDokument51 SeitenMarlene Davis Bankruptcy Filingacsamaha100% (1)

- 10000005743Dokument48 Seiten10000005743Chapter 11 DocketsNoch keine Bewertungen

- Palomar Hangar, LLC Chapter 11 Bankruptcy - MacalusoDokument10 SeitenPalomar Hangar, LLC Chapter 11 Bankruptcy - MacalusoSpoiledMomNoch keine Bewertungen

- Sunset Junction Festival Bankruptcy FilingDokument105 SeitenSunset Junction Festival Bankruptcy FilingTheEastsiderNoch keine Bewertungen

- United States Bankruptcy Court Voluntary Petition Western District of Texas San Antonio Division Atled, LTDDokument9 SeitenUnited States Bankruptcy Court Voluntary Petition Western District of Texas San Antonio Division Atled, LTDChapter 11 DocketsNoch keine Bewertungen

- Affinity First Day SchedulesDokument101 SeitenAffinity First Day SchedulesjaxxstrawNoch keine Bewertungen

- 05014834923Dokument41 Seiten05014834923My-Acts Of-SeditionNoch keine Bewertungen

- Chad Edward Lilly Bankruptcy DocumentsDokument55 SeitenChad Edward Lilly Bankruptcy DocumentsAmanda HugankissNoch keine Bewertungen

- Gregory Owens Chapter 7 Bankruptcy PetitionDokument39 SeitenGregory Owens Chapter 7 Bankruptcy Petitiondavid_lat100% (1)

- Illuzzi Chap 7 BankruptcyDokument46 SeitenIlluzzi Chap 7 BankruptcyAlan BedenkoNoch keine Bewertungen

- Terri Williams BankruptcyDokument59 SeitenTerri Williams BankruptcyThe Greenville Guardian100% (1)

- Far East Energy Corporation - Bankruptcy Petition 15-35970 Doc 1 Filed 10 Nov 15Dokument15 SeitenFar East Energy Corporation - Bankruptcy Petition 15-35970 Doc 1 Filed 10 Nov 15scion.scionNoch keine Bewertungen

- DMX PetitionDokument23 SeitenDMX PetitionMarie Beaudette GlatsteinNoch keine Bewertungen

- Andrei Leon Gill SR Bankruptcy Petition 185 McCarrons BLVD PO Box 11683 06-05-2012Dokument71 SeitenAndrei Leon Gill SR Bankruptcy Petition 185 McCarrons BLVD PO Box 11683 06-05-2012CamdenCanaryNoch keine Bewertungen

- Mason Bankruptcy PetitionDokument195 SeitenMason Bankruptcy PetitionLansingStateJournalNoch keine Bewertungen

- Full Details SugarmanDokument40 SeitenFull Details SugarmanBecket AdamsNoch keine Bewertungen

- Joy Taylor BK DocsDokument45 SeitenJoy Taylor BK DocsStephen DibertNoch keine Bewertungen

- Northern District of Georgia - Atlanta Division: Voluntary Petition United States Bankruptcy CourtDokument5 SeitenNorthern District of Georgia - Atlanta Division: Voluntary Petition United States Bankruptcy CourtRichard Donald JonesNoch keine Bewertungen

- Southern Florida: United States Bankruptcy CourtDokument38 SeitenSouthern Florida: United States Bankruptcy CourtMy-Acts Of-SeditionNoch keine Bewertungen

- Jimmy Taylor Sr. Bankruptcy PetitionDokument51 SeitenJimmy Taylor Sr. Bankruptcy PetitionsrdielNoch keine Bewertungen

- Peticion Quiebra TelexfreeDokument19 SeitenPeticion Quiebra TelexfreelordmiguelNoch keine Bewertungen

- A&P Bankruptcy FilingDokument21 SeitenA&P Bankruptcy FilingJaredNoch keine Bewertungen

- Aletheia Research and Management's Bankruptcy PetitionDokument35 SeitenAletheia Research and Management's Bankruptcy PetitionDealBookNoch keine Bewertungen

- Earl Gaudio & Son PetitionDokument11 SeitenEarl Gaudio & Son PetitionChapter 11 DocketsNoch keine Bewertungen

- Ken King Bankruptcy Petition Kenneth Roy King 6713 ColfaxDokument60 SeitenKen King Bankruptcy Petition Kenneth Roy King 6713 ColfaxCamdenCanaryNoch keine Bewertungen

- Cerberus StatementDokument2 SeitenCerberus StatementDealBookNoch keine Bewertungen

- Corinthian Colleges Chapter 11 PetitionDokument19 SeitenCorinthian Colleges Chapter 11 PetitionDealBookNoch keine Bewertungen

- General Motors Ignition Switch Litigation Crime Fraud Memorandum July 9 2015Dokument48 SeitenGeneral Motors Ignition Switch Litigation Crime Fraud Memorandum July 9 2015DealBookNoch keine Bewertungen

- 16-08697 Notice of InterventionDokument9 Seiten16-08697 Notice of InterventionDealBookNoch keine Bewertungen

- SEC V Syron Resolution April 14 2015Dokument13 SeitenSEC V Syron Resolution April 14 2015DealBookNoch keine Bewertungen

- Robert Madsen Whistle-Blower CaseDokument220 SeitenRobert Madsen Whistle-Blower CaseDealBook100% (1)

- Radioshack's Chapter 11 PetitionDokument22 SeitenRadioshack's Chapter 11 PetitionDealBookNoch keine Bewertungen

- Anne Griffin Request For Temporary Restraining Order in Divorce CaseDokument15 SeitenAnne Griffin Request For Temporary Restraining Order in Divorce CaseDealBookNoch keine Bewertungen

- EBITDA Used and Abused Nov-20141Dokument10 SeitenEBITDA Used and Abused Nov-20141DealBookNoch keine Bewertungen

- Judge's Decision Potentially Allowing Ackman To Vote in Allergan FightDokument30 SeitenJudge's Decision Potentially Allowing Ackman To Vote in Allergan FightDealBookNoch keine Bewertungen

- Inversiones Alsacia Disclosure StatementDokument648 SeitenInversiones Alsacia Disclosure StatementDealBookNoch keine Bewertungen

- The IRR of NoDokument9 SeitenThe IRR of NoDealBookNoch keine Bewertungen

- Globalstar GSAT ReportDokument67 SeitenGlobalstar GSAT ReportDealBook100% (2)

- United States Court of Appeals: Circuit JudgesDokument1 SeiteUnited States Court of Appeals: Circuit JudgesDealBookNoch keine Bewertungen

- Ken Griffin's Response To Divorce Proceeding Counter-PetitionDokument18 SeitenKen Griffin's Response To Divorce Proceeding Counter-PetitionDealBookNoch keine Bewertungen

- Hedge Funds' Suit Against Bank of New York MellonDokument27 SeitenHedge Funds' Suit Against Bank of New York MellonDealBookNoch keine Bewertungen

- Ken Griffin's Further Response To Divorce ProceedingsDokument20 SeitenKen Griffin's Further Response To Divorce ProceedingsDealBookNoch keine Bewertungen

- Mediator's Memorandum LightSquared CaseDokument22 SeitenMediator's Memorandum LightSquared CaseDealBookNoch keine Bewertungen

- New York v. Davis, Et AlDokument60 SeitenNew York v. Davis, Et AlDealBookNoch keine Bewertungen

- FILED Motion To Intervenechallenge SettlementDokument12 SeitenFILED Motion To Intervenechallenge SettlementArik HesseldahlNoch keine Bewertungen

- Greene-v-MtGox Class Action LawsuitDokument32 SeitenGreene-v-MtGox Class Action LawsuitAndrew CoutsNoch keine Bewertungen

- Search WarrantDokument16 SeitenSearch WarrantDealBookNoch keine Bewertungen

- Motion To TransferDokument40 SeitenMotion To TransferDealBook100% (1)

- Instances When A Stockholder Can Exercise His Appraisal RightDokument2 SeitenInstances When A Stockholder Can Exercise His Appraisal RightKaren RabadonNoch keine Bewertungen

- Documented Essay Draft 2Dokument5 SeitenDocumented Essay Draft 2api-241798291Noch keine Bewertungen

- PX Set H Solution PDFDokument14 SeitenPX Set H Solution PDFChristine Altamarino89% (9)

- Credit Appraisal ProcessDokument44 SeitenCredit Appraisal ProcessMuskan Maheshwari100% (2)

- 3 Macapinlac v. RepideDokument1 Seite3 Macapinlac v. RepidePre PacionelaNoch keine Bewertungen

- DIONISIO MOJICA vs. CA, and RURAL BANK OF YAWIT, INC.Dokument2 SeitenDIONISIO MOJICA vs. CA, and RURAL BANK OF YAWIT, INC.Jan Mar Gigi GallegoNoch keine Bewertungen

- Personal Budget SpreadsheetDokument7 SeitenPersonal Budget Spreadsheetamiller1987Noch keine Bewertungen

- Chapter 6: Donor'S Tax: "Transfer of Property in Trust or Otherwise, Direct or Indirect"Dokument5 SeitenChapter 6: Donor'S Tax: "Transfer of Property in Trust or Otherwise, Direct or Indirect"Kiana FernandezNoch keine Bewertungen

- s609 Dispute Letter Template (IT WORKS)Dokument2 Seitens609 Dispute Letter Template (IT WORKS)Bonaparte Phil100% (9)

- Bank ConfirmationDokument13 SeitenBank ConfirmationshibiramuNoch keine Bewertungen

- BCA ECR Documentation Fase IIIDokument70 SeitenBCA ECR Documentation Fase IIIliko anas setyawatiNoch keine Bewertungen

- Share and Share CapitalDokument63 SeitenShare and Share Capitaldolly bhati100% (4)

- Joint Tenancy NotesDokument5 SeitenJoint Tenancy NotesRiccoWashburnNoch keine Bewertungen

- Moneylenders - Amendment - Act No 13 of 2017 PDFDokument54 SeitenMoneylenders - Amendment - Act No 13 of 2017 PDFelvismorey9721Noch keine Bewertungen

- KPMG - Fiji COVID-19 Response Budget Newsletter1859921916929410238Dokument2 SeitenKPMG - Fiji COVID-19 Response Budget Newsletter1859921916929410238Louchrisha HussainNoch keine Bewertungen

- DR - Srinivas Madishetti Professor, School of Business Mzumbe UniversityDokument67 SeitenDR - Srinivas Madishetti Professor, School of Business Mzumbe UniversityNicole TaylorNoch keine Bewertungen

- Retail Banking in IndiaDokument17 SeitenRetail Banking in Indianitinsuba198050% (2)

- Windham Turner Obtain Control of Brazos Land and CattleDokument10 SeitenWindham Turner Obtain Control of Brazos Land and CattleMichael CorwinNoch keine Bewertungen

- Lecture - Extinguishment of Obligations Part IDokument10 SeitenLecture - Extinguishment of Obligations Part IChristina GattocNoch keine Bewertungen

- Current Liabilities and ContingenciesDokument6 SeitenCurrent Liabilities and ContingenciesDivine CuasayNoch keine Bewertungen

- Study Guide of The Special Commercial Laws Prof. Tristan A. CatindigDokument144 SeitenStudy Guide of The Special Commercial Laws Prof. Tristan A. CatindigKreig123Noch keine Bewertungen

- Key Aspects of Paycheck Protection Program (PPP) Loan DataDokument2 SeitenKey Aspects of Paycheck Protection Program (PPP) Loan DataJennifer WeaverNoch keine Bewertungen

- Peter Hart - TransUnion Personal Credit Report - 20200721 PDFDokument12 SeitenPeter Hart - TransUnion Personal Credit Report - 20200721 PDFSusu0% (1)

- 1 G.R. No. 205657Dokument11 Seiten1 G.R. No. 205657Jenely Joy Areola-TelanNoch keine Bewertungen

- Ra 4276Dokument8 SeitenRa 4276Monique Allen LoriaNoch keine Bewertungen

- 5790 Guilford - Performance ReportDokument1 Seite5790 Guilford - Performance ReportBay Area Equity Group, LLCNoch keine Bewertungen

- ABM Module DDokument4 SeitenABM Module DchatsakNoch keine Bewertungen

- Finance & CreditDokument3 SeitenFinance & Creditel khaiat mohamed amineNoch keine Bewertungen

- 2012 Bar Examinations On TaxationDokument19 Seiten2012 Bar Examinations On Taxationjamaica_maglinteNoch keine Bewertungen

- Understanding RA 11057 and Its Effect With NCC and Prior LawsDokument2 SeitenUnderstanding RA 11057 and Its Effect With NCC and Prior LawsKym Algarme100% (2)