Beruflich Dokumente

Kultur Dokumente

Tax Alculations

Hochgeladen von

Chandan Kumar Singh0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

34 Ansichten3 SeitenCopyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

34 Ansichten3 SeitenTax Alculations

Hochgeladen von

Chandan Kumar SinghCopyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

Personal Financial Planning NOVEMBER 18, 2010

Term Paper: (Term III -2010)

Topic: Tax Calculations

Subject: Personal Financial Planning

Submitted to: Mr.Lovey aggerwal

Submitted by: Devesh chauhan

Roll no: RT1902A05

Subject code: MGT 636

1 LOVELY PROFESSIONAL UNIVERSITY

MGT 636

Personal Financial Planning NOVEMBER 18, 2010

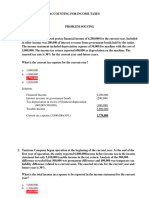

Particulars Amount

Income from salary 400000

Income from house property Nil

Income from business 400000

Income from capital gain 500000

Income from other sources Nil

Gross total income 1300000

Deduction under section 80c 50000

Total income 1250000

Tax calculated

On first 160000 Nil

140000 10% 14000

200000 20% 40000

750000 30% 225000

Tax payable 279000 279000

Edu cess @2% 5580

Shec @1% 2790

Total tax payable 287370 287370

2 LOVELY PROFESSIONAL UNIVERSITY

MGT 636

Personal Financial Planning NOVEMBER 18, 2010

3 LOVELY PROFESSIONAL UNIVERSITY

MGT 636

Das könnte Ihnen auch gefallen

- Tax & Taxation of BangladeshDokument31 SeitenTax & Taxation of BangladeshAl JamiNoch keine Bewertungen

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- Answer: PH P 1,240: SolutionDokument18 SeitenAnswer: PH P 1,240: SolutionadssdasdsadNoch keine Bewertungen

- Global Tax Revolution: The Rise of Tax Competition and the Battle to Defend ItVon EverandGlobal Tax Revolution: The Rise of Tax Competition and the Battle to Defend ItNoch keine Bewertungen

- Assignment 1 Taxes On IndividualsDokument7 SeitenAssignment 1 Taxes On IndividualsMarynissa CatibogNoch keine Bewertungen

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionVon EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNoch keine Bewertungen

- Unit 6-Computation of Total Income and Tax LiabilityDokument23 SeitenUnit 6-Computation of Total Income and Tax LiabilityDisha GuptaNoch keine Bewertungen

- Landlord Tax Planning StrategiesVon EverandLandlord Tax Planning StrategiesNoch keine Bewertungen

- Taxation Review Dec2016Dokument6 SeitenTaxation Review Dec2016Shaiful Alam FCANoch keine Bewertungen

- MG 3027 TAXATION - Week 2 Introduction To Income TaxDokument39 SeitenMG 3027 TAXATION - Week 2 Introduction To Income TaxSyed SafdarNoch keine Bewertungen

- E-Filling of Returns (Shivdas 10 Years)Dokument122 SeitenE-Filling of Returns (Shivdas 10 Years)Unicorn SpiderNoch keine Bewertungen

- Taxation 2004 SolvedDokument18 SeitenTaxation 2004 Solvedapi-3832224100% (2)

- IAET TaxationDokument2 SeitenIAET TaxationRandy Manzano100% (1)

- CH 2.TaxSalary IncomeDokument13 SeitenCH 2.TaxSalary IncomeSajid AhmedNoch keine Bewertungen

- (CBCS) (Regular) Commerce Paper - 4.5: Innovations in AccountingDokument4 Seiten(CBCS) (Regular) Commerce Paper - 4.5: Innovations in AccountingSanaullah M SultanpurNoch keine Bewertungen

- Tax-1-Solutions Bsa Quiz - Theories W AnsDokument6 SeitenTax-1-Solutions Bsa Quiz - Theories W AnsCyrss BaldemosNoch keine Bewertungen

- Taxation Review June2017Dokument9 SeitenTaxation Review June2017Shaiful Alam FCANoch keine Bewertungen

- Approaches in Calculating GDPDokument3 SeitenApproaches in Calculating GDPAsahi My loveNoch keine Bewertungen

- Assignment BFN3114 Tax Planning TRIMESTER 3, 2020/2021: No Student Name Student IdDokument11 SeitenAssignment BFN3114 Tax Planning TRIMESTER 3, 2020/2021: No Student Name Student IdSweethaa ArumugamNoch keine Bewertungen

- Presented by Archana Gupta 0221031 Bharat Gaikwad 0221023Dokument12 SeitenPresented by Archana Gupta 0221031 Bharat Gaikwad 0221023Bharat GaikwadNoch keine Bewertungen

- Exercise 9-5 No 9-20Dokument9 SeitenExercise 9-5 No 9-20Kent LumanasNoch keine Bewertungen

- Activity 2Dokument3 SeitenActivity 2LFGS Finals0% (1)

- New Microsoft Office Excel WorksheetDokument26 SeitenNew Microsoft Office Excel WorksheetMac Ferds100% (1)

- Advance Tax ExampleDokument2 SeitenAdvance Tax ExampleRitsikaGurramNoch keine Bewertungen

- How To Calculate Total IncomeDokument16 SeitenHow To Calculate Total IncomeAshish ChatrathNoch keine Bewertungen

- Tax 1 Bsais Quiz4 Theories W AnsDokument6 SeitenTax 1 Bsais Quiz4 Theories W AnsCyrss BaldemosNoch keine Bewertungen

- CPAT Reviewer - TRAIN (Tax Reform) #1Dokument8 SeitenCPAT Reviewer - TRAIN (Tax Reform) #1Zaaavnn VannnnnNoch keine Bewertungen

- QuickBooks For BeginnersDokument9 SeitenQuickBooks For BeginnersZain U DdinNoch keine Bewertungen

- PGBP QuestionsDokument6 SeitenPGBP QuestionsHdkakaksjsb100% (2)

- Tax Computations SampleDokument5 SeitenTax Computations Samplelcsme tubodaccountsNoch keine Bewertungen

- Business Taxation Past Paper 2017 B.com Part 2 Punjab UniversityDokument3 SeitenBusiness Taxation Past Paper 2017 B.com Part 2 Punjab UniversityAdeel AhmedNoch keine Bewertungen

- Taxation Assignment No 1Dokument8 SeitenTaxation Assignment No 1Ha MimNoch keine Bewertungen

- FUNDALES BTAX MidtermsDokument4 SeitenFUNDALES BTAX MidtermsE. RobertNoch keine Bewertungen

- Business & Profession Q - A 02.9.2020Dokument42 SeitenBusiness & Profession Q - A 02.9.2020shyamiliNoch keine Bewertungen

- Assignment On TaxationDokument13 SeitenAssignment On TaxationRabiul Karim ShipluNoch keine Bewertungen

- Income From Business-ProblemsDokument20 SeitenIncome From Business-Problems24.7upskill Lakshmi V100% (1)

- New Course Solutions May 2019Dokument18 SeitenNew Course Solutions May 2019Kali KhannaNoch keine Bewertungen

- By Prof. Pankaj Jagtap (Mcom, Net, Set, Gdc&A, DTL) S. M. Joshi College Hadapsar Pune 28Dokument12 SeitenBy Prof. Pankaj Jagtap (Mcom, Net, Set, Gdc&A, DTL) S. M. Joshi College Hadapsar Pune 28Kadam KartikeshNoch keine Bewertungen

- Taxation Module 3: Numerical Problems Income From Business or ProfessionDokument5 SeitenTaxation Module 3: Numerical Problems Income From Business or ProfessionShankar HunnurNoch keine Bewertungen

- Income Tax Rates, Rebates & DeductionsDokument35 SeitenIncome Tax Rates, Rebates & DeductionsMaryam IkhlaqeNoch keine Bewertungen

- For Revision of Income TaxDokument5 SeitenFor Revision of Income TaxMA AttariNoch keine Bewertungen

- Tax AssignmentDokument11 SeitenTax AssignmentAM NerdyNoch keine Bewertungen

- Income Taxation 2 Bsa 2Dokument259 SeitenIncome Taxation 2 Bsa 2Jaycie Escuadro100% (1)

- Tax Calculator - Indian Income Tax 2008-09Dokument7 SeitenTax Calculator - Indian Income Tax 2008-09Jayamohan100% (29)

- Cbtax01 Chapter 2 ActivityDokument2 SeitenCbtax01 Chapter 2 ActivityDamayan XeroxanNoch keine Bewertungen

- 10 TP 1 Income Tax San LuisDokument9 Seiten10 TP 1 Income Tax San Luislenlen100% (1)

- Management Programme: TH STDokument3 SeitenManagement Programme: TH ST19BAD007 Bendangsenla JamirNoch keine Bewertungen

- Accrued Liabilities: Problem 3-1 (AICPA Adapted)Dokument15 SeitenAccrued Liabilities: Problem 3-1 (AICPA Adapted)Nila FranciaNoch keine Bewertungen

- TaxDokument3 SeitenTaxLet it beNoch keine Bewertungen

- Fa Ii Individual Assignment For Management StudentsDokument2 SeitenFa Ii Individual Assignment For Management StudentsAbdi Mucee TubeNoch keine Bewertungen

- Income TAX: Prof. Jeanefer Reyes CPA, MPADokument37 SeitenIncome TAX: Prof. Jeanefer Reyes CPA, MPAmark anthony espiritu75% (4)

- Final QuizDokument5 SeitenFinal Quizanamika prasadNoch keine Bewertungen

- Solution - Accounting For Income TaxesDokument12 SeitenSolution - Accounting For Income TaxesKlarissemay MontallanaNoch keine Bewertungen

- Answer 1Dokument5 SeitenAnswer 1mayetteNoch keine Bewertungen

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDokument4 SeitenSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureNoorodden50% (2)

- Assignment 4 - SolutionsDokument2 SeitenAssignment 4 - SolutionsstoryNoch keine Bewertungen

- 2016, August QnsDokument5 Seiten2016, August QnsTimore FrancisNoch keine Bewertungen

- Financial Plan: Start-Up Capital:: Profit Loss StatementDokument6 SeitenFinancial Plan: Start-Up Capital:: Profit Loss Statementparthi 23Noch keine Bewertungen

- Example Deferred TaxDokument7 SeitenExample Deferred TaxTEIK LOONG KHORNoch keine Bewertungen

- Effect of Packaging Information On Consumer Learning With Respect To Food Product in PunjabDokument15 SeitenEffect of Packaging Information On Consumer Learning With Respect To Food Product in PunjabChandan Kumar SinghNoch keine Bewertungen

- RIN Detergent Prelaunch in OrissaDokument20 SeitenRIN Detergent Prelaunch in OrissaChandan Kumar SinghNoch keine Bewertungen

- Advertising Impact On Consumer PreferenceDokument63 SeitenAdvertising Impact On Consumer PreferenceChandan Kumar Singh81% (26)

- Study of Advertisement Impact On Consumer PreferenceDokument48 SeitenStudy of Advertisement Impact On Consumer PreferenceChandan Kumar Singh83% (30)

- KeralaDokument12 SeitenKeralaChandan Kumar SinghNoch keine Bewertungen

- Consumer Awareness and Attitude Towards The Recycled PackagingDokument74 SeitenConsumer Awareness and Attitude Towards The Recycled PackagingChandan Kumar Singh100% (3)

- Term Paper Rural MarketingDokument27 SeitenTerm Paper Rural MarketingChandan Kumar SinghNoch keine Bewertungen

- Open Up A New BusinessDokument22 SeitenOpen Up A New BusinessChandan Kumar SinghNoch keine Bewertungen

- Balance of Payement For The CountyDokument18 SeitenBalance of Payement For The CountyChandan Kumar SinghNoch keine Bewertungen

- Advertisement Impact On ConsumerDokument6 SeitenAdvertisement Impact On ConsumerChandan Kumar Singh33% (3)

- HDFC Customer ExpectationsDokument30 SeitenHDFC Customer ExpectationsChandan Kumar SinghNoch keine Bewertungen

- Implemention of Balance Score Card in An OrganizationDokument13 SeitenImplemention of Balance Score Card in An OrganizationChandan Kumar SinghNoch keine Bewertungen

- BCG Matrix of Amul IndiaDokument20 SeitenBCG Matrix of Amul IndiaChandan Kumar Singh100% (7)

- Leadership Style Preferences For IndividualsDokument7 SeitenLeadership Style Preferences For IndividualsChandan Kumar SinghNoch keine Bewertungen

- Incorporation of A Public BankDokument24 SeitenIncorporation of A Public BankChandan Kumar SinghNoch keine Bewertungen

- Product Life Cycle Stage of Maruti UdyogDokument26 SeitenProduct Life Cycle Stage of Maruti UdyogChandan Kumar Singh100% (14)

- Sales Promotional Activities by Air IndiaDokument15 SeitenSales Promotional Activities by Air IndiaChandan Kumar SinghNoch keine Bewertungen

- Personal Financial Planning For Next Ten YearDokument14 SeitenPersonal Financial Planning For Next Ten YearlowpriceditbooksNoch keine Bewertungen

- On NokiaDokument18 SeitenOn NokiaChandan Kumar Singh80% (5)

- Lovely Professional University: TopicDokument7 SeitenLovely Professional University: TopicChandan Kumar Singh100% (1)

- Design A Print AddDokument3 SeitenDesign A Print AddChandan Kumar SinghNoch keine Bewertungen

- Study On Banking Innovations in IndiaDokument26 SeitenStudy On Banking Innovations in IndiaChandan Kumar Singh100% (1)

- A Study of Consumer Preference and Precept Ion Towards Internet Service Provider in PunjabDokument26 SeitenA Study of Consumer Preference and Precept Ion Towards Internet Service Provider in PunjabChandan Kumar Singh100% (4)

- Personal Fin Plan Assi 2Dokument7 SeitenPersonal Fin Plan Assi 2Chandan Kumar SinghNoch keine Bewertungen

- BCG MATRIX of VedioconDokument18 SeitenBCG MATRIX of Vedioconsweetipie1275% (4)

- Term Paper Synopsis 2009-2011 MGT-519: Lovely Professional UniversityDokument9 SeitenTerm Paper Synopsis 2009-2011 MGT-519: Lovely Professional UniversityChandan Kumar SinghNoch keine Bewertungen

- Consumer Attitude Towards Online Retail Shopping in The Indian ContextDokument4 SeitenConsumer Attitude Towards Online Retail Shopping in The Indian ContextChandan Kumar SinghNoch keine Bewertungen