Beruflich Dokumente

Kultur Dokumente

Jeevan Anand - 9811896425

Hochgeladen von

Harish ChandCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Jeevan Anand - 9811896425

Hochgeladen von

Harish ChandCopyright:

Verfügbare Formate

Harish Chand

Delhi LIC Agent

577, GH-9, PASCHIM VIHAR

NEW DELHI- 110087

INDIA, 9811896425, 9212201725

www.delhiLICagent.com

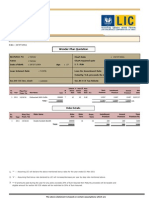

149 - Jeevan Anand

Pg. 1

Term Age Sum

Minimum 5 18 100000

Maximum 57 65 0

Premium Ceasing Age : 75 Premium Ceasing Term : 0

Plan Highlights

Features

Jeevan Anand is a With Profit assurance plan. The plan is a combination of the Whole Life Plan

and the most popular Endowment Assurance Plan. It provides pre-decided Sum Assured and

bonuses at the end of the stipulated premium paying term, but the risk cover on the life

continues till death.

Special Features

· Moderate Premiums

· High bonus

· High liquidity

· Savings oriented.

·Premiums are usually payable for the selected term of years or until death if it occurs during

the term period. This policy not only makes provisions for the family of the life assured in the

event of his early death but also assures a lump sum at a desired age. The lump sum can be

reinvested to provide an annuity during the remainder of his life or in any other way considered

suitable at that time.

Benefits

Survival Benefits:

Sum Assured along with all vested bonuses payable at the end of the premium paying term (

Endowment term).

Accident Benefit:

The Double Accident benefit is available during the premium paying term and thereafter up to

age 70. The premium for this has been built into the tabular premium rates. Maximum accident

cover available under this plan will be Rs. 5 lakh ( this limit excludes accident benefit taken

under other plans).

Premium Stoppage:

If payment of premiums ceases after at least three years' premiums have been paid , a free

paid-up policy for a reduced Sum Assured will be automatically secured provided the reduced

sum assured, exclusive of any attached bonus, is not less than Rs. 250/-. The reduced sum

assured will become payable on the event as stipulated in the policy.

Bonus:

If it is a 'with profits' policy note that every year the LIC distributes its surplus among

policyholder to 'with profits' polices in the form of bonuses. Substantial bonuses have been

declared in the past after each valuation of policy liabilities.

Death Benefits:

Insure And Be Secure

Plan Features Continue .......... Pg. 2

Insure And Be Secure

Das könnte Ihnen auch gefallen

- Michael Guichon Sohn Conference PresentationDokument49 SeitenMichael Guichon Sohn Conference PresentationValueWalkNoch keine Bewertungen

- Rad 01291Dokument2 SeitenRad 01291Harish ChandNoch keine Bewertungen

- Endowment Policy: By: Prateek BindalDokument38 SeitenEndowment Policy: By: Prateek BindalPrateek BindalNoch keine Bewertungen

- 5 YearDokument1 Seite5 YearHarish ChandNoch keine Bewertungen

- Endowment PolicyDokument38 SeitenEndowment PolicyGourav DeNoch keine Bewertungen

- LIC Jeevan Anand HomeDokument3 SeitenLIC Jeevan Anand HomeAnkit AgarwalNoch keine Bewertungen

- EndowmentDokument41 SeitenEndowmentAbhishek SharmaNoch keine Bewertungen

- Bima Gold by Lic of India - 9811896425Dokument3 SeitenBima Gold by Lic of India - 9811896425Harish ChandNoch keine Bewertungen

- A One of Its Kind Plan: For Internal Circulation OnlyDokument16 SeitenA One of Its Kind Plan: For Internal Circulation OnlyAdityaNoch keine Bewertungen

- Jeevan Nidhi - 9811896425Dokument3 SeitenJeevan Nidhi - 9811896425Harish ChandNoch keine Bewertungen

- Jeevan Akshay A Pension Plan - 9811896425Dokument1 SeiteJeevan Akshay A Pension Plan - 9811896425Harish ChandNoch keine Bewertungen

- Bima BachatDokument1 SeiteBima BachatHarish ChandNoch keine Bewertungen

- LICDokument14 SeitenLICGaurav AnandNoch keine Bewertungen

- Seving Surakha Plan: Summary InfoDokument2 SeitenSeving Surakha Plan: Summary InfoPankaj ChauhanNoch keine Bewertungen

- Jeevan Saral - 9811896425Dokument1 SeiteJeevan Saral - 9811896425Harish ChandNoch keine Bewertungen

- PWP LeafletDokument4 SeitenPWP LeafletsatishbhattNoch keine Bewertungen

- Supplementary Income Sanchay Plus RetailDokument5 SeitenSupplementary Income Sanchay Plus RetailSampras DsouzaNoch keine Bewertungen

- Savings Advantage Plan LeafletDokument2 SeitenSavings Advantage Plan LeafletNishanthNoch keine Bewertungen

- HDFC Life Super Income Plan SHAREDokument6 SeitenHDFC Life Super Income Plan SHARESandeep MookerjeeNoch keine Bewertungen

- Jeevan Anand FeaturesDokument2 SeitenJeevan Anand FeaturesSandy DheerNoch keine Bewertungen

- Jeevan SafarDokument7 SeitenJeevan SafarNishant SinhaNoch keine Bewertungen

- Fulfil The Smaller Joys in Life, Through Regular IncomeDokument8 SeitenFulfil The Smaller Joys in Life, Through Regular IncomeSajeed ShaikhNoch keine Bewertungen

- Jeevan Pram UkhDokument9 SeitenJeevan Pram UkhSchool ParentNoch keine Bewertungen

- HDFC Life Click 2 InvestDokument7 SeitenHDFC Life Click 2 InvestShaik BademiyaNoch keine Bewertungen

- POS Goal Suraksha: Key Features of The PlanDokument5 SeitenPOS Goal Suraksha: Key Features of The PlanSoumya BanerjeeNoch keine Bewertungen

- Max Life Monthly Income Advantage Plan ProspectusDokument11 SeitenMax Life Monthly Income Advantage Plan Prospectushemantchawla89Noch keine Bewertungen

- Max Life Saral Jeevan Bima ProspectusDokument9 SeitenMax Life Saral Jeevan Bima Prospectusmohan krishnaNoch keine Bewertungen

- A One of Its Kind Plan: For Internal Circulation OnlyDokument18 SeitenA One of Its Kind Plan: For Internal Circulation OnlyKunal ShahNoch keine Bewertungen

- ICICI Savings Suraksha BrochureDokument8 SeitenICICI Savings Suraksha BrochureJetesh DevgunNoch keine Bewertungen

- IndiaFirst Smart Save Plan BrochureDokument16 SeitenIndiaFirst Smart Save Plan BrochureVishal SharmaNoch keine Bewertungen

- Product SummaryDokument2 SeitenProduct SummaryHarish ChandNoch keine Bewertungen

- POS Goal Suraksha: Key Feature DocumentDokument6 SeitenPOS Goal Suraksha: Key Feature DocumentPiyush VisputeNoch keine Bewertungen

- Jeevan Bharti A Women Plan - 9811896425Dokument2 SeitenJeevan Bharti A Women Plan - 9811896425Harish ChandNoch keine Bewertungen

- IllustrationDokument8 SeitenIllustrationabhi5061448Noch keine Bewertungen

- Bajaj AllianzDokument10 SeitenBajaj AllianzSantosh BandarupalliNoch keine Bewertungen

- IDBI Federal Lifesurance Savings Insurance PlanDokument16 SeitenIDBI Federal Lifesurance Savings Insurance PlanKumarniksNoch keine Bewertungen

- 5years Pay 15years Policy TermDokument3 Seiten5years Pay 15years Policy TermSenthilkumarNoch keine Bewertungen

- IndiaFirst Maha Jeevan Plan - BrochureDokument11 SeitenIndiaFirst Maha Jeevan Plan - BrochureBirddoxyNoch keine Bewertungen

- Life BrochureDokument8 SeitenLife BrochureHar DonNoch keine Bewertungen

- Banking & Insurance Project: Pankaj Raghav Ty-D 3199Dokument10 SeitenBanking & Insurance Project: Pankaj Raghav Ty-D 3199Chetan KanojiyaNoch keine Bewertungen

- CH 3 Final Wit PgnoDokument7 SeitenCH 3 Final Wit PgnoMBA 04 Akshaya BNoch keine Bewertungen

- Marketing of Financial Services: Course Code:-MKT354Dokument14 SeitenMarketing of Financial Services: Course Code:-MKT354Sabab ZamanNoch keine Bewertungen

- Shriram Life Super Income Plan Website VersionDokument24 SeitenShriram Life Super Income Plan Website VersionPraveen BabuNoch keine Bewertungen

- Life Insurance BrouchureDokument2 SeitenLife Insurance BrouchureGuru9756Noch keine Bewertungen

- RLMMP - BrochureDokument13 SeitenRLMMP - BrochureDanish Khan KagziNoch keine Bewertungen

- LIC S Bima Gold - 512N231V01 PDFDokument8 SeitenLIC S Bima Gold - 512N231V01 PDFPooja ReddyNoch keine Bewertungen

- Aegon Life Akhil Bharat Term PlanDokument9 SeitenAegon Life Akhil Bharat Term Planmohinlaskar123Noch keine Bewertungen

- IPru Sarv Jana Suraksha BrochureDokument6 SeitenIPru Sarv Jana Suraksha BrochureyesindiacanngoNoch keine Bewertungen

- GIP Sales BrochureDokument15 SeitenGIP Sales BrochureSiva NandNoch keine Bewertungen

- Jeevan - Sathi Eng BH PDFDokument2 SeitenJeevan - Sathi Eng BH PDFNaygarp IhtapirtNoch keine Bewertungen

- Consumer Preference Towards Shriram Life Insurance CompanyDokument18 SeitenConsumer Preference Towards Shriram Life Insurance Companyprava vamsiNoch keine Bewertungen

- HDFC Life Income Benefit On Accidental Disability RiderDokument4 SeitenHDFC Life Income Benefit On Accidental Disability RiderrechargemystuffNoch keine Bewertungen

- Ace LeafletDokument24 SeitenAce LeafletShyamNoch keine Bewertungen

- Reating Lif: Child Protection Money Back PlanDokument2 SeitenReating Lif: Child Protection Money Back PlanSanjay Ku AgrawalNoch keine Bewertungen

- Exide Life Secured Income Insurance RPDokument10 SeitenExide Life Secured Income Insurance RPrahul sarmaNoch keine Bewertungen

- SBI Life - Smart Platina Assure - BrochureDokument12 SeitenSBI Life - Smart Platina Assure - Brochuresourav agarwalNoch keine Bewertungen

- UIN: 512N279V01: Lic'S New Jeevan Anand (815) PlanDokument3 SeitenUIN: 512N279V01: Lic'S New Jeevan Anand (815) PlanSubham ChoudhuryNoch keine Bewertungen

- Secure Income Plan BrochureDokument18 SeitenSecure Income Plan Brochuremantoo kumarNoch keine Bewertungen

- Samjho Ho Gaya.: Goal AssureDokument21 SeitenSamjho Ho Gaya.: Goal AssureshanmugamNoch keine Bewertungen

- IB On AD Rider Brochure - 2 PDFDokument4 SeitenIB On AD Rider Brochure - 2 PDFsusman paulNoch keine Bewertungen

- Corporate AgentsDokument1.023 SeitenCorporate AgentsVivek Thota0% (1)

- 16 Year at 41 AgeDokument4 Seiten16 Year at 41 AgeHarish ChandNoch keine Bewertungen

- Multi - Plan Chart: Harish ChandDokument3 SeitenMulti - Plan Chart: Harish ChandHarish ChandNoch keine Bewertungen

- Jeevan Anand: Harish ChandDokument4 SeitenJeevan Anand: Harish ChandHarish ChandNoch keine Bewertungen

- Rad 28 E72Dokument1 SeiteRad 28 E72Harish ChandNoch keine Bewertungen

- Mrs. Nirali Mehta: Insurance Proposal ForDokument5 SeitenMrs. Nirali Mehta: Insurance Proposal ForHarish ChandNoch keine Bewertungen

- Mr. Gupta: Harish ChandDokument4 SeitenMr. Gupta: Harish ChandHarish ChandNoch keine Bewertungen

- Multi - Plan Chart: Harish ChandDokument3 SeitenMulti - Plan Chart: Harish ChandHarish ChandNoch keine Bewertungen

- Caf 6 All PDFDokument80 SeitenCaf 6 All PDFMuhammad Yahya100% (1)

- A Section Tues 11-07-17Dokument32 SeitenA Section Tues 11-07-17Jacob LevaleNoch keine Bewertungen

- Brain Drain Is The Emigration of Highly Trained or Intelligent People From A Particular CountryDokument3 SeitenBrain Drain Is The Emigration of Highly Trained or Intelligent People From A Particular CountrydivyanshNoch keine Bewertungen

- CSEC Principles of AccountsDokument6 SeitenCSEC Principles of AccountsNatalie0% (1)

- The Following Is A Research Assignment Made by Harsh Vagal On Financial Management of The Copanies Tata Motors VS Maruti SuzukiDokument25 SeitenThe Following Is A Research Assignment Made by Harsh Vagal On Financial Management of The Copanies Tata Motors VS Maruti SuzukiHarsh VagalNoch keine Bewertungen

- Audit of Cash Module 1Dokument5 SeitenAudit of Cash Module 1calliemozartNoch keine Bewertungen

- InsuranceDokument31 SeitenInsuranceGirish TejwaniNoch keine Bewertungen

- Installment Sales ConceptsDokument61 SeitenInstallment Sales ConceptsRanne BalanaNoch keine Bewertungen

- Georgia Healthcare Group PLC-Annual Report (Apr-08-2020)Dokument188 SeitenGeorgia Healthcare Group PLC-Annual Report (Apr-08-2020)Messina04Noch keine Bewertungen

- Here's What Is Happening in India:: Capital Suggestion by DRDokument3 SeitenHere's What Is Happening in India:: Capital Suggestion by DRPavan ChandoluNoch keine Bewertungen

- Other Income Tax AccountingDokument19 SeitenOther Income Tax AccountingHabtamu Hailemariam AsfawNoch keine Bewertungen

- Kedudukan Hukum Kreditur Yang Tidak Terverifikasi Dalam Undang Undang KepailitanDokument15 SeitenKedudukan Hukum Kreditur Yang Tidak Terverifikasi Dalam Undang Undang KepailitanVictor TumbelNoch keine Bewertungen

- Rental IncomeDokument2 SeitenRental IncomeAlex SirgiovanniNoch keine Bewertungen

- Case 3.1 Enron - A Focus On Company Level ControlsDokument5 SeitenCase 3.1 Enron - A Focus On Company Level ControlsgandhunkNoch keine Bewertungen

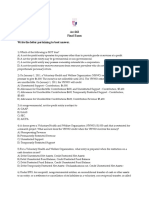

- Acc162 Final Exam Write The Letter Pertaining To Best AnswerDokument3 SeitenAcc162 Final Exam Write The Letter Pertaining To Best AnswerWilliam DC RiveraNoch keine Bewertungen

- Zed Pay Full PlanDokument36 SeitenZed Pay Full Plankukaramp349Noch keine Bewertungen

- Aud Spec 101Dokument19 SeitenAud Spec 101Yanyan GuadillaNoch keine Bewertungen

- Strategic Cost ManagementDokument24 SeitenStrategic Cost Managementsai500Noch keine Bewertungen

- Soft Copy ReportDokument3 SeitenSoft Copy ReportChristine Nathalie BalmesNoch keine Bewertungen

- Handbook For Consultants Selection-GoPDokument75 SeitenHandbook For Consultants Selection-GoPzulfikarmoin001Noch keine Bewertungen

- Sample Exam 3: CFA Level 1Dokument75 SeitenSample Exam 3: CFA Level 1Sandeep JaiswalNoch keine Bewertungen

- EconomicsDokument50 SeitenEconomicshiteshrao810Noch keine Bewertungen

- Behavioral FinanceDokument15 SeitenBehavioral FinanceanupmidNoch keine Bewertungen

- Colege ReportDokument51 SeitenColege ReportVarun WayneNoch keine Bewertungen

- Digest RR 12-2018Dokument5 SeitenDigest RR 12-2018Jesi CarlosNoch keine Bewertungen

- Liquidity Management in Banks Treasury Risk ManagementDokument11 SeitenLiquidity Management in Banks Treasury Risk Managementashoo khoslaNoch keine Bewertungen

- Circular Flow of EconomyDokument19 SeitenCircular Flow of EconomyAbhijeet GuptaNoch keine Bewertungen

- Acca Fa Test 1 - CHP 1,3,4,5 SolnDokument11 SeitenAcca Fa Test 1 - CHP 1,3,4,5 SolnAkash RadhakrishnanNoch keine Bewertungen

- Washington Mutual (WMI) - Project Fillmore (Decapitalization of WMB FSB)Dokument50 SeitenWashington Mutual (WMI) - Project Fillmore (Decapitalization of WMB FSB)meischer100% (1)