Beruflich Dokumente

Kultur Dokumente

2009 12 en 4 QR

Hochgeladen von

Kristian MahardanuOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2009 12 en 4 QR

Hochgeladen von

Kristian MahardanuCopyright:

Verfügbare Formate

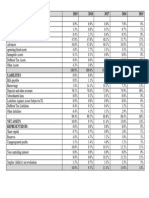

PT. BANK ARTHA GRAHA INTERNASIONAL, Tbk.

CONSOLIDATED FINANCIAL STATEMENT

KEY FINANCIAL RATIOS

PT BANK ARTHA GRAHA INTERNASIONAL TBK AND SUBSIDIARY

AS AT 31 DECEMBER 2009 AND 2008

BANK

NO RATIO (%)

2009 2008

I. CAPITAL

1. Capital Adequacy Ratio (CAR) With Credit Risk Charge 13.87% 14.93%

2. Capital Adequacy Ratio (CAR) With Credit and Market Risk Charge 13.77% 14.90%

3. Fixed Assets to Capital 15.66% 16.43%

II. QUALITY OF ASSETS

1. Non Performing Earning Assets to Total Earning Assets 2.71% 2.90%

2. Allowance for Possible Losses on Earning Assets to Earning Assets 1.70% 1.67%

3. Fulfillment Allowance for Possible Losses on Earning Assets 107.39% 104.35%

4. Fulfillment Allowance for Possible Losses on Non Earning Assets 100.00% 100.00%

5. NPL Gross 3.47% 3.49%

6. NPL Net 2.83% 2.70%

III. RENTABILITY

1. ROA 0.44% 0.34%

2. ROE 4.60% 4.13%

3. NIM 3.81% 3.74%

4. Operating Expenses to Operating Revenues 96.24% 97.54%

IV. LIQUIDITY

1. Loan to Deposit Ratio (LDR) 84.04% 93.47%

V. COMPLIANCE

1. a. Percentage Violation on Legal Lending Limit

a.1. Related Parties 0.00% 0.00%

a.2. Non Related Parties 0.00% 0.00%

b. Percentage Lending In Excess on Legal Lending Limit

b.1. Related Parties 0.00% 0.00%

b.2. Non Related Parties 0.00% 0.00%

2. Statutory Reserve Requirements - Rupiah 5.06% 7.30%

3. Net Open Position (NOP) 4.10% 1.96%

Das könnte Ihnen auch gefallen

- Mercer-Capital Bank Valuation AKG PDFDokument60 SeitenMercer-Capital Bank Valuation AKG PDFDesmond Dujon HenryNoch keine Bewertungen

- Habib Bank Limited - Financial ModelDokument69 SeitenHabib Bank Limited - Financial Modelmjibran_1Noch keine Bewertungen

- Ratio 10-09Dokument1 SeiteRatio 10-09honeygoel13Noch keine Bewertungen

- Financial Model TemplateDokument30 SeitenFinancial Model Templateudoshi_1Noch keine Bewertungen

- Example of PresentationDokument22 SeitenExample of PresentationAygerim NurlybekNoch keine Bewertungen

- Solution For Case 10 Valuation of Common StockDokument8 SeitenSolution For Case 10 Valuation of Common StockHello100% (1)

- Consultative Document On Regulation of MicrofinanceDokument32 SeitenConsultative Document On Regulation of MicrofinanceabhiNoch keine Bewertungen

- Table Page 4-8Dokument6 SeitenTable Page 4-8Tasmia SwarnaNoch keine Bewertungen

- In-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDokument5 SeitenIn-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDinhkhanh NguyenNoch keine Bewertungen

- RGPPSEZ - Annual Report - 2022 - ENGDokument149 SeitenRGPPSEZ - Annual Report - 2022 - ENGsteveNoch keine Bewertungen

- ICICI - Piramal EnterprisesDokument16 SeitenICICI - Piramal EnterprisessehgalgauravNoch keine Bewertungen

- Mini Assignment 1Dokument4 SeitenMini Assignment 1Pratik AgrawalNoch keine Bewertungen

- Public Disclosure March 2021Dokument3 SeitenPublic Disclosure March 2021manjusri lalNoch keine Bewertungen

- Tutorial - Unit 2 - BMDokument7 SeitenTutorial - Unit 2 - BMBrianna GetfieldNoch keine Bewertungen

- Banco Santander Chile 2Q18 Earnings Report: July 26, 2018Dokument27 SeitenBanco Santander Chile 2Q18 Earnings Report: July 26, 2018manuel querolNoch keine Bewertungen

- Mattel - Financial ModelDokument13 SeitenMattel - Financial Modelharshwardhan.singh202Noch keine Bewertungen

- Satori Fund II LP Monthly Newsletter - 2023 06Dokument7 SeitenSatori Fund II LP Monthly Newsletter - 2023 06Anthony CastelliNoch keine Bewertungen

- Financial-Analysis-Procter&Gamble-vs-Reckitt BenckiserDokument5 SeitenFinancial-Analysis-Procter&Gamble-vs-Reckitt BenckiserPatOcampoNoch keine Bewertungen

- Group 3 B&I Section ADokument12 SeitenGroup 3 B&I Section AAnshi SharmaNoch keine Bewertungen

- Analisis FinancieroDokument124 SeitenAnalisis FinancieroJesús VelázquezNoch keine Bewertungen

- Bos 43771 QDokument6 SeitenBos 43771 QSunil KumarNoch keine Bewertungen

- UntitledDokument3 SeitenUntitledDeannaNoch keine Bewertungen

- Synergy Benefits - Mathematical Problem For Valuation ExerciseDokument2 SeitenSynergy Benefits - Mathematical Problem For Valuation ExerciseJayash KaushalNoch keine Bewertungen

- 14 NPA - An OverviewDokument16 Seiten14 NPA - An Overviewm_dattaiasNoch keine Bewertungen

- Final FFCDokument18 SeitenFinal FFCtayyab malikNoch keine Bewertungen

- Solution To Case 12: What Are We Really Worth?Dokument4 SeitenSolution To Case 12: What Are We Really Worth?khalil rebato100% (1)

- The Management of Bond Investments and Trading of DebtVon EverandThe Management of Bond Investments and Trading of DebtNoch keine Bewertungen

- Project Sunny - InstructionsDokument3 SeitenProject Sunny - InstructionsHichem YazidNoch keine Bewertungen

- Why Are There So Many Banking Crises?: The Politics and Policy of Bank RegulationVon EverandWhy Are There So Many Banking Crises?: The Politics and Policy of Bank RegulationNoch keine Bewertungen

- Measuring Banks Performance 1606494463Dokument3 SeitenMeasuring Banks Performance 1606494463Syed Tanvir AhmedSHUVI ShuvoNoch keine Bewertungen

- Financial Analysis of Cherat Cement Company LimitedDokument18 SeitenFinancial Analysis of Cherat Cement Company Limitedumarpal100% (1)

- B. RAK Ceramics (Bangladesh) Ltd. (For The Year Ended 31 December XXX)Dokument6 SeitenB. RAK Ceramics (Bangladesh) Ltd. (For The Year Ended 31 December XXX)Imdad JeshinNoch keine Bewertungen

- MBA104 - Almario - Parco - Online Problem Solving 3 Online Quiz Exam 2Dokument13 SeitenMBA104 - Almario - Parco - Online Problem Solving 3 Online Quiz Exam 2nicolaus copernicusNoch keine Bewertungen

- Perhitungan Analisis RasioDokument3 SeitenPerhitungan Analisis RasiolarastikaNoch keine Bewertungen

- Accenture Fin Model - Par - V1Dokument9 SeitenAccenture Fin Model - Par - V1shahsamkit08Noch keine Bewertungen

- BNM - Analisis Financiero Estructural Nov 2000 - Oct 2001Dokument2 SeitenBNM - Analisis Financiero Estructural Nov 2000 - Oct 2001gonzaloromaniNoch keine Bewertungen

- The Phoenix Companies, Inc. Investment Portfolio Supplement: As of March 31, 2009Dokument31 SeitenThe Phoenix Companies, Inc. Investment Portfolio Supplement: As of March 31, 2009wagnebNoch keine Bewertungen

- D3S3Dokument17 SeitenD3S3Dinesh BabuNoch keine Bewertungen

- International Macroeconomics: A Modern ApproachVon EverandInternational Macroeconomics: A Modern ApproachNoch keine Bewertungen

- Vaibhav BFDokument9 SeitenVaibhav BFVaibhav GuptaNoch keine Bewertungen

- Financial Audit Manual Veranda, Malaybalay City, Bukidnon November 06-07,2019Dokument4 SeitenFinancial Audit Manual Veranda, Malaybalay City, Bukidnon November 06-07,2019Lail PDNoch keine Bewertungen

- Reference Asnwer 2Dokument3 SeitenReference Asnwer 2Kyle Lee UyNoch keine Bewertungen

- BRM Session 4 Basel IIIDokument18 SeitenBRM Session 4 Basel IIISrinita MishraNoch keine Bewertungen

- MFT PRES 406 EN RBI Conference Interpreting India Data in The Context of The Global Market 2011 02Dokument69 SeitenMFT PRES 406 EN RBI Conference Interpreting India Data in The Context of The Global Market 2011 02Chan AyeNoch keine Bewertungen

- Investmentz AugustDokument11 SeitenInvestmentz AugustAnimesh PalNoch keine Bewertungen

- Investor PPT March 2023Dokument42 SeitenInvestor PPT March 2023Sumiran BansalNoch keine Bewertungen

- 2019 2018 2017 2016 2015 AssetsDokument1 Seite2019 2018 2017 2016 2015 AssetsFaisal RafiqueNoch keine Bewertungen

- Ekonomi Global: Willem A. Makaliwe (Lembaga Management FEBUI) 2021Dokument14 SeitenEkonomi Global: Willem A. Makaliwe (Lembaga Management FEBUI) 2021Irma SuryaniNoch keine Bewertungen

- Commercial Banking & Management Project 1: (Camels and Dupont Analysis of 2 Banks)Dokument10 SeitenCommercial Banking & Management Project 1: (Camels and Dupont Analysis of 2 Banks)Pro BroNoch keine Bewertungen

- Steve Eisman - A Long and A ShortDokument34 SeitenSteve Eisman - A Long and A Shortpgold12100% (1)

- Lampiran Perbandingan Antara Basel I, Ii, Dan Iii DAN Implementasi Di IndonesiaDokument13 SeitenLampiran Perbandingan Antara Basel I, Ii, Dan Iii DAN Implementasi Di IndonesiaAlfred SiregarNoch keine Bewertungen

- RatiosDokument2 SeitenRatiosTasmia SwarnaNoch keine Bewertungen

- 04.30.20 Gs DeckDokument22 Seiten04.30.20 Gs DeckV SNoch keine Bewertungen

- LiquiLoans - LiteratureDokument28 SeitenLiquiLoans - LiteratureNeetika SahNoch keine Bewertungen

- 10 07 23 Q22010AnalystsMeetingDokument87 Seiten10 07 23 Q22010AnalystsMeetingdanimetricsNoch keine Bewertungen

- Group 10Dokument12 SeitenGroup 10Vaibhav AroraNoch keine Bewertungen

- Financial ManagementDokument12 SeitenFinancial ManagementVaibhav AroraNoch keine Bewertungen

- Group 10 FMDokument12 SeitenGroup 10 FMVaibhav AroraNoch keine Bewertungen

- Financial ManagementDokument12 SeitenFinancial ManagementVaibhav AroraNoch keine Bewertungen

- Horizontal Analysis 0% 6% 6%: As at December 31, 2017 As at December 31, 2016Dokument7 SeitenHorizontal Analysis 0% 6% 6%: As at December 31, 2017 As at December 31, 2016Sathwik HvNoch keine Bewertungen

- BOIUPIDokument231 SeitenBOIUPIchauhan0124urwanNoch keine Bewertungen

- Types of Loans: Annuity LoanDokument2 SeitenTypes of Loans: Annuity LoanEvelyne BujoreanNoch keine Bewertungen

- Waiver of Interest FormsDokument9 SeitenWaiver of Interest FormsJordan MillerNoch keine Bewertungen

- Negotiable Instruments ActDokument55 SeitenNegotiable Instruments ActAbid AhasanNoch keine Bewertungen

- Tutorial Chapter 10Dokument2 SeitenTutorial Chapter 10Princess AdaleaNoch keine Bewertungen

- BancassuranceDokument18 SeitenBancassuranceMahipal GadhaviNoch keine Bewertungen

- MasterCard AssessmentDokument9 SeitenMasterCard AssessmentPalluRaju100% (2)

- Quantum GravityDokument2 SeitenQuantum GravitySubhodeep BanerjeeNoch keine Bewertungen

- Effects of ""Susu"" - A Traditional Micro-Finance Mechanism On Organized and Unorganized Micro and Small Enterprises (Mses) in GhanaDokument8 SeitenEffects of ""Susu"" - A Traditional Micro-Finance Mechanism On Organized and Unorganized Micro and Small Enterprises (Mses) in GhanaMoses DumayiriNoch keine Bewertungen

- Jeff Hwang Advanced Pot-Limit Omaha IDokument35 SeitenJeff Hwang Advanced Pot-Limit Omaha IMichael Smiechowski0% (1)

- Internship Report On Generel Banking Activities of Exim BankDokument57 SeitenInternship Report On Generel Banking Activities of Exim BankMorshedul Hasan100% (2)

- Market Research and Product Development: Citi Global Consumer BankDokument4 SeitenMarket Research and Product Development: Citi Global Consumer BankAnil Kumar ShahNoch keine Bewertungen

- JAIIB Question Papers On Accounting and Finance Previous Year QuestionDokument18 SeitenJAIIB Question Papers On Accounting and Finance Previous Year Questionanon_980188189Noch keine Bewertungen

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramDokument10 SeitenFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramBrittany LyNoch keine Bewertungen

- Cbi 2010-11 Interim PDFDokument426 SeitenCbi 2010-11 Interim PDFRahul KumarNoch keine Bewertungen

- Your Electricity Bill For: Samir Kumar ChakrabortyDokument2 SeitenYour Electricity Bill For: Samir Kumar ChakrabortyscNoch keine Bewertungen

- Existence 2Dokument2 SeitenExistence 2Demar Ancog100% (1)

- Your Adv Safebalance Banking: Account SummaryDokument10 SeitenYour Adv Safebalance Banking: Account SummaryLaura Del valleNoch keine Bewertungen

- Multi-Purpose Loan (MPL) Application Form: MARCH 4,1988 Numancia, AklanDokument2 SeitenMulti-Purpose Loan (MPL) Application Form: MARCH 4,1988 Numancia, AklanVinz CustodioNoch keine Bewertungen

- MT103Dokument2 SeitenMT103Vikrant Singh100% (4)

- Capital Source 2011 Form 10-KDokument212 SeitenCapital Source 2011 Form 10-KrgaragiolaNoch keine Bewertungen

- Importance of A Trial BalanceDokument1 SeiteImportance of A Trial Balancedanookyere100% (3)

- Hippocrates Health Institute, Inc.Dokument2 SeitenHippocrates Health Institute, Inc.bg giangNoch keine Bewertungen

- RBC SpreadsheetSupplementDokument5 SeitenRBC SpreadsheetSupplementAkash46Noch keine Bewertungen

- Philippine Financial SystemDokument1 SeitePhilippine Financial Systemella bonostro0% (1)

- State Bank of Travancore Recruitment 2013 1030 Peon Posts Apply OnlineDokument6 SeitenState Bank of Travancore Recruitment 2013 1030 Peon Posts Apply OnlinemalaarunNoch keine Bewertungen

- Comunicare in Audit in Limba EnglezaDokument80 SeitenComunicare in Audit in Limba EnglezacostajenitaNoch keine Bewertungen

- Future GainDokument9 SeitenFuture GainSantosh DasNoch keine Bewertungen

- All Debit Card Fees - ChargesDokument2 SeitenAll Debit Card Fees - ChargesS.G. RudrakshaNoch keine Bewertungen

- The Nigerian Financial System at A Glance - Monetary Policy DepartmentDokument356 SeitenThe Nigerian Financial System at A Glance - Monetary Policy DepartmentAgbons EbohonNoch keine Bewertungen