Beruflich Dokumente

Kultur Dokumente

Tds Calculator W.E.F. 1.10.09

Hochgeladen von

rajesh_vajjas0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

28 Ansichten1 SeiteOriginaltitel

tds_calculator_w.e.f._1.10.09

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

XLS, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als XLS, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

28 Ansichten1 SeiteTds Calculator W.E.F. 1.10.09

Hochgeladen von

rajesh_vajjasCopyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als XLS, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

Calculator

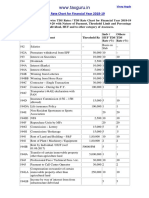

TDS Calculator w.e.f. 01.10.2009

Financial Year 2010-11 (Assessment Year 2011-12)

(for further updates visit at www.fastworking.blogspot.com)

Tax Deduction at Source (Rates) 540550

Section Nature of Payment Threshhold Limit TDS % TDS (Amount)

01-07-10 to

01-10-09 to 30-06-10 Rate (in Rs.)

onwards

194-A Interest from Bank 10000 10000 10 54055

194-A Interest Others 5000 5000 10 54055

194-B Winning from Lotteries 5000 10000 30 162165

194-BB Winning from Horse Races 2500 5000 30 162165

Contractor/Sub Contractor

194-C including Advertisor

1) To Individual/H.U.F. 1 5406

2) To Other than

Individual/H.U.F. 2 10811

3) To Transporters (If

Pan is Furnished) 0 0

194-D Insurance Commission (a) 20000 as single (a) 30000 as single 10 54055

194-H Commission or Brokerage (b) 50000 in a year (b) 75000 in a year 10 54055

Rent (1)

Land,Building,Furniture or

194-I any Property 10 54055

(2) Plant,Machinery &

Equipment 2 10811

Profesional or Technical

194-J Services 20000 30000 10 54055

Note :- Surcharge and Education Cess has been removed w.e.f.

01.10.2009

Note :- If pan is not provided, 20% TDS will be deducted w.e.f. 01.04.10

u/s 206AA

New TDS Procedure w.e.f. 01.04.2010

Page 1

Das könnte Ihnen auch gefallen

- Tds Calculator W.E.F. 1.10.09Dokument1 SeiteTds Calculator W.E.F. 1.10.09priyaradhiNoch keine Bewertungen

- Tds Income Tax Rates Fy 2010-11Dokument13 SeitenTds Income Tax Rates Fy 2010-11Surender KumarNoch keine Bewertungen

- Changes in TDS Limits - F Y 2010-11Dokument1 SeiteChanges in TDS Limits - F Y 2010-11Ronak RanaNoch keine Bewertungen

- TDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11Dokument1 SeiteTDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11Shwetta GogawaleNoch keine Bewertungen

- TDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11Dokument13 SeitenTDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11av_meshramNoch keine Bewertungen

- TDS and TCS-rate-chart-2023 RemovedDokument4 SeitenTDS and TCS-rate-chart-2023 Removeddurgeshsonawane65Noch keine Bewertungen

- TDS and TCS Rate Chart 2023Dokument5 SeitenTDS and TCS Rate Chart 2023DEEPAK SHARMANoch keine Bewertungen

- TDS_and_TCS-rate-chart-2025Dokument5 SeitenTDS_and_TCS-rate-chart-2025jsparakhNoch keine Bewertungen

- TDS Rate Chart 1Dokument1 SeiteTDS Rate Chart 1bulu1987Noch keine Bewertungen

- TDS - and - TCS Rate Chart 2024Dokument5 SeitenTDS - and - TCS Rate Chart 2024Taxation KTPL (Kalyani Techpark Taxation)Noch keine Bewertungen

- WWW - Taxguru.in: TDS Rate Chart For Financial Year 2018-19Dokument1 SeiteWWW - Taxguru.in: TDS Rate Chart For Financial Year 2018-19Sunny NarangNoch keine Bewertungen

- TDS RATE CHART F.Y. 2019-20 (A.Y. 2020-21) : WWW - Bharatax.inDokument1 SeiteTDS RATE CHART F.Y. 2019-20 (A.Y. 2020-21) : WWW - Bharatax.inGajendra Singh Rajpurohit Chadwas IIINoch keine Bewertungen

- TDS Rate ChartDokument2 SeitenTDS Rate Chartshashi370Noch keine Bewertungen

- Understanding TDS With Latest Judicial Judgements: CA Manish Kumar AgarwalDokument13 SeitenUnderstanding TDS With Latest Judicial Judgements: CA Manish Kumar AgarwalNagaraja ShenoyNoch keine Bewertungen

- Accounts & Taxations Interview Related NotesDokument5 SeitenAccounts & Taxations Interview Related NotesRahul Baburao AbhaleNoch keine Bewertungen

- Revised TDS Wef 14.05.20Dokument7 SeitenRevised TDS Wef 14.05.20MANAN KOTHARINoch keine Bewertungen

- TDS Rate Chart for FY 2010-11Dokument2 SeitenTDS Rate Chart for FY 2010-11Ashish JainNoch keine Bewertungen

- TDS Rate Chart - FY 2021-22Dokument3 SeitenTDS Rate Chart - FY 2021-22Ram YadavNoch keine Bewertungen

- TDS Rate & Tax Provisions For F.Y. 2019-20 (A.Y. 2020-21) : TDS Is Deducted On The Following Types of PaymentsDokument10 SeitenTDS Rate & Tax Provisions For F.Y. 2019-20 (A.Y. 2020-21) : TDS Is Deducted On The Following Types of PaymentsnagallanraoNoch keine Bewertungen

- TdsPac RateCard 0910Dokument2 SeitenTdsPac RateCard 0910Ebanezer PaulrajNoch keine Bewertungen

- Tds Rate Chart Fy 2018-19 Ay 2019-20 Tds Deposit-Return Due Dates-Interest-PenaltyDokument2 SeitenTds Rate Chart Fy 2018-19 Ay 2019-20 Tds Deposit-Return Due Dates-Interest-PenaltyNarayanakrishnan RNoch keine Bewertungen

- Commonly used TDS Provisions for payments in IndiaDokument17 SeitenCommonly used TDS Provisions for payments in IndiaSonika GuptaNoch keine Bewertungen

- TDS Rates On Payments Other Than Salary and Wages To Residents (Including Domestic Companies)Dokument3 SeitenTDS Rates On Payments Other Than Salary and Wages To Residents (Including Domestic Companies)Prince RaichandNoch keine Bewertungen

- TDS & TCS Rates Made EasyDokument2 SeitenTDS & TCS Rates Made Easykumar45caNoch keine Bewertungen

- Tds Rate ChartDokument49 SeitenTds Rate ChartSANJEEVNoch keine Bewertungen

- Tds BookletDokument22 SeitenTds BookletSanjayThakkarNoch keine Bewertungen

- TDS 2011-12Dokument3 SeitenTDS 2011-12Aditya SoniNoch keine Bewertungen

- TDS and TCS Rate Chart 2023Dokument3 SeitenTDS and TCS Rate Chart 2023praveenNoch keine Bewertungen

- Rates of TDS For Major Nature of Payments For The Financial Year 2010-11 Particulars Rates From 1.4.10 To 31.03.2011Dokument2 SeitenRates of TDS For Major Nature of Payments For The Financial Year 2010-11 Particulars Rates From 1.4.10 To 31.03.2011Bhupinder SinghNoch keine Bewertungen

- Financial Year: 2020-21 Assessment Year: 2021-22: TDS RATE CHART FY: 2020-21 (AY: 2021-22)Dokument2 SeitenFinancial Year: 2020-21 Assessment Year: 2021-22: TDS RATE CHART FY: 2020-21 (AY: 2021-22)Mahesh Shinde100% (1)

- TDS Rates Chart for IT ProvisionsDokument1 SeiteTDS Rates Chart for IT ProvisionsSatish GoenkaNoch keine Bewertungen

- TDS Rates and ReturnsDokument4 SeitenTDS Rates and ReturnsMohanlal BishnoiNoch keine Bewertungen

- TDS Rate Chart For Financial Year 2020 21Dokument1 SeiteTDS Rate Chart For Financial Year 2020 21Arun RajaNoch keine Bewertungen

- TDS RATE CHART FY 2015-16 AY 16-17: Major Sections of The Income Tax Act That Outline TDS Deductions AreDokument1 SeiteTDS RATE CHART FY 2015-16 AY 16-17: Major Sections of The Income Tax Act That Outline TDS Deductions ArekajalNoch keine Bewertungen

- Rates of TDSDokument30 SeitenRates of TDSsudhanshu88g1Noch keine Bewertungen

- TDS Rate Chart FY 2021-2022: Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) Indv/HUF OthersDokument7 SeitenTDS Rate Chart FY 2021-2022: Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) Indv/HUF OthersRajNoch keine Bewertungen

- Tax Deducted at Source (TDS)Dokument7 SeitenTax Deducted at Source (TDS)Rupali SinghNoch keine Bewertungen

- TDS Rates Applicable from 01.10.2009Dokument2 SeitenTDS Rates Applicable from 01.10.2009Gaurav MalhotraNoch keine Bewertungen

- TDS ChartDokument3 SeitenTDS ChartTiya SabharwalNoch keine Bewertungen

- TDS - Rates - 07 - 08Dokument3 SeitenTDS - Rates - 07 - 08KRISHNAKUMARNoch keine Bewertungen

- TDS and TCS Rate Chart 2022Dokument3 SeitenTDS and TCS Rate Chart 2022Ajay ModiNoch keine Bewertungen

- TDS RATE CHART FY 2021-22-FinalDokument5 SeitenTDS RATE CHART FY 2021-22-FinalLeenaNoch keine Bewertungen

- TDS Stands For Tax Deducted at SourceDokument8 SeitenTDS Stands For Tax Deducted at SourceRahul GuptaNoch keine Bewertungen

- TDS Rate Chart: Assessment Year 2011-12Dokument1 SeiteTDS Rate Chart: Assessment Year 2011-12Saravanan ElumalaiNoch keine Bewertungen

- TDS Rate Chart 2011 - 12Dokument1 SeiteTDS Rate Chart 2011 - 12m_y_chavanNoch keine Bewertungen

- Tds Rate Chart Fy 2021-22Dokument3 SeitenTds Rate Chart Fy 2021-22Kadambari ShelkeNoch keine Bewertungen

- C.H. Padliya & Co.: Chartered AccountantsDokument6 SeitenC.H. Padliya & Co.: Chartered AccountantsSarat KumarNoch keine Bewertungen

- TDS Chart FY 2010-11 & FY 2011-12Dokument1 SeiteTDS Chart FY 2010-11 & FY 2011-12R.Gowri Sankar RajaNoch keine Bewertungen

- TDS Rates Chart Fy 2020 21 Ay 2021 22Dokument6 SeitenTDS Rates Chart Fy 2020 21 Ay 2021 22Brijendra SinghNoch keine Bewertungen

- TDS Ready Reckoner (1) 11Dokument1 SeiteTDS Ready Reckoner (1) 11senthilkumar_kskNoch keine Bewertungen

- Tds Rate 10 11Dokument2 SeitenTds Rate 10 11Sud NadNoch keine Bewertungen

- Gov Accounting PDFDokument8 SeitenGov Accounting PDFShara Monique RolunaNoch keine Bewertungen

- TDS 3Dokument16 SeitenTDS 3payal AgrawalNoch keine Bewertungen

- C.H. Padliya & Co.: Chartered AccountantsDokument5 SeitenC.H. Padliya & Co.: Chartered AccountantsSarat KumarNoch keine Bewertungen

- Flare Finance Ecosystem MapDokument1 SeiteFlare Finance Ecosystem MapEssence of ChaNoch keine Bewertungen

- Ata 36 PDFDokument149 SeitenAta 36 PDFAyan Acharya100% (2)

- Project The Ant Ranch Ponzi Scheme JDDokument7 SeitenProject The Ant Ranch Ponzi Scheme JDmorraz360Noch keine Bewertungen

- AHP for Car SelectionDokument41 SeitenAHP for Car SelectionNguyên BùiNoch keine Bewertungen

- 04 Dasmarinas Vs Reyes GR No 108229Dokument2 Seiten04 Dasmarinas Vs Reyes GR No 108229Victoria Melissa Cortejos PulidoNoch keine Bewertungen

- Jurisdiction On Criminal Cases and PrinciplesDokument6 SeitenJurisdiction On Criminal Cases and PrinciplesJeffrey Garcia IlaganNoch keine Bewertungen

- Beams On Elastic Foundations TheoryDokument15 SeitenBeams On Elastic Foundations TheoryCharl de Reuck100% (1)

- Management Pack Guide For Print Server 2012 R2Dokument42 SeitenManagement Pack Guide For Print Server 2012 R2Quang VoNoch keine Bewertungen

- SE Myth of SoftwareDokument3 SeitenSE Myth of SoftwarePrakash PaudelNoch keine Bewertungen

- Variable Displacement Closed Circuit: Model 70160 Model 70360Dokument56 SeitenVariable Displacement Closed Circuit: Model 70160 Model 70360michael bossa alisteNoch keine Bewertungen

- ITSCM Mindmap v4Dokument1 SeiteITSCM Mindmap v4Paul James BirchallNoch keine Bewertungen

- John GokongweiDokument14 SeitenJohn GokongweiBela CraigNoch keine Bewertungen

- 2020-05-14 County Times NewspaperDokument32 Seiten2020-05-14 County Times NewspaperSouthern Maryland OnlineNoch keine Bewertungen

- Server LogDokument5 SeitenServer LogVlad CiubotariuNoch keine Bewertungen

- Backup and Recovery ScenariosDokument8 SeitenBackup and Recovery ScenariosAmit JhaNoch keine Bewertungen

- Continuation in Auditing OverviewDokument21 SeitenContinuation in Auditing OverviewJayNoch keine Bewertungen

- PTAS-11 Stump - All About Learning CurvesDokument43 SeitenPTAS-11 Stump - All About Learning CurvesinSowaeNoch keine Bewertungen

- Terms and Condition PDFDokument2 SeitenTerms and Condition PDFSeanmarie CabralesNoch keine Bewertungen

- Gates em Ingles 2010Dokument76 SeitenGates em Ingles 2010felipeintegraNoch keine Bewertungen

- Case Study - Soren ChemicalDokument3 SeitenCase Study - Soren ChemicalSallySakhvadzeNoch keine Bewertungen

- Mayor Byron Brown's 2019 State of The City SpeechDokument19 SeitenMayor Byron Brown's 2019 State of The City SpeechMichael McAndrewNoch keine Bewertungen

- Meanwhile Elsewhere - Lizzie Le Blond.1pdfDokument1 SeiteMeanwhile Elsewhere - Lizzie Le Blond.1pdftheyomangamingNoch keine Bewertungen

- Dell 1000W UPS Spec SheetDokument1 SeiteDell 1000W UPS Spec SheetbobNoch keine Bewertungen

- SAP ORC Opportunities PDFDokument1 SeiteSAP ORC Opportunities PDFdevil_3565Noch keine Bewertungen

- Milwaukee 4203 838a PB CatalogaciónDokument2 SeitenMilwaukee 4203 838a PB CatalogaciónJuan carlosNoch keine Bewertungen

- PRE EmtionDokument10 SeitenPRE EmtionYahya JanNoch keine Bewertungen

- L-1 Linear Algebra Howard Anton Lectures Slides For StudentDokument19 SeitenL-1 Linear Algebra Howard Anton Lectures Slides For StudentHasnain AbbasiNoch keine Bewertungen

- Benchmarking Guide OracleDokument53 SeitenBenchmarking Guide OracleTsion YehualaNoch keine Bewertungen

- AWC SDPWS2015 Commentary PrintableDokument52 SeitenAWC SDPWS2015 Commentary PrintableTerry TriestNoch keine Bewertungen

- Sop EcuDokument11 SeitenSop Ecuahmed saeedNoch keine Bewertungen