Beruflich Dokumente

Kultur Dokumente

Penalty

Hochgeladen von

Divyasom MalhanOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Penalty

Hochgeladen von

Divyasom MalhanCopyright:

Verfügbare Formate

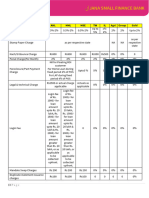

Chart Showing Penalty Provision Under Service Tax

S.

Section Nature of default Minimum Penalty Maximum Penalty

No.

2% per month (on

prorata basis) or Rs. Amount of Service

1 76 Failure to pay service tax:

200/- per day which Tax

ever is higher

Rs. 5000/- or Rs.

200/- per day,

Failure to Get Registered Rs. 5000/-

whichever is

higher

Fails to keep, maintain or

Rs. 5000/-

retain books of account

Failure to furnish Rs. 5000/- or Rs.

2 77 information or Produce 200/- per day,

Rs. 5000/-

Document or Appeal before whichever is

officer against summon higher

Fails to make payment

Rs. 5000/-

electronically

Failure related to Invoice Rs. 5000/-

Residual Penalty Rs. 5000/-

200% of the

100% of the amount

Failure to pay service tax amount of service

3 78 of service tax sought

with intend tax sought to be

to be evaded

evaded.

Late submission of Return

• Rs. 500/-

Period delayed in

furnishing Return

• Rs. 1000/- • Rs. 500/-

Rule 7C of

Service Tax • 15 Days from the Due Date

4 • Rs. 1000/-plus Rs. • Rs. 1000/-

Rules, 1994 read

100/-

with Section 70 • Beyond 15 Days but upto

• Rs. 2000/-

30 Days from the Due Date

per day beyond 30

Days

• Beyond 30 Days from the

Due Date

Das könnte Ihnen auch gefallen

- Assessment of Cash Management in NIBDokument48 SeitenAssessment of Cash Management in NIBEfrem Wondale100% (1)

- Management Accounting Chapter 9Dokument57 SeitenManagement Accounting Chapter 9Shaili SharmaNoch keine Bewertungen

- Financial Accounting and Reporting EllioDokument181 SeitenFinancial Accounting and Reporting EllioThủy Thiều Thị HồngNoch keine Bewertungen

- Foundations of Information Systems in BusinessDokument6 SeitenFoundations of Information Systems in BusinessshellaNoch keine Bewertungen

- Implementing a Balanced Scorecard for Strategic Performance MeasurementDokument11 SeitenImplementing a Balanced Scorecard for Strategic Performance MeasurementMarvin CorpinNoch keine Bewertungen

- Ps Android 210106 2149Dokument1 SeitePs Android 210106 2149Vidura KariyawasamNoch keine Bewertungen

- Survey Fee Schedule - 2017Dokument1 SeiteSurvey Fee Schedule - 2017Devil'sReborn Vishu0% (3)

- PowerPlus account charges and facilitiesDokument2 SeitenPowerPlus account charges and facilitiesßtylish Murthuja ValiNoch keine Bewertungen

- Grace Period Granted - 1 Month As Per RBI Guidelines To Restore MABDokument2 SeitenGrace Period Granted - 1 Month As Per RBI Guidelines To Restore MABprasanNoch keine Bewertungen

- American Express TariffsDokument1 SeiteAmerican Express TariffsSuranga GunasekaraNoch keine Bewertungen

- IDBI Royale Plus Account Sep 01 2018Dokument2 SeitenIDBI Royale Plus Account Sep 01 2018Sumit KumarNoch keine Bewertungen

- 9114 Accts-SERVICE CHARGhjgjgnj)Dokument5 Seiten9114 Accts-SERVICE CHARGhjgjgnj)Girish KumarNoch keine Bewertungen

- Core Savings Account - IDBIDokument2 SeitenCore Savings Account - IDBIprasanNoch keine Bewertungen

- Pca 14 6Dokument2 SeitenPca 14 6Arora MathewNoch keine Bewertungen

- SOC AssetsDokument2 SeitenSOC AssetsptsmithrafoundationNoch keine Bewertungen

- Credit Card Guidelines SummaryDokument6 SeitenCredit Card Guidelines SummaryAnup SrivastavaNoch keine Bewertungen

- SOC Flyer-3Dokument2 SeitenSOC Flyer-3Zeeshan OpelNoch keine Bewertungen

- Tax Year 2013-14 (As Per Finance Act 2013) : Tax Card For Staff and Clients OnlyDokument1 SeiteTax Year 2013-14 (As Per Finance Act 2013) : Tax Card For Staff and Clients OnlyMuhammad sarfrazNoch keine Bewertungen

- Axis Bank Service ChargesDokument4 SeitenAxis Bank Service ChargesRanjith MeelaNoch keine Bewertungen

- Fees and Charges W.E.F. 17th Mar, 2021Dokument3 SeitenFees and Charges W.E.F. 17th Mar, 2021MANOJ PANSENoch keine Bewertungen

- NRENROBeingMeaccountApril 012019Dokument2 SeitenNRENROBeingMeaccountApril 012019KxhsujsnsNoch keine Bewertungen

- Core Savings AccountDokument2 SeitenCore Savings AccountVarshaNoch keine Bewertungen

- Service Charges, Fees and Commissions Domestic OperationsDokument5 SeitenService Charges, Fees and Commissions Domestic OperationsJahankeer MzmNoch keine Bewertungen

- 2 SOBC Booklet Jan June 2023 Final 1 PDFDokument63 Seiten2 SOBC Booklet Jan June 2023 Final 1 PDFAakhri DarvaishNoch keine Bewertungen

- Common Service Charges (1)Dokument3 SeitenCommon Service Charges (1)atharvxunoNoch keine Bewertungen

- Soc 2018 (Finall)Dokument15 SeitenSoc 2018 (Finall)Engr Hafiz Qasim AliNoch keine Bewertungen

- Privy-League-SA -GSFCDokument1 SeitePrivy-League-SA -GSFCvisionsameer39Noch keine Bewertungen

- Meezan Bank schedule of charges update Jan-Jun 2021Dokument1 SeiteMeezan Bank schedule of charges update Jan-Jun 2021Nawaz SharifNoch keine Bewertungen

- Demat ComparisonDokument2 SeitenDemat ComparisonMohit ChhabraNoch keine Bewertungen

- ROC FeesDokument1 SeiteROC FeesGourav MaheshwariNoch keine Bewertungen

- Super Savings Account: Common Service ChargesDokument2 SeitenSuper Savings Account: Common Service ChargesSantosh ThakurNoch keine Bewertungen

- KFS_Deutsche_Bank_AG_-_PakistanDokument3 SeitenKFS_Deutsche_Bank_AG_-_PakistanPrijin UnnunnyNoch keine Bewertungen

- Tariff Sheet For HDFC Bank Individual Demat AccountDokument1 SeiteTariff Sheet For HDFC Bank Individual Demat Accountnirvana8791Noch keine Bewertungen

- ATA Carnet Processing Fee Schedule (As On 18 June 2021)Dokument2 SeitenATA Carnet Processing Fee Schedule (As On 18 June 2021)Aditya PawarNoch keine Bewertungen

- Axis Bank Credit Card Important DetailsDokument23 SeitenAxis Bank Credit Card Important DetailsAdvaitNoch keine Bewertungen

- Service Charges Annexure-A Revised 18-7-11Dokument28 SeitenService Charges Annexure-A Revised 18-7-11Dhaliwal JassieNoch keine Bewertungen

- Being MeDokument2 SeitenBeing MeVarshaNoch keine Bewertungen

- Upcoming Changes to Meezan Bank Schedule of Charges Jan-Jun 2019Dokument1 SeiteUpcoming Changes to Meezan Bank Schedule of Charges Jan-Jun 2019Ahsan IqbalNoch keine Bewertungen

- Savings Account Benefits and Types ComparisonDokument2 SeitenSavings Account Benefits and Types ComparisonMukul RajputNoch keine Bewertungen

- Basic Saving Account With Complete KYCDokument2 SeitenBasic Saving Account With Complete KYCVarsha100% (1)

- Bundled Savings Account Monthly ChargesDokument2 SeitenBundled Savings Account Monthly ChargesSweta MistryNoch keine Bewertungen

- Branch)Dokument3 SeitenBranch)Jeyavel NagarajanNoch keine Bewertungen

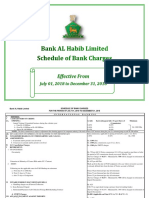

- Schedule of Bank Charges: (Excluding FED)Dokument58 SeitenSchedule of Bank Charges: (Excluding FED)Faisal JavedNoch keine Bewertungen

- Schedule of Charges - Retail (India)Dokument2 SeitenSchedule of Charges - Retail (India)John PeterNoch keine Bewertungen

- Product Features_Updated PPT 07042023 (4)Dokument23 SeitenProduct Features_Updated PPT 07042023 (4)HarshajitNoch keine Bewertungen

- Ready Line SOC Jan June 2024Dokument1 SeiteReady Line SOC Jan June 2024umarNoch keine Bewertungen

- "Being Me" Savings Account (January 01,2021) : Issuance Fee (Personalised Debit Card) Rs.150Dokument2 Seiten"Being Me" Savings Account (January 01,2021) : Issuance Fee (Personalised Debit Card) Rs.150Sweta MistryNoch keine Bewertungen

- Being MeDokument2 SeitenBeing Metharun venkatNoch keine Bewertungen

- Most Important: Terms and ConditionsDokument26 SeitenMost Important: Terms and ConditionsSarkari PostNoch keine Bewertungen

- Soc ChangesDokument2 SeitenSoc Changesabdulsubhanyousaf76Noch keine Bewertungen

- Withholding Income Tax Regime (WHT Rates Card) : DisclaimerDokument2 SeitenWithholding Income Tax Regime (WHT Rates Card) : Disclaimersimran jeswaniNoch keine Bewertungen

- Edelweiss Broking LTD.: V03/Feb/2020Dokument2 SeitenEdelweiss Broking LTD.: V03/Feb/2020Shyam KukrejaNoch keine Bewertungen

- Fees and Charges To DPDokument2 SeitenFees and Charges To DPMohd FarhanNoch keine Bewertungen

- SOC FlyerDokument2 SeitenSOC Flyersammer1985Noch keine Bewertungen

- ICICI Bank Service ChargesDokument7 SeitenICICI Bank Service ChargesRanjith MeelaNoch keine Bewertungen

- Feedback Demat Tariff For Retail Clients W e F 01-07-2016Dokument2 SeitenFeedback Demat Tariff For Retail Clients W e F 01-07-2016vinay senNoch keine Bewertungen

- Axis Direct PDFDokument2 SeitenAxis Direct PDFMahesh KorrapatiNoch keine Bewertungen

- Mojo Platinum Credit Card: INR 1000 INR 1000Dokument4 SeitenMojo Platinum Credit Card: INR 1000 INR 1000Saksham Goel100% (2)

- SOC Jan June 2024 - EnglishDokument20 SeitenSOC Jan June 2024 - Englishbdunkey4Noch keine Bewertungen

- Bank AL Habib Limited Schedule of Bank Charges for International BankingDokument15 SeitenBank AL Habib Limited Schedule of Bank Charges for International BankingBurairNoch keine Bewertungen

- RBL Mitc FinaltDokument42 SeitenRBL Mitc FinaltamanalamseoNoch keine Bewertungen

- NRI Savings Account Tariff StructureDokument4 SeitenNRI Savings Account Tariff StructureRishiNoch keine Bewertungen

- Soc ChangesDokument1 SeiteSoc ChangesABDUL HASEEBNoch keine Bewertungen

- Issuance Fee (Personalised Debit Card) Rs.150/-: Grace Period Granted - 1 Month As Per RBI Guidelines To Restore MABDokument2 SeitenIssuance Fee (Personalised Debit Card) Rs.150/-: Grace Period Granted - 1 Month As Per RBI Guidelines To Restore MABSäñtôsh Kûmãr PrâdhäñNoch keine Bewertungen

- Brand Audit CoeDokument10 SeitenBrand Audit CoeMohammad ZubairNoch keine Bewertungen

- Semi-Detailed Lesson Plan in EntrepreneurshipDokument3 SeitenSemi-Detailed Lesson Plan in EntrepreneurshipJonathan OlegarioNoch keine Bewertungen

- Buku Teks David L.Debertin-293-304Dokument12 SeitenBuku Teks David L.Debertin-293-304Fla FiscaNoch keine Bewertungen

- Calculation of Total Tax Incidence (TTI) For ImportDokument4 SeitenCalculation of Total Tax Incidence (TTI) For ImportMd. Mehedi Hasan AnikNoch keine Bewertungen

- Initial and Subsequent Measurement of Investment PropertyDokument2 SeitenInitial and Subsequent Measurement of Investment PropertydorpianabsaNoch keine Bewertungen

- Company Member Details and Lean Management ReportDokument17 SeitenCompany Member Details and Lean Management ReportAritra BanerjeeNoch keine Bewertungen

- Lesson 1 Analyzing Recording TransactionsDokument6 SeitenLesson 1 Analyzing Recording TransactionsklipordNoch keine Bewertungen

- Burden of Public DebtDokument4 SeitenBurden of Public DebtAmrit KaurNoch keine Bewertungen

- Guess - CLSP - Icmap - Complete-August-2013 - FinalDokument7 SeitenGuess - CLSP - Icmap - Complete-August-2013 - FinalAzam AziNoch keine Bewertungen

- Measure C Voter Guide March 2024 ElectionDokument7 SeitenMeasure C Voter Guide March 2024 ElectionKristin LamNoch keine Bewertungen

- Nikolasdebremaekerresume Docx 5Dokument2 SeitenNikolasdebremaekerresume Docx 5api-344385996Noch keine Bewertungen

- Carta de La Junta Sobre La AEEDokument3 SeitenCarta de La Junta Sobre La AEEEl Nuevo DíaNoch keine Bewertungen

- Bluescope Steel 2016Dokument48 SeitenBluescope Steel 2016Romulo AlvesNoch keine Bewertungen

- ENGINEERING DESIGN GUILDLINES Plant Cost Estimating Rev1.2webDokument23 SeitenENGINEERING DESIGN GUILDLINES Plant Cost Estimating Rev1.2webfoxmancementNoch keine Bewertungen

- Global Responsible Purchasing Guidelines 8dec2021Dokument5 SeitenGlobal Responsible Purchasing Guidelines 8dec2021Luis Gustavo GarcíaNoch keine Bewertungen

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDokument11 SeitenDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAryan JaiswalNoch keine Bewertungen

- Exam SubjectsDokument2 SeitenExam SubjectsMansi KotakNoch keine Bewertungen

- Realizing The American DreamDokument27 SeitenRealizing The American DreamcitizenschoolsNoch keine Bewertungen

- Tugas Uts Mata Kuliah Manajemen Pemasaran Dosen Pembimbing: Muchsin Saggaf. Shihab, MBA, PH, DDokument19 SeitenTugas Uts Mata Kuliah Manajemen Pemasaran Dosen Pembimbing: Muchsin Saggaf. Shihab, MBA, PH, Dbizantium greatNoch keine Bewertungen

- Virtual Reality On BusinessDokument2 SeitenVirtual Reality On BusinessMahrukh AzharNoch keine Bewertungen

- Who Are Managers and What Do They DoDokument11 SeitenWho Are Managers and What Do They DoMa'am KC Lat PerezNoch keine Bewertungen

- Ass 2016Dokument6 SeitenAss 2016annaNoch keine Bewertungen

- Wonder Book Corp. vs. Philippine Bank of Communications (676 SCRA 489 (2012) )Dokument3 SeitenWonder Book Corp. vs. Philippine Bank of Communications (676 SCRA 489 (2012) )CHARMAINE MERICK HOPE BAYOGNoch keine Bewertungen

- Real Estate Sector Report BangladeshDokument41 SeitenReal Estate Sector Report Bangladeshmars2580Noch keine Bewertungen

- Gujarat Socio-Economic Review 2017-18Dokument190 SeitenGujarat Socio-Economic Review 2017-18KishanLaluNoch keine Bewertungen