Beruflich Dokumente

Kultur Dokumente

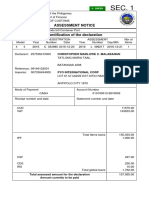

Form 8B

Hochgeladen von

Kishore_knOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Form 8B

Hochgeladen von

Kishore_knCopyright:

Verfügbare Formate

FORM 8B

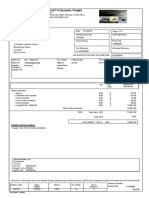

V6 BUSINESS SOLUTIONS Invoice 39

No: 10 DEC

Date: 2010

First floor, VGP Tower, Delivery Note:

Mode/terms of payment:

Opp. Coastal Urban Bank, Suppliers Ref:

Other Ref:

Kottamukku, Kollam- 13.

Ph: 918129110892 Buyers order No: Dated:

Buyer: Dispatch Document No: Dated:

Adarsh

Dispatch Through: Destination:

Sl Description of goods Quanti Rate P Pe Amount Ps

ty s r

1 Sony DVD Writer PATA 1 1100 0 PC 1100 00

0 S

TOTAL 1100 00

Output VAT 4% 44 00

Output CESS 1% 0 44

Round Off +0 56

Grand Total 1145 0

0

Amount Chargeable: SERIAL NUMBER OF PRODUCTS

RUPEES one thousand one

hundred and forty five only 0 0 0

0 0 0

PC CODE (FOR ASSEMBLED PC SALE

ONLY) 0 0 0

S MANAGER

0000- 0 0 0

00000000

Declaration:

Certified that all the particulars shown in the above Tax

Company’s VAT TIN :

32020881715

Invoice are true and correct in all respects and the goods (H.O Kichus Fashion)

on which the tax charged and collected are in accordance CASH RECEIVED

with the provisions of the KVAT Act 2003 and the rules FOR V6 Business Solutions

made there under. It is also certified that my / our

Registration under KVAT Act 2003 is not subject to any

suspension / Cancellation and it is SALES MANAGER

valid as on the date of this bill.

Das könnte Ihnen auch gefallen

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionVon EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionBewertung: 2.5 von 5 Sternen2.5/5 (2)

- Form 8B Invoice Title for V6 Business SolutionsDokument1 SeiteForm 8B Invoice Title for V6 Business SolutionsKishore_knNoch keine Bewertungen

- Factura: "Contribuyendo Por El País Que Todos Queremos"Dokument1 SeiteFactura: "Contribuyendo Por El País Que Todos Queremos"Madie BacNoch keine Bewertungen

- JO Billing - Prooflisting Report: October 21, 2020 8:59 Am Page 1 of 1Dokument1 SeiteJO Billing - Prooflisting Report: October 21, 2020 8:59 Am Page 1 of 1RBV DESIGN & BUILD SERVICESNoch keine Bewertungen

- Sales Quotation: Customer Part No. لبمعلا هعطقلا مقر ةبيرضلا ةبسنDokument2 SeitenSales Quotation: Customer Part No. لبمعلا هعطقلا مقر ةبيرضلا ةبسنTruck TrailerNoch keine Bewertungen

- HSBC Globle InvoiceDokument2 SeitenHSBC Globle Invoicedesaib6189Noch keine Bewertungen

- Model Factura NOUDokument1 SeiteModel Factura NOUCristi StroeNoch keine Bewertungen

- Tax Invoice: Ram Nagar K 1157 Ashiyana Opposite Ashiyana Thana LucknowDokument2 SeitenTax Invoice: Ram Nagar K 1157 Ashiyana Opposite Ashiyana Thana LucknowShobhit DayalNoch keine Bewertungen

- JO Billing Prooflisting ReportDokument1 SeiteJO Billing Prooflisting ReportRBV DESIGN & BUILD SERVICESNoch keine Bewertungen

- Marathon's InvoiceDokument1 SeiteMarathon's InvoiceLily HuzdupNoch keine Bewertungen

- CLY271047Dokument1 SeiteCLY271047Mayra Olalde GuerreroNoch keine Bewertungen

- Sales Tax Return Sept 10Dokument6 SeitenSales Tax Return Sept 10Raheel BaigNoch keine Bewertungen

- Submitted Status:: Sales Tax Credit Gross Value Taxable Value Sales TaxDokument4 SeitenSubmitted Status:: Sales Tax Credit Gross Value Taxable Value Sales TaxaizazbarkiNoch keine Bewertungen

- Philippines Customs Statement for Imported GoodsDokument1 SeitePhilippines Customs Statement for Imported GoodsFaisal Aragon SolaimanNoch keine Bewertungen

- Tax_Invoice_-_IN12720_-_17_04_2024Dokument1 SeiteTax_Invoice_-_IN12720_-_17_04_2024Tatiana DeehNoch keine Bewertungen

- DHL Invoice1578213630Dokument1 SeiteDHL Invoice1578213630Nautical TreasuryNoch keine Bewertungen

- Https WWW - Onlinesbi.com Sbicollect Paymenthistory Paymenthistoryredirecturl - HTMDokument1 SeiteHttps WWW - Onlinesbi.com Sbicollect Paymenthistory Paymenthistoryredirecturl - HTMPavlov Kumar HandiqueNoch keine Bewertungen

- OD123150814622323000Dokument1 SeiteOD123150814622323000Vidhan Chandra RayNoch keine Bewertungen

- Tax Invoice: Golden Star Enterprises (Pty) LTD T/A Dynamic FreightDokument1 SeiteTax Invoice: Golden Star Enterprises (Pty) LTD T/A Dynamic FreightMetzger Tamba KendemaNoch keine Bewertungen

- Mod Lucru Service Auto Deviz Lucrari ListareDokument1 SeiteMod Lucru Service Auto Deviz Lucrari Listarelucian.luci11Noch keine Bewertungen

- Rai Cooling Inv-482Dokument1 SeiteRai Cooling Inv-482stores.hexatronNoch keine Bewertungen

- FCA FCA: To RefundDokument1 SeiteFCA FCA: To Refundbrzezin9Noch keine Bewertungen

- MHG Sales Invoice by Invoice N 170822Dokument2 SeitenMHG Sales Invoice by Invoice N 170822Hammad SheikhNoch keine Bewertungen

- (Please Read This Before Answering The Given Problem) : (I.e. Enriquez/A/Practice Set)Dokument5 Seiten(Please Read This Before Answering The Given Problem) : (I.e. Enriquez/A/Practice Set)Felicitte Mae Guico LabarosaNoch keine Bewertungen

- Ats2023 03742Dokument2 SeitenAts2023 03742Emmanuel OsesNoch keine Bewertungen

- Boss Tents 10 01Dokument1 SeiteBoss Tents 10 01graphics1.bosstentsNoch keine Bewertungen

- PPS 4 Project Payment ScheduleDokument20 SeitenPPS 4 Project Payment ScheduleedNoch keine Bewertungen

- Tax_Invoice_-_IN12721_-_17_04_2024Dokument1 SeiteTax_Invoice_-_IN12721_-_17_04_2024Tatiana DeehNoch keine Bewertungen

- C9714 Assessment NoticeDokument1 SeiteC9714 Assessment NoticeCharles MakozaNoch keine Bewertungen

- Sea Imp Freight Bill Dacbdfy24000515Dokument4 SeitenSea Imp Freight Bill Dacbdfy24000515Nayem Al ImranNoch keine Bewertungen

- DfsDokument98 SeitenDfsŞtefan AlinNoch keine Bewertungen

- Pay SlipDokument1 SeitePay SlipShreya VermaNoch keine Bewertungen

- Total Geral:: Cod. 2 - Fama LtdaDokument1 SeiteTotal Geral:: Cod. 2 - Fama LtdaUemerson MartinsNoch keine Bewertungen

- Skynet Sylhet Inv Jul'20Dokument1 SeiteSkynet Sylhet Inv Jul'20Naeem UR RahmanNoch keine Bewertungen

- Computer Application To Business: Raghib@kasbit - Edu.pkDokument7 SeitenComputer Application To Business: Raghib@kasbit - Edu.pkShazia HameedNoch keine Bewertungen

- 1 FG-702 GXWONT 2 FG-SPLT-1X2 3 FG-SPLT-1X4 4 Big JC Box 4 Way 5 FG-FTTH Box 33,990.00Dokument1 Seite1 FG-702 GXWONT 2 FG-SPLT-1X2 3 FG-SPLT-1X4 4 Big JC Box 4 Way 5 FG-FTTH Box 33,990.00Vikram MaanNoch keine Bewertungen

- Premier Leasing Securities Broking LimitedDokument1 SeitePremier Leasing Securities Broking LimitedGrameen ProductsNoch keine Bewertungen

- TC 0181627-20221012Dokument1 SeiteTC 0181627-20221012GinaNoch keine Bewertungen

- Om Engineering Works: B-186 (A), B-187, RIICO Industrial Area Bhiwadi-3010119Dokument1 SeiteOm Engineering Works: B-186 (A), B-187, RIICO Industrial Area Bhiwadi-3010119Srishti GaurNoch keine Bewertungen

- Adobe Transaction No 1150271428 20200214 PDFDokument1 SeiteAdobe Transaction No 1150271428 20200214 PDFFrancisca InvernoNoch keine Bewertungen

- HCL Singapore Pte Limited: Tax InvoiceDokument2 SeitenHCL Singapore Pte Limited: Tax InvoiceNguyen AnhNoch keine Bewertungen

- Tax Invoice GST Details Housing Cavity ManufacturingDokument1 SeiteTax Invoice GST Details Housing Cavity ManufacturingSrishti GaurNoch keine Bewertungen

- a09c386036593309771771136020SHIPPING CI PDokument5 Seitena09c386036593309771771136020SHIPPING CI PJulian TonioNoch keine Bewertungen

- Invoice Shipment ARIH101442 Order PROJECT 224 ADokument1 SeiteInvoice Shipment ARIH101442 Order PROJECT 224 ASuitable SinghNoch keine Bewertungen

- PandL StkSum MergedDokument2 SeitenPandL StkSum MergedMehul PrajapatNoch keine Bewertungen

- Ais ExerciseDokument26 SeitenAis ExerciseLele DongNoch keine Bewertungen

- Tax_Invoice_-_IN12728_-_17_04_2024Dokument1 SeiteTax_Invoice_-_IN12728_-_17_04_2024Tatiana DeehNoch keine Bewertungen

- Cash Exam 2013Dokument47 SeitenCash Exam 2013jona bermudezNoch keine Bewertungen

- Final Assessment BMPDokument1 SeiteFinal Assessment BMPRickymalou MalapitanNoch keine Bewertungen

- DEBIT NOTE TITLEDokument1 SeiteDEBIT NOTE TITLEVinay vibhuti YadavNoch keine Bewertungen

- PF Invoice - OhsDokument1 SeitePF Invoice - OhsALOKE GANGULYNoch keine Bewertungen

- Asg 4262 PDFDokument3 SeitenAsg 4262 PDFrishiNoch keine Bewertungen

- Tax Invoice: Home Carpets & Furnishing Invoice 109 17/04/2022Dokument1 SeiteTax Invoice: Home Carpets & Furnishing Invoice 109 17/04/2022Sivaprakasam ThamizharasanNoch keine Bewertungen

- Experience APM Terminals Apapa online invoice portalDokument1 SeiteExperience APM Terminals Apapa online invoice portalOnwuka Ikon GabrielNoch keine Bewertungen

- COP5 MergedDokument5 SeitenCOP5 MergedEdson JimenezNoch keine Bewertungen

- 29.03.24 BK InvocieDokument4 Seiten29.03.24 BK InvociehninwutkyiNoch keine Bewertungen

- Inv 000023Dokument1 SeiteInv 000023Rifat SKNoch keine Bewertungen

- Assessment Document TZDL 22 1197501Dokument2 SeitenAssessment Document TZDL 22 1197501danyjustine96Noch keine Bewertungen

- Accountants Formulae BookDokument47 SeitenAccountants Formulae BookVpln SarmaNoch keine Bewertungen

- Hospital Management System Project ProposalDokument34 SeitenHospital Management System Project ProposalJanith Weerasekara88% (33)

- Price ListDokument2 SeitenPrice ListKishore_knNoch keine Bewertungen

- Touch Screen Full ReportDokument25 SeitenTouch Screen Full ReportKishore_knNoch keine Bewertungen

- The Indian Navy - Inet (Officers)Dokument3 SeitenThe Indian Navy - Inet (Officers)ANKIT KUMARNoch keine Bewertungen

- RVU Distribution - New ChangesDokument5 SeitenRVU Distribution - New Changesmy indiaNoch keine Bewertungen

- Objective Plus Subjective Factors of Socialist RevolutionDokument13 SeitenObjective Plus Subjective Factors of Socialist RevolutionjbahalkehNoch keine Bewertungen

- Year 2019 Current Affairs - English - January To December 2019 MCQ by Sarkari Job News PDFDokument232 SeitenYear 2019 Current Affairs - English - January To December 2019 MCQ by Sarkari Job News PDFAnujNoch keine Bewertungen

- Fortianalyzer v6.2.8 Upgrade GuideDokument23 SeitenFortianalyzer v6.2.8 Upgrade Guidelee zwagerNoch keine Bewertungen

- RPPSN Arbour StatementDokument2 SeitenRPPSN Arbour StatementJohnPhilpotNoch keine Bewertungen

- ICAO EDTO Course - Basic Concepts ModuleDokument63 SeitenICAO EDTO Course - Basic Concepts ModuleLbrito01100% (1)

- RA MEWP 0003 Dec 2011Dokument3 SeitenRA MEWP 0003 Dec 2011Anup George Thomas100% (1)

- Tax 2 AssignmentDokument6 SeitenTax 2 AssignmentKim EcarmaNoch keine Bewertungen

- International Marketing StrategiesDokument19 SeitenInternational Marketing StrategiesHafeez AfzalNoch keine Bewertungen

- Phil Pharma Health Vs PfizerDokument14 SeitenPhil Pharma Health Vs PfizerChristian John Dela CruzNoch keine Bewertungen

- DIN EN ISO 12944-4 071998-EnDokument29 SeitenDIN EN ISO 12944-4 071998-EnChristopher MendozaNoch keine Bewertungen

- Pradeep Kumar SinghDokument9 SeitenPradeep Kumar SinghHarsh TiwariNoch keine Bewertungen

- EXL ServiceDokument2 SeitenEXL ServiceMohit MishraNoch keine Bewertungen

- Summary of Kamban's RamayanaDokument4 SeitenSummary of Kamban's RamayanaRaj VenugopalNoch keine Bewertungen

- Sunway Berhad (F) Part 2 (Page 97-189)Dokument93 SeitenSunway Berhad (F) Part 2 (Page 97-189)qeylazatiey93_598514100% (1)

- Ancient Hindu Mythology Deadliest WeaponsDokument3 SeitenAncient Hindu Mythology Deadliest WeaponsManoj KumarNoch keine Bewertungen

- CRPC 1973 PDFDokument5 SeitenCRPC 1973 PDFAditi SinghNoch keine Bewertungen

- PPD Reflective EssayDokument2 SeitenPPD Reflective Essaydelisha kaurNoch keine Bewertungen

- 4 - Factors Affecting ConformityDokument8 Seiten4 - Factors Affecting ConformityKirill MomohNoch keine Bewertungen

- Introduction To The Appian PlatformDokument13 SeitenIntroduction To The Appian PlatformbolillapalidaNoch keine Bewertungen

- Company Profile-SIPLDokument4 SeitenCompany Profile-SIPLShivendra SinghNoch keine Bewertungen

- Interview - Duga, Rennabelle PDokument4 SeitenInterview - Duga, Rennabelle PDuga Rennabelle84% (19)

- Description of A Lukewarm ChristianDokument2 SeitenDescription of A Lukewarm ChristianMariah GolzNoch keine Bewertungen

- School Form 10 SF10 Learners Permanent Academic Record For Elementary SchoolDokument10 SeitenSchool Form 10 SF10 Learners Permanent Academic Record For Elementary SchoolRene ManansalaNoch keine Bewertungen

- Pudri RekpungDokument1 SeitePudri Rekpungpz.pzzzzNoch keine Bewertungen

- Trivandrum District IT Quiz Questions and Answers 2016 - IT Quiz PDFDokument12 SeitenTrivandrum District IT Quiz Questions and Answers 2016 - IT Quiz PDFABINNoch keine Bewertungen

- Service Culture Module 2Dokument2 SeitenService Culture Module 2Cedrick SedaNoch keine Bewertungen

- Lancaster University: January 2014 ExaminationsDokument6 SeitenLancaster University: January 2014 Examinationswhaza7890% (1)

- Agent of The ShroudDokument25 SeitenAgent of The ShroudKoen Van OostNoch keine Bewertungen