Beruflich Dokumente

Kultur Dokumente

Black Stone - Performance Report

Hochgeladen von

Bay Area Equity Group, LLCOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Black Stone - Performance Report

Hochgeladen von

Bay Area Equity Group, LLCCopyright:

Verfügbare Formate

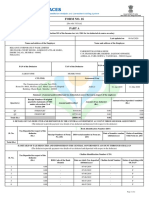

First-Year Performance Projection

19701 Blackstone

View Map View Comps Export to Excel

Detroit, MI 48219

3-bedroom 2-bath

Square Feet 1,100

Initial Market Value $28,995

Purchase Price $28,995

Downpayment $28,995

Loan Origination Fees $0

Depreciable Closing Costs $1,500

Other Closing Costs and Fixup $0

Initial Cash Invested $30,495

Cost per Square Foot $26

Monthly Rent per Square Foot $0.57

Income Monthly Annual Mortgage Info First Second

Gross Rent $625 $7,500 Loan-to-Value Ratio 0% 0%

Vacancy Losses $0 $0 Loan Amount --- ---

Operating Income $625 $7,500 Monthly Payment --- ---

Loan Type --- ---

Expenses Monthly Annual Term --- ---

Property Taxes ($111) ($1,335) Interest Rate --- ---

Insurance ($50) ($600) Monthly PMI ---

Management Fees ($63) ($750)

Leasing/Advertising Fees $0 $0 Financial Indicators

Association Fees $0 $0 Debt Coverage Ratio N/A

Maintenance $0 $0 Annual Gross Rent Multiplier 4

Other $0 $0 Monthly Gross Rent Multiplier 46

Operating Expenses ($224) ($2,685) Capitalization Rate 16.6%

Cash on Cash Return 16%

Net Performance Monthly Annual Total Return on Investment 16%

Net Operating Income $401 $4,815 Total ROI with Tax Savings 16%

- Mortgage Payments $0 $0

= Cash Flow $401 $4,815 Assumptions

+ Principal Reduction $0 $0 Real Estate Appreciation Rate %

+ First-Year Appreciation $0 $0 Vacancy Rate %

= Gross Equity Income $401 $4,815 Management Fee 10%

+ Tax Savings $0 $0 Maintenance Percentage %

= GEI w/Tax Savings $401 $4,815 Equity Share Percentage 100%

© 2004-2011 PropertyTracker.com Terms of Service Privacy Policy

www.bayareaequitygroup.com

Das könnte Ihnen auch gefallen

- 7242 Montrose - Performance ReportDokument1 Seite7242 Montrose - Performance ReportBay Area Equity Group, LLCNoch keine Bewertungen

- Speed NetworkingDokument2 SeitenSpeed NetworkingBay Area Equity Group, LLCNoch keine Bewertungen

- 9941 Mansfield - Performance ReportDokument1 Seite9941 Mansfield - Performance ReportBay Area Equity Group, LLCNoch keine Bewertungen

- 9926 Archdale - Performance ReportDokument1 Seite9926 Archdale - Performance ReportBay Area Equity Group, LLCNoch keine Bewertungen

- 7803 Stahelin - Performance ReportDokument1 Seite7803 Stahelin - Performance ReportBay Area Equity Group, LLCNoch keine Bewertungen

- 9926 Archdale ST - Performance ReportDokument1 Seite9926 Archdale ST - Performance ReportBay Area Equity Group, LLCNoch keine Bewertungen

- Joann - Performance ReportDokument1 SeiteJoann - Performance ReportBay Area Equity Group, LLCNoch keine Bewertungen

- Rutland - Performance ReportDokument1 SeiteRutland - Performance ReportBay Area Equity Group, LLCNoch keine Bewertungen

- 6693 Baldwin - Performance ReportDokument1 Seite6693 Baldwin - Performance ReportBay Area Equity Group, LLCNoch keine Bewertungen

- Ellsworth - Performance ReportDokument1 SeiteEllsworth - Performance ReportBay Area Equity Group, LLCNoch keine Bewertungen

- Maddelein - Performance ReportDokument1 SeiteMaddelein - Performance ReportBay Area Equity Group, LLCNoch keine Bewertungen

- 6100 Greenview - Performance ReportDokument1 Seite6100 Greenview - Performance ReportBay Area Equity Group, LLCNoch keine Bewertungen

- 5790 Guilford - Performance ReportDokument1 Seite5790 Guilford - Performance ReportBay Area Equity Group, LLCNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- AFAR - FINAL EXAMINATION - 03.22.2019 Wo ANSWERSDokument5 SeitenAFAR - FINAL EXAMINATION - 03.22.2019 Wo ANSWERSrain suansingNoch keine Bewertungen

- RE 01 11 Pre Sold Condo Units SolutionsDokument5 SeitenRE 01 11 Pre Sold Condo Units SolutionsAnonymous bf1cFDuepPNoch keine Bewertungen

- Cover Letter Finance ManagerDokument1 SeiteCover Letter Finance ManagerhungdahoangNoch keine Bewertungen

- Acc CH 3Dokument7 SeitenAcc CH 3Tajudin Abba RagooNoch keine Bewertungen

- Certificate in Bookkeeping and Accounting Level 2Dokument38 SeitenCertificate in Bookkeeping and Accounting Level 2McKay TheinNoch keine Bewertungen

- Memorandum of Association of Reliance Industries LimitedDokument4 SeitenMemorandum of Association of Reliance Industries LimitedVarsha ArunNoch keine Bewertungen

- Learnings From DJ SirDokument94 SeitenLearnings From DJ SirHare KrishnaNoch keine Bewertungen

- Funda & BF PTDokument10 SeitenFunda & BF PTReign AlfonsoNoch keine Bewertungen

- Course Guide: AGW 610/3 Finance and Accounting For Management Graduate School of Business Universiti Sains MalaysiaDokument7 SeitenCourse Guide: AGW 610/3 Finance and Accounting For Management Graduate School of Business Universiti Sains MalaysiasamhensemNoch keine Bewertungen

- List of Groups and Topic For Practical Assignment 1Dokument5 SeitenList of Groups and Topic For Practical Assignment 1pareek gopalNoch keine Bewertungen

- The Foreign-Exchange Market-Structure & Case StudyDokument7 SeitenThe Foreign-Exchange Market-Structure & Case StudyAnuranjanSinha80% (5)

- Solution 1-5 1Dokument4 SeitenSolution 1-5 1Dan Edison RamosNoch keine Bewertungen

- PG - M.com - Commerce (English) - 31031 Investment Analysis and Portfolio ManagementDokument166 SeitenPG - M.com - Commerce (English) - 31031 Investment Analysis and Portfolio ManagementDeeNoch keine Bewertungen

- Kumkum YadavDokument51 SeitenKumkum YadavHarshit KashyapNoch keine Bewertungen

- Template For Accounting ManualDokument4 SeitenTemplate For Accounting ManualKent TacsagonNoch keine Bewertungen

- Non - Life Insurance - 6Dokument29 SeitenNon - Life Insurance - 6Legese TusseNoch keine Bewertungen

- Bank Guarantee 1Dokument3 SeitenBank Guarantee 1Yomero Romero75% (4)

- Group 10 Informal Financial InstitutionsDokument56 SeitenGroup 10 Informal Financial InstitutionsRoxanne LutapNoch keine Bewertungen

- Form No. 16: Part ADokument8 SeitenForm No. 16: Part AParikshit ModiNoch keine Bewertungen

- 2012a Buyback NoticeDokument4 Seiten2012a Buyback Noticekv chandrasekerNoch keine Bewertungen

- Tabel DFDokument15 SeitenTabel DFSexy TofuNoch keine Bewertungen

- Question Bank 1. A and B Are Partners Sharing Profits in The Ratio of 3: 2 With Capitals of Rs. 50,000 and Rs. 30,000Dokument2 SeitenQuestion Bank 1. A and B Are Partners Sharing Profits in The Ratio of 3: 2 With Capitals of Rs. 50,000 and Rs. 30,000navin_raghuNoch keine Bewertungen

- Soneri Bank Internship+ (Marketing)Dokument66 SeitenSoneri Bank Internship+ (Marketing)qaisranisahibNoch keine Bewertungen

- Dear Sir/Madam, My Full Name Is Abdullahi Yusuf Moalim NurDokument1 SeiteDear Sir/Madam, My Full Name Is Abdullahi Yusuf Moalim Nurmucaashaq ibnu maxamedNoch keine Bewertungen

- Akuntansi 11Dokument3 SeitenAkuntansi 11Zhida PratamaNoch keine Bewertungen

- Wells Fargo Bank N.A. V Erobobo wNEW YORK 5 2013Dokument13 SeitenWells Fargo Bank N.A. V Erobobo wNEW YORK 5 2013MackLawfirmNoch keine Bewertungen

- School Building Valuation in Rural AreasDokument66 SeitenSchool Building Valuation in Rural AreasMurthy BabuNoch keine Bewertungen

- Tax Avoidance and Coporate Capital Structure (Cristine Harrington)Dokument20 SeitenTax Avoidance and Coporate Capital Structure (Cristine Harrington)Risa Nadya SafrizalNoch keine Bewertungen

- Fund Rankings Sovereign Wealth Fund InstituteDokument3 SeitenFund Rankings Sovereign Wealth Fund Institutelohenci_sammyNoch keine Bewertungen

- Fees & ExpensesDokument3 SeitenFees & ExpensesJames JenkinsNoch keine Bewertungen