Beruflich Dokumente

Kultur Dokumente

Form 403

Hochgeladen von

Prasad Potdar0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

51 Ansichten1 SeiteFORM 403 (See sub-rule (1) of rule 51) Declaration under Section 68 of the Gujarat Value Added Tax Act. 2003 (For movement of goods within the State or goods moving outside the State)

Originalbeschreibung:

Originaltitel

FORM_403

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenFORM 403 (See sub-rule (1) of rule 51) Declaration under Section 68 of the Gujarat Value Added Tax Act. 2003 (For movement of goods within the State or goods moving outside the State)

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

51 Ansichten1 SeiteForm 403

Hochgeladen von

Prasad PotdarFORM 403 (See sub-rule (1) of rule 51) Declaration under Section 68 of the Gujarat Value Added Tax Act. 2003 (For movement of goods within the State or goods moving outside the State)

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

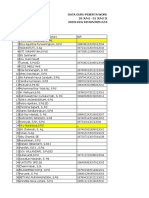

FORM 403

(See sub-rule (1) of rule 51)

Declaration under Section 68 of the Gujarat Value Added Tax Act. 2003

(For movement of goods within the State or goods moving outside the State)

To, The officer in charge, Check Post …………

(1) Place from which goods are dispatched Bangalore District Bangalore

(2) Place to which goods are dispatch Aehmadabad District Aehmadabad

(3) Details of goods invoice Date

_______________________________________________________________________

(4) Consignor’s details:

Name Sutures India Pvt Ltd State Karnataka

Address Plot No 13-16, Sy N 97, State VAT No. 29760864446

Kunigal 1 Phase Date

Telephone CST No.

Fax No Date

(5) Nature of Transaction

1) Inter State Sale : 2) R.R. Endorsement : 3) Depot Transfer:

4) For Job Work / Works Contract : For Job \Work yes

5) Consignment to Branch / Agent : 6) Any Other :

(6) Consignee’s Details:

Name Cure Physicare State Gujarat

Address 9-10, Spectrum Comm Center State VAT No. 24070701429

Near G.P.O, Relief Raod Date

Telephone CST No.

Fax No Date

Consigned Value /- ____________________

Sr Desc. Of Goods Commodity Code Unit Quantity Rate of Tax Value

1 Rubber Gpoves

7) Transporter’ Detail : 8) Driver’s Details :

Name V-Xpress Name

Address Bangalore Address

Owner / Partner Name: Driving Lic. No. :

License Issuing Dt :

Signature : Signature :

(9) Vehicle No _____________________ L.R. No. Date –

(10) Name of the Address of person in charge of goods

Seal Date :

Designation:

___________________________________________ _________________

For Sales Tax Department / Check post

Entry No. Date Time Reason of abnormal stoppage Result if any

Date ______________ Signature _______________ Designation _________________

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Weaving Calculator JointworksDokument8 SeitenWeaving Calculator JointworksPrasad PotdarNoch keine Bewertungen

- Spinning - Textile TodayDokument10 SeitenSpinning - Textile TodayPrasad PotdarNoch keine Bewertungen

- ViscoseDokument34 SeitenViscosePrasad PotdarNoch keine Bewertungen

- Anti Static OilDokument1 SeiteAnti Static OilPrasad PotdarNoch keine Bewertungen

- Irregularity and Imperfections in Ring-Spun: YarnsDokument4 SeitenIrregularity and Imperfections in Ring-Spun: YarnsPrasad PotdarNoch keine Bewertungen

- The Rieter Manual of Spinning Vol. 7 2451-V1 en Original 68509Dokument78 SeitenThe Rieter Manual of Spinning Vol. 7 2451-V1 en Original 68509Prasad Potdar50% (2)

- AR Physical Properties of Sun Yarns 01Dokument36 SeitenAR Physical Properties of Sun Yarns 01Neeraj BhardwajNoch keine Bewertungen

- Irregularity and Imperfections in Ring-Spun: YarnsDokument4 SeitenIrregularity and Imperfections in Ring-Spun: YarnsPrasad PotdarNoch keine Bewertungen

- CottonDokument32 SeitenCottonJavier Palomo100% (2)

- Servo PanasonicDokument133 SeitenServo PanasonicBrasca Erfianto Adhi Nugroho100% (1)

- FactSheet Fiber Yarn Ring SpinningProcessing PDFDokument7 SeitenFactSheet Fiber Yarn Ring SpinningProcessing PDFPrasad PotdarNoch keine Bewertungen

- Assignment 1Dokument2 SeitenAssignment 1Prasad PotdarNoch keine Bewertungen

- PDFSig QFormal RepDokument1 SeitePDFSig QFormal RepcarloschmNoch keine Bewertungen

- Form 403Dokument1 SeiteForm 403Prasad PotdarNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Dalamal Vs Immigration BoardDokument3 SeitenDalamal Vs Immigration BoardErwin BernardinoNoch keine Bewertungen

- People Vs AbanoDokument18 SeitenPeople Vs AbanoEl G. Se ChengNoch keine Bewertungen

- FDGDFGDokument2 SeitenFDGDFGJonathan BautistaNoch keine Bewertungen

- Adeptus Titanicus - Armes Ref SheetDokument2 SeitenAdeptus Titanicus - Armes Ref SheetPsyKo TineNoch keine Bewertungen

- Speakout Extra: Grammar PracticeDokument1 SeiteSpeakout Extra: Grammar PracticeelinaNoch keine Bewertungen

- Chapter-Iii Analysis of Law Commission Reports and CommiteesDokument76 SeitenChapter-Iii Analysis of Law Commission Reports and CommiteeshimanshuNoch keine Bewertungen

- Women EmpowermentDokument15 SeitenWomen EmpowermentMaya DevikaNoch keine Bewertungen

- USTerms For AP ExamDokument16 SeitenUSTerms For AP ExammrsaborgesNoch keine Bewertungen

- Carlos BolusanDokument14 SeitenCarlos BolusanCristel BagaoisanNoch keine Bewertungen

- Cdi August 03 2019 New EditDokument334 SeitenCdi August 03 2019 New EditLex Tamen Coercitor100% (2)

- Criminal Courts A Contemporary Perspective 3rd Edition by Hemmens Brody Spohn ISBN Test BankDokument11 SeitenCriminal Courts A Contemporary Perspective 3rd Edition by Hemmens Brody Spohn ISBN Test Bankshaun100% (22)

- Istanbul Convention On Temporary Admission. Senate Presentation 1.14.2021Dokument37 SeitenIstanbul Convention On Temporary Admission. Senate Presentation 1.14.2021Clinton SamsonNoch keine Bewertungen

- History MSDokument18 SeitenHistory MSAnshu RajputNoch keine Bewertungen

- Passenger Details: Changes To Seat RequestsDokument3 SeitenPassenger Details: Changes To Seat RequestsSarwar SalamNoch keine Bewertungen

- Obc CirtificateDokument1 SeiteObc Cirtificatejnaneswar_125467707Noch keine Bewertungen

- Drama Bahasa InggrisDokument11 SeitenDrama Bahasa InggrisnyshNoch keine Bewertungen

- Weekly Home Learning Plan Grade 6-Amethyst Week 1 Quarter 1 October 5 - 9, 2020Dokument2 SeitenWeekly Home Learning Plan Grade 6-Amethyst Week 1 Quarter 1 October 5 - 9, 2020Julie Pelleja MacaraegNoch keine Bewertungen

- Modulo 1 TareaDokument5 SeitenModulo 1 Tareasamed brionesNoch keine Bewertungen

- TranscriptDokument3 SeitenTranscriptAaron J.Noch keine Bewertungen

- DOJ Filing U.S. v. IgnjatovDokument7 SeitenDOJ Filing U.S. v. IgnjatovDerek JohnsonNoch keine Bewertungen

- Atal Bihari VajpayeeDokument11 SeitenAtal Bihari VajpayeeDevyani ManiNoch keine Bewertungen

- 14 Borromeo V CADokument2 Seiten14 Borromeo V CAcassandra leeNoch keine Bewertungen

- APUSH CH 13 and 14 QuizDokument7 SeitenAPUSH CH 13 and 14 QuizAjeet KokatayNoch keine Bewertungen

- Mact MatterDokument5 SeitenMact MatterADIL ABBASNoch keine Bewertungen

- Data Peserta WS IKM 29-31 Mei - UH - Per 9 Juni 2023Dokument6 SeitenData Peserta WS IKM 29-31 Mei - UH - Per 9 Juni 2023Muhammad Insan Noor MuhajirNoch keine Bewertungen

- Rad BrochureDokument2 SeitenRad Brochureapi-360330020Noch keine Bewertungen

- Facts:: Class 1aa (Ay 11-12) Statcon Case Digest Resubal at Regis: Mga Alagad NG KabutihanDokument5 SeitenFacts:: Class 1aa (Ay 11-12) Statcon Case Digest Resubal at Regis: Mga Alagad NG KabutihanJeiel Jill TajanlangitNoch keine Bewertungen

- A Safer World For The Truth - Sardasht OsmanDokument43 SeitenA Safer World For The Truth - Sardasht OsmanJulesNoch keine Bewertungen

- Low Advanced Analogies 5Dokument2 SeitenLow Advanced Analogies 5Satya KavyaNoch keine Bewertungen