Beruflich Dokumente

Kultur Dokumente

EDHEC-Risk Alternative Indexes - Overview February 2011

Hochgeladen von

chris_clair9652Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

EDHEC-Risk Alternative Indexes - Overview February 2011

Hochgeladen von

chris_clair9652Copyright:

Verfügbare Formate

http://www.edhec-risk.

com

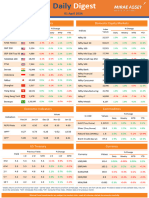

Annual

Annual Std

Average

Hedge Fund Strategies Feb 2011 YTD* Dev since Sharpe Ratio

Return since

January 2001

January 2001

Convertible Arbitrage 1.66% 3.5% 7.3% 7.5% 0.44

CTA Global 1.72% 1.1% 7.6% 8.7% 0.42

Distressed Securities 1.49% 3.3% 11.5% 6.1% 1.23

Emerging Markets -0.45% -1.1% 12.1% 10.5% 0.77

Equity Market Neutral 0.61% 1.2% 4.8% 3.0% 0.27

Event Driven 1.34% 2.8% 8.9% 5.9% 0.83

Fixed Income Arbitrage 1.10% 2.9% 6.4% 4.6% 0.52

Global Macro 0.93% 0.4% 7.7% 4.4% 0.83

Long/Short Equity 1.44% 2.0% 6.2% 7.1% 0.31

Merger Arbitrage 0.63% 1.6% 5.7% 3.3% 0.52

Relative Value 1.12% 2.1% 7.0% 4.8% 0.64

Short Selling -3.22% -4.0% -0.1% 13.9% -0.29

Funds of Funds 0.87% 1.0% 4.5% 5.1% 0.10

* Cumulative return since January 1st of the current year

In February, the stock market continued its positive trend. In a favourable context of decreasing implied

volatility (18.4%), the S&P 500 Index (+3.43%) recorded a sixth consecutive month of profits and a

remarkable cumulative return of 27.73% over the past half year.

A more contrasted situation prevailed on the fixed income market. Like the stock market, convertible bonds

(+2.03%) remained on the rise with a less remarkable but still comfortable return of 15.54% over the same

period. Conversely, regular bonds (-0.15%) registered another limited but persistent loss.

With yet another remarkable return in February, the soaring commodities market (+5.43%) generated a

stunning profit of 38.40% over the past six months, similar to its record progression of the beginning of

2008. The dollar remained depressed and scored negatively (-1.29%) for the third consecutive month.

With the good performance of convertible bonds compensating its negative exposure to the stock market,

the Convertible Arbitrage strategy (+1.66%) managed another month of solid profits. The uptrend of the

commodities market and the declining dollar seemed to sustain the CTA Global strategy (+1.72%) which

renewed with profitability despite the poor performance of regular bonds.

The equity-oriented strategies all managed positive returns that were proportional to their exposure to the

stock market. The Equity Market Neutral strategy registered another moderate but steady gain whereas

both Long/Short Equity (+1.44%) and Event Driven (+1.34%) strategies scored well above their respective

averages.

Overall, the Funds of Funds strategy (+0.87%) managed an above average return in February.

Das könnte Ihnen auch gefallen

- Quarter Report Q3.19Dokument3 SeitenQuarter Report Q3.19DEButtNoch keine Bewertungen

- Valuation Methods and Shareholder Value CreationVon EverandValuation Methods and Shareholder Value CreationBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Amalthea Letter 202206Dokument9 SeitenAmalthea Letter 202206Alessio CalcagnoNoch keine Bewertungen

- Beyond Smart Beta: Index Investment Strategies for Active Portfolio ManagementVon EverandBeyond Smart Beta: Index Investment Strategies for Active Portfolio ManagementNoch keine Bewertungen

- Mercer-Capital Bank Valuation AKG PDFDokument60 SeitenMercer-Capital Bank Valuation AKG PDFDesmond Dujon HenryNoch keine Bewertungen

- Pavise Equity Partners LP Performance Summary and Commentary for July 2022Dokument4 SeitenPavise Equity Partners LP Performance Summary and Commentary for July 2022Kan ZhouNoch keine Bewertungen

- Quarter Report Q3.20Dokument3 SeitenQuarter Report Q3.20DEButtNoch keine Bewertungen

- Satori Fund II LP Monthly Newsletter - 2023 06Dokument7 SeitenSatori Fund II LP Monthly Newsletter - 2023 06Anthony CastelliNoch keine Bewertungen

- Quarter Report Q3.18Dokument3 SeitenQuarter Report Q3.18DEButtNoch keine Bewertungen

- ML Stragegic Balance INDEX - FACT SHEETDokument3 SeitenML Stragegic Balance INDEX - FACT SHEETRaj JarNoch keine Bewertungen

- Quarter Report Q2.18Dokument3 SeitenQuarter Report Q2.18DEButtNoch keine Bewertungen

- SR - No Financial Ratios Bank Alfalah (Commerial Bank) 2020 1 Profitability RatiosDokument2 SeitenSR - No Financial Ratios Bank Alfalah (Commerial Bank) 2020 1 Profitability RatiosAYYAZ TARIQNoch keine Bewertungen

- Himatsingka Seida LTD.: Ratio Analysis SheetDokument1 SeiteHimatsingka Seida LTD.: Ratio Analysis SheetNeetesh DohareNoch keine Bewertungen

- Morning Cuppa 12-DecDokument2 SeitenMorning Cuppa 12-DecSaroNoch keine Bewertungen

- CH 13 Mod 3 Financial IndicatorsDokument2 SeitenCH 13 Mod 3 Financial IndicatorsAkshat JainNoch keine Bewertungen

- Morning Cuppa 14-JulyDokument2 SeitenMorning Cuppa 14-JulyAjish CJ 2015Noch keine Bewertungen

- FDIC Certificate # 9092 Salin Bank and Trust CompanyDokument31 SeitenFDIC Certificate # 9092 Salin Bank and Trust CompanyWaqas Khalid KeenNoch keine Bewertungen

- Quarter Report Q1.17Dokument3 SeitenQuarter Report Q1.17DEButtNoch keine Bewertungen

- Case 4 For AnanlysisDokument2 SeitenCase 4 For AnanlysisLaura HNoch keine Bewertungen

- Evercore Partners 8.6.13 PDFDokument6 SeitenEvercore Partners 8.6.13 PDFChad Thayer VNoch keine Bewertungen

- The Unidentified Industries - Residency - CaseDokument4 SeitenThe Unidentified Industries - Residency - CaseDBNoch keine Bewertungen

- Quarter Report Q2.19Dokument3 SeitenQuarter Report Q2.19DEButtNoch keine Bewertungen

- Quarter Report Q2.17Dokument3 SeitenQuarter Report Q2.17DEButtNoch keine Bewertungen

- Morning Cuppa 08-Oct-202110080838430715214Dokument2 SeitenMorning Cuppa 08-Oct-202110080838430715214flying400Noch keine Bewertungen

- Quarter Report Q1.18Dokument3 SeitenQuarter Report Q1.18DEButtNoch keine Bewertungen

- Quarter Report Q4.18Dokument3 SeitenQuarter Report Q4.18DEButtNoch keine Bewertungen

- Quarter Report Q1.24Dokument2 SeitenQuarter Report Q1.24DEButtNoch keine Bewertungen

- Morning Cuppa 21-NovDokument2 SeitenMorning Cuppa 21-NovSarvjeet KaushalNoch keine Bewertungen

- Financial Analysis of Cherat Cement Company LimitedDokument18 SeitenFinancial Analysis of Cherat Cement Company Limitedumarpal100% (1)

- Daily Digest - 15 June, 2023Dokument2 SeitenDaily Digest - 15 June, 2023Anant VishnoiNoch keine Bewertungen

- Quarter Report Q3.17Dokument3 SeitenQuarter Report Q3.17DEButtNoch keine Bewertungen

- Industry Median 2018 2017 2016 2015 2014 2013 2012Dokument10 SeitenIndustry Median 2018 2017 2016 2015 2014 2013 2012AnuragNoch keine Bewertungen

- Stitch Fix Inc NasdaqGS SFIX FinancialsDokument41 SeitenStitch Fix Inc NasdaqGS SFIX FinancialsanamNoch keine Bewertungen

- Hisar Spinning Mills LTD Ratios Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Per Share RatiosDokument5 SeitenHisar Spinning Mills LTD Ratios Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Per Share Ratiossmartmegha8116947Noch keine Bewertungen

- Case 1 - Financial Manager & PolicyDokument16 SeitenCase 1 - Financial Manager & PolicycatatankotakkuningNoch keine Bewertungen

- Daily Digest - 01 April, 2024Dokument2 SeitenDaily Digest - 01 April, 2024saraonahembram3Noch keine Bewertungen

- Analisis FinancieroDokument124 SeitenAnalisis FinancieroJesús VelázquezNoch keine Bewertungen

- L&T Mutual Fund Views on Indian and Global Markets PerformanceDokument19 SeitenL&T Mutual Fund Views on Indian and Global Markets PerformancekundansudNoch keine Bewertungen

- Gold Market Update April - GSDokument16 SeitenGold Market Update April - GSVictor KerezovNoch keine Bewertungen

- Century Pacific Food Inc Ratios - Key Metrics ReportDokument8 SeitenCentury Pacific Food Inc Ratios - Key Metrics ReportSheena Ann Keh LorenzoNoch keine Bewertungen

- Implied Equity Premiums: Aswath DamodaranDokument16 SeitenImplied Equity Premiums: Aswath DamodaranElliNoch keine Bewertungen

- Final RatiosDokument1 SeiteFinal RatiosRaj GuptaNoch keine Bewertungen

- Mutual Fund Student DataDokument10 SeitenMutual Fund Student DataJANHVI HEDANoch keine Bewertungen

- Morning Cuppa 30-OctDokument2 SeitenMorning Cuppa 30-OctKeshavNoch keine Bewertungen

- Quarter Report Q3.23Dokument3 SeitenQuarter Report Q3.23DEButtNoch keine Bewertungen

- An Index Approach To Factor Investing in India - 0 PDFDokument27 SeitenAn Index Approach To Factor Investing in India - 0 PDFDeep BorsadiyaNoch keine Bewertungen

- Morning Cuppa 22-FebDokument2 SeitenMorning Cuppa 22-FebNitin ChauhanNoch keine Bewertungen

- How to use the DCF model tutorialDokument9 SeitenHow to use the DCF model tutorialTanya SinghNoch keine Bewertungen

- Data 2Dokument14 SeitenData 2abhimanyu.chawla5503Noch keine Bewertungen

- Analyze Martin Manufacturing's financial positionDokument2 SeitenAnalyze Martin Manufacturing's financial positionSean Chris ConsonNoch keine Bewertungen

- Hedge Fund Indices MayDokument3 SeitenHedge Fund Indices Mayj.fred a. voortmanNoch keine Bewertungen

- Ratio Project of Atlas and HondaDokument1 SeiteRatio Project of Atlas and HondaShuja HashmiNoch keine Bewertungen

- Case Study #1: Bigger Isn't Always Better!: Jackelyn Maguillano Hannylen Faye T. Valente Coas Ii-ADokument9 SeitenCase Study #1: Bigger Isn't Always Better!: Jackelyn Maguillano Hannylen Faye T. Valente Coas Ii-AHannylen Faye ValenteNoch keine Bewertungen

- Ganymede Update 202305Dokument1 SeiteGanymede Update 202305Pranab PattanaikNoch keine Bewertungen

- Derivatives and Risk ManagementDokument136 SeitenDerivatives and Risk Managementabbas ali100% (3)

- Morning Cuppa 15-AprDokument2 SeitenMorning Cuppa 15-AprAkshay ChaudhryNoch keine Bewertungen

- Liquidity and Stock Returns in Europe: - July 2009Dokument7 SeitenLiquidity and Stock Returns in Europe: - July 2009RichardNoch keine Bewertungen

- Risk Measures: Risk Analysis Distribution of ReturnsDokument7 SeitenRisk Measures: Risk Analysis Distribution of ReturnsJBPS Capital ManagementNoch keine Bewertungen

- Morning Cuppa 14-DecDokument2 SeitenMorning Cuppa 14-DecKeshav KhetanNoch keine Bewertungen

- Mathema May 2012 Global Investment Insight ReportDokument46 SeitenMathema May 2012 Global Investment Insight Reportchris_clair9652Noch keine Bewertungen

- Preqin - Public Pension HF Exposure DoublesDokument1 SeitePreqin - Public Pension HF Exposure Doubleschris_clair9652Noch keine Bewertungen

- Hedge Fund Intelligence 4Q11Dokument60 SeitenHedge Fund Intelligence 4Q11StreetofWallsNoch keine Bewertungen

- Mathema January 2012 HF Strategy Insight ReportDokument26 SeitenMathema January 2012 HF Strategy Insight Reportchris_clair9652Noch keine Bewertungen

- AFT Response To Attain Capital March 7th 2011Dokument4 SeitenAFT Response To Attain Capital March 7th 2011chris_clair9652Noch keine Bewertungen

- Corzine 111208Dokument21 SeitenCorzine 111208Joseph Weisenthal100% (1)

- CME Group Executive Chairman Terry Duffy's Written Testimony Before The House Agricultural Committee, Dec. 8, 2011Dokument5 SeitenCME Group Executive Chairman Terry Duffy's Written Testimony Before The House Agricultural Committee, Dec. 8, 2011chris_clair9652Noch keine Bewertungen

- Red Zone-Cadwalader Wicker Sham Taft LawsuitDokument16 SeitenRed Zone-Cadwalader Wicker Sham Taft Lawsuitchris_clair9652Noch keine Bewertungen

- Red Zone-Cadwalader Wicker Sham Taft LawsuitDokument16 SeitenRed Zone-Cadwalader Wicker Sham Taft Lawsuitchris_clair9652Noch keine Bewertungen

- Basis Yield Alpha FCIC Report Release020811pdfDokument2 SeitenBasis Yield Alpha FCIC Report Release020811pdfchris_clair9652Noch keine Bewertungen

- Branch Manager Job DescriptionDokument4 SeitenBranch Manager Job DescriptionAsadvirkNoch keine Bewertungen

- Draft Circular Resolution of Board of Directors For Tack On Notes - 08112011Dokument3 SeitenDraft Circular Resolution of Board of Directors For Tack On Notes - 08112011Andry Wisnu UditNoch keine Bewertungen

- Daftar Bank KorespondenDokument10 SeitenDaftar Bank KorespondenRomy Lasso75% (4)

- Cfa2 QuestionsDokument28 SeitenCfa2 QuestionsGabriel AmerNoch keine Bewertungen

- Chapter 2 Regulatory BodiesDokument35 SeitenChapter 2 Regulatory BodiesMssLycheeNoch keine Bewertungen

- Fin333 Secondmt04w Sample QuestionsDokument10 SeitenFin333 Secondmt04w Sample QuestionsSara NasNoch keine Bewertungen

- Growth Through Acquisition (Anslinger Copeland)Dokument15 SeitenGrowth Through Acquisition (Anslinger Copeland)Andre Bigo100% (1)

- Ratio AnalysisDokument15 SeitenRatio AnalysisChandana DasNoch keine Bewertungen

- Capital Structure & Financial Leverage Analysis of Software IndustryDokument13 SeitenCapital Structure & Financial Leverage Analysis of Software Industryanuj surana100% (1)

- Scherer Portfolio Construction and Risk Budgeting 4edDokument498 SeitenScherer Portfolio Construction and Risk Budgeting 4edPeterParker1983100% (4)

- Re InsuranceDokument6 SeitenRe InsuranceVijay100% (4)

- 7th Motilal Oswal Wealth Creation StudyDokument28 Seiten7th Motilal Oswal Wealth Creation StudyarjbakNoch keine Bewertungen

- SanDisk Corporation Equity Valuation AnalysisDokument6 SeitenSanDisk Corporation Equity Valuation AnalysisBrant HammerNoch keine Bewertungen

- Loan Life CycleDokument7 SeitenLoan Life CyclePushpraj Singh Baghel100% (1)

- BM Dec 2004Dokument13 SeitenBM Dec 2004Vinetha KarunanithiNoch keine Bewertungen

- Fi A Test HandoutsDokument102 SeitenFi A Test HandoutsRana Zafar ArshadNoch keine Bewertungen

- Correction of ErrorsDokument15 SeitenCorrection of ErrorsEliyah Jhonson100% (1)

- Gitman-Working Capital & Current AssetDokument64 SeitenGitman-Working Capital & Current AssetSugim Winata EinsteinNoch keine Bewertungen

- Value Added StatementDokument14 SeitenValue Added StatementInigorani0% (1)

- Banking Assignment: PGDM 2017-2019Dokument14 SeitenBanking Assignment: PGDM 2017-2019Pooja NagNoch keine Bewertungen

- Assignment On I.T & Pharma IndustryDokument11 SeitenAssignment On I.T & Pharma IndustryGolu SinghNoch keine Bewertungen

- Midland Energy A1Dokument30 SeitenMidland Energy A1CarsonNoch keine Bewertungen

- Does Islamic Bank Financing Contribute To Economic Growth - The Malaysian CaseDokument22 SeitenDoes Islamic Bank Financing Contribute To Economic Growth - The Malaysian CasePrima Ratna SariNoch keine Bewertungen

- Partnership DissolutionDokument1 SeitePartnership DissolutionCjhay Marcos100% (1)

- TAXATION OF PARTNERSHIPS AND JOINT VENTURESDokument6 SeitenTAXATION OF PARTNERSHIPS AND JOINT VENTURESAngelie Lecapare0% (1)

- HSY Hershey CAGNY 2018Dokument76 SeitenHSY Hershey CAGNY 2018Ala BasterNoch keine Bewertungen

- Value Added TaxDokument6 SeitenValue Added Taxarjohnyabut80% (10)

- Financial Accounting IFRS PresentationDokument10 SeitenFinancial Accounting IFRS PresentationVaishnavi khotNoch keine Bewertungen

- General StrategyDokument5 SeitenGeneral StrategyBenjamin DavidsonNoch keine Bewertungen

- Mindtree ValuationDokument74 SeitenMindtree ValuationAmit RanderNoch keine Bewertungen

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 3.5 von 5 Sternen3.5/5 (8)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 4.5 von 5 Sternen4.5/5 (14)

- Joy of Agility: How to Solve Problems and Succeed SoonerVon EverandJoy of Agility: How to Solve Problems and Succeed SoonerBewertung: 4 von 5 Sternen4/5 (1)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialVon EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNoch keine Bewertungen

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistVon EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistBewertung: 4.5 von 5 Sternen4.5/5 (73)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsVon EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNoch keine Bewertungen

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityVon EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityBewertung: 4.5 von 5 Sternen4.5/5 (4)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisVon EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisBewertung: 5 von 5 Sternen5/5 (6)

- Finance Basics (HBR 20-Minute Manager Series)Von EverandFinance Basics (HBR 20-Minute Manager Series)Bewertung: 4.5 von 5 Sternen4.5/5 (32)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanVon EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanBewertung: 4.5 von 5 Sternen4.5/5 (79)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthVon EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNoch keine Bewertungen

- Value: The Four Cornerstones of Corporate FinanceVon EverandValue: The Four Cornerstones of Corporate FinanceBewertung: 4.5 von 5 Sternen4.5/5 (18)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Von EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Bewertung: 4.5 von 5 Sternen4.5/5 (86)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingVon EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingBewertung: 4.5 von 5 Sternen4.5/5 (17)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorVon EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNoch keine Bewertungen

- Financial Risk Management: A Simple IntroductionVon EverandFinancial Risk Management: A Simple IntroductionBewertung: 4.5 von 5 Sternen4.5/5 (7)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelVon Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNoch keine Bewertungen

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)Von EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Bewertung: 4.5 von 5 Sternen4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialVon EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialBewertung: 4.5 von 5 Sternen4.5/5 (32)

- LLC or Corporation?: Choose the Right Form for Your BusinessVon EverandLLC or Corporation?: Choose the Right Form for Your BusinessBewertung: 3.5 von 5 Sternen3.5/5 (4)

- Key Performance Indicators: Developing, Implementing, and Using Winning KPIsVon EverandKey Performance Indicators: Developing, Implementing, and Using Winning KPIsNoch keine Bewertungen

- The Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, 3rd EditionVon EverandThe Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, 3rd EditionBewertung: 5 von 5 Sternen5/5 (3)

- Financial Management: The Basic Knowledge of Financial Management for StudentVon EverandFinancial Management: The Basic Knowledge of Financial Management for StudentNoch keine Bewertungen

- Will Work for Pie: Building Your Startup Using Equity Instead of CashVon EverandWill Work for Pie: Building Your Startup Using Equity Instead of CashNoch keine Bewertungen

- The McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EVon EverandThe McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EBewertung: 4.5 von 5 Sternen4.5/5 (6)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionVon EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionBewertung: 5 von 5 Sternen5/5 (1)