Beruflich Dokumente

Kultur Dokumente

Budget 2011 Tax Structure For Men

Hochgeladen von

Sujan Annaiah0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

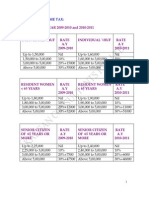

9 Ansichten1 SeiteThe document outlines the 2011 tax structure for men, women, and senior citizens in India, with income brackets and corresponding tax rates. For men and women, income between Rs. 100,000 to Rs. 180,000/190,000 respectively is tax free, 10% is paid on income between Rs. 180,001-500,000/190,001-500,000, 20% is paid on income between Rs. 500,001-800,000, and 30% is paid on income over Rs. 800,001. Senior citizens ages 60-80 pay no tax under Rs. 250,000, and those over 81 pay no tax under Rs. 500,000.

Originalbeschreibung:

Originaltitel

Tax

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe document outlines the 2011 tax structure for men, women, and senior citizens in India, with income brackets and corresponding tax rates. For men and women, income between Rs. 100,000 to Rs. 180,000/190,000 respectively is tax free, 10% is paid on income between Rs. 180,001-500,000/190,001-500,000, 20% is paid on income between Rs. 500,001-800,000, and 30% is paid on income over Rs. 800,001. Senior citizens ages 60-80 pay no tax under Rs. 250,000, and those over 81 pay no tax under Rs. 500,000.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

9 Ansichten1 SeiteBudget 2011 Tax Structure For Men

Hochgeladen von

Sujan AnnaiahThe document outlines the 2011 tax structure for men, women, and senior citizens in India, with income brackets and corresponding tax rates. For men and women, income between Rs. 100,000 to Rs. 180,000/190,000 respectively is tax free, 10% is paid on income between Rs. 180,001-500,000/190,001-500,000, 20% is paid on income between Rs. 500,001-800,000, and 30% is paid on income over Rs. 800,001. Senior citizens ages 60-80 pay no tax under Rs. 250,000, and those over 81 pay no tax under Rs. 500,000.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

Budget 2011 Tax Structure

For Men:

Rs. 1,00,000 to Rs. 1,80,000 – NO TAX

Rs. 1,80,001 to Rs. 5,00,000 – 10 percent

Rs. 5,00,001 to Rs. 8,00,000 – 20 percent

Rs. 8,00,001 and above – 30 percent

For Women:

Rs. 1,00,000 to Rs. 1,90,000 – NO TAX

Rs. 1,90,001 to Rs. 5,00,000 – 10 percent

Rs. 5,00,001 to Rs. 8,00,000 – 20 percent

Rs. 8,00,001 and above – 30 percent

For senior citizen (age between 60 to 80 years):

Rs. 1,00,000 to Rs. 2,50,000 – NO TAX

Rs. 2,50,001 to Rs. 5,00,000 – 10 percent

Rs. 5,00,001 to Rs. 8,00,000 – 20 percent

Rs. 8,00,001 and above – 30 percent

For senior citizen (81 years and above):

Rs. 1,00,000 to Rs. 5,00,000 – NO TAX

Rs. 5,00,001 to Rs. 8,00,000 – 20 percent

Rs. 8,00,001 and above – 30 percent

Das könnte Ihnen auch gefallen

- Revised Leave PolicyDokument8 SeitenRevised Leave PolicySujan AnnaiahNoch keine Bewertungen

- Project ManagementDokument5 SeitenProject ManagementSreeramPavanNemani100% (1)

- Tax Slab 10-11Dokument2 SeitenTax Slab 10-11Mohit TandonNoch keine Bewertungen

- Income Tax SlabDokument2 SeitenIncome Tax SlabKalpesh ChudasamaNoch keine Bewertungen

- Income Tax Slab 2011-2012Dokument2 SeitenIncome Tax Slab 2011-2012Nand Kishore DubeyNoch keine Bewertungen

- Income Tax Slabs A.Y. 2012-2013Dokument1 SeiteIncome Tax Slabs A.Y. 2012-2013yogitatanavadeNoch keine Bewertungen

- Budget Slab ChangesDokument3 SeitenBudget Slab ChangesPaymaster ServicesNoch keine Bewertungen

- 80.1cm (32) HD Flat TV FH4003 Series 4Dokument6 Seiten80.1cm (32) HD Flat TV FH4003 Series 4Jose JohnNoch keine Bewertungen

- Chidambaram Pranab Mukherjee: Arya Baride. Amruta Bage. Tejas Aptikar. Shital Girigosavi. Pradnya ChaudhariDokument10 SeitenChidambaram Pranab Mukherjee: Arya Baride. Amruta Bage. Tejas Aptikar. Shital Girigosavi. Pradnya ChaudhariAnkit JainNoch keine Bewertungen

- Income Tax Slabs 2007-08 To 2010-11Dokument4 SeitenIncome Tax Slabs 2007-08 To 2010-11Manoj ThuthijaNoch keine Bewertungen

- Tax Audit Limit & Tax RatesDokument6 SeitenTax Audit Limit & Tax RatesPhani SankaraNoch keine Bewertungen

- Unit 1 Topic 2ndDokument2 SeitenUnit 1 Topic 2ndAnjali. 1999Noch keine Bewertungen

- Budget SalaryDokument1 SeiteBudget Salarymanjunatha tNoch keine Bewertungen

- Income Tax RatesDokument1 SeiteIncome Tax RatesshubhozNoch keine Bewertungen

- Direct and Indirect Taxes: Assignment OnDokument9 SeitenDirect and Indirect Taxes: Assignment Onpurn kaurNoch keine Bewertungen

- Tax Rates For IndividualsDokument2 SeitenTax Rates For Individualspiyushpandey451876Noch keine Bewertungen

- Income Tax RatesDokument1 SeiteIncome Tax RatesAcharla NarasimhaNoch keine Bewertungen

- Income Tax Rates SlabsDokument2 SeitenIncome Tax Rates Slabspankaj_adv5314Noch keine Bewertungen

- Income Tax Slab For Ay 11Dokument1 SeiteIncome Tax Slab For Ay 11mmmukhtarNoch keine Bewertungen

- EURION - Union BudgetDokument3 SeitenEURION - Union BudgetEurion ConstellationNoch keine Bewertungen

- Slab Rates IncometaxDokument8 SeitenSlab Rates IncometaxPPEARL09Noch keine Bewertungen

- Income Tax Rates Ay12-13Dokument1 SeiteIncome Tax Rates Ay12-13Kashmira RNoch keine Bewertungen

- Union Budget of IndiaDokument6 SeitenUnion Budget of Indiashalinivd3Noch keine Bewertungen

- Income Tax Rates For The Past 10 YearsDokument10 SeitenIncome Tax Rates For The Past 10 YearsTarang DoshiNoch keine Bewertungen

- Income Tax Slab Fy 2009-10Dokument1 SeiteIncome Tax Slab Fy 2009-10naveenNoch keine Bewertungen

- Income Tax Rates/Slabs For A.Y. (2011-12) : Slab (RS.) Tax (RS.)Dokument4 SeitenIncome Tax Rates/Slabs For A.Y. (2011-12) : Slab (RS.) Tax (RS.)Achal MittalNoch keine Bewertungen

- Comparison of Tax Liabilities PreDokument2 SeitenComparison of Tax Liabilities Presandipon1Noch keine Bewertungen

- ASSESSMENT YEAR 2009-2010 Tax Rates For Assessment Year 2009-10 For Resident Woman (Who Is Below 65 Years)Dokument4 SeitenASSESSMENT YEAR 2009-2010 Tax Rates For Assessment Year 2009-10 For Resident Woman (Who Is Below 65 Years)sayyedasif56Noch keine Bewertungen

- Income-Tax-Slab 13-14Dokument2 SeitenIncome-Tax-Slab 13-14rani26octNoch keine Bewertungen

- Income Tax SlabDokument2 SeitenIncome Tax SlabAnonymous Ur3kifA2D8Noch keine Bewertungen

- Income TaxDokument1 SeiteIncome TaxManoj KNoch keine Bewertungen

- Direct Taxes CIA 1Dokument5 SeitenDirect Taxes CIA 1Swathy AjayNoch keine Bewertungen

- Applicable Income Tax Rates For Indian Individual PersonsDokument3 SeitenApplicable Income Tax Rates For Indian Individual PersonstonyvinayakNoch keine Bewertungen

- Income Tax Slab FY 2014-15Dokument3 SeitenIncome Tax Slab FY 2014-15zveeraNoch keine Bewertungen

- Indian Income Tax Rates (AY 1998-99 To 2011-12)Dokument5 SeitenIndian Income Tax Rates (AY 1998-99 To 2011-12)Himanshu0% (1)

- Income Tax Slab Fy 2020-21Dokument1 SeiteIncome Tax Slab Fy 2020-21Nabhya's FamilyNoch keine Bewertungen

- Impact of Budget 2009-2010 On EconomyDokument19 SeitenImpact of Budget 2009-2010 On EconomyPritika JethiNoch keine Bewertungen

- Tax Slab Important Changes For The Fy 2015 16 For IndividualDokument8 SeitenTax Slab Important Changes For The Fy 2015 16 For IndividualSudhir BansalNoch keine Bewertungen

- Income Tax Calculator 2023Dokument50 SeitenIncome Tax Calculator 2023TARUN PRASADNoch keine Bewertungen

- Tax Benifits 2008Dokument2 SeitenTax Benifits 2008Mithun Gurukalla VallappilNoch keine Bewertungen

- FY 2022-23 (AY 2023-24) - Taxguru - inDokument3 SeitenFY 2022-23 (AY 2023-24) - Taxguru - inHarshilNoch keine Bewertungen

- Income Tax Rates Assessment Year 2011-2012Dokument10 SeitenIncome Tax Rates Assessment Year 2011-2012Pankaj KhannaNoch keine Bewertungen

- Notes On DTC BillDokument5 SeitenNotes On DTC Billshikah sidarNoch keine Bewertungen

- Tax RatesDokument3 SeitenTax RatesHaneef ShaikNoch keine Bewertungen

- Types of TaxesDokument15 SeitenTypes of TaxesNischal KumarNoch keine Bewertungen

- Direct Tax BlogDokument3 SeitenDirect Tax BlogArpit GuptaNoch keine Bewertungen

- A Project Report On Direct TaxDokument44 SeitenA Project Report On Direct Taxrani26oct100% (2)

- Income Tax Rates: For AY 2021-22 (New) & A.Y. 2020-21 (Old)Dokument2 SeitenIncome Tax Rates: For AY 2021-22 (New) & A.Y. 2020-21 (Old)pankaj goyalNoch keine Bewertungen

- IncomeTax Calculator 2010-11Dokument2 SeitenIncomeTax Calculator 2010-11Vimal PatelNoch keine Bewertungen

- INDIA BUDGET 2010-11: What Is A Budget ?Dokument25 SeitenINDIA BUDGET 2010-11: What Is A Budget ?adipjksNoch keine Bewertungen

- How To Calculate Ur Income TaxDokument3 SeitenHow To Calculate Ur Income TaxrazeemshipNoch keine Bewertungen

- Budget Analysis 2011Dokument30 SeitenBudget Analysis 2011Vandana SharmaNoch keine Bewertungen

- Radhika Associates: Tax Consultants Roshan Choudhary KolkataDokument8 SeitenRadhika Associates: Tax Consultants Roshan Choudhary KolkataPrakash RanaNoch keine Bewertungen

- Budget 2010 11Dokument2 SeitenBudget 2010 11SababathibeNoch keine Bewertungen

- 6 Centr Al Pay Commi Ssion: BY: Amit Rana Chandani Rajpal Singh Isha Makhija Shruti Saroha Ashmin AroraDokument27 Seiten6 Centr Al Pay Commi Ssion: BY: Amit Rana Chandani Rajpal Singh Isha Makhija Shruti Saroha Ashmin Arorahotvirgo_ranaNoch keine Bewertungen

- India Budget 2011Dokument22 SeitenIndia Budget 2011ashishgautamNoch keine Bewertungen

- Indian Union Budget 2011-2012: Presented By: Presented ToDokument40 SeitenIndian Union Budget 2011-2012: Presented By: Presented ToSimmi GargNoch keine Bewertungen

- Income TaxDokument2 SeitenIncome TaxsunilgswmNoch keine Bewertungen

- Tax Saving Investment Instrument W.R.T To Sole Trader: Preapared by Keval Bhanushali Roll No. 126Dokument22 SeitenTax Saving Investment Instrument W.R.T To Sole Trader: Preapared by Keval Bhanushali Roll No. 126Paras BhanushaliNoch keine Bewertungen

- Income TaxDokument5 SeitenIncome TaxAshish NarulaNoch keine Bewertungen

- Budget Synopsis 2015-16 PDFDokument12 SeitenBudget Synopsis 2015-16 PDFBhagwan PalNoch keine Bewertungen

- Instrumentation and Control ET ZC 341: BITS PilaniDokument24 SeitenInstrumentation and Control ET ZC 341: BITS PilaniSujan AnnaiahNoch keine Bewertungen

- Paxar Bangladesh LTDDokument1 SeitePaxar Bangladesh LTDSujan AnnaiahNoch keine Bewertungen

- Methods of Payments in Import International TradeDokument2 SeitenMethods of Payments in Import International TradeSujan AnnaiahNoch keine Bewertungen

- Group E - Departure: Incoterms or International Commercial Terms Are A Series ofDokument7 SeitenGroup E - Departure: Incoterms or International Commercial Terms Are A Series ofSujan AnnaiahNoch keine Bewertungen

- SAP Ban Galore)Dokument4 SeitenSAP Ban Galore)MaruthiNoch keine Bewertungen