Beruflich Dokumente

Kultur Dokumente

Preservation of Records

Hochgeladen von

Karan GulatiOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Preservation of Records

Hochgeladen von

Karan GulatiCopyright:

Verfügbare Formate

les rtic A

Rules Relating to the Period of Records Preservation (Provision Under The Companies Act 1956)

Professor R Balakrishnan, FCS, Pune.

e-mail : bala.hitsafrica@gmail.com

The Companies Act as well as the various Rules and Regulations framed there under require companies to maintain various records and documents. The time period up to which the various records are to be kept is also specified in the Rules relating to record preservation. This article briefly explains the law and procedure relating to records preservation.

INTRODUCTION

Many organizations keep on accumulating their records relating to their activities storing the same for years together and there could be records of permanent nature such as incorporation certificates, various registration certificates such as excise registration, sales tax registration, factory licence, shop and establishment licence etc. and the records which are generated years to year basis on account of activities carried on by the enterprise such as books of accounts, registers, returns, supporting documents such as vouchers for receipt and expenses, production and distribution related documents etc. However, a question arises as to how long the corporate should preserve these records/documents. Since companies are registered under the Companies Act, 1956, one needs to refer the said Act which prescribes the preservation of records for a minimum period of eight years and there is also rules prescribed for the disposal of records by the Companies (Preservation and Disposal of Records) Rules 1966. The following are the relevant provisions with reference to the Companies Act and Rules applicable on this subject.

Needless to mention that in the case of a company incorporated less than eight years, before the current year, it is required to preserve the records for the entire period proceeding the current year.

Company Law Board Circular on this matter

The Ministry of Law, Justice and Company Affairs, Department of Company Affairs*, vide its circular No. 1/1/ 83-CL-V; No.59/196/CT/91-78.CAB dated 2nd March 1983 issued a circular No. 2/83 on the subject of proper maintenance of accounting records under section 209 of the Companies Act, 1956 which reads as under: (it may be noted that the circular not only specifies the period of maintenance of records but also it specifies that the records to be maintained in indelible ink.) A case has come to the notice of the Government where certain cost accounting records of a company were maintained in pencil. The question whether accounting records could be maintained by entries in pencil was examined by the Department in the light of the requirement under section 209 of the Companies Act, 1956 that proper books of account shall be kept by every company. Further subsection (4A) of section 209 provides that the books of account etc., relating to a period of not less than 8 years shall be maintained in good order. It has been decided that having regard to the provisions of section 209 of the

* Now Ministry of Corporate Affairs

PRESERVATION OF RECORDS

As per the Companies Act, 1956, vide its section 209(4A) corporates are required to preserve the books of accounts and registers along with the vouchers for a minimum period of eight years.

les rtic A

Rules Relating to the Period of Records Preservation (Provision Under The Companies Act 1956)

Companies Act, 1956, should be prepared and maintained in indelible ink for giving a proper and adequate meaning to the words proper books of account in section 209 of the Act.

In such circumstances, the company is required to preserve the specified documents and records as directed by the regulator and can not destroy them till that period. Needless to mention that a contravention shall be punishable with fine which may extend to Rs. 500.

COMPANIES (PRESERVATION AND DISPOSAL OF RECORDS) RULES 1956

The Government has also come out with the above rules for preservation of documents. The above rules provide for destruction and preservation of records as under rule 3 and these rules are in force with effect from 1st February 1966.

Sl. Name of documents No. (1) 1 Register of members commencing from the date of registration of the company Index of Members Register of debenture-holders Index of debenture-holders Period (2) Permanent

RECORDS OF DESTROYED DOCUMENTS OBLIGATIONS

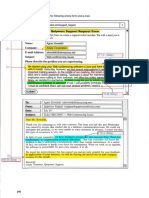

The regulator also wants the company to maintain a register as per form specified by the regulator - and the company is required to enter the brief details/description of the documents destroyed by the company. The above requirement is arising out of rule 4 of the Companies (Preservation and Disposal of Records) Rules, 1956. The format specified by the regulator is given below:APPENDIX (See Rule 4)

Particulars of documents destroyed 1 Date and mode of destruction with the initial of secretary or other authorized person 2

2 3 4

Permanent 15 years after the redemption 15 years after the redemption of debentures 8 years from the date of filing with the Registrar

Copies of all annual returns prepared under sections 159 and 160 and copies of all certificates and documents required to be annexed thereto under sections 160 and 161

The following may be noted in connection with the destruction of records (a) The form prescribed by the regulator says that the secretary or other authorized person shall have to authenticate the particulars of documents destroyed. (b) The above, therefore automatically means by inference that the board may have to authorize the destruction of documents and as well as the person - secretary or any other - for this purpose and the document destruction may have to done under the supervision of the board authorized person. (c) Again, this register would have to be preserved in the safe custody of the company for future reference. (d) Rules also specify that any contravention of this rule would attract penalty and is punishable with fine which may extend to Rs. 500.

The rules further prescribe that a contravention shall be punishable with fine which may extend to Rs. 500.

INCOME TAX RULES

The assessing income tax officer is empowered to reopen the assessment of any year within seven years from the end of the relevant assessment year wherever he finds/suspects that escaped income is likely to exceed Rs. 50,000 or more for that year. This empowerment comes from the Income Tax Act vide section 149(1)(a)(ii) of the Income Tax Act, 1961. Obviously, the record maintenance is required under the Income Tax Act, 1961 is also for a period of eight years.

PRESERVATION OF DOCUMENTS BEYOND THE PRESCRIBED PERIOD

A company may receive an order in writing from the Registrar of Companies directing it to preserve certain documents beyond the prescribed period prescribed by the Act and Rules.

Suggested Board Resolution

Obviously, the Board may have to authorize the destruction and supervision by way of a board resolution and the companies may pass the following board resolution - a suggested one -

Rules Relating to the Period of Records Preservation (Provision Under The Companies Act 1956)

les rtic A

which could be modified as per the need and circumstances of the company. RESOLVED, that all books, documents and records of the company for the period .............to ...............are being over ....... years old be destroyed under the supervision of the secretary/authorized executive who shall prepare and maintain a Register showing books, documents and records so destroyed. FURTHER RESOLVED, that the list of documents destroyed be kept in the safe custody of the secretary/ authorized executive. Of course, a contravention on the above would also be punishable with fine which may extend to Rs. 500.

manner as the company by special resolution directs; and (c) in the case of a creditor voluntary winding up, in such manner as the committee of inspection or, if there is no such committee, as the creditors of the company may direct. After the expiry of five years from the dissolution of the company, no responsibility will rest on the company, the liquidator or any person to whom the custody of the books and papers has been committed, by reason of any books or papers not being forthcoming to any person claiming to be interested therein. The Central Government, may, by Rules:(a) prevent for such period (not exceeding five years from the dissolution of the company) as the Central Government thinks proper, the destruction of the books and papers of a company which has been wound up and of its liquidator; and (b) enable any creditor or contributory of the company to make representations to the Central Government in respect of the matters specified in clause (a) and to appeal to the Court from any direction which may be given by the Central Government in the matter. If any person acts in contravention of any such rules or of any direction of the Central Government hereunder, he shall be punishable with imprisonment for a term which may extend to six months, or with fine which may extend to five thousand rupees or with both.

PROVISION RELATING TO AMALGAMATED COMPANY

Section 396A of the Companies Act is relevant on this subject which reads as under : The books and papers of a company which has been amalgamated with, or whose shares have been acquired by, another company under this Chapter shall not be disposed off without the prior permission of the Central Government and before granting such permission, that Government may appoint a person to examine the books and papers or any of them for the purpose of ascertaining whether they contain any evidence of the commission of an offence in connection with the promotion or formation, or the management of the affairs of the first mentioned company or its amalgamation or the acquisition of its shares. From the above, it is clear that documents of an amalgamated company cannot be destroyed/disposed of unless the prior permission from the Government is taken.

SECRETARIAL STANDARD REGISTERS AND RECORDS

(SS-4)

ON

PROVISION COMPANY

RELATING

TO

DISSOLVED

Similarly in the case of dissolved company, section 550 of the Companies Act, 1956 provides that when the affairs of the company have been completely wound up and it is about to be dissolved, its books and papers and those of the liquidator may be disposed of as follows, that is to say:(extracts from the section itself) (a) in the case of a winding up by or subject to the supervision of the Court, in such a manner as the Court directs; (b) in the case of a members voluntary winding up in such

The Institute of Company Secretaries of India has brought out a Secretarial Standard in October 2005 which is effective from 20th October 2005. The Secretarial Standard spells out the preservation period for different kinds of records and registers the Secretarial Standard is also specifying the record maintenance period in line with the Companies Act, 1956 read with the Companies (Preservation and Disposal of Records) Rules, 1956. The summary of the record preservation period mentioning the types of records and the corresponding preservation period is as given below, as per the Secretarial Standard (SS-4) issued by the Institute of Company Secretaries of India.

les rtic A

Rules Relating to the Period of Records Preservation (Provision Under The Companies Act 1956)

Preservation of records - the time period as per SS-4

Sl. No. 1 2 3 4 5 6 7 8 9 REGISTERS/RECORDS Registers of investments in securities not held in the name of the company Register of buy-back of securities back Register of charges Register and index of members Register and index of debenture holders Foreign Register of members or debenture holder Register of renewed and duplicate certificates Register of contracts in which directors are interested Register of directors, managing director, manager and secretary PRESERVATION PERIOD Permanent 8 years from the date of completion of buyPermanent Permanent 15 years from the date of redemption of debentures To be maintained until discontinued Permanent Permanent Permanent Permanent Permanent 8 years from the date of last entry 8 years from the date of each allotment 8 years from the date of payment 8 years Until the resolution has been implemented or for a period of 10 years whichever is later 8 years from the date of meeting 8 years Permanent Permanent Permanent 8 years from the date of last entry Permanent Permanent Permanent Permanent

10 Register of directors share holding 11 Register of inter corporate loans and investments 12 Register of deposits 13 Register of allotment 14 Register of payment of dividend 15 Register of Directors attendance 16 Register of postal ballot 17 Register of proxies 18 Register of inspection 19 Register of investment (other than securities not held in the name of the company) 20 Register of documents executed under common seal 21 Register of records and documents destroyed 22 Register of investors complaints 23 Register of transfer of shares 24 Register of transmission of shares 25 Register of transfer of debentures 26 Register of transmission of debentures

Rules Relating to the Period of Records Preservation (Provision Under The Companies Act 1956)

les rtic A

27 Register of employee stock options 28 Register of sweat equity shares 29 Register in respect of SEBI (substantial acquisition of shares and takeovers) Regulations, 1997 30 Register of SEBI (Prohibition of insider trading) Regulations, 1992 31 Books of Accounts 32 Annual Return 33 Miscellaneous A. Agreement under section 136 B. Disclosures received by the company under SEBI (Substantial Acquisition of Shares and Takeovers) Regulations 1997 (SAST Regulations) C. General Meeting Records D. Record of Directors particulars E. Notice of disclosure of interest by the Directors, officers and substantial shareholders under Model Code of Conduct F. Various agreements G. Certificate received from Secretarial Auditors H. Documents to be filed with Registrar of Companies I. Copy of Memorandum & Articles of Association J. Certificate issued by Registrar of Companies K. Any court order/CLB order L. Annual Reports M. Replies to show cause notices, if any etc. N. Record of employee Stock Purchase Scheme (ESPS) O. Record of issued and cancelled share/debenture certificates

15 years from the date of exercise of options 8 years from the financial year in which the latest entry is made Permanent 5 years 8 accounting years immediately proceeding the current accounting year Last 8 annual returns

The aforesaid records should be preserved in good order for as long as they remain current, or for a minimum of 8 years and may be destroyed hereafter under the authority of the Board

RECORD PRESEVATION PRESCRIBED PERIOD

BEYOND

THE

The Registrar of Companies may prescribe the period for preservation of records beyond the above period and in such circumstances the companies should preserve the same as per the direction of the Registrar of Companies.

CONCLUSION

Document preservation period for any corporate, by and large is for a minimum period of eight years (current year to be excluded) barring permanent records.

Fifteen years period of preservation has been prescribed in respect of the following: (a) Register of debenture-holders after the redemption and (b) Index of debenture-holders after the redemption of debentures. The books, registers and documents talked about is in relation to all those which are falling under the provision of the Companies Act and in respect of other documents falling under different acts - such as Central Excise, Customs, Sales Tax, Income Tax and such other Acts - the preservation of documents would be governed by the respective Acts.

Das könnte Ihnen auch gefallen

- CHAPTER 8 Analyzing Financial Statements and Creating ProjectionsDokument13 SeitenCHAPTER 8 Analyzing Financial Statements and Creating Projectionscharrygaborno100% (1)

- How to Project Business FinancesDokument12 SeitenHow to Project Business FinancesLenny Ithau100% (1)

- Attachment Report OF Ngonidzashe Simbabure B0923808 AT Hunyani Forests LTDDokument18 SeitenAttachment Report OF Ngonidzashe Simbabure B0923808 AT Hunyani Forests LTDngonyngonyNoch keine Bewertungen

- Centralisation and DecentralisationDokument16 SeitenCentralisation and DecentralisationHS KUHARNoch keine Bewertungen

- Risk and ReturnDokument46 SeitenRisk and ReturnPavanNoch keine Bewertungen

- Budgeting and Budgetary ControlDokument18 SeitenBudgeting and Budgetary ControlchandasumaNoch keine Bewertungen

- Environmental Economics A Complete Guide - 2020 EditionVon EverandEnvironmental Economics A Complete Guide - 2020 EditionNoch keine Bewertungen

- OB Session 1: Defining Organizational BehaviourDokument36 SeitenOB Session 1: Defining Organizational BehaviourMaissa OsmanNoch keine Bewertungen

- Budgeting and Budgetary ControlDokument38 SeitenBudgeting and Budgetary Controlessien akpanukoNoch keine Bewertungen

- Fundamentals of E-CommerceDokument7 SeitenFundamentals of E-CommerceWendoor6696Noch keine Bewertungen

- Objective of IAS 1Dokument10 SeitenObjective of IAS 1April IsidroNoch keine Bewertungen

- MRP and ERP ModelDokument12 SeitenMRP and ERP ModelAmandeep SinghNoch keine Bewertungen

- Public Sector Accounting Standards ExplainedDokument6 SeitenPublic Sector Accounting Standards Explainedragelpoe100% (2)

- AdvantagesDokument1 SeiteAdvantagesAlex AcquayeNoch keine Bewertungen

- Scope of HRMDokument1 SeiteScope of HRMMaddikera Anantha KrishnaNoch keine Bewertungen

- Summary SOXDokument3 SeitenSummary SOXRosaliaWahdiniNoch keine Bewertungen

- Fee Based Activity in India BanksDokument12 SeitenFee Based Activity in India BanksMu'ammar RizqiNoch keine Bewertungen

- Stock ExchangeDokument12 SeitenStock ExchangeGirish ChouguleNoch keine Bewertungen

- Contingency Approaches To Ma NagementDokument31 SeitenContingency Approaches To Ma NagementmavimalikNoch keine Bewertungen

- What Is OM CheatsheetDokument4 SeitenWhat Is OM CheatsheetjordanNoch keine Bewertungen

- Paper Chapter 12 Group 1Dokument17 SeitenPaper Chapter 12 Group 1Nadiani Nana100% (1)

- Fin Innovation (Review)Dokument38 SeitenFin Innovation (Review)RahulNoch keine Bewertungen

- Organizational Behavior Chapter 13Dokument33 SeitenOrganizational Behavior Chapter 13Muhammad Ikhlaq Ahmed Kalroo100% (2)

- Note 08Dokument6 SeitenNote 08Tharaka IndunilNoch keine Bewertungen

- Concept Paper on Labour Market Information SystemDokument0 SeitenConcept Paper on Labour Market Information SystemShihabur RahmanNoch keine Bewertungen

- Write financial plan under 40 charsDokument6 SeitenWrite financial plan under 40 charsGokul SoodNoch keine Bewertungen

- Ba7201 Op PDFDokument265 SeitenBa7201 Op PDFKarthi VijayNoch keine Bewertungen

- Ias 1 Presentation of Financial StatementsDokument42 SeitenIas 1 Presentation of Financial StatementsEjaj-Ur-RahamanNoch keine Bewertungen

- MNCs PDFDokument13 SeitenMNCs PDFOmkar MohiteNoch keine Bewertungen

- Acc 313Dokument231 SeitenAcc 313Bankole MatthewNoch keine Bewertungen

- Cost-Benefit AnalysisDokument7 SeitenCost-Benefit Analysishoogggleee100% (1)

- FICT System Development & Analysis AssignmentDokument3 SeitenFICT System Development & Analysis AssignmentCR7 الظاهرةNoch keine Bewertungen

- Capital Structure Impact On Financial Performance of Sharia and Non Sharia Complaint Companies of Pakistan Stock ExchangeDokument17 SeitenCapital Structure Impact On Financial Performance of Sharia and Non Sharia Complaint Companies of Pakistan Stock ExchangeAnonymous 8UKbHa1soNoch keine Bewertungen

- Financialization - What It Is - Why It MattersDokument31 SeitenFinancialization - What It Is - Why It MattersStefan ErdoglijaNoch keine Bewertungen

- Lecture - Little's LawDokument36 SeitenLecture - Little's LawSamuel Bruce Rockson100% (1)

- Ben SantosDokument6 SeitenBen SantosKiel Geque100% (2)

- FM Notes PDFDokument311 SeitenFM Notes PDFhitmaaaccountNoch keine Bewertungen

- MASB 1 - Presentation of Fi1Dokument2 SeitenMASB 1 - Presentation of Fi1hyraldNoch keine Bewertungen

- Financial Management 2Dokument159 SeitenFinancial Management 2Ivani Katal0% (2)

- Factoring & ForfeitingDokument34 SeitenFactoring & ForfeitingSurbhi Deshmukh100% (1)

- Various Forces of Change in Business EnviromentDokument5 SeitenVarious Forces of Change in Business Enviromentabhijitbiswas25Noch keine Bewertungen

- Assignment 3Dokument5 SeitenAssignment 3Chaudhary AliNoch keine Bewertungen

- The Law of Diminishing Marginal ReturnsDokument2 SeitenThe Law of Diminishing Marginal ReturnsShania RoopnarineNoch keine Bewertungen

- Financial Planning and ForecastingDokument20 SeitenFinancial Planning and ForecastingG-KaiserNoch keine Bewertungen

- Budgeting For Profit and Control - StuDokument42 SeitenBudgeting For Profit and Control - StuAlexis Kaye DayagNoch keine Bewertungen

- 'Basics of AccountingDokument57 Seiten'Basics of AccountingPrasanjeet DebNoch keine Bewertungen

- Opm 101 Chapter 1Dokument27 SeitenOpm 101 Chapter 1Gagan KarwarNoch keine Bewertungen

- Managing Finincial Principles & Techniques Ms - SafinaDokument22 SeitenManaging Finincial Principles & Techniques Ms - SafinajojirajaNoch keine Bewertungen

- Firms and CostsDokument24 SeitenFirms and CostsSaurav Goyal100% (3)

- Management Practices in The Usa Japan and ChinaDokument8 SeitenManagement Practices in The Usa Japan and ChinaDina FatkulinaNoch keine Bewertungen

- Global Introduction of New Products - A Case Study of DellDokument58 SeitenGlobal Introduction of New Products - A Case Study of DellPreeti IyerNoch keine Bewertungen

- Short Essay 1: UnrestrictedDokument8 SeitenShort Essay 1: UnrestrictedSatesh KalimuthuNoch keine Bewertungen

- Critical Path Method A Complete Guide - 2020 EditionVon EverandCritical Path Method A Complete Guide - 2020 EditionNoch keine Bewertungen

- Capital Market Integration in South Asia: Realizing the SAARC OpportunityVon EverandCapital Market Integration in South Asia: Realizing the SAARC OpportunityNoch keine Bewertungen

- National Law Institute UniversityDokument14 SeitenNational Law Institute UniversitypriyaNoch keine Bewertungen

- NLIU analysis of key provisions of Companies Bill 2009Dokument14 SeitenNLIU analysis of key provisions of Companies Bill 2009DikshaNoch keine Bewertungen

- Company Accounts Statutory BooksDokument21 SeitenCompany Accounts Statutory BooksChandru SivaNoch keine Bewertungen

- Accounts of Company: by Haneef Ahmed BhattiDokument30 SeitenAccounts of Company: by Haneef Ahmed BhattiZubair AsifNoch keine Bewertungen

- 209A. (1) (I) (Ii)Dokument29 Seiten209A. (1) (I) (Ii)Manoj NamdevNoch keine Bewertungen

- Check List For Application Under Section 295Dokument2 SeitenCheck List For Application Under Section 295Karan GulatiNoch keine Bewertungen

- Swiss Challenge MethodDokument3 SeitenSwiss Challenge MethodKaran GulatiNoch keine Bewertungen

- Liabilities of Managing DirectorDokument3 SeitenLiabilities of Managing DirectorKaran GulatiNoch keine Bewertungen

- Informative Note On Public Private Partnership (PPP) : BackgroundDokument5 SeitenInformative Note On Public Private Partnership (PPP) : BackgroundKaran GulatiNoch keine Bewertungen

- Income Tax Calculator For Financial Year 2011 12Dokument18 SeitenIncome Tax Calculator For Financial Year 2011 12Karan GulatiNoch keine Bewertungen

- Availability Dependencies EN XXDokument213 SeitenAvailability Dependencies EN XXraobporaveenNoch keine Bewertungen

- I I I I I I I: Quipwerx Support Request FormDokument2 SeitenI I I I I I I: Quipwerx Support Request Form08. Ngọ Thị Hồng DuyênNoch keine Bewertungen

- Complex Property Group Company ProfileDokument3 SeitenComplex Property Group Company ProfileComplex Property GroupNoch keine Bewertungen

- HSS S6a LatestDokument182 SeitenHSS S6a Latestkk lNoch keine Bewertungen

- Office 365 - Information Security Management System (ISMS) ManualDokument18 SeitenOffice 365 - Information Security Management System (ISMS) ManualahmedNoch keine Bewertungen

- The Problem and It'S BackgroundDokument9 SeitenThe Problem and It'S BackgroundGisbert Martin LayaNoch keine Bewertungen

- Politics and Culture Essay PDFDokument6 SeitenPolitics and Culture Essay PDFapi-267695090Noch keine Bewertungen

- Bacaan Bilal Shalat Tarawih 11 Rakaat Bahasa IndonesiaDokument4 SeitenBacaan Bilal Shalat Tarawih 11 Rakaat Bahasa IndonesiaMTSs Tahfizh Ulumul Quran MedanNoch keine Bewertungen

- Predictions of Naimat Ullah Shah Wali by Zaid HamidDokument55 SeitenPredictions of Naimat Ullah Shah Wali by Zaid HamidBTghazwa95% (192)

- A Gateway For SIP Event Interworking: - Sasu Tarkoma & Thalainayar Balasubramanian RamyaDokument20 SeitenA Gateway For SIP Event Interworking: - Sasu Tarkoma & Thalainayar Balasubramanian RamyaMadhunath YadavNoch keine Bewertungen

- Our Common Future, Chapter 2 Towards Sustainable Development - A42427 Annex, CHDokument17 SeitenOur Common Future, Chapter 2 Towards Sustainable Development - A42427 Annex, CHShakila PathiranaNoch keine Bewertungen

- 5658 1Dokument5 Seiten5658 1Afsheen ZaidiNoch keine Bewertungen

- Biernacki - The Fabrication of LaborDokument552 SeitenBiernacki - The Fabrication of LaborvarnamalaNoch keine Bewertungen

- The Seven ValleysDokument17 SeitenThe Seven ValleyswarnerNoch keine Bewertungen

- Pinagsanhan Elementary School Kindergarten AwardsDokument5 SeitenPinagsanhan Elementary School Kindergarten AwardsFran GonzalesNoch keine Bewertungen

- iOS E PDFDokument1 SeiteiOS E PDFMateo 19alNoch keine Bewertungen

- Aztec CodicesDokument9 SeitenAztec CodicessorinNoch keine Bewertungen

- Act 201 Chapter 02 Debit & CreditDokument72 SeitenAct 201 Chapter 02 Debit & Credittanvir ahmedNoch keine Bewertungen

- Ancient Egypt - Basic NeedsDokument3 SeitenAncient Egypt - Basic NeedsSteven Zhao67% (9)

- Guruswamy Kandaswami Memo A.y-202-23Dokument2 SeitenGuruswamy Kandaswami Memo A.y-202-23S.NATARAJANNoch keine Bewertungen

- Life of Prophet Muhammad Before ProphethoodDokument5 SeitenLife of Prophet Muhammad Before ProphethoodHoorain HameedNoch keine Bewertungen

- VA-25 Grammar 5 With SolutionsDokument11 SeitenVA-25 Grammar 5 With SolutionsSOURAV LOHIANoch keine Bewertungen

- Annual GPF Statement for NGO TORA N SINGHDokument1 SeiteAnnual GPF Statement for NGO TORA N SINGHNishan Singh Cheema56% (9)

- List of applicants for admission to Non-UT Pool categoryDokument102 SeitenList of applicants for admission to Non-UT Pool categoryvishalNoch keine Bewertungen

- Excerpt of "The Song Machine" by John Seabrook.Dokument9 SeitenExcerpt of "The Song Machine" by John Seabrook.OnPointRadioNoch keine Bewertungen

- Recolonizing Ngugi Wa Thiongo PDFDokument20 SeitenRecolonizing Ngugi Wa Thiongo PDFXolile Roy NdlovuNoch keine Bewertungen

- Complete Spanish Grammar 0071763430 Unit 12Dokument8 SeitenComplete Spanish Grammar 0071763430 Unit 12Rafif Aufa NandaNoch keine Bewertungen

- HDFC BankDokument6 SeitenHDFC BankGhanshyam SahNoch keine Bewertungen

- Logistics AssignmentDokument15 SeitenLogistics AssignmentYashasvi ParsaiNoch keine Bewertungen

- New Jersey V Tlo Research PaperDokument8 SeitenNew Jersey V Tlo Research Paperfvg7vpte100% (1)