Beruflich Dokumente

Kultur Dokumente

Sylabus

Hochgeladen von

Rohan NakasheOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Sylabus

Hochgeladen von

Rohan NakasheCopyright:

Verfügbare Formate

S.

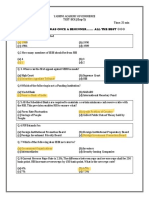

Topics no

Remarks

1. Introduction to Customs & Customs Act 1962 2. Customs Tariff Act 1975 3. Types of Duties 4. Types of Bills of Entries 5. General Rules for Interpretations 6. Warehousing 7. Baggage Rules 8 Valuation rules 1988 amended 2007 9. Documentation for Import clearance 10 Duty calculation . 11 MRP requirement for . Import consignments 12 Abatement calculation . on RSP value ( for all Section 4A assessment) 13 Central Excise Act . 1944 14 Valuation rules for . Central Excise 15 Tariff /Classification /

X X

X X

. 16 . 17 . 18 . 19 20 21

Notifications CENVAT / MODVAT Duty Drawback under section 74 Re-Import ( Warranty replacements) Repair & Return Project Imports Temporary Import ATA Carnet Exhibition / Fair imports Job working Import on Loan

22 Exemptions / Remission . schemes application for duty benefits. 23 100% EOU . 24 SEZ / FTWZ . 25 EPCG. . 26 Deemed Exports .

X X X X

27 Advance Ruling . 28 Settlement Commission .

Das könnte Ihnen auch gefallen

- Cs Manual2015 PDFDokument233 SeitenCs Manual2015 PDFPranith Babu BokinalaNoch keine Bewertungen

- Tax Management and PracticeDokument1.392 SeitenTax Management and PracticeArchana KhapreNoch keine Bewertungen

- Vat GuideDokument174 SeitenVat GuideMoslim SalafiNoch keine Bewertungen

- CPA Paper 6Dokument20 SeitenCPA Paper 6sanu sayed100% (1)

- Cs Manual2013Dokument505 SeitenCs Manual2013SatishBhadraNoch keine Bewertungen

- Customs Manual: Central Board of Excise & Customs Department of Revenue Ministry of Finance Government of IndiaDokument269 SeitenCustoms Manual: Central Board of Excise & Customs Department of Revenue Ministry of Finance Government of IndiacustomsbareillyNoch keine Bewertungen

- Export ProceduresDokument23 SeitenExport ProceduresKiranPoojaryNoch keine Bewertungen

- 11 CPA TAXATION Paper 11Dokument8 Seiten11 CPA TAXATION Paper 11Kiwalabye OsephNoch keine Bewertungen

- Intermediate Paper 11 PDFDokument456 SeitenIntermediate Paper 11 PDFjesurajajNoch keine Bewertungen

- Customs ActDokument126 SeitenCustoms ActRohit VermaNoch keine Bewertungen

- Tax Management and Practice in IndiaDokument1.272 SeitenTax Management and Practice in IndiaCalmguy Chaitu100% (1)

- Exemption From Customs DutyDokument4 SeitenExemption From Customs DutyRavikumar PaNoch keine Bewertungen

- GST 7th Edition PDFDokument366 SeitenGST 7th Edition PDFUtkarshNoch keine Bewertungen

- 17 CPA ADVANCED TAXATION Paper 17Dokument9 Seiten17 CPA ADVANCED TAXATION Paper 17kabendejunior4Noch keine Bewertungen

- Senate Bill 76: The General Assembly of PennsylvaniaDokument155 SeitenSenate Bill 76: The General Assembly of PennsylvaniaLancasterOnlineNoch keine Bewertungen

- Ca, 1962Dokument143 SeitenCa, 1962AshokNoch keine Bewertungen

- Apr Manual V 2Dokument86 SeitenApr Manual V 2rohit guptNoch keine Bewertungen

- Types of Custom DutiesDokument29 SeitenTypes of Custom DutiesShikhar AgarwalNoch keine Bewertungen

- Custom Duty Revision Cum Marathon Dec 22Dokument48 SeitenCustom Duty Revision Cum Marathon Dec 22Suraj PawarNoch keine Bewertungen

- Myanmar CustomsDokument39 SeitenMyanmar CustomsYe Phone100% (4)

- 9 Role of Customs in Regulating International TradeDokument36 Seiten9 Role of Customs in Regulating International Tradesukriti bajpaiNoch keine Bewertungen

- Lecturer Syllabus ABSTDokument9 SeitenLecturer Syllabus ABSTmanishtheswamiboy4uNoch keine Bewertungen

- Duty Drawback Scheme: Hemen Ruparel 1Dokument11 SeitenDuty Drawback Scheme: Hemen Ruparel 1Ritu JainNoch keine Bewertungen

- Income TaxesDokument43 SeitenIncome Taxesasachdeva17Noch keine Bewertungen

- GST Book 6th Edition CDokument438 SeitenGST Book 6th Edition CUtkarsh100% (1)

- Cs Manual2011Dokument256 SeitenCs Manual2011Shilpa DangNoch keine Bewertungen

- Custome Process - Advances Commercial InformationDokument37 SeitenCustome Process - Advances Commercial Informationreme moNoch keine Bewertungen

- Faculty of Law: Jamia Millia IslamiaDokument25 SeitenFaculty of Law: Jamia Millia IslamiaShimran ZamanNoch keine Bewertungen

- Customs Import Procedure FullDokument200 SeitenCustoms Import Procedure FullAnupam BaliNoch keine Bewertungen

- Area of Referrals For ConsiderationsDokument2 SeitenArea of Referrals For ConsiderationsNaveen KumarNoch keine Bewertungen

- Exim PolicyDokument5 SeitenExim PolicyRavi_Kumar_Gup_7391Noch keine Bewertungen

- Customs & Excise ActDokument85 SeitenCustoms & Excise ActAndrew JoriNoch keine Bewertungen

- Foreign Trade PolicyDokument26 SeitenForeign Trade PolicySamuel Aravind GunnabathulaNoch keine Bewertungen

- Income Tax Solution ManualDokument32 SeitenIncome Tax Solution ManualAnne RNoch keine Bewertungen

- ADIT Syllabus 2016Dokument68 SeitenADIT Syllabus 2016Ali ZafaarNoch keine Bewertungen

- Petroleum CompleteDokument4 SeitenPetroleum CompleteAngela ArleneNoch keine Bewertungen

- Documents Availing For Export IncentivesDokument13 SeitenDocuments Availing For Export IncentivesArun MannaNoch keine Bewertungen

- Test 2 Importation and Exportation ProcedureDokument9 SeitenTest 2 Importation and Exportation ProcedureRohitesh KumarNoch keine Bewertungen

- FinalDokument1.200 SeitenFinalRahulNoch keine Bewertungen

- Appraising Manual IIDokument96 SeitenAppraising Manual IIrohit guptNoch keine Bewertungen

- SC-CF-04 - Completion of Declarations - External ManualDokument74 SeitenSC-CF-04 - Completion of Declarations - External ManualiadhiaNoch keine Bewertungen

- Chapter 14 - Cash Flow Estimation and Capital Budgeting DecisionsDokument109 SeitenChapter 14 - Cash Flow Estimation and Capital Budgeting DecisionsJawad ButtNoch keine Bewertungen

- 13 - Tax Law - Customs Law - 271219Dokument25 Seiten13 - Tax Law - Customs Law - 271219Sushil BansalNoch keine Bewertungen

- Supllimentary Duty, Submission of Vat ReturnDokument51 SeitenSupllimentary Duty, Submission of Vat ReturnKhadeeza ShammeeNoch keine Bewertungen

- Tax SyllabusDokument3 SeitenTax SyllabusTalhakgsNoch keine Bewertungen

- EPCGDokument18 SeitenEPCGAaditya MathurNoch keine Bewertungen

- Business Law OverviewDokument25 SeitenBusiness Law Overviewapce501Noch keine Bewertungen

- ITLPDokument3 SeitenITLPSridhanyas kitchenNoch keine Bewertungen

- Chapter - 1 Custom Act, Definitions, TypesDokument11 SeitenChapter - 1 Custom Act, Definitions, TypesTarun Kumar SinghNoch keine Bewertungen

- Import Policy Bangladesh (2015-2018) Spring2017Dokument8 SeitenImport Policy Bangladesh (2015-2018) Spring2017mtauhid20087888Noch keine Bewertungen

- CA Final GST and Customs Flow Charts Nov 2018Dokument173 SeitenCA Final GST and Customs Flow Charts Nov 2018Amar ShahNoch keine Bewertungen

- One Day Before Exam - N23 NewDokument16 SeitenOne Day Before Exam - N23 NewVikash AgarwalNoch keine Bewertungen

- Customclearance 27march2017Dokument2 SeitenCustomclearance 27march2017rajen sahaNoch keine Bewertungen

- 5 ICL EU Customs Law KormychDokument27 Seiten5 ICL EU Customs Law Kormychb.kormychNoch keine Bewertungen

- Custom Law - ManualDokument100 SeitenCustom Law - Manualmiteshpatel.judicialNoch keine Bewertungen

- Fast-Track Tax Reform: Lessons from the MaldivesVon EverandFast-Track Tax Reform: Lessons from the MaldivesNoch keine Bewertungen

- Complete SBI PO Syllabus and Guide For Prelims 2018 Download As PDFDokument13 SeitenComplete SBI PO Syllabus and Guide For Prelims 2018 Download As PDFRohan NakasheNoch keine Bewertungen

- The Background: Jumping LungingDokument10 SeitenThe Background: Jumping LungingRohan NakasheNoch keine Bewertungen

- Brown Bread, Followed by Plenty of Water.: Breakfast: An Apple, A Boiled or Scrambled Egg and A Slice ofDokument1 SeiteBrown Bread, Followed by Plenty of Water.: Breakfast: An Apple, A Boiled or Scrambled Egg and A Slice ofRohan NakasheNoch keine Bewertungen

- Documents To Be Used in ImportDokument3 SeitenDocuments To Be Used in ImportRohan NakasheNoch keine Bewertungen

- Vinayak Chavan: Career ObjectiveDokument2 SeitenVinayak Chavan: Career ObjectiveRohan NakasheNoch keine Bewertungen

- Micromax MobilesDokument73 SeitenMicromax MobilesTarun100% (2)

- RefeDokument2 SeitenRefeRohan NakasheNoch keine Bewertungen

- Brown Bread, Followed by Plenty of Water.: Breakfast: An Apple, A Boiled or Scrambled Egg and A Slice ofDokument1 SeiteBrown Bread, Followed by Plenty of Water.: Breakfast: An Apple, A Boiled or Scrambled Egg and A Slice ofRohan NakasheNoch keine Bewertungen

- NounsDokument2 SeitenNounsRohan NakasheNoch keine Bewertungen

- We Create Path To SuccessDokument3 SeitenWe Create Path To SuccessRohan NakasheNoch keine Bewertungen

- Federal Aviation Administration Air CarriersDokument43 SeitenFederal Aviation Administration Air CarriersRohan NakasheNoch keine Bewertungen

- Home Tuitions For STD 5th To 10thDokument1 SeiteHome Tuitions For STD 5th To 10thRohan NakasheNoch keine Bewertungen

- Off-Campus CV FormatDokument2 SeitenOff-Campus CV FormatRohan NakasheNoch keine Bewertungen

- About ATA CarnetDokument4 SeitenAbout ATA CarnetRohan NakasheNoch keine Bewertungen

- Ferrovial / BAA - A Transforming Acquisition: 3rd July 2006Dokument38 SeitenFerrovial / BAA - A Transforming Acquisition: 3rd July 2006Andrew YangNoch keine Bewertungen

- Class Assignment 2Dokument3 SeitenClass Assignment 2fathiahNoch keine Bewertungen

- Assignment of Killamsetty Rasmita Scam 1992Dokument8 SeitenAssignment of Killamsetty Rasmita Scam 1992rkillamsettyNoch keine Bewertungen

- BACS2042 Research Methods: Chapter 1 Introduction andDokument36 SeitenBACS2042 Research Methods: Chapter 1 Introduction andblood unityNoch keine Bewertungen

- 9MFY18 MylanDokument94 Seiten9MFY18 MylanRahul GautamNoch keine Bewertungen

- Arba Minch University Institute of Technology Faculty of Computing & Software EngineeringDokument65 SeitenArba Minch University Institute of Technology Faculty of Computing & Software Engineeringjemu mamedNoch keine Bewertungen

- Manual de Partes Dm45-50-lDokument690 SeitenManual de Partes Dm45-50-lklausNoch keine Bewertungen

- Katalog Bonnier BooksDokument45 SeitenKatalog Bonnier BooksghitahirataNoch keine Bewertungen

- CRM (Coca Cola)Dokument42 SeitenCRM (Coca Cola)Utkarsh Sinha67% (12)

- Iso 269-2022-014 Rotary Table NDT Cat IV - Rev1Dokument1 SeiteIso 269-2022-014 Rotary Table NDT Cat IV - Rev1Durgham Adel EscanderNoch keine Bewertungen

- Pay Policy and Salary ScalesDokument22 SeitenPay Policy and Salary ScalesGodwin MendezNoch keine Bewertungen

- Rules and Regulations of Asian Parliamentary Debating FormatDokument2 SeitenRules and Regulations of Asian Parliamentary Debating FormatmahmudNoch keine Bewertungen

- Option - 1 Option - 2 Option - 3 Option - 4 Correct Answer MarksDokument4 SeitenOption - 1 Option - 2 Option - 3 Option - 4 Correct Answer MarksKISHORE BADANANoch keine Bewertungen

- Project SummaryDokument59 SeitenProject SummarynaseebNoch keine Bewertungen

- BroucherDokument2 SeitenBroucherVishal PoulNoch keine Bewertungen

- Manufacturer MumbaiDokument336 SeitenManufacturer MumbaiNafa NuksanNoch keine Bewertungen

- Hey Can I Try ThatDokument20 SeitenHey Can I Try Thatapi-273078602Noch keine Bewertungen

- Midterm Quiz 1 March 9.2021 QDokument5 SeitenMidterm Quiz 1 March 9.2021 QThalia RodriguezNoch keine Bewertungen

- BCK Test Ans (Neha)Dokument3 SeitenBCK Test Ans (Neha)Neha GargNoch keine Bewertungen

- Example of Praxis TicketDokument3 SeitenExample of Praxis TicketEmily LescatreNoch keine Bewertungen

- Legal Framework of Industrial RelationsDokument18 SeitenLegal Framework of Industrial Relationsdeepu0787Noch keine Bewertungen

- Hand Planer PDFDokument8 SeitenHand Planer PDFJelaiNoch keine Bewertungen

- Solution Manual For Labor Relations Development Structure Process 12th Edition Fossum 0077862473 9780077862473Dokument16 SeitenSolution Manual For Labor Relations Development Structure Process 12th Edition Fossum 0077862473 9780077862473savannahzavalaxodtfznisq100% (27)

- Group 7 - Mountain DewDokument18 SeitenGroup 7 - Mountain DewRishabh Anand100% (1)

- Aaa0030imb02 FDokument30 SeitenAaa0030imb02 FJvr Omar EspinozaNoch keine Bewertungen

- Reliability EngineerDokument1 SeiteReliability EngineerBesuidenhout Engineering Solutions and ConsultingNoch keine Bewertungen

- Define Constitution. What Is The Importance of Constitution in A State?Dokument2 SeitenDefine Constitution. What Is The Importance of Constitution in A State?Carmela AlfonsoNoch keine Bewertungen

- Analyzing Sri Lankan Ceramic IndustryDokument18 SeitenAnalyzing Sri Lankan Ceramic Industryrasithapradeep50% (4)

- NDA For Consultants Template-1Dokument4 SeitenNDA For Consultants Template-1David Jay Mor100% (1)

- ISA 265 Standalone 2009 HandbookDokument16 SeitenISA 265 Standalone 2009 HandbookAbraham ChinNoch keine Bewertungen