Beruflich Dokumente

Kultur Dokumente

Sample Answer Foreclosure Defense New Jersey

Hochgeladen von

jack1929Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Dieses Dokument in anderen Sprachen lesen

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Sample Answer Foreclosure Defense New Jersey

Hochgeladen von

jack1929Copyright:

Verfügbare Formate

Earl S. David, Esq. Attorney At Law The Law Center 1091 River Ave, Unit 17 Lakewood NJ 08701 Tel.

908-907-0953 Attorney for Defendant(s)

-----------------------------------------------------------X FORECLOSURE BANK SUPERIOR COURT OF NEW JERSEY CHANCERY DIVISION MERCER COUNTY Plaintiff, DOCKET NO.: XXXXXX --against-CIVIL ACTION ANSWER, DEFENSES AND COUNTERCLAIMS JOHN DOE, Defendant(s). -----------------------------------------------------------X

CONTESTING ANSWER

Defendants and their spouses,as and for their Answer to Plaintiff's Complaint respectfully hereby answer and allege as follows: 1. paragraph 1. 2. 2.1 3. 4. 5. Defendants admit the allegations set forth in paragraph 2. Defendants admit the allegations set forth in paragraph 2.1. Defendant deny the allegations in paragraph 3 and demand strict proof thereof. Defendants admit that Plaintiffs Schedule A describes the property in question. Defendants neither admit nor deny the allegations set forth in paragraph 5. Defendants admit that Mr.DOE executed a note on Feb. 13, 2007 as set forth in

6.

Defendants neither admit nor deny the allegations set forth in paragraph 6.

6a. Defendants neither admit nor deny the allegations set forth in paragraph 6a. 6b. Defendants neither admit nor deny the allegations set forth in paragraph 6b. 7. Defendants deny the allegations in paragraph 7 and demand strict proof thereof. 8. 9. 10. Defendants deny the allegations in paragraph 8 and demand strict proof thereof. Defendants neither admit nor deny the allegations set forth in paragraph 9. Defendants deny the allegations in paragraph 10 and demand strict proof thereof. AS TO THE SECOND COUNT: 1. 2. 3. Defendants deny the allegations in paragraph 1 and demand strict proof thereof. Defendants deny the allegations in paragraph 2 and demand strict proof thereof. Defendants deny the allegations that plaintiff is deprived of the subject premises

and demand strict proof thereof.

AS TO THE THIRD COUNT: 1. Defendants deny the allegations in paragraph 1 and demand strict proof thereof. 2. Defendants neither admit nor deny the allegations in paragraph 2. 3. Defendants neither admit nor deny the allegations in paragraph 3.

AS TO ALL COUNTS: Defendants deny each and every allegation of the Complaint not hereinbefore expressly and specifically admitted, controverted or denied.

AFFIRMATIVE DEFNSES: AFFIRMATIVE DEFENSES AS AND FOR A FIRST, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE:

1.

The Complaint fails to state a cause of action.

AS AND FOR A SECOND, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE:

2.

This Court lacks personal jurisdiction over this defendant.

AS AND FOR A THIRD, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE:

3. expired.

That upon information and belief, the applicable Statute of Limitations has

AS AND FOR A FOURTH, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE:

4.

That upon information and belief, the damages claimed in Plaintiff's Cause(s) of

Action were caused, if any were in fact sustained, by acts or omissions of others, including Plaintiff, for which Defendants has no legal responsibility or culpability. AS AND FOR A FIFTH, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE:

5.

That upon information and belief, no contract ever existed in accordance with the

terms that were set forth in the Complaint. AS AND FOR A SIXTH, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE:

6.

That upon information and belief, defendant alleges that any wrong that may have

been done to Plaintiff, was a direct and/or proximate result of Plaintiff's carelessness, recklessness and/or negligent conduct and as such should be precluded from any kind of recovery. AS AND FOR A SEVENTH, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE:

7.

That upon information and belief, Plaintiff should be estopped from asserting any

claim of any kind against the defendant. AS AND FOR AN EIGHTH, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE:

8.

That upon information and belief, the claim which is the subject matter of the

cause of action set forth in the complaint in the above entitled action is prohibited by and contravenes the statutory law and public policy of the State of New Jersey and/or federal law by reason of the fact that the underlying claim violates the usury laws and/or the Fair Debt Collections Act, and/or any City and State of New Jersey or federal ordinance law or codified statute. AS AND FOR A NINTH, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE:

(Truth in Lending Act) 9. Plaintiff is in violation of the Truth in Lending Act, 15 U.S.C.A. 1601 et.seq.,

since required disclosures were not made at the time of the closing of the loan. AS AND FOR A TENTH, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE:

(Fraud, Duress, and Undue Influence) 10. Plaintiff's claim is barred because the note was procured by fraud and/or duress

and/or undue influence. The alleged note is void and unenforceable. Any alleged loss to the Plaintiff is caused by the fraud of the Plaintiff and/or the fraud of third parties over which the Defendant had no control. AS AND FOR A ELEVENTH, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE:

(Fair Debt Collection Practices Act) 11. Plaintiff has not provided Defendant with payoff and reinstatement figures or debt

verification, and/or other information as was requested according to the Fair Debt Collection Practices Act, 15 U.S.C. 1601, et.seq. AS AND FOR A TWELVTH, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE:

12.

The Complaint is procedurally flawed because Plaintiff ignored the requirement

to attach all necessary documents to the Complaint according to the Rules Governing the Courts of the State of New Jersey and case law. Without these documents, it is impossible for the Defendant to know if the party currently doing the suing is the proper party to be bringing the suit. Thus, these are necessary documents that must be included for the Complaint to be considered complete and ripe for proceeding.

AS AND FOR A THIRTEENTH, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE:

13.

The loan money was not disbursed by the lender in accordance with the terms of

its loan commitment, either in whole or in part, and therefore there was a lack of consideration when the supposed contract was entered into.

AS AND FOR A FOURTEENTH, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE:

14.

Waiver may be implied since the conduct of the lender is such that a reasonable

inference can be made by the borrower that the lender has voluntarily given up certain rights. AS AND FOR A FIFTEENTH, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE:

15.

The rate of interest for the current loan is unethically high, so the Court should

find this interest rate to be usurious and dismiss the foreclosure action.

AS AND FOR A SIXTEENTH, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE:

16.

Where a bank becomes involved in a transaction with a customer with whom it

has established a relationship of trust and confidence, and it is a transaction from which the bank is likely to benefit at the customer's expense (such as collecting interest payments, for example), the bank may be found to have a duty to disclose all facts that are material to the transaction. The

bank had information about the Note and closing that was not made available to Defendant at the time of the closing or before, and therefore they have breached their fiduciary duty to Defendant.

AS AND FOR A SEVENTEENTH, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE:

17. Plaintiff did not abide by N.J.S.A. 2A:50-56(b) when it did not give an adequate description of the default in the notice of intent AS AND FOR AN EIGHTEENTH, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE:

18. Plaintiff is not in compliance with FDCPA due to an improper verification required by 15 USC 1692g(b). AS AND FOR ANINETEENTH, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE: 19. Lack of Assignment and Power of Attorney as no proof nor allegation asserted that the Lender assigned the Mortgage and Note to the Plaintiff herein.

AS AND FOR A TWENTIETH, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE: 20. The absence of a chain of title, with appropriate assignments requires dismissal of the action, pursuant to New jersey rule 4:64-(1)(a)(1). By reason of the failure of

assignments, proof of ownership and title to the mortgage and note, the action must be dismissed.

AS AND FOR A TWENTY FIRST, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE: 21. ILLEGAL CHARGES ADDED TO BALANCE: Plaintiff has charged and/or collected payments from Defendants for attorney fees, legal fees, foreclosure costs, late charges, property inspection fees, title search expenses, filing fees, broker price opinions, appraisal fees, and other charges and advances, and predatory lending fees and charges that are not authorized by or in conformity with the terms of the subject note and mortgage or the controlling pooling and servicing agreement which specifies the waiver of late payments and other collection charges as part of the forbearance and loan modification default loan servicing. Plaintiff wrongfully added and continues to unilaterally add these illegal charges to the balance Plaintiff claims is due and owing under the subject note and mortgage.

AS AND FOR A TWENTY SECOND, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE:

22. Plaintiff is in violation of the Real Estate Settlement Procedures Act, 12 U.S.C. 2601 et. ~because there were certain facts that were important to the closing of the original loan that were not disclosed to Defendant by the mortgage broker who was acting as an agent for the Plaintiff.

AS AND FOR TWENTY THIRD, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE:

23. The original terms of the Note and Mortgage are unconscionable pursuant to the New Jersey Consumer Fraud Act, NJ.S.A. 56:8-1 et. seq.

AS AND FOR A TWENTY FOURTH, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE:

24. Plaintiff's claim is barred because the mortgage was procured by fraud and/or duress and/or undue influence. The alleged mortgage is void and unenforceable. Any alleged loss to the Plaintiff is caused by the fraud of the Plaintiff and/or the fraud of third parties over which the Defendant had no control.

AS AND FOR A TWENTY FIFTH , SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE:

25. The Complaint is procedurally flawed because Plaintiff ignored the requirement to attach all necessary documents to the Complaint according to the Rules Governing the Courts of the State of New Jersey and case law. Without these documents, it is impossible for the Defendant to know if the party currently doing the suing is the proper party to be bringing the suit. Thus, these are necessary documents that must be included for the Complaint to be considered complete and ripe for proceeding. THE MORTGAGE AND NOTE were not attached to the complaint.

AS AND FOR A TWENTY SIXTH, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE:

26. The Complaint is procedurally flawed because Plaintiff failed to serve Defendant with information and instructional materials on the New Jersey Foreclosure Mediation Program with the Summons and Complaint as required by R. 4:4-4 and R. 4:64-1(d).

AS AND FOR A TWENTY SEVENTH, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE: 27. Plaintiff should not be allowed to foreclose at this point because they waited too long to bring the action and Defendant has been detrimentally affect by their delay.

AS AND FOR A TWENTY EIGHTH, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE: 28. Additionally, the notices by law and the terms of the mortgage were not sent by an authorized person, nor did said notices contain the required statements, and were not sent in an authorized manner. By reason thereof, Plaintiff may not foreclose on the mortgage and the instant action must be dismissed. AS AND FOR A TWENTY NINTH, SEPARATE AND COMPLETE AFFIRMATIVE DEFENSE, THE DEFENDANT(S) ALLEGE: 29. Plaintiff was not in possession of the Note at the time of commencement of the action and by reason thereof, Plaintiff did not own the purported debt. The mortgage cannot be separated from

the debt and thereof, Plaintiff was not authorized to commence the action. Even if plaintiff was in possession of note at the time the action was started, no proper certification was made. This omission warrants dismissal of this action.

COUNTERCLAIMS (FIRST COUNT) (New Jersey Consumer Fraud Act) 1. 2. Defendant repeats and re-alleges all paragraphs above as if fully set forth herein. Plaintiff or Plaintiff's predecessor in interest engaged in unconscionable

commercial practices, deception, fraud, false pretense, false promise and/or misrepresentations with regard to the subject loan. 3. Alternatively, and/or additionally, Plaintiff or Plaintiff's predecessor in interest

engaged in acts of omission, including but not limited to knowing concealment, suppression and omissions of material facts in connection with the subject loan.

4.

The foregoing acts of Plaintiff constitute violations of New Jersey's Consumer

Fraud Act, et.seq., as a result of which Defendant suffered ascertainable loss.

SECOND COUNT (Violations of the Truth in Lending Act) 1. Defendant repeats and re alleges all paragraphs above as if fully set forth herein.

2.

At all times relevant Plaintiff or Plaintiff's assignor was a creditor under the

federal Truth in Lending Act, 15 U.S.C.A. 1601 et.seq. (TILA) that was required to provide notices of the right to rescind the loan and deliver material disclosures to Defendants. 3. Plaintiff or Plaintiff's alleged assignor failed to comply with TILA by failing to

provide Defendant with proper and accurate written rescission notices and accurate material disclosures as required by TILA. 4. The TILA violations complained of herein were apparent on the face of the

assigned documents, resulting in assignee liability pursuant to 15 U.S.C. 1641(e). 5. In light of these violations, Defendant was and is entitled to rescind the loan.

THIRD COUNT (Defamation of Credit) 1. 2. Defendants repeats and re alleges all paragraphs above as if fully set forth herein. As a direct result of Plaintiff's filing of this lawsuit against Defendant, it has

defamed, ruined and irreparably damaged Defendant's credit as the lawsuit is a matter of the public record.

WHEREFORE, Defendant demands judgment against the Plaintiff as follows: A. B. C. D. Dismissing the Complaint in its entirety with prejudice; Awarding actual and statutory damages, attorney's fees and costs; Declaratory and injunctive relief rescinding and/or reforming the agreement; and Granting such other relief as this Honorable Court deems equitable and just.

DATED: August 2, 2011

__________________________ Earl S. David, Esq.

CERTIFICATION PURSUANT TO RULE 4:5-1 The undersigned does hereby certify that the matter in controversy is not the subject of any other action pending in any other New Jersey Court. There are no pending arbitration proceedings. No other action or arbitration proceedings are contemplated. No non-party is known who would be subject to inclusion or joinder in this case because of potential liability.

DATED:August 3, 2011

__________________________ Earl S. David, Esq.

CERTIFICATION OF MAILING ANSWER TO COURT AND TO THE ATTORNEY FOR THE PLAINTIFF PURSUANT TO RULE 4:6-1(d) I hereby certify that: 1. A copy of the within Answer was filed within the time prescribed by the Rules of Court. 2. On August 3, 2011, the undersigned, mailed to ,Attorneys for Plaintiff, by regular mail, a true copy of the within Answer. I hereby certify that the statements made by me in this document are true. I am aware that ifany are willfully false, I am subject to punishment.

Dated:August 3, 2011 _________________________

Das könnte Ihnen auch gefallen

- Foreclosure - Answer With 27 Affirmative DefensesDokument8 SeitenForeclosure - Answer With 27 Affirmative Defenseswinstons2311100% (5)

- Foreclosure Answer - D. Graham Esq.Dokument8 SeitenForeclosure Answer - D. Graham Esq.winstons2311100% (1)

- Foreclosure Answer and Affirmative DefensesDokument11 SeitenForeclosure Answer and Affirmative Defensesarcfingrp100% (14)

- Defendants' Answer, Affirmative Defenses and CounterclaimsDokument14 SeitenDefendants' Answer, Affirmative Defenses and CounterclaimsMarcy Abitz50% (2)

- Loan Modifications, Foreclosures and Saving Your Home: With an Affordable Loan Modification AgreementVon EverandLoan Modifications, Foreclosures and Saving Your Home: With an Affordable Loan Modification AgreementNoch keine Bewertungen

- Florida Quiet Title Complaint by Kathy Ann Garcia-Lawson (KAGL)Dokument85 SeitenFlorida Quiet Title Complaint by Kathy Ann Garcia-Lawson (KAGL)Bob Hurt60% (5)

- CARLOS AGUIRRE - Quiet Title ActionDokument33 SeitenCARLOS AGUIRRE - Quiet Title Actionprosper4less822075% (4)

- FL Motion To Dismiss Foreclosure Complaint - Failure To Post Cost BondDokument7 SeitenFL Motion To Dismiss Foreclosure Complaint - Failure To Post Cost Bondwinstons2311100% (2)

- April Charney Emergency Motion To Stop Foreclosure Sale 1Dokument10 SeitenApril Charney Emergency Motion To Stop Foreclosure Sale 1winstons2311100% (2)

- Motion To Dismiss or Strike Complaint Lack of VerificationDokument5 SeitenMotion To Dismiss or Strike Complaint Lack of VerificationForeclosure HamletNoch keine Bewertungen

- Amended Response and Objection To Motion For Summary Judgment in ForeclosureDokument20 SeitenAmended Response and Objection To Motion For Summary Judgment in ForeclosureNan EatonNoch keine Bewertungen

- Quantum of Justice - The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall Street: The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall StreetVon EverandQuantum of Justice - The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall Street: The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall StreetNoch keine Bewertungen

- Motion to Cancel Foreclosure Sale Due to Lack of Standing and FraudDokument16 SeitenMotion to Cancel Foreclosure Sale Due to Lack of Standing and FraudNelson Velardo100% (9)

- Dismissed Foreclosure!!Dokument15 SeitenDismissed Foreclosure!!Mortgage Compliance Investigators100% (14)

- Defeat Foreclosure: Save Your House,Your Credit and Your Rights.Von EverandDefeat Foreclosure: Save Your House,Your Credit and Your Rights.Noch keine Bewertungen

- Foreclosure Defense Motion To DismissDokument4 SeitenForeclosure Defense Motion To DismissNick Ekonomides0% (1)

- SUP CT Emergency Motion For StayDokument58 SeitenSUP CT Emergency Motion For StayBarry EskanosNoch keine Bewertungen

- Motion To Set Aside JudgmentDokument8 SeitenMotion To Set Aside JudgmentMike RobinsonNoch keine Bewertungen

- Motion For Rehearing and or ReconsiderationDokument8 SeitenMotion For Rehearing and or ReconsiderationJohn Carroll100% (1)

- Circuit Court Complaint Challenges Wrongful ForeclosureDokument28 SeitenCircuit Court Complaint Challenges Wrongful ForeclosureBarry Eskanos100% (2)

- Fla. Motion To Dismiss1 - Foreclosure - D.Graham Esq.Dokument4 SeitenFla. Motion To Dismiss1 - Foreclosure - D.Graham Esq.winstons2311100% (1)

- Foreclosure Answer Counter Claim DeutschebankDokument38 SeitenForeclosure Answer Counter Claim DeutschebankCharlton ButlerNoch keine Bewertungen

- Superior Court of The State of California County of SacramentoDokument19 SeitenSuperior Court of The State of California County of Sacramentomlkral100% (1)

- Wrongful Foreclosure Complaint - GA StateDokument22 SeitenWrongful Foreclosure Complaint - GA Statewekesamadzimoyo1100% (5)

- Wrongful Foreclosure Xyz ABCDokument37 SeitenWrongful Foreclosure Xyz ABCJanet and James93% (14)

- Action to Quiet Title Against Lender and ServicerDokument6 SeitenAction to Quiet Title Against Lender and ServicerGreg Wilder100% (1)

- Complaint Foreclosure CitiMortgage Template Example OnlyDokument10 SeitenComplaint Foreclosure CitiMortgage Template Example OnlyshelbymachNoch keine Bewertungen

- DEFENDANTS REsponse To Motion For Summary JudgementDokument1 SeiteDEFENDANTS REsponse To Motion For Summary Judgementkwhite6734Noch keine Bewertungen

- American Foreclosure: Everything U Need to Know About Preventing and BuyingVon EverandAmerican Foreclosure: Everything U Need to Know About Preventing and BuyingNoch keine Bewertungen

- How To Answer A Foreclosure LawsuitDokument5 SeitenHow To Answer A Foreclosure LawsuitRicharnellia-RichieRichBattiest-Collins100% (1)

- Court Documents Request for Mortgage CaseDokument5 SeitenCourt Documents Request for Mortgage CaseNick Ekonomides100% (1)

- Lis Pendens SampleDokument1 SeiteLis Pendens Samplemonicagraham100% (2)

- Response To Motion For Summary Judgment of Foreclosure (Florida)Dokument11 SeitenResponse To Motion For Summary Judgment of Foreclosure (Florida)Robert Lee Chaney86% (7)

- CASE NO 812-cv-690-T-26EAJDokument12 SeitenCASE NO 812-cv-690-T-26EAJForeclosure Fraud100% (1)

- Foreclosure Fraud Complaint Vs Wells FargoDokument61 SeitenForeclosure Fraud Complaint Vs Wells FargoDavid StarkeyNoch keine Bewertungen

- Motion To Set AsideDokument17 SeitenMotion To Set AsideRaoul Clymer100% (5)

- Mortgage Fraud Lawsuits 2-19-2014Dokument87 SeitenMortgage Fraud Lawsuits 2-19-2014Kelly L. HansenNoch keine Bewertungen

- FLORIDA Foreclosure Bench Book2013Dokument98 SeitenFLORIDA Foreclosure Bench Book2013lauren5maria100% (1)

- Chain of Title: How Three Ordinary Americans Uncovered Wall Street’s Great Foreclosure FraudVon EverandChain of Title: How Three Ordinary Americans Uncovered Wall Street’s Great Foreclosure FraudBewertung: 3 von 5 Sternen3/5 (1)

- Foreclosure Overturned Due To Faulty AssignmentDokument3 SeitenForeclosure Overturned Due To Faulty Assignmentdivinaw100% (1)

- Memorandum in Opposition To Summary Judgment Harley 11 2009Dokument13 SeitenMemorandum in Opposition To Summary Judgment Harley 11 2009AC Field100% (2)

- Motion To Cancel SaleDokument26 SeitenMotion To Cancel SaleHolly LeeNoch keine Bewertungen

- WRONGFUL Foreclosure Action NOTICE JeaDokument19 SeitenWRONGFUL Foreclosure Action NOTICE JeaAlbertelli_Law100% (1)

- Foreclosure DefenseDokument80 SeitenForeclosure Defense83jjmack100% (8)

- Quiet TitleDokument8 SeitenQuiet TitleJOSHUA TASK100% (3)

- Florida Motion Set Aside JudgmentDokument7 SeitenFlorida Motion Set Aside Judgmentwinstons2311100% (1)

- Motion To DismissDokument13 SeitenMotion To Dismissnationalmtghelp100% (2)

- JSC First Amended Complaint For Wrongful ForeclosureDokument22 SeitenJSC First Amended Complaint For Wrongful Foreclosurejsconrad12100% (1)

- Quiet Title Actions in CaliforniaDokument7 SeitenQuiet Title Actions in Californiadsnetwork100% (2)

- HSBC Verified Answer: FRAUDDokument20 SeitenHSBC Verified Answer: FRAUDHarry DavidoffNoch keine Bewertungen

- MERS Case Law - MERS Milestone ReportDokument10 SeitenMERS Case Law - MERS Milestone Reportwinstons231150% (2)

- Post-Foreclosure Complaint Plaintiff)Dokument48 SeitenPost-Foreclosure Complaint Plaintiff)tmccand100% (1)

- Sample Answer Foreclosure Defense New JerseyDokument15 SeitenSample Answer Foreclosure Defense New Jerseyjorg100% (2)

- Circuit Court Case Over Deutsche Bank ForeclosureDokument42 SeitenCircuit Court Case Over Deutsche Bank ForeclosureMackLawfirmNoch keine Bewertungen

- Sample Motion For Dismissal of Summary JudgmentDokument2 SeitenSample Motion For Dismissal of Summary JudgmentStanley Ford100% (1)

- Answer and Counterclaim - (If Being Sued)Dokument6 SeitenAnswer and Counterclaim - (If Being Sued)Jacqueline Graham0% (1)

- 18th Circuit Court DocumentDokument11 Seiten18th Circuit Court DocumentwicholacayoNoch keine Bewertungen

- NOA, Answer (Cicchino)Dokument7 SeitenNOA, Answer (Cicchino)smithjust2A100% (1)

- Ad 8-14-11Dokument1 SeiteAd 8-14-11jack1929Noch keine Bewertungen

- Earl S. David: Attorney at LawDokument4 SeitenEarl S. David: Attorney at Lawjack1929Noch keine Bewertungen

- Cover Letter and Brief To Court For Foreclosure Defense 8-16-11Dokument3 SeitenCover Letter and Brief To Court For Foreclosure Defense 8-16-11jack1929Noch keine Bewertungen

- Cover Letter and Brief To Court 08-15-11 12-30 Am - 10Dokument2 SeitenCover Letter and Brief To Court 08-15-11 12-30 Am - 10jack1929Noch keine Bewertungen

- Stipulation of Dismissal 2011 - 02!15!16!52!26Dokument1 SeiteStipulation of Dismissal 2011 - 02!15!16!52!26jack1929Noch keine Bewertungen

- Gmac v. Boots F-33406-08 Default VacatedDokument2 SeitenGmac v. Boots F-33406-08 Default Vacatedjack1929Noch keine Bewertungen

- New Jersey Court - BONY V Elghossain - Paintiff Must Name LenderDokument6 SeitenNew Jersey Court - BONY V Elghossain - Paintiff Must Name LenderAsburyParkHistorianNoch keine Bewertungen

- Ad On ScribdDokument1 SeiteAd On Scribdjack1929Noch keine Bewertungen

- Chase v. Mordechai Cohen Judgment Vacated FileDokument3 SeitenChase v. Mordechai Cohen Judgment Vacated Filejack1929Noch keine Bewertungen

- Earl S. David: Attorney at LawDokument4 SeitenEarl S. David: Attorney at Lawjack1929Noch keine Bewertungen

- Earl S. David: Attorney at LawDokument3 SeitenEarl S. David: Attorney at Lawjack1929Noch keine Bewertungen

- Trop Opposition MotionDokument11 SeitenTrop Opposition Motionjack1929Noch keine Bewertungen

- Shira Brief 21044-10Dokument3 SeitenShira Brief 21044-10jack1929Noch keine Bewertungen

- Legal Memorandum in Opposition To Motion To Strike Defendants Answer Us Bank v. Trop 2-8-11 F-F-28757-10Dokument10 SeitenLegal Memorandum in Opposition To Motion To Strike Defendants Answer Us Bank v. Trop 2-8-11 F-F-28757-10jack1929100% (1)

- Tracy Boots Certification in Support of Motion 10-27-10Dokument4 SeitenTracy Boots Certification in Support of Motion 10-27-10jack1929Noch keine Bewertungen

- Mordechai Cohen Certificaiton in Support of MotionDokument3 SeitenMordechai Cohen Certificaiton in Support of Motionjack1929Noch keine Bewertungen

- Certification Chaim Friedman 9-19-10Dokument6 SeitenCertification Chaim Friedman 9-19-10Brendon StevensNoch keine Bewertungen

- Trop Opposition MotionDokument11 SeitenTrop Opposition Motionjack1929Noch keine Bewertungen

- CTS experiments comparisonDokument2 SeitenCTS experiments comparisonmanojkumarNoch keine Bewertungen

- Department of Ece Vjec 1Dokument29 SeitenDepartment of Ece Vjec 1Surangma ParasharNoch keine Bewertungen

- Database Chapter 11 MCQs and True/FalseDokument2 SeitenDatabase Chapter 11 MCQs and True/FalseGauravNoch keine Bewertungen

- Employee Central Payroll PDFDokument4 SeitenEmployee Central Payroll PDFMohamed ShanabNoch keine Bewertungen

- Journal Publication FormatDokument37 SeitenJournal Publication FormatAbreo Dan Vincent AlmineNoch keine Bewertungen

- Diagnostic Information For Database Replay IssuesDokument10 SeitenDiagnostic Information For Database Replay IssuesjjuniorlopesNoch keine Bewertungen

- Trinath Chigurupati, A095 576 649 (BIA Oct. 26, 2011)Dokument13 SeitenTrinath Chigurupati, A095 576 649 (BIA Oct. 26, 2011)Immigrant & Refugee Appellate Center, LLCNoch keine Bewertungen

- Asian Construction Dispute Denied ReviewDokument2 SeitenAsian Construction Dispute Denied ReviewJay jogs100% (2)

- Magnetism 02Dokument10 SeitenMagnetism 02Niharika DeNoch keine Bewertungen

- ANDRITZ Company Presentation eDokument6 SeitenANDRITZ Company Presentation eAnonymous OuY6oAMggxNoch keine Bewertungen

- Pig PDFDokument74 SeitenPig PDFNasron NasirNoch keine Bewertungen

- EDI810Dokument11 SeitenEDI810ramcheran2020Noch keine Bewertungen

- Bancassurance Black Book Rahul 777-2Dokument62 SeitenBancassurance Black Book Rahul 777-2Shubham ShahNoch keine Bewertungen

- Deed of Sale - Motor VehicleDokument4 SeitenDeed of Sale - Motor Vehiclekyle domingoNoch keine Bewertungen

- DHPL Equipment Updated List Jan-22Dokument16 SeitenDHPL Equipment Updated List Jan-22jairamvhpNoch keine Bewertungen

- (SIRI Assessor Training) AM Guide Book - v2Dokument19 Seiten(SIRI Assessor Training) AM Guide Book - v2hadeelNoch keine Bewertungen

- How To Make Money in The Stock MarketDokument40 SeitenHow To Make Money in The Stock Markettcb66050% (2)

- Conversion of Units of Temperature - Wikipedia, The Free Encyclopedia PDFDokument7 SeitenConversion of Units of Temperature - Wikipedia, The Free Encyclopedia PDFrizal123Noch keine Bewertungen

- WitepsolDokument21 SeitenWitepsolAnastasius HendrianNoch keine Bewertungen

- Software EngineeringDokument3 SeitenSoftware EngineeringImtiyaz BashaNoch keine Bewertungen

- Victor's Letter Identity V Wiki FandomDokument1 SeiteVictor's Letter Identity V Wiki FandomvickyNoch keine Bewertungen

- Operation Roman Empire Indictment Part 1Dokument50 SeitenOperation Roman Empire Indictment Part 1Southern California Public RadioNoch keine Bewertungen

- Green Management: Nestlé's Approach To Green Management 1. Research and DevelopmentDokument6 SeitenGreen Management: Nestlé's Approach To Green Management 1. Research and DevelopmentAbaidullah TanveerNoch keine Bewertungen

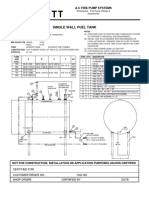

- Single Wall Fuel Tank: FP 2.7 A-C Fire Pump SystemsDokument1 SeiteSingle Wall Fuel Tank: FP 2.7 A-C Fire Pump Systemsricardo cardosoNoch keine Bewertungen

- Mini Ice Plant Design GuideDokument4 SeitenMini Ice Plant Design GuideDidy RobotIncorporatedNoch keine Bewertungen

- AE383LectureNotes PDFDokument105 SeitenAE383LectureNotes PDFPoyraz BulutNoch keine Bewertungen

- Milton Hershey's Sweet StoryDokument10 SeitenMilton Hershey's Sweet Storysharlene sandovalNoch keine Bewertungen

- Department Order No 05-92Dokument3 SeitenDepartment Order No 05-92NinaNoch keine Bewertungen

- 6vortex 20166523361966663Dokument4 Seiten6vortex 20166523361966663Mieczysław MichalczewskiNoch keine Bewertungen

- CSEC IT Fundamentals of Hardware and SoftwareDokument2 SeitenCSEC IT Fundamentals of Hardware and SoftwareR.D. Khan100% (1)