Beruflich Dokumente

Kultur Dokumente

RG1 Excise Concept

Hochgeladen von

Shobhit KastuarOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

RG1 Excise Concept

Hochgeladen von

Shobhit KastuarCopyright:

Verfügbare Formate

Excise Liability-Theory: 1. If anyone produces a material WHICH IS DECLARED AS MANUFACTURE IN EXCISE LAW then he is liable for Excise duty.

2. When the manufactured materials LEAVE THE FACTORY PREMISES (Stock transfer to depot/Sale from factory) or terminated...-like scrapping/theft- the liable excise duty shall be paid (Thru Cash (PLA)/By Adjustment of Cenvat on inputs (Raw material or Capital Goods)/Services. etc ((Due date= By next month 5th from time of goods leaving the factory ). 3. To keep REGISTER (RG1) with track of Quantity movements (Like as of Part1),Assessable value for excise duty and value of Excise duty (Like as of part2) Excise Liability-SAP: i. In SAP material will be declared as RG1 relevant material. ii. In SAP Movement type will be declared as RG1 relevant material. Only if both the conditions are fulfilled it is relevant for RG1. iii. In SAP Manufacturing Plant will be declared as excise unit. Only if all the conditions are fulfilled it is relevant for RG1. iv. No relevance to storage location except that it helps in filtering the records relevant for RG1. iv. Based on business scenario-appropriate movement type, transaction code will be used- Based on these System determines excise transaction type. Also appropriate excise group, sub transaction type, company code will be entered at the time of data entry. GL is linked to- Excise transaction type account determination logic & Excise Group/sub transaction type/company code entered at the time of Data Entry. Process 1. How/When the material will come to RG1 register? 2. How/When material will go out of RG1 register? 3. How/When the material will come to SAP MM module? 4. How/When the materials go out of SAP MM module? 5. Which transaction code and movement type to be used? 6. How excise transaction type is determined? 7. How the GL is determined?

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- RMH 10 Scion of DarknessDokument31 SeitenRMH 10 Scion of DarknessSteve stone100% (3)

- Commercial Law Notes PDFDokument19 SeitenCommercial Law Notes PDFJinal SanghviNoch keine Bewertungen

- My CertificateDokument1 SeiteMy CertificateIAA Surgical Instruments Co.Noch keine Bewertungen

- FCL1 2010R3 PDFDokument12 SeitenFCL1 2010R3 PDFsunil kumarNoch keine Bewertungen

- 2007 PNP Disciplinary Rules of ProcedureDokument33 Seiten2007 PNP Disciplinary Rules of Procedure...Noch keine Bewertungen

- Accreditation Process PresentationDokument14 SeitenAccreditation Process PresentationEdward Dean CarataoNoch keine Bewertungen

- Declaraciòn Jurada ModeloDokument1 SeiteDeclaraciòn Jurada ModelostephanieNoch keine Bewertungen

- PNB vs. Ritratto Group, IncDokument3 SeitenPNB vs. Ritratto Group, IncOrlando DatangelNoch keine Bewertungen

- Corporations Barzuza Spring 2011Dokument46 SeitenCorporations Barzuza Spring 2011Chippu AnhNoch keine Bewertungen

- Student Consolidated Oral Reading Profile (English)Dokument2 SeitenStudent Consolidated Oral Reading Profile (English)Angel Nicolin SuymanNoch keine Bewertungen

- Indian Evidence Act, 1872 Section 101 Section 111Dokument11 SeitenIndian Evidence Act, 1872 Section 101 Section 111Kanishk BansalNoch keine Bewertungen

- Cases Labor 3rd BatchDokument340 SeitenCases Labor 3rd BatchBillie Balbastre-RoxasNoch keine Bewertungen

- Defamation Against LawyerDokument5 SeitenDefamation Against LawyerRyan AcostaNoch keine Bewertungen

- 7a.simple InterestDokument50 Seiten7a.simple InterestJanani MaranNoch keine Bewertungen

- Airvac Operations ManualDokument12 SeitenAirvac Operations ManualArbortoolsNoch keine Bewertungen

- Tenderdocmanderial PDFDokument27 SeitenTenderdocmanderial PDFVeena NageshNoch keine Bewertungen

- The Language of Legal DocumentsDokument15 SeitenThe Language of Legal DocumentsAldo CokaNoch keine Bewertungen

- Cic Aeeso A 2022 132674Dokument2 SeitenCic Aeeso A 2022 132674Utkarsh JoshiNoch keine Bewertungen

- Public Safety and Security LandscapeDokument7 SeitenPublic Safety and Security LandscapePJr MilleteNoch keine Bewertungen

- UN Charter (Full Text) : We The Peoples of The United Nations DeterminedDokument20 SeitenUN Charter (Full Text) : We The Peoples of The United Nations DeterminedRengie GaloNoch keine Bewertungen

- Basic MP3 License AgreementDokument5 SeitenBasic MP3 License AgreementThe Real Velocity FilmsNoch keine Bewertungen

- Asiatic Petroleum Co. Ltd. v. LlanesDokument6 SeitenAsiatic Petroleum Co. Ltd. v. LlanesJuls EspyNoch keine Bewertungen

- G.R. No. L-40486Dokument7 SeitenG.R. No. L-40486Sheena PagoNoch keine Bewertungen

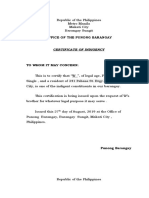

- Office of The Punong BarangayDokument4 SeitenOffice of The Punong Barangayfergie1trinidad100% (1)

- Guanzon vs. de VillaDokument26 SeitenGuanzon vs. de VillaArthur TalastasNoch keine Bewertungen

- 1st Technology LLC v. Rational Enterprises Ltda. Et Al - Document No. 25Dokument1 Seite1st Technology LLC v. Rational Enterprises Ltda. Et Al - Document No. 25Justia.comNoch keine Bewertungen

- FINAL EXAM (Police Blotter)Dokument17 SeitenFINAL EXAM (Police Blotter)Santa Caressa LoquillanoNoch keine Bewertungen

- Equipment: Chapter 25: PROPERTY, PLANT &Dokument4 SeitenEquipment: Chapter 25: PROPERTY, PLANT &Czar RabayaNoch keine Bewertungen

- Catalog Double Door Elevator VES SDDokument206 SeitenCatalog Double Door Elevator VES SDsorangel_123Noch keine Bewertungen

- Santa Cruz Et Al V City of San Jose Et Al Candce-20-00351 0001.0Dokument30 SeitenSanta Cruz Et Al V City of San Jose Et Al Candce-20-00351 0001.0Carlos Miller100% (2)