Beruflich Dokumente

Kultur Dokumente

Excel Margin Call Calculations

Hochgeladen von

api-27174321100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

4K Ansichten1 SeiteOriginaltitel

Excel > Margin Call Calculations

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

XLS, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als XLS, PDF, TXT herunterladen oder online auf Scribd lesen

100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

4K Ansichten1 SeiteExcel Margin Call Calculations

Hochgeladen von

api-27174321Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als XLS, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

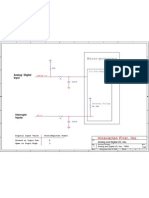

Margin Call Examples

Example 1 Example 2 Example 3 Example 4 Example 5

Initial Portfolio Value 20,000 50,000 100,000 75,000 12,000

Your Initial Equity (Margin) 10,000 30,000 50,000 40,000 10,000

Maintenance Margin Requirement 25% 30% 30% 35% 30%

Portfolio Value to Trigger Margin Call 13,333.33 28,571.43 71,428.57 53,846.15 2,857.14

Your Equity at Time of Margin Call 3,333.33 8,571.43 21,428.57 18,846.15 857.14

Portfolio % Loss at Time of Margin Call 33.33% 42.86% 28.57% 28.21% 76.19%

To figure the portfolio value that will

trigger a margin call:

IM % −1

V2 = ×V1

MM % −1

Where:

IM% = Initial Equity as a % of Portfolio Value

MM% = Required Minimum Equity %

V1 = Initial Value of Portfolio

V2 = Portfolio Value To Trigger Margin Call

Das könnte Ihnen auch gefallen

- IPO and SEOsDokument30 SeitenIPO and SEOsXinwei YeNoch keine Bewertungen

- Fixed Income Bond Trading 1999 - Rich-Cheap & Relative ValueDokument38 SeitenFixed Income Bond Trading 1999 - Rich-Cheap & Relative Valueapi-27174321100% (1)

- Term Sheet For Intercreditor Agreement 1.21Dokument4 SeitenTerm Sheet For Intercreditor Agreement 1.21Helpin HandNoch keine Bewertungen

- LC Form Agent AgreementDokument4 SeitenLC Form Agent AgreementMsTiaPerfectoNoch keine Bewertungen

- Asset Backed Commercial Paper Criteria ReportDokument33 SeitenAsset Backed Commercial Paper Criteria Reported_nycNoch keine Bewertungen

- Information MemorandumDokument29 SeitenInformation MemorandumAditya Lakhani100% (1)

- Securitisation Primer and Analysis of A Financial Technique: Andrea Durante November 2010Dokument25 SeitenSecuritisation Primer and Analysis of A Financial Technique: Andrea Durante November 2010Emmanuele Orospies SpadaroNoch keine Bewertungen

- CMBS Pitchbook Ver 1 13112011Dokument17 SeitenCMBS Pitchbook Ver 1 13112011Rashdan IbrahimNoch keine Bewertungen

- Series Seed Term Sheet (v2)Dokument2 SeitenSeries Seed Term Sheet (v2)zazenNoch keine Bewertungen

- Loot - Convertible Picus Countersigned PDFDokument10 SeitenLoot - Convertible Picus Countersigned PDFPaul LangemeyerNoch keine Bewertungen

- Chapter 7 InventoriesDokument5 SeitenChapter 7 InventoriesJoyce Mae D. FloresNoch keine Bewertungen

- Aladdin Synthetic CDO II, Offering MemorandumDokument216 SeitenAladdin Synthetic CDO II, Offering Memorandumthe_akinitiNoch keine Bewertungen

- CLO Investing: With an Emphasis on CLO Equity & BB NotesVon EverandCLO Investing: With an Emphasis on CLO Equity & BB NotesNoch keine Bewertungen

- PPPs HYIP Explained.Dokument18 SeitenPPPs HYIP Explained.FjbatisNoch keine Bewertungen

- Case 03Dokument21 SeitenCase 03Anonymous CmcvwSgkNoch keine Bewertungen

- Advanced Option Risk ManagementDokument97 SeitenAdvanced Option Risk Managementvenkraj_iitm100% (2)

- Leverage Capital Group - ProfileDokument23 SeitenLeverage Capital Group - Profileanon_601430920Noch keine Bewertungen

- Fundamentals of Private Equity Deal StructuringDokument39 SeitenFundamentals of Private Equity Deal StructuringRahul KhuranaNoch keine Bewertungen

- JAT IPO - Teaser - June2021Dokument10 SeitenJAT IPO - Teaser - June2021cpasl123Noch keine Bewertungen

- Sap MM - ASAPDokument7 SeitenSap MM - ASAPraoraj78100% (1)

- SREI Infrastructure Bond Application FormDokument8 SeitenSREI Infrastructure Bond Application FormPrajna CapitalNoch keine Bewertungen

- External Commercial BorrowingDokument14 SeitenExternal Commercial BorrowingKK SinghNoch keine Bewertungen

- Services Marketing Become Difficult Because ofDokument10 SeitenServices Marketing Become Difficult Because ofDrAbhishek SarafNoch keine Bewertungen

- 2.5 CC Trade ReceivablesDokument36 Seiten2.5 CC Trade ReceivablesDaefnate KhanNoch keine Bewertungen

- Commercial Credit Insurance PDFDokument3 SeitenCommercial Credit Insurance PDFvinaysekhar0% (1)

- European Private Placement Platform PDFDokument2 SeitenEuropean Private Placement Platform PDFMalikNoch keine Bewertungen

- Fin FSCM CCD 3Dokument4 SeitenFin FSCM CCD 3car_pierreNoch keine Bewertungen

- Loi Sha009 GicDokument2 SeitenLoi Sha009 GicgreenindiacargoplNoch keine Bewertungen

- New York Placement ListDokument4 SeitenNew York Placement ListDan Primack100% (1)

- Derivatives Equity DerivativesDokument31 SeitenDerivatives Equity Derivativesapi-27174321100% (1)

- 02 - International Corporate Joint VentureDokument19 Seiten02 - International Corporate Joint VentureMatías Sebastián DíazNoch keine Bewertungen

- Term Sheet: Business) (Business)Dokument10 SeitenTerm Sheet: Business) (Business)arvindNoch keine Bewertungen

- AMFI Questionnaire For Due DiligenceDokument7 SeitenAMFI Questionnaire For Due DiligenceHarish Ruparel100% (2)

- Odoo Partnership AgreementDokument7 SeitenOdoo Partnership AgreementFarooq ArifNoch keine Bewertungen

- Rajiv ShahDokument32 SeitenRajiv ShahRajiv ShahNoch keine Bewertungen

- Risk & Procure Management ExampleDokument27 SeitenRisk & Procure Management ExampleShaji Viswanathan. Mcom, MBA (U.K)Noch keine Bewertungen

- Skadden Letter March 31Dokument4 SeitenSkadden Letter March 31ForkLogNoch keine Bewertungen

- The Locked Box MechanismDokument3 SeitenThe Locked Box MechanismAnish NairNoch keine Bewertungen

- Step by Step Process of Letter of CreditDokument1 SeiteStep by Step Process of Letter of CreditDhoni KhanNoch keine Bewertungen

- Aid For Trade Needs Assessments Regional ReviewDokument106 SeitenAid For Trade Needs Assessments Regional ReviewUNDP in Europe and Central AsiaNoch keine Bewertungen

- Executive Summary Business PlanDokument3 SeitenExecutive Summary Business PlanMama ChamNoch keine Bewertungen

- IFX Affiliate AgreementDokument14 SeitenIFX Affiliate AgreementKalanda HabibNoch keine Bewertungen

- Fatca Strawman v1.15Dokument18 SeitenFatca Strawman v1.15sauravhwasiaNoch keine Bewertungen

- Trade Finance - Week 7-2Dokument15 SeitenTrade Finance - Week 7-2subash1111@gmail.comNoch keine Bewertungen

- Homework Chapter 6Dokument19 SeitenHomework Chapter 6Trung Kiên NguyễnNoch keine Bewertungen

- Volans 2007-1 CDO Term SheetDokument4 SeitenVolans 2007-1 CDO Term Sheetthe_akinitiNoch keine Bewertungen

- UnderwritingDokument3 SeitenUnderwritingkalidharNoch keine Bewertungen

- Hedge Fund Business Plan PDFDokument98 SeitenHedge Fund Business Plan PDFMarius AngaraNoch keine Bewertungen

- Spartina Convertible Note MemoDokument6 SeitenSpartina Convertible Note MemospartinaNoch keine Bewertungen

- Investment Banking Fees Examined WhitepaperDokument5 SeitenInvestment Banking Fees Examined WhitepaperKyle SitlerNoch keine Bewertungen

- Contingent Value Rights (CVRS) : Igor Kirman and Victor Goldfeld, Wachtell, Lipton, Rosen & KatzDokument12 SeitenContingent Value Rights (CVRS) : Igor Kirman and Victor Goldfeld, Wachtell, Lipton, Rosen & KatzTara SinhaNoch keine Bewertungen

- CMO Monetization SummaryDokument7 SeitenCMO Monetization Summarygalindo07Noch keine Bewertungen

- CFIRA Response To Investor Advisory CommitteeDokument3 SeitenCFIRA Response To Investor Advisory CommitteeCrowdfundInsiderNoch keine Bewertungen

- NCNDA (Agreement)Dokument3 SeitenNCNDA (Agreement)Frances OgboluNoch keine Bewertungen

- Estafa 3Dokument1 SeiteEstafa 3Ojo-publico.comNoch keine Bewertungen

- Standard Agreement Engagement Letter For Municipal Advisory ServicesDokument2 SeitenStandard Agreement Engagement Letter For Municipal Advisory ServicesArif ShaikhNoch keine Bewertungen

- Term Sheet: NBAD GCC Opportunities Fund (AJAJ)Dokument12 SeitenTerm Sheet: NBAD GCC Opportunities Fund (AJAJ)gaceorNoch keine Bewertungen

- Rankingball Token Sale AgreementDokument7 SeitenRankingball Token Sale AgreementCharles ChangNoch keine Bewertungen

- SBLC & Advance Performance Guarantee (Apg)Dokument11 SeitenSBLC & Advance Performance Guarantee (Apg)Jasvinder Kaur100% (1)

- SBLC MT760 - DraftDokument2 SeitenSBLC MT760 - DraftTushar SharmaNoch keine Bewertungen

- Securitization of IPDokument8 SeitenSecuritization of IPKirthi Srinivas GNoch keine Bewertungen

- SAMPLE Master Distribution Agreement DRAFT 042213 (3) - 1Dokument17 SeitenSAMPLE Master Distribution Agreement DRAFT 042213 (3) - 1Syed Muhammad HassanNoch keine Bewertungen

- Growth Lending Guide BOOST and Co Apr19Dokument31 SeitenGrowth Lending Guide BOOST and Co Apr19Ilya HoffmanNoch keine Bewertungen

- Mandate TemplateDokument6 SeitenMandate TemplateStephenNoch keine Bewertungen

- Private Placement Term Sheet PDFDokument2 SeitenPrivate Placement Term Sheet PDFsigitsutoko8765100% (1)

- Arbitrage PDFDokument60 SeitenArbitrage PDFdan4everNoch keine Bewertungen

- Lbo Model Short FormDokument4 SeitenLbo Model Short FormAkash PrasadNoch keine Bewertungen

- Introduction To Derivatives: B. B. ChakrabartiDokument34 SeitenIntroduction To Derivatives: B. B. ChakrabartiSiddharth AgarwalNoch keine Bewertungen

- Dolphin TrustDokument4 SeitenDolphin TrustErick JoseNoch keine Bewertungen

- Index ofDokument1 SeiteIndex ofapi-27174321Noch keine Bewertungen

- Fixed Income SecuritiesDokument103 SeitenFixed Income Securitiesaru1977Noch keine Bewertungen

- Interest Rate ModelsDokument109 SeitenInterest Rate ModelsJessica HendersonNoch keine Bewertungen

- Basis Trading BasicsDokument51 SeitenBasis Trading BasicsTajinder SinghNoch keine Bewertungen

- Eco No Metrics Forecasting 1999 - NonLinear DynamicsDokument43 SeitenEco No Metrics Forecasting 1999 - NonLinear Dynamicsapi-27174321Noch keine Bewertungen

- Fixed Income Bond Trading 1999 - Bonds With Embedded OptionsDokument26 SeitenFixed Income Bond Trading 1999 - Bonds With Embedded Optionsapi-27174321Noch keine Bewertungen

- Derivatives Equity Linked DebtDokument28 SeitenDerivatives Equity Linked Debtapi-27174321Noch keine Bewertungen

- Option Risk ManagementDokument44 SeitenOption Risk ManagementThanh Tam LuuNoch keine Bewertungen

- Derivatives - Option ValuationDokument73 SeitenDerivatives - Option ValuationBala MuruganNoch keine Bewertungen

- Vex Analog Digital InputDokument1 SeiteVex Analog Digital Inputapi-27174321Noch keine Bewertungen

- Lego Story TellingDokument6 SeitenLego Story Tellingapi-27174321100% (1)

- Socialism and International Economic OrderDokument316 SeitenSocialism and International Economic OrderchovsonousNoch keine Bewertungen

- Socialism and Religion: PREFACE To The Second Edition (1911)Dokument19 SeitenSocialism and Religion: PREFACE To The Second Edition (1911)api-27174321Noch keine Bewertungen

- Director VP Business Development in Chicago IL Resume Steven HepburnDokument3 SeitenDirector VP Business Development in Chicago IL Resume Steven HepburnStevenHepburnNoch keine Bewertungen

- Final MBA - 3rd Semester-22Dokument38 SeitenFinal MBA - 3rd Semester-22rajjurajnish0% (1)

- Lecture 2 - Identifying Customer NeedsDokument29 SeitenLecture 2 - Identifying Customer NeedsYash MaullooNoch keine Bewertungen

- 06 in TC Pim BulletinDokument16 Seiten06 in TC Pim Bulletintanto_deep_15Noch keine Bewertungen

- 1 Running Head: The Strategic Change CycleDokument11 Seiten1 Running Head: The Strategic Change CycleStephanie ElliottNoch keine Bewertungen

- Starbucks Case Study AnswersDokument3 SeitenStarbucks Case Study AnswersTrisha Lionel100% (1)

- ZACL Annual Report 2022 FinalDokument115 SeitenZACL Annual Report 2022 FinalStefano PatoneNoch keine Bewertungen

- Chapter 3Dokument27 SeitenChapter 3Roseanne YumangNoch keine Bewertungen

- Chapter 4 ISP640Dokument19 SeitenChapter 4 ISP640nadiah2kawaiiNoch keine Bewertungen

- Construction Project ManagementDokument59 SeitenConstruction Project ManagementSanthosh KumarNoch keine Bewertungen

- Resource AllocationDokument3 SeitenResource AllocationSukesh R50% (2)

- mkt-623 Chapter 2Dokument18 Seitenmkt-623 Chapter 2PrincessNoch keine Bewertungen

- Lesson #4Dokument2 SeitenLesson #4mrshojaeeNoch keine Bewertungen

- Open Door PolicyDokument14 SeitenOpen Door PolicyStephanny SylvesterNoch keine Bewertungen

- Final Project of BSPDokument6 SeitenFinal Project of BSPMuhammad Ali KhanNoch keine Bewertungen

- Life Cycle CostingDokument3 SeitenLife Cycle Costingaryan_007_kshatriyNoch keine Bewertungen

- Shivika SIP InterimDokument19 SeitenShivika SIP InterimShivika AroraNoch keine Bewertungen

- Kline 2017Dokument10 SeitenKline 2017OsamaIbrahimNoch keine Bewertungen

- Profile Final MSD Tire and Rubber CompanyDokument11 SeitenProfile Final MSD Tire and Rubber CompanySinggih FatkhurohmanNoch keine Bewertungen

- CMPM 1Dokument9 SeitenCMPM 1Cuttie Anne GalangNoch keine Bewertungen

- Location StrategyDokument67 SeitenLocation StrategyGautam JrNoch keine Bewertungen

- Driving Growth Though Distribution Strategy and Sales ManagementDokument27 SeitenDriving Growth Though Distribution Strategy and Sales ManagementAkshay ChadhaNoch keine Bewertungen