Beruflich Dokumente

Kultur Dokumente

Soverein Bonds

Hochgeladen von

comploreOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Soverein Bonds

Hochgeladen von

comploreCopyright:

Verfügbare Formate

What is Sovereign Debt?

Before knowing about the sovereign debt, you must know about the other two terms Sovereign Bond and Government Bond. Government Bonds Bonds are debt instruments issued by the government, banks, companies to raise t he money from public. This money will be used for meeting the future expenses, e xpansion plans for the companies, building infrastructure for the country, etc. In short, the bond holders are the lenders to the bond issuers. When government is in short of money, it will issue the bonds in its local curre ncy or the international currency. If the bonds are in the local currency, it is called as the Government Bonds. People would be more interested in buying the g overnment bonds because of its high security and returns are assured. It is a fi xed income instrument. Bond holders would receive the specified interest income on the specified periods. The principal amount will be returned at the time of m aturity. The government bonds are categorized based on the tenure of the bonds. * Government Bills: Bonds with maturity period of less than one year. * Government Notes: Bonds with maturity period of one year to ten years. * Government Bonds: Bonds with maturity period of more than ten years Sovereign Bonds I hope now you have understood the government bonds. As I have mentioned in the above section, government bonds are issued in the local currency. The main diffe rence between government bonds and sovereign bonds are the issuing currency. Sov ereign bonds are issued in the international currency and it can be sold to the other countries and foreign investors. It is very common that when a country nee ds huge capital to support the spending, it can borrow money from other countrie s by issuing the sovereign bonds. It has to pay the interest money on specific p eriod and principal amount on the maturity period. Now you must have got the basic idea on the sovereign debt by reading the above section about sovereign bonds. Sovereign debt is bonds sold to other countries or money borrowed from outside (it is equivalent of borrowing money from other c ountries or public) to meet the country s spending. It has to be repaid on the mat urity and will have to pay the interest for that borrowings. This will grow by s ize if a country can not increase the income from taxes because of economic grow th is very slow.

Das könnte Ihnen auch gefallen

- UntitledDokument1 SeiteUntitledcomploreNoch keine Bewertungen

- UntitledDokument1 SeiteUntitledcomploreNoch keine Bewertungen

- Sachin Jain MarketingDokument3 SeitenSachin Jain MarketingcomploreNoch keine Bewertungen

- Setting Up A Maven RepositoryDokument12 SeitenSetting Up A Maven RepositorycomploreNoch keine Bewertungen

- CAT 2009 Quant QuestionsDokument3 SeitenCAT 2009 Quant QuestionscomploreNoch keine Bewertungen

- CAT 2009 Quant QuestionsDokument3 SeitenCAT 2009 Quant QuestionscomploreNoch keine Bewertungen

- CAT 2009 Quant QuestionsDokument3 SeitenCAT 2009 Quant QuestionscomploreNoch keine Bewertungen

- CfaDokument1 SeiteCfacomploreNoch keine Bewertungen

- NITINJAIN BuildandReleaseDokument5 SeitenNITINJAIN BuildandReleasecomploreNoch keine Bewertungen

- CAT 2009 Quant QuestionsDokument3 SeitenCAT 2009 Quant QuestionscomploreNoch keine Bewertungen

- CAT 2009 Quant QuestionsDokument3 SeitenCAT 2009 Quant QuestionscomploreNoch keine Bewertungen

- CAT 2009 Quant QuestionsDokument3 SeitenCAT 2009 Quant QuestionscomploreNoch keine Bewertungen

- Cat RC4Dokument3 SeitenCat RC4comploreNoch keine Bewertungen

- CAT 2009 Quant QuestionsDokument3 SeitenCAT 2009 Quant QuestionscomploreNoch keine Bewertungen

- CAT Quant24Dokument3 SeitenCAT Quant24comploreNoch keine Bewertungen

- CAT 2009 Quant QuestionsDokument3 SeitenCAT 2009 Quant QuestionscomploreNoch keine Bewertungen

- CAT 2009 Quant QuestionsDokument3 SeitenCAT 2009 Quant QuestionscomploreNoch keine Bewertungen

- CAT Quant18Dokument3 SeitenCAT Quant18comploreNoch keine Bewertungen

- CAT 2009 Quant QuestionsDokument3 SeitenCAT 2009 Quant QuestionscomploreNoch keine Bewertungen

- CAT 2009 Quant QuestionsDokument3 SeitenCAT 2009 Quant QuestionscomploreNoch keine Bewertungen

- CAT 2009 Quant QuestionsDokument3 SeitenCAT 2009 Quant QuestionscomploreNoch keine Bewertungen

- CAT 2009 Quant QuestionsDokument3 SeitenCAT 2009 Quant QuestionscomploreNoch keine Bewertungen

- CAT 2009 Quant QuestionsDokument3 SeitenCAT 2009 Quant QuestionscomploreNoch keine Bewertungen

- CAT 2009 Quant QuestionsDokument3 SeitenCAT 2009 Quant QuestionscomploreNoch keine Bewertungen

- CAT 2009 Quant QuestionsDokument3 SeitenCAT 2009 Quant QuestionscomploreNoch keine Bewertungen

- CAT 2009 Quant QuestionsDokument3 SeitenCAT 2009 Quant QuestionscomploreNoch keine Bewertungen

- CAT 2009 Quant QuestionsDokument3 SeitenCAT 2009 Quant QuestionscomploreNoch keine Bewertungen

- CAT 2009 Quant QuestionsDokument3 SeitenCAT 2009 Quant QuestionscomploreNoch keine Bewertungen

- CAT 2009 Quant QuestionsDokument3 SeitenCAT 2009 Quant QuestionscomploreNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5782)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- C AE26 MODULE 1 Introduction To TaxationDokument16 SeitenC AE26 MODULE 1 Introduction To TaxationBaek hyunNoch keine Bewertungen

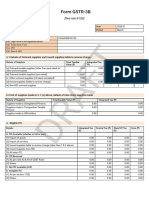

- Form GSTR-3B: (See Rule 61 (5) )Dokument2 SeitenForm GSTR-3B: (See Rule 61 (5) )Pabitra Kumar PrustyNoch keine Bewertungen

- Understanding Income TaxDokument43 SeitenUnderstanding Income TaxMerediths KrisKringleNoch keine Bewertungen

- Taxation ST 06. Documentary Stamp Tax: 4. Certificates of Profits orDokument2 SeitenTaxation ST 06. Documentary Stamp Tax: 4. Certificates of Profits orFabrienne Kate LiberatoNoch keine Bewertungen

- RMC No. 143-2019 Clarifications On The Inclusion of Taxpayers As Top Withholding Agents Who Are Obliged To Remit 1% PDFDokument2 SeitenRMC No. 143-2019 Clarifications On The Inclusion of Taxpayers As Top Withholding Agents Who Are Obliged To Remit 1% PDFKriszan ManiponNoch keine Bewertungen

- GST Book Bank AnswersDokument10 SeitenGST Book Bank AnswersAditya DasNoch keine Bewertungen

- International Shipping OffersDokument1 SeiteInternational Shipping Offersone powerNoch keine Bewertungen

- SSPUSADVDokument1 SeiteSSPUSADVJamesNoch keine Bewertungen

- Taxing Power Under The Federal Structure of IndiaDokument11 SeitenTaxing Power Under The Federal Structure of IndiaKanishka NluoNoch keine Bewertungen

- Receipt BookingDokument1 SeiteReceipt BookingSultan Gamer 18Noch keine Bewertungen

- Tax Exemption Rules in The PhilippinesDokument1 SeiteTax Exemption Rules in The PhilippinesEllen Glae DaquipilNoch keine Bewertungen

- 3459 N. Kildare Galleria Domain2 Sex Shop Pedophile Eric Skalinder AddressDokument49 Seiten3459 N. Kildare Galleria Domain2 Sex Shop Pedophile Eric Skalinder AddressJohn KuglerNoch keine Bewertungen

- Reg Section 1.861-4Dokument13 SeitenReg Section 1.861-4EDC AdminNoch keine Bewertungen

- NYS-45 quarterly tax filingDokument2 SeitenNYS-45 quarterly tax filingMichael WalkerNoch keine Bewertungen

- Tax SimulatorDokument10 SeitenTax SimulatorAnil KesarkarNoch keine Bewertungen

- PDFDokument1 SeitePDFPradeep KNoch keine Bewertungen

- Rto MardanDokument2 SeitenRto Mardanjanbahadur393100% (1)

- MM - Excise Master DataDokument19 SeitenMM - Excise Master DataSathish B SathishNoch keine Bewertungen

- Income From House Property: Ms. Harmanpreet Kaur Assistant Professor Shivaji College University of DelhiDokument40 SeitenIncome From House Property: Ms. Harmanpreet Kaur Assistant Professor Shivaji College University of DelhiRAKESH KUMAR GOUTAMNoch keine Bewertungen

- CONTEXT CORP. v. CIR - DigestDokument2 SeitenCONTEXT CORP. v. CIR - DigestMark Genesis RojasNoch keine Bewertungen

- Review of The Case of AG Rivers State v. FIRSDokument9 SeitenReview of The Case of AG Rivers State v. FIRSKilli Nancwat0% (1)

- Cir V Lingayen Gulf Electric PowerDokument4 SeitenCir V Lingayen Gulf Electric PowerkeloNoch keine Bewertungen

- Taxation Law Review Case ListDokument18 SeitenTaxation Law Review Case ListSabritoNoch keine Bewertungen

- PTI's Clarification About Chairman Imran Khan's Tax ReturnsDokument8 SeitenPTI's Clarification About Chairman Imran Khan's Tax ReturnsPTI OfficialNoch keine Bewertungen

- PhilipsDokument1 SeitePhilipsDhruva yadavNoch keine Bewertungen

- Acc 421Dokument3 SeitenAcc 421Anonymous dLIq7U3DKzNoch keine Bewertungen

- Input Tax Credit: Understanding the Core Concept of GSTDokument14 SeitenInput Tax Credit: Understanding the Core Concept of GSTratna supriyaNoch keine Bewertungen

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sushma KumariNoch keine Bewertungen

- False False True True True FalseDokument7 SeitenFalse False True True True Falsegazer beam100% (1)

- Chapter 9 Tax 2 (9-7&9-8)Dokument1 SeiteChapter 9 Tax 2 (9-7&9-8)Elai grace FernandezNoch keine Bewertungen