Beruflich Dokumente

Kultur Dokumente

My Internship Report (2) Hina Masood

Hochgeladen von

ulovetOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

My Internship Report (2) Hina Masood

Hochgeladen von

ulovetCopyright:

Verfügbare Formate

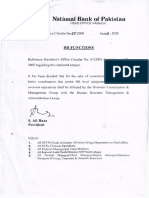

NATIONAL BANK OF PAKISTAN

Table of Contents

CHAPTER 1

INTRODUCTION 4

Evolution of Banking-------------------------------------------------------------------------------------------------------------------5 Modern Banking-------------------------------------------------------------------------------------------------------------------------5 Definition of Bank-----------------------------------------------------------------------------------------------------------------------6 Types of Bank----------------------------------------------------------------------------------------------------------------------------6 Banking Channels-----------------------------------------------------------------------------------------------------------------------8 Banks in the Economy----------------------------------------------------------------------------------------------------------------10

CHAPTER 2

BANKING IN PAKISTAN 12

History of Banking in Pakistan-----------------------------------------------------------------------------------------------------13 Efforts towards Islamic Banking--------------------------------------------------------------------------------------------------15

CHAPTER 3

NATIONAL BANK OF PAKISTAN (NBP) 16

Introduction of an organization---------------------------------------------------------------------------------------------------17 Golden History of NBP----------------------------------------------------------------------------------------------------------------18 Phases of NBP --------------------------------------------------------------------------------------------------------------------------20 Present Status of NBP-----------------------------------------------------------------------------------------------------------------21 Awards and Achievement-----------------------------------------------------------------------------------------------------------22 Vision-------------------------------------------------------------------------------------------------------------------------------------25 Mission-----------------------------------------------------------------------------------------------------------------------------------26 Core Values & Goals-------------------------------------------------------------------------------------------------------------------27 Credit Rating----------------------------------------------------------------------------------------------------------------------------28 Market Recognization----------------------------------------------------------------------------------------------------------------29

CHAPTER 4

SWOT ANALYSIS OF NATIONAL BANK OF PAKISTAN 30

SWOT Analysis Strengths------------------------------------------------------------------------------------------------------------31 SWOT Analysis Weaknesses--------------------------------------------------------------------------------------------------------33 SWOT Analysis Opportunities------------------------------------------------------------------------------------------------------35 SWOT Analysis Threats--------------------------------------------------------------------------------------------------------------36

HINA MASOOD O7

Page 1

NATIONAL BANK OF PAKISTAN

CHAPTER 5

MANAGEMENT STRUCTURE 38

Corporate Profile----------------------------------------------------------------------------------------------------------------------38 Board of Directors---------------------------------------------------------------------------------------------------------------------39 Senior Management-------------------------------------------------------------------------------------------------------------------39 Overseas Operation Management-------------------------------------------------------------------------------------------------40 NBP Head office Setup----------------------------------------------------------------------------------------------------------------41 Management Hierarchy--------------------------------------------------------------------------------------------------------------43 Branch Organogram------------------------------------------------------------------------------------------------------------------45

CHAPTER 6

POLICY FORMULATION PROCESS 46

Managerial Policies-------------------------------------------------------------------------------------------------------------------46 Operation Policies---------------------------------------------------------------------------------------------------------------------47 Credit Policies --------------------------------------------------------------------------------------------------------------------------47 Human Resource Policies-----------------------------------------------------------------------------------------------------------48

CHAPTER 7

CATEGORIES OF NBP BRANCHES 49

Employees in various Departments----------------------------------------------------------------------------------------------50 Job Description-------------------------------------------------------------------------------------------------------------------------51 Salary Conditions----------------------------------------------------------------------------------------------------------------------57 Human Resource-----------------------------------------------------------------------------------------------------------------------58 Career Ladder-------------------------------------------------------------------------------------------------------------------------- 61 Performance Appraisal--------------------------------------------------------------------------------------------------------------62

CHAPTER 8

MANAGEMENT STYLES 63

CHAPTER 9

MARKETING 64

Marketing Mix--------------------------------------------------------------------------------------------------------------------------74 Products----------------------------------------------------------------------------------------------------------------------------------75 Price-------------------------------------------------------------------------------------------------------------------------------------100 Place-------------------------------------------------------------------------------------------------------------------------------------123 Promotion------------------------------------------------------------------------------------------------------------------------------133 HINA MASOOD O7 Page 2

NATIONAL BANK OF PAKISTAN

CHAPTER 10

NBP ISLAMIC BANKING 138

CHAPTER 11

FINANCIAL ANALYSIS 144

Horizontal Analysis of Balance Sheet------------------------------------------------------------------------------------------147 Vertical Analysis of Balance Sheet----------------------------------------------------------------------------------------------149 Index Analysis------------------------------------------------------------------------------------------------------------------------151 Liquidity Ratio------------------------------------------------------------------------------------------------------------------------153 Portfolio Management Ratio------------------------------------------------------------------------------------------------------154 Capital Adequacy Ratio-------------------------------------------------------------------------------------------------------------156 Financial Leverage Ratio-----------------------------------------------------------------------------------------------------------158 Profitability Ratio--------------------------------------------------------------------------------------------------------------------160

CHAPTER 12

DEPARTMENTS 170

General Banking----------------------------------------------------------------------------------------------------------------------171 Account Opening Department----------------------------------------------------------------------------------------------------171 Cash Department---------------------------------------------------------------------------------------------------------------------182 Clearance-------------------------------------------------------------------------------------------------------------------------------186 Billing & Government Receipt/Payment--------------------------------------------------------------------------------------190 Remittances---------------------------------------------------------------------------------------------------------------------------191 Computer Section--------------------------------------------------------------------------------------------------------------------196 Credits----------------------------------------------------------------------------------------------------------------------------------200

CHAPTER 13

STRATEGY FORMULATION 216

Input Stage Internal Factor Evaluation Matrix (IFE) ---------------------------------------------------------------------------------220 External Factor Evaluation Matrix (EFE)-------------------------------------------------------------------------------- 222 Competitive Profile Matrix (CPM)------------------------------------------------------------------------------------------224 Matching Stage SWOT Matrix Model SPACE Matrix Boston Consulting Group Matrix (BCG) Decision Stage Quantitative Strategic Planning Matrix (QSPM)

ANNEXURE

HINA MASOOD O7 Page 3

NATIONAL BANK OF PAKISTAN

HINA MASOOD O7

Page 4

NATIONAL BANK OF PAKISTAN

EVOLUTION OF BANKING

Banks are in some senses a very old profession, but the modern way of banking affecting the whole of society so much is of course very new. The first banks were probably religious temples of the ancient world. In them was stored gold in the form of easy-to-carry compressed plates. Their owners justly felt that temples were the safest places to store their gold as they were constantly attended, well built and were sacred, thus deterring would-be thieves. There are extant records of loans from the 18th century BC in Babylon that were made by temple priests to merchants.

MODERN BANKING:

Banking in its modern form and structure started in Britain when many of the Lombardy merchants came to England in the 14THCentury and settled in the parts of the city of the London now called Lombard Street. The King Edward-III established the office of Royal Exchanger in 1565 for changing foreign money at a profit for the benefit of crown. At that time moneychangers were already called bankers, though the term "bank" usually referred to their offices, and did not carry the meaning it does today. Around the time of Adam Smith (1776) there was a massive growth in the banking industry. Within the new system of ownership and investment, money holders were able to reduce the State's intervention in economic affairs, remove barriers to competition, and, in general, allow anyone willing to work hard enough-and who also has access to capital-to become a capitalist. It wasn't until over 100 years after Adam Smith, however, that US companies began to apply his policies in large scale and shift the financial power from England to America. By the end of 2000, a year in which a record level of financial services transactions with a market value of $10.5 trillion occurred, the top ten banks commanded a market share of more than 80% and the top five, 55%. Of the top ten banks ranked by market share, seven were large universal-type banks (three American and four European), and the remaining three were large U.S. investment banks who between them accounted for a 33% market share. This growth and opportunity also led to an unexpected outcome: entrance into the market of other financial intermediaries: nonbanks. Large corporate players were beginning to find their way into the

HINA MASOOD O7 Page 5

NATIONAL BANK OF PAKISTAN

financial service community, offering competition to established banks. The main services offered included insurances, pension, mutual, money market and hedge funds, loans and credits and securities. Indeed, by the end of 2001 the market capitalization of the world's 15 largest financial services providers included four nonbanks.

DEFINITIONS OF BANK

Banks are guardian distributor of money Banks do business of money. Rather banks do business of lending & borrowing money Banker or a banker or a person or a company carrying on the business receiving moneys and collecting drafts for customers subject to the obligation of honouring cheques drawn upon them from time to time by the customer to the extent of the amount available on their current accounts

TYPES OF BANKS

Commercial banks:

The term used for a normal bank to distinguish it from an investment bank. After the Great Depression, the U.S. Congress required that banks only engage in banking activities, whereas investment banks were limited to capital market activities. Since the two no longer have to be under separate ownership, some use the term "commercial bank" to refer to a bank or a division of a bank that mostly deals with deposits and loans from corporations or large businesses.

Community banks:

Locally operated financial institutions that empower employees to make local decisions to serve their customers and the partners.

Community development banks:

Regulated banks that provide financial services and credit to under-served markets or populations.

HINA MASOOD O7

Page 6

NATIONAL BANK OF PAKISTAN

Postal saving banks:

Saving banks associated with national posting systems.

Private banks:

Banks that manage the assets of high net worth individuals.

Offshore banks:

Banks located in jurisdictions with low taxation and regulation. Many offshore banks are essentially private banks.

Savings banks:

In Europe, savings banks take their roots in the 19th or sometimes even 18th century. Their original objective was to provide easily accessible savings products to all strata of the population. In some countries, savings banks were created on public initiative; in others, socially committed individuals created foundations to put in place the necessary infrastructure. Nowadays, European savings banks have kept their focus on retail banking: payments, savings products, credits and insurances for individuals or small and medium-sized enterprises. Apart from this retail focus, they also differ from commercial banks by their broadly decentralised distribution network, providing local and regional outreachand by their socially responsible approach to business and society.

Ethical banks:

Banks that prioritize the transparency of all operations and make only what they consider to be socially-responsible investments.

Types of investment banks: Investment banks: Investment banks "underwrite" (guarantee the sale of) stock and bond issues,

trade for their own accounts, make markets, and advise corporations on capital market activities such as mergers and acquisitions.

HINA MASOOD O7

Page 7

NATIONAL BANK OF PAKISTAN

Merchant banks:

Merchant banks were traditionally banks which engaged in trade finance. The modern definition, however, refers to banks which provide capital to firms in the form of shares rather than loans. Unlike venture capital firms, they tend not to invest in new companies.

Other Types of Banks: Islamic banks:

Islamic banks adhere to the concepts of Islamic law. This form of banking revolves around several well-established principles based on Islamic canons. All banking activities must avoid interest, a concept that is forbidden in Islam. Instead, the bank earns profit (mark-up) and fees on the financing facilities that it extends to customers.

Banking channels

Banks offer many different channels to access their banking and other services:

BRANCH

A branch banking centre or financial centre is a retail location where a bank or financial institution offers a wide array of face-to-face service to its customers.

ATM

ATM is a computerized telecommunications device that provides a financial institution's customers a method of financial transactions in a public space without the need for a human clerk or bank teller. Most banks now have more ATMs than branches, and ATMs are providing a wider range of services to a wider range of users. For example in Hong Kong, most ATMs enable anyone to deposit cash to any customer of the bank's account by feeding in the notes and entering the account number to be credited. Also, most ATMs enable card holders from other banks to get their account balance and withdraw cash, even if the card is issued by a foreign bank.

HINA MASOOD O7

Page 8

NATIONAL BANK OF PAKISTAN

MAIL

Mail is part of the postal system which itself is a system wherein written documents typically enclosed in envelopes, and also small packages containing other matter, are delivered to destinations around the world. This can be used to deposit cheques and to send orders to the bank to pay money to third parties. Banks also normally use mail to deliver periodic account statements to customers.

TELEPHONE BANKING

Telephone banking is a service provided by a financial institution which allows its customers to perform transactions over the telephone. This normally includes bill payments for bills from major billers (e.g. for electricity).

ONLINE BANKING

Online banking is a term used for performing transactions, payments etc. over the Internet through a

bank, credit union or building society's secure website.

MOBILE BANKING

Mobile banking is a method of using one's mobile phone to conduct simple banking transactions by

remotely linking into a banking network.

VIDEO BANKING

Video banking is a term used for performing banking transactions or professional banking consultations via a remote video and audio connection. Video banking can be performed via purpose built banking transaction machines (similar to an Automated teller machine), or via a videoconference enabled bank branch.

HINA MASOOD O7

Page 9

NATIONAL BANK OF PAKISTAN

Banks in the economy

Role in the money supply

A bank raises funds by attracting deposits, borrowing money in the inter-bank market,or issuing financial instruments in the money market or a capital market.The bank then lends out most of these funds to borrowers. However, it would not be prudent for a bank to lend out all of its balance sheet. It must keep a certain proportion of its funds in reserve so that it can repay depositors who withdraw their deposits. Bank reserves are typically kept in the form of a deposit with a central bank.This behaviour is called Fractional-Reserve Bnking and it is a central issue of monetary policy.

Size of global banking industry

Worldwide assets of the largest 1,000 banks grew 16.3% in 2006/2007 to reach a record $74.2 trillion. This follows a 5.4% increase in the previous year. EU banks held the largest share, 53%, up from 43% a decade earlier. . The growth in Europes share was mostly at the expense of Japanese banks, whose share more than halved during this period from 21% to 10%. The share of US banks remained relatively stable at around 14%. Most of the remainder was from other Asain and Europeon countries. The United States has by far the most banks in the world, both in terms of institutions (7,540 at the end of 2005) and branches (75,000). This is an indicator of the geography and regulatory structure of the USA, resulting in a large number of small to medium-sized institutions in its banking system. Japan had 129 banks and 12,000 branches. In 2004, Germany, France, and Italy each had more than 30,000 branches-more than double the 15,000 branches in the UK.

Bank Regulation

Bank regulations are a form of government regulation, which subject banks to certain requirements, restrictions and guidelines aiming to uphold the soundness and integrity of the financial system. The combination of the instability of banks as well as their important facilitating role in the economy led

HINA MASOOD O7

Page 10

NATIONAL BANK OF PAKISTAN

to banking being thoroughly regulated. The amount of capital a bank is required to hold is a function of the amount and quality of its assets.

Another reason banks are thoroughly regulated is that ultimately, no government can allow the banking system to fail. There is almost always a lender of last resort-in the event of a liquidity crisis, some element of government will step in to lend banks enough money to avoid bankruptcy. The Banking industry main obstacles to increasing profits are existing regulatory burdens, new government regulation, and increasing competition from non-traditional financial institutions.

Bank crisis

Banks are susceptible to many forms of risk which have triggered occasional systemic crises. These include liquidity risk (where many depositors may request withdrawals beyond available funds), credit

risk (the chance that those who owe money to the bank will not repay it), and interest rate risk (the

possibility that the bank will become unprofitable, if rising interest rates force it to pay relatively more on its deposits than it receives on its loan). Banking crises have developed many times throughout history, when one or more risks have materialized for a banking sector as a whole. Prominent examples include the bank run that occurred during the Great Depression, the U.S. Savings and Loan crisis in the 1980s and early 1990s, the Japanese banking crisis during the 1990s, and the subprime mortgage crisis in the 2000s.

HINA MASOOD O7

Page 11

NATIONAL BANK OF PAKISTAN

HINA MASOOD O7

Page 12

NATIONAL BANK OF PAKISTAN

HISTORY OF BANKING IN PAKISTAN

The partition was announced on June 3, 1947 and August 15, 1949 was fixed as the date on which independence was to take effect. It was decided that the Reserve Bank of India should continue to function in the dominion of Pakistan until September 30, 1948 due to administrative and technical difficulties involved in immediately establishing and operating a Central Bank. At the time of Partition, total number of Banks in Pakistan was 38; out of these the commercial banks in Pakistan were 2, which were Habib Bank Limited and Australia Bank of India. The total deposits in Pakistani Banks stood at Rs.880 million where as the advances were Rs.198 million. The Governor General of Pakistan, Muhammad Ali Jinnah issued the order for the establishment of State Bank of Pakistan on 1st of July 1948.In 1949, National Bank of Pakistan was established. It started with six offices in Former East Pakistan. There were 14 Pakistani scheduled commercial banks operating in the country on December 1973, the name of these were:

1. 2. 3. 4. 5. 6. 7. 8. 9. National Bank of Pakistan Habib Bank Limited Habib Bank Overseas Limited United Bank Limited Muslim Commercial Bank Limited Commerce Bank Limited Australia Bank Limited Standard Bank Limited Bank of Bahawalpur Limited

10. Premium Bank Limited 11. Pak Bank Limited 12. Lahore Commercial Bank Limited 13. Sarhad Bank Limited 14. Punjab Provincial Co-operative Bank Limited

HINA MASOOD O7

Page 13

NATIONAL BANK OF PAKISTAN

The Pakistan Banking Council prepared Banks amalgamation schemes in 1974 for amalgamation of Smaller Banks with the five bigger banks of Country. These five banks are as under: 1. National Bank of Pakistan 2. Habib Bank Limited 3. United Bank Limited 4. Muslim Commercial Bank Limited 5. Allied Bank Limited

So through the Nationalization of Bank Act 1974, the State Bank of Pakistan, all the commercial banks incorporated in Pakistan and carrying on Business in or outside the country were brought under the government ownership with effect from Jan 1, 1974. The ownership, control and management of all the Banks in Pakistan stood transferred to and vested in the Federal Government. The Finance Minister announced plans to start Islamic Banking System in Pakistan in the Budget speech on June 26, 1980, but it could not be possible till August 2003.

HINA MASOOD O7

Page 14

NATIONAL BANK OF PAKISTAN

EFFORTS TOWARDS ISLAMIC BANKING IN PAKISTAN

Pakistan was created in the name of Islam on August 14, 1947.But since then the interest is paying the cardinal role in resourse allocation of the economy.The Banking system in Pakistan based on Interest Divergences with islamic ideology and is forbidden by Almighty Allah and His Prophet Muhammad(SAW). Any government till now in the country except President Zia-ul-Haq did not dare to change the welldigged system based on interest in Banking in Pakistan. The only step taken under this direction is starting of PLS Deposits from January 1,1982.Only PLS saving account PLS term deposits shall be accepted on profit and loss sharing basis.The banks were allowed to meet the working capital requirements of their clients on the basis of Musharika, and Leasing and Hire purchase.Beside it, different efforts are made time by time in this respect but could not be acted upon at all. Recently in June 2002,the Shariah Applet Bench of Pakistan issued an order to all the banks in Pakistan to change the interest-based Banking system to Islamic Modes but the lawyer from the government of Pakistan challanged it by saying that if any affair is in the favor of the public of the country and is also admired by the public then it cannot be abondoned by the government.So this issue is still not resolved.

HINA MASOOD O7

Page 15

NATIONAL BANK OF PAKISTAN

HINA MASOOD O7

Page 16

NATIONAL BANK OF PAKISTAN

Introduction of an Organization

National Bank of Pakistan is a government bank. Its principal activities are to provide commercial banking and related services in Pakistan and overseas. The Group handles treasury transactions for the Government of Pakistan as agent to the State Bank of Pakistan. It has its head office in Karachi. The Bank has 1254 domestic branches. In addition, NBP has 22 overseas branches and one representative office including the Export Processing Zone Branch. The Bank also provides services as trustee to National Investment Trust including safe custody of securities on behalf of NIT. National Bank of Pakistan maintains its position as Pakistan premium Bank determined to set high standards of Achievements. It is the major business partner of Government of Pakistan with special emphasis on fostering Pakistans economic growth through aggressive and balanced lending policies, technologically oriented products and services offered through its large network of branches locally, internationally and representative offices.

CURRENT POSITION OF NBP:

The current position of NBP with regards to price, earnings, dividends are as follows:

Current Price (6/30/2009):

67.03

(Figures in Pakistan Rupees)

HINA MASOOD O7

Page 17

NATIONAL BANK OF PAKISTAN

Golden History of National Bank of Pakistan

In 1949 (September) U.K devalued its currency, India followed suit but Pakistan did not. India said we had contravened the agreement of keeping both currencies at par. We said we had not done that, India had done it arbitrarily without consulting us. On October 3, 1949 the two central banks were to announce the new par value of both the currencies but India denied a day earlier. India also froze our trade-balance surplus that is still an unsettled dispute. India also withdraws the Marwari Merchants who were employed annually for movement of Jute crop by financing it. There being no jute industry, prices fell sharply, foreign banks and foreign merchants stood aside and an agrarian unrest was threatening. Two ordinances were, therefore, issued 1. Jute Board Establishment Ordinance 2. NBP Ordinance dated 08-11-1949 National Bank of Pakistan was established on November 9, 1949 under the National Bank of Pakistan Ordinance 1949 in order to cope with the crisis conditions which were developed after trade deadlock with India and devaluation of Indian Rupee in 1949.Initially the bank was established with the objective to extend credit to the agriculture sector. The normal procedure of establishing a banking company under the companies Law was set aside and a bank was established through the promulgation of an ordinance due to the crisis situation that had developed with regard to financing of Jute trade. The bank commenced its operations from November 20, 1949 at six important jute centres in the East Pakistan and directed its resources in financing of jute crop. The Banks Karachi and Lahore offices were subsequently opened in December 1949.The nature of responsibilities of the Bank is different and unique from other Banks/Financial institutions. The Bank Act as the agent to the State Bank of Pakistan for handling Provincial/Federal Government receipts and payments on their behalf.

HINA MASOOD O7

Page 18

NATIONAL BANK OF PAKISTAN

Mr. Ghulam Farooq was Chairman Jute Board and Mr.Mumtaz Hassan was Chairman NBP.Until June, 1950, NBP remained exclusively in jute operations, there after other commodities were also taken up. After that Mr. Zahid Husain. Governor SBP assumed additional charge also as Chairman NBPs Board of Directors and Mr. M.A Mohair became its first M.D. In 1952 NBP replaced Imperial Bank of India. This arrangement was negotiated by Mr. Mumtaz Hassan as acting Governor of SBP. In 1962, when Mumtaz Hassan became the M.D (He had already served NBP for 10 years as its Chairman of Government Director), the number of Branches had increased from 6 to 239 and deposits from Rs. 50 million (5 Crore) to 1 billion and 60 million (106 crore), profit from 3 million (3 lac) to 21 million (2.1 crore) and the staff increased from 380 to 7091, as compared to 1949-50. In December 1966 its 600TH branch was opened raising the deposits to 2.31 bn. And staff to 14,963.Upto 1965, the shareholders had received 225% of their original investment. Now it has more than 21549 employees 1537 branches and Rs.208283 million deposits. The Bank has also played an important role in financing the country growing trade, which has expanded through the years as diversification took place. Today the Bank finances imports/exports business to the tune of Rs. 62.17 billion, where as in 1960, financing under this head was only Rs. 1.54 billion. The field is being de-layered to improve customer services and enable faster decision making. As a result of this de-layering zones have been eliminated and the numbers of regions have been increased. Organizational Hierarchy at the regional level has been restructured and operational and business activities have been completely separated. This separation will improve communication, decision making and promote teamwork.

HINA MASOOD O7

Page 19

NATIONAL BANK OF PAKISTAN

PHASES OF NBP

National Bank of Pakistan also has suffered from four different phases of banking in Pakistan like other banks.

Commercialization

(Profit Oriented 1946-1973)

National Bank of Pakistan was established in 1949 to promote jute and cotton production. At the time of independence we had no jute factory but in 1957 just within 10 years, Pakistan successfully established 6 jute factories through NBP assistance. Pakistan had just 16 cotton factories which increased within 10years up to 70. It was a big success of National Bank of Pakistan during commercialization era.

Nationalization

(Socio-Economic Development 1974-1991)

In the first phase of nationalization which remains from 1.1.1974 to 30.6.1974, The National Bank of Pakistan was merged with Bank of Behawalpur. This was done to give proper attention towards socioeconomic development & structural improvements.

ISLAMIZATION

(Islamic Revolution 1977-2004)

National bank of Pakistan introduced three types of profit & loss accounts during this era. Zakat & Usher ordinance was introduced. Non interest bearing accounts were introduced.

Privatization

(Free Market economy 1991-2004)

NBP suffered massive losses in past, particularly in 1996, posted USD 17.7 million in pre-tax profits in 2000 and doubled this figure in 2001

HINA MASOOD O7

Page 20

NATIONAL BANK OF PAKISTAN

PRESENT STATUS OF NBP

The new management team having extensive experience of management of large financial institutions both within and outside the country is expected to further enhance the profitability and operational efficiency of the Bank. National Bank of Pakistan is the largest commercial bank operating in Pakistan. It has redefined its role and has moved from a public sector organisation into a modern commercial bank. The Bank's services are available to individuals, corporate entities and government. While it continues to act as trustee of public funds and as the agent to the State Bank of Pakistan (in places where SBP does not have a presence) it has diversified its business portfolio and is today a major lead player in the debt equity market, corporate investment banking, retail and consumer banking, agricultural financing, treasury services and is showing growing interest in promoting and developing the country's small and medium enterprises and at the same time fulfilling its social responsibilities, as a corporate citizen. In today's competitive business environment, NBP needed to redefine its role and shed the public sector bank image, for a modern commercial bank. It has offloaded 23.2 percent share in the stock market, and while it has not been completely privatized like the other three public sector banks, partial privatization has taken place. It is now listed on the Karachi Stock Exchange. National Bank of Pakistan is today a progressive, efficient, and customer focused institution. It has developed a wide range of consumer products, to enhance business and cater to the different segments of society. The Bank's financial performance has been remarkable. The Bank maintains a sound loan portfolio diversified in nature to counter the risk of credit concentration. It ranges from providing credit to the un-banked market segment under NBP Karobar, to small and medium enterprises, to agricultural loans, to large corporate customers.

HINA MASOOD O7

Page 21

NATIONAL BANK OF PAKISTAN

AWARDS AND ACHIEVEMENTS:

National Bank has earned recognition and numerous awards internationally. "Best Foreign Exchange Bank 2008 awarded by world's leading financial journal Global Finance."

Best Return on Capital for 2006 amongst all Banks in Asia Banker Magazine in July 2007 World's leading financial journal, Global Finance has named NBP as the Best Emerging Market Bank from Pakistan for the year 2006 . "Best Foreign Exchange Bank Pakistan award for the year 2006 by world's leading financial journal Global Finance . Due to consistent improvement in NBP's Core Profitability , Asset Quality and Economic Capitalization in recent years ,Moody's Investors Service upgraded the Financial Strength Rating (FSR) rom E+ to D-, in November 2005 . Best Foreign Exchange Bank Pakistan award for the year 2005 by world's leading financial journal Global Finance . Best Bank - Pakistan award for the year 2005 by world's leading financial journal Global Finance.

HINA MASOOD O7

Page 22

NATIONAL BANK OF PAKISTAN

The Asian Banker, a reputable financial journal, has published the report of its research project on the ranking of 300 of Asia 's Strongest Banks based on a 11-Dimensional Dynamic Scoring Criteria has adjudged National Bank of Pakistan as the Strongest Bank in Pakistan . On the basis of overall financial performance during 2004, NBP has been listed Amongst top 1000 banks in the world and Number 1 Bank in Pakistan by the prestigious Banker Magazine in its issue of July 2005 . The Banker Magazine in July 2005 recognized NBP as the 10th Best Bank in terms of Profit on Capital' in the world . Bank of the Year awarded for the year 2005 by the world renowned The Banker magazine owned by the Financial Times Group, London. On an all Pakistan basis National Bank of Pakistan was awarded the Kissan Times Award for the year 2005 by the Prime Minister , Mr. Shaukat Aziz, for its services in the Agriculture Sector .World's leading financial journal, Global Finance in an exclusive survey has named NBP as the Best Emerging Market Bank from Pakistan for the year 2005 . Bank of the Year award for the year 2004 by the world renowned The Banker magazine owned by the Financial Times Group , London . Euromoney Magazine, a leading and prestigious journal, published from London , UK , in its issue of March 2005 has published Moody's Investors Service rankings in which NBP is the only Pakistani bank which has been ranked among the Top 100 banks of Asia for it performance in the fiscal year 2003 WEBCOP-AASHA, an alliance against gender discrimination at workplace, presented a Recognition Award to National Bank of Pakistan on December 18, 2004 for having a Gender Sensitive Management . In May 2004, NBP's standalone long-term rating was upgraded by JCR-VIS Credit Rating Agency to AA (double A) from AA -( double A minus) with stable outlook, while standalone short-term

HINA MASOOD O7

Page 23

NATIONAL BANK OF PAKISTAN

rating was maintained at A-1+(A one plus). This is now the best rating for a local commercial bank in Pakistan . In its issue of March 2004, Global Finance has also declared NBP as The Best Foreign Exchange Bank in Pakistan . The Banker Magazine in July 2003 recognized NBP as the bank with the highest return on capital in Asia and No.8 in the world. World's leading financial journal, Global Finance after a worldwide survey declared NBP in its issue of May 2003 as one of the best banks in the emerging markets. Bank of the Year awarded for the year 2002 by the world renowned The Banker magazine owned by the Financial Times Group, London Bank of the Year awarded for the year 2001 by the world renowned The Banker magazine owned by the Financial Times Group, London

President's Awards

1) Mr. S. Ali Raza, Chairman & President, NBP was awarded The Asian Banker Leadership Achievement Award 2007 by Asian Banker ( an internationally reputed Financial Journal) in its issue of June 2007 2) Mr. S. Ali Raza Chairman & President, NBP, was conferred Sitara-i-Imtiaz by the President of Pakistan , General Pervaiz Musharraf on August 14, 2005 3) Business Week of The McGraw Hill Companies in its July 11,2005 edition has adjudged Mr. S. Ali Raza, Chairman President, NBP as one of the twenty five Leaders of Asia at the & Forefront of Change and has identified them as Stars of Asia including the President of Indonesia 4) Mr. S. Ali Raza's (Chairman & President, NBP) capabilities were also recognized by the Institute of Bankers in Pakistan when he was awarded a gold medal in 2003 .

HINA MASOOD O7 Page 24

NATIONAL BANK OF PAKISTAN

Vision

To be recognized as a leader and a brand synonymous with trust, highest standards of service quality, international best practices and social responsibility.

HINA MASOOD O7

Page 25

NATIONAL BANK OF PAKISTAN

Mission

NBP will aspire to the values that make NBP truly the Nations Bank, by: Institutionalizing a merit and performance culture Creating a distinctive brand identity by providing the highest standards of services Adopting the best international management practices Maximizing stakeholders value Discharging our responsibility as a good corporate citizen of Pakistan and in countries where we operate

HINA MASOOD O7

Page 26

NATIONAL BANK OF PAKISTAN

CORE VALUES

Highest standards of Integrity Institutionalizing team work and performance culture Excellence in service Advancement of skills for tomorrows challenges Awareness of social and community responsibility Value creation for all stakeholders

GOALS

To enhance profitability and maximization of NBP share through increasing leverage of existing customer base and diversified range of products

HINA MASOOD O7 Page 27

NATIONAL BANK OF PAKISTAN

Credit Rating

State Bank of Pakistan has been endeavouring to promote self-discipline in the financial markets of Pakistan through transparency and sufficient disclosure by the market participants. In order to maximize disclosure for the benefit of stakeholders and market participants, all banks were required to get themselves credit rated with effect from June 30, 2001.

Objective of Credit Rating:

The objective is to provide yardstick to the market participants and stakeholders for informed decision making, promote healthy competition and induce financial institutions to improve their state of financial affairs.

CREDIT RATING OF NBP

Moody's maintained NBP's financial strength rating at D-thereby recognizing the internal strength and leadership position of the Bank. In addition, NBP also enjoys the highest Credit Rating amongst Pakistani banks; JCR-VIS Credit Rating Co. JCR-VIS, Japan Credit Rating Agency Ltd. Is a well known rating agency of the country. JCR-VIS has rated National Bank of Pakistan AAA (triple A) for long term and A-1+ (A-One plus) for the short term with stable outlook The JCR-VIS Credit Rating Co. comments about NBP says a lot about the bank: The organization has been able to strategically manage and build on its competitive advantages which has translated into the strong and well managed improvement in profitability trend observed over the last few years, a substantial balance sheet of sound asset quality, and strong liquidity and capitalization levels. These ratings denote a very low expectation of Credit Risk, strong capacity for timely payment of financial commitments in the long term and by highest capacity for timely repayment in the short term, respectively.

HINA MASOOD O7 Page 28

NATIONAL BANK OF PAKISTAN

NBPs key strength remains its extensive outreach in the domestic and international markets, as well as its broad based, cost effective deposit base. Further strength is also derived from deposits. With the lowest cost of funds in the market during 2008, NBPs net finance margins remained amongst the highest in the sector, and core earnings rose considerably. The rating committee has also favourably considered recent efforts made with the objective of improving internal controls and strengthening of the banks internal audit function.

MARKET RECOGNITION

In addition to the highest Credit Rating in the banking sector NBP is exultant to receive several awards from both local and foreign institutes of repute. NBP in year 2007 received the award for Best Return on Capital for 2006 amongst all banks in Asia by Bankers Magazine' in July 2007. Mr. Ali Raza, Chairman & President was awarded The Asian Banker Leadership Achievement Award 2007 by Asian Banker in 2007. The Asian Banker has adjudged NBP as the Strongest Bank in Pakistan .

HINA MASOOD O7

Page 29

NATIONAL BANK OF PAKISTAN

HINA MASOOD O7

Page 30

NATIONAL BANK OF PAKISTAN

SWOT ANALYSIS

STRENGTHS

NATIONAL BANK THE NATIONS BANK:

NBP is government owned bank that is why Pakistani Nation has a trust on a bank that their deposits are secured. Due to this reason the deposits of the banks are increasing with the passage of time.

AGENT OF STATE BANK OF PAKISTAN:

National Bank of Pakistan also works as an agent of state bank of Pakistan in those cities where SBP branches are not working. AGENCY ARRANGEMENTS: National Bank of Pakistan is enjoying with deposit of different government organization like Pakistan Railways, PIA, WAPDA, SUI-GAS due to agency arrangements.

MORE DEPOSITS THAN OTHER BANKS:

NBP has the relative competence in having in having more deposits than the other bank. This is because of the confidence the customer have in the bank. The bank being the privileged and oldest bank in banking sector of Pakistan enjoys this edge over all others, lacking it.

PROFITABILITY:

The pre-tax profits of NBP have gone up to Rs.6.05 Billion.

BROAD NETWORK:

The bank has another competency i.e. it has broad bases network of branches through out the country also more than one branch in high productive cities. The customers are provided services at their nearest possible place to confirm customer satisfied.

HINA MASOOD O7

Page 31

NATIONAL BANK OF PAKISTAN

PROFESSIONAL COMPETENCE:

The employees at NBP here have a good hold on their descriptions, as they are highly skilled Professionals with background in business administration, banking, economics etc. These professional competencies enable the employees to understand and perform the function and operation in better way. COMPREHENSIVE RANGE OF FINANCIAL PRODUTS: In order to facilitate the customers, NBP is offering comprehensive range of financial products which are as follows: Credit Cards Foreign exchange Bearer Certificates National Bank Daily accounts Travellers Cheques

ONLINE BANKING:

This is also strength of NBP that 130 branches are online. It helps the speedy services giving to the customers. There is also help in checking the balances and daily transactions just at one key press.

INVESTING IN CAPITAL MARKET:

NBP has decided to diversify the fund base by investing in capital markets not only in Pakistan but also in foreign countries.

ATM FACILITY:

ATM facility is also provided by NBP for the customers.

HINA MASOOD O7

Page 32

NATIONAL BANK OF PAKISTAN

WEAKNESSES:

LACK OF MARKETING EFFORT:

The bank does not promote its corporate image, services etc on a competitive way. Hence lacks far behind in marketing effort. A need for aggressive marketing in the era marketing is now becoming a part of every organization. POOR WORKING CONDITIONS: Despite, cultural change program the working condition of the NBP is not up to standard.

NBP UNDER POLITICAL PRESSURE:

The strong hold of some parties and government and their dominance is affecting the bank in a negative way. They sometime have to provide loan under the pressure, which leads to uneven and adjusted feeling in the bank employees.

RECRUITMENT POLICY:

In NBP, employees are recruited on the basis of favouritism or through other tools of corruption.

INCOMPETENT STAFF:

Due to wrong recruitment policy staff of NBP is not proficient in their work. IRREGULARITIES IN PROMOTIONS: In NBP there is no smooth and continuous promotion system. Unfair means are used in order to get the promotion especially the promotion of the managers.

HINA MASOOD O7

Page 33

NATIONAL BANK OF PAKISTAN

LACK OF COMPUTERIZED NETWORK:

The bank lacks the strength of being powered by the network of computers, which have saved time, energy and would have lessened the mental stress. This would add to the strength if it were powered by network of computers.

LACK OF MODERN EQUIPMENT:

The bank also lacks the modern equipment that is not counting machine computers. Even if there is any equipment they lack to fall in the criteria of being rearmed as updated and upgraded.

UNEVEN WORK DISTRIBUTION:

The workload in NBP is not evenly distributed and the workload tends to be more on some employees while others are away from their responsibilities, which serves as a de-motivation factor for employees performing above average work.

LACK OF COMMUNICATION BETWEEN EMPLOYEES:

There is a lack of communication between employees and management. They have not very much understanding with each other and not share the work of each other.

STAFF SHORTAGE:

There is also a weak point for NBP that staff is very short and more staff is required to meet the needs of the branch work.

STRONG UNION:

Union has strong impact on the performance of NBP, so the top management is unable to punish the violators.

ORGANIZATIONAL STRUCTURE:

In this organization the organizational structure is bureaucratic which a barrier in rapid and effective decision making.

HINA MASOOD O7 Page 34

NATIONAL BANK OF PAKISTAN

OPPORTUNITIES:

ELECTRONIC BANKING:

The world today has become a global village because of advancement in the technologies, especially in communication sector. More emphasis is now given to avail the modern technologies to better the performances. NBP can utilize the electronic banking opportunity to ensure online banking 24 hours a day. This would give a competitive edge over others.

GROWING BANKING SYSTEM:

Now a days banking system is growing quickly so NBP have opportunities to improve the standard and get the more share in market.

INVESTING IN THE FOREIGN CAPITAL MARKET:

NBP can enjoy handsome return its funding base by investing in capital markets in the foreign countries.

ADVISORY SERVICES:

It can establish advisory services in order to facilitate the customers in investing in securities.

INCREASE IN ECONOMIC ACTIVITIES:

The economic activities are increasing nowadays, so banks are contribute more in economic activities. Banks played a major role in trade and commerce. So the businesses of commercial banks are increasing.

ISSUANCE OF BOND:

To enjoy large amount, NBP can introduce a comprehensive range of bonds.

FOREIGN BRANCHES:

NBP by establishing new branches in foreign countries can expand its business and can enjoy with profit.

HINA MASOOD O7 Page 35

NATIONAL BANK OF PAKISTAN

CONSUMER BANKING :

The basis need of the consumer such as housing, transportation and other durable goods are not adequately financed by banks. So by initiating these services, the bank can enjoy with more funds.

THREATS

EMERGENCE OF NEW COMPETITOR: The bank is facing threats with the emergence of new competitors especially in terms of foreign banks. These foreign banks are equipped with heavy financial power with excellent and innovative ways of promoting and performing their services. The bank has to take initiative in this regard or will find itself far back in competition.

INFLATION:

In our country, the rate of inflation is increasing along with unemployment. So due to increase in price of the products, the savings of the nation is decreasing with the passage of time. So it is threat for banking sector. In the future the deposits of the bank will decrease.

CUSTOMER COMPLAINTS:

There exists no regular and specific system of the removal of customer complaints. Now a day a need for total customer satisfaction is emerging and in their demanding consequences customers complaints are ignored.

MODERN TYPE OF BANKING:

Modern and computerized banking is required to fulfil customers needs. So maximum branches of NBP are working in old traditional ways.

THE WHOLE STRUCTURE CHANGES TO ONLINE:

NBP has wide network of branches. Only 130 branches are online, so it is very difficult and time consuming to convert all branches to online system. So there is also a risk involves that if one

HINA MASOOD O7 Page 36

NATIONAL BANK OF PAKISTAN

computer of one branch suffers in problem, all systems and all computers of the branch must be turn off.

GOVERNMENT POLICY:

On NBP Govt. policies have strong impact. A slight change in Govt. policies may affect the performance of the bank. The bank has to work within the regulation frame work.

POLITICAL PRESSURE BY ELECTED GOVERNMENT:

The ongoing shift in power in political arena in the country affects the performance of the bank has to forward loans to politically powerful persons whom create a sense of insecurity and demoralization in the customer as well as employees.

HINA MASOOD O7

Page 37

NATIONAL BANK OF PAKISTAN

HINA MASOOD O7

Page 38

NATIONAL BANK OF PAKISTAN

MANAGEMENT STRUCTURE

Corporate Profile:

The complete profile of the people who serves as the think tank of National Bank of Pakistan is given in hierarchical order in the following lines.

BOARD OF DIRECTORS Syed Ali Raza Chairman & Director

Mr. Sikandar Hayat Jamali Mian Kausar Hameed Mr. Ibrar A.Mumtaz Mr. Tariq Kirmani Mr. Mohammad Ayub Khan Tarin Mrs. Haniya Shahid Naseem Mr. Ekhlaq Ahmed

Director Director Director Director Director Director Secretary Board of Directors

HINA MASOOD O7

Page 39

NATIONAL BANK OF PAKISTAN

SENIOR MANAGEMENT

Qamar Hussain Chief Operating Officer , Credit Management Group

Dr. Asif A. Brohi SEVP & Group Chief, Operations Group

Imam Bakhsh Baloch SEVP & Group Chief, Audit & Inspection Group

N. B. Soomro SEVP Islamic Banking Group

Masood Karim Shaikh SEVP & Group Chief, Corporate & Investment Banking Group

Agha Fidaullah EVP/Group Chief, Special Assets Management Group

Ziaullah Khan Senior Executive Vice President

Ekhlaq Ahmed EVP & Secretary Board of Directors

Dr. Mirza Abrar Baig SEVP & Group Chief, Human Resources Management & Administration Group Nadeem A. Ilyas EVP & PSO to President , Group Chief (A), Compliance Group Amer Siddiqui SEVP & Group Chief, Commercial & Retail Banking Group Naeem Syed EVP, Divisional Head, Project Management Office

Shahid Anwar Khan SEVP & Group Chief, Overseas Banking Group

HINA MASOOD O7

Page 40

NATIONAL BANK OF PAKISTAN

Aamir Sattar SVP, Divisional Head, Financial Control Division

Muhammad Nusrat Vohra SEVP & Group Chief, Treasury Management Group

Atif Hassan Khan Group Chief (A), Information Technology Group

Ali Hassan SVP-Head PMO-CBA / Chief Information Security Officer

OVERSEAS OPERATIONS MANAGEMENT

R.A. Kaleemi

SEVP & Chief Representative, Canada Office

M. Rafiq Bengali SEVP & Regional Chief Executive, Americas Region

Asif Hassan SEVP & Regional Chief Executive, Far East Region

Nausherwan Adil SEVP & Regional Chief Executive, Europe Region

Khawar Saeed SVP & Regional Chief Executive, Central Asian Republics Region

Zubair Ahmed EVP & Regional Chief Executive, Middle East, Africa & South Asia Region

Muhammad Hanif Khan SVP & Coordinator, Afghan Operations NBP'S INITIATIVE IN 2007

HINA MASOOD O7

Page 41

NATIONAL BANK OF PAKISTAN

AUDIT COMMITTEE

Azam Faruque Ibrar A.Mumtaz Mian Kausar Hameed

AUDITORS

Ford Rhodes Sidat Hyder & Co. Chartered Accountants M.Yousaf Adil Saleem & Co. Chartered Accountants

LEGAL ADVISORS

Mandviwala & Zafar Advocates & Legal Consultants

Registered & Head office

NBP Building I.I. Chundrigar Road , Karachi, Pakistan

Registrars & Share Registration Office

THK Associates (Pvt.) Ltd. Shares Department, Ground Floor, State life Building : 3 Dr. Ziauddin Ahmed Road, Karachi, Pakistan

WEBSITE

HINA MASOOD O7

www.nbp.com.pk

Page 42

NATIONAL BANK OF PAKISTAN

NBP HEAD OFFICE SET UP

President & Chairman Board of Directors

Chief Coordinator Islamabad PSO & Secretariat

Board of Directors

Secretary BOD

Operations Committee BOD Audit Committee

Assets & Liability Committee

Credit Committee

Training & HR Steering Committee

I.T. Steering Committee

Operations Group

Finance Group

Corporate & Investment Banking Group

Risk Management Group

Commercial & Retail Banking Group

Audit & Inspection Group Special Assets & Remedial Management Group

IT Planning Development & Implementation Group

Strategic Planning & Economic Research Group

HR Management Department

Four Overseas Regional Chiefs

Organization Development & Training Department

HINA MASOOD O7

Page 43

NATIONAL BANK OF PAKISTAN

ORGANIZATIONAL STRUCTURE

PRESIDENT

DIRECTORS/ SEVPS

PROVISIONAL CHIEFS/EVP

REGIONAL CHIEFS/EVP ZONAL CHIEFS/SVP VICE PRESIDENT ASSISTANT VICE PRESIDENT OFFICER GRADE I, II, III

CLERICAL & NON CLERICAL STAFF

HINA MASOOD O7

Page 44

NATIONAL BANK OF PAKISTAN

BRANCH ORGAN GRAM (NEW GARDEN TOWN)

MANAGER OPERATION MANAGER HALL/DEPOSIT INCHARGE

BANKING OPERATIONS

CREDITS

PENSION PAYMENT

GOVERNMENT COLLECTION

CLEARING

EOBI

Consumer Banking

GOVT.

Account opening

Cash Department

DISPATCH

B

Head Cashier

DEMAND FINANCE RUNNING FINANCE Utility Bills Govt. Tax Passport Fee Collection

Remittances

STUDENT LOAN CASH FINANCE SMALL FINANCE

Page 45

Customer Relationship

HINA MASOOD O7

NATIONAL BANK OF PAKISTAN

POLICY FORMULATION PROCESS

National bank of Pakistan policy formulation process is carried out by the top level managers. Executive committee is responsible for designing policies in order to achieve strategic objective. The committee holds meetings on monthly basis and half year basis. The committee consists of members including; Board of Director Chief Executive Officer Executive-in-charge of strategic planning and global marketing

MAJOR FUNCTIONS

Major functions performed by the executive committee are as follows; Analyzing the overall growth of bank. Defining the features of policy. Do the virtual testing. Remove the flaws. Implementation of the policy.

MANAGERIAL POLICIES

In NBP, the policies are of three types:

Operational policies Credit policies Human recourse policies

HINA MASOOD O7 Page 46

NATIONAL BANK OF PAKISTAN

OPERATIONAL POLICIES

Operational and system division is responsible for the formation of the operational policies. Executive in charge of the system and the operation division is there to implement the operational policies. It is the duty of executive-in-charge to:

Monitor the overall operation of the bank Activities performed by operation department of different branches Analyzing the workflow of different departments such as remittance, current deposit department, and account department Rate of increase in deposits of different branches Specify the rules regarding the account maintenance

Executive in charge also designs the motivational policies for: Home Finance Business Finance Leasing

CREDIT POLICIES

Two division form credit policies: Credit Division Credit Monitoring Division

CREDIT DIVISION

Major purpose of credit division is to approve corporate loans, short and long term loans. Real earning for the bank comes from the credit division.

HINA MASOOD O7

Page 47

NATIONAL BANK OF PAKISTAN

Executive-in-charge of the credit division is responsible for making lending policies that are duly approved by the board of directors and followed by different branches. Credit division design the policies after taking into account the credit policies made by SBP. Credit department of all branches must follow all the instructions given by the Executive-in-charge of the credit division.

CREDIT MONITORING DIVISION

Credit monitoring division monitor overall credit exposure and takes analytical and systematic approaches to its credit structure categorized by group industry. This division has built up and maintains a sound loan portfolio in terms of well-defined credit policy. Bank credit a valuation system comprises of well-defined credit appraisal, sanctioning and review procedures for the purpose of emphasizing prudence in its lending activities.

HUMAN RESOURCE POLICIES

Development of the professional skills and knowledge of the employees is essential for the efficient functioning of the organization. At Bank appropriate design policies and practices have been instituted to achieve strategic objective. HR policies made by the Executive-in-charge of human resource division. These policies are as follows:

HR Development Type of Human Development Type of loans provided to staff member Setting the career path of the employees Staff training programs Promotion of the staff members according to the performance Policies about the staff bonuses and staff benefits schemes

HINA MASOOD O7

Page 48

NATIONAL BANK OF PAKISTAN

CATEGORIES OF NBP BRANCHES

There are three categories of NBP branches:

CATEGORY (I) BRANCH:

It consists of more than 16

Employees.

Separate Compliance Officer Separate Operation Manager Separate Branch Manager

CATEGORY (II) BRANCH:

It consists of 6

to 16 Employees.

Separate Branch Manager Operation Manager will work as compliance officer.

CATEGORY (III) BRANCH:

It consists of 1

to 5 Employees.

Branch Manager will work as Compliance officer and Operation manager along with one cashier.

Note: I did internship in category (II) branch

HINA MASOOD O7

Page 49

NATIONAL BANK OF PAKISTAN

EMPLOYEES IN VARIOUS DEPARTMENTS

(NEW GARDEN TOWN BRANCH) EMPLOYEE NAME

MIAN SAEED MEHMOOD MRS. ZAHIDA NASEER HABIBULLAH SHEIKH FARHAN JAVAID WASEEM WAHEED BUTT ABDUL SAMAD BAIG MUHAMMAD ATIF MUHAMMAD ZUBAIR MRS. FARIHA NOSHEEN GHULAM SHABAR MUHAMMAD SALEEM ABDUL RAZZAQ BABAR JASWANT

DEPARTMENT/DESIGNATION

ASSISTANT VICE PRESIDENT(AVP)/

BRANCH MANAGER OG (I) / OPERATION

M ANAGER INCHARGE

OG (I) / HALL AND DEPOSIT

OG (II) / CREDIT ADMINISTRATION

OG ( II) / PENSION PAYMENT INCHARGE

ASSISTANT / SCROLLING OF PASSPORT FEES ASSISTANT / REMITTANCES & DISPATCH

INCHARGE

OG ( II) /ACCOUNT OPENING INCHARGE

OG (II) / DEPOSIT OFFICER PASSPORT FEE COLLECTION & TRANSFER INCHARGE OG

(I) / HEAD CASHIER CASHIER

CASH DEPARTMENT

CASH DEPARTMENT

OG (I)/PASSPORT FEE COLLECTION INCHARGE

MESSENGER

HINA MASOOD O7

Page 50

NATIONAL BANK OF PAKISTAN

JOB DESCRIPTION:

A Banker is responsible for establishing and maintaining positive customer relationships, planning and delivering effective sales strategies and monitoring the progress of new and existing financial products. Bankers may work as managers in high street branches providing operational support on a day-to-day basis, or in more specialized posts in corporate and commercial departments at area, regional or head offices. Banks operate in a fiercely competitive market place where change is common. Products and services offered have to develop to satisfy the expectations and demands of customers and working with staff and customers to achieve targets has become a very major part of the role.

TYPICAL WORK ACTIVITIES OF EMPLOYEES IN VARIOUS DEPARTMENTS

BRANCH MANAGER:

Mian Saeed Mehmood is performing the duties of Branch Manager in New Garden Town Branch of National Bank. The Duties of Branch Manager includes: Marketing of Credit Advances & Recovering Loans and Mark-ups.

OPERATION MANAGER:

Mrs. Zahida Naseer is the operation manager and performing the following duties: All the circulars/office orders are followed up by operation Manager. Loan Sanction--- supervise the credit In-charge along with Branch Manager. Overall assigning of Branch employees duties on different departments is supervised by operation manager.

HINA MASOOD O7 Page 51

NATIONAL BANK OF PAKISTAN

Overall checking of bank books whether they are complete and accurate. Work as a compliance officer (To rectify flaws and Mistakes in different banking operations).

HALL AND DEPOSIT INCHANGE:

Habibullah Sheikh is Hall and deposit incharge and performing the following duties: Supervising all the activities of operations. Act as a joint custodian with Head Cashier. Maintaining Bank Cash Scroll.

Receipt

Payment

Balancing the cash with Head Cashier on day end. Locking the Strong Room (Room that contain remaining cash balance at day end) Act as a Joint Signatory.

CREDIT INCHARGE:

Farhan Javaid is dealing with credit administration and serves as a purpose of incharge in Credit Department. His work activities include: Administration of Credits. Preparing Loan Proposals. Sanction the loans. Keep proper investigation of Securities from customers (i.e. mortgages, pledge, stock etc.) Preparing Loan Case. Recovering Principal amount of Loans (i.e. instalments, lump sum) Recovering Mark-up as bank income from customers periodically (i.e. half yearly, quarterly, annually) Preparing Branch Profit and Loss Statements. (i.e. monthly, half yearly, quarterly, annually)

HINA MASOOD O7 Page 52

NATIONAL BANK OF PAKISTAN

Dealing with WESTERN UNION PAYMENT through SWIFT Code.

DEPOSIT OFFICER:

Mrs. Fariha Nosheen is a deposit officer in the branch and performing the following work activities: Accepting Account Holders Cheques and after verification of balance in account, customer signature from Specimen Signature Card, debit the Customers account in the system i.e. posting of cheque. All the receipts received by Branch Account Holders are also credited by the officer in their accounts. Also give details to customers about Balance Enquiry. Collection and transfer of Passport Fees. (Being the Hub Branch for collection of Passport Fee from nearest 7 to 8 branches and keeping it weekly nil by transferring the Govt. passport collection to Govt. offices along with Govt. Debit Scroll

PENSION PAYMENT INCHARGE:

National Bank is the only bank that performing pension payment responsibility for Govt. Employees. Waseem Waheed Butt is the in-charge of pension payment in this branch and performing the following functions: Giving pension payment to Govt. employees after verifying Pension Payment number (P.P.NO.), File Number (maintained by bank and relevant Govt. office) and claim NO. (EOBI) Also performs Clearing services. Receiving Inward Clearing and return in any case of objection through NIFT. Making outward clearing for our customers to be clear from other banks through NIFT. Maintaining intercity Cheques through TCS services or DAK.

HINA MASOOD O7

Page 53

NATIONAL BANK OF PAKISTAN

REMITTANCES AND DISPATCH INCHARGE:

Muhammad Atif is remittances and dispatch in charge, performing following Work Activities: All the Dak which is send to Main Branch or other branches is made with TCS slip enter in DISPATCH REGISTER. All the Dak which is received from other banks branches with their particulars enter in MAIL INWARD REGISTER.

GOVT. COLLECTION INCHARGE (CASHIER):

MUHAMMED SALEEM is in-charge of this collection and performing the following duties:

Collecting Govt. utility bills ( SUI-GAS, WASA, WAPDA )

Receiving bill payment from customer and entering the particulars in CASH RECIEPT BOOK Collecting Govt. tax i.e. income tax, sales tax, property tax and keeping the record of TAX VOUCHER COPY.

Receiving Tax payment from customers and enters into CASH RECIEPT BOOK. On day end, totalling the govt. bills and Govt. tax collection and hand over the physical cash plus vouchers after proper balancing to Head Cashier for final cash balancing.

PASSPORT FEE COLLECTION:

Abdul Razzaq is performing the responsibility of passport fee collection incharge. His duty includes: Collecting Govt. Passport (Urgent/Normal) and receiving payment from customers. Entering the particulars in Cash Receipt Book. On day end, balancing the total cash receive for passport fee and transfer the record to Head Cashier for final cash balancing.

HINA MASOOD O7

Page 54

NATIONAL BANK OF PAKISTAN

ASSISTANT (SCROLLING OF PASSPORT FEE):

Abdul Samad Baig is responsible for Scrolling of Passport Fee and: Preparing Passport collection scrolls also called Govt. Debit Scrolls and maintaining 3 copies of it for Main Branch Banks Branch Copy Passport Office

ACCOUNT OPENING INCHARGE:

Muhammad Zubair performs the following activities: Opening of Bank Accounts. Basic Banking Account (BBA) PLS Saving Account Current Account Fixed Account Visually impaired/Blind Persons Account

Maintenance of Cheque Book records. Entering of newly printed cheque books with their particulars in Cheque Book Register. Taking signature of authorized Account Holder on relevant entry of Cheque book register at the time of issuance. Keeping all the cheque books under Lock and Key. Sending Letter of Thanks to newly account opening customers. After Letter of Thanks ACKNOWLEDGEMENT received from customers on verification of his Home Address only then Bank Officer can issue Cheque Book. Attach the Letter of Thank Acknowledgement part with Account Opening Form of those customers. Maintaining Locker Record. Act as a CLEAN CASH WRITER.

HINA MASOOD O7 Page 55

NATIONAL BANK OF PAKISTAN

Generate all the day books i.e. PLS, current, payment order etc. Generate General Ledger. Generate General Ledger Abstract.

MESSENGER:

Baber Jaswant acts as a messenger for the branch and performs; Immediate DAK on daily basis is to transfer from branch to branch. Regulating office orders/circulars from one branch to another.

HINA MASOOD O7

Page 56

NATIONAL BANK OF PAKISTAN

SALARY AND CONDITIONS

Starting salaries for new entrants to Batch Trainee Programs from Rs.15000 to Rs.25000.Typical salaries at senior level range from Rs.50000 to Rs.100,000 depending on level of responsibility and including bonuses based on meeting targets. In some specialized roles, such as marketing or human resources, salary ranges at senior level are market driven and reflect pay levels for similar roles in other organizations. Salary prospects are good. There are a variety of fringe benefits, including preferential schemes for private healthcare, contributory pension, share-save, development and training allowances, annual profit-share, life assurance, territorial/location allowance, subsidized mortgages and cheap loans. Working hours are generally 9 am to 5 pm but extra hors may be required from time to time. JOB Opportunities exist throughout Pakistan and are advertised via Bank Websites and internal vacancy bulletins. The majority of Senior Management positions continue to be male dominated but an increasing number of females is also increasing day by day. There are no opportunities for self-employment in retail banking and they are rare in corporate and commercial banking. It is sometimes possible to work as an independent financial adviser following appropriate training. Because of the nature of the job, it is important to pay special attention to personal security. Smart appearance and exemplary professional development training may sometimes give rise to stress. To optimize career progression, mobility is essential as banks often expect their staff to relocate to different branches all over Pakistan. During training, graduates move around on placements. After training, work location will depend on factors such as the type of banking you prefer and where jobs are available

HINA MASOOD O7

Page 57

NATIONAL BANK OF PAKISTAN

HUMAN RESOURCE

For NBP the dedicated, hardworking staff is one of the key strengths of the bank. NBP has been investing in developing this valuable resource through need based training and career growth development. Our HR objective is to become an employer of choice and to maintain complete industrial harmony within the institution.

ENTRY LEVEL REQIREMENTS

Batch Trainees

Management Training Officers (MTO)

Operation officers

NBP offers unlimited opportunities to its employees for continuous personal and professional growth:

1)

Change Management Program:

NBP has started an ambitious Change Management Program to further train its employees to meet the challenges of present day requirements.

2)

Training of new staff:

Training and development are the core issues of HR, which will ultimately improve our customer service and help us, attain the standard of a progressive bank.

HINA MASOOD O7

Page 58

NATIONAL BANK OF PAKISTAN

3)

Benefits:

Besides a competitive financial package, we offer excellent working conditions, job satisfaction, superior leadership, and a conducive environment for growth. The jobs at National Bank of Pakistan are open to all graduates applicants from a wide variety of degree subjects. However, for specialist roles numerate degree disciplines may be preferred. These include: Mathematics Finance Business Studies Economics Law Accounting

Apart from an excellent academic record, candidates will need to show evidence of the following: Team players with excellent interpersonal skills Knowledge and use of information technology Strong analytical and problem solving skills Excellent written and verbal communication skills in English

MTO Program:

Our new hiring of top class MBAs as Management Trainee Officers (MTOs) and search for talent within the bank has helped in preparing second and third tier leadership lines which will shape our succession planning process and at the same time will ensure that with the passage of time our employee refinement and skill enrichment program continues. NBP also have started new Employee Communication Program' and internal organizational magazine to improve the interaction of top and middle level management with the lower management. Female employees are being encouraged through female empowerment program under which they are given responsible and challenging assignments. Currently over 60 females are employed as branch manager all over country and some females hold senior management positions

HINA MASOOD O7 Page 59

NATIONAL BANK OF PAKISTAN

National Bank management trainee program is a dynamic path to launch fast track banking career. The program provides high quality training and development of the bank across Pakistan. Eligibility Criteria : MBA or Masters Degree with 3.0o/4.oo 0r 3.70/5.00 GPA or higher from an HEC recognized institution or a 4-year foreign/local Bachelors Degree, excellent communication skills and an age limit of 25 years.

OPERATION OFFICER BATCH:

Joining the National Bank operation officer Batch is a sure way to get involved in various day to day consumer-banking activities of the bank such .as: Account opening, remittances, collection, clearing, government securities, lockers, etc. This position includes an intense 4-week training program designed to teach officers how to manage the above mention areas. Eligibility Criteria: Graduate/Post Graduate Degree with 1st or 2nd Division from an HEC recognized institution, excellent communication skills, and age limit of 24 years.

TRAINING PROGRAMMES:

NBPs management believes in developing the potential of the banks employees to the fullest extent. Training & development Centre of the Bank are housed in state of the art facilities at Lahore, Karachi, and Islamabad. The centres are responsible for providing multi-level high quality training programmes to all staff members in the following areas: Customer service skills Consumer Banking Operations Credit Marketing & Credit proposals Administration/Documentation Marketing and selling skills Leadership and Management skills Personal effectiveness and skills

HINA MASOOD O7

Page 60

NATIONAL BANK OF PAKISTAN

It is obligatory for each staff member of the bank to attend at least two days of training in a calendar year in order to cope up with new methods and procedures. Whenever the Training Department is unable to provide focused training for certain group of staff, reputable external training providers are invited to fill the gap. Management trainees are able to progress rapidly to senior management positions, often via a fast track route where they can expect a managerial appointment at the end of the successful training. Some management trainees will choose to move to another NBPs branch where they may manage a particular business area, such as personal loans. Other may prefer corporate banking or a more specialized role, such as: Human resources Marketing Credit and Risk analysis Card services Operational management Investment analysis

CAREER LADDER

Career Advancement is usually linked to high levels of performance, especially by meeting sales/customer targets. It is also important to prove potential management ability by, for example, providing evidence of having efficiently executed responsibilities in specific areas of the bank. NBP is committed to the personal welfare and professional development of all its employees. The management realizes that proper career development is essential, not only for a more productive and satisfied workforce but also for a excellent corporate culture. Career planning is very important aspect for development of the employees. By career planning employees career goals are set and to achieve them. The bank feels the responsibility to develop the careers of their employees so that they would be able to get themselves high and high in corporate hierarchy. Then the principle aim of career development programs is to help employees, analyze their

HINA MASOOD O7

Page 61

NATIONAL BANK OF PAKISTAN

abilities and interests to better match personal needs for growth and development with the needs of the organization.

PERFORMANCE APPRAISAL

Performance appraisal is the process of reviewing the individual performance. First of all bank set some standards for different level of employees and direct to their employees to do work according to these standards and evaluation their performance.

TIME PERIOD:

In NBP performance appraisals are usually prepared after every six months, performances of every employee are to be reviewed and on the basis of these performances compensations and benefits are determined.

PERFORMANCE APPRAISAL METHODS:

PERFORMANCE APPRAISAL METHODS which are being used in bank are : Essay about employee performance description Work standard

HINA MASOOD O7

Page 62

NATIONAL BANK OF PAKISTAN

MANAGEMENT STYLES

NATIONAL BANK OF PAKISTAN (NEW GARDEN TOWN BRANCH)