Beruflich Dokumente

Kultur Dokumente

Non Trading Concerns

Hochgeladen von

Muhammad Usman SaeedOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Non Trading Concerns

Hochgeladen von

Muhammad Usman SaeedCopyright:

Verfügbare Formate

GOVERNMENT ISLAMIA COLLEGE, RAILWAY ROAD, LAHORE

NON TRADING CONCERNS

Definition: Organizations or individuals involved in the activities for social welfare or for promotion of trade, commerce, arts, sports, etc. and there primary objective is not to earn profit. OR: Organizations or individuals working for social welfare or promotion of trade, commerce, sports, etc. and not for earning profit.

EXAMPLES:

Trade Associations; Chamber of commerce; Lahore Gym Khana; Pakistan Agricultural Research Council Islamabad; Pakistan arts Council; etc.

In non trading concerns following things are used:

1. Receipts and Payments Account:

It is a summary of all cash received and paid either these are capital receipts and payments or revenue receipts and payments. OR: It is a summary against all capital receipts and payments or revenue receipts or payments. NOTE: A receipt and payments account ios a summarized cash book of given period.

2. Income and Expenditure Account:

It is a summary of all revenue incomes and expenditures and difference b/w all incomes and expenditures shown in form of surplus an deficit. Surplus: It is known as income is excess over expenditures. Deficit: It is known as expenditures are excess over income.

3. Balance Sheet:

It is the summary of all Assets, Liabilities and Capital fund.

Capital Fund: In Non Trading Concerns capital is collected in form of funds so it is regarded as Capital fund.

By: Muhammad Usman Saeed

B.Com. Government Islamia college, Railway Road, Lahore

GOVERNMENT ISLAMIA COLLEGE, RAILWAY ROAD, LAHORE

Specimen of Income and expenditures Account: NAME OF ORGANIZATION Income and expenditure Account For the year ended ________________ Credit

Amount Rs. xxxx xxxx xxxx xxxx xxxx xxx xxxxx Incomes Subscription xxx Add: O/S subscription xxx Less: Advance Sbscrp xxx Less: Last Year Sbscrp xxx Entrance Fee, donations, Life membership fee, etc. Deficit/Excess of expenditures over income Amount Rs.

Specimen: Debit

Expenditures Salaries Rent, Rates and Taxes Advertising Printing & Stationary Honorarium, Etc. Surplus/Excess of income over expenditures

xxxx xxxx xxx xxxxx

Specimen:

Liabilities Capital Fund xxxx Add: Capitalized receipts x Add: Surplus xxx Or Less: Deficit (xxx) Long term Liabilities: A------------B------------etcShort Term Liabilities: C------------D------------etc-

Specimen of Balance Sheet: NAME OF ORGANIZATION Balance Sheet As on_______________

Amount Rs. Assets Fixed Assets: A-----------------B-----------------C-----------------etcCurrent Assets: D------------------E------------------F------------------G------------------H------------------etcAmount Rs. xxx xxx xxx xxx xxx xxx xxx xxx

xxxx xxx xxx xxx xxx XXXXX

XXXXX

Calculation of capital asset fund: Capital fund = Opening Assets + Instructions given in the question + Opening Liabilities.

By: Muhammad Usman Saeed

B.Com. Government Islamia college, Railway Road, Lahore

GOVERNMENT ISLAMIA COLLEGE, RAILWAY ROAD, LAHORE

Treatments of some important items:

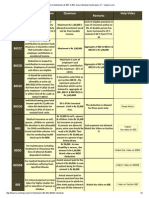

Items Donation Given in Receipts & paymentsA/C Treatment Income& expenditure A/C Normally it is written on income side. OR if it is not mentioned that make some part of donation as revenue then only revenue part will written in this a/c and remaining will be Capitalized Balance sheet Heavy donations, or donations collected for special purpose are written in Capital fund on Liabilities side. Capital fund Properties or cash received on A/C of Legacy is shown on assets side on one hand nd and on 2 hand it is added into capital fund After deducting current period amount, remaining amount will be shown iin balance sheet on Liabilities side. In special cases or if it is given in lump sum then it is added to capital fund. NO TRATMENT

Given in Receipts side

Legacy Legacy refers to property or cash received by virtue of a will of a person after his death.

-------NO TREATMENT-----Receipts Side

Life Membership Fee Receipts Side

In income side Current period is written, fair portion of this, written on income side. If nothing is mentioned then No Treatment

Entrance Fee

Receipts side

Generally it is our income or if it is given in portions

Purchase and sale of newspaper Purchase and sale of sports material Sale of Assets

Purchase is given in payment side and sale is given in receipts side. Purchase is given in payment side and sale is given in receipts side. Receipts Side

SUBSRIPTIONS i. ii. iii. iv. v. Last year O/S Subscription Last year O/S Subscription Current year O/S Sbscrp Advance Sbscrp (of next year/s) Advance Sbscrp (of next year/s)

Receipts side Receipts side Adjustment Adjustment Receipts Side Adjustment

Purchase of newspaper is written on expense side and sale is written on income side Purchase of sports material is written on expense side and sale is written on income side In case of Profit or loss, loss will be debited the I&E A/C and in case of profit, If amount of profit is small then it may be credited the I&E A/C. Current year subscription is written on income side NO TREATMENT Less from current subscription in income side Added in current subscription on Income side NO EFFECT Less from current subscription on income side Expenditures side

NO TREATMENT

In case of heavy, big or normal profit, profit will be added to the Capital Fund NO TREATMENT Added in capital Fund NO TREATMENT Written in Balance Sheet Written on Liabilities side It is written on liabilities side. NO EFFECT

Honorarium

Payment side

By: Muhammad Usman Saeed

B.Com. Government Islamia college, Railway Road, Lahore

GOVERNMENT ISLAMIA COLLEGE, RAILWAY ROAD, LAHORE

Special funds are our Liabilities. All current years/periods, outstanding expenses or incomes at the beginnings will be less and at the end will be add. All previous years or next years expenses or incomes will be less or ignored. All current periods incomes and expenditures will be written in current years Income & Expenditures A/C. During year purchase of any asset or liabilities are not included in Opening statement of affairs, to find capital fund.

POINTS TO BE PONDER

__________________________________________________________ If You learn from your mistakes then you are Intelligent. But If you learn from others mistakes then you are Genius.

By: Muhammad Usman Saeed

B.Com. Government Islamia college, Railway Road, Lahore

Das könnte Ihnen auch gefallen

- AccountingDokument437 SeitenAccountingNeel Hati100% (1)

- CMA Foundation (Accounts) by CA Mohit RohraDokument341 SeitenCMA Foundation (Accounts) by CA Mohit Rohramalltushar975Noch keine Bewertungen

- Financial Reporting and Analysis GuideDokument16 SeitenFinancial Reporting and Analysis GuideSagar KumarNoch keine Bewertungen

- GST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyVon EverandGST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyBewertung: 5 von 5 Sternen5/5 (1)

- A Practical Approach to the Study of Indian Capital MarketsVon EverandA Practical Approach to the Study of Indian Capital MarketsNoch keine Bewertungen

- 17 Checklist NBFC NDDokument11 Seiten17 Checklist NBFC NDaasitabhatt71% (7)

- Dr. Mehul P.Mehta: Assistant Professor BRCM College of Business Administration. Surat, GujaratDokument3 SeitenDr. Mehul P.Mehta: Assistant Professor BRCM College of Business Administration. Surat, GujaratMohammad ShirazNoch keine Bewertungen

- Whatsapp No: +917670919347 Tuesday, August 10, 2021: 12Th of August Weekly ExpiryDokument1 SeiteWhatsapp No: +917670919347 Tuesday, August 10, 2021: 12Th of August Weekly ExpiryKrishna SharmaNoch keine Bewertungen

- Organisation of Commerce and ManagementDokument100 SeitenOrganisation of Commerce and ManagementAMIN BUHARI ABDUL KHADERNoch keine Bewertungen

- India VIXDokument2 SeitenIndia VIXNihilisticDelusionNoch keine Bewertungen

- Calculation of AND Indexes: NSE BSEDokument5 SeitenCalculation of AND Indexes: NSE BSEnaveenNoch keine Bewertungen

- WWW Investopedia Com MACD PrimulDokument10 SeitenWWW Investopedia Com MACD PrimulAvram Cosmin GeorgianNoch keine Bewertungen

- The basics of stock market tradingDokument26 SeitenThe basics of stock market tradingSubhransuNoch keine Bewertungen

- Gss Sheet - Goela Stock Selector: Fact ListDokument9 SeitenGss Sheet - Goela Stock Selector: Fact ListRakesh BehuriaNoch keine Bewertungen

- Trading Plan Essentials: Capital: Risk: Risk/Reward: Profit Target: Processes: Management: Limits: WithdrawsDokument1 SeiteTrading Plan Essentials: Capital: Risk: Risk/Reward: Profit Target: Processes: Management: Limits: WithdrawsParviz GhoibovNoch keine Bewertungen

- Private Equity FundsDokument225 SeitenPrivate Equity FundsvnavaridasNoch keine Bewertungen

- Module 1 Chapter 2 Accounting ProcessDokument116 SeitenModule 1 Chapter 2 Accounting ProcessADITYAROOP PATHAKNoch keine Bewertungen

- Untangling NPS Taxation: Your ContributionsDokument8 SeitenUntangling NPS Taxation: Your ContributionsNItishNoch keine Bewertungen

- Yta School BookletDokument37 SeitenYta School BookletAditi100% (1)

- How To Predict If A Stock Will Go Up or DownDokument18 SeitenHow To Predict If A Stock Will Go Up or DownBrijesh YadavNoch keine Bewertungen

- Income Tax Complete - E-Notes - Udesh Regular - Group 1Dokument250 SeitenIncome Tax Complete - E-Notes - Udesh Regular - Group 1Uday Tomar100% (1)

- Accounting for Non-Profits ExplainedDokument6 SeitenAccounting for Non-Profits ExplainedSGENoch keine Bewertungen

- Easy Chart of Deductions U - S 80C To 80U Every Individual Should Aware of ! - TaxworryDokument2 SeitenEasy Chart of Deductions U - S 80C To 80U Every Individual Should Aware of ! - Taxworrytiata777Noch keine Bewertungen

- Income Tax Concept Book (Amended)Dokument298 SeitenIncome Tax Concept Book (Amended)Ajai SNoch keine Bewertungen

- JAIIB N I Act 1881Dokument42 SeitenJAIIB N I Act 1881Umesh ChandraNoch keine Bewertungen

- Stock Market Basics: Name:-Pawan Chabriya. ROLL - NO: - 5. STD: - T.Y-B.F.M. Subject: - Marketing in Financial ServicesDokument17 SeitenStock Market Basics: Name:-Pawan Chabriya. ROLL - NO: - 5. STD: - T.Y-B.F.M. Subject: - Marketing in Financial ServicesPAWAN CHHABRIANoch keine Bewertungen

- Ca Inter Advanced Accounts Imp Questions BookletDokument112 SeitenCa Inter Advanced Accounts Imp Questions BookletUdaykiran BheemaganiNoch keine Bewertungen

- F&O NotescombinedDokument200 SeitenF&O NotescombinedMunish GuptaNoch keine Bewertungen

- Ultimate Guide To Investments For BeginnersDokument18 SeitenUltimate Guide To Investments For BeginnersArkya MojumderNoch keine Bewertungen

- Tax Study Material PDFDokument151 SeitenTax Study Material PDFROHITH R MENONNoch keine Bewertungen

- Annexure-92. (B.Com Hons) SYLLABUS PDFDokument136 SeitenAnnexure-92. (B.Com Hons) SYLLABUS PDFPrakharNoch keine Bewertungen

- Banknifty 3 30 FormulaTrading Strategy 1699629081727Dokument1 SeiteBanknifty 3 30 FormulaTrading Strategy 1699629081727samidh MorariNoch keine Bewertungen

- Kumar VishwasDokument2 SeitenKumar VishwasSimme MinaNoch keine Bewertungen

- CMSL Notes PDFDokument105 SeitenCMSL Notes PDFVamsi KrishnaNoch keine Bewertungen

- Passing of Board Resolution by Circulation Under Section 289Dokument3 SeitenPassing of Board Resolution by Circulation Under Section 289Rajagopal ChellappanNoch keine Bewertungen

- IT CircularDokument65 SeitenIT Circularnavdeepsingh.india8849100% (2)

- Final Project ForexDokument145 SeitenFinal Project ForexdamupatelNoch keine Bewertungen

- SM CMM RevDokument168 SeitenSM CMM Revprafulvg100% (2)

- Hero Motocorp Balance Sheet AnalysisDokument23 SeitenHero Motocorp Balance Sheet AnalysisabchbvNoch keine Bewertungen

- Management of Foreign Exchange ExposureDokument13 SeitenManagement of Foreign Exchange ExposureTuki DasNoch keine Bewertungen

- Hedging Techniques in Indian Stock Market-Indiabulls (1) - FinalDokument108 SeitenHedging Techniques in Indian Stock Market-Indiabulls (1) - FinalUpendra SaiNoch keine Bewertungen

- Ind As 7 PDFDokument38 SeitenInd As 7 PDFmanan3466Noch keine Bewertungen

- Taxmann's Labour Laws With Code On Wages 2020 Edition TaxmannDokument799 SeitenTaxmann's Labour Laws With Code On Wages 2020 Edition Taxmannbharathi tNoch keine Bewertungen

- 52 Essential Metrics For The Stock MarketDokument10 Seiten52 Essential Metrics For The Stock Marketzekai yangNoch keine Bewertungen

- Dalal Street Sep 2019Dokument84 SeitenDalal Street Sep 2019rgecamitNoch keine Bewertungen

- What Is Sensex - How Is It Calculated - Basics of Share Market PDFDokument14 SeitenWhat Is Sensex - How Is It Calculated - Basics of Share Market PDFMayur Mohanji GuptaNoch keine Bewertungen

- Annual ReportDokument160 SeitenAnnual ReportSivaNoch keine Bewertungen

- Iso 14001 Syllabus PDFDokument4 SeitenIso 14001 Syllabus PDFSeni OkeNoch keine Bewertungen

- Mutual Fund Insight Mar - 2024Dokument85 SeitenMutual Fund Insight Mar - 2024AtulNoch keine Bewertungen

- Receipts and Payments Accounts and Income and Expenditure AccountsDokument5 SeitenReceipts and Payments Accounts and Income and Expenditure AccountsVikrant Joshi0% (2)

- Financial Accounting PPT 123Dokument29 SeitenFinancial Accounting PPT 123An KitNoch keine Bewertungen

- Financial Statements of Not For Profit Organisations BBEDokument27 SeitenFinancial Statements of Not For Profit Organisations BBEanirudh.dubey10001Noch keine Bewertungen

- Non Trading OrganizationDokument2 SeitenNon Trading OrganizationPBGYB60% (5)

- Bad Debts and Provision For Doubtful DebtsDokument13 SeitenBad Debts and Provision For Doubtful DebtsbillNoch keine Bewertungen

- 19674ipcc Acc Vol1 Chapter-9Dokument44 Seiten19674ipcc Acc Vol1 Chapter-9Sonu KamalNoch keine Bewertungen

- Receipts & Payments - Income & Expenditure AccountsDokument16 SeitenReceipts & Payments - Income & Expenditure AccountsAriel JonesNoch keine Bewertungen

- 16 - Not For Profit Organisation - An Introduction (134 KB) PDFDokument14 Seiten16 - Not For Profit Organisation - An Introduction (134 KB) PDFramneekdadwalNoch keine Bewertungen

- Accounts of Non Trading OrganisationDokument13 SeitenAccounts of Non Trading OrganisationMahesh Kumar100% (2)

- Trial Balance To Profit & Loss A/c and Balance Sheet For Corporate & Non-Corporate EntitiesDokument24 SeitenTrial Balance To Profit & Loss A/c and Balance Sheet For Corporate & Non-Corporate EntitiesChintan PatelNoch keine Bewertungen

- Affiliation Rules & RegulationsDokument22 SeitenAffiliation Rules & RegulationsMuhammad Usman SaeedNoch keine Bewertungen

- Suggested Answers Intermediate Examination - Spring 2013: TaxationDokument7 SeitenSuggested Answers Intermediate Examination - Spring 2013: TaxationMuhammad Usman SaeedNoch keine Bewertungen

- 4bfp Brochure-Qatar PDFDokument1 Seite4bfp Brochure-Qatar PDFMuhammad Usman SaeedNoch keine Bewertungen

- MFN Status and Trade Between Pakistan and IndiaDokument18 SeitenMFN Status and Trade Between Pakistan and IndiaMuhammad Usman SaeedNoch keine Bewertungen

- Audit EngagementDokument2 SeitenAudit EngagementMuhammad Usman SaeedNoch keine Bewertungen

- Government of Pakistan Federal Board of RevenueDokument2 SeitenGovernment of Pakistan Federal Board of Revenuezubairkhan_leoNoch keine Bewertungen

- Commission, Fee and ChargesDokument1 SeiteCommission, Fee and ChargesMuhammad Usman SaeedNoch keine Bewertungen

- Digital Library Registration RequirementsDokument1 SeiteDigital Library Registration Requirementsasher_tfm1693Noch keine Bewertungen

- Types of Software Used in BanksDokument3 SeitenTypes of Software Used in BanksMussadaq JavedNoch keine Bewertungen

- First Women Bank LimitedDokument18 SeitenFirst Women Bank LimitedMuhammad Usman SaeedNoch keine Bewertungen

- Job Advertisement StyleDokument2 SeitenJob Advertisement StyleMuhammad Usman SaeedNoch keine Bewertungen

- OriginDokument2 SeitenOriginMuhammad Usman SaeedNoch keine Bewertungen

- 2013 LalPir Power LTD ProspectusDokument84 Seiten2013 LalPir Power LTD ProspectusMuhammad Usman Saeed0% (1)

- 2002 National Bank of PakistanDokument29 Seiten2002 National Bank of PakistansooperusmanNoch keine Bewertungen

- Iv. Information and Communication Technology Infrastructure: A. IntroductionDokument18 SeitenIv. Information and Communication Technology Infrastructure: A. IntroductionMuhammad Usman SaeedNoch keine Bewertungen

- The 7 CS: The Essential Building Blocks of ResilienceDokument1 SeiteThe 7 CS: The Essential Building Blocks of ResilienceMuhammad Usman SaeedNoch keine Bewertungen

- AC07Dokument2 SeitenAC07shreyas_devangaNoch keine Bewertungen

- Alberta Budget 2019 Fiscal PlanDokument208 SeitenAlberta Budget 2019 Fiscal Planedmontonjournal100% (4)

- The Effect of Capital Flight On Nigerian EconomyDokument127 SeitenThe Effect of Capital Flight On Nigerian EconomyAdewole Aliu OlusolaNoch keine Bewertungen

- 5.1 Demand and Supply-Side PoliciesDokument13 Seiten5.1 Demand and Supply-Side PoliciesMarisa VetterNoch keine Bewertungen

- UGB371 Managing and Leading ChangeDokument16 SeitenUGB371 Managing and Leading ChangePhương Anh Nguyễn100% (1)

- Saudi EconomicDokument70 SeitenSaudi EconomicFrancis Salviejo100% (1)

- MCQ's On EconomicsDokument42 SeitenMCQ's On EconomicsDHARMA DAZZLENoch keine Bewertungen

- Differences PSAK 45 (Organization and Entity) and PSAK 1 + ISAK 35Dokument2 SeitenDifferences PSAK 45 (Organization and Entity) and PSAK 1 + ISAK 35Vanadisa SamuelNoch keine Bewertungen

- Warnings of The Maharlika Investment FundDokument1 SeiteWarnings of The Maharlika Investment FundAha BodowskyNoch keine Bewertungen

- Rudiger Dornbusch, Mario Draghi-Public Debt Management - Theory and History-Cambridge University Press (1990)Dokument378 SeitenRudiger Dornbusch, Mario Draghi-Public Debt Management - Theory and History-Cambridge University Press (1990)Koen van den Bos100% (2)

- CFA三级密卷 题目Dokument61 SeitenCFA三级密卷 题目vxm9pctmrrNoch keine Bewertungen

- BC Budget 2023Dokument182 SeitenBC Budget 2023CityNewsToronto100% (1)

- Ela Career Development Unit 3-Module 1 - Resource 2 Analyze A Salary-Based Budget 1Dokument3 SeitenEla Career Development Unit 3-Module 1 - Resource 2 Analyze A Salary-Based Budget 1api-542822113Noch keine Bewertungen

- 01-Sta - mariaIS2021 Audit ReportDokument107 Seiten01-Sta - mariaIS2021 Audit ReportAnjo BrillantesNoch keine Bewertungen

- ECON212 Sample Final ExamDokument17 SeitenECON212 Sample Final Examstharan23Noch keine Bewertungen

- Economic Growth: Trade BalanceDokument54 SeitenEconomic Growth: Trade BalancepiyushmamgainNoch keine Bewertungen

- How To Crack The IELTS Writing Test - Vol 1Dokument308 SeitenHow To Crack The IELTS Writing Test - Vol 1JaydenNoch keine Bewertungen

- Midterm 2 With SolutionsDokument12 SeitenMidterm 2 With SolutionsNikoleta TrudovNoch keine Bewertungen

- 2018 Peoples Budget For PostingDokument49 Seiten2018 Peoples Budget For PostingAlvinDumanggas100% (1)

- Social Security and Medicare Trustees ReportDokument28 SeitenSocial Security and Medicare Trustees ReportAustin DeneanNoch keine Bewertungen

- Chattisgarh CSERC MYT Tariff Order For State Power Companies 2011-12Dokument315 SeitenChattisgarh CSERC MYT Tariff Order For State Power Companies 2011-12Neeraj Singh GautamNoch keine Bewertungen

- Ias Exam Portal: (Online Course) Pub Ad For IAS Mains: Public Policy - State Theories & Public Policy (Paper - 1)Dokument4 SeitenIas Exam Portal: (Online Course) Pub Ad For IAS Mains: Public Policy - State Theories & Public Policy (Paper - 1)Gourangi KumarNoch keine Bewertungen

- Critical Issues in Transportation: Congestion, Emergencies, Energy, Equity, Finance, Innovation, Infrastructure, Institutions, and SafetyDokument16 SeitenCritical Issues in Transportation: Congestion, Emergencies, Energy, Equity, Finance, Innovation, Infrastructure, Institutions, and SafetyKamal MirzaNoch keine Bewertungen

- Indian Economy Paper - Key ConceptsDokument13 SeitenIndian Economy Paper - Key ConceptsMad MadhaviNoch keine Bewertungen

- Public Finance MCQs ExplainedDokument11 SeitenPublic Finance MCQs ExplainedIbrahimGorgage100% (1)

- Economics Crisis of PakistanDokument6 SeitenEconomics Crisis of PakistanHassam MalhiNoch keine Bewertungen

- October 2022 Revision Rbi 247Dokument71 SeitenOctober 2022 Revision Rbi 247Nitika VermaNoch keine Bewertungen

- Canada Telecommunication SWOT AnalysisDokument3 SeitenCanada Telecommunication SWOT AnalysisTheonlyone01Noch keine Bewertungen

- How Will Modi Govt Handle Revenue Deficit Without Raising Income TaxDokument3 SeitenHow Will Modi Govt Handle Revenue Deficit Without Raising Income TaxPNoch keine Bewertungen

- Chapter 1Dokument10 SeitenChapter 1Ngoh Jia HuiNoch keine Bewertungen

- Cash BudgetDokument10 SeitenCash BudgetShrinivasan IyengarNoch keine Bewertungen