Beruflich Dokumente

Kultur Dokumente

F 12 C

Hochgeladen von

premkumar.bathalaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

F 12 C

Hochgeladen von

premkumar.bathalaCopyright:

Verfügbare Formate

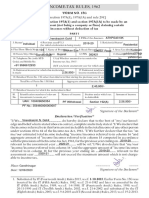

FORM NO.

12C

[See rule 26B] Form for sending particulars of income under section 192 (2B) for the year ending 31st March, 19 1. Name and address of the employee 2. Permanent Account Number 3. Residential Status

4.

Particulars of income under any head of income other than Salaries (not being loss under any such head other than the loss under the head Income from house property) received in the financial year (i) Income from house property (in case of loss, enclose computation thereof )

(ii)

Rs. Rs. Rs.

. . .

Profits and gains of business or profession gains

(iii) Capital

(iv)Income from other sources (a) Dividends Rs. . (b) Interest Rs. . (c) Other income Rs. . (specify) Total Rs. 5. Aggregate of sub-items (I) to (v) of item 4 6. Tax deducted at source [enclosed certificate(s) issued under section 203] Place Date . . Verification I, true to the best of my knowledge and belief. Verified today, Place Date . . day of , do hereby declare that what is stated above is 19 . Signature of the employer

Signature of the employer

Das könnte Ihnen auch gefallen

- Declaration FormDokument1 SeiteDeclaration FormDattatraya ParleNoch keine Bewertungen

- Form 12C PDFDokument1 SeiteForm 12C PDFNithya RahulNoch keine Bewertungen

- Form 12C PDFDokument1 SeiteForm 12C PDFKanishka MandalNoch keine Bewertungen

- Form 12CDokument1 SeiteForm 12CSrinivasa Rao TNoch keine Bewertungen

- Annexure III&IIIA-Form12C&ComputationSheetDokument2 SeitenAnnexure III&IIIA-Form12C&ComputationSheetBhooma Shayan100% (1)

- Annexure III&IIIA Form12C&ComputationSheetDokument2 SeitenAnnexure III&IIIA Form12C&ComputationSheetkalpNoch keine Bewertungen

- Other IncomeDokument2 SeitenOther IncomeSandeep ReddyNoch keine Bewertungen

- Form 12CDokument1 SeiteForm 12Csadiqsein01Noch keine Bewertungen

- Form 12C Income DetailsDokument2 SeitenForm 12C Income DetailsGyanendra GautamNoch keine Bewertungen

- Form 12C Income DetailsDokument1 SeiteForm 12C Income DetailsRaghunath DhandapaniNoch keine Bewertungen

- Form 12C Income DetailsDokument1 SeiteForm 12C Income DetailsSireeshaVeluruNoch keine Bewertungen

- FRE Form12CDokument1 SeiteFRE Form12Cappsectesting3Noch keine Bewertungen

- Form NoDokument1 SeiteForm Nomurali_mohan_5Noch keine Bewertungen

- Itrform12bb PDFDokument3 SeitenItrform12bb PDFtpchoNoch keine Bewertungen

- Itrform12bb PDFDokument3 SeitenItrform12bb PDFvizay237_430788222Noch keine Bewertungen

- INCOME TAX DEDUCTION CLAIM FORMDokument3 SeitenINCOME TAX DEDUCTION CLAIM FORMvizay237_430788222Noch keine Bewertungen

- INCOME TAX DEDUCTION CLAIM FORMDokument3 SeitenINCOME TAX DEDUCTION CLAIM FORMSunnyGouravNoch keine Bewertungen

- Income-Tax Rules, 1962Dokument3 SeitenIncome-Tax Rules, 1962Akarsh ReghunathNoch keine Bewertungen

- Ministry of Finance (Department of Revenue)Dokument24 SeitenMinistry of Finance (Department of Revenue)grameshchandraNoch keine Bewertungen

- Income Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Dokument5 SeitenIncome Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Santosh Aditya Sharma ManthaNoch keine Bewertungen

- Form 12C Income DetailsDokument1 SeiteForm 12C Income DetailsSudha SNoch keine Bewertungen

- Form2FandInstructions 06062006Dokument11 SeitenForm2FandInstructions 06062006Mnaoj PatelNoch keine Bewertungen

- (See Rule 31 (1) (A) ) : Form No. 16Dokument8 Seiten(See Rule 31 (1) (A) ) : Form No. 16Amol LokhandeNoch keine Bewertungen

- FORM 16 TDS CERTIFICATE DECODEDDokument4 SeitenFORM 16 TDS CERTIFICATE DECODEDSuman HalderNoch keine Bewertungen

- FORM 12C (Let Out Property)Dokument1 SeiteFORM 12C (Let Out Property)Sureshkumar MauryaNoch keine Bewertungen

- ACC 203 Taxation in NepalDokument9 SeitenACC 203 Taxation in NepalSophiya PrabinNoch keine Bewertungen

- Form 23ac: Form For Filing Balance Sheet and Other Documents With The RegistrarDokument7 SeitenForm 23ac: Form For Filing Balance Sheet and Other Documents With The Registrarcoolavi066628Noch keine Bewertungen

- Form 23BDokument2 SeitenForm 23BnavanitguptaNoch keine Bewertungen

- Form 23ACDokument6 SeitenForm 23ACNikkhil GuptaaNoch keine Bewertungen

- Form 16 TDS SummaryDokument4 SeitenForm 16 TDS SummarySushma Kaza DuggarajuNoch keine Bewertungen

- Form 12CDokument2 SeitenForm 12CAllahBaksh100% (2)

- Basic Income Tax Concepts ExplainedDokument48 SeitenBasic Income Tax Concepts ExplainedRohit BadgujarNoch keine Bewertungen

- Amendment in TDS RulesDokument3 SeitenAmendment in TDS RulesjohnsuthaNoch keine Bewertungen

- Form No 15GDokument2 SeitenForm No 15Gnarendra1968Noch keine Bewertungen

- ITR-A Form for Modified Return Under Section 170ADokument2 SeitenITR-A Form for Modified Return Under Section 170Asai charanNoch keine Bewertungen

- Rayat Educational Trust Income Tax FormDokument2 SeitenRayat Educational Trust Income Tax Formvijay_2594Noch keine Bewertungen

- 15G PDFDokument2 Seiten15G PDFSudhendu ChauhanNoch keine Bewertungen

- Form 3CDDokument8 SeitenForm 3CDmahi jainNoch keine Bewertungen

- FORM NO. 13 APPLICATION FOR CERTIFICATE FOR LOWER OR NIL TAX DEDUCTION/COLLECTIONDokument6 SeitenFORM NO. 13 APPLICATION FOR CERTIFICATE FOR LOWER OR NIL TAX DEDUCTION/COLLECTIONRajasekar SivaguruvelNoch keine Bewertungen

- How To Fill-Up ITR Using EBIRForm - 2022 - v1Dokument10 SeitenHow To Fill-Up ITR Using EBIRForm - 2022 - v1Michael PantonillaNoch keine Bewertungen

- Paymentof Bonus ActDokument2 SeitenPaymentof Bonus ActSrinivasan .MNoch keine Bewertungen

- Itr 62 Form 16Dokument4 SeitenItr 62 Form 16Hardik ShahNoch keine Bewertungen

- IT FormDokument8 SeitenIT Formapi-3829020Noch keine Bewertungen

- Form IV - Annual ReturnDokument2 SeitenForm IV - Annual Returnhdpanchal86Noch keine Bewertungen

- Notification 88 2023Dokument4 SeitenNotification 88 2023sarvagya.mishra448Noch keine Bewertungen

- Printed From WWW - Incometaxindia.gov - in Page 1 of 4Dokument4 SeitenPrinted From WWW - Incometaxindia.gov - in Page 1 of 4Thil ThilNoch keine Bewertungen

- Form No. 3aaa (Now Redundant) Audit Report Under Section 32ABDokument4 SeitenForm No. 3aaa (Now Redundant) Audit Report Under Section 32ABAnonymous 2evaoXKKdNoch keine Bewertungen

- Income Tax Declaration Form - F.Y. 2020-21Dokument8 SeitenIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNoch keine Bewertungen

- ITR62 Form 15 CADokument5 SeitenITR62 Form 15 CAMohit47Noch keine Bewertungen

- 1089 Form68Dokument3 Seiten1089 Form68vigneshNoch keine Bewertungen

- Taxation of IncomeDokument10 SeitenTaxation of IncomeDavis Deo KagisaNoch keine Bewertungen

- Return of Income: Basic InformationDokument8 SeitenReturn of Income: Basic InformationSudmanNoch keine Bewertungen

- Form16fy10 11Dokument3 SeitenForm16fy10 11atishroyNoch keine Bewertungen

- 31 thU9V8pZIEoijGbRNn7OXQ0eDokument1 Seite31 thU9V8pZIEoijGbRNn7OXQ0eAvinash KumarNoch keine Bewertungen

- Form 26A Accountant CertificateDokument3 SeitenForm 26A Accountant CertificateKumar KumarNoch keine Bewertungen

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionVon EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNoch keine Bewertungen