Beruflich Dokumente

Kultur Dokumente

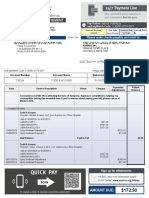

OH May 20 Paystub

Hochgeladen von

Kari Jones KennedyOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

OH May 20 Paystub

Hochgeladen von

Kari Jones KennedyCopyright:

Verfügbare Formate

Pay Group:

Pay Begin Date:

Pay End Date:

OhioHealth Corporation

180 East Broad Street

Columbus, OH 43215

Associate ID:

Department:

Location:

Job Title:

Pay Rate:

Kari S. Kennedy

138 Rome Dr

Pataskala, OH 43062

Description

Regular

Shift 2 Evening

Tuition Reimbursed-Before

TAP Authorized

Shift 3 Night

TAP Unscheduled

Holiday Pay

WorkShop

80.00

BEFORE-TAX DEDUCTIONS

Description

Current

Medical - PCA

114.00

Dental

18.37

Vision Service Plan

10.35

403(b) Savings Plan

149.96

FSA - Health Care Account

96.15

YTD

1,140.00

183.70

103.50

1,499.13

961.52

TOTAL:

3,887.85

LEAVE BALANCES

Available Balance

60120

13040-Neonatal Special Care

Riverside Methodist Hospital

Clinical Nurse Mgr

$32.740000 Hourly

HOURS AND EARNINGS

Current

--------Hours

Earnings

80.00

2,619.20

80.00

380.00

0.00

0.00

0.00

0.00

0.00

0.00

------Rate

32.740000

4.750000

TOTAL:

Current

YTD

388.83

TOTAL GROSS

2,999.20

34,817.50

TAP

163.14

R01-Grant/Riverside Methodist Hosp

05/01/2011

05/14/2011

SSP

0.0

2,999.20

TAX DATA:

Marital Status:

Allowances:

Addl. Pct:

Addl. Amt:

Federal

Single

0

OH State

Not applicable

0

60.00

10.00

48.00

30.00

8.00

2.00

--------Earnings

24,555.00

3,562.50

4,835.00

327.40

228.00

982.20

261.92

65.48

Description

Fed Withholdng

Fed MED/EE

Fed OASDI/EE

OH Withholdng

OH COLUMBUS Withholdng

OH SW LCKNGSD

Withholdng

1,598.00

34,817.50

TOTAL:

YTD

YTD

41.40

48.60

13.80

11.10

275.00

231.72

50.70

162.58

22.17

15.00

TOTAL:

91.09

872.07

FED TAXABLE GROSS

2,610.37

26,094.65

TOTAL TAXES

889.95

8,895.98

PERS LEAVE

Payment Type

Advice #000000003402870

TAP Hours Earned this Pay

MESSAGE:

RVHSP

000000003402870

05/20/2011

10.00

TAXES

-----Hours

750.00

750.00

AFTER-TAX DEDUCTIONS

Description

Current

Group Term Life

4.14

AD&D (Personal Acc. Ins.)

4.86

Dependent Life Insurance

1.38

Supplemental Spousal Life

1.15

Long Term Disability

27.50

Nutrition Deduction

24.93

Riverside Gift Shop

6.30

Tim Horton's

20.83

RMB Pharmacy

0.00

United Way

0.00

0.0

Business Unit:

Check #:

Check Date:

Description

YTD

5,431.34

400.11

1,158.94

1,020.00

689.86

195.73

889.95

8,895.98

EMPLOYER PAID BENEFITS

Current

YTD

*TAXABLE

TOTAL DEDUCTIONS

479.92

4,759.92

NET PAY DISTRIBUTION

Account Type

Account Number

Savings

xx5139

Checking

xxxxxxxxx2140

6.15

Current

543.36

40.02

115.94

102.04

69.01

19.58

TOTAL:

NET PAY

1,629.33

21,161.60

Amount

$200.00

$1,429.33

$1,629.33

Das könnte Ihnen auch gefallen

- Wells Fargo Combined Statement of AccountsDokument6 SeitenWells Fargo Combined Statement of AccountsEverardo HaroNoch keine Bewertungen

- November PDFDokument6 SeitenNovember PDFhilsong100% (2)

- PDFDokument1 SeitePDFBrian SmithNoch keine Bewertungen

- Wal-Mart Statement of Earnings and Deductions.: 702 S.W. 8th St.,Bentonville, Arkansas 72716Dokument1 SeiteWal-Mart Statement of Earnings and Deductions.: 702 S.W. 8th St.,Bentonville, Arkansas 72716osce1349Noch keine Bewertungen

- Pay Stub 4022018-4152018Dokument1 SeitePay Stub 4022018-4152018lilian hutsilNoch keine Bewertungen

- SunTrust TemplateDokument1 SeiteSunTrust TemplateJustin Mason100% (2)

- CheckStub - 2020-11-06 v3.6Dokument1 SeiteCheckStub - 2020-11-06 v3.6dijaje865Noch keine Bewertungen

- DJ L Pay Stubs 2Dokument1 SeiteDJ L Pay Stubs 2jase0% (1)

- Earnings Statement Only Non NegotiableDokument1 SeiteEarnings Statement Only Non NegotiableLiz MatzNoch keine Bewertungen

- Pete's Salary For A Week PDFDokument1 SeitePete's Salary For A Week PDFCarmen KuhneNoch keine Bewertungen

- Dave Banking Statement For February 2021Dokument5 SeitenDave Banking Statement For February 2021Vampire Lady0% (1)

- Cheesecakefacory PDFDokument1 SeiteCheesecakefacory PDFTate YatesNoch keine Bewertungen

- Dewitt Gibson: This Is Not A CheckDokument1 SeiteDewitt Gibson: This Is Not A CheckDewitr GibsonNoch keine Bewertungen

- Job PRC Contracting Inc Attn: Job PRC Contracting Inc Payroll 10610 Union Hall ST Jamaica Ny 11433 ToDokument1 SeiteJob PRC Contracting Inc Attn: Job PRC Contracting Inc Payroll 10610 Union Hall ST Jamaica Ny 11433 ToDevon JohnsonNoch keine Bewertungen

- Liska PaystubDokument1 SeiteLiska PaystubCreative Puppy100% (1)

- Earnings Statement: Non-NegotiableDokument1 SeiteEarnings Statement: Non-NegotiableMorenita ParelesNoch keine Bewertungen

- Earnings Statement PAY STUBDokument1 SeiteEarnings Statement PAY STUBAtonye Nyingifa100% (1)

- Global Cash Card - Paystub Detail PDFDokument1 SeiteGlobal Cash Card - Paystub Detail PDFVerónica Del RioNoch keine Bewertungen

- A DP Payroll With CheckDokument1 SeiteA DP Payroll With CheckFuvv FreeNoch keine Bewertungen

- T3TSL - Syndicated Loans - R11.1Dokument238 SeitenT3TSL - Syndicated Loans - R11.1sivanandini100% (1)

- Paystub 1Dokument1 SeitePaystub 1Lori JohnsonNoch keine Bewertungen

- View - Weekly Paystub - JanDokument1 SeiteView - Weekly Paystub - JannodropcarwashNoch keine Bewertungen

- Employee Pay StubDokument2 SeitenEmployee Pay StubTasnim jamil100% (1)

- Screenshot 2019-12-04 at 17.37.04Dokument1 SeiteScreenshot 2019-12-04 at 17.37.04Arthur LottieNoch keine Bewertungen

- Earnings Statement: Non-NegotiableDokument1 SeiteEarnings Statement: Non-NegotiableYanet AlvarezNoch keine Bewertungen

- Jennifer Baer Feb PersonalDokument4 SeitenJennifer Baer Feb Personaldarcywoodham67% (3)

- Jan 2020 Bank StatementDokument5 SeitenJan 2020 Bank StatementAluvya AdamsNoch keine Bewertungen

- Paystub 04.30.2019 PDFDokument1 SeitePaystub 04.30.2019 PDFGanesh RautNoch keine Bewertungen

- Non-Negotiable: 1033 Massachusetts Avenue 2nd Floor Cambridge, MA 02138Dokument1 SeiteNon-Negotiable: 1033 Massachusetts Avenue 2nd Floor Cambridge, MA 02138DearNoodlesNoch keine Bewertungen

- J6Hooo009310710000r0313131DE64F521 PDFDokument1 SeiteJ6Hooo009310710000r0313131DE64F521 PDFRoll KingsNoch keine Bewertungen

- Paystub Green 03-25-2022Dokument1 SeitePaystub Green 03-25-2022Juan Ignacio Ramirez Jaramillo100% (2)

- Manuel Medel Paystubs PDFDokument7 SeitenManuel Medel Paystubs PDFSantiago ManuelNoch keine Bewertungen

- MR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDDokument1 SeiteMR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDSharanu HosamaniNoch keine Bewertungen

- Payslip PDFDokument1 SeitePayslip PDFTwilliams SavgeeNoch keine Bewertungen

- October 2021Dokument6 SeitenOctober 2021Adriana JohnsonNoch keine Bewertungen

- Carsons Deed Tax BillDokument14 SeitenCarsons Deed Tax BillBurton PhillipsNoch keine Bewertungen

- Temple CPU Appeal - Scanned Docs - USPS Disclosures No 1-6, Bates StampedDokument546 SeitenTemple CPU Appeal - Scanned Docs - USPS Disclosures No 1-6, Bates StampedBrent MartinNoch keine Bewertungen

- SCM DaburDokument21 SeitenSCM Daburanshvaidhya0% (1)

- StatementDokument1 SeiteStatementNozipho Zipho DlaminiNoch keine Bewertungen

- View PDF Form Paycheck MonthDokument1 SeiteView PDF Form Paycheck Monthnodropcarwash100% (1)

- PayStubDokument1 SeitePayStubwilson0514Noch keine Bewertungen

- The Texas A&M University System: Statement of Earnings For: Jadhav, Sangramsinh PDokument1 SeiteThe Texas A&M University System: Statement of Earnings For: Jadhav, Sangramsinh PSangram JadhavNoch keine Bewertungen

- Paystub For 10-08-2021Dokument1 SeitePaystub For 10-08-2021DP Creativos ImprentaNoch keine Bewertungen

- PaystubDokument1 SeitePaystubAlberto MoralesNoch keine Bewertungen

- Earnings Current YTD Amount Current Units YTD Units: Town of Guttenberg 6808 Park Avenue Guttenberg, NJ 07093Dokument1 SeiteEarnings Current YTD Amount Current Units YTD Units: Town of Guttenberg 6808 Park Avenue Guttenberg, NJ 07093Alfredo MurrugarraNoch keine Bewertungen

- WAHPBC PayStub Lawanda GardinerDokument1 SeiteWAHPBC PayStub Lawanda GardinerwahpbcNoch keine Bewertungen

- Gina L Eggleton 22965 NE Albertson RD Gaston, OR 97119: Company: Check No. Group: Loc. Dept: Check Date: HoursDokument4 SeitenGina L Eggleton 22965 NE Albertson RD Gaston, OR 97119: Company: Check No. Group: Loc. Dept: Check Date: HoursGigi EggletonNoch keine Bewertungen

- PsDokument1 SeitePsCarrie EvansNoch keine Bewertungen

- Pay Details: Taxable Gross 248.22Dokument1 SeitePay Details: Taxable Gross 248.22ArtemisNoch keine Bewertungen

- Total Deduction This Perio: Earnings StatementDokument1 SeiteTotal Deduction This Perio: Earnings StatementPepe DecaroNoch keine Bewertungen

- Pay StatementDokument1 SeitePay Statementjmatos_297262Noch keine Bewertungen

- Paystub For 11-08-2019Dokument1 SeitePaystub For 11-08-2019Roberin SegarNoch keine Bewertungen

- Paystub - 2009 03 31Dokument1 SeitePaystub - 2009 03 31jrodasc100% (1)

- Aws Apystub - Pay Stub TemplateDokument4 SeitenAws Apystub - Pay Stub TemplateAlex Gamble100% (1)

- Els 10 29 2016 PDFDokument1 SeiteEls 10 29 2016 PDFRebeca LedezmaNoch keine Bewertungen

- PaystubsDokument3 SeitenPaystubsapi-418014547Noch keine Bewertungen

- Check StubDokument2 SeitenCheck StubJuan EnriqueNoch keine Bewertungen

- Pay StubDokument1 SeitePay StubLulu HuttonNoch keine Bewertungen

- Paystub Golden Limousine, Inc 20210906 20210919Dokument2 SeitenPaystub Golden Limousine, Inc 20210906 20210919Alexander Weir-WitmerNoch keine Bewertungen

- Statement 65762Dokument5 SeitenStatement 65762toddNoch keine Bewertungen

- PayStubDokument1 SeitePayStubhaideegracebordadorNoch keine Bewertungen

- Married 0: 401 14Th Street North, Kerkoven, MN 56252Dokument1 SeiteMarried 0: 401 14Th Street North, Kerkoven, MN 56252Scott DoeNoch keine Bewertungen

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeVon EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNoch keine Bewertungen

- Earn StatementDokument1 SeiteEarn StatementKhu RehNoch keine Bewertungen

- Republic of Philippines Court of Tax Appeals Quezon: Davao City Water District, NoDokument21 SeitenRepublic of Philippines Court of Tax Appeals Quezon: Davao City Water District, NoEdrese AguirreNoch keine Bewertungen

- New Balance $6,751.10 Payment Due Date 10/05/19: American Express Classic Gold CardDokument8 SeitenNew Balance $6,751.10 Payment Due Date 10/05/19: American Express Classic Gold CardIrshad aliNoch keine Bewertungen

- Ahmedabad Bhopal MR Jaygopal Khatri: Verma TravelsDokument2 SeitenAhmedabad Bhopal MR Jaygopal Khatri: Verma TravelsJay Gopal KhatriNoch keine Bewertungen

- 509 Bob Statement PDFDokument1 Seite509 Bob Statement PDFMansuri SalmanNoch keine Bewertungen

- Andina FreightDokument73 SeitenAndina FreightReynolds TorresNoch keine Bewertungen

- NOTEDokument9 SeitenNOTEkatieNoch keine Bewertungen

- PaytmDokument10 SeitenPaytmKunal randhirNoch keine Bewertungen

- Standard Chartered 360 Rewards Catalog PDFDokument50 SeitenStandard Chartered 360 Rewards Catalog PDFPiyal Hossain60% (5)

- BBP GST Implementation - Draft - V1.3 LorealDokument103 SeitenBBP GST Implementation - Draft - V1.3 LorealBina Bisht100% (1)

- Rebate: Due DateDokument2 SeitenRebate: Due DateRakesh Dey sarkarNoch keine Bewertungen

- Bir 1701Dokument4 SeitenBir 1701Vanesa Calimag ClementeNoch keine Bewertungen

- Account Move LineDokument4 SeitenAccount Move LineMay Thu LwinNoch keine Bewertungen

- Picop VS CaDokument17 SeitenPicop VS CaQuennie Jane SaplagioNoch keine Bewertungen

- Sekai Pasific IndonesiaDokument1 SeiteSekai Pasific IndonesiaAlNoch keine Bewertungen

- Vistara Free Ticket Voucher TC FinalDokument2 SeitenVistara Free Ticket Voucher TC FinalSanjenbam SumitNoch keine Bewertungen

- Ingenico iWL250 QRG PDFDokument10 SeitenIngenico iWL250 QRG PDFZen Eulalio TalubanNoch keine Bewertungen

- Chapter 05 LTC and BSNL TA DA RulesDokument12 SeitenChapter 05 LTC and BSNL TA DA Rulesgsdurai.mba2725100% (2)

- Bonus PaymentDokument2 SeitenBonus PaymentBilkissNoch keine Bewertungen

- CoverPage DigitalDokument1 SeiteCoverPage Digitalsandeep1996dwivediNoch keine Bewertungen

- Invoice 20054017 25.06.2023Dokument1 SeiteInvoice 20054017 25.06.2023Robert KozielNoch keine Bewertungen

- Sample Bil Astro (Satelite TV Di Malaysia)Dokument3 SeitenSample Bil Astro (Satelite TV Di Malaysia)Daenarys Targariyen100% (1)

- 1555311708760Dokument2 Seiten1555311708760vikram reddy beeravoluNoch keine Bewertungen

- State Bank of Pakistan (8)Dokument1 SeiteState Bank of Pakistan (8)Corporate IncomeNoch keine Bewertungen

- E Tax 2Dokument1 SeiteE Tax 2TemesgenNoch keine Bewertungen

- Chapter Five Customs DutyDokument14 SeitenChapter Five Customs DutyVijai AnandNoch keine Bewertungen

- 0413 Germany Yapp PDFDokument9 Seiten0413 Germany Yapp PDFBharatNoch keine Bewertungen