Beruflich Dokumente

Kultur Dokumente

Concepts of Tax Planning

Hochgeladen von

Kalidindi Vamsi Krishna VarmaOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Concepts of Tax Planning

Hochgeladen von

Kalidindi Vamsi Krishna VarmaCopyright:

Verfügbare Formate

Concepts of Tax Planning: The prime objectives of tax planning are as follows: Reduction of tax liability Minimization of litigation

Productive investment Healthy growth of economy Economic stability How tax payers minimize tax liability: Tax evasion Tax avoidance Tax planning Tax Evasion: This is a dishonest means which are Concealment of income Inflation of expenses and suppress income Falsification of accounts Conscious violation of rules. The above means are unethical, attracts penalties and prosecution. Tax avoidance: Minimising the incidence of tax by adjusting the affairs in such a manner that although it is within the four corners of the taxation laws but the advantage is taken by finding out loopholes in the laws. The shortest definition of tax avoidance is that it is the art of dodging tax evasion without breaking the law. Tax planning is the arrangement of financial activities in such a way that maximum tax benefits are enjoyed by making use of all beneficial provisions in the tax laws. It entitles the assessee to avail certain exemptions, deductions, rebates and reliefs, so as to minimize tax liability. This is permitted and not frowned upon. It is legitimate provided it is within the framework of law. Colourable devices (dubious methods) cannot be part of tax planning and it is wrong.

Tax Planning:

Tax Management: Refers to the compliance with the statutory provisions of law. Tax planning is optional, tax management is mandatory. It includes maintenance of accounts, payment of taxes, filing of return, deduction of tax at source, timely payment of advance taxes, etc. Tax management is first step towards tax planning.

Das könnte Ihnen auch gefallen

- Concepts of Tax PlanningDokument1 SeiteConcepts of Tax PlanningKshetriyas Mass PrdiveNoch keine Bewertungen

- Tax PlanningDokument16 SeitenTax PlanningAddis YawkalNoch keine Bewertungen

- Corporate Tax Planning Unit 1Dokument26 SeitenCorporate Tax Planning Unit 1Abinash PrustyNoch keine Bewertungen

- Tax Planning and ManagementDokument8 SeitenTax Planning and ManagementUpendra SinghNoch keine Bewertungen

- What Is Tax Planning?Dokument4 SeitenWhat Is Tax Planning?Mrigendra MishraNoch keine Bewertungen

- Tax PlanningDokument8 SeitenTax Planninghgoyal190Noch keine Bewertungen

- 19P0310314 - Corporate Tax Planning - Meaning, Objectives and ScopeDokument8 Seiten19P0310314 - Corporate Tax Planning - Meaning, Objectives and ScopePriya KudnekarNoch keine Bewertungen

- Unit 4 LAB FairDokument15 SeitenUnit 4 LAB Fairmurugesan.NNoch keine Bewertungen

- Bjectives of Tax PlanningDokument6 SeitenBjectives of Tax PlanningSruthiDeetiNoch keine Bewertungen

- TAX AssignmentDokument8 SeitenTAX AssignmentJaydeep KumarNoch keine Bewertungen

- Tax Planning: Submitted By: Natasha Sharon Beck (Mba/10031/18) MANAS MAHESHWARI (MBA/10094/18)Dokument11 SeitenTax Planning: Submitted By: Natasha Sharon Beck (Mba/10031/18) MANAS MAHESHWARI (MBA/10094/18)Manas MaheshwariNoch keine Bewertungen

- MeaningDokument9 SeitenMeaningMrigendra MishraNoch keine Bewertungen

- Income Tax PlanningDokument28 SeitenIncome Tax PlanningAtul GuptaNoch keine Bewertungen

- Tax Planning: Prof. Sonali Avhad MamDokument10 SeitenTax Planning: Prof. Sonali Avhad Mamkirandeshmukh40Noch keine Bewertungen

- CT Part 1-IntroductionDokument45 SeitenCT Part 1-IntroductionSHAURYA VERMANoch keine Bewertungen

- Cost AccountingDokument21 SeitenCost AccountingXandarnova corpsNoch keine Bewertungen

- Tax Planning Tax Avoidance AND Tax EvasionDokument17 SeitenTax Planning Tax Avoidance AND Tax EvasionSpUnky RohitNoch keine Bewertungen

- Unit 1 Tax Planning Tax Evasion and TaxDokument29 SeitenUnit 1 Tax Planning Tax Evasion and TaxAmisha Singh VishenNoch keine Bewertungen

- Tax Planning, Tax Evasion, Tax Avoidance & Tax ManagementDokument2 SeitenTax Planning, Tax Evasion, Tax Avoidance & Tax ManagementAkhil RajNoch keine Bewertungen

- Corporate Tax Planning and Management Module 1.Dokument46 SeitenCorporate Tax Planning and Management Module 1.Viraja GuruNoch keine Bewertungen

- Methods of Reducing Tax LiabilitiesDokument6 SeitenMethods of Reducing Tax LiabilitiesAryan SharmaNoch keine Bewertungen

- Introduction of Tax PlanningDokument17 SeitenIntroduction of Tax PlanningNurmanNoch keine Bewertungen

- Intro To Tax ManagementDokument3 SeitenIntro To Tax Managementangclaire47Noch keine Bewertungen

- Tax Planning and Managerial DecisionDokument163 SeitenTax Planning and Managerial DecisionDr Linda Mary Simon100% (2)

- Personal Tax Planning PDFDokument7 SeitenPersonal Tax Planning PDFShivam SinghNoch keine Bewertungen

- Module - 1 Corporate TaxDokument7 SeitenModule - 1 Corporate TaxVishnupriya RameshNoch keine Bewertungen

- Tax PlanningDokument21 SeitenTax Planningpriyani0% (1)

- Meaning of Tax PlanningDokument5 SeitenMeaning of Tax PlanningTanmoy ChakrabortyNoch keine Bewertungen

- Corporate Tax Planning & ManagemenDokument94 SeitenCorporate Tax Planning & ManagemenArshit PatelNoch keine Bewertungen

- 1 TaxplanningchapterDokument60 Seiten1 TaxplanningchapterGieanne Prudence Venculado100% (1)

- Unit VDokument18 SeitenUnit VdepeshsnehaNoch keine Bewertungen

- SHORT ANSWERS ChaurasiaDokument22 SeitenSHORT ANSWERS ChaurasiaSatvik MishraNoch keine Bewertungen

- Tax PlanningDokument2 SeitenTax Planningamrendra kumarNoch keine Bewertungen

- Introduction To Tax PlanningDokument14 SeitenIntroduction To Tax Planningshanu RajputNoch keine Bewertungen

- Tax Planning - Tax Avoidance - Tax EvasionDokument4 SeitenTax Planning - Tax Avoidance - Tax EvasionDr Linda Mary Simon67% (3)

- Corporate Tax Planning and ManagemantDokument11 SeitenCorporate Tax Planning and ManagemantVijay KumarNoch keine Bewertungen

- Corporate Tax PlanningDokument7 SeitenCorporate Tax PlanningimamNoch keine Bewertungen

- Tax Efficiency Financial Plan Tax Liability: DEFINITION of 'Tax Planning'Dokument4 SeitenTax Efficiency Financial Plan Tax Liability: DEFINITION of 'Tax Planning'mba departmentNoch keine Bewertungen

- Unit 1Dokument35 SeitenUnit 1nandan velankarNoch keine Bewertungen

- Short Answers: Submitted To: Prof.K.K.Bajpai Simran Gupta Mba (FC) 4 Sem ROLLNO.8131051Dokument22 SeitenShort Answers: Submitted To: Prof.K.K.Bajpai Simran Gupta Mba (FC) 4 Sem ROLLNO.8131051Satvik MishraNoch keine Bewertungen

- The Difference Between Tax Avoidance and Tax EvasionDokument6 SeitenThe Difference Between Tax Avoidance and Tax EvasionPARUL BOBALNoch keine Bewertungen

- Advanced Tax Laws CS Professional, YES AcademyDokument33 SeitenAdvanced Tax Laws CS Professional, YES AcademyKaran AroraNoch keine Bewertungen

- Introduction To Indian Tax StructureDokument45 SeitenIntroduction To Indian Tax StructureSadir AlamNoch keine Bewertungen

- Tax AssignmentDokument5 SeitenTax AssignmentDiwakar AnandNoch keine Bewertungen

- Final Project SunitaDokument37 SeitenFinal Project SunitaAtul LabdiNoch keine Bewertungen

- Tax PalnningDokument25 SeitenTax PalnningVish Nu VichuNoch keine Bewertungen

- Tax - Planning - and - Managerial - Decisions 4th ChapterDokument16 SeitenTax - Planning - and - Managerial - Decisions 4th ChapterVidya VidyaNoch keine Bewertungen

- Topic 1 Summary STRATADokument10 SeitenTopic 1 Summary STRATAShien Angel Delos ReyesNoch keine Bewertungen

- Tax Planning and Management DecisionsDokument36 SeitenTax Planning and Management Decisionsharshini kishore singhNoch keine Bewertungen

- Tax Evasion and AviodanceDokument9 SeitenTax Evasion and AviodancepoojaNoch keine Bewertungen

- Tax Mr0003Dokument172 SeitenTax Mr0003Nigist WoldeselassieNoch keine Bewertungen

- Tax Planning Tax Avoidance &tax EvasionDokument8 SeitenTax Planning Tax Avoidance &tax EvasionIshpreet Singh BaggaNoch keine Bewertungen

- AX Lanning: by Anup K SuchakDokument27 SeitenAX Lanning: by Anup K SuchakanupsuchakNoch keine Bewertungen

- CS Pro DT New (05.06.20) PDFDokument175 SeitenCS Pro DT New (05.06.20) PDFKapil KaroliyaNoch keine Bewertungen

- Types of Planning Discussed AboveDokument2 SeitenTypes of Planning Discussed AboveHarshika DaswaniNoch keine Bewertungen

- In Come Tax PlanningDokument9 SeitenIn Come Tax PlanningHitesh GuptaNoch keine Bewertungen

- SynopsisDokument7 SeitenSynopsisJagruti KisnaniNoch keine Bewertungen

- Tax Planning Tax Avoidance & Tax EvasionDokument8 SeitenTax Planning Tax Avoidance & Tax EvasionIshpreet Singh Bagga67% (6)

- Tax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024Von EverandTax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024Noch keine Bewertungen

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthVon EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthNoch keine Bewertungen

- Trading Arrangements: Trade Blocs Trade Blocks - Trade EmbargoesDokument9 SeitenTrading Arrangements: Trade Blocs Trade Blocks - Trade EmbargoesKalidindi Vamsi Krishna VarmaNoch keine Bewertungen

- By: Vamsi Krishna Rajul Dubey Daksh Bhatnagar Debashree Pal Aritraa Choudhary Rajesh GurnaniDokument9 SeitenBy: Vamsi Krishna Rajul Dubey Daksh Bhatnagar Debashree Pal Aritraa Choudhary Rajesh GurnaniKalidindi Vamsi Krishna VarmaNoch keine Bewertungen

- Marketing Management: Case Study On Grove Fresh LTDDokument4 SeitenMarketing Management: Case Study On Grove Fresh LTDKalidindi Vamsi Krishna VarmaNoch keine Bewertungen

- The Statement of Cash Flow: Presented By: Deepshikha Maitra Kalidindi Vamsi Krishna Rohit Jasoo Ruchika MohantyDokument16 SeitenThe Statement of Cash Flow: Presented By: Deepshikha Maitra Kalidindi Vamsi Krishna Rohit Jasoo Ruchika MohantyKalidindi Vamsi Krishna VarmaNoch keine Bewertungen

- Diffarence Between US GAAP and Indian Accounting StandardsDokument18 SeitenDiffarence Between US GAAP and Indian Accounting StandardsKalidindi Vamsi Krishna VarmaNoch keine Bewertungen

- Tax Invoice/Bill of Supply/Cash Memo: 01-A, 1ST/F, 183/2,19/2, ANZDokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: 01-A, 1ST/F, 183/2,19/2, ANZsachin shindeNoch keine Bewertungen

- Arizona FBLA Test 1 (New Numbers)Dokument10 SeitenArizona FBLA Test 1 (New Numbers)bob smithNoch keine Bewertungen

- Online 645Dokument2 SeitenOnline 645Aishwarya SenthilNoch keine Bewertungen

- E-Filing of Returns (Income Tax Online Filing)Dokument23 SeitenE-Filing of Returns (Income Tax Online Filing)Prashant Jadhav0% (1)

- Income Taxation of Individual Taxpayers in The Philippines: 25k/child 25k/child 25k/childDokument7 SeitenIncome Taxation of Individual Taxpayers in The Philippines: 25k/child 25k/child 25k/childLet it beNoch keine Bewertungen

- Pag - Ibig MDFDokument2 SeitenPag - Ibig MDFvenemysamson50% (2)

- Waiver of Statute of LimitationsDokument13 SeitenWaiver of Statute of LimitationsFrancis PunoNoch keine Bewertungen

- Week 4 Day 2: Salient Features of GST ObjectivesDokument2 SeitenWeek 4 Day 2: Salient Features of GST Objectivestina tanwarNoch keine Bewertungen

- It 000147370701 2024 12Dokument1 SeiteIt 000147370701 2024 12Revenue sectionNoch keine Bewertungen

- Question Bank Depreciation P31 AnswerDokument4 SeitenQuestion Bank Depreciation P31 AnswerKajal YadavNoch keine Bewertungen

- RMO No. 10-2019 - DigestDokument3 SeitenRMO No. 10-2019 - DigestAMNoch keine Bewertungen

- Assignment 1 Outline and Guideline UpdateDokument3 SeitenAssignment 1 Outline and Guideline UpdateĐan Nguyễn PhươngNoch keine Bewertungen

- Cta Eb CV 02543 D 2023may11 AssDokument11 SeitenCta Eb CV 02543 D 2023may11 AssErlinda SantiagoNoch keine Bewertungen

- Encomenda Fornecedor - Clubefashion Ecfcf 2021/10286: Circunland, SaDokument4 SeitenEncomenda Fornecedor - Clubefashion Ecfcf 2021/10286: Circunland, SaMuhammad Ameer Hamza KayanNoch keine Bewertungen

- Fringe Benefits: Classifications: Employees and Managerial or Supervisory PositionsDokument64 SeitenFringe Benefits: Classifications: Employees and Managerial or Supervisory PositionsDempseyNoch keine Bewertungen

- Kuenzle Vs CIRDokument2 SeitenKuenzle Vs CIRHaroldDeLeon100% (1)

- Sample Withdrawal Letter PPFDokument1 SeiteSample Withdrawal Letter PPFkay riveraNoch keine Bewertungen

- CIR vs. PHILEXDokument2 SeitenCIR vs. PHILEXBarem Salio-anNoch keine Bewertungen

- Quote - 1537 AirDokument1 SeiteQuote - 1537 AirBlas HernándezNoch keine Bewertungen

- Usha Quartz Room HeaterDokument1 SeiteUsha Quartz Room HeaterArunNoch keine Bewertungen

- Tax 2 Case Digest 5Dokument1 SeiteTax 2 Case Digest 5Leo NekkoNoch keine Bewertungen

- 2021 Turbo Tax ReturnDokument4 Seiten2021 Turbo Tax ReturnEmonee WellsNoch keine Bewertungen

- Historical Development of Taxing System in IndiaDokument17 SeitenHistorical Development of Taxing System in IndiasenthamilanNoch keine Bewertungen

- Calculation of Short Term Capital Gain TaxDokument2 SeitenCalculation of Short Term Capital Gain TaxSAGAR BALAGARNoch keine Bewertungen

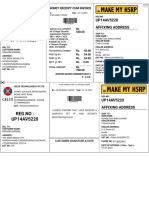

- HSRPDokument1 SeiteHSRPRakesh SinghNoch keine Bewertungen

- Tax Invoice: Original For RecipientDokument3 SeitenTax Invoice: Original For RecipientS V ENTERPRISESNoch keine Bewertungen

- May 2022 PayslipDokument1 SeiteMay 2022 PayslipJustice Agbeko100% (1)

- Form 16 - IT DEPT Part A - 20202021Dokument2 SeitenForm 16 - IT DEPT Part A - 20202021Kritansh BindalNoch keine Bewertungen

- PwcSalesInvoiceReport DesignJCDokument2 SeitenPwcSalesInvoiceReport DesignJCCHOTINoch keine Bewertungen

- Au 1Dokument1 SeiteAu 1ubattleg5Noch keine Bewertungen