Beruflich Dokumente

Kultur Dokumente

1 Analysis of FRS 138 Intangible Assets

Hochgeladen von

Wilber LohOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

1 Analysis of FRS 138 Intangible Assets

Hochgeladen von

Wilber LohCopyright:

Verfügbare Formate

1.

INTRODUCTION

Financial Reporting Standards, also known as FRS, is a set of accounting standards issued or adopted by MASB, Malaysian Accounting Standards Board, for application by all entities other than private entities. In this term project, we will discuss about FRS 138 Intangible assets. The International Accounting Standards Board (IASB) revised IAS 38 as part of its project on business combinations. The projects objective is to improve the quality of, and seek international convergence on, the accounting for business combinations and the subsequent accounting for goodwill and intangible assets acquired in business combinations. FRS 138 was introduced in 1st Jan 2006 to replace International Accounting Standards (IAS) 38 that issued in 1998. An intangible asset was defined in the previous version of IAS 38 as an identifiable nonmonetary asset without physical substance held for use in the production or supply of goods or services, for rental to others, or for administrative services. The definition in the revised standard eliminates the requirement for the asset to be held for use in the production or supply of goods or services, for rental to others, or for administrative services. There are three essential characteristics of intangible assets. Firstly, intangible assets are resources controlled by the entity from which future economic benefits are expected to flow to the entity. Secondly, intangible assets are lack of physical substance. Lastly, intangible assets are identifiable. Intangible assets can be divided into six types such as marketing-related intangible asset, customer-related intangible asset, artistic-related intangible asset, contract-related intangible asset, technology-related intangible asset and goodwill.

2.0

ANALYSIS OF FRS 138 INTANGIBLE ASSETS

2.1

Meaning and Identifiable Intangible Asset

An intangible asset is an identifiable without physical substance. Intangible asset are one of the non-monetary assets. It is important for analytical purposes because of its potential materiality on the balance sheet of firm heavily involved in acquisitions activity. The examples of intangible assets are patents, customer list, artistic, copyrights, licensing, trademarks, construction permit, brands, franchise agreements, and goodwill. This asset is difficult to measure because we cannot touch or weight intangibles, we cannot measure this asset directly but we must use some other variable that can be measured. Lack of physical substance is the main characteristic of the intangible asset. These characteristic separates assets like property, plant, and equipment from intangible assets. The intangible assets can be identifiable by a few groups: Marketing-related intangible assets Customer-related intangible assets Artistic-related intangible assets Contract-based intangible assets Technology-based intangible assets

2.2

Internally Generates Goodwill and Intangible Assets

The cost of an internally generated intangible asset comprises all directly attributable costs necessary to create, produce, and prepare the asset to be capable of operating in the manner intended by management. For examples, costs of materials and services used or consumed in

generating the intangible asset and costs of employee benefits arising from the generation of the intangible asset. The goodwill will exist when the companies make the business combination. The goodwill can be determined by difference between the fair value of the entity as a whole and the sum of the fair value of the identifiable net assets of the entity. The goodwill must be measured at cost. Two phases need to be done when to begin capitalizing costs, there are research phase and development phase. For the research phase, we will totally send the cost into Income Statement under expenses. While the development phase, we need to know whether it will be available to use or sale. If there are available to use, we will recognized this cost while if there are no market, it will be the expenses. These was mention on the paragraph 57 of the FRS 138, in order to development outlays, an entity must be able to demonstrate all of the following: The technical feasibility of completing the intangible asset so that it will be available for use or sale. Its intension to complete the intangible asset and use or sell it. Its ability to use or sell the intangible asset. Its ability to measure reliably the expenditure attributable to the intangible asset during its development.

2.3

Measurement Basis

The intangible assets can be measured by two methods or model; there are cost model and revaluation model. Via cost model, the asset is recorded at the initial cost of acquisition less any accumulated amortization and any accumulated impairment losses.

3

Under the revaluation model, the assets are carried at fair value at date of the revaluation less any subsequent accumulated amortization and any subsequent accumulated impairment losses. Accounting for intangible assets measured using the revaluation model is exactly the same as for property, plant and equipment. The revaluation model does not allow the revaluation of intangible assets that have not previously been recognized as assets or the initial recognition of intangible assets at amounts other than cost. The revaluation model is applied after an asset has been initially recognized at cost. However, if only part of the cost of an intangible asset is recognized as an asset because the asset did not meet the criteria for recognition until part of the way through the process, the revaluation model may be applied to the whole of that asset. Also, the revaluation model may be applied to an intangible asset that was received by way of a government grant and recognized at a nominal amount.

2.4

Amortization of Intangible Assets

The useful life of the intangible asset is dividing by to, finite or indefinite. If finite, the intangible asset should be amortized through it useful life that was set up by the management of the company. While, if the intangible asset is indefinite, then there is no annual amortization charge for that intangible asset. The useful life of the intangible assets that is not being amortized must be shown for each period. The principles of amortization are the same as those for depreciating property, plant and equipment. Many factors are considered in determining the useful life of an intangible asset, including: The expected usage of the asset by the entity and whether the asset could be managed efficiently by another management team.

4

Typical product life cycles for the asset and public information on estimates of useful lives of similar assets that are used in a similar way.

Technical, technological, commercial or other types of obsolescence. The stability of the industry in which the asset operates and changes in the market demand for the products or services output from the asset. The amortization method used shall reflect the pattern in which the asset's future

economic benefits are expected to be consumed by the entity. If that pattern cannot be determined reliably, the straight-line method shall be used. The amortization charge for each period shall be recognized in profit or loss unless this or another standard permits or requires it to be included in the carrying amount of another asset. These methods include the straight-line method, the diminishing balance method and the unit of production method. Amortization is usually recognized in profit or loss. The residual value of an intangible asset with a finite useful life shall be assumed to be zero unless: There is a commitment by a third party to purchase the asset at the end of its useful life There is an active market for the asset and residual value can be determined by reference to that market and it is probable that such a market will exist at the end of the assets useful life. The depreciable amount of an asset with a finite useful life is determined after deducting its residual value. A residual value other than zero implies that an entity expects to dispose of the intangible asset before the end of its economic life.

2.5

Retirement and Disposals

An intangible asset shall be derecognized on disposal or when no future economic benefits are expected from its use or disposal. The gain or loss arising from derecognition of an intangible asset shall be determined as the difference between the net disposal proceeds, and the carrying amount of the asset. It shall be recognized in profit or loss when the asset is derecognized. Gains shall not be classified as revenue. Accounting for the retirement or disposal of intangible assets is the same as that for property, plant and equipment. The amortization of and intangible with a finite useful life does not cease when the asset becomes temporarily idle or is retired from active use. Intangible assets measured after recognition using the revaluation model if intangible assets are accounted for at revalued amounts, an entity shall disclose the following By class of intangible assets through the effective date of the revaluation, the carrying amount of revalued intangible assets and the carrying amount that would have been recognized had the revalued class of intangible assets been measured after recognition using the cost model; The amount of the revaluation surplus that relates to intangible assets at the beginning and end of the period, indicating the changes during the period and any restrictions on the distribution of the balance to shareholders. The methods and significant assumptions applied in estimating the assets fair values.

3.0

EXAMPLE OF LISTED COMPANIES

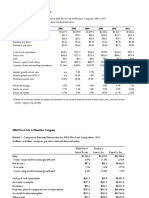

3.1 Maxis Berhad Annual Report - Abstracted Balance Sheet and Abstracted Notes to the Account for the Year Ended 31st December 2010

From the above, we can see the abstract annual report of Maxis Berhad in the year 2009/2010. We also look at the presentation of non-current assets. With that FRS, the top level is property, plant and equipment, and then they follow with the intangible assets, investment in subsidiaries, loan to subsidiaries and deferred tax assets.

In the note to account year 2009/2010, show that the opening balance of the intangible assets for the current year. Then, they plus with the additional value and the acquisition during the financial year and lastly minus with amortization for the intangible assets that have a useful life. The total cost of intangible asset will be deducted with the accumulated amortization. Other than that, there is also impairment testing for cash-generated units containing goodwill.

3.2 Digi.Com Berhad Annual Report - Abstract Balance Sheet and Abstracted Notes to the Account for the Year Ended 31st December 2010

Next is the DIGI.COM Berhad. Their company also show the same ways like Maxis Berhad. They located the intangible assets under the non-current assets. The sequence of the intangible asset was place under the property, plant and equipment. The detail of the intangible assets was shown in the note to account. In the note to account, we can see that the opening balance at 1 January was added with the additions value. Then all the cost for the year will deduct with accumulated amortization and the current year amortization expenses. When the cost minus with the accumulated amortization, we can see the carry amount for the year was shown in balance sheet.

4.0

CONCLUSION

An intangible asset must be identifiable, lack of physical existence and is a non monetary asset. The revaluation of the intangible asset was based on useful life of the intangible asset itself. The useful life and residual value of the intangible asset must be reviewed annually. For define intangible asset, amortization is incurred while loss on impairment will be incurred to both define intangible asset and indefinite intangible asset. According to FRS 138, companies are required to show the intangible assets in financial statement. Both companies, Maxis and Digi had followed the standard of FRS with the intangible assets well presented in their annual report. As we can see, intangible assets were shown in the Statement of Financial Position under Non Current Assets. In the Statement of Financial Position, the amount of intangible assets shown was the carrying amount, while the further explanation or details of the intangible assets were shown in the Notes to the Account after the financial statements.

10

5.0

REFERENCES

Michael J. Mard, James R. H., & Steven D. H. (2011). Valuation for Financial Reporting: Business Combinations. John Wiley & Sons, Inc.

Juergen H. Daum. (2003). Intangible Assets and Value Creation: Intangible Assets. John Wiley & Sons Ltd.

Lyn M. Fraser, & Aileen O. (2007). Understanding Financial Statements: Intangible Assets. Pearson Prentice Hall

Ken Leo, John H., John S., & Jennie R. (2009). Company Accounting: Intangible Assets. John Wiley & Sons Australia, Ltd.

FRS 138 Intangible Asset. (2006). http://www.masb.org.my/

11

6.0 APPENDICES

12

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- 2.4d Diy-Exercises (Questionnaire)Dokument10 Seiten2.4d Diy-Exercises (Questionnaire)MaeNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Financial Accounting 2017 Ist Semester FinalDokument100 SeitenFinancial Accounting 2017 Ist Semester FinalLOVERAGE MUNEMONoch keine Bewertungen

- HUL Financial AnalysisDokument11 SeitenHUL Financial AnalysisAbhishek Khanna0% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Wild Wood Case StudyDokument6 SeitenWild Wood Case Studyaudrey gadayNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Project SystemDokument45 SeitenProject Systemprashanti shetty0% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Accounting and Its Relationship To Engineering EconomyDokument53 SeitenAccounting and Its Relationship To Engineering Economymacmolles2380% (5)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Solman Milan Special TransDokument158 SeitenSolman Milan Special TransPanda AsiaNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Strategic Management Cesim Report: Submission DateDokument22 SeitenStrategic Management Cesim Report: Submission DateRaj Shekhar GohiyaNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- ACCT 100-Principles of Financial Accounting - Atifa Dar - Omair HaroonDokument7 SeitenACCT 100-Principles of Financial Accounting - Atifa Dar - Omair HaroonAbdelmonim Awad OsmanNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Depreciation R.L GuptaDokument15 SeitenDepreciation R.L GuptaaNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Standalone Balance Sheet 2Dokument1 SeiteStandalone Balance Sheet 2rahulNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- 3 Introduction To IPSASs Liabilities NEW FORMAT 2 - FINAL - 0Dokument59 Seiten3 Introduction To IPSASs Liabilities NEW FORMAT 2 - FINAL - 0Judith GlogowerNoch keine Bewertungen

- HbsDokument45 SeitenHbsClaudia Ladolcevita JohnsonNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Mercury Mining Investment LTD - Audited Reports For 2022Dokument16 SeitenMercury Mining Investment LTD - Audited Reports For 2022tankodanjumacNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- 11 CaipccaccountsDokument19 Seiten11 Caipccaccountsapi-206947225Noch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Comprehensive Cases (Chapters 12-20) : Comprehensive Case One Seacourt Restaurants LTDDokument5 SeitenComprehensive Cases (Chapters 12-20) : Comprehensive Case One Seacourt Restaurants LTDborislutka0% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Solution Manual For Financial Accounting An Introduction To Concepts Methods and Uses 13th Edition by StickneyDokument32 SeitenSolution Manual For Financial Accounting An Introduction To Concepts Methods and Uses 13th Edition by Stickneya540142314Noch keine Bewertungen

- Individual Paper Income Tax Return 2016Dokument39 SeitenIndividual Paper Income Tax Return 2016aarizahmadNoch keine Bewertungen

- Accounting Activation AssignmentDokument19 SeitenAccounting Activation AssignmentKen WuNoch keine Bewertungen

- BORROWING COSTS With AnswerDokument3 SeitenBORROWING COSTS With AnswerMaeNoch keine Bewertungen

- Depreciation: Mathematics of InvestmentDokument18 SeitenDepreciation: Mathematics of InvestmentAjese C. Almirez100% (1)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Inflation Accounting PDFDokument20 SeitenInflation Accounting PDFadil sheikhNoch keine Bewertungen

- Annual Financial Statements: Noah'S Ark Animal Rehabilitation Center and Sanctuary, IncDokument23 SeitenAnnual Financial Statements: Noah'S Ark Animal Rehabilitation Center and Sanctuary, IncGong LinNoch keine Bewertungen

- Advance AccountingDokument7 SeitenAdvance AccountingPutri anjjarwatiNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Conservatism in Accounting - Ross L WattsDokument39 SeitenConservatism in Accounting - Ross L WattsDekri FirmansyahNoch keine Bewertungen

- Chapter 6 SolutionsDokument43 SeitenChapter 6 SolutionsDwightLidstrom83% (6)

- PFRS For SMEsDokument13 SeitenPFRS For SMEsJennifer RasonabeNoch keine Bewertungen

- Octorara Area School District - Financial and Compliance ReportDokument80 SeitenOctorara Area School District - Financial and Compliance ReportTimothy AlexanderNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Accounting For Non-Profit OrganizationsDokument38 SeitenAccounting For Non-Profit Organizationsrevel_131100% (1)

- Javier, A.F. (Lorenzo Shipping Corporation)Dokument20 SeitenJavier, A.F. (Lorenzo Shipping Corporation)Abigail Faith JavierNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)