Beruflich Dokumente

Kultur Dokumente

Tech Mahindra - Main Points

Hochgeladen von

Pallab PriyabraOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Tech Mahindra - Main Points

Hochgeladen von

Pallab PriyabraCopyright:

Verfügbare Formate

About The Company BSE/NSE Code Founding Year CEO of the company Area of Business Website How the

ow the company grew

About The Business Something about the s/w business Product and Services-Mix Export Volume Number of Client What percentage of revenue is generated by top 10 clients? Proportion of US, Europe, rest of the world client Main segment of the business Revenue contribution of each segment

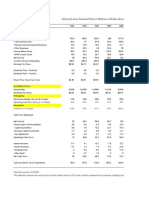

Financials for last 5 years Balance Sheet o Reserves o Net worth o Total Debt o Net Block o Inventories o Account Receivable o Cash and Bank Balance o Net Current Asset/Working Capital o Book Value per share Income Statement o Total Income o Employee Cost o Selling and general administration cost o Operating profit o PBDIT o Interest o Tax o PAT/Reported Net Profit o Equity Dividend o Shares in issue (lakhs) o Earning per share Cash Flow o Net cash flow from operating activities o Closing cash and cash equivalent

Analysis of Financial of last 5 years o Current ratio, quick ratio o Gross profit, Net Profit, operating profit o ROE(Return on Equity), ROA (Return on Asset), ROCE (Return on Capital Employed) o Receivable turn over, Account receivable Days, Inventory Turn Over, Inventory Turn Over days o Debt Equity Ratio

Market Data Current Market Price Trailing PE Ratio Peg ratio Price/Cash Flow ratio Market Cap. Number of stocks out-standing Share Holding pattern

Quarterly Data Latest quarter data of (December 2011 data) o Revenue o Net Profit o Earning per share Quarterly Data of (September 2011) o Revenue o Net Profit o Earning per share Quarterly Data of (December 2010) o Revenue o Net Profit o Earning per share Analysis of Quarterly Data o Revenue Growth(Quarter On Quarter, Year on Year) o Net Profit Growth (Quarter On Quarter, Year on Year) o Earning per Share growth (Quarter On Quarter, Year on Year)

About the sector Size of sector/industry Top 5 companies in the industries (Based on Revenue) Position of Tech-Mahindra in the Industry o Rank based on revenue o Profit Margin as compared to TCS, Infosys and IBM o Business Area where Tech-Mahindra is the leader Growth Projection for the sector in next 5 years.

Risk

Risk in the sector Risk for the company

Short Term View Long Term View Valuation of Tech-Mahindra Technical Analysis Conclusion

Das könnte Ihnen auch gefallen

- Trade & Technical Schools Miscellaneous Revenues World Summary: Market Values & Financials by CountryVon EverandTrade & Technical Schools Miscellaneous Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Offices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryVon EverandOffices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Technical & Trade School Revenues World Summary: Market Values & Financials by CountryVon EverandTechnical & Trade School Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Sound Recording Studio Revenues World Summary: Market Values & Financials by CountryVon EverandSound Recording Studio Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Overview of Financial AnalysisDokument6 SeitenOverview of Financial AnalysisClarineRamosNoch keine Bewertungen

- Miscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryVon EverandMiscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Business Service Centers Miscellaneous Revenues World Summary: Market Values & Financials by CountryVon EverandBusiness Service Centers Miscellaneous Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Report For The Third Quarter Ended December 31, 2011: Letter To The ShareholderDokument4 SeitenReport For The Third Quarter Ended December 31, 2011: Letter To The ShareholderfunaltymNoch keine Bewertungen

- Cosmetology & Barber School Revenues World Summary: Market Values & Financials by CountryVon EverandCosmetology & Barber School Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Body Panels, Doors, Wings & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryVon EverandBody Panels, Doors, Wings & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Business Service Center Revenues World Summary: Market Values & Financials by CountryVon EverandBusiness Service Center Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Oriental AromatDokument64 SeitenOriental AromatVikrant DeshmukhNoch keine Bewertungen

- Professional & Management Development Training Revenues World Summary: Market Values & Financials by CountryVon EverandProfessional & Management Development Training Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Corporate Financial Analysis NotesDokument19 SeitenCorporate Financial Analysis NotesWinston WongNoch keine Bewertungen

- SSR Stock Analysis SpreadsheetDokument33 SeitenSSR Stock Analysis Spreadsheetpvenky100% (1)

- Tyres (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryVon EverandTyres (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Ratios - Maruti 2017-18Dokument6 SeitenRatios - Maruti 2017-18chandel08Noch keine Bewertungen

- AFS - Financial ModelDokument6 SeitenAFS - Financial ModelSyed Mohtashim AliNoch keine Bewertungen

- Mercantile Reporting Agency Revenues World Summary: Market Values & Financials by CountryVon EverandMercantile Reporting Agency Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- RatiosDokument2 SeitenRatiossunshine9016Noch keine Bewertungen

- Financial Plan2Dokument6 SeitenFinancial Plan2raazoo19Noch keine Bewertungen

- Ratio Diagram 1Dokument6 SeitenRatio Diagram 1James JungNoch keine Bewertungen

- Study Guide (CH 1-2-3) FIRE 311Dokument5 SeitenStudy Guide (CH 1-2-3) FIRE 311JamieNoch keine Bewertungen

- Interior Fittings, Trim, Seats, Heating & Ventilation (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryVon EverandInterior Fittings, Trim, Seats, Heating & Ventilation (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Telephone Answering Service Revenues World Summary: Market Values & Financials by CountryVon EverandTelephone Answering Service Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Sports & Recreation Instruction Revenues World Summary: Market Values & Financials by CountryVon EverandSports & Recreation Instruction Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Management Consulting Services Miscellaneous Revenues World Summary: Market Values & Financials by CountryVon EverandManagement Consulting Services Miscellaneous Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Understanding of Financial Statements: What Is An Accounting?Dokument53 SeitenUnderstanding of Financial Statements: What Is An Accounting?Rashmi KhatriNoch keine Bewertungen

- CFP Chapter07 Fundamental AnalysisDokument27 SeitenCFP Chapter07 Fundamental AnalysischarymvnNoch keine Bewertungen

- Instruments, Indicating Devices & Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryVon EverandInstruments, Indicating Devices & Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Financial Statement AnalysisDokument4 SeitenFinancial Statement AnalysisGuia LeeNoch keine Bewertungen

- FUNDAMENTAL ANALYSIS NotesDokument8 SeitenFUNDAMENTAL ANALYSIS NotesBalaji GaneshNoch keine Bewertungen

- Finance Major Interview PrepDokument1 SeiteFinance Major Interview Prephevarts1Noch keine Bewertungen

- Instruments, Indicating Devices & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryVon EverandInstruments, Indicating Devices & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Jaiib Accounts PaperDokument10 SeitenJaiib Accounts PapermonaNoch keine Bewertungen

- Finance Profitability Ratio ProjectDokument6 SeitenFinance Profitability Ratio ProjectG Shabrish KumarNoch keine Bewertungen

- Book 1Dokument3 SeitenBook 1prasadmvkNoch keine Bewertungen

- Outboard Engines World Summary: Market Sector Values & Financials by CountryVon EverandOutboard Engines World Summary: Market Sector Values & Financials by CountryNoch keine Bewertungen

- Accounting & Financial Reporting Chapter 14Dokument9 SeitenAccounting & Financial Reporting Chapter 14Ahmed El-HashemyNoch keine Bewertungen

- Collection Agency Revenues World Summary: Market Values & Financials by CountryVon EverandCollection Agency Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Fundamental Analysis (EIC Analysis) : Macroeconomic Factors Fiscal & Monetary Policy Industry / Company AnalysisDokument26 SeitenFundamental Analysis (EIC Analysis) : Macroeconomic Factors Fiscal & Monetary Policy Industry / Company AnalysisSomasundaram LakshminarasimhanNoch keine Bewertungen

- Rasio Tahun 2014 (1) AutoDokument7 SeitenRasio Tahun 2014 (1) AutoMuhamad SyofrinaldiNoch keine Bewertungen

- Flowmeters World Summary: Market Values & Financials by CountryVon EverandFlowmeters World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Case Study FaDokument5 SeitenCase Study Faabhishek ladhaniNoch keine Bewertungen

- Investor Update: Key HighlightsDokument24 SeitenInvestor Update: Key Highlightsmanoj.samtani5571Noch keine Bewertungen

- Important Things To Analyse in An Annual Repor1Dokument5 SeitenImportant Things To Analyse in An Annual Repor1Rahul VangaNoch keine Bewertungen

- Complete Engines, Part Engines & Engine Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryVon EverandComplete Engines, Part Engines & Engine Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Conference Call Transcript: Edelweiss Capital LimitedDokument17 SeitenConference Call Transcript: Edelweiss Capital LimitedLuna YeshaNoch keine Bewertungen

- Exam Preparation & Tutoring Revenues World Summary: Market Values & Financials by CountryVon EverandExam Preparation & Tutoring Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- (Barnardos Free Docs.) It Doesn T Happen Here Full Report 8878 1Dokument68 Seiten(Barnardos Free Docs.) It Doesn T Happen Here Full Report 8878 1innocentbystanderNoch keine Bewertungen

- TCS Profit Up 50%, Declares 1:1 Bonus, 1,350% DividendDokument6 SeitenTCS Profit Up 50%, Declares 1:1 Bonus, 1,350% DividendBhaskar NiraulaNoch keine Bewertungen

- Valuation of Goodwill Class NotesDokument4 SeitenValuation of Goodwill Class NotesRajesh NangaliaNoch keine Bewertungen

- Dr. Jones Case StudyDokument2 SeitenDr. Jones Case StudyHaironezza AbdullahNoch keine Bewertungen

- Strides Pharma Science - Elara Securities - 7 February 2021Dokument7 SeitenStrides Pharma Science - Elara Securities - 7 February 2021Ranjan BeheraNoch keine Bewertungen

- Audit of PovertyDokument36 SeitenAudit of Povertykunal100% (2)

- Premier PresentationDokument38 SeitenPremier Presentationapi_sweetarien2216Noch keine Bewertungen

- Mutual FundDokument27 SeitenMutual FundDinesh sawNoch keine Bewertungen

- Types of MortgageDokument5 SeitenTypes of MortgageAneeka NiazNoch keine Bewertungen

- Fin Ac Robles Empleo CH 5 Vol 1 Answers2012Dokument18 SeitenFin Ac Robles Empleo CH 5 Vol 1 Answers2012Engel Ken Castro71% (7)

- AMPPSolution To The Sample Questions MidtermDokument18 SeitenAMPPSolution To The Sample Questions MidtermPyan AminNoch keine Bewertungen

- EXERCISES 1-Introduction To AccountingDokument4 SeitenEXERCISES 1-Introduction To AccountingAnna Jeramos100% (1)

- Solution Manual For Financial Accounting 10th by LibbyDokument36 SeitenSolution Manual For Financial Accounting 10th by Libbyslugwormarsenic.ci8riNoch keine Bewertungen

- Linear Tech Dividend PolicyDokument25 SeitenLinear Tech Dividend PolicyAdarsh Chhajed0% (2)

- Income Taxation Case DigestDokument22 SeitenIncome Taxation Case DigestCoyzz de Guzman100% (1)

- Payroll AccountingDokument26 SeitenPayroll AccountingShean VasilićNoch keine Bewertungen

- Avery India Limited 2012Dokument10 SeitenAvery India Limited 2012Abhisek MukherjeeNoch keine Bewertungen

- Ac3101 Homebranch 1Dokument5 SeitenAc3101 Homebranch 1jumbo hotdogNoch keine Bewertungen

- Acc/563 Week 11 Final Exam QuizDokument68 SeitenAcc/563 Week 11 Final Exam QuizgoodNoch keine Bewertungen

- The Revaluation ModelDokument20 SeitenThe Revaluation ModelPRECIOUSNoch keine Bewertungen

- Ackman's Letter To PWC Regarding HerbalifeDokument52 SeitenAckman's Letter To PWC Regarding Herbalifetheskeptic21100% (1)

- SalarySlip 5876095Dokument1 SeiteSalarySlip 5876095Larry WackoffNoch keine Bewertungen

- CIR Vs Club FilipinoDokument3 SeitenCIR Vs Club Filipinolovekimsohyun89Noch keine Bewertungen

- 1 MLJ 186 (2009) 1 MLJ 186Dokument14 Seiten1 MLJ 186 (2009) 1 MLJ 186cyelaniusyNoch keine Bewertungen

- R12x Oracle Payroll Fundamentals Configuration (Global) - D60571GC10Dokument3 SeitenR12x Oracle Payroll Fundamentals Configuration (Global) - D60571GC10lava.cupidNoch keine Bewertungen

- Badal Haji I SaveDokument5 SeitenBadal Haji I SaveShadaitul M ZinNoch keine Bewertungen

- Prob Set 1Dokument6 SeitenProb Set 1Nikki BulanteNoch keine Bewertungen

- Chapter 7 SummaryDokument3 SeitenChapter 7 SummaryAce Hulsey TevesNoch keine Bewertungen

- Yeast Production IndustryDokument71 SeitenYeast Production IndustryShabir TrambooNoch keine Bewertungen

- Republic Act 7722Dokument10 SeitenRepublic Act 7722wendybalaodNoch keine Bewertungen