Beruflich Dokumente

Kultur Dokumente

F.M CH 3

Hochgeladen von

Ameet Kumar MaheshwariOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

F.M CH 3

Hochgeladen von

Ameet Kumar MaheshwariCopyright:

Verfügbare Formate

1

FINANCIAL STATEMENTS, CASH FLOW AND TAXES CORPORATIONS ISSUE TO THEIR STOCKHOLDERS THE ANNUAL REPORT

FIRST TYPE OF INFORMATION, THERE IS VERBAL SECTION, DESCRIBING THE FIRMS OPERATING RESULTS DURING PAST YEAR.

SECOND TYPE OF INFORMATION, THE ANNUAL REPORT REPRESENTS FOUR BASIC FINANCIAL STATEMENTS THE BALANCE SHEET, THE INCOME STATEMENT, THE STATEMENT OF RETAINED EARNINGS AND THE STATEMENT OF CASH FLOW. THE FINANCIAL STATEMENTS REPORT WHAT HAS ACTAULLY HAPPENED TO ASSETS , EARNINGS, AND DIVIDENDS OVER PAST FEW YEARS. THE VERBAL STATEMENTS ATTEMPT TO EXPLAIN WHY THINGS TURNED OUT THE WAY THEY DID.

THE BALANCE SHEET

THE BALANCE SHEET REPRESENTS SNAP SHOT OF ITS FINANCIAL POSITION THE FIRST PART OF BALANCE SHEET LISTS ASSETS, WHICH ARE THINGS THE COMPANY OWNS.

THEY ARE LISTED IN ORDER OF LIQUIDITY.

THE OTHER PART LISTS THE CLAIMS THAT VARIOUS GROUPS HAVE AGAINST THE COMPANYS VALUE, LISTED IN ORDER IN WHICH THEY MUST BE PAID.

STOCK HOLDERS COME LAST IN BALANCE SHEET FOR TWO REASONS FIRST THEIR CLAIM REPRESENTS OWNERSHIP.

SECOND THEY HAVE A RESIDUAL CLAIM IN THE SENSE THAT THEY MAY RECEIVE PAYMENTS.

THE AMOUNTS SHOWN ON THE BALANCE SHEETS ARE CALLED BOOK VALUES. ASSETS CASH, SHORT-TERM INVESTMENTS, ACCOUNTS RECEIVABLE, AND INVENTORIES ARE LISTED AS CURRENT ASSETS. BECAUSE COMPANY IS EXPECTED TO CONVERT THEM INTO CASH WITHIN A YEAR. INVENTORIE SHOW THE DOLLARS COMPANY HAS INVESTED IN RAW MATERIALS. FOR LONG TERM ASSETS IN THE PURCHASE YEAR ACCOUNTANTS SPREAD THE PURCHASE COST OVER THE ASSETSS USEFUL LIFE.

THE AMOUNT THEY CHARGE EACH YEAR IS CALLED THE DEPRECIATION EXPENSE.

LIABILITIES

ACCOUNT PAYABLE, COMPANY PURCHASES SUPPLIES BUT DOES NOT PAY AT ONCE, IT TAKE AN OBLIGATION. NOTE PAYABLES WHEN COMPANY TAKES LOAN THAT MUST BE REPAID WITHIN A YEAR.

ACCRUALS, FIRMS DO NOT PAY WAGES AND TAXES DAILY, THE AMOUNT IT OWES ON THESE ITEMS AT ANY POINT.

LONG TERM BONDS AND SHARES ARE LONG TERM LIABILITIES EQUITY

WHEN COMPANY SELLS SHARES OF STOCK, THE PROCEEDS ARE RECORDED IN THE COMMON STOCK ACCOUNT RETAINED EARNINGS ARE THE CUMULATIVE AMOUNT OF EARNINGS THAT HAVE NOT BEEN PAID OUT AS DIVIDEND. COMMON EQUITY, THE SUM OF COMMON STOCK AND RETAINED RERNINGS.

THE INCOME STATEMENT THE INCOME STATEMENT SHOW ITS FINANCIAL PERFORMANCE OVER EACH OF THE YEAR.(OR LAST TWO YEARS)

SUBTRACTING OPERATING COSTS FROM NET SALES, BUT EXCLUDING DEPRECIATION AND AMORTIZATION, RESULTS IN EBITDA.

STATEMENT OF RETAINED EARNINGS RATAINED EARNINGS REPRESENTS A CLAIM AGAINST ASSETS. NET CASH FLOW MANY FINANCIAL ANALYSTS FOCUS ON NET CASH FLOW.

A BUSINESSS NET CASH FLOW GENERALLY DIFFERS FROM ITS ACCOUNTING PROFIT. BECAUSE SOME REVENUES AND EXPENSES LISTED ON THE INCOME STATEMENT WERE NOT RECEIVED OR PAID IN CASH DURING THE YEAR.

THE STATEMENT OF CASH FLOWS STATEMENT OF CASH FLOWS SUMMARIZES THE CHANGES IN A COMPANYS CASH POSITION THE STATEMENT SEPARATES INTO THREE CATERORIES, PLUS A SUMMARY SECTION. 1. OPERATINTG ACTIVITIES, WHICH INCLUDES NET INCOME , DEPRECIATION, CHANGES IN CURRENT ASSETS AND LIABILITIES OTHER THAN CASH, SHORT TERM INVESTMENTS, AND SHORT- TERM DEBT. 2. INVESTING ACTIVITIES, WHICH INCLUDES INVESTMENTS IN OR SALES OF FIXED ASSETS. 3. FINANCING ACTIVITIES, WHICH INCLUDES RAISING CASH BY SELLING SHORT TERM INVESTMENTS OR BY ISSUING SHORT- TERM DEBT, LONG TERM DEBT, OR STOCK.

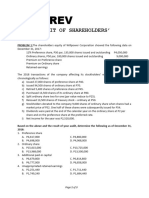

1.EARNING PER SHARE= EPS= NET INCOME/ COMMON SHARES OUTSTANDING 2. DIVIDEND PER SHARE = DPS=DIVIDEND PAID TO COMMON STOCKHOLDERS/ COMMON SHARES OUTSTANDING 3. NET CASH FLOW= NET INCOME- NONCASH REVENUES+ NONCASH CHARGES

Das könnte Ihnen auch gefallen

- C11 - PAS 8 Accounting Policies, Estimate and ErrorsDokument10 SeitenC11 - PAS 8 Accounting Policies, Estimate and ErrorsAllaine Elfa100% (2)

- Preparing Financial Stat. Cemba 560Dokument172 SeitenPreparing Financial Stat. Cemba 560nanapet80Noch keine Bewertungen

- Solution Chapter 12 Advanced Accounting II 2014 by DayagDokument20 SeitenSolution Chapter 12 Advanced Accounting II 2014 by DayagCindy Pausanos Paradela73% (11)

- Financial Reporting ReviewerDokument30 SeitenFinancial Reporting ReviewerElla Marie Lopez100% (1)

- BookkeepingDokument34 SeitenBookkeepingABBYGAIL DAVIDNoch keine Bewertungen

- PDF Document 2Dokument46 SeitenPDF Document 2vskNoch keine Bewertungen

- BUSINESS FINANCE Lesson 5Dokument88 SeitenBUSINESS FINANCE Lesson 5Pavi Antoni VillaceranNoch keine Bewertungen

- Fabm2 - 4 Statement of Cash FlowDokument22 SeitenFabm2 - 4 Statement of Cash FlowJacel GadonNoch keine Bewertungen

- Graham3e PPT 02Dokument26 SeitenGraham3e PPT 02Lim Yu ChengNoch keine Bewertungen

- Basics of Financial AccountingDokument30 SeitenBasics of Financial AccountingSAURABH PATELNoch keine Bewertungen

- Module 8 (Albay)Dokument43 SeitenModule 8 (Albay)randyblanza2014Noch keine Bewertungen

- Fabm Reviewer SHS Abm A Tycoons 11Dokument3 SeitenFabm Reviewer SHS Abm A Tycoons 11Ma Ramyla Gale InfanteNoch keine Bewertungen

- Analysis of Financial Statements: Jian XiaoDokument115 SeitenAnalysis of Financial Statements: Jian XiaoLim Mei SuokNoch keine Bewertungen

- Financial StatementsDokument22 SeitenFinancial StatementsChaaaNoch keine Bewertungen

- Accounting Principles (Accounting)Dokument13 SeitenAccounting Principles (Accounting)Eranga LakmaliNoch keine Bewertungen

- Fundamentals of Accounting, Business and Management 2Dokument85 SeitenFundamentals of Accounting, Business and Management 2Louie Jee LabradorNoch keine Bewertungen

- Accounting and BookkeepingDokument37 SeitenAccounting and BookkeepingtekleyNoch keine Bewertungen

- Seminar Week 9 (Lecture Slides Chapter 7)Dokument27 SeitenSeminar Week 9 (Lecture Slides Chapter 7)palekingyeNoch keine Bewertungen

- Cash Flow AnalysisDokument7 SeitenCash Flow AnalysisHema LathaNoch keine Bewertungen

- Chapter 12Dokument8 SeitenChapter 12Hareem Zoya WarsiNoch keine Bewertungen

- Cash Flow StatementDokument19 SeitenCash Flow StatementGokul KulNoch keine Bewertungen

- JHMKTUCGGCDokument30 SeitenJHMKTUCGGCRAZEL ROSE ESTRADANoch keine Bewertungen

- Principles of Accounting College MaeDokument115 SeitenPrinciples of Accounting College Maesuzaneasiado0825Noch keine Bewertungen

- Advanced Financial AccountingDokument17 SeitenAdvanced Financial AccountingFisher100% (1)

- Fundamentals of Accountancy, Business and Management 2: Crisly Mae L. Villarin FABM 2 TeacherDokument54 SeitenFundamentals of Accountancy, Business and Management 2: Crisly Mae L. Villarin FABM 2 TeacherKimberly andrinoNoch keine Bewertungen

- Basic Accounting Principles: The Financial StatementsDokument55 SeitenBasic Accounting Principles: The Financial Statementsthella deva prasadNoch keine Bewertungen

- Financial ManagementDokument17 SeitenFinancial Managementdracula nagrajNoch keine Bewertungen

- Financial Reporting and Analysis - SIGFi - Finance HandbookDokument12 SeitenFinancial Reporting and Analysis - SIGFi - Finance HandbookSneha TatiNoch keine Bewertungen

- FA 2024 NotesDokument32 SeitenFA 2024 NotesJoshua JamesNoch keine Bewertungen

- ACC117 - Chapter 1 - Introduction To AccountingDokument28 SeitenACC117 - Chapter 1 - Introduction To AccountingFlix HusniNoch keine Bewertungen

- Fundamentals of Accounting, Business and Management 2Dokument86 SeitenFundamentals of Accounting, Business and Management 2Derek Jason DomanilloNoch keine Bewertungen

- FABM2 - Lesson 1Dokument27 SeitenFABM2 - Lesson 1wendell john mediana100% (1)

- Cash Flow Statement: By:-Aditya SoniDokument8 SeitenCash Flow Statement: By:-Aditya SoniAshutosh GuptaNoch keine Bewertungen

- Accounting: The Language of BusinessDokument13 SeitenAccounting: The Language of BusinessSania YaqoobNoch keine Bewertungen

- Finance Ch4Dokument41 SeitenFinance Ch4Tofig HuseynliNoch keine Bewertungen

- Accounting Principles 10th Chapter 1Dokument48 SeitenAccounting Principles 10th Chapter 1Osama Alvi100% (1)

- Basic Accounting Principles and Budgeting FundamentalsDokument14 SeitenBasic Accounting Principles and Budgeting Fundamentalsmillion shiferawNoch keine Bewertungen

- Introduction To Finance (Profit & Loss, Working Capital) : Lesson 6Dokument24 SeitenIntroduction To Finance (Profit & Loss, Working Capital) : Lesson 6danaNoch keine Bewertungen

- Introduction To AccountingDokument28 SeitenIntroduction To AccountingMohamed Yousif HamadNoch keine Bewertungen

- To The: Course OnDokument48 SeitenTo The: Course OnMilagros Cardona100% (7)

- Module 1-Review of Accounting ProcessDokument49 SeitenModule 1-Review of Accounting ProcessJenny Flor PeterosNoch keine Bewertungen

- Financial Management Final Exam ReviewerDokument15 SeitenFinancial Management Final Exam ReviewerElla Marie LopezNoch keine Bewertungen

- Cash and Fund Flow StatementDokument6 SeitenCash and Fund Flow StatementAsma SaeedNoch keine Bewertungen

- Indian Accounting StandardsDokument19 SeitenIndian Accounting StandardsrohitjagtapNoch keine Bewertungen

- DP1 FM FaDokument32 SeitenDP1 FM FaananditaNoch keine Bewertungen

- Financial Analysis and Accounting-Victorio, P.ADokument24 SeitenFinancial Analysis and Accounting-Victorio, P.Ajek vinNoch keine Bewertungen

- Introduction To Financial Statements and Other Financial ReportingDokument24 SeitenIntroduction To Financial Statements and Other Financial ReportingAlina ZubairNoch keine Bewertungen

- Financial Statements, Cash Flow, and TaxesDokument52 SeitenFinancial Statements, Cash Flow, and TaxesOwais MehmoodNoch keine Bewertungen

- Final Accounts: Trading Account Profit Loss Account Income & Expenditure Account Balance SheetDokument13 SeitenFinal Accounts: Trading Account Profit Loss Account Income & Expenditure Account Balance Sheetsanjaydubey3Noch keine Bewertungen

- CF FichesDokument19 SeitenCF Fichescamille.barsottiNoch keine Bewertungen

- Financial Management: Sources of FinanceDokument21 SeitenFinancial Management: Sources of FinanceananditaNoch keine Bewertungen

- ACC117 - Chapter 1 - Introduction To Accounting PDFDokument25 SeitenACC117 - Chapter 1 - Introduction To Accounting PDFirfan ShahrilNoch keine Bewertungen

- Lesson 1Dokument17 SeitenLesson 1Aceain SoNoch keine Bewertungen

- Understanding Financial StatementsDokument30 SeitenUnderstanding Financial StatementsTeh PohkeeNoch keine Bewertungen

- Learning Unit 3busnes MagtDokument19 SeitenLearning Unit 3busnes MagtNompumelelo ZuluNoch keine Bewertungen

- Financial Accounting CrashDokument57 SeitenFinancial Accounting CrashSAIGAGANNoch keine Bewertungen

- Golis University: Faculty of Business and Economics Chapter Six Balance SheetDokument22 SeitenGolis University: Faculty of Business and Economics Chapter Six Balance Sheetsaed cabdiNoch keine Bewertungen

- Cash Flow StatementDokument21 SeitenCash Flow StatementthejojoseNoch keine Bewertungen

- ACM 31 Lec2Dokument18 SeitenACM 31 Lec2Vishal AmbadNoch keine Bewertungen

- BusFin NotesDokument10 SeitenBusFin NotesJeremae EtiongNoch keine Bewertungen

- Financial Accounting and Reporting Study Guide NotesVon EverandFinancial Accounting and Reporting Study Guide NotesBewertung: 1 von 5 Sternen1/5 (1)

- HyiDokument4 SeitenHyiSirius BlackNoch keine Bewertungen

- Subsequent Acquisition PDFDokument21 SeitenSubsequent Acquisition PDFEvangeline WongNoch keine Bewertungen

- Week 11 - CH 11 QuestionsDokument2 SeitenWeek 11 - CH 11 QuestionslizaNoch keine Bewertungen

- FARAP-4516Dokument10 SeitenFARAP-4516Accounting StuffNoch keine Bewertungen

- Sears Vs Walmart - v01Dokument37 SeitenSears Vs Walmart - v01chansjoy100% (1)

- Friedlan4e SM Ch03Dokument115 SeitenFriedlan4e SM Ch03Sunrise ConsultingNoch keine Bewertungen

- Business Finance FormulaDokument9 SeitenBusiness Finance FormulaGeorge Nicole BaybayanNoch keine Bewertungen

- Fulltext (Secs 60-75)Dokument169 SeitenFulltext (Secs 60-75)anailabucaNoch keine Bewertungen

- Audit of SheDokument3 SeitenAudit of ShePrince PierreNoch keine Bewertungen

- 681 Questions + Answers: Cfa ExamDokument256 Seiten681 Questions + Answers: Cfa ExamAbdullah MantawyNoch keine Bewertungen

- 2010 General Mills Kellogg's Current Assets Current Liabilities Current Ratio 0.92 0.92Dokument3 Seiten2010 General Mills Kellogg's Current Assets Current Liabilities Current Ratio 0.92 0.92SHIVANI SHARMANoch keine Bewertungen

- Research Project Fourth Assignment: Submitted ToDokument32 SeitenResearch Project Fourth Assignment: Submitted ToMahmoud KassabNoch keine Bewertungen

- Chapter 15 Buss CombDokument23 SeitenChapter 15 Buss CombChristine Jean BaguioNoch keine Bewertungen

- Acn301 Assignment FinalDokument13 SeitenAcn301 Assignment FinalMd Mohimenul IslamNoch keine Bewertungen

- ReporttDokument7 SeitenReporttaryan nicoleNoch keine Bewertungen

- Bethany's Bicycle CorporationDokument15 SeitenBethany's Bicycle CorporationKailash Kumar100% (2)

- 2 Intercompany Sale TransactionsDokument1 Seite2 Intercompany Sale TransactionsIm NayeonNoch keine Bewertungen

- Lat TakeDokument8 SeitenLat TakeCamila Gail GumbanNoch keine Bewertungen

- CA Final - FR Faster Batch - Consolidation Additional QuestionsDokument8 SeitenCA Final - FR Faster Batch - Consolidation Additional QuestionsRonaldo GOmesNoch keine Bewertungen

- CH 15 Equity LanjutanDokument35 SeitenCH 15 Equity LanjutanKalyana MittaNoch keine Bewertungen

- FAR-2 Mock September 2021 FinalDokument8 SeitenFAR-2 Mock September 2021 FinalMuhammad RahimNoch keine Bewertungen

- Chapter9 18Dokument243 SeitenChapter9 18Xander ClockNoch keine Bewertungen

- Functional Budget - SolutionDokument11 SeitenFunctional Budget - SolutionLance Jewel RamosNoch keine Bewertungen

- Chapter 31 - AnswerDokument15 SeitenChapter 31 - AnswerPam PolonioNoch keine Bewertungen

- Statement of Changes in EquityDokument24 SeitenStatement of Changes in EquityChristine SalvadorNoch keine Bewertungen

- K 18Dokument15 SeitenK 18Sx nNoch keine Bewertungen

- Johnstone 9e Auditing Chapter 13 PPT FINALDokument63 SeitenJohnstone 9e Auditing Chapter 13 PPT FINALNurlinaEzzati100% (1)

- Chapter 1 and 2Dokument5 SeitenChapter 1 and 2Kei HanzuNoch keine Bewertungen