Beruflich Dokumente

Kultur Dokumente

C.A IPCC Capital Budgeting

Hochgeladen von

Akash GuptaOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

C.A IPCC Capital Budgeting

Hochgeladen von

Akash GuptaCopyright:

Verfügbare Formate

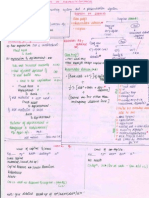

TARUN JHALANI Capital Budgeting: Methods Pay Back Period Accounting Avg.

Rate of Return When ACF are even When EAT are Even NI/ACF i. EAT/NI When ACF are uneven ii. EAT/(NI+SV/2) In case of Uneven EAT Avg EAT will be used Pay back Reciprocal instead of EAT 1/Pay back period or 1/(NI/ACF) Discounted Cash flow method/ PV Method Discounted cash flows -When ACF are even ACF x Annuity factor -When ACF are uneven ACF x Pv factor NPV Method PV of CI-PV of CO Profitability Index/Desirability factor/Benefit cost ratio PV of CI/PV of CO

9887595895 Internal Rate of Return(IRR) When ACF are even NI/ACF When ACF are uneven Steps Determination of First Rate of IRR 1.Calculate Avg CI 2. Calculate Pay Back Period=Cost /Avg CI 3. See Annuity Table

NPV Index NPV / PV of CO If the life of the Project is not same , then EQUILVENT ANNUAL NPV(EANPV) Method will be used. EANPV=NPV/ cumulative Annuity Factor Equilvent annual cost (EAV)= PV Of CO/cumulative annuity factor ACF= Annual Cash Flows NI=Net investment = Cost of EAT=Earning After Tax instead investment- scrap value of ACF EAT+Depreciation=ACF CI=Cash Inflows =All the cash CO=Cash Outflows= All the F.V.=Future Value profits after tax earned through capital exp. Net off cash R=Interst rate/cost of capital out the life of the investment + receipts.+ working capital SV=scrap value salvage + working capital invested PV= Present Value realized at the end of the NPV=Net Present Value project Method Pay Back Period Annual Rate Of Return NPV IRR Expressed In Years % Rs. % Bench mark (Basis of Selection) Shortest Highest Greatest Value Highest Formula Recovery time of investment 1) AR / II 2) AR / AI Discounted CI - Discounted CO At this rate Discounted CI = Discounted CO and NPV = 1, PI = 1 Discounted CI Discounted CO When to use When no cost of capital is given When no cost of capital is given When two projects is same in all aspects ie. No disparity Rarely used in finding Cost of Capital.

Profitability Index (PI)

Points

Highest

Size Disparity

CAPITAL BUDGETING Unique Approach ____________________________________1

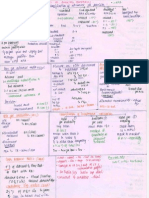

TARUN JHALANI EAC (or) EAB Rs. EAC = Lowest EAB = Highest EAC = Discounted CO PV Factor EAB = 1) Discounted CI Annuity Factor 2) NPV PV Factor Recovery time of Investment

9887595895 Life Disparity

Discounted Pay Back

Years

Shortest

Break even time

Calculating the Initial Investment Cost Of New Machine Depreciation +Installation cost Outlay -Proceeds from sale of Investment +/-Tax on sale of old machine +Opportunity cost +/-change in Working Capital

Initial Investment

Operating Cash Flows (Calculate each year seprately) Revenue -Expenses(excluding Depreciation) Profit Before Dep & Tax -Depreciation NetProfit Before Tax -Taxes Net Profit After Tax +Depreciation Xxx Cash INFLOWS +Salvage value +Recovery of Working Cap. Xxx Xxx Xxx Xxx Xxx Xxx Depreciation base of new machine in replacement situation XX WDV of existing machine XX +total cost of new machine XX -sale proceeds of existing machine. XX XX

Xxx Xxx Xxx Xxx Xxx Xxx Xxx xxx Xxx Xxx Xxx

Cash Flow in Replacement Situation Cost of New Machine +Installation cost +/-Working Capital -Sales proceeds of existing machine -Tax saving on loss on sale of old machine

Depreciation is an imp cash flow when taxation is considered , if no taxation , no Dep. Try Only Incremental basis ignore Average Calculation. Capital gain arise in the following situations o Sales > WDV of the block o Block is sold out o 100 % Depreciable assets Special formula of IRR o LDR + Annuity Factor at LDR Pay back period Annuity factor at LDR- Annuity Factor at HDR Net advantage of Leasing-calculation of outflows in case of leasing. +Loss on tax shield of DEP. +Lease payment -Tax shield on lease payment +Loss on salvage value Borrowing- calculation of Net cash outflow Principal + Interest (Tax saving on Interest and Dep)= Net cash outflow CAPITAL BUDGETING Unique Approach ____________________________________2

Das könnte Ihnen auch gefallen

- Auto & Power Industries Portfolio AnalysisDokument35 SeitenAuto & Power Industries Portfolio AnalysisHK SahuNoch keine Bewertungen

- Ch.3 Redemption of Preference SharesDokument10 SeitenCh.3 Redemption of Preference SharesCA INTERNoch keine Bewertungen

- Financial Analysis of Vodafone Group PLCDokument9 SeitenFinancial Analysis of Vodafone Group PLCsara_isar0% (1)

- FM Cia 1.1 NewDokument18 SeitenFM Cia 1.1 NewRohit GoyalNoch keine Bewertungen

- Banking and Non Banking Financial InstitutionsDokument28 SeitenBanking and Non Banking Financial Institutionsmamta jainNoch keine Bewertungen

- AIP INDIA GEN 4.1 - Airport ChargesDokument8 SeitenAIP INDIA GEN 4.1 - Airport Chargesitsrijo100% (1)

- ABFRL Ambit Oct16 PDFDokument33 SeitenABFRL Ambit Oct16 PDFDoshi VaibhavNoch keine Bewertungen

- Research PIIND 06032013Dokument39 SeitenResearch PIIND 06032013equityanalystinvestor100% (1)

- 1-A) 5 Marks 1-b) 5 Marks 2-A) 5 Marks 2-b) 5 Marks: 1 Group Assignment 2Dokument5 Seiten1-A) 5 Marks 1-b) 5 Marks 2-A) 5 Marks 2-b) 5 Marks: 1 Group Assignment 2Pravina Moorthy100% (1)

- Project On Online Trading at Sharekhan LTDDokument136 SeitenProject On Online Trading at Sharekhan LTDNITIKESH GORIWALENoch keine Bewertungen

- Parle Agro Vision RealizationDokument18 SeitenParle Agro Vision RealizationShashvathi HariharanNoch keine Bewertungen

- A Study On Financial Statement Analysis of Primary Agricultural Cooperative Credit Society in Paiyanoor Branch at Chengalpattu District.Dokument14 SeitenA Study On Financial Statement Analysis of Primary Agricultural Cooperative Credit Society in Paiyanoor Branch at Chengalpattu District.k.karthikeyanNoch keine Bewertungen

- SalesDokument37 SeitenSalesMaaz34Noch keine Bewertungen

- Fundamental and Technical Analysis of Automobile SectorDokument82 SeitenFundamental and Technical Analysis of Automobile SectorAnant SharmaNoch keine Bewertungen

- HDFC Small Cap Fund - Presentation - April 23Dokument30 SeitenHDFC Small Cap Fund - Presentation - April 23Niks MystryNoch keine Bewertungen

- Project On TATA MotorsDokument140 SeitenProject On TATA MotorsSk Imran IslamNoch keine Bewertungen

- Final Summer Internship ReportDokument41 SeitenFinal Summer Internship ReportThanikachalam McNoch keine Bewertungen

- IFRS - 2016 - Solved QPDokument14 SeitenIFRS - 2016 - Solved QPSharan ReddyNoch keine Bewertungen

- Capgemini Resume TemplateDokument3 SeitenCapgemini Resume TemplateVishalakshi NNoch keine Bewertungen

- Kane 900plus Operating ManualDokument37 SeitenKane 900plus Operating ManualRenzo VargasNoch keine Bewertungen

- Hud PDFDokument5 SeitenHud PDFPhan van ThanhNoch keine Bewertungen

- Final Project Report Muthuraja.mDokument73 SeitenFinal Project Report Muthuraja.mNaveen kumar5Noch keine Bewertungen

- Quiz Practice 1 - AnswersDokument5 SeitenQuiz Practice 1 - AnswersJawad KaramatNoch keine Bewertungen

- A Study On Customer Perception On The Maruti Suzuki Services and Products at BangaloreDokument12 SeitenA Study On Customer Perception On The Maruti Suzuki Services and Products at BangaloreVedashree TnNoch keine Bewertungen

- Shree Cement: Treading Smoothly On The Growth PathDokument6 SeitenShree Cement: Treading Smoothly On The Growth Pathanjugadu100% (1)

- FM Cia 3Dokument28 SeitenFM Cia 3Rohit Goyal100% (1)

- Hul Mid Sem3Dokument24 SeitenHul Mid Sem3Abhay Singh ParmarNoch keine Bewertungen

- Case Study On EducompDokument17 SeitenCase Study On Educomppaisa321Noch keine Bewertungen

- Nerolac Sales Force ManagementDokument52 SeitenNerolac Sales Force Managementaneela05Noch keine Bewertungen

- Chapter 1: IntroductionDokument41 SeitenChapter 1: IntroductionreshmatummalaNoch keine Bewertungen

- Training Report Atul Auto Ltd.Dokument46 SeitenTraining Report Atul Auto Ltd.Renu ChoudheryNoch keine Bewertungen

- The OM Triangle in HealthcareDokument9 SeitenThe OM Triangle in HealthcareMwaisa BangaNoch keine Bewertungen

- Mip - Summer Project Report: Zfunds Financial ServicesDokument48 SeitenMip - Summer Project Report: Zfunds Financial ServicesSrishti TanejaNoch keine Bewertungen

- Evaluation of Cotton Textile Supply Chain Programme and Potential For Scale-Up in Hyderabad, IndiaDokument87 SeitenEvaluation of Cotton Textile Supply Chain Programme and Potential For Scale-Up in Hyderabad, IndiaOxfamNoch keine Bewertungen

- PepsiCo ValuesDokument19 SeitenPepsiCo ValuesSudhir SinghNoch keine Bewertungen

- Vtu Mba Final Summer Project On Hyundai Part ADokument31 SeitenVtu Mba Final Summer Project On Hyundai Part AShanu shriNoch keine Bewertungen

- Transfer Credit Guide - BCDokument8 SeitenTransfer Credit Guide - BCpransguNoch keine Bewertungen

- Air Engine With DC Air CompressorDokument54 SeitenAir Engine With DC Air CompressorvinothNoch keine Bewertungen

- FM 2marks AllDokument22 SeitenFM 2marks AllKathiresan NarayananNoch keine Bewertungen

- Maruti SM Project Complete AnalysisDokument48 SeitenMaruti SM Project Complete AnalysisBhavin Nilesh PandyaNoch keine Bewertungen

- Mitsubishi 380Dokument8 SeitenMitsubishi 380robertoNoch keine Bewertungen

- Quarz Capital Management CSE Global Presentation FINAL 26th Feb 2018Dokument23 SeitenQuarz Capital Management CSE Global Presentation FINAL 26th Feb 2018qpmoerzhNoch keine Bewertungen

- DKSH Employment Application Form 2022Dokument6 SeitenDKSH Employment Application Form 2022syariel haziqNoch keine Bewertungen

- DXC Select BrochureDokument18 SeitenDXC Select BrochurePradyut TiwariNoch keine Bewertungen

- Assign1 Manac1Dokument4 SeitenAssign1 Manac1Chirag BhatiaNoch keine Bewertungen

- STK 8 Statement of AccountsDokument3 SeitenSTK 8 Statement of Accountsdhananjay kulkarniNoch keine Bewertungen

- Hdspcam App User Manual PDFDokument6 SeitenHdspcam App User Manual PDFJFco VANoch keine Bewertungen

- Subex Limited HRDokument37 SeitenSubex Limited HRBhawana SaloneNoch keine Bewertungen

- Robi-Airtel CorrectionDokument7 SeitenRobi-Airtel CorrectionMiraz AhmedNoch keine Bewertungen

- Supply Chain Management ProjectDokument7 SeitenSupply Chain Management ProjectSyed Burhan AhmadNoch keine Bewertungen

- UAE Banking Sector Outlook 2014: An Uptick in Lending and Economic Activity Signal Continued Profitable GrowthDokument10 SeitenUAE Banking Sector Outlook 2014: An Uptick in Lending and Economic Activity Signal Continued Profitable Growthapi-227433089Noch keine Bewertungen

- Tata Welspun DealDokument17 SeitenTata Welspun DealrkmouryaNoch keine Bewertungen

- Introduction To Working Capital of NTPCDokument13 SeitenIntroduction To Working Capital of NTPCShahzad SaifNoch keine Bewertungen

- POM.C6 Aggregate Planning ExcercisesDokument16 SeitenPOM.C6 Aggregate Planning ExcercisesDuy UyênNoch keine Bewertungen

- Market Timing Performance of The Open enDokument10 SeitenMarket Timing Performance of The Open enAli NadafNoch keine Bewertungen

- The Ultimate Solution - Question BankDokument311 SeitenThe Ultimate Solution - Question BankHarshil ShahNoch keine Bewertungen

- All HandsDokument24 SeitenAll HandsAlicia YarbroughNoch keine Bewertungen

- Belum Mengisi Link Covid (Update 21 Sept)Dokument155 SeitenBelum Mengisi Link Covid (Update 21 Sept)Angga SaputraNoch keine Bewertungen

- FORMULAEDokument3 SeitenFORMULAEmikaenonNoch keine Bewertungen

- NCA SummaryDokument5 SeitenNCA Summary465jgbgcvfNoch keine Bewertungen

- Sify Notes For C.S ExcDokument16 SeitenSify Notes For C.S ExcAkash GuptaNoch keine Bewertungen

- Main Points of Food Security Bill 2013Dokument2 SeitenMain Points of Food Security Bill 2013Akash GuptaNoch keine Bewertungen

- Co's Bill Highlights 2013Dokument18 SeitenCo's Bill Highlights 2013Akash GuptaNoch keine Bewertungen

- Cs Online Test Sify 1500 Questions MCQDokument110 SeitenCs Online Test Sify 1500 Questions MCQcsjournal70% (10)

- EclDokument44 SeitenEclAkash GuptaNoch keine Bewertungen

- Syllabus Maths Xii (I) To (III)Dokument3 SeitenSyllabus Maths Xii (I) To (III)Akash GuptaNoch keine Bewertungen

- Sify Notes For C.S ExcDokument16 SeitenSify Notes For C.S ExcAkash GuptaNoch keine Bewertungen

- Underwiting of Shares & DebenturesDokument1 SeiteUnderwiting of Shares & DebenturesAkash GuptaNoch keine Bewertungen

- Sify NotesDokument3 SeitenSify NotesAkash GuptaNoch keine Bewertungen

- Sify NotesDokument2 SeitenSify NotesAkash GuptaNoch keine Bewertungen

- Class 11th Cbse AccountsDokument2 SeitenClass 11th Cbse AccountsAkash GuptaNoch keine Bewertungen

- Class 11th Economics NotesDokument2 SeitenClass 11th Economics NotesAkash Gupta0% (1)

- Cs Online Test Sify 1500 Questions MCQDokument110 SeitenCs Online Test Sify 1500 Questions MCQcsjournal70% (10)

- Self Balancing LedgersDokument2 SeitenSelf Balancing LedgersAkash Gupta0% (1)

- Respaper CA (Icai) - Ipcc - Model Mock Test Group I Paper 1 AccountingDokument6 SeitenRespaper CA (Icai) - Ipcc - Model Mock Test Group I Paper 1 AccountingAkash GuptaNoch keine Bewertungen

- Cash Flow StatementDokument2 SeitenCash Flow StatementCa Anil DangiNoch keine Bewertungen

- Issue and Redemption of DebentureDokument2 SeitenIssue and Redemption of DebentureAkash GuptaNoch keine Bewertungen

- Departmental AccountsDokument2 SeitenDepartmental AccountsAkash GuptaNoch keine Bewertungen

- Partnership AccountsDokument8 SeitenPartnership AccountsAkash GuptaNoch keine Bewertungen

- Internal ReconstructionDokument1 SeiteInternal ReconstructionAkash GuptaNoch keine Bewertungen

- Investment AccountsDokument1 SeiteInvestment AccountsAkash GuptaNoch keine Bewertungen

- Company Final AccountsDokument2 SeitenCompany Final AccountsAkash GuptaNoch keine Bewertungen

- Accounts From Incomplete RecordsDokument1 SeiteAccounts From Incomplete RecordsAkash GuptaNoch keine Bewertungen

- Branch AccountsDokument4 SeitenBranch AccountsAkash GuptaNoch keine Bewertungen

- Accounts of Electricity CompaniesDokument2 SeitenAccounts of Electricity CompaniesAkash GuptaNoch keine Bewertungen

- Accounts of Banking CompaniesDokument2 SeitenAccounts of Banking CompaniesAkash GuptaNoch keine Bewertungen

- Suggested Answers: QuestionsDokument1 SeiteSuggested Answers: QuestionsAkash GuptaNoch keine Bewertungen

- Accountants Formulae BookDokument47 SeitenAccountants Formulae BookVpln SarmaNoch keine Bewertungen

- Solved Answer Accounts CA IPCC May. 2010Dokument13 SeitenSolved Answer Accounts CA IPCC May. 2010Akash GuptaNoch keine Bewertungen

- ContentsDokument2 SeitenContentsAkash GuptaNoch keine Bewertungen

- Supply Installation Commissioning of Worlld Largest MillDokument12 SeitenSupply Installation Commissioning of Worlld Largest MillAbe ArdiNoch keine Bewertungen

- AQUATOOL A Generalized Decision Support System For Water Resources Planning and Operational Management 1996 Journal of HydrologyDokument23 SeitenAQUATOOL A Generalized Decision Support System For Water Resources Planning and Operational Management 1996 Journal of Hydrologyhoc_kinowNoch keine Bewertungen

- 235practice Exam 2 AnswerDokument9 Seiten235practice Exam 2 Answernbobs7Noch keine Bewertungen

- Lerdge-Gcode List V3.0.5Dokument108 SeitenLerdge-Gcode List V3.0.5osman perez vidalNoch keine Bewertungen

- User Manual For P12S01Dokument40 SeitenUser Manual For P12S01Behrouz HajianNoch keine Bewertungen

- Paper I & 11 Answer All Questions: (E) Explain The Use of Correlation and Regression Studies in Busainess?Dokument5 SeitenPaper I & 11 Answer All Questions: (E) Explain The Use of Correlation and Regression Studies in Busainess?Suthaharan PerampalamNoch keine Bewertungen

- Soal B.inggris Paket 3Dokument9 SeitenSoal B.inggris Paket 3sitiNoch keine Bewertungen

- Modul Ke-4 Perhitungan Sieve AnalisisDokument36 SeitenModul Ke-4 Perhitungan Sieve AnalisisFredi CherboundNoch keine Bewertungen

- What Is A Philosophical Problem - HackerDokument12 SeitenWhat Is A Philosophical Problem - Hackersnain1Noch keine Bewertungen

- Grade 11 SEM: Markscheme Examiners ReportDokument29 SeitenGrade 11 SEM: Markscheme Examiners ReportDr. Love TrivediNoch keine Bewertungen

- 06a Consolidation and Settlement in ClayDokument10 Seiten06a Consolidation and Settlement in ClayAlly KhooNoch keine Bewertungen

- Installation and Operation Manual: 3161 GovernorDokument48 SeitenInstallation and Operation Manual: 3161 GovernorMiguel Sotelo100% (1)

- IBM Data Science CapstoneDokument51 SeitenIBM Data Science CapstonePeter Quoc88% (8)

- Ultra Structure of ChromosomeDokument9 SeitenUltra Structure of ChromosomeJigarS.MehtaNoch keine Bewertungen

- Geotextiles and Geomembranes: E.C. Lee, R.S. DouglasDokument8 SeitenGeotextiles and Geomembranes: E.C. Lee, R.S. DouglasPaula T. LimaNoch keine Bewertungen

- M2-Exam 2Dokument13 SeitenM2-Exam 2youngturtlevibesNoch keine Bewertungen

- ANFISDokument19 SeitenANFISShimaa Barakat100% (1)

- PIA B2 - Module 2 (PHYSICS) SubModule 2.1 (Matter) Final1Dokument17 SeitenPIA B2 - Module 2 (PHYSICS) SubModule 2.1 (Matter) Final1samarrana1234679Noch keine Bewertungen

- Base Tree PropertyDokument17 SeitenBase Tree PropertyMario Jardon SantosNoch keine Bewertungen

- For Bookbind Final April 2019 PDFDokument151 SeitenFor Bookbind Final April 2019 PDFNeo VeloriaNoch keine Bewertungen

- Srinivasan Engineering College, Perambalur: Part B Unit IDokument2 SeitenSrinivasan Engineering College, Perambalur: Part B Unit IPrabhat SinghNoch keine Bewertungen

- Neeraj Pal 2Dokument1 SeiteNeeraj Pal 2NeerajPalNoch keine Bewertungen

- Department of Mechanical Engineering Question Bank Subject Name: Heat & Mass Transfer Unit - I Conduction Part - ADokument3 SeitenDepartment of Mechanical Engineering Question Bank Subject Name: Heat & Mass Transfer Unit - I Conduction Part - AkarthikNoch keine Bewertungen

- JCrenshaw ImplementingCRCsDokument17 SeitenJCrenshaw ImplementingCRCsspyeagleNoch keine Bewertungen

- GEM4D Geotech Block Models Process DescriptionDokument5 SeitenGEM4D Geotech Block Models Process DescriptionMarcos GuimarãesNoch keine Bewertungen

- Comba ODV-065R15E18J-GDokument1 SeiteComba ODV-065R15E18J-GGaga ChubinidzeNoch keine Bewertungen

- Maya Dynamics Basics:: MEL and ExpressionDokument33 SeitenMaya Dynamics Basics:: MEL and ExpressionNguyễn HuỳnhNoch keine Bewertungen

- Jain 2018Dokument10 SeitenJain 2018Pablo Ignacio Contreras EstradaNoch keine Bewertungen

- Casing and Tubing Crossovers: ScopeDokument4 SeitenCasing and Tubing Crossovers: Scopeislam atifNoch keine Bewertungen

- Registry TweaksDokument5 SeitenRegistry TweaksArlie TaylorNoch keine Bewertungen