Beruflich Dokumente

Kultur Dokumente

Bharath Electronics Report

Hochgeladen von

Sathyanarayana SrsOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bharath Electronics Report

Hochgeladen von

Sathyanarayana SrsCopyright:

Verfügbare Formate

WORKING CAPITAL MANAGEMENT

INDUSTRY PROFILE

The foundations for India's Defence Industry are widely believed to have been laid in 1801 with the establishment of the Gun Carriage Agency in Calcutta by the East India Company Although historically true, the birth of India's current defence industrial really came during the Second World War, when the decision was taken to establish a limited defence production capability in the country, to support the British war effort in Asia and the Middle East. Before then, the British had decided against establishing a significant defence equipment manufacturing capability in India, for fear of 'giving the natives access to modem military industry.

Ordnance Factories and Public Sector Undertakings:

At the Chi of the World War 2 India's Defence Industry capacity amounted to 16 ordnance factories. a clothing establishment, and an aircraft production plant; and the new government subsequently inherited this capability. No new factories were built in the first years after independence. From 1958 onwards, however, the ordnance factories were steadily expanded. The war against China in 1962 prompted a further expansion in India's ordnance capability. By 1970, the number of ordnance factories had risen to 31 and by the 1980s the number had reached 35. Today the country has 39 ordnance factories. In addition to its ordinance factors, India has eight defence focused public sector undertakings (PSUs)'. These are Bharat Electronics; Bharat Earth Movers; Mazagon Dockyards; Garden Reach Shipbuilders and Engineers; Goa Shipyard; Bharat Dynamics; Mishra Dhatu Nigam (Midhani); and Hindustan Aeronautics. The PSUs produce a range of defence equipment including helicopters, state of the art electronics, heavy trucks and tank transportation trailers, submarines, missile boats destroyers, frigates, corvettes, fast attack craft, guided missiles, and aeronautics.

Defence Research and Development:

India also has a defence research and development capability: the Defence Research and Development Organisation (DRDO), The DRDO has its roots in the Technical Development Establish (TDES) formed during the Second World War. These were amalgamated in 1959 to form the Defence Science Organisation (DSO).This in turn, was amalgamated with the Defence Science Services in 1958, to form the DRDO.

PES Institute of Technology

Page 1

WORKING CAPITAL MANAGEMENT

The DRDO draws on the work of 51 laboratories/establishments across the country, and has close links with the eight PSUs. It also co-operates with 70 academic research institutions, 50 national science and technology centres, and some companies in the private sector. The organisation really came into its own in the 1980s, under the leadership of Dr A.J.P Abdul Kalam, when a number of major programmes were launched. These were the Integrated Guided Missile Development Project (1983); the Light Combat Aircraft (1983); the Advanced Light Helicopter; the Arjun Tank (first conceived in 1974); and a number of smaller projects, such as the Pinaka, a multiple barrel rocket launcher (MRBL).

Major Government Actors:

India's Defence Industry system is centred on the Ministry of Defence (MOD), which uniquely, is manned only by civilians. In simple organisation terms, the Ministry of Defence (MOD) is the major co-ordinating body for defence production and R&D. It consists of three main Dain departments: the Department of Defence; the Department of Defence Production and Supplies; and the Department of Defence R&D. In addition to this, there is the MOD Finance Division, which exists at the same level. The Department of Defence (DOD) is headed by the Secretary of State for Defence. His co-ordinates the activities of the other MOD Departments and the three armed services The Department of Defence Production was established in 1962 after the war with China in order to create an indigenous defence production base, while the Department for Defence supplies was established in 1965, with a view to forging links between the civil industries and defence production units. The two departments were eventually merged into one 1984. The department of Defence Research and Development, meanwhile, is headed by a secretary who so Scientific Adviser to the Defence Minister. Its main responsibilities are R&D planning and advising the Defence Minister on scientific aspects of military equipment. Several committees are also involved in the defence planning process: The Defence Ministers Committee (now replaced by the Defence Minster's weekly morning meeting); the MoD production and supply committee, which deals with matters relating to import substitution, domestic arms production, and the operation of the ordnance factories; and the Defence R&D Council, which formulates and reviews R&D defence programmes, and brings together the Defence Minister and the Directors General of the Council for Scientific and Industrial Research. The chief of the Staff Committee, which comprises of the three Chiefs of the Armed forces, provides a channel for providing military advice to the Prime Minster.

PES Institute of Technology

Page 2

WORKING CAPITAL MANAGEMENT

Approaches to Defence Procurement and Industrialisation:

The approach that India has adopted in defence procurement and defence industrial development is similar to that followed other less developed countries (LDCs). Within this general model, however, the countrys experience can be divided into three stages. The first was from independence in 1947 until the early to mid-1960s. The second went from the period following the Sino-India war (1962) and second Indo-Pakistan (1965) conflict until the mid-1980s. And the third went from the mid-1980s until the present day. In the first period, India only possessed the ability to make things such as shells and other ammunition, small arms, guns and explosives; it also had a limited aircraft and ship maintenance capabilities based in Bangalore and Calcutta. Thus, it had to look abroad to foreign defence equipment suppliers, such as the United Kingdom and France to meet its needs. During the second stage, efforts were made to build up domestic production, mostly through assembly under license from the Soviet Union and the United Kingdom. (This programme was centred on the PSUs). During this period, the range of activities undertaken by defence sector was also deliberately widened it include previously peripheral items such as clothing. The third period started with large purchases from the Soviet Union by the former Prime Minister Rajiv Gandhis government (1984-1989). During this period, India consistently spent over 3.3 % of Gross Domestic Product (GDP) on building up its armed forces. By the end of the decade, India had the fourth largest armed forces in the world, the fifth biggest air-force, and the sixth biggest navy. Likewise, India became the worlds largest importer of conventional weapons, spending $US 12.2 billion in the period, of which Russia was the largest supplier. By the end of the 1980s India was assessed as being able to assemble Completer Knock Down (CKD) and Semi-Knock Down (SKDs) purchased from foreign companies and production under license. Furthermore, gradual improvements were also made in and greater attention paid to the country's defence research and development capability, as well as systems integration for the incountry assembly of weapons. The move towards defence indigenisation and the tensions associated with it in the I990s did not occur in a vacuum; indeed it arguably happened earlier than India either predicted or was ready for. For example, the 1991 economic crisis that best the economy forced India to reduce defence spending as a percentage of GDP, from four per cent in the late 1980s to below three per cent in 1994, while the amount of funding allocated to procurement was slashed.

PES Institute of Technology

Page 3

WORKING CAPITAL MANAGEMENT

Table One: Indian Defence Spending - $US and % of GDP: 1990 1991 1992 1993 1994 1995 1996 US $ 10.01 8.07 6.75 7.0 7.33 8.3 11.8 GDP 3.5 3.0 2.48 2.5 2.7 2.5 2.8 % *Estimate. Source: IISS Military Balance, 1990-1991, 2000-2001

1997 12.2 3.1

1998 10.0 2.0

1999 12.4 2.8

2000 15.9 3.6

The end of the Cold War and the col Japse of the Soviet Union, meanwhile, led to the end of the supply of cheap and subsidised weaponry from Moscow. As the previously centralised Soviet arms industry was now spread across the new Republics, India also found it increasingly difficult to acquire spare parts for much of this equipment. Against this backdrop, indigenous R&D was apparently seen a way around the problem. India's approach to defence industrial development from Independence onwards is also closely related to its approach to economic development generally. Crucial Jy, a significant proportion of India's defence production and R&D base is entirely under state control. This is the result of the Industrial Policy Resolutions of 1948 and 1956. These placed the development of all key sectors of the economy, such as machine tools, railways, iron and steel and defence production, under state control. The large-scale participation of private sector companies III defence production, in the meantime, is limited to providing components to the PSUs. Even though the manufacture of components, assemblies and sub-assemblies was opened up to the private sector in 1991, the Indian armed forces procure 250 per cent more from the public than the private sector. A survey of 500 top companies in Indian in the same year also reported that only 30 of them had involved in defence contracts. Thus manufacturing of defence equipment had been and has been traditionally under the control of Government of India since independence. The Industrial Policy of the country had kept defence production in the public sector since First Industrial Policy outlined in the Industry Policy Resolution of 1948. The Industries (Development & Regulation) Act, 1951 gave statutory base to the Industrial Policy. Under .this policy, the Defence Industry, which required heavy investments, strong R&D backing and on which there could be total reliance because of its criticality, remained under Government Control at all times. The control over defence industry was exercised under the Industries (Development & Regulation) Act, 1951, which made licensing compulsory. As a consequence of the then industrial policy, a large infrastructure for Defence production consisting of 39 Ordnance Factories, 8 Defence PSUs and 50 Research & Development laboratories was created in the country.

PES Institute of Technology Page 4

WORKING CAPITAL MANAGEMENT

After considering the capital intensive nature of defence industry sector as also the need to infuse foreign technology and additional capital including FDI, Govt. decided in May, 2001 to open Defence industry for private sector participation up to 100% with FDI permissible up to 26% - both subject to licensing. Now with this policy change all defence related items have been removed from Reserved Category and transferred to the licensed category, as a result of which private sector can manufacture all types of defence equipment after getting a licence. Consequent to the Government's announcement about the policy change, Department of Industrial Policy & Promotion (DIPP) in consultation with Ministry of Defence, issued detailed guidelines regarding the modalities for consideration of applications for grant of Industrial License. After the announcement of policy changes, there has been a paradigm shift in the role of private sector in the field of indigenisation, i.e., from the role of supplier of raw materials, components, sub-systems, they have now become partners in the manufacture of complete advanced equipment/system. The basic objective of allowing private sector participation is to harness available expertise in the private sector towards the total defence efforts and search for self-reliance. In-built advantages of the private sector are its reservoir of management, scientific and technological skills coupled with its ability to raise resources. The involvement of private sector with its world-class expertise and high technology would not only augment. India's indigenous defence production capability but also lead to creation of employment and infrastructure in the country, giving a strong impetus to the economy. It must be acknowledged that the policy change of May 2001 for allowing private industry to produce any defence item under licence was a logical outcome of liberalization initiated in India in 1991. The private sector industry in India is now just beginning to become significant partier in production and development of Defence items. However, contrary to the common perception, the Private Sector has been playing significant role it the Defence industry sector as sub-contractors and ancillary industry. The private sector mainly has been involved in supply of raw materials, semi-finished products, parts and components to Defence PSUs and Ordnance Factories to a great extent and also to Base Workshops of Army and Base Repair Depots of Air Force and the Dockyards of the Navy. Defence PSUs and Ordnance Factories are outsourcing their requirements from private sector (mainly SMEs) in the range of 20-25%. Out of this outsourcing, about 25% requirement is met though small-scale sector. Increasing security concerns of a rapidly growing economy along with India's strategic geographical and political positioning have driven industry towards giant strides in indigenous manufacture of weaponry, machinery and sophisticated equipments. The market for export of India's defence technology and products is expanding every year, as are the requirements of its own armed forces making India an attractive market as well as an investment destination for joint venture.

PES Institute of Technology

Page 5

WORKING CAPITAL MANAGEMENT

The joint venture offers one of the most comprehensive on-site products ranges from small, easy to use pagers to practical, durable private Mobile Radios and the latest technology, digital cordless communication systems. Brief details of the products are: Access 700 one-way speech paging system which supports 100 pagers. Access 1000/3000 Radio Paging system which supports 1500/5000 users. Computer Radio Integration units. Digital Cordless Communication System

PES Institute of Technology

Page 6

WORKING CAPITAL MANAGEMENT

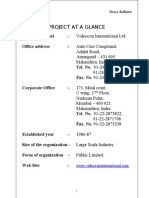

COMPANY PROFILE

HISTORY

The growth and diversification of BEL over the years mirrors the advances in the electronics technology, with which BEL has kept pace. Starting with the manufacture of a few communication equipment in1956, BEL went on to produce Receiving Valves in 1962 and Radio Transmitters for AIR in 1964. In 1966, BEL set up a Radar manufacturing facility for the Army and in-house R&D, which has been over the years. Manufacture of Transmitting Tubes, Silicon Devices and Integrated Circuits started in 1967. The PCB manufacturing facility was established in 1968. In 1970, manufacture black & White TV Picture Tube, X-ray Tube and Microwave Tubes started. e following year, facilities for manufacture of Integrated Circuits and Hybrid Micro Circuits were set up. 1972 saw BEL manufacturing TV Transmitters for Doordarshan. The following year, manufacture of Frigate Radars for the Navy began. Under the government's policy of decentralization and due to strategic reasons, BEL ventured to set up new Units at various places. The second Unit of BEL was set up at Ghaziabad in 1974 to manufacture Radarsj and Tropo communication equipment for the Indian Air Force. The third Unit was established at Pune in 1979 to manufacture Image Converter and Image Intensifier Tubes. In 1980, BEL's first overseas office was set up at New York for procurement of components and materials. In 1981, a manufacturing facility for Magnesium Manganese Dioxide batteries was set up at the Pune Unit. The Space Electronic Division was set up at Bangalore to support the satellite programme in 1982. The same year saw BEL achieve a turnover of Rs.100 crores. In 1983, an ailing Andhra Scientific Company (ASCO) was taken over by BEL as the fourth manufacturing Unit at Machilipatnam. In 1985, the fifth Unit was set up in Chennai for supply of Tank electronics, with proximity to HVF, Avadi. The sixth Unit was set up at Panchkula the same year to manufacture Military Communication equipment. ISO saw BEL manufacturing on a large scale Low Power TV Transmitters and TVROs for the expansion of Doordarshans coverage. In1986 witnessed the setting up of the seventh Unit at Kotdwara to manufacture Switching Equipment, the eighth Unit to manufacture TV Glass Shell at Taloja (Navi Mumbai) and the ninth Unit at Hyderabad to manufacture Electronic Warfare Equipment.

PES Institute of Technology

Page 7

WORKING CAPITAL MANAGEMENT

In 1987, a separate Naval Equipment Division was set up at Bangalore to give greater focus to Naval projects. The first Central Research Laboratory was established at Bangalore in 1988 to focus on futuristic R&D. 1989 saw the manufacture of Telecom Switching and Transmission Systems as also the setting tip of the Mass Manufacturing Facility in Bangalore and the manufacture of the first batch of 75,000 Electronic Voting Machines. The agreement for setting up BEL's first Joint Venture Company, BE DELFT, with M/s Delft of Holland was signed in 1990. Recently this became a subsidiary of BEL with the exit of the foreign partner and has been renamed BEL Optronic Devices Limited. The second Central Research Laboratory was established at Ghaziabad in 1992. The first disinvestment (20%) and listing of the Company's shares in Bangalore and Mumbai Stock Exchanges took place the same year. BEL Units obtained ISO 9000 certification in 1993-94. The second disinvestment (4.14%) took place in 1994. In 1996, BEL achieved Rs.l,000crores turnover. In 1993, all Units / SBUs / Divisions of the company have been certified for ISO 9001 Quality Management System and ISO 1400 Environment Management System. Seven Units / SBUs (Ghaziabad, Panchkula, Kotdwara, Hyderabad, Military Communication, Electronics Warfare &Avionics and Export Manufacturing) are also certified for AS 9100 Aerospace Standards. The Central Software Development group of the company has CMMi Level 5 certification. In 1997, GE BEL, the second Joint Venture Company with M/s GE, USA, was formed as also the third JVC with M/s Multitone, UK, and BEL Multitone. The same year, USA imposed supply restrictions on BEL. In 1998, BEL set up its second overseas office at Singapore to source components from South East Asia. The same year, US and European sanctions were imposed on BEL. The Company was able to overcome the effects of the sanctions and insulate Indian defence forces from the fall-out of denial regimes by finding technical solutions to circumvent the denials and by keeping up the promised deliveries to customers.

PES Institute of Technology

Page 8

WORKING CAPITAL MANAGEMENT

The year 2000 saw the Bangalore Unit, which had grown very large, being reorganized into six Strategic Business Units (SBUs). The R&D groups in Bangalore were also restructured into Specific Core Groups and Product Development Groups. The same year, BEL shares were listed in the National Stock Exchange. In2002, BEL became the first defence PSU to get operational Mini Ratna Category I status. In 2003, the Company's turnover crossed the Rs.2,500 marks. In 2006-07, BEL achieved a turnover of Rs.3,952.69 crores. In June 2007, BEL was conferred the prestigious Navratna status based on its consistent performance. BEL looks forward to leverage the increased functional autonomy for further business growth and diversification. BEL has its corporate office at Bangalore and manufacturing units at nine locations in India. A network of marketing and customer support centres across India completes the vertically integrated company profile. To mark the company's International presence. There are two offices, one in New York and the other in Singapore.

PES Institute of Technology

Page 9

WORKING CAPITAL MANAGEMENT

VISION&MISSION VISION:

To be a world-class enterprise in Professional Electronics.

MISSION:

To be a customer focused globally competitive company in defence electronics and in other chosen areas of professional electronics, through quality, technology & innovation.

VALUE:

Putting customers first. Working with transparency, honesty & integrity. Trusting and respecting individuals. Fostering teamwork. Striving to achieve high employee satisfaction. Encouraging flexibility & innovation. Endeavouring to fulfil social responsibilities. Proud of being a part of the organization.

OBJECTIVES:

To be a customer focussed company providing state-of-the-art products & solutions at competitive prices, meeting the demands of quality, delivery & service. To generate internal resources for profitable growth. To attain technological leadership in defence electronics through in-house R&D, partnership with defence/research laboratories & academic institutions. To give thrust to exports. To create a facilitating environment for people to realise their full potential through continuous learning & team work. To give value for money to customers & create wealth for shareholders. To constantly benchmark company's performance with best-in-class internationally. To raise marketing abilities to global standards. To strive for self-reliance through indigenization.

PES Institute of Technology

Page 10

WORKING CAPITAL MANAGEMENT

Quality objective:

1. Effective and efficient design and development process, considering the present and future needs of customers. 2. Enhanced customer on-time delivery of defect free products and effective life cycle support. 3. Continual up gradation and utilization of infrastructure and human resources. 4. Mutually beneficial alliances with suppliers.

Production and Services:

BEL offers Products under Defence, Non - Defence, Turn Key Solutions. They also offer services like Contract Manufacturing, Design & Manufacturing Services, Semi- conductor Device Packaging, Software Development and Quality Assurance Facilities.

Product Range:

1. RADARS: 3 Dimensional Tactical Control Radar Low Level Weigh Radar Weapon Locating Radar Airport Surveillance Radar IFF Equipment/Secondary Surveillance Radar 2. SONAR&UNDERWATER EQUIPMENT: Sonar & Transducers Towed Torpedo Decoy ASW Fire Control Systems Sonar Simulators Sonobuoys 3. NAVAL FIRE CONTROL SYSTEMS: Gun Fire Control Systems for Naval Platform Optical Director Systems for Naval Guns Electro Optical Fire Control System 4. COMMAND & CONTROL SYSTEMS Battle Management system (BMS) Shakti (Artillery Combat Command & Control System) Sanjay (Battlefield Surveillance System) Samvahak (Command Information & Decision Support System)

PES Institute of Technology

Page 11

WORKING CAPITAL MANAGEMENT

5. COMMUNACTION EQUIPMENT: Receivers Transmitters Tran receivers 6. SATCOM SYSTEMS: Fly Away Terminals TV uplink earth station Intelsat F3 earth station Digital Satellite Communication Terminal 7. TELECOM EQUIPMENT/ SYSTEMS: 2/8/34 Mbps Intermediate Data Rate Full range of ADSL2+CPEs Wi-Fi/ Wi- Max based Broadband Networks 8. SOUND &VISION BROADCASTING: MW Transmitters and FM Transmitters 10KW MW Mobile Broadcast Station Remote Unmanned TV Station TV Receiver Only(TVRO) Terminals Disaster Warning Set Top Box (STB) 9. TANK ELECTRONIC AND CONTROL SYSTEMS: NBC Protection System for Armoured Fighting Vehicles Advanced Land Navigation System (ALNS) Hydraulics for T-72 Tanker Stabilisers 10. OPTIC & ELECTRO-OPTICS: Optical Sub-Assemblies Laser range Finders Multifunctional Uncooled Thermal Images T1 based Disaster Managements system 11. ELECTRONIC WARFARE SYSTEMS: Electronic warfare Equipment (Airborne, Shipborne, Land-Based) 12. ANTENNAE: Shaped Reflector Radar Antenna Multi Beam & Scanning Beam Antenna IFF Array Antenna (Linear & Planner)

PES Institute of Technology

Page 12

WORKING CAPITAL MANAGEMENT

A brief list of the Customers in the defence and civilian market segments and the products and services offered to them by BEL is given below:

Brief list of Products, Services and Customers in BEL:

Products and Services Defence Communication Radars & Sonar Customers Indian Defence Services, Para-military forces. Indian Defence Services, Civil Aviation, Meteorological Department, Space Department Department of Telecommunication, Para-military forces. Power Sector, Oil industry, Railway.

Telecommunication

Broadcasting Equipments& Studio All India Radio, Doordarshan, (National Radio & TV Systems Broadcasters) Electronic Voting Machine Solar Products & Systems Tunkey Systems, Networks Components Election Commission Of India Individual, Private & Government Organizations

E-Governance Police, State Governments, Public sector Undertakings.

All India Radio &Doordarshan the National Radio & TV Broadcasters, Instrumentation Industry, Switching Industry, Entertainment Industry, Telephone Industry.

PES Institute of Technology

Page 13

WORKING CAPITAL MANAGEMENT

Exports play a key role in BEL's strategic perspective. The ranges of products and services that are exported have been increasing over the years. A number of international companies also use the facilities at BEL for contract manufacturing. The broad list of products and services being exported is given below:

List of Products and Services Exported:

Products and Services Defence Communication Equipment spare parts Radars &Sub-systems Electronic Warfare products and services Opto-electronics products Customers and Botswana, Indonesia, Suriname, Malaysia

Indonesia, Egypt, Switzerland Russia, Brazil Sri Lanka, Nepal, Israel, South Africa

Semiconductor devices, Microwave Tubes Malaysia, Singapore, Turkey, Netherlands, UK, USA, and Transmitting Tubes France, Hong Kong Suriname, Germany, Zimbabwe, Botswana, Solar Products &Systems Kenya, Nigeria Vacuum Interrupters Contract Manufacturing Services Electronic Voting System Radio &TV Broadcasting Systems Telecom and SATCOM systems Malaysia, UAE, Uganda, Turkey, UK, Azerbaijan &Outsourcing USA, Canada, Belgium, Italy, Germany, France, UAE. Sri Lanka, Uganda, Malawi, South Africa. products and Nepal, Mauritius

Nigeria, Kenya

PES Institute of Technology

Page 14

WORKING CAPITAL MANAGEMENT

BEL operates at 9 units mainly and has 11,180 employees (as on 31.03.2011) comprising 4914 executives, 598 technical cadre and 5668 non executives. The different types of units that fall under BEL can be divided into 11 parts and they are as depicted below.

Corporate office Regional office

Manufacturing network

Marketing office and service centers

Joint venture companies

Central research laboratories

BEL

Subsidiary company

Liason office

Overseas office Technical cell (BEL FOJ/GRSE Ltd) Systems division

PES Institute of Technology

Page 15

WORKING CAPITAL MANAGEMENT

These units/main divisions have their own offices at various cities. Their locations are as follows shown

Manufacturing Network:

Bangalore (in 1954) Ghaziabad (in 1974) Pune (in 1979) Machilipatnam (in 1983) Chennai (in 1985) Panchakula (in 1985) Hyderabad (in 1986) Kotdwara (in 1986) Taloja (Navi Mumbai in 1986)

Corporate Office:

Bangalore

Regional Office:

New Delhi Mumbai Calcutta Hyderabad Chennai Vishakhapatnam

Marketing Office and Service Centre:

International Marketing Centre, Bangalore Central Marketing, New Delhi Delhi Marketing Centre & Regional Service Centre, New Delhi National Marketing Division, New Delhi Mumbai Marketing Centre, Mumbai

Central Research Lab:

Bangalore Ghaziabad

PES Institute of Technology

Page 16

WORKING CAPITAL MANAGEMENT

Overseas Office:

New York (NYRO) Singapore (SIRO)

Liaison Office:

Agra

Systems Division:

Bangalore

Technical Cell:

Kolkatta

Subsidiary Company:

BEL Optronic devices Ltd.(Pune)

Joint Venture:

BEL-Multitone Ltd (Bangalore) GE-BE Pvt. Ltd. (Bangalore)

BG Complex Strategic Business Unit (SBU):

1. SBU 10 MR (Military Radar) 2. SBU 20 NS (Naval System) 3. SBU 30 MCE & EW (Military Communication & Electronic Warfare) MCE EWA NCS 4. SBU 40 T&BS (Transmitting & Broad casting System) 5. SBU 50 Comp (Components) 6. SBU 60 EM (Export Manufacturing) 7. SBU 70 Finance Central

PES Institute of Technology

Page 17

WORKING CAPITAL MANAGEMENT

OWNERSHIP PATTERN:

Anil Kumar M.L. Shanmukh I.V.Sarma M.G.Raghuveer H.N. Ramakrishna M.N. Krishnamurthy,IPS V.V. Balakrishnan Elaine Mathias R.C. Nautiyal J.k. Batheja GhanshyamNarain M.V. Gowtama VipinKatara Chairman and Managing Director Director (Human Resources) Director (R & D) Director (Finance) Director (Marketing) Chief Vigilance Officer General Manager (International Marketing) General Manager (Finance) General Manager (Human Resources) General Manager (Internal Audit & Systems) General Manager (TORQUE) General Manager (Technology Planning) General Manager (Strategic Planning)

Infrastructure:

Over the years, commitment to maintaining clean and green environment has taken deep roots in the organisation as evidenced by improved result in prevention of pollution, energy conservation, water conservation, use of renewable energy and hazardous waste reduction, use of besides introduction of eco-friendly processes and materials. Sustenance of Zero discharge, Legal compliance, measurement and monitoring, verdant surroundings and a forestation are a way of life in BEL. The Company, with its ISO 14001 (2004) certified Environmental Management System, addresses environmental issues in a wider perspective with a firm resolve to reduce all form of environmental degradation, passionately participates in our environmental endeavours to promote an environmental free of pollution. Some of the initiatives taken are presented below: Cleaner Technology. Emission to Air. Water Pollution. Hazardous waste Management System. Biomedical Waste. On Site Emergency Plan and Systems. Water Management.

PES Institute of Technology

Page 18

WORKING CAPITAL MANAGEMENT

LIQUIDITY:

The Companys shares are very liquid and are actively traded on the Indian exchanges. Relevant data of turnover for the financial year 2010-2011 is given below: BSE No. of shares traded Value( in Lakhs) Market Price Data: Quotation on BSE ` Per Share Month Oct-10 Nov-10 Dec-10 Jan-11 Feb-11 Mar-11 High 1927.40 1760.00 1800.00 1793.00 1840.00 1729.95 Low 1602.00 1625.50 1616.30 1613.25 1610.10 1620.00 Quotation on NSE ` Per Share High 1928.40 1758.00 1807.00 1795.00 1842.80 1727.90 Low 1600.00 1625.30 1651.05 1624.20 1612.05 1620.00 26,83,242 47,706 NSE 132,44,660 2,36,210 BSE+NSE 159,27,902 2,83,916

Top 10 Shareholders as on 31st March 2011:

Sl No. Name No. of Shares 6,06,89,600 21,19,931 13,75,081 12,48,437 7,89,503 7,05,369 5,71,982 5,36,000 4,50,749 4,28,351 % Holding 75.86 2.65 1.72 1.56 0.99 0.88 0.71 0.67 0.56 0.45

Page 19

1 President of India (including 5 Govt. nominees) 2 Life Insurance Corporation of India 3 LIC of India Market Plus-1 4 LIC of India Market Plus 5 HDFC Trustee Co Ltd-HDFC Equity Fund 6 LIC of India-Money Plus 7 Life Insurance Corporation of India- Profit Plus 8 HDFC Trustee Co Ltd-HDFC Top 200 Fund 9 SBI Mutual Fund- Magnum Tax Gain 1993 10 HDFC Trustee Co Ltd-HDFC Tax Saver Fund

PES Institute of Technology

WORKING CAPITAL MANAGEMENT

Awards & Recognition:

Standing Conference of Public Enterprises (SCOPE) Meritorious Award for Corporate Governance for the year 2009-10. SCOPR Award for R&D Technology Development & Innovation for the year 2007-08. Raksha Mantris Award in the categories of Best Performing Division, Import Substitution, Design Effort and Innovation for the year 2008-09 Selected as the top Indian Company under the Electrical & Electronic Equipment, Technology Development sector for the Dun & Bradstreet-Rolta Corporate Award 2010. International Aerospace Award 2011 under the categories of Most Influential Company of the Year and Excellence in Innovation. Gold prize in the Heavy industries category of DNA-Dainik Bhaskar Indian Pride Award (2010) for Excellence in Innovation. BEL employees received the prestigious Prime Ministers Shram Award for the year 2005, 2006, and2007 in the categories of Shram Bhushan, Shram Devi, ShramVir/Veerangana and Shram Shree, respectively. A Senior Technical Assistant of Bangalore Complex has been selected for the Prime Ministers Shram Ratna for the 2008.

PES Institute of Technology

Page 20

WORKING CAPITAL MANAGEMENT

DIRECTOR (F)

GM (F) GM (IA)

DIRECTOR (R&D)

GM (TP) CS (CRL/BG) CS (CRL/DEL)

GM (SP) GM (HR)/BC GM (F)/BC GM (T&BS) GM (ES) GM (MR) GM (EM) GM (COMPS) GM (MC & EW) GM (NS)

DIRECTOR (HR)

CMD

DIRECTOR (HR)

GM (HR)/CO

GM (TORQUE)

DIRECTOR (OU)

CVO

GM (GAD) GM (PK) GM (CHN) GM (MC) GM (PN) GM (HYD) GM (KOT) GM (NAMU)

DIRECTOR (MKTNG)

GM (IM) GM (SYS)

PES Institute of Technology

Page 21

WORKING CAPITAL MANAGEMENT

Mckensys 7s frame work with special reference to BEL.

STRUCTURE:

Organizational structure refers to formal hierarchical relationships & positional arrangements it deals with how members communicate with others, how information flows, what roles he performs, Rules & procedures existing to guide the activities of members as part of organization With reference to BEL, it has good mentor, disciplined relationship, encouragement, help & guidance. Anil Kumar M.L. Shanmukh I.V.Sarma M.G.Raghuveer H.N. Ramakrishna M.N. Krishnamurthy,IPS V.V. Balakrishnan Elaine Mathias R.C. Nautiyal J.k. Batheja GhanshyamNarain M.V. Gowtama VipinKatara

PES Institute of Technology

Chairman and Managing Director Director (Human Resources) Director (R & D) Director (Finance) Director (Marketing) Chief Vigilance Officer General Manager (International Marketing) General Manager (Finance) General Manager (Human Resources) General Manager (Internal Audit & Systems) General Manager (TORQUE) General Manager (Technology Planning) General Manager (Strategic Planning)

Page 22

WORKING CAPITAL MANAGEMENT

SKILL:

Skills are capabilities of organization as a whole. Skills, which describe the organization as competence like in BEL has manufacturing skills, R&D etc, The skills, which BEL process are assertive, decision-making, business knowledge, leadership, attitude, adaptability, courageous, & dynamism. However the skill requirement varies from the job to job. Recruitment & Selection process in BEL handpicks the best engineering and managerial talent from the countrys reputed organizations, technical and management colleges. The selection is been done from reputed business houses, campus selection, placement agencies, and Advertisements & Data base. There is a selection committee, which conducts group discussions, personal interviews & other formalities. TRAINING & DEVELOPMENT: To bridge the gap between existing skills & desired skills. Training in BEL is aimed at the systematic development of knowledge, skills, attitude and teamwork. Training & development of personal skills is considered a high priority area and it forms an integral part. Programs are undertaken keeping in view the dynamic changes in the environment, which are contributed by rapid technological obsolescence or for personality development or as an Induction. INTERNAL TRAINING. EXTERNAL TRAINING. ON THE JOB TRAINING.

STYLE:

In BEL there are Quality circles where the employees can suggest any improvements in systems. There is a grass root level participation. These suggestions are implemented either by interdepartmental communications, mutual understanding, or by top-level analysis, where huge investments are involved. Even the policy decisions are taken with consultancy of respective persons. Employees take casual decisions & their immediate head gives the feedback. From the above facts we can say that BEL has a participative management style.

PES Institute of Technology

Page 23

WORKING CAPITAL MANAGEMENT

SYSTEMS:

It refers to all rules, regulations & procedures both formal & informal. It includes production plans, control system, capital budgeting systems, cost accounting procedures, budgetary systems, recruitment training & development plans. In BEL, every department has got their own Management Information system.

Human Resource Information System: There is an HR package which stores all

employee profile such as employee ID, code no, joining date, place of posting, place of posting, name, personal profile, bank name, A\c no, grade, department, qualifications, designation, experience, pay scale, & history. On the basis of this data rating is done. It also gives information of overall employee structure like no of persons joined in a month, transfers, promoted, land giver category, loan taken employees, etc

Quality Systems: Every production department has quality packages. They have their

own targets & grades. JSW has Laboratory, R&D & Testing facilities.

STAFF:

BEL operates at 9 units mainly and has 11,180 employees (as on 31.03.2011) comprising 4914 executives, 598 technical cadre and 5668 non executives.

SHARED VALUES:

People come first in the new business paradigm. The success of an organization essentially depends upon utilization of this resource. All the employees in BEL can give suggestions on improvement of technology, production process or operations. Proposals with the implementation process are welcomed. The top people reviews & analyses. Scheme makers get awards. Department with zero level accidents & quality achieved gets incentives. On Independence Day every year, one employee gets BEST EMPLOYEE of BEL award.

STRATEGY:

It includes basic purposes, missions, objectives, goals & major action plans & policies. In BEL, every department has its own strategies & policies. Marketing Strategies focusing on selected major customers (I.e. Indian Govt) in terms of their locations, demands etc., Customizing of product so that the best advantage by using BEL product in terms of yield.

PES Institute of Technology

Page 24

WORKING CAPITAL MANAGEMENT

SWOT Analysis: Strength:

Strong R & D base-in-house as well as by close association DRDO labs. Well established system & procedures skilled, dedicated & motivated work force. Compatibility to provide lifetime product support. Implementation of SAP across all the Units/offices.

Weaknesses:

Low risk taking ability not proactive enough. Lack of aggressive marketing. Dependence on Defense sector.

Opportunities:

System solution business. Export though offset mechanism. Strategic Alliances.

Threats:

Private sector participation in Defense production. Sourcing of Technology-non-availability & exorbitant cost. Large number of international players.

Unit wise Budget Details for 2011-12(` in Lakhs)

Unit Bangalore Ghaziabad Pune Navi Mumbai Machilipatnam Panchkula Kotdwara Hyderabad Chennai Head Office (CRLs) Total Budget 8627 9492 303 352 772 122 200 936 672 1103 22579 Norms 25% of PAT 16333 3208 365 53 515 1343 39 964 244 0 23064 Surplus / Excess 7706 -6284 62 -299 -257 1221 -161 28 -428 0 1588

PES Institute of Technology

Page 25

WORKING CAPITAL MANAGEMENT

A Summary of the Companys Financial result is given below: 2010-11 Value of Production Turnover (Gross) Profit Before Depreciation. Interest & Tax Interest Depreciation Provision for Tax Profit After Tax Add: Balance brought forward from previous year Less: Amount transferred to Capital Reserve Balance available for Appropriation Interim Dividend @`6 per share on paid up Capital of 8,000 lakhs Proposed Final Dividend @`15.60 per share on paid up Capital of 8,000 lakhs Tax on Dividend Transfer to General Reserve Transfer to Capital Reserve Reserves & Surplus Net Worth Earnings Per Share (in`) Book Value Per Share (in`) 12,480.00 2,821.79 40,000.00 41.98 490,570.65 498,570.65 107.68 623.21 4,800.00 552,080.34 552,969.32 128,362.22 43.36 12,204.23 29,967.78 86,146.85 191,303.51 41.98 277,408.38

(` in Lakhs)

2009-10 524,788.20 521,977.40 116,150.66 53.48 11,594.23 32,415.25 72,087.10 177,236.84 90.77 249,233.17

4,800.00

10,560.00 2,569.66 40,000.00 90.77 424,525.59 432,525.59 90.11 540.66

PES Institute of Technology

Page 26

WORKING CAPITAL MANAGEMENT

LEARNING EXPERIENCE:

I was very fortunate to undergo project in Bharat Electronics Limited, Bangalore. It is one of the monopolist players in the Defence Industry in India, very large in size. I could understand various dynamics of this sector during my industry study. I studied various strategies of this organization and I came to know how they are important in overall development of the company and the organization as whole. This project has made me realize how working capital acts as a life blood to the organization. How important is working capital in smooth running of organization. I learnt the different types, components o f working capital. Conservative Policy, Aggressive Policy, the ratios and formulas used were Liquidity Ratio, Profitability Ratio, Turnover Ratio, and Leverage Ratio. I even learned what additional competencies I may have to develop to be a successful professional in corporate world. By and large it was a fruitful & useful experience of undergoing project Bharat Electronics Limited, Bangalore as I could observe the way in which an organization of its size actually functioned.

PES Institute of Technology

Page 27

WORKING CAPITAL MANAGEMENT

INTRODUCTION

The project is carried out in Bharat Electronics Limited (BEL), a Government of India Enterprise, and Ministry of Defense. The project studies the working capital management in BEL and evaluates its financial management performance. Working Capital Management is the integral part of overall financial management. Management of investment of funds in business. Funds can be invested permanent/long term purpose such as acquisition of fixed assets, expansion and diversification of business, modernization of plants and machinery and R&D. Funds are also needed for short-term purpose that is for day-to-day operation of the business. Day-to-day operation includes procurement of raw materials, payment of wages and meeting and other day-to-day expenses these funds are known as working capital. It refers to that part of the firms capital, which is required for financing current assets such as cash, marketable securities, debtors, inventories, work-in-progress and finished goods. Working capital management helps to carryout day-to-day operation of business smoothly.

MEANING:

Working capital management refers to management of current assets and current liabilities and the inter-relationship that exists between them. In other words, it refers to all aspects of administration of both current assets and current liabilities. Working capital management is significant facet of financial management. Because investments in current assets represent a substantial portion of total investment and investment in current assets and the level of current liabilities have to be geared quickly to change in sales.

DEFINITION:

According to Hoagland working capital is descriptive of that capital which is not fixed. But the more common use of the working capital is to consider it as the difference between the book value of the current assets and the current liabilities.

IMPORTANCE OF THE WORKING CAPITAL:

The developing economies are generally faced with the problem of inefficient utilization of resources available to them. Capital is the scarcest productive resource in such economies and proper utilization of these resources promotes the rate of growth, cuts down the cost of production and above all improves the efficiency of the productive system.

PES Institute of Technology

Page 28

WORKING CAPITAL MANAGEMENT

Fixed capital and working capital are the dominant contributors to the total capital of the developing country. Fixed capital investment generates production capacity whereas working capital makes the utilization of that capacity possible. Thus the study of working capital behavior occupies an important place in financial management. Working capital has acquired a great significance and sound position for the twin objects of Profitability and Liquidity.

WORKING CAPITAL:

Every business needs funds for two purposes its establishment and to carry out day-to-day operations. Accordingly, funds needed for a business can be broadly classified under: Fixed capital (long needs) Working capital (short-term needs) Fixed capital forms the skeleton of any business; working capital is its flesh and blood.

SHORT TERM CAPITAL CURRENT ASSETS MEDIUM TERM CAPITAL FIXED ASSETS LONG TERM CAPITAL

Fig. 1.1: Working Capital Management & Profitability Analysis of BEL Long-term funds are required to create a production facility through purchase of fixed assets such as plant, machinery, land, building, furniture etc. Investments in these assets represent a part of the firms capital that is blocked more or less on a permanent or fixed basis and hence is called fixed capital. Funds are also required for short-term purpose like purchase of raw materials, payment of wages, salaries and other expenses. These funds are known as working capital. Working capital is what makes a company work. It is impossible to carry on any business only with fixed assets, working capital is a must. Inadequately of working capital takes any business to death.

PES Institute of Technology

Page 29

WORKING CAPITAL MANAGEMENT

Working capital management deals with the most dynamic field in finance, which needs constant interaction between finance and other functional managers. The finance manager acting alone cannot improve a companys working capital situation. The ultimate long-term solution for a difficult working capital does not lie with the banks; rather, it lies with the manufacturing, marketing and finance activities. Manufacturing has an important role to play in operating with minimum inventories; the purchase department should be able to obtain the best possible terms from suppliers. The marketing department should negotiate with customers for the best terms. The finance manager should be able to coordinate and achieve optimal utilization of operating funds at the lowest interest cost. Thus,

Working capital management has come to be known as the cash triangle:

MARKETING (CREDIT) FINANCE (CASH FLOW)

MANUFACTURING (INVENTORY)

Fig. 1.2: The Cash Triangle. Due to the factors mentioned above the management of working capital become one of the most significant jobs of the finance manager. In this project the various components of current assets & liabilities, the extent of funds tied up in each, the trend of changes in funds tied up with each components, the efficiency with each component are managed and overall efficiency of working capital management and its impact on profitability is studied.

CONCEPT OF WORKING CAPITAL:

The term working capital literally means capital used for conducting the day to day operations. It refers to that part of total capital which is used for carrying out the routine and regular business operations. In short, it is the amount of funds used for financing the short-term working capital requirements. Short term working capital includes stock of raw materials, supplies needed to manufacture, semi-finished goods awaiting sale, sundry debtors constituting the pending collections against sales and short-term investment. The working capital is also termed as circulating capital. Circulating capital means current assets of a company that are changed in the ordinary course of business from one firm to another, as for example from cash to inventories to receivables, receivables into cash.

PES Institute of Technology

Page 30

WORKING CAPITAL MANAGEMENT

Working capital referred to as floating capital consist of funds invested in current assets. Current assets imply those assets which in the ordinary course of business can be converted into cash within a short period of time. In the same way current liabilities are the payable with in a short-term out of the day today income. In short, Working capital is the amount of funds necessary to cover the cost of operating the enterprise working capital in a going concern, it consist of cash receipt from sales which are used to cover the cost of current operations.

KINDS OF WORKING CAPITAL

On the basis of concepts

On the basis of time

Gross working capital

Net working capital

Fixed working capital

Temporary working capital

Regular working capital

Reserve working capital

Seasonal working capital

Special working capital

Fig. 1.3 Shows the kinds of Working Capital

Gross working capital:

The concept of gross working capital is a financial concept. Gross working capital refers to the total investment in current assets, such as cash in hand, cash at bank, accounts receivables, stock of finished goods, work in progress, and stock of raw materials prepaid expenses etc. working capital is also expressed as circulating or operating or current capital.

PES Institute of Technology

Page 31

WORKING CAPITAL MANAGEMENT

Net working capital:

The concept of networking is an accounting concept. Net working capital means net current assets, i.e. the excess of current assets over current liabilities. It is also referred to as positive working capital. In case current liabilities excess the current asset it is expressed as negative working capital or working capital deficit.

Operating cycle or working capital cycle:

In modern business, the concept of working capital has changed a lot. In the present time a new concept known as operating cycle has emerged and is gaining popularity. There is much different between current and fixed assets, as far as recovery of investment is concerned. Every business required many years to recover the investment in fixed assets is turned over many times in a year. Investment in current assets is recovered through a firms operating cycle. When stocks of finished goods are sold and debtors are collected. Usually firms operating cycle is less than a year. The term operating cycle implies the period of time required to convert sales into cash. As per operating cycle concept working capital is that part of capital which circulates in different firms such as cash to raw material, to work in progress, to finished good, to sales, to debtors, to cash. It is also called circulating capital. The working capital rotates in such a way that money will be blocked at different stages in different forms till recovery in the form of cash. The cycle begins with cash and ends with appreciation or depreciation of cash. This can be called cash conversion cycle. The operating cycle of any manufacturing firm has to pass through three stages: Assembling of resources like raw materials, labour power and fuel etc. Manufacturing the goods i.e. conversion of raw material into work in progress into finished goods. Selling the goods i.e. cash sale/credit sale. Credit sale creates book debts or bills receivables.

PES Institute of Technology

Page 32

WORKING CAPITAL MANAGEMENT

Purchases

RMCP+WIPCP+FGCP

Payment

Credit sales

Collection

Inventory Conversion

Receivables Conversion

Period

Period

Payables Gross Operating Cycle

Net Operating Cycle

Fig. 1.4: Showing operating cycle RMCP (Raw material conversion period) WIPCP (Work in process conversion period) FGCP (Finished goods conversion period) The operating cycle of the manufacturing concern starts with the purchase of raw materials and services and ends with the realization of the cash. The following steps are followed in between these: Purchase of raw materials and services. Conversion of raw materials into work in progress. Conversion of work in progress into finished goods inventory. Conversion of finished goods stock into sales debtors and receivables. Realization of cash.

This cycle continues again from cash to purchase of raw materials and so on. The length of operating cycle of a manufacturing firm is the total of inventory conversion period and receivable period and accounts payable period from the financial statement of the firms. For this the following formula can be used.

PES Institute of Technology

Page 33

WORKING CAPITAL MANAGEMENT

Table 1.2: Showing the ratios and its formulas

Sl.No. 1 Inventory Turnover Ratio (ITR) Therefore, Inventory conversion period. 2 Debtors Turnover Ratio (DTR) Therefore, Inventory conversion period. 3 Creditors Turnover Ratio. = Accounts receivable period Number of days in a year = Net Credit purchase Average accounts payable Or = Net purchase Average Crs = Net sales Average debtors = Number of days in a year Inventory Turnover Ratio = Cost of goods sold Average inventory Ratios Formulas

(Note: In case of information about credit purchase is not available total purchases may be assumed to be credit purchase) Net operating cycle = Inventory conversion period + Accounts receivable period accounts payable period

PES Institute of Technology

Page 34

WORKING CAPITAL MANAGEMENT

Fig. 1.5: Showing permanent and temporary working capital

TYPES OF WORKING CAPITAL: Permanent or fixed working capital:

It is the minimum level of working capital in terms of current asset which is always required by the firm to carry on its business operations. This part of working capital is fixed irrespective of changes in the operations. There is a need for current asset for the smooth flow of operating cycle which is a continuous process. Hence the need for current asset is felt regularly. In any business certain fixed portion of current asset is always required that is referred to as permanent or fixed working capital as core capital asset thus the permanent working capital is permanently needed for the business and it is usually financed out of long term funds. This is why current ratio should be more than one.

PES Institute of Technology

Page 35

WORKING CAPITAL MANAGEMENT

Temporary working capital

Permanent working capital

Fig. 1.6: Showing Permanent and temporary working capital

Temporary or variable or fluctuating working capital:

It is a type of working capital which keeps on fluctuating from time to time depending on business activities. It indicates the need for additional current asset required at different times, example Additional inventory has to be procured to support series during peak sales Period. Investment in inventories decreases during depression period. Thus, it is the extra working capital required to support the changes in the production and sales activities. It is usually financed from short term sources of finance such as bank credit.

COMPONENTS OF WORKING CAPITAL:

The composition of working capital varies from one business to another. The composition of working capital of trading concern is quite different from that of manufacturing. The term composition implies the various components or constituent parts that are included in the working capital, the major components of working capital are current asset and current liabilities.

PES Institute of Technology

Page 36

WORKING CAPITAL MANAGEMENT

Current Asset:

These are the assets which can be converted into cash within an accounting year or within the operating cycle whichever is longer. Some of these assets like stock of finished goods debtors and bills receivables may not be converted into cash within the required period. Even then these assets are still included in the list of current assets. Basically, the current asset include inventories trade debtors, advances, investments, prepaid expenses and cash in hand and cash at bank. The components of current asset are shown in the following manner: Inventories raw materials, stores and spares, work in progress, finished goods etc. Loans and advances trade debtors, bills receivables, prepayments like prepaid expenses advance payment of taxes. Investment government securities, semi government securities, industrial securities, private deposits. Cash and bank balances fixed deposits with banks, cash at bank cash in hand.

Finished Goods

Accounts Receivable

Working Process Wages, Salaries factory overheads

Cash

Raw materials

Suppliers

Fig. 1.7 Current Asset Cycle

PES Institute of Technology

Page 37

WORKING CAPITAL MANAGEMENT

Current Liabilities:

These are the liabilities which are payable within an accounting year. Usually, all those liabilities which are required to be paid within a year are regarded as current liabilities. These liabilities include trade creditors, bank overdraft, provisions for taxes, dividends and bonus, outstanding expenses etc. Some of these liabilities may not strictly be described as current liabilities but nevertheless these liabilities are included in the category of current liabilities. The components of current liabilities are in the following manner: Trade dues- Trade creditors, bills payable, outstanding expenses. Borrowing- Loans from banks, public deposits, bank overdrafts, cash credit. Advances received Provisions- Provision for taxation proposed dividend.

The three important methods of maintaining current assets at optimum levels are: Current assets and fixed assets ration Liquidity Vs. Profitability Cost benefit Trade off

Current assets to Fixed assets ratio:

Optimum level of current assets is required to maximize the shareholders wealth and firm needs fixed and current assets to support particular level of output. We can measure the level of current asset by relating it to fixed asset. Therefore, Current assets ratio = Current Assets Fixed assets

Current Asset Policies:

Mainly there are three policies. The following figure shows the alternative current asset policies.

Conservative Policy:

Assuming Fixed asset as constant and higher current asset/ fixed asset ratio indicates conservative policy. It implies that if liquidity is greater, the risk is lower.

PES Institute of Technology Page 38

WORKING CAPITAL MANAGEMENT

Aggressive Policy:

Lower current asset/ fixed asset ration indicates aggressive policy. It implies that if liquidity is lower, the risk is higher.

Average Policy:

It is also called as moderate policy. It lies between conservative and aggressive policy.

Liquidity Vs profitability: Risk - Return Off:

The current assets holdings will depend upon its working capital policy that it may follow conservative or aggressive policy. These policies involve risk return trade-offs. Under certainty condition larger investments in current assets yield lower rate of return and smaller investments yield higher rate of return. The working capital management policies of a firm largely affect its profitability, liquidity, and structural health of organization. The most important aim of working capital management is profitability and solvency. Solvency refers to ability to maturing obligations. For ensuring solvency the firm should be very liquid which means it holds large amount of current assets. Thus liquid firm has less risk of insolvency. Therefore the aim of working capital policy is to provide enough liquidity to the firm.

. '

Fig. Showing cost trade off

PES Institute of Technology Page 39

WORKING CAPITAL MANAGEMENT

To earn higher amount of profitability, the firm has to sacrifice solvency. Because to maintain liquidity, firm has to in certain cost that, cost tied up in current assets and that extent investment will idle and it affect the profitability position. When firm wants to earn higher profitability it has to sacrifice solvency and this pose firm the greater risk of cash shortage and stock outs. So the goal of working capital management is to maintain a trade-off between profitability and risk.

Cost benefits Trade Off:

The cost benefit trade-off is different way of looking in to risk- return off in terms of cost of maintaining a particular level of current assets. These are two types of costs involved in the current assets. Cost of liquidity Cost of ill liquidity

Cost of Liquidity:

If the firm's level of current asset is very high, it has excessive liquidity. Its return on assets will be low as funds tied up in idle cash and stocks earn nothing and high levels of debtors (through low rates of rerun) increase with the level of current assets.

Cost of illiquidity:

It is the cost of folding insufficient current assets. The firm will not be in a position to honour its obligations if it carries too little cash. This may force the firm to borrow funds at high rates of interest and adversely affect credit worthiness of the firm and also it pose difficulties in obtaining funds in future. So in determining the optimum level of current assets the firm should balance the profitability solvency tangible by minimizing total costs- costs of liquidity and costs of illiquidity. The following figure indicates that with level of current assets, the cost of liquidity increases while the cost of illiquidity decreases and vice versa. The minimum cost point indicates the optimum level of current assets. Some of the approaches to the study of working capital analysis or analysis of working capital can be conducted through a number of devices, such as: 1)

Ratio analysis:

The technique of ratio analysis can be employed for measuring short term liquidity or working capital position of firm.

PES Institute of Technology

Page 40

WORKING CAPITAL MANAGEMENT

2)

Fund flow analysis:

It is a technical device designated to study the source from which additional funds were derived and the use to which there sources were put. Such a statement provides an efficient method for a financial manager to assess the growth of the firm, its financial.

3)

Working capital budget:

A budget is a financial and! or quantitative expression of business plans and policies to be pursued in the future period of time. Working capital budget, as a part of total budgeting process of business, is prepared estimating future long term and short term working capital needs and the source of finance them, then comparing the budgeted figures with the actual performance for calculating variance if any so that corrective actions may be taken in the future. The objective of working capital budget is to ensure availability of funds as and when needed and to ensure effective utilization of these resources. However the first two approaches have been adopted in the analysis of Working Capital.

Table 1.3: Showing the ratios and its formulas and its significance Ratio Liquidity Ratio Current Ratio Formula Significant

I 1)

= Current assets Current Liability = Quick assets Quick Liability It measures short term solvency of the firm

2)

Quick / liquid ratio

3)

Cash/absolute ratio

liquid = Cash + bank balance Current Liability

4)

Net working capital = Net working capital ratio Net asset Interval measure = Current assets - inventory x 365 Average daily operating expense

5)

PES Institute of Technology

Page 41

WORKING CAPITAL MANAGEMENT

II 1)

Profitability Ratio Operating ratio expenses = Operating expenses x 100 Net sales = Operating profit x 100 Capital employed = Gross profit x 100 Sales It measures the operating efficiency of the firm

2)

Return on investment

3)

Gross profit margin

4)

Net profit margin

= Profit after tax x 100 Net sales

III 1)

Turnover Ratio Inventory turnover ratio Current assets turnover ratio Working capital ratio = Net sales Net current assets = Cost of goods sold Average inventory To measure the efficiency and effectiveness of the firm

2)

= Net sales Current asset

3)

IV 1)

Leverage Ratio Debt ratio = Total debt Net asset/ capital employed = Fixed assets Net worth = Total debt Shareholders equity or net worth

2)

Fixed assets

3)

Debt equity ratio

PES Institute of Technology

Page 42

WORKING CAPITAL MANAGEMENT

RESEARCH DESIGN

INTRODUCTION:

The present study is a micro consigned to BEL. It attempts to analyse and interpret the Working capital management" For the purpose of collecting the required information for research study the following methods have been adopted the field survey method and case study methods have been used the interview techniques and non-participant observations were adopted for the collection of data from the different working capital management.

STATEMENT OF THE PROBLEM:

The project is carried out in Bharat Electronics Limited (BEL), a Government of India Enterprise, Ministry of Defence Since the industry scenario is such that it has a long selling cycle time. Hence it has a continuously increasing turnover, the operating cycle is long and the working capital requirements are high. In such a scenario, management of the company play according to the dynamics of the industry in such a way that it leads to an advantage to the company. The management should workout the optimal level of working capital, which gives an deal trade-off between risk, return and profitability. The short-term solvency of the firm depends upon proper management of working capital.

OBJECTIVES OF THE STUDY:

The main objectives of the study are: To analyse working capital management practices at the Public sector (BEL). To suggest remedial measures.

RESEARCH DESIGN DETAILS:

TYPE OF RESEARCH DATA COLLECTION METHOD AREA OF RESERCH Case Study Method Secondary Data ANALISYS WORKING CAPITAL MANAGEMENT PRATICE AT PUBLIC SECTOR IN CASE OF BHARAT ELECTRONICS Ltd. 5 Years (2007-2011)

DATA SELECTED

PES Institute of Technology

Page 43

WORKING CAPITAL MANAGEMENT

This project a Study on Analisys of Working Capital Management practice at Public Sector a case of BHARAT ELECTRONICS Ltdis considered as an analytical research. Analytical Research is defined as the research in which, researcher has to use facts or information already available, and analyse these to make a critical evaluation of the facts, figures, data or material. The project includes finding of primary data and secondary data. It includes surveys and fact-finding enquiries. So, the project basically covers description of state of affairs, as it exists at present. Here in this case, the researcher does not have control over the variables. Here, the job done as a researcher is to use the facts and information already available. The research is done with the aid of the annual reports, the company database textbooks and the observation and interaction being the only source of primary data whatever is used. The same set information is analysed to make the critical evaluation of the material. With the given nature of research this is an analytical type of research wherein the analysis of the existing set of affairs are used to arrive the effect of working capital management on the return and profitability of the company.

TOOLS USED:

The data were analyzed using the following financial tools and techniques. Ratio analysis Statement of changes in working capital

TECHNIQUES:

The techniques used for the collections of the financial statements, data and other information as follows. The primary data were collected by interaction and observation. The secondary data were collected from the-published annual reports, budgeted manuals and the audited balance sheet and profit and loss account, database of the company.

LIMITATIONS:

Usefulness of the Working Capital depends upon the ability &intensions of the Company. Working capital is required only for financing the current assets ¤t liabilities. Current assets ¤t liabilities can change, they are not constant. The effect of working capital in the firm/organization leads to insecure. The component of working capital can varies from one Business to another Business.

PES Institute of Technology

Page 44

WORKING CAPITAL MANAGEMENT

NEED AND SIGNIFICANCE OF THE STUDY:

It is difficult to decide any inference from the mass of figures in order to judge accurately, regroup and analyse the figures as disclosed by these financial statements and also to know the earning capacity, operating efficiency, and financial condition etc. of a concern. The need for working capital arises at every stage of business concern. A new concern requires a lot of liquid funds to meet initial expenses like promotion, formation, etc. The amount needed as working capital in new concern depends primarily on its size and the ambitions of its promoters. Greater the size of business unit generally larger will be the need for working capital and the amount of working capital goes on increasing with the growth and expansion of business up to it attains maturity stage. Therefore working capital is needed for, Purchase of raw material, components and spares. Pay wages and salaries. Incur day to day expenses and overhead costs such as fuel, power and office expenses. To meet the selling costs as packing, advertising etc. To provide credit facilities to the customer. To maintain the inventories of raw material, work in progress, stores and spares and finished goods.

The management of assets in any organization is an essential part of overall management. The enterprise at the time of formation attaches great importance to fixed assets management as a part of investment decision making. However, in the overall day-to-day financial management, after the initial investment, the management given more importance to managing Working Capital. It we look at any financial statement it will be evident that the investment in fixed assets remains more or less static but the working capital is constantly changing or always fluctuating in nature.

METHODOLOGY:

Methodology is defined as a particular or a set of procedures, the analysis of these procedures of enquiry in a particular field. This chapter gives a clear picture of how the study has been carried on. It summarizes the procedures followed in this study. The methodology adopted to collect the information is secondary data is mainly taken from the annual reports of the company for past four years i.e. from year 2007-08, year 2008-09, year 2009-10, 2010-11, And data so collected was properly analysed and interpreted to achieve the objective of the project study conducted.

PES Institute of Technology

Page 45

WORKING CAPITAL MANAGEMENT

PURPOSE:

Literature review is the beginning of the primary data collection. It acts as a gateway to the familiarity exercise by getting exposed to the study field in details. Literature review included texts, databases, internet, journals and dailies. The purpose of literature review is innumerable in research work. Specific need for references and citations makes secondary data quite valid. Literature review forms the integral part of larger research. Secondary data form sole basis for research for research in some instances. Above all, secondary data has proven to be less costly, readily available, less time consuming and less effort required compared to primary data. Literature review provides support to validate secondary data hence complementing the field data conclusion. It has also been observed that secondary data gives insight into the research details. It is mandatory to examine secondary data as a prerequisite for accuracy and relevance for primary data and subsequent analysis. Literature review heavily relied on published texts, Annual Reports accounting and financial database of the company, fact sheets of the company, other manuals, internet and revered journals and case studies in the field of working capital management were constantly reviewed. The review of the literature provided a solid guideline to conduct the study. It provided the secondary data required and the adequate guideline for the nature of the primary data.

PES Institute of Technology

Page 46

WORKING CAPITAL MANAGEMENT

DATA ANALYSIS AND INTERPRETATION

CURRENT RATIO:

The current ratio is the ratio of the current liabilities. It is calculated by dividing current assets by current liabilities This ratio is an indicator of firm's commitment to meet its short-term liabilities. Higher ratio, better the coverage, 2: 1 ratio is treated as standard ratio. This ratio is also called as solvency/working capital ratio. Formula: Quick ratio = Quick assets (except stock and prepaid exp) Current Liabilities

QUICK ACID TEST/ LIQUID RATIO:

This ratio is also termed as "Acid Test Ratio" or "Liquid Ratio." This ratio is ascertained by comparing the liquid assets (i.e. assets which are immediately convertible into cash without much loss) to current liabilities prepaid expenses and stock are no taken as liquid assets. The ratio is also an indicator of short term solvency of the company. It measures the short term liquidity i.e. it measures short term debt paying ability. Higher the ratio better the coverage standard ratio is 1: 1. Formula: Quick Ratio = Quick assets (except stock and prepaid exp) Current liabilities

CASH / ABSOULTE LIQUID RATIO:

Cash is the most liquid asset. Here trade investments or marketable securities are equivalent of cash therefore they are included in computation of cash ratio. This ratio indicates the liquidity position of the company and its commitment to meet its short-term liabilities standard ratio for this is 0.5: 1. Formula: Cash Ratio = Cash + bank balance Current liabilities

PES Institute of Technology

Page 47

WORKING CAPITAL MANAGEMENT

INVENTORY TURNOVER RATIO:

It indicates the efficiency of the firm in producing and selling it products. A low ratio indicates that inventory does not sell fast and stable in the warehouse for a long time. Whereas high ratio is indicator of good inventory management for judging inventory turnover ratio is ratio is good or bad it should be compared with past and expected ratios. High ratio is also good from the view point of liquidity and vice versa. Avg. Inventory is calculated by taking stock levels of raw materials, working process and finished goods at the beginning of year & at the end of the year & that is divided by two. Formula: Inventory turnover ratio =

Cost of goods sold Average inventory

Hence Avg. Inventory = Opening stock + Closing stock 2 The different tools of Inventory Management: Fixation of levels. ABC Analysis. VED Analysis. FSN Analysis. Economic Order Quantity (EOQ) Perceptual Inventory System

Explanation: Inventory management refers to managing the stores to ensure that there is neither over stocking nor under stocking of materials. An efficient system of inventory management will determine what to purchase, from where to purchase, how much to purchase and where to store.

PES Institute of Technology

Page 48

WORKING CAPITAL MANAGEMENT

The tools of Inventory Management:

Fixation of levels: It is a tool through by which materials ate maintained in the store houses by fixing different levels namely maximum level, Re-Order level, Minimum level and Danger level. Levels are fixed taking into consideration the factors like cost and nature of raw materials, lead time storage spare etc. ABC Analysis: Materials are controlled giving importance to its value. Materials are graded as A,B &C where in materials with "A" grade are costlier in value but less in number where as materials with " C" grade are cheaper in value and more in number. "B" grade materials are moderate in value and moderate numbers of such items are maintained. VED Analysis: Materials are categorized as Vital, Essential and Desirable components. Much importance is given to the materials categorized as Vital than to the desirable components. FSN Analysis: Under this type, materials are grouped according to their movements Fast Moving Items are stored in large quantities to meet the requirements. Slow moving items are moderately stored Non- moving items are rarely required therefore the quantity stored is very less. Inventory will be coming in to the business. That would help the fixation of value of the firm Economic Order Quantity: Economic order quantity is the size of the lot to be purchased which is economically viable EOQ is a point at which the ordering cost and the carrying cost are minimum. Perceptual Inventory System: A record is kept on a continues basis as and when the materials are received and issued and hence, it is called perpetual inventory system.

PES Institute of Technology

Page 49

WORKING CAPITAL MANAGEMENT

INVENTORY CONVERSION PERIOD:

Inventory conversion period is the time taken between purchase of raw materials &sale of finished goods. It includes: Raw Materials Conversion Period WIP Conversion Period Finished goods conversion period

Formula: Inventory conversion period = Inventory (Net) X 365 Value of production

Inventory ration for the year 2007-08 = 13515.7 X 365 =120 days 41113.7 2008-09 = 24209.6 X 365 = 167 days 52732.7 2009-10 = 24487.1 X 365 = 170 days 52478.8 2010-11 = 24607.7 X 365 = 163 days 55208.0

Table showing Inventory Ratio for the year: Inventory ratio for the Year 2007-08 2008-09 2009-10 2010- 11 Days 120 167 170 163

PES Institute of Technology

Page 50

WORKING CAPITAL MANAGEMENT

Chart showing Inventory ratio for the year: Inventory ratio for the year

180 160 140 120 100 80 60 40 20 0 2007-08 2008-09 2009-10 2010-11 120 167 170 163