Beruflich Dokumente

Kultur Dokumente

H Theory of Money Supply

Hochgeladen von

Shofi R KrishnaOriginalbeschreibung:

Copyright

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

H Theory of Money Supply

Hochgeladen von

Shofi R KrishnaCopyright:

THEORY OF MONEY SUPPLY The supply of money supply is determined jointly by the monetary authority, banks and the

public. There is a distinction between two kinds of money: (a) Ordinary money [M] and (b) High powered money [H]. M is defined narrowly as the sum of currency and demand deposits of banks [including the RBI] held by the public; and that since other deposits of the RBI included in the measure of M are a very small proportion [less than one per cent] of the total money supply of M, other deposits of the RBI is ignored for theoretical simplification. Accordingly, (1)

High powered money [H] is money produced by the RBI and the GoI [small coins including one rupee notes] and held by the public and banks. The RBI calls H Reserve Money. H is the sum of (i) currency held by the public [C], (ii) Cash reserves of banks [R], and (iii) Other deposits of the RBI [OD]. (2) is common to both M and H and that the only difference between the latter two is due to the second component of each, namely DD in M and R in H. This difference arises from the presence of banks as the producers of demand deposits. But to be able to produce DD, banks have to maintain R, which is a part of H, produced only by the monetary authority and not by banks themselves. A. THE H THEORY OF MONEY SUPPLY us As a first approximation, it is assumed that the supply of H [Hs] is policy determined. This assumption gives where the bar above H signifies that it is given exogenously to the public and banks. The analysis of the demand for H [Hd] is much more important for the H theory. The key insight of the theory is to relate it DD or M. H is demanded partly by the public as currency [C] and partly by the banks as reserves [R]. These are the only two sources of demand for H in this model. The demand for C [Cd] as a component of M is affected largely by the same factors as affect the demand for M, such as level of income and the rate of interest, among other things. The same is true of the demand for DD [DDd]. Therefore as a first approximation, it is reasonable to assume that Cd and DDd will be highly correlated-that Cd will be a proportional function of DD. This may be expressed as (4) c, then, is the ratio of Cd to DD. In short, it is the desired currency-deposit ratio of the public. c itself will express the preferences of the public as between currency and demand deposits of banks. Therefore c is a behavioural ratio. But it is assumed to be a constant in this model. The reserves of banks are usually divided under two heads: (a) required reserves [RR] and (b) excess reserves [ER]. Required reserves are reserves which banks are required statutorily to hold with the RBI. Banks have no choice about them. Under the law, the RBI empowered to stipulate the statutory reserve ratio, which may be varied between 3 per cent and 15 per cent of the total demand and time liabilities of a bank. Every scheduled bank is required to maintain all its RR as balances with the RBI. All reserves in excess of RR are called ER. Banks are free to hold them as cash on hand also called [vault cash] with themselves or as balances with the RBI. Banks hold ER voluntarily. They are held to meet their clearing drains [i.e., net loss of cash due to crossclearing of cheques among banks] as well as currency drains [i.e., net withdrawal of currency by their depositors]. These drains are partly expected and partly unexpected, giving rise to what may be called banks transactions and precautionary demand for cash reserves. We hypothesize that ERd will be determined largely by the banks total liabilities. (3)

Thus both RR and ER and so Rd become increasing functions of the total demand and time liabilities of banks. The demand and time liabilities of banks are predominantly [about 92%] due to the demand and time deposits from the public. Therefore as a simplification, say that Rd is largely a proportional function of the total deposits of the banks: (5) r, then is the ratio of Rd to total deposits of banks. For short, it is called reserve-deposit ratio. It is assumed that bank deposits are of two kinds- demand deposits [DD] and time deposits [TD]. The former are counted as money; the latter not. The division between DD and TD is decided by the public, given the terms and conditions on which banks are willing to sell the two kinds of the deposits to the public. In other words, it is the public who decides how much TD to hold in relation to DD. Again, as a simplification, it is hypothesized that TDd is an increasing proportional function of DD. (6) (7) t is the ratio of TDd to DD. It is called as time-deposit ratio. From equation (7) and from (6) we get

( From equation (5) & (8) ( Recalling that

(8)

(9)

, from equation (4) & (9) we have ( ( ) ) (10)

Thus Hd has been expressed as a function of DD and three behavioural ratios c, t and r. The market for H will be in equilibrium when Hd=Hs or from equation (3) & (10) when ( )

The above equation can be solved for DD

( )

(11)

The above equation gives the equilibrium value of DD in terms of H and the three behavioural ratios c, t and r.

( )

is called the demand deposit multiplier. Next, from equation (1) & (4) and assuming that C=Cd, we have

(

(

)

)

(12)

The above is the key equation of the H theory of money supply. It makes the supply of money a function of H and the three behavioural ratios, c, t and r. The expression gives the value of what is known as the money ( ) multiplier, . Then, the equation (12) can be written as The H theory of money supply is popularly called the money multiplier theory of money supply. The equation says that the determinants of the money supply of M can be classified under two main heads: (a) those that affect H and (b) those that affect . From the theory it is clear that whereas changes in H are largely policy-controlled, changes in are largely endogenous, i.e. are such as depend mainly on the behavioural choices of the public and banks. This is a useful distinction, analytically as well as for monetary planning. It implies that, for policy purposes, the monetary authority will do well to take the behaviour of as something outside its control and to concentrate its efforts on controlling H to control M. The following figure shows the determination of money supply under H theory. In the figure H is measured vertically and DD are measured horizontally. Since the supply of H is assumed to be given exogenously by the monetary authority at , the curve is drawn parallel to the horizontal axis at the height , showing that is perfectly inelastic to DD. The three demand curves in the market for are upward sloping straight lines going through the origin in accordance with the hypotheses of equations (4), (9) & (10). The curve represents equation (4), with its slope equal to c. [In India at present the value of c is about one. So the curve has been drawn to make an angle of about 450 with the horizontal axis.] The curve represents equation (9). Its slope has ) The the value of ( curve is simply the vertical summation of the curves. Thus, it represents equation (10). The intersection of the curve with the curve gives the equilibrium of the market. That is, at this point the public and banks are fully happy to hold all the amount of the monetary authority chooces to place in the market. In this situation, the equilibrium amount of , is that shown by ; the public holds amount of currency and leaves the balance of , that is, for banks to hold. For amount, this is exactly equal to banks . It will also be noted that, given the function, is exactly the amount of currency the public would like to hold when .

Equilibrium of the H Market

Das könnte Ihnen auch gefallen

- The H Theory of Money SupplyDokument22 SeitenThe H Theory of Money Supplycarolsaviapeters100% (1)

- Theories of Demand For MoneyDokument18 SeitenTheories of Demand For MoneyAppan Kandala Vasudevachary80% (15)

- Post-Keynesion Approach To Demand For MoneyDokument7 SeitenPost-Keynesion Approach To Demand For MoneyAppan Kandala Vasudevachary100% (7)

- Tobin's Theory of Demand For MoneyDokument6 SeitenTobin's Theory of Demand For MoneyShofi R Krishna100% (20)

- Baumol's Demand For MoneyDokument7 SeitenBaumol's Demand For MoneyShofi R Krishna100% (19)

- Chapter-1 Evolution and Fundamentals of BusinessDokument26 SeitenChapter-1 Evolution and Fundamentals of BusinessRiddhesh Nadkarni100% (3)

- Ricardian Theory of RentDokument12 SeitenRicardian Theory of RentRinky Talwar100% (1)

- Must Prepare Topics List For GS 3 Mains 2020 & 2021Dokument9 SeitenMust Prepare Topics List For GS 3 Mains 2020 & 2021Bharath Naik ANoch keine Bewertungen

- National Income and Its LimitationsDokument10 SeitenNational Income and Its LimitationsAman Das100% (1)

- Common Characteristics of SHGsDokument3 SeitenCommon Characteristics of SHGsJessica Maynard67% (3)

- Price and Output Determination Under OligopolyDokument21 SeitenPrice and Output Determination Under OligopolyRajeshsharmapurang100% (2)

- Standard Xii (Isc) Economics Chapter 3: Theory of Consumer BehaviourDokument7 SeitenStandard Xii (Isc) Economics Chapter 3: Theory of Consumer Behavioursourav kumar ray100% (1)

- Chap I Basics of EconomicsDokument37 SeitenChap I Basics of EconomicsDaniel Yirdaw100% (1)

- Revenue: Concepts: Kamal Vatsa Mob: 9650100453Dokument7 SeitenRevenue: Concepts: Kamal Vatsa Mob: 9650100453Manya NagpalNoch keine Bewertungen

- The Theory of Factor PricingDokument12 SeitenThe Theory of Factor Pricinglali6275% (4)

- Exchange Rate Policy of IndiaDokument35 SeitenExchange Rate Policy of Indiasangeetaangel88% (16)

- Methods of Note IssueDokument8 SeitenMethods of Note IssueNeelabh KumarNoch keine Bewertungen

- Social AccountingDokument2 SeitenSocial AccountingRajveer Singh SekhonNoch keine Bewertungen

- Intermediaries in New Issue MarketDokument5 SeitenIntermediaries in New Issue MarketSandeep Savarkar33% (3)

- New Industrial Policy 1991Dokument10 SeitenNew Industrial Policy 1991Akash DixitNoch keine Bewertungen

- 11 Economics - Measures of Central Tendency - NotesDokument16 Seiten11 Economics - Measures of Central Tendency - NotesHimanshu Pandey100% (4)

- BBA 122 Notes On ProbabilityDokument64 SeitenBBA 122 Notes On Probabilitybasuta250% (1)

- Project On Finalization of Partnership FirmDokument38 SeitenProject On Finalization of Partnership Firmvenkynaidu67% (3)

- Fundamentals of Marketing 4th Sem-1Dokument38 SeitenFundamentals of Marketing 4th Sem-1Kunal Khadka100% (3)

- Functions of SEBIDokument6 SeitenFunctions of SEBIKumar Raghav MauryaNoch keine Bewertungen

- Investment Management NotesDokument40 SeitenInvestment Management NotesSiddharth Ingle100% (1)

- Nelson's Low Level Equilibrium Trap Theory ExplainedDokument3 SeitenNelson's Low Level Equilibrium Trap Theory ExplainedKris Sara Sajiv100% (1)

- BEHAVIOURAL FINANCE Note PDFDokument13 SeitenBEHAVIOURAL FINANCE Note PDFBIYONA BENNY100% (1)

- Ch.1 - Circular Flow of Income - MacroeconomicsDokument16 SeitenCh.1 - Circular Flow of Income - MacroeconomicsMayank MallNoch keine Bewertungen

- Cardinal and Ordinal Utility Theories of Consumer BehaviourDokument39 SeitenCardinal and Ordinal Utility Theories of Consumer Behaviouravneet kaur100% (1)

- Keynes Demand For MoneyDokument9 SeitenKeynes Demand For MoneyAppan Kandala Vasudevachary100% (1)

- Circular Flow of IncomeDokument11 SeitenCircular Flow of IncomeAppan Kandala Vasudevachary100% (4)

- Approaches To Grievance MachineryDokument2 SeitenApproaches To Grievance MachinerySumathy S Ramkumar0% (1)

- 5 Phases of A Business CycleDokument5 Seiten5 Phases of A Business CycleValerie CoNoch keine Bewertungen

- Basic Economic Tools in Managerial EconomicsDokument11 SeitenBasic Economic Tools in Managerial EconomicsDileep Kumar Raju100% (2)

- Company Regulatory Legislations in IndiaDokument57 SeitenCompany Regulatory Legislations in IndiaAmit verma100% (1)

- Niti AayogDokument46 SeitenNiti AayogLavkesh Bhambhani100% (1)

- Legal Aspects of Advertising in IndiaDokument29 SeitenLegal Aspects of Advertising in IndiaDehradun Moot100% (1)

- Isoquant, Isocost Line, Expansion Path, Ridge Lines, Returns To ScaleDokument27 SeitenIsoquant, Isocost Line, Expansion Path, Ridge Lines, Returns To ScaleAKASH KULSHRESTHA100% (2)

- Difference Between Business Economics and EconomicsDokument2 SeitenDifference Between Business Economics and EconomicsTanishq JainNoch keine Bewertungen

- How Emotions and Social Forces Impact Financial DecisionsDokument25 SeitenHow Emotions and Social Forces Impact Financial DecisionsDhaval ShahNoch keine Bewertungen

- The Ethical Dimension of Human Resource ManagementDokument15 SeitenThe Ethical Dimension of Human Resource ManagementBikash Kumar Shah100% (1)

- Law of Variable ProportionsDokument10 SeitenLaw of Variable ProportionsTarang DoshiNoch keine Bewertungen

- Managerial Theories of Firms - PPTX MeDokument26 SeitenManagerial Theories of Firms - PPTX MeNachiket Hanmantgad100% (3)

- Nature and Scope of MacroeconomicsDokument12 SeitenNature and Scope of MacroeconomicsHaren Shylak0% (1)

- Credit Control Methods of RBI or Quantitative and Qualitative Measures of RBIDokument2 SeitenCredit Control Methods of RBI or Quantitative and Qualitative Measures of RBItulasinad123100% (6)

- Restatement of Quantity Theory of MoneyDokument6 SeitenRestatement of Quantity Theory of MoneyAppan Kandala Vasudevachary67% (3)

- Economics PPT On DemonetisationDokument23 SeitenEconomics PPT On DemonetisationutkarshNoch keine Bewertungen

- Government Budget IndiaDokument7 SeitenGovernment Budget IndiaNikhil Goel100% (1)

- New Issue MarketDokument13 SeitenNew Issue MarketKanivarasi Hercule100% (2)

- Indian Financial SystemDokument111 SeitenIndian Financial SystemRishi Saini100% (1)

- The H Theory of Money Supply ExplainedDokument7 SeitenThe H Theory of Money Supply ExplainedTanishq VijayNoch keine Bewertungen

- Lec 2Dokument10 SeitenLec 2amitava deyNoch keine Bewertungen

- Currency With The Public:: in Order To Arrive at The Total Currency With The Public in India We Add The Following ItemsDokument6 SeitenCurrency With The Public:: in Order To Arrive at The Total Currency With The Public in India We Add The Following ItemsKeran VarmaNoch keine Bewertungen

- Determinants of Money SupplyDokument10 SeitenDeterminants of Money SupplyumarNoch keine Bewertungen

- Money SupplyDokument12 SeitenMoney SupplyAmanda RuthNoch keine Bewertungen

- Supply of MoneyDokument13 SeitenSupply of MoneyNonit Hathila100% (1)

- Concept of Money SupplyDokument7 SeitenConcept of Money SupplyMD. IBRAHIM KHOLILULLAHNoch keine Bewertungen

- Definition: The Total Stock of Money Circulating in An Economy Is The Money Supply. TheDokument7 SeitenDefinition: The Total Stock of Money Circulating in An Economy Is The Money Supply. TheSufian HimelNoch keine Bewertungen

- Time Table: B.A Economics IV Semester, Calicut UniversityDokument1 SeiteTime Table: B.A Economics IV Semester, Calicut UniversityShofi R KrishnaNoch keine Bewertungen

- Time Table: B.Com IV Semester, Calicut UniversityDokument1 SeiteTime Table: B.Com IV Semester, Calicut UniversityShofi R KrishnaNoch keine Bewertungen

- Time Table: B.Com II Semester, Calicut UniversityDokument1 SeiteTime Table: B.Com II Semester, Calicut UniversityShofi R KrishnaNoch keine Bewertungen

- B.SC Chemistry Syllabus (CCSS-UG) : Calicut UniversityDokument197 SeitenB.SC Chemistry Syllabus (CCSS-UG) : Calicut UniversityShofi R Krishna0% (1)

- MA Economics Syllabus (CUCSS) : Calicut UniversityDokument22 SeitenMA Economics Syllabus (CUCSS) : Calicut UniversityShofi R KrishnaNoch keine Bewertungen

- Time Table: B.A Economics II Semester, Calicut UniversityDokument1 SeiteTime Table: B.A Economics II Semester, Calicut UniversityShofi R KrishnaNoch keine Bewertungen

- BA ECONOMICS Syllabus (CCSS UG) : Calicut UniversityDokument40 SeitenBA ECONOMICS Syllabus (CCSS UG) : Calicut UniversityShofi R KrishnaNoch keine Bewertungen

- Calicut University Exam CircularDokument6 SeitenCalicut University Exam CircularShofi R KrishnaNoch keine Bewertungen

- How To Apply For RBI Young Scholar Award?Dokument1 SeiteHow To Apply For RBI Young Scholar Award?Shofi R KrishnaNoch keine Bewertungen

- RBIYOUN130910Dokument1 SeiteRBIYOUN130910Maddy AliNoch keine Bewertungen

- Rbi Young Scholars Award SchemeDokument1 SeiteRbi Young Scholars Award SchemeShofi R KrishnaNoch keine Bewertungen

- Reading 71.9 Guidance For Standard VIIDokument12 SeitenReading 71.9 Guidance For Standard VIIAmineNoch keine Bewertungen

- Insurance Bill 2016 GuyanaDokument82 SeitenInsurance Bill 2016 GuyanaRocky HanomanNoch keine Bewertungen

- Mittal School of Business: Course Code: MGN358 Course Title: E BusinessDokument13 SeitenMittal School of Business: Course Code: MGN358 Course Title: E BusinessNitin PatidarNoch keine Bewertungen

- Navinon Possession NoticeDokument2 SeitenNavinon Possession NoticePriyanka ShembekarNoch keine Bewertungen

- FAR Preweek (B44)Dokument10 SeitenFAR Preweek (B44)Haydy AntonioNoch keine Bewertungen

- Maruti Suzuki Capital Budgeting Performance 2012-2022Dokument8 SeitenMaruti Suzuki Capital Budgeting Performance 2012-2022Vaibhavi PatelNoch keine Bewertungen

- Analysis of Mutual Funds in IndiaDokument78 SeitenAnalysis of Mutual Funds in Indiadpk1234Noch keine Bewertungen

- 5 Types of Business Records You Need To TrackDokument2 Seiten5 Types of Business Records You Need To TrackXhinghiang WuNoch keine Bewertungen

- Onlinestatement (1) LWDokument3 SeitenOnlinestatement (1) LWDustin Knechtel-wickertNoch keine Bewertungen

- Demonetisation and AdvertisingDokument68 SeitenDemonetisation and AdvertisinghelloNoch keine Bewertungen

- Lease FinancingDokument16 SeitenLease Financingparekhrahul9988% (8)

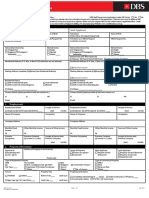

- DBS Mortgage All-In-One Application Form 2016Dokument3 SeitenDBS Mortgage All-In-One Application Form 2016Viola HippieNoch keine Bewertungen

- HDFC Bank E-Banking Customer Survey AnalysisDokument4 SeitenHDFC Bank E-Banking Customer Survey AnalysisśíDDHÁŔTH śíŃǴHNoch keine Bewertungen

- Examination About Investment 21Dokument1 SeiteExamination About Investment 21BLACKPINKLisaRoseJisooJennieNoch keine Bewertungen

- Pph1Cnrpcf : Application For Cash Withdrawal and Policy Loan FormDokument4 SeitenPph1Cnrpcf : Application For Cash Withdrawal and Policy Loan FormEDMC PAYMENT CENTERNoch keine Bewertungen

- Summer Project Black BookDokument50 SeitenSummer Project Black BookBhagesh Gharat100% (1)

- Paid Client Sample Data CRM HackerDokument12 SeitenPaid Client Sample Data CRM HackerUpendraNoch keine Bewertungen

- p3246 Flexplus GuideDokument21 Seitenp3246 Flexplus Guideadheera20Noch keine Bewertungen

- Assignment Classification Table: Topics Brief Exercises Exercises ProblemsDokument95 SeitenAssignment Classification Table: Topics Brief Exercises Exercises ProblemsMtl AndyNoch keine Bewertungen

- StudyDokument10 SeitenStudyirahQNoch keine Bewertungen

- Midterm Review - Key ConceptsDokument10 SeitenMidterm Review - Key ConceptsGurpreetNoch keine Bewertungen

- Mojaloop AssessmentDokument15 SeitenMojaloop AssessmentJeoffrey LimNoch keine Bewertungen

- Double Entry System ExplainedDokument9 SeitenDouble Entry System ExplainedshiyntumNoch keine Bewertungen

- Statement of Comprehensive Income (SCI) Single StepDokument11 SeitenStatement of Comprehensive Income (SCI) Single StepNikolai MarasiganNoch keine Bewertungen

- Life Insurance Premium Statement 2018-2019Dokument1 SeiteLife Insurance Premium Statement 2018-2019Apratim BiswasNoch keine Bewertungen

- Bills of ExchangeDokument7 SeitenBills of ExchangeNeeraj KumarNoch keine Bewertungen

- Finmar ReviewerDokument5 SeitenFinmar ReviewerGelly Dominique GuijoNoch keine Bewertungen

- Simon Willis - OrXDokument31 SeitenSimon Willis - OrXjtnylson0% (1)

- Audit work papers for accounts receivable and allowance for doubtful accountsDokument2 SeitenAudit work papers for accounts receivable and allowance for doubtful accountsALMA MORENANoch keine Bewertungen

- (#3) Basic Concepts of Risk and Return, and The Time Value of MoneyDokument22 Seiten(#3) Basic Concepts of Risk and Return, and The Time Value of MoneyBianca Jane GaayonNoch keine Bewertungen