Beruflich Dokumente

Kultur Dokumente

The Intrinsic Value

Hochgeladen von

Ashwini AnandOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Intrinsic Value

Hochgeladen von

Ashwini AnandCopyright:

Verfügbare Formate

The intrinsic value (or "monetary value") of an option is the value of exercising it now.

Thus if the current (spot) price of the underlying security is above the agreed (strike) price, a call has positive intrinsic value (and is called "in the money"), call option spot strike price. while a put has zero intrinsic value. Strike spot. Time value: Both call and put have time value. Time value of an option si dfifference between premium intrisic value. Longer the expitration od option gretar the time value or else it will be equal.At expiration option has no time value The time value of an option is a function of the option value less the intrinsic value. It equates to uncertainty in the form of investor hope. It is also viewed as the value of not exercising the option immediately. In the case of a European option, you cannot choose to exercise it at any time, so the time value can be negative; for an American option if the time value is ever negative, you exercise it: this yields a boundary condition. Time value =Option value intrinisic value

[edit] ATM: At-the-money

An option is at-the-money if the strike price is the same as the spot price of the underlying security on which the option is written. An at-the-money option has no intrinsic value, only time value.

[edit] ITM: In-the-money

An in-the-money option has positive intrinsic value as well as time value. A call option is in-the-money when the strike price is below the spot price. A put option is in-the-money when the strike price is above the spot price.

[edit] OTM: Out-of-the-money

An out-of-the-money option has no intrinsic value. A call option is out-of-the-money when the strike price is above the spot price of the underlying security.

A put option is out-of-the-money when the strike price is below the spot price.

Bull spread: This is basically done utilizing two call options having the same expiration date, but

different exercise prices. The buyer of a bull spread buys a call with an exercise price below the current index level and sells a call option with an exercise price above the current index level.

Bear spread: the buyer of bear spread buys a call with strike price above the index level and sell the

call option with strike price below the index level.

Das könnte Ihnen auch gefallen

- Option BasicsDokument4 SeitenOption Basicsbhavnesh_muthaNoch keine Bewertungen

- Options MSCFIÂ DECÂ 2022Dokument8 SeitenOptions MSCFIÂ DECÂ 2022kenedy simwingaNoch keine Bewertungen

- Presented by:-D.Pradeep Kumar Exe-MBA, IIPM, HydDokument25 SeitenPresented by:-D.Pradeep Kumar Exe-MBA, IIPM, Hydpradeep3673Noch keine Bewertungen

- Derivatives InsightsDokument11 SeitenDerivatives InsightsalfinprinceNoch keine Bewertungen

- Derivatives Financial MarketDokument7 SeitenDerivatives Financial MarketevaNoch keine Bewertungen

- DunnaDokument69 SeitenDunnaYanugonda ThulasinathNoch keine Bewertungen

- Module 4Dokument8 SeitenModule 4Nidhin NalinamNoch keine Bewertungen

- E Book of OptionsDokument29 SeitenE Book of OptionsmohitNoch keine Bewertungen

- Out of The Money-CONTRACTDokument2 SeitenOut of The Money-CONTRACTramyatan SinghNoch keine Bewertungen

- Points Forward Contract Futures Contract: MeaningDokument6 SeitenPoints Forward Contract Futures Contract: Meaningershad123Noch keine Bewertungen

- Introduction To OptionsDokument9 SeitenIntroduction To OptionsKumar NarayananNoch keine Bewertungen

- Options Theory For Professional TradingDokument4 SeitenOptions Theory For Professional TradingRaju.KonduruNoch keine Bewertungen

- Options: Minimum Correct Answers For This Module: 3/6Dokument14 SeitenOptions: Minimum Correct Answers For This Module: 3/6Jovan SsenkandwaNoch keine Bewertungen

- In The Money ContractDokument2 SeitenIn The Money Contractramyatan SinghNoch keine Bewertungen

- Derivatives Buy PutDokument11 SeitenDerivatives Buy PutRajan kumar singhNoch keine Bewertungen

- Class Notes On OptionsDokument7 SeitenClass Notes On OptionsAnvesha TyagiNoch keine Bewertungen

- Chapter Option ValuationDokument18 SeitenChapter Option ValuationAk TanvirNoch keine Bewertungen

- Option PricingDokument19 SeitenOption PricingAnonymous L4SKc8ENoch keine Bewertungen

- Day 1Dokument28 SeitenDay 1CHENAB WEST100% (1)

- Unit-3 Options: Call OptionDokument25 SeitenUnit-3 Options: Call OptionUthra PandianNoch keine Bewertungen

- Derivatives Buy PutDokument10 SeitenDerivatives Buy PutRajan kumar singhNoch keine Bewertungen

- Preface: National Institute of Financial Market (NIFMDokument65 SeitenPreface: National Institute of Financial Market (NIFMSankitNoch keine Bewertungen

- Shreyash & Nishant C - OptionsDokument11 SeitenShreyash & Nishant C - OptionsShreyash satamNoch keine Bewertungen

- An Introduction To Derivatives: A Presentation by Derivative ResearchDokument45 SeitenAn Introduction To Derivatives: A Presentation by Derivative ResearchUmeshwari RathoreNoch keine Bewertungen

- Introduction To Derivatives: Nse Academy CertifiedDokument55 SeitenIntroduction To Derivatives: Nse Academy CertifiedSrividhya RaghavanNoch keine Bewertungen

- Future and OptionsDokument8 SeitenFuture and OptionsshashvatNoch keine Bewertungen

- Derivatives and Risk ManagementDokument5 SeitenDerivatives and Risk ManagementabhishekrameshnagNoch keine Bewertungen

- OptionsDokument49 SeitenOptionssacos16074Noch keine Bewertungen

- Options StrategiesDokument26 SeitenOptions StrategiesPrasad VeesamshettyNoch keine Bewertungen

- Option MoneynessDokument26 SeitenOption MoneynessVaidyanathan RavichandranNoch keine Bewertungen

- Chapter 3Dokument14 SeitenChapter 3Kethavarapu RamjiNoch keine Bewertungen

- Chapter-3 Options: Meaning of Options-Options Are Financial Derivatives That Give Buyers TheDokument15 SeitenChapter-3 Options: Meaning of Options-Options Are Financial Derivatives That Give Buyers TheRaj KumarNoch keine Bewertungen

- Option Pricing TheoryDokument5 SeitenOption Pricing TheoryNadeemNoch keine Bewertungen

- Derivatives and HedgingDokument13 SeitenDerivatives and HedgingDeo Corona100% (1)

- Options & ModelsDokument48 SeitenOptions & ModelsPraveen Kumar SinhaNoch keine Bewertungen

- Study Report On Option Trading Strategies in Equity DerivativesDokument33 SeitenStudy Report On Option Trading Strategies in Equity DerivativesDeepak Singh MauryaNoch keine Bewertungen

- The Only Certainty Is That There Will Be "Uncertainty": Risk ManagementDokument24 SeitenThe Only Certainty Is That There Will Be "Uncertainty": Risk ManagementvnevesNoch keine Bewertungen

- O&S Final PDFDokument13 SeitenO&S Final PDFrajNoch keine Bewertungen

- Study On Option Strategy Fin Vikash SinhaDokument22 SeitenStudy On Option Strategy Fin Vikash SinhaVikash SinhaNoch keine Bewertungen

- What Are Futures and Options?: Share This Ask Users Write A CommentDokument10 SeitenWhat Are Futures and Options?: Share This Ask Users Write A Comment86sujeetsinghNoch keine Bewertungen

- Option BasicDokument1 SeiteOption BasicDipak KumarNoch keine Bewertungen

- DerivativesDokument44 SeitenDerivativesKhyati KariaNoch keine Bewertungen

- Strike PriceDokument3 SeitenStrike PriceNiño Rey LopezNoch keine Bewertungen

- 05.option FaqsDokument15 Seiten05.option FaqsAMAN KUMAR KHOSLANoch keine Bewertungen

- Understanding Strike PricesDokument2 SeitenUnderstanding Strike PricesSeemaNoch keine Bewertungen

- Understanding Strike PricesDokument2 SeitenUnderstanding Strike PricesSeemaNoch keine Bewertungen

- Call and Put Only Point..Dokument38 SeitenCall and Put Only Point..seaswimmerNoch keine Bewertungen

- Chapter 11Dokument16 SeitenChapter 11jtom1988Noch keine Bewertungen

- OptionsDokument57 SeitenOptionssinghdharmendra137Noch keine Bewertungen

- 04 - 05 - Option Strategies & Payoff'sDokument66 Seiten04 - 05 - Option Strategies & Payoff'sMohammedAveshNagoriNoch keine Bewertungen

- Option - DerivativesDokument89 SeitenOption - DerivativesProf. Suyog ChachadNoch keine Bewertungen

- DV TheoryDokument8 SeitenDV Theoryudaya kumarNoch keine Bewertungen

- FX Options ReadingDokument16 SeitenFX Options ReadingdayyanbajwaNoch keine Bewertungen

- Handz University: Trading OptionsDokument44 SeitenHandz University: Trading OptionsAman JainNoch keine Bewertungen

- Derivative and Risk ManagementDokument35 SeitenDerivative and Risk ManagementRajendra LamsalNoch keine Bewertungen

- RM 3Dokument96 SeitenRM 3ankitadarji31Noch keine Bewertungen

- Financial Drivatives Assignment 2Dokument6 SeitenFinancial Drivatives Assignment 2striker shakeNoch keine Bewertungen

- Introduction To Futures andDokument22 SeitenIntroduction To Futures andViplaw PandeyNoch keine Bewertungen

- OptionDokument7 SeitenOptionmanoranjanpatraNoch keine Bewertungen

- Mang InasalDokument2 SeitenMang InasalAriel Dimalanta100% (1)

- Dendrite International: Submitted by Group 8 Kavita Patil Kavya Gupta Narender Tanya Jain Tasya KatiyarDokument6 SeitenDendrite International: Submitted by Group 8 Kavita Patil Kavya Gupta Narender Tanya Jain Tasya KatiyarTanya JainNoch keine Bewertungen

- Gillette - Case StudyDokument11 SeitenGillette - Case StudyJing Rocapor0% (1)

- HSBC Vs National SteelDokument6 SeitenHSBC Vs National SteelRaffella Theriz PagdilaoNoch keine Bewertungen

- Sales & Negotiating Skills For EntrepreneursDokument104 SeitenSales & Negotiating Skills For EntrepreneursKen GermaineNoch keine Bewertungen

- Application of JIT in Toyota in IndiaDokument2 SeitenApplication of JIT in Toyota in IndiaAru BhartiNoch keine Bewertungen

- Supply and Demand ExamplesDokument2 SeitenSupply and Demand ExamplesJay R ChivaNoch keine Bewertungen

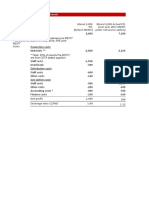

- Menai $,000 P/L (Before MEXIT) Menai $,000 Actual P/L (One Year After MEXIT Under Outsource Option)Dokument2 SeitenMenai $,000 P/L (Before MEXIT) Menai $,000 Actual P/L (One Year After MEXIT Under Outsource Option)Ripon Das Acma Acpa27% (56)

- KIPS: A Proposed Business PlanDokument40 SeitenKIPS: A Proposed Business PlanpicefeatiNoch keine Bewertungen

- AmulDokument100 SeitenAmulsaikripa121100% (1)

- Mangament AccountingDokument17 SeitenMangament AccountingDue WellNoch keine Bewertungen

- Determinants of Conversion Rates PDFDokument8 SeitenDeterminants of Conversion Rates PDFWahab HananiNoch keine Bewertungen

- DeBeers Case AnalysisDokument14 SeitenDeBeers Case AnalysisRohit Srivastav100% (2)

- Biscuit Industry India KuberDokument17 SeitenBiscuit Industry India KuberPRIYA KUMARINoch keine Bewertungen

- Chapter 1 FlashcardsDokument11 SeitenChapter 1 FlashcardsMert OğuzNoch keine Bewertungen

- BrandingDokument2 SeitenBrandingsubhashis87Noch keine Bewertungen

- (SBE) JedaDokument8 Seiten(SBE) JedaNur SyazwinNoch keine Bewertungen

- Economics QuestionsDokument4 SeitenEconomics Questionsncb5601Noch keine Bewertungen

- The Marketing Game Information DeckDokument29 SeitenThe Marketing Game Information DeckretrokryzNoch keine Bewertungen

- Chapter 1 5Dokument52 SeitenChapter 1 5chen NituradaNoch keine Bewertungen

- 2.mis Case Study JoyDokument3 Seiten2.mis Case Study JoyJoyae ChavezNoch keine Bewertungen

- Ii. Capacity To Buy or SellDokument6 SeitenIi. Capacity To Buy or SellJi YuNoch keine Bewertungen

- Case Studies On Growth Strategies - Vol. IIDokument11 SeitenCase Studies On Growth Strategies - Vol. IIibscdcNoch keine Bewertungen

- Transferable Letter of Credit1Dokument2 SeitenTransferable Letter of Credit1azharejaz121100% (1)

- Avon Case Study in Strategic ManagementDokument7 SeitenAvon Case Study in Strategic Managementiyerlakshmi100% (3)

- Paper 5 Revised PDFDokument576 SeitenPaper 5 Revised PDFameydoshiNoch keine Bewertungen

- Orvis OCDokument6 SeitenOrvis OCpooja jaiswalNoch keine Bewertungen

- IC Restaurant Balanced Scorecard ExampleDokument1 SeiteIC Restaurant Balanced Scorecard ExampleClint Jan Salvaña75% (4)

- Nov 22 Cases in SalesDokument17 SeitenNov 22 Cases in Saleskumiko sakamotoNoch keine Bewertungen

- Industry Life Cycle StagesDokument7 SeitenIndustry Life Cycle StagesUmar ButtNoch keine Bewertungen