Beruflich Dokumente

Kultur Dokumente

How Is WPI Inflation Rate Calculated in India

Hochgeladen von

Abhishek BansalOriginalbeschreibung:

Originaltitel

Copyright

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

How Is WPI Inflation Rate Calculated in India

Hochgeladen von

Abhishek BansalCopyright:

How is WPI inflation rate calculated in India?

Categories: Economy and Policy, Quantitative Finance With inflation rate surging to new heights, the term is more in the news than ever in India. While leaving aside the debate on whether India should adopt CPI (Consumer Price Index) based inflation calculation rather than the current WPI (Wholesale Price Index) based one, lets find in detail how inflation rate is calculated in India; which is the WPI based inflation rate.

What is inflation? Inflation rate of a country is the rate at which prices of goods and services increase in its economy. It is an indication of the rise in the general level of prices over time. Since its practically impossible to find out the average change in prices of all the goods and services traded in an economy (which would give comprehensive inflation rate) due to the sheer number of goods and services present, a sample set or a basket of goods and services is used to get an indicative figure of the change in prices, which we call the inflation rate.

Mathematically, inflation or inflation rate is calculated as the percentage rate of change of a certain price index. The price indices widely used for this are Consumer Price Index (adopted by countries such as USA, UK, Japan and China) and Wholesale Price Index (adopted by countries such as India). Thus inflation rate, generally, is derived from CPI or WPI. Both methods have advantages and disadvantages. Since India uses WPI method for inflation calculation, lets go in to the details of WPI based inflation calculation.

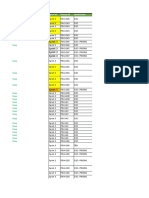

How is WPI (Wholesale Price Index) calculated? In this method, a set of 435 commodities and their price changes are used for the calculation. The selected commodities are supposed to represent various strata of the economy and are supposed to give a comprehensive WPI value for the economy.

WPI is calculated on a base year and WPI for the base year is assumed to be 100. To show the calculation, lets assume the base year to be 1970. The data of wholesale prices of all the 435 commodities in the base year and the time for which WPI is to be calculated is gathered.

Let's calculate WPI for the year 1980 for a particular commodity, say wheat. Assume that the price of a kilogram of wheat in 1970 = Rs 5.75 and in 1980 = Rs 6.10

The WPI of wheat for the year 1980 is, (Price of Wheat in 1980 Price of Wheat in 1970)/ Price of Wheat in 1970 x 100 i.e. (6.10 5.75)/5.75 x 100 = 6.09

Since WPI for the base year is assumed as 100, WPI for 1980 will become 100 + 6.09 = 106.09.

In this way individual WPI values for the remaining 434 commodities are calculated and then the weighted average of individual WPI figures are found out to arrive at the overall Wholesale Price Index. Commodities are given weight-age depending upon its influence in the economy.

How is inflation rate calculated? If we have the WPI values of two time zones, say, beginning and end of year, the inflation rate for the year will be, (WPI of end of year WPI of beginning of year)/WPI of beginning of year x 100

For example, WPI on Jan 1st 1980 is 106.09 and WPI of Jan 1st 1981 is 109.72 then inflation rate for the year 1981 is, (109.72 106.09)/106.09 x 100 = 3.42% and we say the inflation rate for the year 1981 is 3.42%.

Since WPI figures are available every week, inflation for a particular week (which usually means inflation for a period of one year ended on the given week) is calculated based on the above method using WPI of the given week and WPI of the week one year before. This is how we get weekly inflation rates in India.

Characteristics of WPI Following are the few characteristics of Wholesale Price Index 835 commodities for inflation calculation

has a time lag of two weeks, which means WPI of the week two weeks back will be available now

There are certain arguments in the open saying that the government shall adopt Consumer Price Index (CPI) method for inflation calculation, which gives a more correct picture.

India uses the Wholesale Price Index (WPI) to calculate and then decide the rate of inflation in the economy. Most developed countries use the Consumer Price Index (CPI) to calculate inflation.

WPI was first published in 1902, and was one of the major economic indicators available to policy makers until it was replaced by the Consumer Price Index in most developed countries by in the 1970s.

WPI is the index that is used to measure the change in the average price level of goods traded in wholesale market. In India, price data for 435 commodities is tracked through WPI which is an indicator of movement in prices of commodities in all trades and transactions. It is also the price index which is available on a weekly basis with the shortest possible time lag -- two weeks. The Indian government has taken WPI as an indicator of the rate of inflation in the economy.

CPI is a statistical time-series measure of a weighted average of prices of a specified set of goods and services purchased by consumers. It is a price index that tracks the prices of a specified basket of consumer goods and services, providing a measure of inflation.

CPI is a fixed quantity price index and considered by some a cost of living index. Under CPI, an index is scaled so that it is equal to 100 at a chosen point in time, so that all other values of the index are a percentage relative to this one.

Some economists argue that it is high time that India abandoned WPI and adopted CPI to calculate inflation.

India is the only major country that uses a wholesale index to measure inflation. Most countries use the CPI as a measure of inflation, as this actually measures the increase in price that a consumer will ultimately have to pay for.

CPI is the official barometer of inflation in many countries such as the United States, the United Kingdom, Japan [ Images ], France [ Images ], Canada [ Images ], Singapore and China. The governments there review the commodity basket of CPI every 4-5 years to factor in changes in consumption pattern.

WPI does not properly measure the exact price rise an end-consumer will experience because, as the same suggests, it is at the wholesale level.

The main problem with WPI calculation is that more than 100 out of the 435 commodities included in the Index have ceased to be important from the consumption point of view. Take, for example, a commodity like coarse grains that go into making of livestock feed. This commodity is insignificant, but continues to be considered while measuring inflation.

India constituted the last WPI series of commodities in 1993-94; but has not updated it till now that economists argue the Index has lost relevance and can not be the barometer to calculate inflation.

The WPI is published on a weekly basis and the CPI, on a monthly basis. And in India, inflation is calculated on a weekly basis and announced on every Friday.

Overhauling the dynamics of calculating inflation (or Wholesale Price Index) It is yet another reformist movement in India; though not a big reform, but nonetheless an important change to keep pace with current times. The Commerce Ministry has released a new series of annual rate of inflation, based on monthly Wholesale Price Index (WPI) , which stood at 8.51% for the month of August, 2010, as compared to 9.78% for the previous month. The figure as per the old base year came in it at around 9.5%, just in case you need a better understanding of the comparative parameters.

The base year against which the price rise is measured has been advanced by a decade from 1993-94 to 2004-05. Moreover, the new WPI index will be more accurate and indicative about the actual price movement, than the previous one in a bid to produce more relevant indicators of inflation based on modern consumption.

(Source : Business Line) The new series would comprise of different weight-age levels, relative to the changes in the economy over a period of time. For instance, the weight of manufactured products would surge from 63.74% as per 1993-94 base price levels to 64.97% now. On the other hand, the weight of primary articles in the new index would come down to 20.11% as against 22.02 earlier. As such, the food prices would still comprise a big fifth of a share in the WPI index. Interestingly, the new WPI index now also includes the more commonly used items such as refrigerator, washing machine, microwave oven, computer and Television sets which have now turned into basic needs, from wants. In fact, even Consumer items widely used by middle class such ice-cream, mineral water, readymade and instant food products, canned meat, leather products, dish antenna and even precious metals like gold and silver finds its place in the new index The new WPI series now measures a total of 676 items, an improvement by 241 items from the previous list comprising of 435 items only. The basket of manufactured products has surged from earlier 318 items to 555 items now. The list under primary article group has gone up from 98 to 102. The Department of Industrial Policy and Promotion has also said that it would tinker with the Services Price Index by the end of 2010-11 for services such as banking and finance and trade and transport. Other services which could be taken up at a later date could include ports, aviation, telecom and post and telegraphy among others.

Das könnte Ihnen auch gefallen

- Exercise (Final Accounts)Dokument14 SeitenExercise (Final Accounts)Abhishek BansalNoch keine Bewertungen

- Rail Budget 2012-13Dokument7 SeitenRail Budget 2012-13NDTVNoch keine Bewertungen

- Winter SchoolDokument32 SeitenWinter SchoolAbhishek BansalNoch keine Bewertungen

- Resume Sample.Dokument1 SeiteResume Sample.Abhishek BansalNoch keine Bewertungen

- Wto and India: Presented By:-Abhishek Bansal Chandni Chandok Anshum Garg Gaurav JainDokument14 SeitenWto and India: Presented By:-Abhishek Bansal Chandni Chandok Anshum Garg Gaurav JainAbhishek BansalNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Gold Deposit Scheme 1999 and Recent ChangesDokument3 SeitenGold Deposit Scheme 1999 and Recent ChangesakurilNoch keine Bewertungen

- Why Profits Vary Among FirmsDokument12 SeitenWhy Profits Vary Among FirmsRiyaad MandisaNoch keine Bewertungen

- Strategic Fit in SCDokument36 SeitenStrategic Fit in SCJomin PjoseNoch keine Bewertungen

- Investment Appraisal Techniques SOHO BarDokument6 SeitenInvestment Appraisal Techniques SOHO BarvermannieNoch keine Bewertungen

- EntrepreneursDokument237 SeitenEntrepreneursangeprince24Noch keine Bewertungen

- 1Dokument5 Seiten1Absolute ZeroNoch keine Bewertungen

- Unit 5 BBA SEM I DepreciationDokument24 SeitenUnit 5 BBA SEM I DepreciationRaghuNoch keine Bewertungen

- Soleadea Mock Exam 1 Level I Cfa 130106103558 Phpapp02Dokument33 SeitenSoleadea Mock Exam 1 Level I Cfa 130106103558 Phpapp02Syed AhmadNoch keine Bewertungen

- Chapter-11 Sale of Goods On Return or Approval Basis PDFDokument6 SeitenChapter-11 Sale of Goods On Return or Approval Basis PDFTarushi Yadav , 51BNoch keine Bewertungen

- Rajasthan Economic Review highlights strong growthDokument229 SeitenRajasthan Economic Review highlights strong growthkhushbuNoch keine Bewertungen

- CEB Case InterviewsDokument17 SeitenCEB Case Interviewsnimi_wNoch keine Bewertungen

- FINAL GRP 7Dokument26 SeitenFINAL GRP 7Louise AnneNoch keine Bewertungen

- Sprint 3 Process Tracking ReportDokument32 SeitenSprint 3 Process Tracking ReportPratik MandlikNoch keine Bewertungen

- Pay For Performance and Financial Incentives: Gary DesslerDokument45 SeitenPay For Performance and Financial Incentives: Gary DesslerAeintNoch keine Bewertungen

- iITC Infotech Placement PapersDokument4 SeiteniITC Infotech Placement Papers07vikash02Noch keine Bewertungen

- Contract To SellDokument3 SeitenContract To SellEduardNoch keine Bewertungen

- Analysis of China's Primary Wood Products Market (Minli Wan) PDFDokument129 SeitenAnalysis of China's Primary Wood Products Market (Minli Wan) PDFthaonguyen1993Noch keine Bewertungen

- Finance Test Bank 7Dokument22 SeitenFinance Test Bank 7Tam Dinh100% (1)

- English PaperDokument24 SeitenEnglish Paperlulu100% (1)

- History of Tawara Mining: Report Produced By: Cristian Andres Salamanca ArevaloDokument2 SeitenHistory of Tawara Mining: Report Produced By: Cristian Andres Salamanca ArevaloCristian Andres Salamanca ArevaloNoch keine Bewertungen

- 2464 20th Century Furniture & Decorative ArtsDokument105 Seiten2464 20th Century Furniture & Decorative ArtsSkinnerAuctions100% (1)

- Stock MarketDokument24 SeitenStock MarketRig Ved100% (2)

- Ratchet EffectDokument3 SeitenRatchet EffectCatherine Roween Chico-AlmadenNoch keine Bewertungen

- Fearon 1998Dokument25 SeitenFearon 1998Ganesh Masih BoTjahNoch keine Bewertungen

- The Nirma Story: - Karsanbhai Patel, CMD, Nirma LTDDokument4 SeitenThe Nirma Story: - Karsanbhai Patel, CMD, Nirma LTDiqbalahmed9993Noch keine Bewertungen

- Mountain Man Brewing CompanyDokument1 SeiteMountain Man Brewing Companynarender sNoch keine Bewertungen

- Product MarketingDokument2 SeitenProduct MarketingAmirul AzwanNoch keine Bewertungen

- NIFTY PSE Index overviewDokument2 SeitenNIFTY PSE Index overviewHarDik PatelNoch keine Bewertungen

- Jyothy Fabricare Services Ltd.Dokument25 SeitenJyothy Fabricare Services Ltd.Lini Susan John100% (2)