Beruflich Dokumente

Kultur Dokumente

WIP Format

Hochgeladen von

prathapsalian02Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

WIP Format

Hochgeladen von

prathapsalian02Copyright:

Verfügbare Formate

Electrical Contractor: Track the WIP

Page 1 of 5

Email to a Friend

Focus

Track the WIP

by Philip Nimmo, Sam Shabander, Dr. Perry Daneshgari Published: March 2008

Work-in-progress report helps monitor and manage cash flow

Construction contracting is one of the few professions that requires massive, up-front investment prior to actual cash inflow. The rule of thumb for any project startup is 30 percent of the total value of the contract has to be available before any billings. In fact, most projects do not become cash-flow positive until the last 5 to 10 percent of the job. The dilemma contractors face in income, cash flow, billings and expenditures requires a constant balancing act. Contractors need a system that allows them to see cash-out, billing and cash-in to manage their daily activities. Unfortunately, neither the accounting nor the estimation data can help create a visible and responsive process to see these. The fact is the sales of a contractor have nothing to do with its billing. This misunderstanding could cost the contractors tens of thousands of dollars in revenues and taxes. What is WIP? Most construction accounting programs have a module dealing with work-in-progress (WIP). The typical elements of a simple and basic WIP are as follows: Contract values (base amount plus approved changes) Contract cost estimates (base amount plus approved changes) Original estimated profit margin (with and without approved changes) Job cost to date Value of completed construction Actual billings Over/underbilling Projected profit margin The WIP calculation relies on a combination of hard numbers (actual job costs, actual billing amounts and revised contract values) and the project managers educated guess at values such as the following: Construction put in place (value of the scope of work completed) Projected cost to complete the remaining work Value of pending changes and extra work When provided with the necessary information and routine updates, most accounting software packages will provide some sort of standard reporting that goes beyond a simple tally of the job costs incurred to date. Often these reports, by various names, will contain calculations of the percent complete (based on the proportion of estimated cost that has been incurred), an estimate of the remaining cost to complete the scope of work, the expected profit margin and whether the project is overbilled or underbilled. A WIP report should be used by core management and outside parties for the assessment of the current financial health of the contracting business. This report is a critical measure of the managements financial accountability in the contracting business, and as such, the accuracy of the WIP report is a key focus area for contractors of all sizes.

http://www.ecmag.com/index.cfm?fa=article&articleID=8752

3/27/2008

Electrical Contractor: Track the WIP

Page 2 of 5

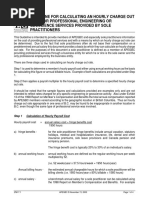

Whether a company is small and privately held or a multibillion-dollar holding company seeking compliance with Sarbanes-Oxley reporting requirements, the WIP report is a principal tool for accurately monitoring a projects financial performance. How to create your own WIP Many contractors find the reports in construction accounting software contain information that is either beyond their immediate interest, more than they care to share outside the company, in need of modification and refinement using data that is outside of the accounting system, or simply not formatted the way they want to see it. Often contractors attempt to build a custom WIP report containing the information and the format that provides the most appropriate information for their individual needs. Whether the WIP is created using a pencil and paper, an Excel spreadsheet, a custom report within the accounting system, or within another third-party mechanism, there will be some basic elements that must be included. These basic or fundamental elements are sales, billings and profits. In order to provide accurate reporting, one must understand the elements of each component. One of the most common misconceptions in contracting is that sales and billings are the same. A sale occurs when goods and services are exchanged for an agreed price. In contrast, billings are the amount that the contractor has invoiced to the customer for the work completed. Profitability is simply the difference between the contract price and the costs incurred to complete the job. Given the data described above, the simplest and most basic form of the WIP report can be constructed easily using the following steps. Step 1Calculating sales The calculation of sales involves the basic estimation and contract data. Listed below is the information needed for the WIP schedule and sales calculation: Original contract value Original estimated costs (labor, material, subcontracts and all other costs including planned allocations to the project) Agreed value for each fully executed change order Estimated costs for each fully executed change order (labor, material, subcontracts and all other costs including planned allocations to the project) Actual job costs incurred and/or allocated to date The WIP report uses the revised contract value and the value of construction put-in-place to calculate sales to date. By summing the original contract value and the agreed value of each fully executed change order, we will arrive at the revised contract value. However, this is not recognized as sales until the agreed scope has been delivered to the customer. The final calculations for the WIP report are the original and revised profit expectations. The original profit expectation is calculated by taking the difference between the original contract value and the original estimated project cost and dividing this by the original contract value. The revised profit expectation is calculated similarly using the revised valuesthe difference between revised contract value and the revised contract cost divided by the revised contract value. These calculations are shown below, and Figure 1 illustrates a common layout for the Contract Values and Costs portion of the WIP report.

http://www.ecmag.com/index.cfm?fa=article&articleID=8752

3/27/2008

Electrical Contractor: Track the WIP

Page 3 of 5

Original Estimated Costs + All Estimated Change Order Costs = Revised Contract Costs Original Contract Value + Agreed Value of All Fully -Executed Change Orders = Revised Contract Value (Original Contract Value Original Estimated Costs)/Original Contract Value = Original Profit (%) (Revised Contract Value Revised Estimated Costs)/Revised Contract Value = Revised Profit (%)

To calculate the portion of the contract that has been sold (actual sales), as of the report date, a simple two-step formula is used. Step one is to calculate the percent complete (the portion of the total project price that has been delivered to the customer). This is determined by dividing the total job costs incurred to date by the total of all estimated costs (original contract costs plus the sum of all costs for each fully executed change order). Once this value (percent) is determined, step two is to apply it to the total revised contract price. This will result in a value of the construction put-in-place: sales to date. The calculations are shown below, and Figure 2 illustrates a common layout for the earnings section of the basic WIP report. Actual Job Costs to Date/Total Estimated Costs = Percent Complete Revised Contract Value Percent Complete = Earned Value or Actual Sales to Date

Step 2Managing cash flow When it comes to maintaining a healthy business, cash-flow management on construction projects often is more critical than attaining high profit margins. It is common that a job will not achieve positive cash flow until the last 5 to 10 percent of the project. Contractors have come to expect large initial cash investments in their projects to get them started. The failure to monitor and manage cash flow can extend the duration of borrowing to the point that both the project and contractor can be jeopardized. The WIP report can be used to determine two fundamental and critical measures to help monitor and manage cash flow on the project. First, it identifies the amount billed for the scope of work that has been delivered and, secondly,

http://www.ecmag.com/index.cfm?fa=article&articleID=8752

3/27/2008

Electrical Contractor: Track the WIP

Page 4 of 5

the monies collected from the customer. Project billings to date (invoice totals) and cash collected to date (payments received against these invoices) are necessary for the WIP schedule: The WIP report also identifies a contractors billing status in terms of over/under billings. Overbilling occurs when billings are more than the sales recognized to date. Underbilling occurs when billings are less than the sales to date. These amounts are separated so the contractor can evaluate his total overbilled and total underbilled status, as opposed to monitoring only his net over/underbilled status. This distinction is critical because the fact that one job is overbilled does not justify having another job underbilled by the same amount. The cash-flow calculation compares the amount received from the customer to the actual project costs paid to date. When costs to date exceed the amount collected, this is reflected as a negative number (cash short). When received cash exceeds the paid costs, this is a positive number (cash over). These calculations are shown below, and Figure 3 illustrates a common layout for the billings and cash position section of the basic WIP report. If Earned Value > Project Billings to Date, then: Earned Value (Sales) Project Billings to Date = Amount Underbilled If Project Billings to Date > Earned Value, then: Project Billings to Date Earned Value (Sales) = Amount Overbilled Total Cash Received to Date Actual Job Costs Incurred to Date = Cash (Short) Over

Going beyond the basics There are no established requirements limiting the content of the WIP report. The WIP may be expanded to include other useful management tools that help create a visible snapshot of the project, department and company financial health and associated risk areas. In future feature articles, we will investigate some additions to the basic WIP. We will expand on the connection between accounting and operations by discussing the financial management information available through a more detailed WIP report designed to help CFOs, accountants and owners accurately project future cash flows and potential write downs (or ups) from data available early in the project life cycle. Further expansion of the WIP can allow for refinement of both profit and cash-flow projections based on actual job productivity experience as well as consideration of estimated, actual and committed costs. A well-designed and regularly maintained WIP report can be one of the most valuable tools for any contractor, regardless of size or specialty. Even a very basic WIP will allow owners and managers to accurately project profitability and better manage cash, improving relationships with employees, creditors, surety providers and customers. For companies with more complicated risk situations, tighter lending covenants or Sarbanes-Oxley reporting requirements, WIP can be expanded to provide the key ingredient in a management information system

http://www.ecmag.com/index.cfm?fa=article&articleID=8752

3/27/2008

Electrical Contractor: Track the WIP

Page 5 of 5

solution for financial assurance at the project level and higher. DANESHGARI is president of MCA Inc. He is a consultant for various electrical and general contracting companies. NIMMO is the director of operations for MCA Inc. SHABANDER, M.B.A., has 25 years of experience as a CFO and accounting adviser for various industries, specializing in labor productivity.

http://www.ecmag.com/index.cfm?fa=article&articleID=8752

3/27/2008

Das könnte Ihnen auch gefallen

- How To Estimate Electrical WorkDokument5 SeitenHow To Estimate Electrical WorkZzzdddNoch keine Bewertungen

- Facilities Management Tools A Complete Guide - 2020 EditionVon EverandFacilities Management Tools A Complete Guide - 2020 EditionBewertung: 4 von 5 Sternen4/5 (1)

- Guideline For Calculating Hourly RateDokument4 SeitenGuideline For Calculating Hourly RatemallinathpnNoch keine Bewertungen

- Project Cost Management A Complete Guide - 2019 EditionVon EverandProject Cost Management A Complete Guide - 2019 EditionNoch keine Bewertungen

- Knowledge-Based Process Planning for Construction and ManufacturingVon EverandKnowledge-Based Process Planning for Construction and ManufacturingNoch keine Bewertungen

- Construction estimating software Standard RequirementsVon EverandConstruction estimating software Standard RequirementsNoch keine Bewertungen

- Prefabrication in Electrical ConstructionDokument10 SeitenPrefabrication in Electrical ConstructionegremogaNoch keine Bewertungen

- Labor Only AgreementDokument12 SeitenLabor Only AgreementAe R ONNoch keine Bewertungen

- PM Blind SpotsDokument12 SeitenPM Blind SpotsIgnacio ManzaneraNoch keine Bewertungen

- RSMeansOnlineTips PDFDokument33 SeitenRSMeansOnlineTips PDFPraveen Varma VNoch keine Bewertungen

- Cash Flow Forecast TemplateDokument1 SeiteCash Flow Forecast TemplateMohamed Ahmed100% (1)

- Excel Construction Project Management Templates Time and Materials InvoiceDokument6 SeitenExcel Construction Project Management Templates Time and Materials InvoiceYsaiNoch keine Bewertungen

- Sunera Technologies Pvt. LTD.: Standard Operating Procedure TemplateDokument14 SeitenSunera Technologies Pvt. LTD.: Standard Operating Procedure Templatesastrylanka_1980Noch keine Bewertungen

- Fit Out - Designing Buildings WikiDokument4 SeitenFit Out - Designing Buildings Wikiharp_p24Noch keine Bewertungen

- Constrution ManagementDokument5 SeitenConstrution ManagementCarl Andrew PimentelNoch keine Bewertungen

- A Project Manager's Guide To Cost Estimating and Cost PlanningDokument7 SeitenA Project Manager's Guide To Cost Estimating and Cost Planningsarathirv6Noch keine Bewertungen

- Sales Call Planner: Info Classification Info NotesDokument1 SeiteSales Call Planner: Info Classification Info NotesHoang NguyenNoch keine Bewertungen

- Import Costing Calculation Sheet: Spare Parts SupplierDokument1 SeiteImport Costing Calculation Sheet: Spare Parts SupplierajayNoch keine Bewertungen

- A3 Problemsolving Trainingtemplate Tcm36-68772Dokument2 SeitenA3 Problemsolving Trainingtemplate Tcm36-68772rahul sharmaNoch keine Bewertungen

- Level of Schedule in PlanningDokument5 SeitenLevel of Schedule in PlanningVisas SivaNoch keine Bewertungen

- Cash Flow Statement1Dokument1 SeiteCash Flow Statement1EiflaRamosStaRita100% (1)

- Human Resource PlanningDokument97 SeitenHuman Resource PlanningJulius Dennis100% (1)

- Organizing Sysytems and Procedures of Project ImplementationsDokument5 SeitenOrganizing Sysytems and Procedures of Project ImplementationsAmar Nath PrasadNoch keine Bewertungen

- Daily Construction Inspection Report TemplateDokument2 SeitenDaily Construction Inspection Report TemplateAbigail100% (1)

- Excel Timeline TemplateDokument8 SeitenExcel Timeline TemplatesapcanNoch keine Bewertungen

- PEM - Types of ContractDokument117 SeitenPEM - Types of ContractNimit PorwalNoch keine Bewertungen

- Electrical EstimateDokument7 SeitenElectrical EstimateEngr Zain Ul AbaidinNoch keine Bewertungen

- OT1 How To Estimate The Impacts of Overtime On Labor ProductivityDokument17 SeitenOT1 How To Estimate The Impacts of Overtime On Labor ProductivityTarzan da SelvaNoch keine Bewertungen

- Cost Control - It ' S Not Just About NumbersDokument12 SeitenCost Control - It ' S Not Just About NumbersShabbeer ZafarNoch keine Bewertungen

- Project Schedule Critical Path and GanttDokument21 SeitenProject Schedule Critical Path and GanttJustus OtungaNoch keine Bewertungen

- 12 FinalReport Lab PECIDokument19 Seiten12 FinalReport Lab PECIAsmara KanthiNoch keine Bewertungen

- Design-Build, Design-Bid-Build and Contract Management How To Select The One That Is Right For You!Dokument4 SeitenDesign-Build, Design-Bid-Build and Contract Management How To Select The One That Is Right For You!Ar Pun PunithaNoch keine Bewertungen

- Construction Project Manager Commercial Residential in Philadelphia PA Resume John MarescaDokument2 SeitenConstruction Project Manager Commercial Residential in Philadelphia PA Resume John MarescaJohnMarescaNoch keine Bewertungen

- Change Control RegisterDokument12 SeitenChange Control RegisterSunil BenedictNoch keine Bewertungen

- Commercial Construction ScheduleDokument60 SeitenCommercial Construction ScheduleJon HendersonNoch keine Bewertungen

- Cost Code Breakdown: 03-001 NW Food WarehouseDokument2 SeitenCost Code Breakdown: 03-001 NW Food WarehouseAnonymous szDONqNoch keine Bewertungen

- Construction General PermitDokument270 SeitenConstruction General Permit22noelgNoch keine Bewertungen

- Lean Six SigmaDokument2 SeitenLean Six SigmaAkash RathodNoch keine Bewertungen

- Electrical Electronic and Communications Contracting Award Ma000025 Pay GuideDokument17 SeitenElectrical Electronic and Communications Contracting Award Ma000025 Pay GuideaidenNoch keine Bewertungen

- The Cost EngineersDokument24 SeitenThe Cost Engineersluis carlosNoch keine Bewertungen

- Funding No: Full Project Name: Technology Deployed: Project Manager: Action Item No. Date Opened Responsible Party Completion DateDokument9 SeitenFunding No: Full Project Name: Technology Deployed: Project Manager: Action Item No. Date Opened Responsible Party Completion DateAnonymous K3FaYFlNoch keine Bewertungen

- Project Work NotesDokument7 SeitenProject Work NotesLiew Chee KiongNoch keine Bewertungen

- Electrical Inspection ChecklistsDokument101 SeitenElectrical Inspection ChecklistsMagdy OmarNoch keine Bewertungen

- FrameworkDokument24 SeitenFrameworkislam essamNoch keine Bewertungen

- Planning and Scheduling of Project Using Microsoft Project (Case Study of A Building in India)Dokument7 SeitenPlanning and Scheduling of Project Using Microsoft Project (Case Study of A Building in India)IOSRjournalNoch keine Bewertungen

- SS Electrical - Electrical Price Bid ScheduleDokument32 SeitenSS Electrical - Electrical Price Bid Scheduledox4printNoch keine Bewertungen

- Case TimeManagementDokument4 SeitenCase TimeManagementsherynNoch keine Bewertungen

- Developing A I Based Scheme For Project Planning byDokument10 SeitenDeveloping A I Based Scheme For Project Planning byNazeer AlamNoch keine Bewertungen

- Chapter 3 - Construction ManagmentDokument9 SeitenChapter 3 - Construction Managmentabdata wakjiraNoch keine Bewertungen

- Appendix Vi Preconstruction Conference Checklist: Facilities Division, Engineering and Architectural ServicesDokument7 SeitenAppendix Vi Preconstruction Conference Checklist: Facilities Division, Engineering and Architectural ServicesJM Subion100% (1)

- Hays DNA of A Chief EstimatorDokument22 SeitenHays DNA of A Chief EstimatorTamajit ChakrabortyNoch keine Bewertungen

- CEC MG Lessons Learned Workshop PresentationDokument51 SeitenCEC MG Lessons Learned Workshop PresentationsuderNoch keine Bewertungen

- Family Budget Action Plan TemplateDokument2 SeitenFamily Budget Action Plan TemplateDustin BackusNoch keine Bewertungen

- Quality Management Tools: Cause-And-Effect DiagramDokument4 SeitenQuality Management Tools: Cause-And-Effect DiagramDevi PriyaNoch keine Bewertungen

- Accounting Excel Reports - Report Generalledger ExcelDokument36 SeitenAccounting Excel Reports - Report Generalledger ExcelMark Ceddrick MioleNoch keine Bewertungen

- Cost Estimating Checklist PDFDokument17 SeitenCost Estimating Checklist PDFwalidNoch keine Bewertungen

- Work Breakdown Structure: U.S. Department of EnergyDokument18 SeitenWork Breakdown Structure: U.S. Department of EnergyMohammed Thofeek KhanNoch keine Bewertungen

- 11 Sps Silos Vs PNBDokument7 Seiten11 Sps Silos Vs PNBNaomi InotNoch keine Bewertungen

- Mba Vtu 3 Sem SyullabusDokument8 SeitenMba Vtu 3 Sem SyullabusShiva KumarNoch keine Bewertungen

- ACBS Commercial Loan System Fact SheetDokument4 SeitenACBS Commercial Loan System Fact SheetRajitNoch keine Bewertungen

- Test Bank Fin Man 3Dokument2 SeitenTest Bank Fin Man 3Phillip RamosNoch keine Bewertungen

- Balancing and Closing AccountsDokument2 SeitenBalancing and Closing AccountsMildred C. WaltersNoch keine Bewertungen

- Black Book BbiDokument84 SeitenBlack Book BbiVikas Shah67% (3)

- Project Report On Risk Factors in Capital MarketDokument56 SeitenProject Report On Risk Factors in Capital MarketMudrika Jain100% (2)

- List of Favourite SFM Examination QuestionsDokument12 SeitenList of Favourite SFM Examination QuestionsAnkit RastogiNoch keine Bewertungen

- Role of Insurance Industry in Economic Growth of IndiaDokument56 SeitenRole of Insurance Industry in Economic Growth of IndiaOmkar pawarNoch keine Bewertungen

- VCB-ib@nking User Guide PDFDokument34 SeitenVCB-ib@nking User Guide PDFThông Hà ThúcNoch keine Bewertungen

- Materi Bu AprilDokument29 SeitenMateri Bu AprilQorry Aini HaniNoch keine Bewertungen

- England & Wales: Mortgage DeedDokument4 SeitenEngland & Wales: Mortgage DeedSteven Yeti GriffithsNoch keine Bewertungen

- Monetary Policy - IndicatorsDokument4 SeitenMonetary Policy - IndicatorsGJ RamNoch keine Bewertungen

- The Impact of Financial Structure On The Cost of Solar EnergyDokument40 SeitenThe Impact of Financial Structure On The Cost of Solar EnergyAlexander VovaNoch keine Bewertungen

- Teks Tentang Manajemen Dalam Bahasa InggrisDokument5 SeitenTeks Tentang Manajemen Dalam Bahasa InggrisElip Bin Nasi Kuning100% (1)

- American Bar Association - Role of The Trustee in Asset-Backed Securities July2010Dokument12 SeitenAmerican Bar Association - Role of The Trustee in Asset-Backed Securities July20104EqltyMom100% (1)

- New Employee Orientation - Feb 2019 PDFDokument31 SeitenNew Employee Orientation - Feb 2019 PDFSrikānt BhāradwājNoch keine Bewertungen

- Indian Contract Act, 1872Dokument81 SeitenIndian Contract Act, 1872Anonymous jrIMYSz9Noch keine Bewertungen

- Assumption of Mortgage....Dokument1 SeiteAssumption of Mortgage....kardel sharpeyeNoch keine Bewertungen

- Edu-Care Professional Academy:, 243, Sundaram Coplex, Bhanwerkuan Main Road, IndoreDokument10 SeitenEdu-Care Professional Academy:, 243, Sundaram Coplex, Bhanwerkuan Main Road, IndoreCA Gourav Jashnani100% (1)

- GMO 2009 1st Quarter Investor LetterDokument14 SeitenGMO 2009 1st Quarter Investor LetterBrian McMorris100% (2)

- OPPT-SA Awareness Drive 02Dokument5 SeitenOPPT-SA Awareness Drive 02Anton CloeteNoch keine Bewertungen

- Gregory Owens Chapter 7 Bankruptcy PetitionDokument39 SeitenGregory Owens Chapter 7 Bankruptcy Petitiondavid_lat100% (1)

- Solution Manual For Financial Reporting and Analysis 7th Edition by RevsineDokument33 SeitenSolution Manual For Financial Reporting and Analysis 7th Edition by Revsinea619353646100% (1)

- How To Face Bank InterviewDokument74 SeitenHow To Face Bank InterviewTushar PatilNoch keine Bewertungen

- Introduction To FinanceDokument309 SeitenIntroduction To Financepawan69100% (3)

- How To Read A Financial Report by Merrill LynchDokument0 SeitenHow To Read A Financial Report by Merrill Lynchjunaid_256Noch keine Bewertungen

- TVM Test BankDokument52 SeitenTVM Test BankShahzaib MaharNoch keine Bewertungen

- Investment in Equity Securities 1Dokument11 SeitenInvestment in Equity Securities 1dfsdfdsfNoch keine Bewertungen

- Loan AmortizationDokument3 SeitenLoan AmortizationMarvin AlmariaNoch keine Bewertungen