Beruflich Dokumente

Kultur Dokumente

F6 - TAXATION (PAKISTAN) ACCA - 2012 - Jun - Q

Hochgeladen von

IrfanOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

F6 - TAXATION (PAKISTAN) ACCA - 2012 - Jun - Q

Hochgeladen von

IrfanCopyright:

Verfügbare Formate

Fundamentals Level Skills Module

Taxation (Pakistan)

Tuesday 12 June 2012

Time allowed Reading and planning: Writing:

15 minutes 3 hours

ALL FIVE questions are compulsory and MUST be attempted. Tax rates and allowances are on pages 23.

Do NOT open this paper until instructed by the supervisor. During reading and planning time only the question paper may be annotated. You must NOT write in your answer booklet until instructed by the supervisor. This question paper must not be removed from the examination hall.

The Association of Chartered Certified Accountants

Paper F6 (PKN)

SUPPLEMENTARY INSTRUCTIONS 1. 2. 3. Calculations and workings need only be made to the nearest rupee. All apportionments should be made to the nearest month except where the exact number of days is given in the question. All workings should be shown.

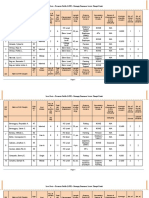

TAX RATES AND ALLOWANCES The following tax rates and allowances for the tax year 2012 are to be used in answering all questions on this paper. A. Tax rates for salaried individuals where salary income exceeds 50% of taxable income Taxable income Up to Rs. 350,000 Rs. 350,001 Rs. 400,000 Rs. 400,001 Rs. 450,000 Rs. 450,001 Rs. 550,000 Rs. 550,001 Rs. 650,000 Rs. 650,001 Rs. 750,000 Rs. 750,001 Rs. 900,000 Rs. 900,001 Rs. 1,050,000 Rs. 1,050,001 Rs. 1,200,000 Rs. 1,200,001 Rs. 1,450,000 Rs. 1,450,001 Rs. 1,700,000 Rs. 1,700,001 Rs. 1,950,000 Rs. 1,950,001 Rs. 2,250,000 Rs. 2,250,001 Rs. 2,850,000 Rs. 2,850,001 Rs. 3,550,000 Rs. 3,550,001 Rs. 4,550,000 Over Rs. 4,550,000 B. Rate of tax on taxable income 0% 150% 250% 350% 450% 600% 750% 900% 1000% 1100% 1250% 1400% 1500% 1600% 1750% 1850% 2000%

Tax rates for non-salaried individuals to whom the rates given in A are not applicable Taxable income Up to Rs. 350,000 Rs. 350,001 Rs. 500,000 Rs. 500,001 Rs. 750,000 Rs. 750,001 Rs. 1,000,000 Rs. 1,000,001 Rs. 1,500,000 Over Rs. 1,500,000 Rate of tax on taxable income 0% 750% 1000% 1500% 2000% 2500%

C.

Tax rate for associations of persons On taxable income 25% of taxable income

D. Tax rates for companies Small company Public company/private company E. 25% of taxable income 35% of taxable income

Tax rates on capital gains on the disposal of securities Where holding period of a security is less than six months more than six months but less than 12 months more than one year 100% 80% 0%

F.

Tax rates for income from property (i) For individuals and associations of persons Up to Rs. 150,000 Rs. 150,001 to Rs. 400,000 Rs. 400,001 to Rs. 1,000,000 Above Rs. 1,000,000 0% 5% of the amount exceeding Rs. 150,000 Rs. 12,500 plus 75% of the amount exceeding Rs. 400,000 Rs. 57,500 plus 10% of the amount exceeding Rs. 1,000,000 5% Rs. 20,000 plus 75% of the amount exceeding Rs. 400,000 Rs. 65,000 plus 10% of the amount exceeding Rs. 1,000,000

(ii) For companies Up to Rs. 400,000 Rs. 400,001 to Rs. 1,000,000 Above Rs. 1,000,000

G.

Other tax rates On dividends received from a company 10%

H. Rates of deduction/collection of tax at source Sale of goods (general) Services (other than transport) Contracts Commission or brokerage Profit on debt Import of goods (general rate) I. Depreciation rates Buildings (all types) Furniture and fittings Plant and machinery (not otherwise specified) Motor vehicles (all types) Computer hardware J. Initial allowance Eligible depreciable asset K. Pre-commencement expenditure Amortisation of pre-commencement expenditure L. Benchmark rate Interest free loan to employees 14% per annum 20% 50% of cost 35% 6% 6% 10% 10% 5%

10% 15% 15% 15% 30%

of the tax written down value

[P.T.O.

ALL FIVE questions are compulsory and MUST be attempted 1 For the purpose of this question, you should assume that todays date is 15 July 2012. Sheesham Ltd (Sheesham), a manufacturer of office and domestic furniture, was incorporated as a non-listed public company under the Companies Ordinance, 1984 on 15 July 2010. On 20 August 2011, Sheesham was enlisted on the Islamabad Stock Exchange (ISE). Sheeshams summarised income statement for year ended 30 June 2012 is given below: Note Gross profit Operating expenses Depreciation Legal and professional fees Repairs and renovations Miscellaneous expenses Rs. Rs. 3,000,000

1 2 3

1,000,000 90,000 80,000 450,000 (1,720,000) 1,280,000

Operating profit Other income Profit from bank Income from the lease of manufacturing unit Miscellaneous income Loss on sale of fixed asset Financial charges Profit before tax

4 5 6 7 8

45,000 690,000 40,000 2,055,000 (35,000) 2,020,000 (400,000) 1,620,000

Unless stated otherwise, Sheesham paid for all the expenditure through crossed cheques and tax was deducted and deposited as required under the law. Notes: Note 1 Legal and professional fees Accountancy and audit fee Legal fees in connection with the purchase of land Legal fees in connection with the filing of statements with the ISE Rs. 64,000 96,000 30,000 190,000

Note 2 Repairs and renovations The amount of Rs. 80,000 includes Rs. 50,000 for the reconstruction of a car park on the companys premises and Rs. 30,000 for the running and maintenance of a truck used for the delivery of furniture.

Note 3 Miscellaneous expenses Refreshment for shareholders at the annual general meeting Provision for future bad debts likely to arise from the current years business transactions Fine for infringing health and safety regulations of the Federal Government Payment to the Forest Research Institute (FRI) of the Government of Pakistan for their help in improving the method of seasoning wood used by the company 100,000 Fair estimation of the loss in value of wood rendered unfit for the manufacturing of furniture 74,000 General expenditure, all admissible under the law 100,000 450,000 Note 4 Profit from bank The net figure of Rs. 45,000 has been derived as below: Rs. Gross amount of profit from saving accounts with banks Less: Profit paid on running a finance account facility used for business Bank charges relating to running the finance account Bank charges relating to running the finance account Rs. 700,000 Rs. 56,000 70,000 50,000

645,000 10,000 (655,000) 45,000

The principal amount on which profit was earned had been deposited out of the companys own funds. The banks have deducted tax at 10% from the gross amount of profit. Note 5 Income from the lease of a manufacturing unit Construction of a new factory building was completed in June 2011. It remained unused until second-hand plant and machinery was installed therein in September 2011 and the unit was given on lease on 1 October 2011 to an individual. The net amount of Rs. 690,000 has been arrived at as below: Rs. Gross lease amount for nine months Less: Whitewashing of the building Depreciation Property tax Rs. 1,200,000

20,000 350,000 140,000 (510,000) 690,000

No other expenditure was incurred in earning this income. The value of the assets given on lease as on 1 July 2011, was as below: Building (value of land not included) Plant and machinery None of the above assets is included in note no. 9. Rs. 3,000,000 1,000,000

[P.T.O.

Note 6 Miscellaneous income Unrealised gain in respect of US$ held by the company on 30 June 2012 Revaluation of a sawing machine, yet to be installed, for use in the business Rs. 25,000 15,000 40,000

Note 7 Loss on sale of fixed asset Particulars of the asset (not included in notes 5 and 9) sold in the open market giving rise to a loss of Rs. 35,000 are given below: Sale proceeds Book value on the date of sale Tax written down value on 1 July 2011 Note 8 Financial charges Rs. Finance charges in respect of an asset taken on lease from an approved leasing company and used fully for business purposes. (This asset is not included in the assets mentioned in notes 5 and 9) Profit paid to individual debenture holders on which no tax was deducted Rs. 100,000 135,000 30,000

150,000 250,000 400,000

The total lease rentals paid to the leasing company were Rs. 600,000. Note 9 Own fixed assets used for business Sr. No Description of asset Tax written down value (TWDV) on 1 July 2011 Rs. 4,000,000 500,000 600,000 200,000 2,500,000 Added on 10 June 2012 Rs. 1,000,000

1 2 3 4 5 6

Land Factory building Canteen building for employees Furniture and fittings Technical design books Second-hand truck purchased for the delivery of furniture

Note 10 Previous year file note Perusal of the tax record of the previous year reveals that Sheesham had incurred Rs. 350,000 on feasibility studies, prior to the commencement of business. The amount of Rs. 70,000 was allowed by the Commissioner in the tax year 2011 and the company agreed to this treatment. No amount has been charged to the accounts this year. Note 11 Taxation Apart from the tax deducted by banks on profit (see note 4), Sheesham also paid Rs. 500,000 as advance tax in four equal instalments on the dates as prescribed in the law.

Required: (a) Compute the taxable income of Sheesham Ltd for the tax year 2012 under the appropriate heads of income, giving brief reasons/explanations for the inclusion in or exclusion from the computation of each of the items listed in the question. Note: The reasons/explanations for the items not listed in the computation of taxable income should be shown separately. Specific marks are allocated for this part of the requirement. (27 marks) (b) Calculate the tax payable by/refundable to Sheesham Ltd for the tax year 2012. Note: Ignore minimum tax payable on the basis of turnover. (3 marks) (30 marks)

[P.T.O.

For the purpose of this question, you should assume that todays date is 15 July 2012. Mr Musa, resident in Pakistan, has provided the following information in respect of his tax affairs for the financial year ended 30 June 2012. From employment with Best Homes (Pvt) Ltd (BHPL) as principal architect Musa worked for BHPL for the six months to 31 December 2011. In addition to his basic salary of Rs. 125,000 per month, BHPL provided him with the following: an electricity allowance at 10% of his basic salary; commission for introducing new clients of Rs. 120,000; repaid a loan of Rs. 158,000 owed by Musa to a banking company; the services of a housekeeper for the six months free of cost. The salary of the housekeeper was Rs. 15,000 per month; a departing bonus of Rs. 100,000; made a concessional study loan to his child of Rs. 100,000 on 30 June 2011. Interest charged on the loan which continued until 30 June 2012 was at 4% per annum; the option of purchasing 1,000 shares of the company at Rs. 20 per share. Musa exercised the option. A restriction on the sale of the shares was removed on 10 September 2011 when the per share price was Rs. 40. However, Musa has not sold these shares and on 30 June 2012 the fair market price per share was estimated at Rs. 50; a gratuity of Rs. 200,000 from the gratuity fund of the company approved by the Commissioner Inland Revenue; and reimbursed medical charges of Rs. 80,000 which had been paid by Musa on his hospitalisation. The medical bills did not bear the national tax number of the hospital.

BHPL deducted tax on the commission paid at 10% and Rs. 240,000 on Musas other income falling under the head salary. From architectural professional practice Musa started his own professional practice from 1 January 2012. His clients are individuals who are not required to deduct tax from his fees. He has employed the accrual-basis method of accounting. His books of account show the following position for the six months ended on 30 June 2012. Note Gross receipts Operating expenses Salaries paid to his staff Rent paid for six months Computer software Lease rentals paid Other expenses Rs. Rs. 3,000,000

1 2 3 4 5

800,000 400,000 300,000 200,000 200,000 (1,900,000) 1,100,000

Notes: Note 1 Salaries The minimum salary paid to any employee is Rs. 20,000 per month. Salaries of Rs. 100,000 were paid by transfer of funds to the employees bank account. The balance amounts were paid in cash. Note 2 Rent The rent amount was paid through a crossed cheque. No tax was withheld by Musa from rent. Note 3 Computer software The useful life of the computer software is estimated to be six years. The software was put into use for 182 days during the tax year (having 366 days) ended 30 June 2012. 8

Note 4 Lease rentals The lease rentals were paid to an approved leasing company through crossed cheque on account of a car taken on finance lease. It is fairly estimated that 50% mileage was for the private purposes of Musa. Note 5 Other expenses The amount of Rs. 200,000, which was all paid in cash, includes: Rs. Rs. Rs. Rs. 100,000 of business travel fares reimbursed to employees on an actual basis; 50,000 for utility bills; and 50,000 of petty expenses paid to different parties for office supplies, each payment for which was below 5,000.

Note 6 Own fixed assets The business purchased the following assets on 1 January 2012: Office furniture Computer hardware The above assets had never been used in Pakistan before. Other information: 1. 2. 3. 4. Tax withheld on cash withdrawals is Rs. 5,000. On 15 October 2011, Musa won a prize of Rs. 700,000 on a prize bond. The prize paying authority deducted tax at the prescribed rate of 10% of the prize money. Rs. 4,000 tax was deducted on the bills for the landline telephones installed at Musas residence. Musa paid Zakat of Rs. 100,000 under the Zakat and Ushr Ordinance, 1980 and of Rs. 120,000 to indigent relatives and neighbours. Rs. 400,000 500,000

Required: Compute Mr Musas taxable income and income assessable under the final tax regime (FTR) and his total tax payable for the tax year 2012. Give brief reasons for the treatment of any items excluded from taxable income or for which no expense/deduction is allowed. (25 marks)

[P.T.O.

For the purpose of this question, you should assume that todays date is 15 July 2012. Mr Abdullah, who is resident in Pakistan, disposed of the following assets during the year ended 30 June 2012: (1) (2) (3) (4) 1 July 2011: Sold machinery for Rs. 550,000 used exclusively for manufacturing goods exported to KSA in the year ended 30 June 2011. He had originally purchased this machinery on 30 June 2010 for Rs. 500,000. 10 July 2011: Sold 5,000 ordinary shares in Bhalwal Citrus Ltd (BCL), an unquoted trading company, for Rs. 200,000. He had originally purchased 40,000 shares in the company on 25 June 2004 for Rs. 440,000. 9 August 2011: Sold his horse for Rs. 200,000. The horse had been purchased on 20 January 2010 for Rs. 140,000 for his dependent son, an amateur horse rider. 15 September 2011: Sold 7,000 shares in Organic Fertilizers Ltd (OFL), a company listed on the Lahore Stock Exchange, for Rs. 675,000. He had purchased these shares for Rs. 550,000 on 10 May 2011. Brokerage paid and other expenses on the sales transaction were Rs. 1,200, including Rs. 100 being tax withheld at source. 20 November 2011: Sold his antique watch for Rs. 300,000. The watch had been gifted to him by his father back in 1999. Its fair market value at the time of the gift was Rs. 175,000. 20 January 2012: Sold two capital assets A and B for a consideration of Rs. 500,000 in a single transaction. The assets do not fall within the definition of security. Other particulars of the assets are given below: Date of acquisition Cost of acquisition (Rs.) Fair market value at the time of disposal (Rs.) (7) Asset A 30 July 2010 180,000 200,000 Asset B 30 November 2011 180,000 300,000

(5) (6)

10 March 2012: Sold machinery for Rs. 1,700,000. Mr Abdullah planned to set up a factory in an underdeveloped area and for this purpose purchased machinery on 20 July 2011 at a subsidised cost of Rs. 1,000,000 from the Punjab Government when the open market price of the machinery was Rs. 1,700,000. However, due to the recent energy crisis, he changed his plan and sold the machinery before putting it into use. 15 June 2012: Made a gift of his entire shareholding of 10,000 ordinary shares in Multitech Ltd (MTL) to his non-resident daughter. On that date, MTL shares were quoted on the Karachi Stock Exchange at Rs. 25 per share. He had purchased these shares on 15 October 2011 on initial offer by the company at the discounted price of Rs. 9 per share (face value Rs.10). 25 June 2012: Received Rs. 700,000 from an insurance company on account of the theft of a car in his personal use. The open market price of the car at the time of the theft was estimated to be Rs. 750,000. He had paid a Rs. 30,000 insurance premium for the said car.

(8)

(9)

(10) 30 June 2012: Sold his licence to import LPG gas for Rs. 3,000,000. He had purchased the licence on 10 November 2011 for Rs. 2,000,000 and paid Rs. 200,000 as an annual renewal fee on 1 January 2012. Additional information: The latest assessed taxable income of Mr Abdullah was Rs. 400,000 under the head Income from Business. He had no other taxable activity during the tax year 2012, except as stated above. No advance tax was paid by Mr Abdullah, except as stated above. Required: (a) Compute the taxable income of Mr Abdullah for the tax year 2012 and compute the tax payable on this income. Give brief reasons for your treatment of each item. (18 marks) (b) State, giving reasons, whether Mr Abdullah was liable to pay advance tax in four quarterly instalments in the year ended 30 June 2012. (2 marks) (20 marks)

10

(a) During the tax year 2012, Data Industries (Pvt) Ltd paid rent of Rs. 1,000,000 to a person without any tax deduction and claimed it as expenditure for computing its taxable income under the normal law. Required: List FOUR tax implications which Data Industries (Pvt) Ltd may face because of its failure to deduct tax from the rent paid by it. Note: a computation is not required. (4 marks)

(b) For the tax year 2011, Rose Petals (Pvt) Ltd, filed its return of income late by 20 days. The total income declared in the return was Rs. 5,000,000, on which the tax payable was Rs. 1,750,000. Required: (i) State the minimum and maximum penalty that can be levied for the late filing of the return of income; (2 marks)

(ii) Compute the maximum penalty that Rose Petals (Pvt) Ltd shall be liable to pay for its late filing of the return for the tax year 2011. (1 mark) (c) Mr Safdar is a doctor by profession. His case was selected for audit in the tax year 2008. Subsequent to his selection, the Federal Board of Revenue (Board) issued a circular to the effect that audit proceedings initiated for the tax year 2008 in the case of individual taxpayers be dropped. However, the Commissioner Inland Revenue intends to continue the proceedings on the ground that there was no provision in the Ordinance authorising him to drop the audit proceedings, once initiated. Required: (i) Explain whether the Commissioner is right in his intention to continue with the audit proceedings; (2 marks) (1 mark)

(ii) Explain the legal validity of a circular of the Board for a tax payer.

(d) Modern Technologies (Pvt) Ltd (MTPL) was incorporated in June 2011 and commenced business on 15 July 2011. During the financial year ended 30 June 2012, MTPL had no taxable income due to admissible initial allowances and depreciation. MTPLs total turnover for the year ended 30 June 2012 was Rs. 50,000,000 and it has paid no advance tax. Required: Explain the basis and dates on which Modern Technologies (Pvt) Ltd should have paid advance tax during the year ended 30 June 2012 to avoid the levy of default surcharge, and calculate the amount to be paid on each date. (5 marks) (15 marks)

11

[P.T.O.

(a) Mr Naveed, a registered person under the Sales Tax Act, 1990, made supplies, during May 2012, of the different goods manufactured by him in the following manner: (1) Goods, of which the market price was Rs. 500,000, were supplied to Superior Industries Ltd (SIL). SIL settled the transaction by paying Rs. 400,000 in cash and by giving goods of Rs. 100,000 to Naveeds son on his directions. The value of the supply was shown as Rs. 400,000 in the accounts. (2) Consumed taxable goods at home and showed their sale value as zero in the accounts. The open market price of the consumed goods is Rs. 78,000. (3) Naveeds son started his business in May 2012. In order to assist him, Naveed supplied him the goods at a discounted price of Rs. 2,500,000. The discount rate allowed was 18% against the normal business practice of allowing a discount at 8%. (4) Supplied goods to Mr Fareed, a consumer from the general public, on an instalment basis at Rs. 900,000 inclusive of a mark-up of Rs. 50,000. At the time of supply, the open market price of the goods was Rs. 850,000. In the accounts, the value of the supply was recorded as Rs. 900,000. Required: In each of the above situations, state, with reasons, the correct value of the supply on which Mr Naveed would be chargeable to sales tax under the Sales Tax Act, 1990. (6 marks) (b) State who can issue a sales tax invoice and list the particulars that must be given on a sales tax invoice issued under the Sales Tax Act, 1990. (4 marks) (10 marks)

End of Question Paper

12

Das könnte Ihnen auch gefallen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- (Umaira Ahmed) Hum Kahan Kay Sachay Thay (Novel # 0083)Dokument96 Seiten(Umaira Ahmed) Hum Kahan Kay Sachay Thay (Novel # 0083)Muhammad Usman Khan81% (21)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Financial Reporting IIDokument478 SeitenFinancial Reporting IIIrfan100% (3)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Chapter 18 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Dokument10 SeitenChapter 18 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Process CostingDokument48 SeitenProcess CostingIrfanNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Events After The Reporting Period (IAS-10)Dokument6 SeitenEvents After The Reporting Period (IAS-10)IrfanNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Who Assissainated BENAZIR BHUTTODokument213 SeitenWho Assissainated BENAZIR BHUTTOIrfanNoch keine Bewertungen

- Suggested Answers Certificate in Accounting and Finance - Autumn 2014Dokument6 SeitenSuggested Answers Certificate in Accounting and Finance - Autumn 2014IrfanNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- SYLLABUS Spring 2015Dokument83 SeitenSYLLABUS Spring 2015IrfanNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- (Umaira Ahmed) Kiss Jahan Kaa Zar Liya (Novel # 0004)Dokument91 Seiten(Umaira Ahmed) Kiss Jahan Kaa Zar Liya (Novel # 0004)Muhammad Usman Khan100% (3)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Ifrs 16 (Property, Plant and Equpement)Dokument82 SeitenIfrs 16 (Property, Plant and Equpement)Irfan100% (7)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- Karway Khrbozay BY JAVED CHAUDHRYDokument1 SeiteKarway Khrbozay BY JAVED CHAUDHRYIrfanNoch keine Bewertungen

- Right of Parents, Wife and TeachersDokument176 SeitenRight of Parents, Wife and TeachersIrfanNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Leases IAS 17Dokument56 SeitenLeases IAS 17Irfan100% (4)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Leases IAS 17Dokument56 SeitenLeases IAS 17Irfan100% (4)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Decentralization (Organization Behaviour)Dokument15 SeitenDecentralization (Organization Behaviour)Irfan100% (1)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- True Stories of WomanDokument12 SeitenTrue Stories of WomanIrfanNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Ifrs 36 (Impairement of Assets)Dokument33 SeitenIfrs 36 (Impairement of Assets)Irfan100% (4)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- F7-FINANCIAL REPORTING - ACCA (INT) 2011 JunDokument9 SeitenF7-FINANCIAL REPORTING - ACCA (INT) 2011 JunIrfanNoch keine Bewertungen

- Borrowing CostsDokument19 SeitenBorrowing CostsIrfan100% (20)

- First Term Exam of Taxtion (Pak) For Module C of C.ADokument3 SeitenFirst Term Exam of Taxtion (Pak) For Module C of C.AIrfanNoch keine Bewertungen

- Solution of First Term Exam of Taxation (Module C) of C.ADokument4 SeitenSolution of First Term Exam of Taxation (Module C) of C.AIrfanNoch keine Bewertungen

- Financial Reporting of IcampDokument20 SeitenFinancial Reporting of IcampIrfanNoch keine Bewertungen

- P2-Coporate Reporting-Acca - Jun 2011Dokument8 SeitenP2-Coporate Reporting-Acca - Jun 2011IrfanNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- First Term Exam of Taxation For Moudul C of C.ADokument3 SeitenFirst Term Exam of Taxation For Moudul C of C.AIrfanNoch keine Bewertungen

- F6-TAXATION - ACCA (PK) 2011 JunDokument11 SeitenF6-TAXATION - ACCA (PK) 2011 JunIrfanNoch keine Bewertungen

- Topic Wise Taxation Icap Past Papers (Pak) of C.ADokument30 SeitenTopic Wise Taxation Icap Past Papers (Pak) of C.AIrfan33% (3)

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 ExaminationsDokument4 SeitenInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 ExaminationsIrfanNoch keine Bewertungen

- Financial Reporting (S-501) : Stage-5 / Professional IIIDokument4 SeitenFinancial Reporting (S-501) : Stage-5 / Professional IIIIrfanNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsDokument4 SeitenInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsIrfanNoch keine Bewertungen

- Collins2e PPT03 EdDokument35 SeitenCollins2e PPT03 EdnatNoch keine Bewertungen

- This Is An ObliCon Reviewer Is It Not - PDFDokument154 SeitenThis Is An ObliCon Reviewer Is It Not - PDFJean Jamailah TomugdanNoch keine Bewertungen

- Himal Iron and Steel QuestionareDokument9 SeitenHimal Iron and Steel QuestionareAdarsha Man TamrakarNoch keine Bewertungen

- Zillow Racism SuitDokument35 SeitenZillow Racism Suitnshapiro5288Noch keine Bewertungen

- SMC Vs NLRCDokument2 SeitenSMC Vs NLRCMavic MoralesNoch keine Bewertungen

- Fox S Frames of ReferenceDokument10 SeitenFox S Frames of ReferenceMilanSimkhadaNoch keine Bewertungen

- Small Business FeaturesDokument4 SeitenSmall Business FeatureshikunanaNoch keine Bewertungen

- Stress QuestionnaireDokument3 SeitenStress QuestionnaireOllie EvansNoch keine Bewertungen

- Local Socio - Economic Profile (LSEP) - Barangay Panamaon, Loreto, Dinagat IslandsDokument11 SeitenLocal Socio - Economic Profile (LSEP) - Barangay Panamaon, Loreto, Dinagat IslandsMay Chelle ErazoNoch keine Bewertungen

- PDS Revised 2018Dokument13 SeitenPDS Revised 2018Ericson DunqueNoch keine Bewertungen

- B. Doors C. Plays D. Students: Try To Become A Better Version of Yourself!Dokument5 SeitenB. Doors C. Plays D. Students: Try To Become A Better Version of Yourself!Anh NguyễnNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Lunenberg Self EfficacyDokument4 SeitenLunenberg Self EfficacyAn KmNoch keine Bewertungen

- Youth Impact Labs Kenya Gig Economy Report 2019 0 0Dokument87 SeitenYouth Impact Labs Kenya Gig Economy Report 2019 0 0h3493061Noch keine Bewertungen

- Sons, Et Al. vs. UST GR No. 211273 Full TextDokument18 SeitenSons, Et Al. vs. UST GR No. 211273 Full TextJasper Magbanua BergantinosNoch keine Bewertungen

- HRM in A Global EnvironmentDokument52 SeitenHRM in A Global Environmentshubhakar100% (3)

- KarnatakaDokument21 SeitenKarnatakaHannet Raja PreethaNoch keine Bewertungen

- A20254 Strategic Workforce Planning - Assessments - v1.2Dokument12 SeitenA20254 Strategic Workforce Planning - Assessments - v1.2Rayza OliveiraNoch keine Bewertungen

- Privatisation Question (CHONG ZHENG YANG)Dokument3 SeitenPrivatisation Question (CHONG ZHENG YANG)dss sdsNoch keine Bewertungen

- Personnel RequirementsDokument8 SeitenPersonnel RequirementsAmar BeheraNoch keine Bewertungen

- The Tradition of Spontaneous Order: Hayek's Insights Into Market CoordinationDokument12 SeitenThe Tradition of Spontaneous Order: Hayek's Insights Into Market CoordinationAnonymous ORqO5yNoch keine Bewertungen

- Jia Li (2022) History of Feminism and Gender Equality in Modern PhilippinesDokument12 SeitenJia Li (2022) History of Feminism and Gender Equality in Modern PhilippinesFRANCESCA LUISA GEMOTANoch keine Bewertungen

- DelegationDokument4 SeitenDelegationThandie MizeckNoch keine Bewertungen

- Finnie V Lee County 1-12Dokument67 SeitenFinnie V Lee County 1-12Anonymous HiNeTxLMNoch keine Bewertungen

- I. Appointment Letter-PermanentDokument9 SeitenI. Appointment Letter-PermanentsunilkumarchaudharyNoch keine Bewertungen

- JSA Pembuatan Dinding PenahanDokument8 SeitenJSA Pembuatan Dinding PenahanBaso Firdaus PannecceNoch keine Bewertungen

- Flexible Budget and Variances Practice Questions 3Dokument364 SeitenFlexible Budget and Variances Practice Questions 3Saram NadeemNoch keine Bewertungen

- Labor - Only ContractingDokument34 SeitenLabor - Only ContractingAnthea Louise RosinoNoch keine Bewertungen

- THE BEST LAID INCENTIVE PLAN (Group Case Study)Dokument4 SeitenTHE BEST LAID INCENTIVE PLAN (Group Case Study)Annisa NurrachmanNoch keine Bewertungen

- Balwant Rai Saluja v. Air India LTD., (2014) 9 SCC 407: Eastern Book Company Generated: Friday, November 10, 2017Dokument2 SeitenBalwant Rai Saluja v. Air India LTD., (2014) 9 SCC 407: Eastern Book Company Generated: Friday, November 10, 2017Teja Prakash chowdaryNoch keine Bewertungen

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetVon EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNoch keine Bewertungen

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindVon EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindBewertung: 5 von 5 Sternen5/5 (231)

- Profit First for Therapists: A Simple Framework for Financial FreedomVon EverandProfit First for Therapists: A Simple Framework for Financial FreedomNoch keine Bewertungen

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Von EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (12)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Von EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Bewertung: 4.5 von 5 Sternen4.5/5 (14)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantVon EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantBewertung: 4.5 von 5 Sternen4.5/5 (146)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Von EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Bewertung: 4.5 von 5 Sternen4.5/5 (5)