Beruflich Dokumente

Kultur Dokumente

Pirovano Vs de La Rama Steamship

Hochgeladen von

Kris GrubaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Pirovano Vs de La Rama Steamship

Hochgeladen von

Kris GrubaCopyright:

Verfügbare Formate

Pirovano vs. De la Rama Steamship Co.

Facts:

Enrico Pirovano became the president of the De la Rama seamship where it grew and progressed and became a multi-million corporation by the time he was executed by the Jupanese during the occupation He was married to Estefania de la Rama (one of the stockholders) and to them 4 children were born who are the plaintiffs in this case The stocks were practically owned and controlled by Don Esteban de la Rama, which he distributed among his 5 daughters including Estefania. The company had an outstanding bonded indebtedness to the National Development Company (NDC) and had all the assets of the company, plus other properties of its sister corporations as security. The outstanding bonded indebtedness was converted into non-voting preferred shares of stock of the De la Rama Company under the express condition that they would bear a fixed cumulative dividend of 6% per annum and would be redeemable within 15 yrs. This increased the representation of NDC from 2 to 4 of the 9 members of said Board of Directors In July 1946, the Board of Directors granted a resolution in favor of the minor heirs of Enrico Pirovano. o Sum of P400,000 be set aside for the minor children (from the life insurance policy that the company would receive) o Said sum of money to be convertible into 4,000 shares of stock of the Company, at par, or 1000 shares for each child. The resolution was submitted to the stockholders at a meeting properly convened and on the same day, the same was approved. Lourdes de la Rama later on found out that because the calue then of the shares of stock was actually 3.6 times their par value, the donation putporting to be only P400,000, would actually amount to a total of P1,440,000. In lieu of the amount, Mrs. Pirovano, as the guardian of the children, would have a voting power twice as much as that of her sisters. This caused Lourdes to ask for the cancellation and waiver of her preemptive rights. Don Esteban asked the corporate secretary to nullify the said resolution The board adopted a resolution changing the form of the donation of 4,000 shares of stock as originally planned into a renunciation in favor of the children of all the companys right, title, and interest as beneficiary in and to the proceeds of the life insurance policies subject to the the express condition that said proceeds shuld be retained as a loan drawing interest at 5% per annum and shall be payable after the company shall have first settled in full the balance of its present remaining bonded indebtedness to NDC Estefania, acting as guardians of her children, accepted the donation in their behalf Said donation was ratified in 1949 when the board approved of the proposition of Estefania to buy the house of New York amounting to $75,000, which would be paid from the funds held in trust belonging to the minor children. In 1950, Osmea, president of the corporation, addressed an inquiry to SEC asking for opinion regarding the validity of the donation of the proceeds of the insurance policies to the Pirovino children. SEC rendered it void because the corporation could not dispose of its assets by gift and therefore the corporation acted beyond the scope if its corporate powers. Board revoked the donation.

Issue: Whether or not the said resolution was an ultra vires act? Held: No. The grant or donation in question is remunerative in nature and was given in consideration of the services rendered by the heirs father to the corporation. The donation has already been perfected such that the corporation could no loner rescind it. It was embodied in a Board Resolution. Representatives of the corporation and even its creditors as the NDC have given their concurrence. The resolution was actually carried out when the corporation and Estefania entered into an agreement that the proceeds will be entered as a loan. Estefania accepted the donation and such was recorded by the corporation. The Board of Directors approved Estefanias purchase of the house in New York. Company stockholders formally ratified the donation. The donation was a corporate act carried out by the corporation not only with the sanction of the Board of Directors but also of its stockholders. The donation has reached a stage of perfection which is valid and binding upon the corporation and cannot be rescinded unless there exists legal grounds for doing so. The SEC opinion nor the subsequent Board Resolution are not sufficient reasons to nullify the donation.

Estefania seeks to enforce the resolution adapted by the Board and Stockholders but the company contends that the execution of the resolution was an ultra vires act and if valid, the obligation to pay is not yet due and demandable Lower court decided in favor of the minor children

The donation is also not an ultra vires act. The corporation was given broad and unlimited powers to carry out the purpose for which it was organized which includes the power to (1) invest and deal with corporate money not immediately required in such manner as from time to time may be determined (2) aid in any other manner to any person, association or corporation of which any obligation is held by this corporation. The donation undoubtedly comes within the scope of this broad power. An ultra vires act is (1) an act contrary to law, morals, or public order or contravene some rules of public policy or duty. It cannot acquire validity by performance, ratification, estoppel. It is essentially void (2) those within the scope of the Articles of Incorporation and not always illegal. It is merely voidable and may become binding and enforceable when ratified by stockholders. Since it is not contended that the donation is illegal or contrary to any of the expressed provisions of the Articles of Incorporation nor prejudicial to the creditors of the corporation, said donation even if ultra vires is not void and if voidable, its infirmity has been cured by ratification and subsequent acts of the corporation. The corporation is now estopped or prevented from contesting the validity of the donation. To allow the corporation to undo what it has done would be most unfair and contravene the well-settled doctrine that the defense of ultra vires cannot be se up or availed of in any completed transaction. NOTE: The ratification of the stockholders of the donation made is the key in this case. Because such ratification is meant to protect the contractual relationship or interest of stockholders

Das könnte Ihnen auch gefallen

- RR 4-99Dokument3 SeitenRR 4-99matinikkiNoch keine Bewertungen

- Payment Voucher OctoberDokument1 SeitePayment Voucher OctoberKris GrubaNoch keine Bewertungen

- RMC 39-2012Dokument2 SeitenRMC 39-2012Kris GrubaNoch keine Bewertungen

- E TicketDokument1 SeiteE TicketKris GrubaNoch keine Bewertungen

- Miriam College PtaDokument1 SeiteMiriam College PtaKris GrubaNoch keine Bewertungen

- Payment Voucher AugustDokument1 SeitePayment Voucher AugustKris GrubaNoch keine Bewertungen

- Boarding PassDokument1 SeiteBoarding PassKris GrubaNoch keine Bewertungen

- LedgerDokument1 SeiteLedgerKris GrubaNoch keine Bewertungen

- 50-Meralco Vs Province of LagunaDokument2 Seiten50-Meralco Vs Province of LagunaKris GrubaNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Senior Retail Bank Manager in Plano TX Resume Steven CrosbieDokument2 SeitenSenior Retail Bank Manager in Plano TX Resume Steven CrosbieStevenCrosbieNoch keine Bewertungen

- Healthsouth ScandalDokument11 SeitenHealthsouth ScandalAnshak KumarNoch keine Bewertungen

- SC's NRA Judgement On Sec.68: Threadbare Analysis of Subsequent DecisionsDokument5 SeitenSC's NRA Judgement On Sec.68: Threadbare Analysis of Subsequent DecisionsArchit ShethNoch keine Bewertungen

- Shree Cement Cimb Oct13Dokument8 SeitenShree Cement Cimb Oct13Ajit AjitabhNoch keine Bewertungen

- Common Stocks and Uncommon Profits and Other WritingsDokument13 SeitenCommon Stocks and Uncommon Profits and Other WritingsAnirbanDeshmukhNoch keine Bewertungen

- BES171 00 Gist of Eco Survey 14 ChaptersDokument30 SeitenBES171 00 Gist of Eco Survey 14 Chaptersjainrahul2910Noch keine Bewertungen

- Auditing Midterm NotesDokument25 SeitenAuditing Midterm NotesAmanda Claro0% (2)

- A Literature Review On Investors Perception TowarDokument227 SeitenA Literature Review On Investors Perception Towartilak kumar vadapalliNoch keine Bewertungen

- Liquidity and Profitability AnalysisDokument100 SeitenLiquidity and Profitability Analysisjoel john100% (1)

- Training Tuesdays: Officials Mull Fix in Indio's Terra Lago Tax FightDokument5 SeitenTraining Tuesdays: Officials Mull Fix in Indio's Terra Lago Tax FightBrian DaviesNoch keine Bewertungen

- Chapter 06 - Risk & ReturnDokument42 SeitenChapter 06 - Risk & Returnmnr81Noch keine Bewertungen

- Rapport Efficient TechnoDokument134 SeitenRapport Efficient Technosouki1Noch keine Bewertungen

- Chapter 6-The Companies Act, 2013 Incorporation of Company and Matters Incidental TheretoDokument101 SeitenChapter 6-The Companies Act, 2013 Incorporation of Company and Matters Incidental TheretoJay senthilNoch keine Bewertungen

- Financial Services in India: Basic ConceptsDokument20 SeitenFinancial Services in India: Basic Conceptsgouri khanduallNoch keine Bewertungen

- OpenMind 2010Dokument48 SeitenOpenMind 2010Venture PublishingNoch keine Bewertungen

- The Time Value MoneyDokument4 SeitenThe Time Value Moneycamilafernanda85Noch keine Bewertungen

- The Balance of Payment of IndiaDokument6 SeitenThe Balance of Payment of IndiaAby Abdul Rabb100% (1)

- 4 8 15 CPB2impactreport PDFDokument13 Seiten4 8 15 CPB2impactreport PDFShaun AdamsNoch keine Bewertungen

- Cash Flow Indirec Metode PD Mitra Revisi Upk 2016Dokument2 SeitenCash Flow Indirec Metode PD Mitra Revisi Upk 2016Faie RifaiNoch keine Bewertungen

- Cashflows For Capital BudgetingDokument1 SeiteCashflows For Capital BudgetingSaurabh KumarNoch keine Bewertungen

- 54103bos43406 p1Dokument31 Seiten54103bos43406 p1Aman GuptaNoch keine Bewertungen

- Acheson-Anthropology of FishingDokument43 SeitenAcheson-Anthropology of FishingjonavarrosNoch keine Bewertungen

- Investment Behavior of Women: A Conceptual StudyDokument8 SeitenInvestment Behavior of Women: A Conceptual StudyDr. KavitaNoch keine Bewertungen

- STRATEGYDokument22 SeitenSTRATEGYPRAGYAN PANDANoch keine Bewertungen

- MarketingDokument3 SeitenMarketingN.MUTHUKUMARANNoch keine Bewertungen

- Chapter 15 - Consolidation: Controlled Entities: Review QuestionsDokument13 SeitenChapter 15 - Consolidation: Controlled Entities: Review QuestionsShek Kwun Hei100% (1)

- Akuntansi Keuangan Lanjutan: Laba Atas Transaksi Antarperusahaan - Persediaan P5-6 DAN P5-7Dokument5 SeitenAkuntansi Keuangan Lanjutan: Laba Atas Transaksi Antarperusahaan - Persediaan P5-6 DAN P5-7doniNoch keine Bewertungen

- 20132014ProposedBudget Sep19 9pmDokument765 Seiten20132014ProposedBudget Sep19 9pmChs BlogNoch keine Bewertungen

- SWOT AnalysisDokument13 SeitenSWOT AnalysisAkshat Kaul100% (2)

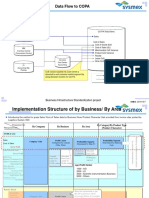

- Data Flow To COPA: Business Infrastructure Standardization ProjectDokument3 SeitenData Flow To COPA: Business Infrastructure Standardization ProjectT SAIKIRANNoch keine Bewertungen