Beruflich Dokumente

Kultur Dokumente

Results Tracker 17.07.2012

Hochgeladen von

Mansukh Investment & Trading SolutionsOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Results Tracker 17.07.2012

Hochgeladen von

Mansukh Investment & Trading SolutionsCopyright:

Verfügbare Formate

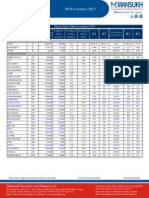

Results Tracker

Q1FY13

Tuesday, 17 July 2012 make more, for sure.

Results to be Declared on Tuesday, 17th July 2012

COMPANIES NAME

Automotive Stamp Axis Bank Bajaj Finserv BAJFINANCE GIC Housing GMM Pfaudler Hercules Hoist Jindal Hotels Kirloskar Pneu Kitex Garments Oriental Hotels Premier Poly Sungold Cap Triveni Turbine

Results Announced on 16th July 2012 (Rs Million)

South Indian Bank

Quarter ended 201206 Interest Earned Other Income Interest Expended Operating Expenses Operating Profit Prov.& Contigencies Tax PAT Equity OPM 10694.3 749.8 7726.5 1642.7 0 253.9 590.6 1230.4 1135 19.4 201106 7687.2 516.3 5637.5 1642.7 0 208.4 398.1 824.9 1130.1 18.62 % Var 39.12 45.23 37.06 44.78 0 21.83 48.35 49.16 0.43 4.2 Year to Date 201206 10694.3 749.8 7726.5 1642.7 0 253.9 590.6 1230.4 1135 19.4 201106 7687.2 516.3 5637.5 1134.6 0 208.4 398.1 824.9 1130.1 18.62 % Var 39.12 45.23 37.06 44.78 0 21.83 48.35 49.16 0.43 4.2 Year ended 201203 35834.3 2470.7 25616.9 6172.9 0 791.8 1706.9 4016.5 1133.7 18.18 201103 24460.1 1966.9 16549.2 4625.4 0 797.5 1529.3 2925.6 1130.1 21.47 % Var 46.5 25.61 54.79 33.46 0 -0.71 11.61 37.29 0.32 -15.33

The sales figure stood at Rs. 10694.30 millions for the June 2012 quarter. The mentioned figure indicates a growth of about 39.12% as compared to Rs. 7687.20 millions during the year-ago period.An average growth of 49.16% was recorded for the quarter ended June 2012 to Rs. 1230.40 millions from Rs. 824.90 millions.

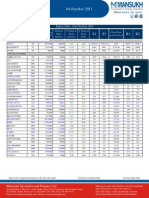

Castrol India

Quarter ended 201206 201106 8544 7932 131 1856 3 1853 60 1793 584 0 1209 2473 18.79 194 2182 2 2180 63 2117 692 0 1425 2473 23.99 % Var 7.72 -32.47 -14.94 50 -15 -4.76 -15.3 -15.61 0 -15.16 0 -21.66 Year to Date 201206 16387 440 3759 10 3749 120 3629 1191 0 2438 2473 22.94 201106 15464 472 4279 6 4273 126 4147 1356 0 2791 2473 27.67 % Var 5.97 -6.78 -12.15 66.67 -12.26 -4.76 -12.49 -12.17 0 -12.65 0 -17.1 Year ended 201112 29932 731 7429 19 7410 251 7159 2349 0 4810 2473 21.6 201012 27429 313 7645 24 7621 243 7378 2475 0 4903 2473 24.29 % Var 9.13 133.55 -2.83 -20.83 -2.77 3.29 -2.97 -5.09 0 -1.9 0 -11.08

Sales Other Income PBIDT Interest PBDT Depreciation PBT TAX Deferred Tax PAT Equity PBIDTM(%)

A fair growth of 7.72% in the revenue at Rs. 8544.00 millions was reported in the June 2012 quarter as compared to Rs. 7932.00 millions during year-ago period.Net profit declined -15.16% to Rs. 1209.00 millions from Rs. 1425.00 millions.Operating Profit reported a sharp decline to 1856.00 millions from 2182.00 millions in the corresponding previous quarter.

Please refer to important disclosures at the end of this report

For Private circulation Only

For Our Clients Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431 PMS Regn No. INP000002387

Results Tracker

Q1FY13 make more, for sure.

Data Source : ACE Equity

NAME

Varun Gupta Pashupati Nath Jha Vikram Singh

DESIGNATION

Head - Research Research Analyst Research Analyst

E-MAIL

varungupta@moneysukh.com pashupatinathjha@moneysukh.com vikram_research@moneysukh.com

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Mansukh Securities and Finance Ltd (hereinafter referred as MSFL) is not soliciting any action based on it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any person in any form. The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete. MSFL or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MSFL or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and noninfringement. The recipients of this report should rely on their own investigations. MSFL and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. This information is subject to change without any prior notice. MSFL reserves the right to make modifications and alterations to this statement as may be required from time to time. Nevertheless, MSFL is committed to providing independent and transparent recommendations to its clients, and would be happy to provide information in response to specific client queries.

Please refer to important disclosures at the end of this report

For Private circulation Only

For Our Clients Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431 PMS Regn No. INP000002387

Das könnte Ihnen auch gefallen

- Results Tracker 18.07.2012Dokument2 SeitenResults Tracker 18.07.2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker 12.07.2012Dokument2 SeitenResults Tracker 12.07.2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker 11.07.2012Dokument2 SeitenResults Tracker 11.07.2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker 10.07.2012Dokument2 SeitenResults Tracker 10.07.2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker 10.01.13Dokument2 SeitenResults Tracker 10.01.13Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker 12.01.12Dokument2 SeitenResults Tracker 12.01.12Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Q2FY12 Results Tracker 13.10.11Dokument2 SeitenQ2FY12 Results Tracker 13.10.11Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Friday, 03 Aug 2012Dokument4 SeitenResults Tracker: Friday, 03 Aug 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Saturday, 14 July 2012Dokument4 SeitenResults Tracker: Saturday, 14 July 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker: Thursday, 19 July 2012Dokument4 SeitenResults Tracker: Thursday, 19 July 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker 18 August 2011Dokument3 SeitenResults Tracker 18 August 2011Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Daily Technical Report: Sensex (16846) / NIFTY (5110)Dokument4 SeitenDaily Technical Report: Sensex (16846) / NIFTY (5110)Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17279) / NIFTY (5243)Dokument4 SeitenDaily Technical Report: Sensex (17279) / NIFTY (5243)Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (16918) / NIFTY (5128)Dokument4 SeitenDaily Technical Report: Sensex (16918) / NIFTY (5128)angelbrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17185) / NIFTY (5216)Dokument4 SeitenDaily Technical Report: Sensex (17185) / NIFTY (5216)angelbrokingNoch keine Bewertungen

- Results Tracker: Wednesday, 08 Aug 2012Dokument4 SeitenResults Tracker: Wednesday, 08 Aug 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Daily Technical Report: Sensex (16640) / NIFTY (5043)Dokument4 SeitenDaily Technical Report: Sensex (16640) / NIFTY (5043)Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (16897) / NIFTY (5121)Dokument4 SeitenDaily Technical Report: Sensex (16897) / NIFTY (5121)Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17214) / NIFTY (5227)Dokument4 SeitenDaily Technical Report: Sensex (17214) / NIFTY (5227)Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17105) / NIFTY (5193)Dokument4 SeitenDaily Technical Report: Sensex (17105) / NIFTY (5193)angelbrokingNoch keine Bewertungen

- Results Tracker 21.04.12Dokument3 SeitenResults Tracker 21.04.12Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Accounts AssignmentDokument15 SeitenAccounts AssignmentGagandeep SinghNoch keine Bewertungen

- Results Tracker: Saturday, 28 July 2012Dokument13 SeitenResults Tracker: Saturday, 28 July 2012Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Daily Technical Report: Sensex (17103) / NIFTY (5197)Dokument4 SeitenDaily Technical Report: Sensex (17103) / NIFTY (5197)Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (16913) / NIFTY (5114)Dokument4 SeitenDaily Technical Report: Sensex (16913) / NIFTY (5114)Angel BrokingNoch keine Bewertungen

- HDFCDokument78 SeitenHDFCsam04050Noch keine Bewertungen

- Daily Technical Report: Sensex (16882) / NIFTY (5115)Dokument4 SeitenDaily Technical Report: Sensex (16882) / NIFTY (5115)Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (16719) / NIFTY (5068)Dokument4 SeitenDaily Technical Report: Sensex (16719) / NIFTY (5068)Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17158) / NIFTY (5205)Dokument4 SeitenDaily Technical Report: Sensex (17158) / NIFTY (5205)angelbrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (16860) / NIFTY (5104)Dokument4 SeitenDaily Technical Report: Sensex (16860) / NIFTY (5104)Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (16907) / NIFTY (5121)Dokument4 SeitenDaily Technical Report: Sensex (16907) / NIFTY (5121)Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 24.07.2013Dokument4 SeitenDaily Technical Report, 24.07.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (16991) / NIFTY (5149)Dokument4 SeitenDaily Technical Report: Sensex (16991) / NIFTY (5149)Angel BrokingNoch keine Bewertungen

- GmmpfaudlerDokument16 SeitenGmmpfaudlerJay PatelNoch keine Bewertungen

- Daily Technical Report: Sensex (16968) / NIFTY (5142)Dokument4 SeitenDaily Technical Report: Sensex (16968) / NIFTY (5142)Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 02.11.2012Dokument4 SeitenTechnical Format With Stock 02.11.2012Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 06.09Dokument4 SeitenTechnical Format With Stock 06.09Angel BrokingNoch keine Bewertungen

- Cebbco Spa 030412Dokument3 SeitenCebbco Spa 030412RavenrageNoch keine Bewertungen

- Technical Report 7th March 2012Dokument5 SeitenTechnical Report 7th March 2012Angel BrokingNoch keine Bewertungen

- Daily Equity Newsletter: Indian MarketDokument4 SeitenDaily Equity Newsletter: Indian Marketapi-196234891Noch keine Bewertungen

- Daily Technical Report: Sensex (16219) / NIFTY (4924)Dokument4 SeitenDaily Technical Report: Sensex (16219) / NIFTY (4924)Angel BrokingNoch keine Bewertungen

- Results Tracker: Tuesday, 18 Oct 2011Dokument4 SeitenResults Tracker: Tuesday, 18 Oct 2011Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- HDFC Bank AnnualReport 2012 13Dokument180 SeitenHDFC Bank AnnualReport 2012 13Rohan BahriNoch keine Bewertungen

- Daily Technical Report: Sensex (16881) / NIFTY (5121)Dokument4 SeitenDaily Technical Report: Sensex (16881) / NIFTY (5121)Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 21.05.2013Dokument4 SeitenDaily Technical Report, 21.05.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17033) / NIFTY (5165)Dokument4 SeitenDaily Technical Report: Sensex (17033) / NIFTY (5165)Angel BrokingNoch keine Bewertungen

- Stock Update Housing Development Finance Corporation: IndexDokument5 SeitenStock Update Housing Development Finance Corporation: IndexRajasekhar Reddy AnekalluNoch keine Bewertungen

- Daily Technical Report: Sensex (17657) / NIFTY (5363)Dokument4 SeitenDaily Technical Report: Sensex (17657) / NIFTY (5363)Angel BrokingNoch keine Bewertungen

- Daily Derivative Report 11.09.13Dokument3 SeitenDaily Derivative Report 11.09.13Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Technical Report 15th May 2012Dokument4 SeitenTechnical Report 15th May 2012Angel BrokingNoch keine Bewertungen

- Annual Report 2010 11Dokument80 SeitenAnnual Report 2010 11infhraNoch keine Bewertungen

- Technical Report 26th April 2012Dokument5 SeitenTechnical Report 26th April 2012Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17491) / NIFTY (5288)Dokument4 SeitenDaily Technical Report: Sensex (17491) / NIFTY (5288)Angel BrokingNoch keine Bewertungen

- Price To Book Value Stocks 161008Dokument2 SeitenPrice To Book Value Stocks 161008Adil HarianawalaNoch keine Bewertungen

- Daily Technical Report: Sensex (17489) / NIFTY (5306)Dokument4 SeitenDaily Technical Report: Sensex (17489) / NIFTY (5306)angelbrokingNoch keine Bewertungen

- Daily Technical Report: FormationDokument5 SeitenDaily Technical Report: FormationAngel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17633) / NIFTY (5348)Dokument4 SeitenDaily Technical Report: Sensex (17633) / NIFTY (5348)Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (15948) / NIFTY (4836)Dokument4 SeitenDaily Technical Report: Sensex (15948) / NIFTY (4836)Angel BrokingNoch keine Bewertungen

- Technical Report 30th September 2011Dokument3 SeitenTechnical Report 30th September 2011Angel BrokingNoch keine Bewertungen

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsVon EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNoch keine Bewertungen

- Results Tracker 08.11.2013Dokument3 SeitenResults Tracker 08.11.2013Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker 09.11.2013Dokument3 SeitenResults Tracker 09.11.2013Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Results Tracker 07.11.2013Dokument3 SeitenResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 07 November 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 07 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 08 November 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 08 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 31 October 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 31 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 30 October 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 30 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 08 October 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 08 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 25 October 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 25 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 28 October 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 28 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokument5 SeitenF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Derivative 24 October 2013 by Mansukh Investment and Trading SolutionDokument3 SeitenDerivative 24 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Equity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionDokument3 SeitenEquity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Walkie TalkieDokument1 SeiteWalkie TalkieYohan RahmadaniNoch keine Bewertungen

- 13 Areas of Assessment 3yrs OldDokument2 Seiten13 Areas of Assessment 3yrs OldLegendX100% (2)

- Music Assignment 1Dokument3 SeitenMusic Assignment 1Rubina Devi DHOOMUNNoch keine Bewertungen

- Ration Analysis: 7.3 Parties Interested in Ratio AnalysisDokument17 SeitenRation Analysis: 7.3 Parties Interested in Ratio AnalysisMuhammad NoumanNoch keine Bewertungen

- Series: Instruction ManualDokument10 SeitenSeries: Instruction Manualjbernal89Noch keine Bewertungen

- Arch DamsDokument24 SeitenArch DamsChalang AkramNoch keine Bewertungen

- Folletos de BibliotecaDokument2 SeitenFolletos de BibliotecaCFBISDNoch keine Bewertungen

- KatalogDokument732 SeitenKatalogNebulle WebDesignNoch keine Bewertungen

- SikafloorMultiFlexPB-21-certificare OS13Dokument4 SeitenSikafloorMultiFlexPB-21-certificare OS13George EnescuNoch keine Bewertungen

- 12th Five - Year Plan 2012 - 2017Dokument3 Seiten12th Five - Year Plan 2012 - 2017workingaboNoch keine Bewertungen

- Tle-Computer Systems SERVICING (Grade 10) : First Quarter - Module 1 Elements of ComputerDokument9 SeitenTle-Computer Systems SERVICING (Grade 10) : First Quarter - Module 1 Elements of ComputerQuerl Manzano SarabiaNoch keine Bewertungen

- 2.Trần Hưng Đạo Bình ThuậnDokument18 Seiten2.Trần Hưng Đạo Bình ThuậnHa HoangNoch keine Bewertungen

- What Is Meant by WBS Element and in What ScenarioDokument2 SeitenWhat Is Meant by WBS Element and in What ScenariokvreddyNoch keine Bewertungen

- Test Study On The Fatigue Performance of HSS For Steel WheelsDokument4 SeitenTest Study On The Fatigue Performance of HSS For Steel WheelsdamlaNoch keine Bewertungen

- NERVOUS SYSTEM CHEMICAL INTERMEDIARIESDokument40 SeitenNERVOUS SYSTEM CHEMICAL INTERMEDIARIESPopa NicuNoch keine Bewertungen

- Valvulas MotorizadasDokument3 SeitenValvulas MotorizadasvicmanolNoch keine Bewertungen

- Models HL300 & HL400 ML-134351 ML-134348: 701 S. RIDGE AVENUE TROY, OHIO 45374-0001Dokument24 SeitenModels HL300 & HL400 ML-134351 ML-134348: 701 S. RIDGE AVENUE TROY, OHIO 45374-0001ZackyExlipzNoch keine Bewertungen

- 15 Pawn FormationsDokument11 Seiten15 Pawn FormationsCMCNoch keine Bewertungen

- Mary Slessor of Calabar: Pioneer Missionary by Livingstone, W. P.Dokument231 SeitenMary Slessor of Calabar: Pioneer Missionary by Livingstone, W. P.Gutenberg.orgNoch keine Bewertungen

- Impact of Monetary Incentives On Employees' Performance in Federal Polytechnic NasarawaDokument45 SeitenImpact of Monetary Incentives On Employees' Performance in Federal Polytechnic NasarawaChida EzekielNoch keine Bewertungen

- Case Study 4: Rescuing NissanDokument3 SeitenCase Study 4: Rescuing NissanAngel GondaNoch keine Bewertungen

- WM8731Dokument6 SeitenWM8731Pradeep Jagathratchagan0% (1)

- ITCT - Syllabus - 245052Dokument8 SeitenITCT - Syllabus - 245052Ravi KumarNoch keine Bewertungen

- Ojt Polvoron Rimpy-BgDokument5 SeitenOjt Polvoron Rimpy-BgBilly JoeNoch keine Bewertungen

- SAP Simple Finance - Chantal Rivard - PD Week 2014Dokument16 SeitenSAP Simple Finance - Chantal Rivard - PD Week 2014antonio_abbateNoch keine Bewertungen

- Professional Practice ManagementDokument3 SeitenProfessional Practice ManagementMohit GuptaNoch keine Bewertungen

- Passengers' Perspective of Philippine Airlines Within Nueva EcijaDokument15 SeitenPassengers' Perspective of Philippine Airlines Within Nueva EcijaPoonam KilaniyaNoch keine Bewertungen

- Assignment - JP Morgan Chase & Co.Dokument32 SeitenAssignment - JP Morgan Chase & Co.ShivamNoch keine Bewertungen

- Carbide Burrs: High Performance Cutting ToolsDokument30 SeitenCarbide Burrs: High Performance Cutting ToolsVigneswaranNoch keine Bewertungen

- Fundamentals of Gymnastics Group 1Dokument35 SeitenFundamentals of Gymnastics Group 1Precious LuntayaoNoch keine Bewertungen