Beruflich Dokumente

Kultur Dokumente

(MBAskool) Aditya Jandial - The'I' Transplant at BRICS

Hochgeladen von

Aditya JandialOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

(MBAskool) Aditya Jandial - The'I' Transplant at BRICS

Hochgeladen von

Aditya JandialCopyright:

Verfügbare Formate

2012

Symbiosis Institute of Business Management Pune Aditya Jandial MBA I Finance

THE I TRANSPLANT AT BRICS

MBA skool May 2012 Contents Introduction............................................................................................................. 3 The Great Indian Story:............................................................................................4 The Rise of a new I - Indonesia...............................................................................5 Counter Point........................................................................................................... 6 Conclusion............................................................................................................... 7 Annexure:................................................................................................................ 8 Credit Suisse Comparative analysis:......................................................................8 India Performance: 2011 v/s 2012 as compared to Indonesia:...............................9 ............................................................................................................................. 9 BRICS v/s Indonesia..............................................................................................9 Works Cited............................................................................................................... 10

MBA skool May 2012

Introduction

BRIC countries or the BRIC nations, evolved as a famous acronym in the 2001 paper entitled "Building Better Global Economic BRICs" by Jim O'Neill, Chairman Goldman Sachs. The acronym was first used to signify a set of countries that had the capability of being the next superpowers by 2050. The countries namely Brazil, Russia, India and China were the rising superpowers which had the infrastructure, required resources, the global confidence and above all a strong rising monetary muscle. This evolution came at the time when the global economy was shifting poles from a unipolar U.S economy to a much diverse multi-polar world. Another addition came to the group transforming it to BRICS in 2010, with South Africa joining the elite group. The story of the BRICS since its inception has been built on the strong economic ties amongst the countries who lead the global table in terms of rising GDP and growth rate. The driving forces for a strong BRICS cooperation were similar cultural and economic factors: Higher performing markets Availability of low cost resources Oppression during the pre-independence periods Rise of the middle class High Foreign inflows (FDI/FII) Huge demand at their backyards Changing demographics Shift from Agricultural society

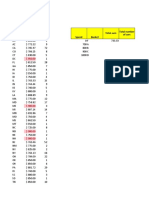

Following is the global ranking analysis of the BRIC nations in terms of the factors considered during BRIC formation, based on 2011 data: Brazil GDP (Nominal) GDP (PPP) GDP growth Rate Population Rail Network Road Network Literacy Rate Labor Force Electricity Consumption Internet Users Population growth Rate Exports Imports FDI Received (2010 CIA) External Debt Military Expenditure Current Account deficit 6 7 115 5 10 4 50 5 10 5 107 22 20 12 25 11 187 Russia 9 6 87 6 2 7 5 6 5 7 221 9 17 16 22 3 4 India 11 3 13 2 4 3 78 2 3 4 90 19 10 22 27 8 186 China 2 2 6 1 3 2 22 1 1 1 167 1 2 8 18 2 1 South Africa 29 25 108 34 12 18 58 34 16 44 158 41 41 39 42 43 1771

Data Cited from Reports of World Bank, CIA World fact book 2011, IMF 2011, SIPRI yearbook, International Union of Railways.

MBA skool May 2012 The Great Indian Story: Post liberalization in 1991, India had its eyes set on the world markets. By late 1990s Indian markets were free totally prone to trade in the International circle. The advances made by India post liberalization are evident from the following facts:

The period between 2004 and 2008 is considered the golden age for Indian economy. An economist from CIA called it as a period- Where nothing could go back for the country. The Indian economy was booming and this created ripples throughout the globe. The high returns at the stock exchanges, backed by strong GDP growth which was hovering at around 8%, pulled in money all over the globe and this was at a time when real INDIA shining came in front of the globe. The strong regulation of the Indian economic system also made it a haven for global currency during the 2008 subprime. Although the global economy was shrinking, India along with China had their GDPs growing at a nearly double digit rate. Post the 2008 crisis, a lot of the currency was pulled out of India which was where the decline of the great Indian story started. The recovery was back on track with the end of 2009 with the global economy once again on the cross roads of progress. The end of the first decade of new millennium was marred by a number of issues that saw the global markets decline: 1) The Greek and Euro Debt crisis 2) The U.S debt ceiling

1

Data cited from Wikipedia article on Indian Globalization

MBA skool May 2012 3) 4) 5) 6) The Jasmine Revolution in the middle east Tsunami in Japan, leading to interruption in output Rising petroleum prices that shook up to $125/barrel The loss of confidence in markets because of Credit degrades

These global factors were further coupled with indigenous issues back home: 1) High demand pull inflation leading to STAGFLATION 2) Political limbo on decision making 3) Global stress on Corruption 4) Rising Imports and falling output 5) Currency Depreciation 6) Credit Degrade of Banking system 7) High exposure to European unions All these factors have contributed to creating a negative sentiment amongst global investors regarding the growth of their money in India. As a result India is losing out the comparative edge it was supposed to have in the early 2000s. The Rise of a new I - Indonesia Post 2010, if we have a look at the comparative analysis of the BRICS, India has suffered the most severe blows in terms of currency decline, market returns, FDI/FII inflows, crowding out of private companies, declining IIP, the widening current deficit have also struck down its position in the global market. Following the lean patch there have been talks of India losing down its position amongst its peers at BRICS. One such headline is the rise of a fellow South Asian neighbor- Indonesia which has been a favorite with the global investors because of the following factors: 1) The Bombay Stock Exchange Sensex (BSE) has fallen by around 25%, the steepest for a BRICS country whereas the Jakarta exchange grew by over 3%. 2) The Rupee slid around 20% compared to foreign currency since August 2011. 3) The Indian growth rate has slipped to below 7%. Lowest in 3 years while Indonesia has also entered the 6% growth window 4) India has the widest fiscal deficit target of above 5% amongst BRICS, while Brazil has just 1.2% 5) Around $403 million have been pulled out of Indian equity markets in April, according to Reuters 6) Indonesia`s current account deficit in 2012 will be 0.8% of GDP, while India`s will come in at around 3.9%.2 7) Net Foreign Direct Investment (FDI) will offset the current account deficit while in India`s case, an estimated net FDI inflow of USD 15-20 billion will be well short of the current account deficit. 8) The investment grade given to India in 2007 by credit agencies is under threat, while Indonesia has been awarded the investment grade last December by Fitch and Moodys. 9) The confidence of global leaders on BREAKOUT nations including Indonesia, Poland, Thailand etc.

2

CLSA economic report 2011

MBA skool May 2012 10) The Bond Yield on the Indonesian benchmark bonds and equities have rallied across the Indian counterpart throughout 2011. ( Refer Annexure A) So, it is clear from the facts disclosed above by some of the leading economists and credit agencies, that no doubt India has been hit deep by the ongoing crisis as compared to the rest of the world while Indonesia has made it up the ladder

Counter Point

Although there have been suggestions of Indonesia overtaking the Indian juggernaut, there are factors that point that the Indian tiger is there to stay. The points mentioned here show that, may be India has been a bit slow in the recent phase but it is still beyond the reach of Indonesia at least in the near future. 1) Size does matter, a 7% growth rate for $1.67 trillion economy is a much stronger sign that a$840 billion economy. 2) India is much ahead of Indonesia in terms of population which acts as a source of labor as well as demand rise 3) The Indian market is far different than the Indonesian market, while the former is a service economy latter has a domination of commodities. 4) The cost of living index in Indonesia is far higher than in India, as seen in the data below:

Mumbai Consumer Prices Rent Price (1 BHK in city centre) Internet Prices (6MBPS, unlimited data, Cable ADSL) Cost of Living index $509 $19 38.2

Jakarta Higher (by 65%) $715 33.35 64.3

5) The investment horizon in BRICs is 20 years which is sufficiently large for a country like India to make up.

MBA skool May 2012

6) The tighter monetary regulations have been the stand out point amongst both countries. 7) Indonesia needs to root out corruption, since a country with pervasive corruption cannot hope to become a dynamic and prosperous country. 8) Indonesia needs to works on building a world class infrastructure which seems missing from the picture. 9) The projections for India in 2012 are much better than 2011 and compared to 2011 ( Refer Annexure B) 10) Compared to other BRIC countries, the level Income levels in Indonesia are far below the Indian levels. (Refer to annexure C)

Conclusion

Inflation Rates of India v/s Indonesia :Credit Suisse Report

MBA skool May 2012

Annexure:

Credit Suisse Comparative analysis:

http://blogs.ft.com/beyond-brics/2011/05/19/india-vs-indonesia-which-is-more-at-risk-from-inflation/

MBA skool May 2012 India Performance: 2011 v/s 2012 as compared to Indonesia:

BRICS v/s Indonesia

Citi Research Analysis Unit http://www.globalsherpa.org/bric-emerging-market-research-china-brazil-india

MBA skool May 2012

Works Cited

1) 2) 3) 4) 5) 6) 7) 8) http://www.imf.org/external/pubs/ft/ar/2011/eng/index.htm https://www.cia.gov/library/publications/the-world-factbook www.wikipedia.org/wiki/BRIC www.moneycontrol.com https://www.cia.gov/library/publications/the-world-factbook/geos/iz.html www.business-standard.com/india/news/falling-bric/463828 www.globalsherpa.org/bric-emerging-market-research-china-brazil-india. http://blogs.ft.com/beyond-brics/2011/05/19/india-vs-indonesia-which-is-more-at-riskfrom-inflation/

10

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Batman Animated (1998) (Scan) (Stacalkas)Dokument169 SeitenBatman Animated (1998) (Scan) (Stacalkas)João Gabriel Zó100% (11)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Baixar Livro Draw With Jazza Creating Characters de Josiah Broo PDFDokument5 SeitenBaixar Livro Draw With Jazza Creating Characters de Josiah Broo PDFCarlos Mendoza25% (4)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- D. Michael Quinn-Same-Sex Dynamics Among Nineteenth-Century Americans - A MORMON EXAMPLE-University of Illinois Press (2001)Dokument500 SeitenD. Michael Quinn-Same-Sex Dynamics Among Nineteenth-Century Americans - A MORMON EXAMPLE-University of Illinois Press (2001)xavirreta100% (3)

- Isolated Foundation PDFDokument6 SeitenIsolated Foundation PDFsoroware100% (1)

- 2nd Quarter Exam All Source g12Dokument314 Seiten2nd Quarter Exam All Source g12Bobo Ka100% (1)

- Ancient Egyptian TimelineDokument5 SeitenAncient Egyptian TimelineMariz Miho100% (2)

- The Carlton Polish CompanyDokument9 SeitenThe Carlton Polish CompanyAditya Jandial100% (1)

- Honest Tea: Identification of Financing Source (Venture Capital or Angel Investing)Dokument7 SeitenHonest Tea: Identification of Financing Source (Venture Capital or Angel Investing)Aditya JandialNoch keine Bewertungen

- Discounted Cash FlowDokument9 SeitenDiscounted Cash FlowAditya JandialNoch keine Bewertungen

- Assignment - Session 8Dokument20 SeitenAssignment - Session 8Aditya JandialNoch keine Bewertungen

- PLIMSOLDokument4 SeitenPLIMSOLAditya JandialNoch keine Bewertungen

- Explain Any Three Reasons As To What Considerations Managers' Should Take Into Account For Proper Layout Decisions'Dokument6 SeitenExplain Any Three Reasons As To What Considerations Managers' Should Take Into Account For Proper Layout Decisions'Aditya JandialNoch keine Bewertungen

- AssignmentData1 - With AnalysisDokument28 SeitenAssignmentData1 - With AnalysisAditya JandialNoch keine Bewertungen

- Economic Order Quantity (EOQ) Answer SampleDokument2 SeitenEconomic Order Quantity (EOQ) Answer SampleAditya JandialNoch keine Bewertungen

- Operation - ExamDokument10 SeitenOperation - ExamAditya JandialNoch keine Bewertungen

- SolutionDokument5 SeitenSolutionAditya JandialNoch keine Bewertungen

- FINA 408 Individual Project Fall 2017 Outline - FINALDokument3 SeitenFINA 408 Individual Project Fall 2017 Outline - FINALAditya JandialNoch keine Bewertungen

- Costco - 5 ForcesDokument2 SeitenCostco - 5 ForcesAditya JandialNoch keine Bewertungen

- Vinand Kumar Verma: Experience SummaryDokument3 SeitenVinand Kumar Verma: Experience SummaryAditya JandialNoch keine Bewertungen

- Managerial Accounitng Project InstructionsDokument3 SeitenManagerial Accounitng Project InstructionsAditya JandialNoch keine Bewertungen

- Tesla - Valuation and Company ProfileDokument29 SeitenTesla - Valuation and Company ProfileAditya JandialNoch keine Bewertungen

- Case Study Evaluation Criteria - MG315 - Summer 2 2019Dokument2 SeitenCase Study Evaluation Criteria - MG315 - Summer 2 2019Aditya JandialNoch keine Bewertungen

- Case Study InstructionsDokument2 SeitenCase Study InstructionsAditya JandialNoch keine Bewertungen

- The Truman Show - AdityaDokument3 SeitenThe Truman Show - AdityaAditya JandialNoch keine Bewertungen

- Bakery Management SynopsisDokument13 SeitenBakery Management SynopsisSHiVaM KRNoch keine Bewertungen

- E-Governance Horizon Report 2007 PDFDokument240 SeitenE-Governance Horizon Report 2007 PDFtouhedurNoch keine Bewertungen

- Case 3 GROUP-6Dokument3 SeitenCase 3 GROUP-6Inieco RacheleNoch keine Bewertungen

- Rata-Blanca-La Danza Del FuegoDokument14 SeitenRata-Blanca-La Danza Del FuegoWalter AcevedoNoch keine Bewertungen

- EEN 203 Slide Notes Year 2018: PART I - Numbers and CodesDokument78 SeitenEEN 203 Slide Notes Year 2018: PART I - Numbers and CodesSHIVAM CHOPRANoch keine Bewertungen

- Quizo Yupanqui StoryDokument8 SeitenQuizo Yupanqui StoryrickfrombrooklynNoch keine Bewertungen

- Peer-to-Peer Lending Using BlockchainDokument22 SeitenPeer-to-Peer Lending Using BlockchainLuis QuevedoNoch keine Bewertungen

- Agitha Diva Winampi - Childhood MemoriesDokument2 SeitenAgitha Diva Winampi - Childhood MemoriesAgitha Diva WinampiNoch keine Bewertungen

- Index-Formal Spoken Arabic Dialogue - Al Kitaab Based - MSA - From Langmedia Five CollegesDokument5 SeitenIndex-Formal Spoken Arabic Dialogue - Al Kitaab Based - MSA - From Langmedia Five CollegesD.ElderNoch keine Bewertungen

- WRAP HandbookDokument63 SeitenWRAP Handbookzoomerfins220% (1)

- Adobe Scan Sep 06, 2023Dokument1 SeiteAdobe Scan Sep 06, 2023ANkit Singh MaanNoch keine Bewertungen

- Chapter 14ADokument52 SeitenChapter 14Arajan35Noch keine Bewertungen

- DB - Empirically Based TheoriesDokument3 SeitenDB - Empirically Based TheoriesKayliah BaskervilleNoch keine Bewertungen

- Types of Vegetation in Western EuropeDokument12 SeitenTypes of Vegetation in Western EuropeChemutai EzekielNoch keine Bewertungen

- National Healthy Lifestyle ProgramDokument6 SeitenNational Healthy Lifestyle Programmale nurseNoch keine Bewertungen

- Novi Hervianti Putri - A1E015047Dokument2 SeitenNovi Hervianti Putri - A1E015047Novi Hervianti PutriNoch keine Bewertungen

- Title: Daily Visit Report: SDL Mini - Project Academic Year 2020-21 Group ID:GB6Dokument2 SeitenTitle: Daily Visit Report: SDL Mini - Project Academic Year 2020-21 Group ID:GB6Arjuna JppNoch keine Bewertungen

- Apush Leq Rubric (Long Essay Question) Contextualization (1 Point)Dokument1 SeiteApush Leq Rubric (Long Essay Question) Contextualization (1 Point)Priscilla RayonNoch keine Bewertungen

- Knowledge, Attitude and Practice of Non-Allied Health Sciences Students of Southwestern University Phinma During The Covid-19 PandemicDokument81 SeitenKnowledge, Attitude and Practice of Non-Allied Health Sciences Students of Southwestern University Phinma During The Covid-19 Pandemicgeorgemayhew1030Noch keine Bewertungen

- HitchjikersGuide v1Dokument126 SeitenHitchjikersGuide v1ArushiNoch keine Bewertungen

- 6977 - Read and Answer The WorksheetDokument1 Seite6977 - Read and Answer The Worksheetmohamad aliNoch keine Bewertungen

- Sikarep® Microcrete-4: Product Data SheetDokument2 SeitenSikarep® Microcrete-4: Product Data Sheetsidharthsud28Noch keine Bewertungen

- Tim Horton's Case StudyDokument8 SeitenTim Horton's Case Studyhiba harizNoch keine Bewertungen

- Bike Chasis DesignDokument7 SeitenBike Chasis Designparth sarthyNoch keine Bewertungen