Beruflich Dokumente

Kultur Dokumente

EIOPA-OPSG-12-06 Feedback Statement On EC White Paper On Pensions

Hochgeladen von

pensiontalkOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

EIOPA-OPSG-12-06 Feedback Statement On EC White Paper On Pensions

Hochgeladen von

pensiontalkCopyright:

Verfügbare Formate

EIOPA OCCUPATIONAL PENSIONS STAKEHOLDER GROUP FEEDBACK STATEMENT EUROPEAN COMMISSION WHITE PAPER AN AGENDA FOR ADEQUATE, SAFE

E AND SUSTAINABLE PENSIONS _______________________________________________________________________________

EIOPA-OPSG-12-06

04 July 2012

OPSG Feedback Statement on European Commission White Paper An Agenda for Adequate, Safe and Sustainable Pensions (COM(2012) 55 final, 16 February 2012)

1/11

EIOPA OCCUPATIONAL PENSIONS STAKEHOLDER GROUP FEEDBACK STATEMENT EUROPEAN COMMISSION WHITE PAPER AN AGENDA FOR ADEQUATE, SAFE AND SUSTAINABLE PENSIONS

The Pension Challenge

The population in Europe is ageing. The number of people of prime working age (20-59) will fall every year over the coming decades. This fact will have far-reaching economic and budgetary consequences in the EU, reducing the economic growth potential and exercising pressure on public finances. The current fiscal and economic crisis is aggravating the prospects. Low economic growth, budget deficits, debt burdens, financial instability and low employment have made it harder for pension schemes to deliver on pension promises. Pay-as-you-go pension schemes are affected by falling employment, and hence lower pension contributions. Funded schemes are affected by falling assets values and reduced returns. The Commission raised a large number of questions in relation to this challenge in the Green Paper Towards adequate, sustainable and safe European pension systems (COM(2010)365 final, 7 July 2010). The Commission answer came in the White Paper An Agenda for Adequate, Safe and Sustainable Pensions (COM(2012)55 final, 16 February 2012). In the White Paper the Commission tables an analysis followed by 20 EU initiatives in support of Member State efforts. At the crux of the analysis and the initiatives is the fact that economic and demographic pressure on governments for a long period will make them ill equipped to deliver the pensions hitherto expected (pillar 1 pensions). As a consequence citizens will have to make their own arrangements to be sure that they will get the benefits they want or expect as retirees. That means that citizens have to use capital based pensions more. The occupational pensions shall play an important role in the new pension pattern. The Commission urges the Member States to pay significant attention to the future retirement income of the citizens and to develop policies and initiatives necessary for citizens preparing for their retirement.

The Competency Challenge

The Union and the Commission have limited competences with regard to pensions and more generally social policy. For some of the matters raised in the white paper the OPSG questions whether the European Commission has the legal competence. In some areas the white paper seems to neglect this incompetence of the Union. Although the white paper explicitly mentions the fact that the responsibilities of the Member States are respected and that the Union and the Commission has no powers on the design of the pension system, the white paper includes some EU initiatives that influence the national level possibly more than strictly legally possible. The OPSG believes that the issue of legal competences in the area of pensions should be clarified and systematized so that member States, the Union and all stakeholders are clear what legal bases of the treaties are relevant to which parts of Member State pension systems. OPSG urges the European Commission to work in close cooperation with the national competent authorities in these matters.

2/11

EIOPA OCCUPATIONAL PENSIONS STAKEHOLDER GROUP FEEDBACK STATEMENT EUROPEAN COMMISSION WHITE PAPER AN AGENDA FOR ADEQUATE, SAFE AND SUSTAINABLE PENSIONS

But the national economies in the Union have become closely interdependent. Member States call for solidarity from other Member States like citizens call for solidarity inside the Member States between geographical areas and between generations. The important question to the citizens is not whether pensions are a part of the mandate of the Union and the Commission. What matters to the citizens is that the Member States on their own or with help from the Commission initiatives can make certain, that citizens can get adequate, safe and sustainable pensions and that the occupational pensions have the possibility to develop to the advantage of the working force.

OPSG Comments to the Commission analysis and initiatives

OPSG understands and accepts the rationale for changing the pension systems by raising retirement ages, encourage citizens to work longer, equalise the pensionable ages for women and men. The consequence is a reduction of the importance of the state provided pensions over the coming years. The Commission expects citizens to be active and make decisions safeguarding their own retirement benefits through pillar 2 and 3 pensions. But citizens need better and reliable information about the pillar 1 pensions they will receive and about the taxation of pensions in order to plan. OPSG wants to stress that it can - in a difficult economic environment - be difficult, not only for low-income employees, for unemployed, and for self-employed to find the necessary economic means, but also for companies facing the pressure of international competition. So, it is of paramount importance that the governments as emphasized by the Commission look specifically at all three pillars of the pension system as an integrated system and take their particular characteristics into account. The pension system The pension system has developed in the Member States in different ways1. The three pillars are regarded differently and the importance of the three pillars is different in the Member States. OPSG understands and welcomes the White Paper as a strategic umbrella concept for different future initiatives on pension systems from the Commission and the Member States. Pillar 1 Pillar 1 pensions (state provided pensions) are publicly managed pensions schemes with defined benefits and pay-as-you-go (PAYG) finance based on tax. Pillar 1 pension schemes are ruled by the legislator. The individual can do little to change the sum she or he will receive. Legislator decides.

The description of pensions in three pillars follows the classification developed by OECD. However Bulgaria, Estonia, Hungary, Latvia, Lithuania,Poland, Romania and Slovak republic replaced part of their public, PAYG-financed pension system with a new, fully-funded, defined-contribution pensions scheme. Part of public pension contributions are diverted from the public pension system and invested in pension funds managed by private institutions. These systems can be treated as a supplement to mandatory public pensions systems.

3/11

EIOPA OCCUPATIONAL PENSIONS STAKEHOLDER GROUP FEEDBACK STATEMENT EUROPEAN COMMISSION WHITE PAPER AN AGENDA FOR ADEQUATE, SAFE AND SUSTAINABLE PENSIONS

For many reasons Member States most likely will not be able to deliver pillar 1 pensions able to meet the needs of the coming retirees for adequate retirement incomes. In all Member States pillar 1 pensions will need to be supplemented through capital based retirement provision. It is nevertheless important, that Member States do everything possible to ensure a decent value of the pillar 1 pensions. The demographic changes and the economic development forces governments to change the rules. Citizens are obliged to remain in the labour market longer and the pillar 1 pensions are modified or even reduced. That is understandable but governments must make the changes in a way that is seen as fair and acceptable to all citizens. Early retirement with full pillar 1 benefits should not be possible except under special conditions like physical, mental or social handicaps. Access to pre-pension arrangements should be restricted to exceptional economic or social circumstances. Pillar 2 Pillar 2 pensions (occupational pensions) are privately managed pension schemes which are provided as part of an employment contract. Pillar 2 pension schemes are ruled by the legislator and/or by the social partners. They are capital based. Contributions come from the employees and the employers. They can be fully funded or unfunded. Tax deduction or deferred taxation is part of the pillar 2 pensions. Legislation related to pillar 2 pensions is a combination of social policy, labour policy, financial regulation and tax policy. The pillar 2 pensions (occupational pensions) are not open for a free choice. Citizens join the scheme open to them according to the agreements their trade union or employer adheres to. One of the lessons learnt from the severe state debt crisis is that efficiency is of utmost importance in all areas also in retirement provision. Systems are needed that provide the best possible benefits at the lowest possible costs. Pillar 2 occupational pensions have proved in many Member States to be an efficient system. OPSG welcomes that the White Paper emphasizes the particular role and responsibility of the social partners. The social partners will be able to realize unused efficiency gains for the future strength of capital based retirement provision in many Member States. They will also play a decisive role regarding spread, coverage and equality of occupational pension schemes. Collective agreements can be a very efficient instrument for reaching many new employers and employees. It is important that the coming pension and labour market reforms support the occupational pension schemes. And that the occupational pension schemes are supported by the tax regulations. Pillar 2 schemes should not be burdened by unnecessary copying of the solvency II approach. Pillar 3 Pillar 3 pensions (private pensions) are personal pension plans in the form of saving and annuity schemes. Pillar 3 pension schemes are contracts between a financial company and a client. Pillar 3 pensions are fully funded. Pillar 3 pensions can be tax deductible or deferred taxation. Legislation related to pillar 3 pensions is mainly consumer protection law, prudential financial legislation, and tax legislation in some Member States also social legislation. Pillar 3 pensions are normally open for individual arrangements. The citizen is normally free to choose between different possible providers.

4/11

EIOPA OCCUPATIONAL PENSIONS STAKEHOLDER GROUP FEEDBACK STATEMENT EUROPEAN COMMISSION WHITE PAPER AN AGENDA FOR ADEQUATE, SAFE AND SUSTAINABLE PENSIONS

Pillar 3 pensions will together with other savings be a supplement to pillar 1 and pillar 2 pensions. Pillar 3 pensions must be safe and sustainable. The regulation and taxation should not invite employers and employees to move from pillar 2 to pillar 3. Information to citizens Citizens need high quality information. Individual pension statements from all pension schemes (pillar 1, 2, and 3) so that citizens can plan their retirement savings and consider taking up supplementary pensions. The information must be understandable and comparable (wherever possible) for schemes across the pillars and across borders. The information must contain information about taxation and compulsory social security contributions. It must be possible to track pensions cross borders. Unemployment The White Paper is only in a general way looking at a situation with many unemployed. The changing focus from pillar 1 to pillar 2 and 3 create special problems for people with unemployment periods. The White Paper mentions the problem that unemployed seen as a group are paying less in taxes than employed and thus creates a financing problem for the payas-you-go schemes. But the individual consequences for the unemployed are more severe. An unemployed is not contributing to the pillar 2 scheme - that means reduced pillar 2 pensions. In addition to that unemployed have difficulties contributing to pillar 3 schemes and sometimes they have to stop a pillar 3 scheme and use the savings. So citizens who have been unemployed will get smaller pillar 2 and pillar 3 pensions. That is not an acceptable situation. It stresses that Member States must put more effort in reducing unemployment. If not, citizens in difficulties should be supported at an early stage, part of the unemployment insurance benefit could be contribution to pillar 2 pensions, but that would be a correction of symptoms not a correction of the problem. Changing conditions Citizens are changing jobs, employers, city, country and families. It is important that these changes are not punished through reductions in pension benefits out of proportions to the costs related to the individual changes. When citizens are obliged to keep working longer than they used to it will be necessary to adapt labour regulations and collective agreements to these new conditions. It should be possible to change from full employment to other types of work like working parttime and having part-pension or becoming self-employed. Pillar 1 and pillar 2 schemes will have to make that possible. In some Member States self-employed cannot be members of an occupational pension scheme. In order to give self-employed the possibility to complement their pillar 1 pensions, this situation has to be adapted. Therefore it is essential to enlarge pillar 2. It should be possible for the entire working population to participate in a pillar 2 scheme. It seems logical to increase tax benefits, rather than to decrease them.

5/11

EIOPA OCCUPATIONAL PENSIONS STAKEHOLDER GROUP FEEDBACK STATEMENT EUROPEAN COMMISSION WHITE PAPER AN AGENDA FOR ADEQUATE, SAFE AND SUSTAINABLE PENSIONS

The IORP directive The revision of the IORP directive has already been treated in the OPSG Opinion from December 2011. IORPs need their own dedicated and efficient supervisory regime that takes their specific characteristics adequately into account.

6/11

EIOPA OCCUPATIONAL PENSIONS STAKEHOLDER GROUP FEEDBACK STATEMENT EUROPEAN COMMISSION WHITE PAPER AN AGENDA FOR ADEQUATE, SAFE AND SUSTAINABLE PENSIONS

OPSG recommendations

For a vast majority of workers across the Member States, adequate, safe and sustainable pensions will only be possible when pillar 1 pensions are supplemented by capital based retirement pensions. Of paramount importance is that the providers of capital based pensions act in the best interest of the members and beneficiaries. The pillar 2 pensions at their best are characterized by cooperation between employees and employer or on a larger scale between the social partners. This cooperation should provide a market power able to get the best conditions from the market and the financial institutions. The financial institutions providing pillar 3 pensions are to a large extent guided by a profit motive and may find themselves in a conflict between corporate interests and the best interests of the members and beneficiaries. However, appropriate governance structures for such kind of providers may contribute to re-balance the interests of shareholders and pension plan members and beneficiaries. Pillar 2 The Fiscal Compact Treaty and agreements between Member States should establish an obligation for Member States to encourage and motivate employers, companies and social partners - with the help of incentives - to introduce, maintain and develop efficient occupational pension systems. Occupational pensions must, to be able to counteract the consequences of the declining importance of the pillar 1 pensions, be developed and supported by Member States, the Social Partners and the Union as a cornerstone in the pension system. The indicators in this process will be: Will an overwhelming majority of citizens be covered by pillar 2 pensions? Will more occupational pension schemes be established? Will citizens who today are cut off get possibilities to join the pillar 2 pensions? Will pillar 2 pensions give members adequate, safe and sustainable pensions? Are pillar 2 pension schemes regulated in such a way that they are not attractive? Reporting obligations When a Member State reports about the state of the economy a PAYG pension scheme will give a better economic standing of the Member State than a funded pension scheme would do. The debt and deficit definitions of the Stability and Growth Pact are constructed in such a way that they discourage the continuation or introduction of funded pension schemes. Only in depth reporting will look into whether an overall pension system will deliver adequate, safe and sustainable pensions.

7/11

EIOPA OCCUPATIONAL PENSIONS STAKEHOLDER GROUP FEEDBACK STATEMENT EUROPEAN COMMISSION WHITE PAPER AN AGENDA FOR ADEQUATE, SAFE AND SUSTAINABLE PENSIONS

OPSG urges the Commission to analyse the definitions and reporting obligations covering pensions and propose to the Member States changes to the definitions that can foster the development of adequate, safe and sustainable pensions. Flexibility Citizens shall be able to change jobs, domicile, employer, country without being punished by reductions in their pensions or high costs out of proportion with the individual change. Citizens wanting to change pension schemes shall be able to do that without consequences out of proportion to the costs related to the change. Citizens who stay in the same pillar 2 scheme for years shall not have irrelevant costs imposed because other citizens are leaving the scheme. Self-employed should be able to opt for an equivalent of an occupational scheme to enable them to adhere to a pension scheme with similar tax rules and social protection as those under employment contract. It is important that citizens with long careers have possibilities to change working conditions and remain covered by pillar 2 schemes. Changes like going from full working time to part-time, from employed to self-employed or being part-time working and having supplementary pensions. Reasonable solutions must be found so that citizens meeting severe difficulties like unemployment or ill health are not lost in the system by the double effects of periods with bad economy and reduced pillar 2 and 3 pensions. The Commission or the Member States should carry out a survey of problems related to crossborder constellations. The Pension Portability Directive A pension portability directive, which aims to set minimum standards for the acquisition and preservation of supplementary pension rights was debated some years ago and abandoned. The abandoned project would have enhanced the benefits provided to plan members by reducing the minimum vesting period and making indexation of vested entitlements mandatory while conversely it expanded the employment benefits budgets of existing plan structures at the expense of the sponsoring companies. It is today possible for the supervisory authorities in a Member State to prevent or block member group transfers from one IORP to another IORP on the occasion of company mergers, takeover or other transactions, although the transfers are in accordance with labour legislation. That should not be possible. OPSG recommends reconsidering the questions related to portability with the specific aim of improving transferability. It is important to bear in mind that improving transferability should not lead to any unreasonable costs neither for employers nor for employees. Information to pension scheme members Citizens can be members of different pension schemes, not only pillar 1, 2 and 3 but also within the pillars can citizens be members of different pension schemes. The parameters across pillars and systems might differ, therefore citizens shall have information like the KIID for all types of pension schemes they are members of.

8/11

EIOPA OCCUPATIONAL PENSIONS STAKEHOLDER GROUP FEEDBACK STATEMENT EUROPEAN COMMISSION WHITE PAPER AN AGENDA FOR ADEQUATE, SAFE AND SUSTAINABLE PENSIONS

Citizens shall have understandable and comparable pension statements for all pension schemes giving the information necessary for planning the retirement. Information should neither be complex nor unintelligible or opaque. It will be helpful if standardised forms are used. Tracking services should help citizens collect all information. The information shall be presented in a format and style which meets the needs of the member. Information may not be misleading. The information should encompass: Contributions paid by the citizen Contributions to be paid in the future by the citizen (or the principles for calculation of the contributions) Contributions from other sources Future contributions from other sources Fees and other costs related to the product Duration of the contract The expected benefit The tax regime for the product Risks linked to the product (qualitative as well as quantitative, including risks on investments, regardless of their nature) Other rights and obligations of the contract

Protection of pensions and good practice The protection of pillar 1 pensions is in the hands of the legislator and the political processes. The protection of pillar 2 pensions is a combination of legislative protection from social law, labour law and financial legislation. Some occupational pensions are protected by the agreements between the social partners or pension protection schemes. The actual protection in the Member States is very different. Pillar 3 pensions are protected by prudential financial legislation and perhaps social legislation. The consumer protection from consumer protection law and the financial legislation applies to pillar 3. Part of this protection is not relevant for pillar 1 and 2, because the citizens have only very limited choice if any - in relation to these pillars. Rules on good practice or codes of good practice for providers of pensions could help maintain or even develop the quality of pillar 2 and 3 pensions perhaps for pillar 1 pension as well. Pension schemes should develop their governance systems. It is important that the pensions are governed in the best interest of the members. Board members and other officers responsible for the management of pension schemes must be fit and proper and competent as responsible for pension schemes.

9/11

EIOPA OCCUPATIONAL PENSIONS STAKEHOLDER GROUP FEEDBACK STATEMENT EUROPEAN COMMISSION WHITE PAPER AN AGENDA FOR ADEQUATE, SAFE AND SUSTAINABLE PENSIONS

Balanced regulation The regulation of pensions must be balanced between citizens rights and economic needs. The overall aim is to provide a framework for adequate, safe and sustainable pensions. With the reduction of the role of pillar 1 pension is it important that the legislator foster citizens participation in pillar 2 pension schemes and the possibility of adding to the pillar 1 and 2 pensions with pillar 3 pensions and other savings, in a balanced way in consideration of people who cannot afford them on one hand, and of the level of risk associated with investments in the present and future economic situation. Taxation is simultaneously a protection and a threat, a protection because both tax deduction and tax deferment are incentives to join the pension schemes, a threat because public debt and need for additional resources are very high and the possibility of reducing a budget deficit now is politically more attractive than stable pensions saving and pensions benefits. The necessity for citizens to save in pillar 2 and 3 pensions must be respected by the Member States, the Union and the Social Partners. The general approach should be that pillar 2 pensions provide the main supplement to pillar 1 pensions. Member States must support pillar 2 pensions through the tax system. If pillar 2 pensions are not attainable for citizens then pillar 3 pensions should have the same tax support. Member States must cooperate and coordinate so that taxation is only an incentive to pension not an expensive deterrent. A subject to start with is the abolishment of double taxation of pensions and pension savings. The Solvency II rules developed for insurance should only be used for pillar 2 pensions in areas where it is relevant. Solvency II rules should only be used for pensions if it adds to the development of adequate, safe and sustainable pensions. The application of the Solvency II qualitative requirements regarding governance and best practices, disclosure to stakeholders and reporting to supervisors could be a relevant approach. Information at EU level and monitored development A constant monitoring of the development of pensions, pensions obligations and pensions provisions in the Member States is important. Not all obligations and provisions are visible. Obligations and provisions should be more visible across the three pillars so that it is possible for the Union and the Member States to make evaluations and economic decisions on a sound statistical basis. Apparently no reliable figures are available as far as the number of IORPs in the Member States are concerned. The number is told to be 140.000 IORPs. It is important to get that number verified, broken down to Member State level and monitored, so that changes in the population of IORPs can be known. OPSG recommends that EIOPA in cooperation with the national authorities establish this basic information. The development of IORPs in the Member States should be known. Online lists of IORPs would make it easy to ascertain in case of transfer that the transfer is made to an institution with consistent supervisory and qualitative standards.

10/11

EIOPA OCCUPATIONAL PENSIONS STAKEHOLDER GROUP FEEDBACK STATEMENT EUROPEAN COMMISSION WHITE PAPER AN AGENDA FOR ADEQUATE, SAFE AND SUSTAINABLE PENSIONS

The Commission and the Member States shall also follow the development in pension schemes from all pillars and report about: Are schemes adequate, safe and sustainable? Do occupational pension schemes (pillar 2) develop? Do private schemes (pillar 3) develop? Changes in the pillar 2 and pillar 3 according to changes in pillar 1. OPSG strongly recommends that the Commission reviews its general perspective towards the capital based pension provision and contribute to readjust the particular weight of pillar 2 pensions within the future structure of the pension system in the Union and in the Member States. EIOPA EIOPA has, as the authority in charge of supervision of pillar 2 institutes and systems under the IORP directive and of insurance companies, an important role to play in the implementation of the agenda for adequate, safe and sustainable pensions. The EIOPA mandate should cover all information on and monitoring of pillar 2 and 3 pensions at Union level.

* * *

Adopted by the EIOPA Occupational Pensions Stakeholder Group at Frankfurt am Main, 04 July 2012,

The Chairperson of the EIOPA Occupational Pensions Stakeholder Group

Chris VERHAEGEN

11/11

Das könnte Ihnen auch gefallen

- Ip079 en PDFDokument406 SeitenIp079 en PDFpensiontalkNoch keine Bewertungen

- The 2015 Pension Adequacy Report: Current and Future Income Adequacy in Old Age in The EU Volume IDokument396 SeitenThe 2015 Pension Adequacy Report: Current and Future Income Adequacy in Old Age in The EU Volume IpensiontalkNoch keine Bewertungen

- Ip065 en PDFDokument240 SeitenIp065 en PDFpensiontalkNoch keine Bewertungen

- The 2018 Pension Adequacy Report: Current and Future Income Adequacy in Old Age in The EU Volume IDokument188 SeitenThe 2018 Pension Adequacy Report: Current and Future Income Adequacy in Old Age in The EU Volume IpensiontalkNoch keine Bewertungen

- Ip065 en PDFDokument240 SeitenIp065 en PDFpensiontalkNoch keine Bewertungen

- The 2018 Pension Adequacy Report: Current and Future Income Adequacy in Old Age in The EU Volume IIDokument288 SeitenThe 2018 Pension Adequacy Report: Current and Future Income Adequacy in Old Age in The EU Volume IIpensiontalkNoch keine Bewertungen

- 2017 Au Melbourne Mercer Global Pension Index Report HighlightsDokument4 Seiten2017 Au Melbourne Mercer Global Pension Index Report HighlightspensiontalkNoch keine Bewertungen

- EIOPA Identifies Spill-Over Risks Into The Real Economy From Shocks To The European Occupational Pensions SectorDokument4 SeitenEIOPA Identifies Spill-Over Risks Into The Real Economy From Shocks To The European Occupational Pensions SectorpensiontalkNoch keine Bewertungen

- Ip065 en PDFDokument240 SeitenIp065 en PDFpensiontalkNoch keine Bewertungen

- Pensions at A Glance 2017 BELGIUMDokument6 SeitenPensions at A Glance 2017 BELGIUMpensiontalkNoch keine Bewertungen

- Pensions at A Glance 2017Dokument167 SeitenPensions at A Glance 2017pensiontalkNoch keine Bewertungen

- Aeip - Response Green Paper LtiDokument10 SeitenAeip - Response Green Paper LtipensiontalkNoch keine Bewertungen

- 315towards An Equitable and Sustainable Points System A Proposal For Pension Reform in BelgiumDokument32 Seiten315towards An Equitable and Sustainable Points System A Proposal For Pension Reform in BelgiumpensiontalkNoch keine Bewertungen

- Report On European Private Pension Schemes: Functioning, Vulnerabilities and Future ChallengesDokument136 SeitenReport On European Private Pension Schemes: Functioning, Vulnerabilities and Future ChallengespensiontalkNoch keine Bewertungen

- 8th Edition Scoreboard enDokument108 Seiten8th Edition Scoreboard enpensiontalkNoch keine Bewertungen

- 2017 Melbourne Mercer Global Pension Index Country Chart NetherlandsDokument1 Seite2017 Melbourne Mercer Global Pension Index Country Chart NetherlandspensiontalkNoch keine Bewertungen

- 2017 Melbourne Mercer Global Pension Index Full ReportDokument80 Seiten2017 Melbourne Mercer Global Pension Index Full ReportpensiontalkNoch keine Bewertungen

- EU-rapport 'On Ageing 2015'Dokument436 SeitenEU-rapport 'On Ageing 2015'pensiontalkNoch keine Bewertungen

- NL 2016 Mmgpi Pension Index Report MercerDokument4 SeitenNL 2016 Mmgpi Pension Index Report Mercerpensiontalk100% (1)

- GL 2016 Mmgpi Impact Ageing Populations Full ReportDokument88 SeitenGL 2016 Mmgpi Impact Ageing Populations Full ReportpensiontalkNoch keine Bewertungen

- Premies - VergoedingenDokument197 SeitenPremies - VergoedingenpensiontalkNoch keine Bewertungen

- 23-9-2013 EcDokument97 Seiten23-9-2013 EcpensiontalkNoch keine Bewertungen

- Bvpi-Abip-green Paper Lti - ResponsepdfDokument5 SeitenBvpi-Abip-green Paper Lti - ResponsepdfpensiontalkNoch keine Bewertungen

- Een Blauwdruk Voor Pensioenen. Genoeg Sparen, Goed Sparen en Slim Sparen (2017 Insurance Europe)Dokument44 SeitenEen Blauwdruk Voor Pensioenen. Genoeg Sparen, Goed Sparen en Slim Sparen (2017 Insurance Europe)pensiontalkNoch keine Bewertungen

- Overview of Swiss Social Security 2015Dokument45 SeitenOverview of Swiss Social Security 2015pensiontalkNoch keine Bewertungen

- Answer GreenPaper On LongTermFinancing of European EconomyDokument27 SeitenAnswer GreenPaper On LongTermFinancing of European EconomypensiontalkNoch keine Bewertungen

- Pensionseurope Response To Ec Green Paper On Long-Term FinancinDokument17 SeitenPensionseurope Response To Ec Green Paper On Long-Term FinancinpensiontalkNoch keine Bewertungen

- Wereld Kan Vergrijzing Niet Aan: UNFPA Exec Summary 2012Dokument8 SeitenWereld Kan Vergrijzing Niet Aan: UNFPA Exec Summary 2012pensiontalkNoch keine Bewertungen

- Rapport EIOPA Over Informeren Over PensioenDokument4 SeitenRapport EIOPA Over Informeren Over PensioenpensiontalkNoch keine Bewertungen

- CSB Working Paper 12 09 - Oktober 2012Dokument71 SeitenCSB Working Paper 12 09 - Oktober 2012pensiontalkNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

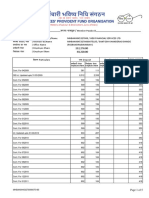

- Passbook PFDokument5 SeitenPassbook PFDarshan SarodeNoch keine Bewertungen

- Aninon VS GsisDokument2 SeitenAninon VS GsisEarvin Joseph BaraceNoch keine Bewertungen

- Ra 7875Dokument12 SeitenRa 7875ineedpptsNoch keine Bewertungen

- RRL ForeignDokument4 SeitenRRL Foreignゔ違でStrawberry milkNoch keine Bewertungen

- Employee Benefits Part 1Dokument12 SeitenEmployee Benefits Part 1Khiks ObiasNoch keine Bewertungen

- 2023 CFA LIII MockExamA-PMDokument23 Seiten2023 CFA LIII MockExamA-PMHugo VALERIO100% (1)

- Vicente Vs ECCDokument1 SeiteVicente Vs ECCxyrakrezelNoch keine Bewertungen

- Economic Well-Being of U.S. Households in 2021: Research & AnalysisDokument98 SeitenEconomic Well-Being of U.S. Households in 2021: Research & AnalysisForkLogNoch keine Bewertungen

- Fixation Table PRC-08Dokument2 SeitenFixation Table PRC-08navn7650% (2)

- Temporary Rehabilitation Remuneration Form-HR114: Section 1. To Be Completed by The EmployeeDokument3 SeitenTemporary Rehabilitation Remuneration Form-HR114: Section 1. To Be Completed by The EmployeeLexNoch keine Bewertungen

- Maria de Leon Transport vs. Macuray - 2018Dokument13 SeitenMaria de Leon Transport vs. Macuray - 2018Fenina ReyesNoch keine Bewertungen

- NATIONAL BUDGET CIRCULAR NO 579 Dated January 24 2020Dokument9 SeitenNATIONAL BUDGET CIRCULAR NO 579 Dated January 24 2020renbuenaNoch keine Bewertungen

- TVM TablesDokument13 SeitenTVM TablesSaurabh ShuklaNoch keine Bewertungen

- Mansell v. Mansell, 490 U.S. 581 (1989)Dokument20 SeitenMansell v. Mansell, 490 U.S. 581 (1989)Scribd Government DocsNoch keine Bewertungen

- National Grid DB LevellingDokument2 SeitenNational Grid DB LevellingVincent India Elspeth HardyNoch keine Bewertungen

- Llora Motors Vs DrilonDokument2 SeitenLlora Motors Vs DrilonTedd JavarNoch keine Bewertungen

- Wage Revn 2002Dokument33 SeitenWage Revn 2002tsrajanNoch keine Bewertungen

- Dictionary of Insurance Terms - Fourth EditionDokument590 SeitenDictionary of Insurance Terms - Fourth EditionfrajogodiNoch keine Bewertungen

- Comparative Studies in Pension FundDokument7 SeitenComparative Studies in Pension Fundela mukNoch keine Bewertungen

- Un Pan 92431Dokument12 SeitenUn Pan 92431Farid HilmiNoch keine Bewertungen

- Serrano v. Severino Santos TransitDokument3 SeitenSerrano v. Severino Santos TransitGia DimayugaNoch keine Bewertungen

- One Page Summary Millionaire FastLaneDokument9 SeitenOne Page Summary Millionaire FastLaneHisfan NaziefNoch keine Bewertungen

- UST Labor Law CD - Re Application For Retirement of Judge Moslemen MacarambonDokument2 SeitenUST Labor Law CD - Re Application For Retirement of Judge Moslemen MacarambonAnne MacaraigNoch keine Bewertungen

- Statement of AdviceDokument19 SeitenStatement of Adviceapi-337581948Noch keine Bewertungen

- Presentation On Summer Internship ProjectDokument12 SeitenPresentation On Summer Internship ProjectsushantmhamunkarNoch keine Bewertungen

- Master Agreement: by and Between The Bow School Board and The Bow Education AssociationDokument48 SeitenMaster Agreement: by and Between The Bow School Board and The Bow Education Associationyachiru121Noch keine Bewertungen

- Kenya Finance Bill 2020Dokument36 SeitenKenya Finance Bill 2020Life NoanneNoch keine Bewertungen

- Employee Benefits 2 Employee Benefits 2Dokument4 SeitenEmployee Benefits 2 Employee Benefits 2XNoch keine Bewertungen

- Chapter 5 Employee Benefit Part 1Dokument9 SeitenChapter 5 Employee Benefit Part 1maria isabellaNoch keine Bewertungen

- 12 PensionDokument4 Seiten12 PensionMichael BongalontaNoch keine Bewertungen