Beruflich Dokumente

Kultur Dokumente

Depreciation

Hochgeladen von

Nabela SinkuanOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Depreciation

Hochgeladen von

Nabela SinkuanCopyright:

Verfügbare Formate

Depreciation

acompanymusthave the equipment, and value of capital always diferrent year to year. So, in this meeting we talk about this. Example, a car must have depreciation Depreciation methods generally can be grouped on four parts, namely: 1. 1. Average method, the method is devided over three parts, namely. 1. a. straight line method Depreciation = (Purchase price - salvage value / economic life) example : An engine plant has a purchase price of Rp. 55,000,000.00. Have estimated economic life of 5 years with a residual value of Rp 5.000.000, -. Then the depreciation per year is depreciation = (Rp. 55.000.000,00 Rp. 5.000.000,00)/5 = Rp. 10.000.000,00 b. (service hours method) Depreciation per hour = (purchase price, residual value of assets) / total hours worked economically Depreciation per year = the depreciation rate per hour X hours of use example : An aircraft purchased at a price of Rp. 100,000,000.00. Expected to provide aviation services 10 000 flying hours services. In the year 2008 is estimated to be used for 1,500 hours of flying. Then calculated the depreciation for the year 2008: Depreciation per hour = Rp. 100,000,000, -/10.000 = Rp. 10.000, Depreciation in 2008 = Rp. 10000.00 x 1500 = Rp. 15.000.000,-

c. (Product Units Method) Depreciation = purchase price- residual value number of units over the economic life of the machine Depreciation per year = number of production a year X depreciation per unit Depreciation per unit = (purchase price, residual value) estimated number of production Example : A factory machine has a purchase price of Rp 50,000,000.00 is estimated to have the economic life of 5 years with a residual value of Rp 5,000,000.00 and is expected to result in the production unit for 5 years as follows: 1st year = 14,000 units The second year = 12,000 units 3rd year = 10,000 units 4th year = 8000 units Year-to-5 = 6000 units The amount of shrinkage is : Depreciation per unit = (Rp.50.000.000,00 Rp. 5.000.000,00)/50.000= Rp. 900 depreciation per year :

year 1 2 3 4 5

production unit 14.000 12.000 10.000 8.000 6.000

pare Rp. 900 Rp. 900 Rp. 900 Rp. 900 Rp. 900

depreciation Rp 12.600.000,00 Rp 10.800.000,00 Rp 9.000.000,00 Rp 7.200.000,00 Rp. 5.400.000,00

Depreciation schedules are Over 5 Years: YearThe annual amount of end depreciation depreciation 0 1 12.600.000 12.600.000 2 10.800.000 23.400.000 3 9.000.000 32.400.000 4 7.200.000 39.600.000 5 5.400.000 45.000.000

book value 50.000.000 37.400.000 26.600.000 17.600.000 10.400.000 5.000.000

2 a. Annuity method purchase price of a machine Rp. 50.000.000 with an estimated salvage value of Rp. 10.000.000 and economic life set for 5 years. The effective interest rate calculated at 18% per year. How big is the annual depreciation to be done by using the annuity method? answer : The purchase price of assets = Rp.50.000.000 economic life of assets = 5 tahun residual value = Rp.10.000.000 i =18% to determine the depreciated value of the assets should be calculated present value of the scrap value / residual value using the following formula: Depreciation = scrap value (1 + i)n D = 10.000.000 (1+0.18)-5 D = 10.000.000 (0,43710922) = 4.371.092 present assets are depreciated An = purchase price of assets - depreciation 50.000.000 4.371.092= Rp. 45.628.908; An = R. [ (1 (1 + i)-n )] I Depreciation per year is calculated as follows: R = 45.628.908 [ 0,18 ] -5 (1 (1+0.18) R = 45.628.908 (0.31977784) R = Rp. 14.591.114 b. Sinking fund method unknown:

n= 5 year i = 18% B (original cost) = Rp 50.000.000 S (scrape value) = Rp 10.000.000 Sn = B S = Rp. 50.000.000 10.000.000= Rp. 40.000.000 R = Sn [ i ] {(1+i) 1 ) R = 40.000.000 [ 0.18 ] {1+0.18)5 -1) R = Rp.40.000.000 (0.139777837)= 5.591.113 Thus, the amount of depreciation in one year Rp. 5.591.113 3 a. method the number of annual rate For example, a cracker company purchased equipment for Rp. 15 million; have economic life for 6 years, and the calculated residual value of Rp. 3,000,000; the amount of depreciation in each year can be calculated as follows : The annual rate: 1 + 2 + 3 + 4 + 5 + 6 = 21 depreciated value of assets : (B S) = 15.000.000 3.000.000 = Rp. 12.000.000 Depreciation each year 1year = 6/21 x Rp. 12.000.000 = Rp. 3.428.571,4 2year = 5/21 x Rp. 12.000.000 = Rp. 2.857.142,9 3year = 4/21 x Rp. 12.000.000 = Rp. 2.285.714,3 4year = 3/21 x Rp. 12.000.000 = Rp. 1.171.285,7 5year = 2/21 x Rp. 12.000.000 = Rp. 1.142.857,1 6year= 1/21 x Rp. 12.000.000 = Rp. 571.428,57 Rp. 12.000.000 b. depreciation method the average percentage If the asset purchase price of Rp. 10 million dollars in economic life for 5 years, the annual depreciation amount is equal to 100% / 5 = 20%. To purchase a new asset at the time will come yanga with higher prices, either as a result of the inflation rate due to changes in technology and the average percentage of depreciation increased by multiples of two. Based on this description, the amount of depreciation each year is calculated as : Tahun I = 40% x Rp. 10.000.000 = Rp. 4.000.000 Rp. 10.000.000 Rp. 4.000.000 = Rp. 6.000.000 Tahun II = 40% x Rp. 6.000.000 = Rp. 2.400.000 = Rp. 6.000.000 Rp. 2.400.000 =Rp. 3.600.000 Tahun III = 40% x Rp. 3.600.000 = Rp. 1.440.000 = Rp. 3.600.000 Rp. 1. 440.000 = Rp. 2.160.000 Tahun IV = 40% x Rp. 2.160.000 = Rp. 864.000 = Rp. 2.160.000 Rp. 864.000 = Rp. 1.296.000 Tahun V = 40% x Rp. 1.296.000 = Rp. 518.400 Rp. 1. 296.000 Rp. 518.400 = Rp. 777.600

4. Composite depreciation method Example: a company has three pieces of machinery, machine I purchase price of Rp. 10 million; machine II Rp. 7 million; and III machine purchase price is Rp. 5 million; economic life of the machine I, II, and III each 5 years, 4 years, and 10 years. Scarp value of the three machines are assumed to Rp. 2.000.000;, Rp. 1,000,000; and a third engine Rp. 400 000 Mac Purcase price (Rp) Scar value hine (Rp) Depreciation life of the (Rp) engine (yaer) 8.000.000 5 6.000.000 4 4.600.000 10 18.000.000 19 Year depreciation

A 10.000.000 2.000.000 1.600.000 B 7.000.000 1.000.000 1.500.000 C 5.000.000 400.000 460.000 Jum 22.000.000 3.400.0000 3.560.000 lah Amount of depreciation in one year is calculated based on fixed depreciation are as follows : percentage of depreciation = the amount of annual depreciation amount of the purchase price of assets = 3.560.000 = 0,161818181=16,18% 22.000.000 Conducted on the amount of depreciation each year is as follows : 0,161818181 x 22.000.000 = 3.600.000 The length of time for the depreciation is calculated as follows: 18.000.000 = 5 year 2 month 3.600.000

Das könnte Ihnen auch gefallen

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Von EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Bewertung: 3.5 von 5 Sternen3.5/5 (17)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsVon EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNoch keine Bewertungen

- Productive Output MethodDokument36 SeitenProductive Output MethodEcha NoviandiniNoch keine Bewertungen

- Construction Equipment Costs: Courtesy of Dr. Emad ElbeltagyDokument30 SeitenConstruction Equipment Costs: Courtesy of Dr. Emad ElbeltagyBruce DoyaoenNoch keine Bewertungen

- Financial Accounting Disposal of Asset and Good Will Week 3Dokument28 SeitenFinancial Accounting Disposal of Asset and Good Will Week 3Hania SohailNoch keine Bewertungen

- ES19 Depreciation April 19,2023Dokument19 SeitenES19 Depreciation April 19,2023angusdelosreyes23Noch keine Bewertungen

- Depriciation in AccountingDokument3 SeitenDepriciation in AccountingpoornapavanNoch keine Bewertungen

- Depreciation: Basic ConceptsDokument15 SeitenDepreciation: Basic ConceptsAlie DysNoch keine Bewertungen

- Engineering Economics: DepreciationDokument50 SeitenEngineering Economics: DepreciationLeahlainne MinisterioNoch keine Bewertungen

- Chapter 5 - Replacement AnalysisDokument29 SeitenChapter 5 - Replacement AnalysisUpendra ReddyNoch keine Bewertungen

- DepreciationDokument24 SeitenDepreciationKRISHNA KANT GUPTANoch keine Bewertungen

- Lecture (2) (12-11-2023) UpdateDokument34 SeitenLecture (2) (12-11-2023) UpdateAbdulrahman YounesNoch keine Bewertungen

- Depreciation 181008092040Dokument23 SeitenDepreciation 181008092040kidest mesfinNoch keine Bewertungen

- DepreciationDokument6 SeitenDepreciationMichaelNoch keine Bewertungen

- Lesson 5 - Depreciation PDFDokument10 SeitenLesson 5 - Depreciation PDFJoshua DayritNoch keine Bewertungen

- Unit V Depreciation: Prepared ByDokument27 SeitenUnit V Depreciation: Prepared BySrinivasNoch keine Bewertungen

- FIN 213 Review Questions: Question OneDokument16 SeitenFIN 213 Review Questions: Question OneJustus MusilaNoch keine Bewertungen

- Depreciation Session 8Dokument76 SeitenDepreciation Session 8Madhura Dabak100% (1)

- Case Study (Latest)Dokument16 SeitenCase Study (Latest)MAHEN DRANNoch keine Bewertungen

- DepreciationDokument54 SeitenDepreciationDarkie Drakie0% (1)

- 03 DEPRECIATION - Sinking Fund MethodDokument4 Seiten03 DEPRECIATION - Sinking Fund MethodDexter JavierNoch keine Bewertungen

- Depreciation CostingDokument3 SeitenDepreciation Costingfathimath ahmedNoch keine Bewertungen

- 32439287Dokument18 Seiten32439287Anjo Vasquez67% (3)

- Depreciation Method 160210070304Dokument14 SeitenDepreciation Method 160210070304Ved PrakashNoch keine Bewertungen

- Decisions Under CertaintyDokument23 SeitenDecisions Under CertaintyJom Ancheta Bautista100% (1)

- Depreciation AccountingDokument17 SeitenDepreciation AccountingSwati Rathour100% (1)

- Unit III CTMDokument23 SeitenUnit III CTMShashank SinghNoch keine Bewertungen

- Final Practrice (Unit 4 and 5)Dokument9 SeitenFinal Practrice (Unit 4 and 5)mjlNoch keine Bewertungen

- Chapter SixDokument27 SeitenChapter SixMisganaw WaleNoch keine Bewertungen

- Marjorie ArevaloDokument22 SeitenMarjorie ArevaloFrancis CayananNoch keine Bewertungen

- Engineering Economy Module 4Dokument38 SeitenEngineering Economy Module 4Jared TeneberNoch keine Bewertungen

- 5 Annual WorthDokument14 Seiten5 Annual Worthabinaya sriramNoch keine Bewertungen

- TOPIC 11-Property, Plant and EquipmentDokument8 SeitenTOPIC 11-Property, Plant and EquipmentHerlyn QuintoNoch keine Bewertungen

- Engr. Mel Kenneth Mabute FIRST Semester, A.Y. 2018-2019Dokument46 SeitenEngr. Mel Kenneth Mabute FIRST Semester, A.Y. 2018-2019Karen Keith TengcoNoch keine Bewertungen

- Sample Cases 1-11 With SolutionsDokument10 SeitenSample Cases 1-11 With SolutionsJenina Rose SalvadorNoch keine Bewertungen

- DepreciationDokument35 SeitenDepreciationJames Kevin IgnacioNoch keine Bewertungen

- BAMA 1101, CH5, DepreciationDokument26 SeitenBAMA 1101, CH5, DepreciationWijdan Saleem EdwanNoch keine Bewertungen

- CH 10Dokument26 SeitenCH 10EmadNoch keine Bewertungen

- BMMW4393 Tutorial 2 B091810287Dokument9 SeitenBMMW4393 Tutorial 2 B091810287nur aliaaNoch keine Bewertungen

- DepreciationDokument11 SeitenDepreciationShiela Marie BautistaNoch keine Bewertungen

- Chapter 8 SolutionsDokument66 SeitenChapter 8 SolutionssevtenNoch keine Bewertungen

- MAS Ass1Dokument4 SeitenMAS Ass1Tin BulaoNoch keine Bewertungen

- Present, Future, Annual Worth and Rate of Returns: ObjectivesDokument19 SeitenPresent, Future, Annual Worth and Rate of Returns: ObjectivesMohammed Shakeel khudusNoch keine Bewertungen

- Calculation 2.Dokument3 SeitenCalculation 2.Fizza ShahidNoch keine Bewertungen

- DepreciationDokument26 SeitenDepreciationApril VegaNoch keine Bewertungen

- Plant Assets: Created by Ina IndrianaDokument23 SeitenPlant Assets: Created by Ina IndrianadewiestiNoch keine Bewertungen

- Answers of The ProblemDokument11 SeitenAnswers of The ProblemRavi KantNoch keine Bewertungen

- Chapter Four Depreciation and InflationDokument23 SeitenChapter Four Depreciation and InflationnathnaelNoch keine Bewertungen

- Adjusting Entries (Accounting)Dokument25 SeitenAdjusting Entries (Accounting)Elaiza Jane CruzNoch keine Bewertungen

- What Is DepreciationDokument6 SeitenWhat Is DepreciationDaley NangasNoch keine Bewertungen

- Module 4 Depreciation NEWDokument34 SeitenModule 4 Depreciation NEWMarielle CochicoNoch keine Bewertungen

- I. Rental Method of Valuation: Capitalized Value Net Rent Year's PurchaseDokument3 SeitenI. Rental Method of Valuation: Capitalized Value Net Rent Year's PurchasebhushrutiNoch keine Bewertungen

- A7 Accounting For Depreciation and Disposal of Fixed Assets 2Dokument17 SeitenA7 Accounting For Depreciation and Disposal of Fixed Assets 2diggywilldoitNoch keine Bewertungen

- Chapter 4 AnswersDokument9 SeitenChapter 4 AnswersCDT MIKI EMERALD CUEVANoch keine Bewertungen

- AnswerDokument15 SeitenAnswerBIRHANU GEMECHUNoch keine Bewertungen

- Chapter 3 - Replacement Analysis-1Dokument28 SeitenChapter 3 - Replacement Analysis-1VENKATA SAI KRISHNA YAGANTINoch keine Bewertungen

- SM 300 EE Annual WorthDokument36 SeitenSM 300 EE Annual WorthAnushka DasNoch keine Bewertungen

- CPA Review Notes 2019 - BEC (Business Environment Concepts)Von EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Bewertung: 4 von 5 Sternen4/5 (9)

- Handbook of Capital Recovery (CR) Factors: European EditionVon EverandHandbook of Capital Recovery (CR) Factors: European EditionNoch keine Bewertungen

- Session 5 PPSDDokument22 SeitenSession 5 PPSDemmyNoch keine Bewertungen

- Keltan 2470 - Cooper EuropeDokument2 SeitenKeltan 2470 - Cooper EuropeHakim BOUTNoch keine Bewertungen

- FTA HSRP Solutions Pvt. LTDDokument1 SeiteFTA HSRP Solutions Pvt. LTDJamil VoraNoch keine Bewertungen

- Gorbachev and ReformsDokument24 SeitenGorbachev and ReformsMofeOmatsoneNoch keine Bewertungen

- Lion Air Eticket Itinerary / ReceiptDokument3 SeitenLion Air Eticket Itinerary / ReceiptDanets SNoch keine Bewertungen

- Emerging Global World: CPP X Class (History)Dokument2 SeitenEmerging Global World: CPP X Class (History)suryachandra27Noch keine Bewertungen

- PSPCL Tariff Order FY 2021 22 Annex 2Dokument21 SeitenPSPCL Tariff Order FY 2021 22 Annex 2Himanshu SundanNoch keine Bewertungen

- Affidavit of Non ImprovementDokument1 SeiteAffidavit of Non Improvementnagelyn mejiaNoch keine Bewertungen

- Guc 57 56 21578 2022-06-21T23 25 51Dokument3 SeitenGuc 57 56 21578 2022-06-21T23 25 51Mariam MhamoudNoch keine Bewertungen

- Tender Evaluation Details March 22 2022Dokument9 SeitenTender Evaluation Details March 22 2022Stephan CheongNoch keine Bewertungen

- Heat Shrink Busbar Insulation Tubing (Edbi) : Voltage Class 24 KV Application Ø 6.5 MM - 150 MMDokument2 SeitenHeat Shrink Busbar Insulation Tubing (Edbi) : Voltage Class 24 KV Application Ø 6.5 MM - 150 MMdinhdoanspcNoch keine Bewertungen

- MacabacusEssentialsDemoComplete 210413 104622Dokument21 SeitenMacabacusEssentialsDemoComplete 210413 104622Pratik PatwaNoch keine Bewertungen

- Technical Manual. Level & Pressure Transmitter TYPE PL3700Dokument30 SeitenTechnical Manual. Level & Pressure Transmitter TYPE PL3700stéphane pervesNoch keine Bewertungen

- Division of Profits and Losses Case #1: Sufficient Profit: Partnership OperationsDokument7 SeitenDivision of Profits and Losses Case #1: Sufficient Profit: Partnership OperationsJuliana Cheng100% (3)

- Yogesh K Kansal ResumeDokument3 SeitenYogesh K Kansal ResumeShree RamNoch keine Bewertungen

- Consumer BehaviourDokument24 SeitenConsumer BehaviourGopisri kamatamNoch keine Bewertungen

- Unit 8: Accounting For Spoilage, Reworked Units and Scrap ContentDokument26 SeitenUnit 8: Accounting For Spoilage, Reworked Units and Scrap Contentዝምታ ተሻለ0% (1)

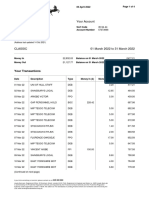

- Statement 2022 3Dokument4 SeitenStatement 2022 3Dulo WegnerNoch keine Bewertungen

- The Five Generic Competitive Strategies: Presentation by Omkar, Vijay and DilleshwarDokument20 SeitenThe Five Generic Competitive Strategies: Presentation by Omkar, Vijay and DilleshwarEverton Snow MuberekwaNoch keine Bewertungen

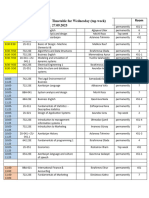

- Timetable For Wednesday Top Week (Fall 2023)Dokument3 SeitenTimetable For Wednesday Top Week (Fall 2023)wingardium of devilNoch keine Bewertungen

- Learning Task 2 Financial Statements of Rosalina Besario SurveyorsDokument6 SeitenLearning Task 2 Financial Statements of Rosalina Besario SurveyorsNeil Matundan100% (1)

- Basic Finance An Introduction To Financial Institutions Investments and Management 11th Edition Mayo Solutions ManualDokument4 SeitenBasic Finance An Introduction To Financial Institutions Investments and Management 11th Edition Mayo Solutions Manualknackishfantigue.63von100% (28)

- Larceny in The Heart-DraftDokument159 SeitenLarceny in The Heart-DraftChalcedon Foundation100% (1)

- Approved Crane ContractorsDokument19 SeitenApproved Crane ContractorsJoseph JwNoch keine Bewertungen

- Yarina Doily IriSkaBeat ENGDokument7 SeitenYarina Doily IriSkaBeat ENGBenoit LapalmeNoch keine Bewertungen

- CU-2021 B.A. B.sc. (Honours) Economics Semester-3 Paper-SEC-A-2 QPDokument2 SeitenCU-2021 B.A. B.sc. (Honours) Economics Semester-3 Paper-SEC-A-2 QPsourojeetsenNoch keine Bewertungen

- Panel DiscussionDokument2 SeitenPanel DiscussionjenNoch keine Bewertungen

- Problematika Pasar ModalDokument1 SeiteProblematika Pasar ModalRahmat ArdiansyahNoch keine Bewertungen

- BOMA Best Practices 2Dokument4 SeitenBOMA Best Practices 2ken kerchNoch keine Bewertungen

- BillDokument1 SeiteBillMauz AshrafNoch keine Bewertungen