Beruflich Dokumente

Kultur Dokumente

Daily Technical Report: Sensex (17279) / NIFTY (5243)

Hochgeladen von

Angel BrokingOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Daily Technical Report: Sensex (17279) / NIFTY (5243)

Hochgeladen von

Angel BrokingCopyright:

Verfügbare Formate

Daily Technical Report

July 20, 2012

Sensex (17279) / NIFTY (5243)

Yesterday, our benchmark indices opened higher on the back of strong rally in the US and European markets but remained in narrow range throughout the day to close well above 5200 mark. On the sectoral front, the buying interest was seen in IT, Consumer Durables and Oil & Gas counters; whereas Auto sector ended with a marginal loss. The advance to decline ratio was in favor of advancing counters (A=1513 D=1299) (Source www.bseindia.com). Formation The weekly 61.8% Fibonacci retracement of the fall from 18524 /5630 (February 22, 2012) 15749 / 4770 (June 4, 2012) is seen at 17464 / 5302. On the weekly chart, we are witnessing a Downward Sloping Trend Line resistance near 17687 / 5386 formed by joining the highs of 21109 / 6339 (November 5, 2010) 18524 / 5630 (February 24, 2012). A horizontal consolidation band is observed in the range of 17034 / 5159 and 17635 / 5350. The 20 day EMA is placed at 17200 / 5218 level.

Exhibit 1: Nifty Daily Chart

Source: Falcon

Trading strategy: Yesterday, indices opened higher and maintained their early gains throughout the day. Our markets have now convincingly closed above '20-day EMA'. This gives a slight hint of optimism. Indices are now approaching their immediate intraday resistance of 17343 / 5267 level. A sustainable move above this level may attract enhanced buying interest among market participants. In this scenario, indices are likely to rally towards 17467 - 17583 / 5300 - 5336. On the downside, the gap area of (17135 - 17034 / 5189 5159 levels) formed on 29thJune 2012 remains to be an important support zone for our markets.

Actionable points:

View Expected Targets Support Levels

Bullish above 5267 5300 - 5336 5189 - 5159

www.angelbroking.com

Daily Technical Report

July 20, 2012

Bank Nifty Outlook - (10622)

Yesterday, Bank Nifty opened with an upside gap in line with our benchmark indices but selling pressure at higher levels led the index to close near days low. The momentum oscillators on the daily chart and hourly chart are painting a mixed picture. Thus we expect volatility to increase in coming trading session. At present the index is hovering around its hourly 20 EMA which coincides with yesterdays low of 10606. A move below the 10606 mark would lead to a further fall and the Index is likely to drift lower to test 10544 10500 levels. On the upside 10666 10690 levels are likely to act as resistance in coming trading session. Actionable points:

View Resistance Levels Support Level Neutral 10666 - 10690 10544 - 10500

Exhibit 2: Bank Nifty Daily Chart

Source: Falcon

www.angelbroking.com

Daily Technical Report

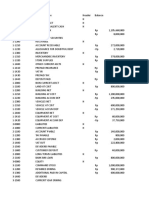

July 20, 2012 Daily Pivot Levels for Nifty 50 Stocks

SCRIPS SENSEX NIFTY BANKNIFTY ACC AMBUJACEM ASIANPAINT AXISBANK BAJAJ-AUTO BANKBARODA BHARTIARTL BHEL BPCL CAIRN CIPLA COALINDIA DLF DRREDDY GAIL GRASIM HCLTECH HDFC HDFCBANK HEROMOTOCO HINDALCO HINDUNILVR ICICIBANK IDFC INFY ITC JINDALSTEL JPASSOCIAT KOTAKBANK LT M&M MARUTI NTPC ONGC PNB POWERGRID RANBAXY RELIANCE RELINFRA SAIL SBIN SESAGOA SIEMENS STER SUNPHARMA TATAMOTORS TATAPOWER TATASTEEL TCS WIPRO S2 17,207 5,220 10,544 1,244 168 3,563 1,035 1,481 669 308 231 374 313 329 355 204 1,610 349 2,614 474 685 583 2,028 120 442 940 136 2,173 251 416 75 560 1,388 700 1,069 155 281 802 111 485 713 515 92 2,113 190 680 104 619 222 99 411 1,187 363 S1 17,243 5,231 10,583 1,253 169 3,591 1,046 1,514 682 312 233 381 318 331 358 206 1,632 353 2,633 477 689 586 2,058 121 444 945 138 2,209 253 421 76 570 1,397 705 1,093 156 283 813 111 487 721 522 93 2,136 192 687 105 623 224 100 413 1,194 366 PIVOT 17,281 5,245 10,646 1,266 170 3,643 1,056 1,540 704 320 235 386 322 333 361 208 1,665 357 2,649 481 692 589 2,097 122 447 951 139 2,229 254 428 77 586 1,409 712 1,134 158 285 828 112 491 725 529 94 2,176 193 695 106 627 225 101 415 1,202 368 R1 17,317 5,256 10,685 1,275 171 3,671 1,067 1,573 718 324 237 394 327 335 363 209 1,687 361 2,668 484 697 592 2,128 123 449 957 141 2,266 256 433 78 597 1,418 717 1,158 159 287 839 113 494 732 536 94 2,199 195 702 107 631 226 102 417 1,209 370 R2 17,355 5,269 10,748 1,287 172 3,723 1,078 1,599 740 331 239 399 331 337 366 211 1,720 365 2,684 488 700 594 2,166 124 451 962 142 2,286 258 441 79 613 1,430 723 1,199 160 289 854 113 498 737 544 95 2,240 197 710 107 635 228 102 419 1,217 372

www.angelbroking.com

Daily Technical Report

July 20, 2012

Research Team Tel: 022 - 39357800 E-mail: research@angelbroking.com Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni Sameet Chavan Sacchitanand Uttekar Mehul Kothari Ankur Lakhotia Head Technicals Technical Analyst Technical Analyst Technical Analyst Technical Analyst

For any Queries, Suggestions and Feedback kindly mail to sameet.chavan@angelbroking.com

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3952 6600

Sebi Registration No: INB 010996539

www.angelbroking.com

Das könnte Ihnen auch gefallen

- Financial Management - Brigham Chapter 3Dokument4 SeitenFinancial Management - Brigham Chapter 3Fazli AleemNoch keine Bewertungen

- Business Plan of A Boutique HouseDokument27 SeitenBusiness Plan of A Boutique HouseSoniaa100% (2)

- Conflicts in Accounting Concepts and ConventionsDokument4 SeitenConflicts in Accounting Concepts and ConventionsGuru Nathan71% (7)

- Daily Technical Report: Sensex (17185) / NIFTY (5216)Dokument4 SeitenDaily Technical Report: Sensex (17185) / NIFTY (5216)angelbrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17105) / NIFTY (5193)Dokument4 SeitenDaily Technical Report: Sensex (17105) / NIFTY (5193)angelbrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17103) / NIFTY (5197)Dokument4 SeitenDaily Technical Report: Sensex (17103) / NIFTY (5197)Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17657) / NIFTY (5363)Dokument4 SeitenDaily Technical Report: Sensex (17657) / NIFTY (5363)Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17633) / NIFTY (5348)Dokument4 SeitenDaily Technical Report: Sensex (17633) / NIFTY (5348)Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17158) / NIFTY (5205)Dokument4 SeitenDaily Technical Report: Sensex (17158) / NIFTY (5205)angelbrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17489) / NIFTY (5306)Dokument4 SeitenDaily Technical Report: Sensex (17489) / NIFTY (5306)angelbrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (16918) / NIFTY (5128)Dokument4 SeitenDaily Technical Report: Sensex (16918) / NIFTY (5128)angelbrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17679) / NIFTY (5350)Dokument4 SeitenDaily Technical Report: Sensex (17679) / NIFTY (5350)Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17214) / NIFTY (5227)Dokument4 SeitenDaily Technical Report: Sensex (17214) / NIFTY (5227)Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 14.09Dokument4 SeitenTechnical Format With Stock 14.09Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (16846) / NIFTY (5110)Dokument4 SeitenDaily Technical Report: Sensex (16846) / NIFTY (5110)Angel BrokingNoch keine Bewertungen

- DailyTech Report 07.08.12 Angel BrokingDokument4 SeitenDailyTech Report 07.08.12 Angel BrokingAngel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17399) / NIFTY (5279)Dokument4 SeitenDaily Technical Report: Sensex (17399) / NIFTY (5279)Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 13.09Dokument4 SeitenTechnical Format With Stock 13.09Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 07.09Dokument4 SeitenTechnical Format With Stock 07.09Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17602) / NIFTY (5337)Dokument4 SeitenDaily Technical Report: Sensex (17602) / NIFTY (5337)Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 23.11.2012Dokument4 SeitenTechnical Format With Stock 23.11.2012Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17728) / NIFTY (5380)Dokument4 SeitenDaily Technical Report: Sensex (17728) / NIFTY (5380)Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 11.09Dokument4 SeitenTechnical Format With Stock 11.09Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (16640) / NIFTY (5043)Dokument4 SeitenDaily Technical Report: Sensex (16640) / NIFTY (5043)Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17885) / NIFTY (5421)Dokument4 SeitenDaily Technical Report: Sensex (17885) / NIFTY (5421)Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17233) / NIFTY (5235)Dokument4 SeitenDaily Technical Report: Sensex (17233) / NIFTY (5235)Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 16.11.2012Dokument4 SeitenTechnical Format With Stock 16.11.2012Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (16877) / NIFTY (5118)Dokument4 SeitenDaily Technical Report: Sensex (16877) / NIFTY (5118)angelbrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17632) / NIFTY (5335)Dokument4 SeitenDaily Technical Report: Sensex (17632) / NIFTY (5335)Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17491) / NIFTY (5288)Dokument4 SeitenDaily Technical Report: Sensex (17491) / NIFTY (5288)Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (16897) / NIFTY (5121)Dokument4 SeitenDaily Technical Report: Sensex (16897) / NIFTY (5121)Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17151) / NIFTY (5188)Dokument4 SeitenDaily Technical Report: Sensex (17151) / NIFTY (5188)Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (16860) / NIFTY (5104)Dokument4 SeitenDaily Technical Report: Sensex (16860) / NIFTY (5104)Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 06.09Dokument4 SeitenTechnical Format With Stock 06.09Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17847) / NIFTY (5413)Dokument4 SeitenDaily Technical Report: Sensex (17847) / NIFTY (5413)Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 04.07.2013Dokument4 SeitenDaily Technical Report, 04.07.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report 15.02.2013Dokument4 SeitenDaily Technical Report 15.02.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 21.05.2013Dokument4 SeitenDaily Technical Report, 21.05.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (16913) / NIFTY (5114)Dokument4 SeitenDaily Technical Report: Sensex (16913) / NIFTY (5114)Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17618) / NIFTY (5345)Dokument4 SeitenDaily Technical Report: Sensex (17618) / NIFTY (5345)Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 11.10Dokument4 SeitenTechnical Format With Stock 11.10Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17601) / NIFTY (5338)Dokument4 SeitenDaily Technical Report: Sensex (17601) / NIFTY (5338)Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 02.11.2012Dokument4 SeitenTechnical Format With Stock 02.11.2012Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17558) / NIFTY (5320)Dokument4 SeitenDaily Technical Report: Sensex (17558) / NIFTY (5320)Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17521) / NIFTY (5317)Dokument4 SeitenDaily Technical Report: Sensex (17521) / NIFTY (5317)Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 12.09Dokument4 SeitenTechnical Format With Stock 12.09Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 25.10Dokument4 SeitenTechnical Format With Stock 25.10Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17392) / NIFTY (5275)Dokument4 SeitenDaily Technical Report: Sensex (17392) / NIFTY (5275)Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 18.12.2012Dokument4 SeitenTechnical Format With Stock 18.12.2012Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 23.10Dokument4 SeitenTechnical Format With Stock 23.10Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 22.03.2013Dokument4 SeitenDaily Technical Report, 22.03.2013Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 04.09Dokument4 SeitenTechnical Format With Stock 04.09Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 24.07.2013Dokument4 SeitenDaily Technical Report, 24.07.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17691) / NIFTY (5366)Dokument4 SeitenDaily Technical Report: Sensex (17691) / NIFTY (5366)Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 20.06.2013Dokument4 SeitenDaily Technical Report, 20.06.2013Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 29.11.2012Dokument4 SeitenTechnical Format With Stock 29.11.2012Angel BrokingNoch keine Bewertungen

- Technical Report 3rd May 2012Dokument4 SeitenTechnical Report 3rd May 2012Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 05.10Dokument4 SeitenTechnical Format With Stock 05.10Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17539) / NIFTY (5327)Dokument4 SeitenDaily Technical Report: Sensex (17539) / NIFTY (5327)Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 09.10Dokument4 SeitenTechnical Format With Stock 09.10Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 21.09Dokument4 SeitenTechnical Format With Stock 21.09Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17033) / NIFTY (5165)Dokument4 SeitenDaily Technical Report: Sensex (17033) / NIFTY (5165)Angel BrokingNoch keine Bewertungen

- Credit Union Revenues World Summary: Market Values & Financials by CountryVon EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDokument4 SeitenRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNoch keine Bewertungen

- Oilseeds and Edible Oil UpdateDokument9 SeitenOilseeds and Edible Oil UpdateAngel BrokingNoch keine Bewertungen

- WPIInflation August2013Dokument5 SeitenWPIInflation August2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 14 2013Dokument2 SeitenDaily Agri Tech Report September 14 2013Angel BrokingNoch keine Bewertungen

- International Commodities Evening Update September 16 2013Dokument3 SeitenInternational Commodities Evening Update September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 16 2013Dokument9 SeitenDaily Agri Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 16 2013Dokument6 SeitenDaily Metals and Energy Report September 16 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 8th JanDokument3 SeitenDerivatives Report 8th JanAngel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 16 2013Dokument2 SeitenDaily Agri Tech Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Dokument4 SeitenDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNoch keine Bewertungen

- Currency Daily Report September 16 2013Dokument4 SeitenCurrency Daily Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 12 2013Dokument2 SeitenDaily Agri Tech Report September 12 2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Dokument4 SeitenDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Metal and Energy Tech Report Sept 13Dokument2 SeitenMetal and Energy Tech Report Sept 13Angel BrokingNoch keine Bewertungen

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDokument1 SeitePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNoch keine Bewertungen

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDokument6 SeitenTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNoch keine Bewertungen

- Currency Daily Report September 13 2013Dokument4 SeitenCurrency Daily Report September 13 2013Angel BrokingNoch keine Bewertungen

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDokument4 SeitenJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument12 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 12Dokument2 SeitenMetal and Energy Tech Report Sept 12Angel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 12 2013Dokument6 SeitenDaily Metals and Energy Report September 12 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 12 2013Dokument9 SeitenDaily Agri Report September 12 2013Angel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Currency Daily Report September 12 2013Dokument4 SeitenCurrency Daily Report September 12 2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Dokument4 SeitenDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNoch keine Bewertungen

- INTRODUCTIONDokument93 SeitenINTRODUCTIONbaba baba black sheepNoch keine Bewertungen

- Direct Taxation Memorial FinalDokument16 SeitenDirect Taxation Memorial FinalAmitKumarNoch keine Bewertungen

- Risk and ReturnDokument38 SeitenRisk and ReturnSunil Shaw0% (1)

- Infrastructure Financing PPP and Regulation Course OutlineDokument4 SeitenInfrastructure Financing PPP and Regulation Course OutlineSaksham GoyalNoch keine Bewertungen

- 4 - Cash Flow EstimationDokument11 Seiten4 - Cash Flow Estimationdestinyrocks88Noch keine Bewertungen

- Function and Role of Financial SystemsDokument33 SeitenFunction and Role of Financial Systemsaamirjewani100% (1)

- Peso/Dollar Exchange Rate MovementsDokument22 SeitenPeso/Dollar Exchange Rate MovementsSilverio J. VasquezNoch keine Bewertungen

- SEC Vs Jonnie WilliamsDokument8 SeitenSEC Vs Jonnie WilliamsFuzzy PandaNoch keine Bewertungen

- PG ValidationDokument10 SeitenPG ValidationDerwin DomiderNoch keine Bewertungen

- Erp 2011Dokument83 SeitenErp 2011Hadi P.Noch keine Bewertungen

- As Unnit 5 Class NotesDokument38 SeitenAs Unnit 5 Class NotesAlishan VertejeeNoch keine Bewertungen

- How Mintoff Killed The NBMDokument4 SeitenHow Mintoff Killed The NBMsevee2081Noch keine Bewertungen

- Peter Low - The Northern Pacific Panic of 1901Dokument4 SeitenPeter Low - The Northern Pacific Panic of 1901Adrian KachmarNoch keine Bewertungen

- Man Econ Midterm Exam Condensed ReviewerDokument12 SeitenMan Econ Midterm Exam Condensed ReviewerCeline Mae MorillaNoch keine Bewertungen

- Portfolio Performance Evaluation MCQDokument74 SeitenPortfolio Performance Evaluation MCQAssad Javed83% (6)

- Met Smart GoldDokument10 SeitenMet Smart GoldyatinthoratscrbNoch keine Bewertungen

- Ej Philip Turner and Elnora Turner Petitioners vs. Lorenzo Shipping Corporation Respondent.Dokument2 SeitenEj Philip Turner and Elnora Turner Petitioners vs. Lorenzo Shipping Corporation Respondent.Ej Turingan50% (2)

- Acctg.222 Exam - Questionnaire FINALDokument7 SeitenAcctg.222 Exam - Questionnaire FINALAnonymous dbNSSxXPBNoch keine Bewertungen

- Feb Focus 2011Dokument12 SeitenFeb Focus 2011nketchumNoch keine Bewertungen

- On Types of BanksDokument14 SeitenOn Types of BanksRahulTikoo100% (1)

- BIR Form 1700 - Income Tax Return FilingDokument1 SeiteBIR Form 1700 - Income Tax Return FilingMarriz Bustaliño TanNoch keine Bewertungen

- Creating+Accounting+Masters+in+Tally Erp+9Dokument34 SeitenCreating+Accounting+Masters+in+Tally Erp+9Girish Chandra KollamparambilNoch keine Bewertungen

- Technical Analysis in Forex TradingDokument7 SeitenTechnical Analysis in Forex TradingIFCMarketsNoch keine Bewertungen

- Cluster FinancingDokument3 SeitenCluster FinancingdestinationsunilNoch keine Bewertungen

- Technical Anomalies: A Theoretical Review: Keywords: Technical Anomalies, Short-Term Momentum, Long-Run Return ReversalsDokument8 SeitenTechnical Anomalies: A Theoretical Review: Keywords: Technical Anomalies, Short-Term Momentum, Long-Run Return ReversalsAlan TurkNoch keine Bewertungen

- Insurance Awareness PDF Capsule 2017 by AffairscloudDokument56 SeitenInsurance Awareness PDF Capsule 2017 by AffairscloudMegha SharmaNoch keine Bewertungen

- Coa MyobDokument4 SeitenCoa Myobalthaf alfadliNoch keine Bewertungen